Collective Mining (TSXV:CNL) has announced major assay results from the Olympus Target within the Gauayabales project in Colombia. The results were from four additional diamond drill holes, and included 216.7m grading 1.08g/t gold equivalent. The company has also expanded the target area for follow-up exploration based on revised geological modelling data. Guayabales has seen multiple discoveries and follow-up drilling, as part of the minimum 20,000-metre program in 2022. The drill program is fully financed, with three diamond drill rigs operating at various targets.

Ari Sussman, Executive Chairman of Collective Mining, commented in a press release: “The Olympus target is advancing rapidly due to our exploration work and geological understanding and this has resulted in a 125 percent expansion of the target area. We are extremely excited about the precious metal potential of the system given the broad intercepts of gold and silver mineralization encountered in early drilling, the sheer size of the alteration system and the plethora of high-grade gold and silver-bearing, porphyry related, CBM veins. All the ingredients are in place for Olympus to evolve into a multi-million-ounce precious metal deposit. As our team understands full-well from our prior experience of exploring and developing the Buriticá project in Colombia, porphyry-related CBM veins can demonstrate robust continuity over significant vertical and lateral dimensions. Analogous to Olympus are both the multi-million-ounce high-grade Marmato and Buriticá systems, with each deposit measuring more than 1.5 vertical kilometres. The Marmato project is located approximately 3 kilometres to the southeast of Olympus and is situated within the same structurally controlled, porphyry intrusion – CBM vein, corridor.”

Highlights from the drill results are as follows:

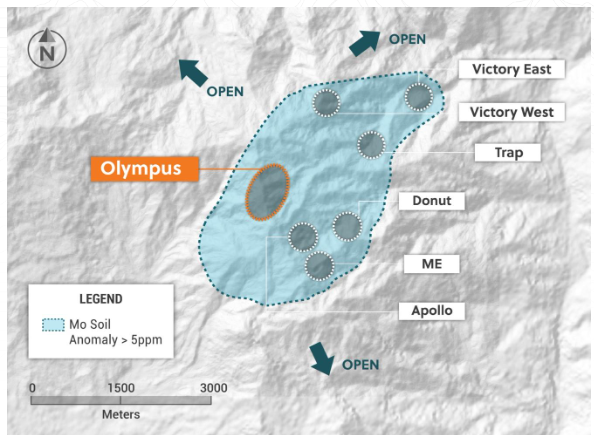

- As a result of geological modelling, drilling, underground sampling and detailed mapping, the Company now interprets Olympus Central and Olympus South to be one large interconnected mineralized system measuring up to 1.4 kilometres north-south by 900 metres east-west. The area, which will now be referred to simply as “Olympus,” remains open for expansion to the northwest, west, south and east.

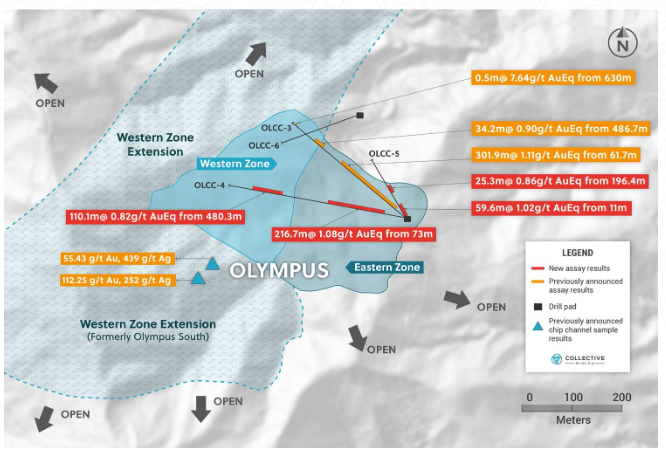

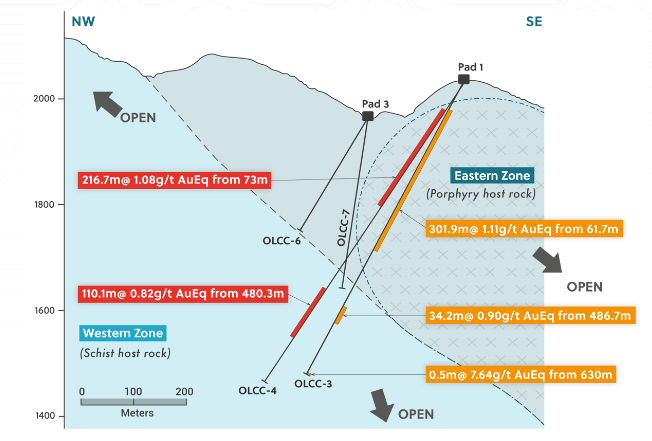

- Olympus hole OLCC-4 was drilled westward at a 60-degree angle and intersected both the mineralized Eastern and Western zones. The Eastern Zone is hosted primarily within porphyry diorite and has carbonate base metal (“CBM”) veins overprinting it while the Western Zone is hosted predominately within schist country rock impregnated by multiple zones of sheeted CBM veins with results as follows:

- 216.7 metres @ 1.08 g/t gold equivalent from 73 metres down-hole (Eastern Zone, drill hole OLCC-4)

- 110.1 metres @ 0.82 g/t gold equivalent from 480.3 metres down-hole (Western Zone, drill hole OLCC-4)

- Olympus hole OLCC-5 was drilled to the northwest at 70-degree angle and intercepted the Eastern Zone as follows:

- 59.6 metres @ 1.02 g/t gold equivalent from 11 metres down-hole before crossing into a late phase intrusion which appears to have eliminated the mineralization in this location. Additional patchy mineralization in the Eastern Zone was encountered further down-hole including 25.3 metres @ 0.86 g/t gold equivalent. The Company will focus future drilling in the Eastern Zone along strike to the south where it remains wide open for expansion. Lastly, this hole was not drilled far enough to intersect the projection of the Western Zone.

- Recent surface mapping and interpretation of drill data has led to a refinement of the Company’s model for the Western Zone. The schist-intrusive contact is shallow dipping and daylights at surface in the west for at least 200 metres of strike. Future drilling will target the untested, shallow projection of the Western Zone. Holes OLCC-6 and OLCC-7 were unfortunately, not drilled deep enough to intersect this Western Zone projection at depth (see Figure 3).

- Exploration work to date within both historical and current artisanal mines has outlined more than 25 veins. Previously announced chip channel sampling assay results have confirmed the high-grade nature of the veins with precious and base metal grades assaying up to 485 g/t gold, 1,919 g/t silver, 2.86% copper and combined zinc and lead grades in excess of 25 percent. Drilling completed thus far by the Company has been principally focused on the northern portion of the eastern zone and has not therefore tested below these high grade, artisanal mines. An extensive chip channel sampling campaign has been undertaken within the old mines with assay results anticipated in the near term.

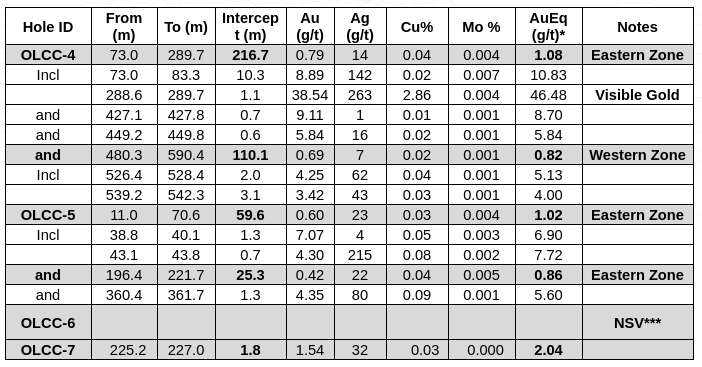

Table 1: Assay Results

*AuEq (g/t) is calculated as follows: (Au (g/t) x 0.95) + (Ag g/t x 0.017 x 0.95) + (Cu (%) x 2.06 x 0.95) + (Mo (%) x 6.86 x 0.95), utilizing metal prices of Cu – US$4.50/lb, Mo – US$15.00/lb, Ag – $25/oz and Au – US$1,500/oz and recovery rates of 95% for Au, Ag, Cu and Mo.

Recovery rate assumptions are speculative as no metallurgical work has been completed to date.

** A 0.1 g/t AuEq cut-off grade was employed with no more than 10% internal dilution. True widths are unknown, and grades are uncut.

*** No significant values reported in this intercept

Figure 2: Plan View of the Olympus Target

Figure 3: Cross Section W-E as Outlined on the Olympus Plan View Image

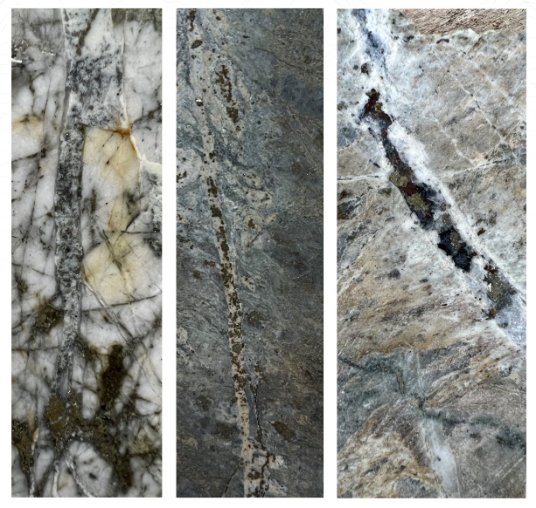

Figure 4: Drill Hole OLCC-4 Core Photos

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.