Cross River Ventures Corp. (CSE:CRVC) has announced results from the Altered Zone drill program at the McVicar Project. Located 150 kilometres northeast of Red Lake Ontario, the planned follow-up work for the Altered Zone target area includes geophysics and step-out drill holes.

Geologic modelling was done by Cross River in 2021 which used historic drilling data. This modelling yielded new interpretations of the Altered Zone geometry as well as an orogenic gold targeting framework. The resulting geological evaluation suggests that the high-grade gold-bearing structure continues at depth and is coincident with lithologic breaks. It also suggests it is localized within a broader damage zone corridor characterized by intense hydrothermal alteration overprint.

Alex Klenman, CEO of Cross River Ventures Corp., commented in a press release: “We are pleased with the progress made during 2021-2022 at McVicar, and in particular with the drill results at the Bear Head and Altered Zones. New and extended mineralized zones, and an improved understanding of the geology in the region will create a pathway to further successful drill intercepts going forward. We’re expanding known zones and discovering others. There’s a lot to like with McVicar and we intend to pursue ounces in the ground. We’re formulating follow up plans and will announce those once determined.”

The drill program at the Altered Zone tested the gold grade and continuity along strike, down-dip and down-plunge. This is now considered open in all directions. It also tested for new gold shoots and domains at several locations along the broader Altered Zone structural trend.

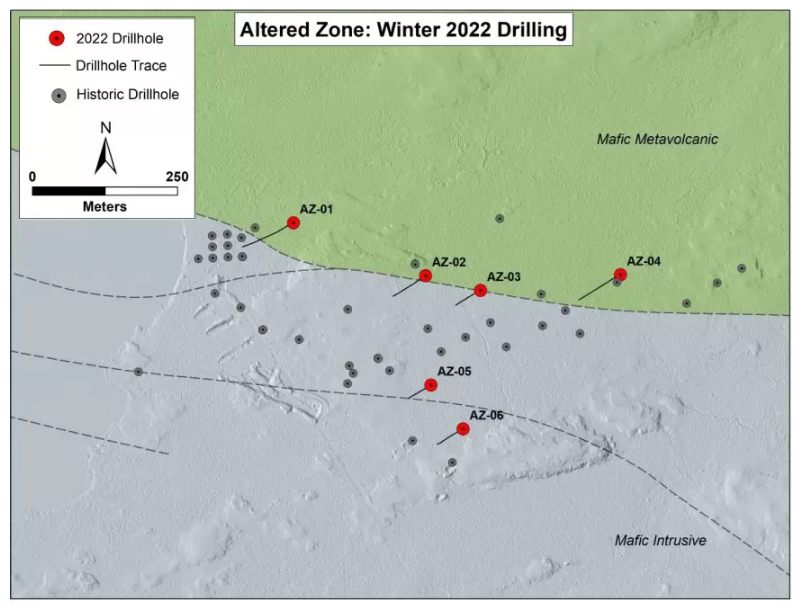

Figure 1: Altered Zone Drill Locations

Highlights from the results are as follows:

- Drill Hole AZ-03 contained 14.6 m of 0.55 g/t gold (“Au”) including 4.15 m of 1.42 g/t Au

- Drill Hole AZ-04 contained 1.0 m at 4.45 g/t Au (Figure 1; See Table 1 for complete results)

Six diamond drillholes tested the Altered Zone during the winter 2022 program. Notable Drilling Intercepts (>0.5 g/t Au) at Altered Zone include:

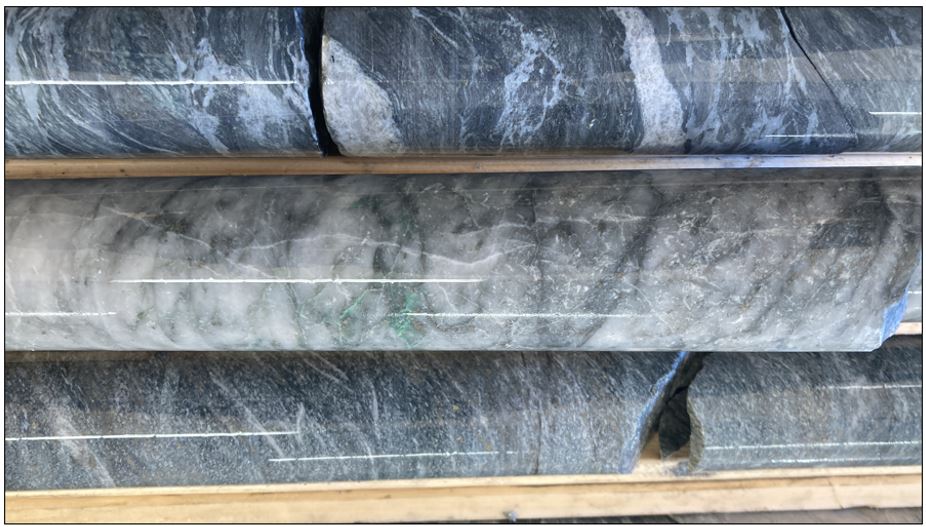

Figure 2: AZ-03 intercept of 14.63m grading 0.55 g/t Au (from 113-127.63m), including 4.15m @ 1.42 g/t Au (from 117.04 to 121.9m), and 0.56m @ 4.02 g/t Au (from 118-118.56m), hosted in quartz veins within the “Altered Zone Structure”.

AZ-03:

- 14.0 meters at 0.55 g/t Au from 113 m downhole

- Including 4.15 meters at 1.42 g/t Au from 117.04 m downhole

- Including 0.56 meters at 4.02 g/t Au from 118.00 m downhole (Picture 2)

AZ-04:

- 1.0 meters at 4.45 g/t Au from 160 m downhole

Figure 3: Quartz+carb+pyrite+fuchsite veining including 0.56m @ 4.02 g/t Au (from 118 – 118.56m) hosted in sheared, altered gabbro

Notable Copper and Nickel Intercepts at Altered Zone include:

AZ-01:

- 7.3 meters at 0.20% copper (“Cu”) and 0.11% nickel (“Ni”) from 209 m downhole

AZ-02:

- 3.0 meters at 0.12% Cu and 0.19% Ni from 36.22 m downhole

AZ-05:

- 9.66 meters at 0.08% Cu and 0.09% Ni from 72 m downhole

Summary

Table 1. = Significant gold intercepts (>0.25 g/t) and notable copper and nickel intercepts in each drill hole:

| Hole ID | From (m) | To (m) | Length | Au (g/t) | Cu (ppm) | Ni (ppm) |

| AZ-01 | 209 | 216.3 | 7.3 | 0.03 | 1977 | 1115 |

| AZ-01 | 258 | 259 | 1.0 | 0.34 | 178.5 | 43.9 |

| AZ-02 | 72 | 75 | 3.0 | 0.02 | 760 | 915 |

| AZ-03 | 113 | 127.63 | 14.63 | 0.55 | 113 | 130 |

| Incl. | 117.04 | 121.19 | 4.15 | 1.42 | 109 | 29.7 |

| Incl. | 118 | 118.56 | 0.56 | 4.02 | 24.9 | 17.7 |

| AZ-04 | 160 | 161 | 1.0 | 4.45 | 17.2 | 2.9 |

| AZ-05 | 36.22 | 45.88 | 9.66 | 0.02 | 1210 | 1852 |

NOTE: All intervals are core lengths, and true thicknesses are yet to be determined. Mineral resource modeling is required before true thicknesses can be estimated.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.