Sitting in one of the most prolific mining camps, there is a company that has been aggressively expanding its resources through good times and bad. Now with renewed interest in gold mining projects, it is time to look at teams and resources that have weathered the storm and learned discipline to advance their project with current drilling underway.

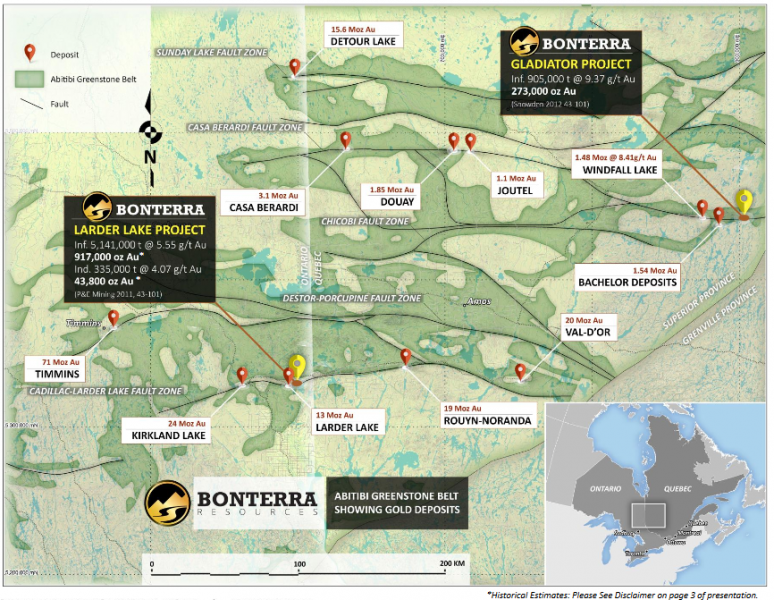

Bonterra Resources Inc. (BTR: TSX-V) ( BONXF: US) (9BR:FSE) is one such company that exemplifies determination and dedication to their deposit. Bonterra is a Canadian gold exploration company focused on expanding its NI 43-101 compliant gold resource on its properties in the Abitibi Greenstone Belt in the mining-friendly jurisdiction of Quebec.

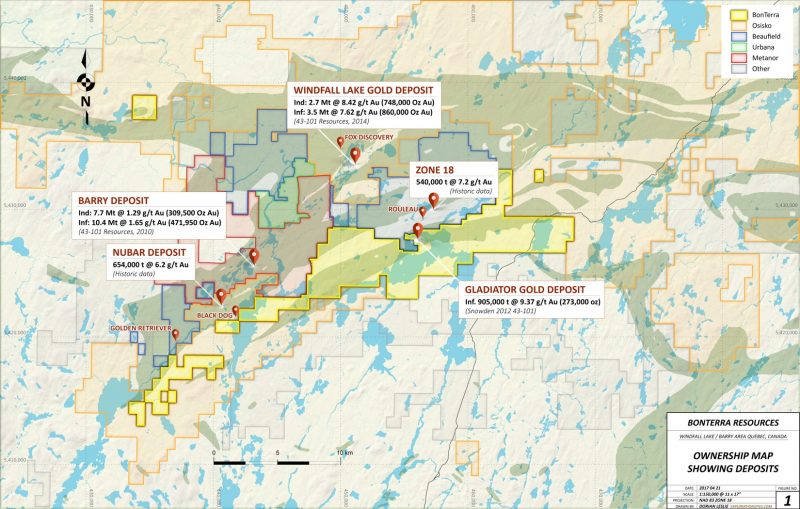

The company is currently drilling at its 10,541-hectare Gladiator Project. The drill program comprises over 50,000 meters utilizing a minimum of four drill rigs. Using a 4 g/t Au cut-off grade, the project currently contains an inferred resource of 905,000 tonnes, grading 9.37 g/t Au for 273,000 ounces of gold according to a Mineral Resource Estimate and technical report filed July 27, 2012, prepared by Snowden Mining Consultants. The company plans on completing 70,000 metres of drilling this year. With this drilling, expect the resource to expand when the company puts out its updated NI 43-101 Mineral Resource Estimate in mid-2018

Recent drilling from Gladiator has impressed the market by reaching a year high of 72 cents. On Dec. 12, 2017, the company released drill results of 18.5 g/t Au over 4.0 m and 11.9 g/t Au over 3.2 m in the south zone which increased and further defined the size of the high-grade core area. Holes BA-17-42A and BA-17-48 improved the definition of the high-grade core of the footwall zone, with significant grade and width in hole BA-17-48, which intersected 10.1 g/t Au over 6.3 m. Holes BA-17-42, BA-17-43B and BA-17-46 confirmed the eastern continuity of the north zone, with an intersection of 9.6 g/t Au over 3.0 m. This recent drilling also extends the north zone down plunge to the east. Results from these seven recent drill holes have expanded the size and demonstrate the continuity of the north, footwall and south zones.

According to Dale Ginn, vice-president of exploration: “Drill results from Gladiator continue to demonstrate superior widths and grades in all five of our defined zones to date. These mineralized zones are not only visible with sharp contacts, but are continuous and highly predictable. Stand-alone high-grade gold deposits in Canada, especially with extensive infrastructure and easy access, are extremely rare and valuable and we look forward to demonstrating that Gladiator is among that class.”

The company can follow up on these results year round and access some of the more difficult ground with the recent upgrade to its camp to an all-season exploration camp at the Gladiator gold project. The expansion to a larger year-round exploration camp will help advance the company during at time when most explorers are taking time off and their share prices are dropping due to lack of activity. Furthermore, drilling in the winter firms up the ground and allows for improved access and drilling.

Ginn stated, “The expansion and construction of a year-round camp provides the key infrastructure required to ensure we execute our resource development program at the Gladiator gold project on budget and on time to meet the market’s expectations of a mineral resource update in 2018.”

Bonterra plans to mobilize two additional drills (totalling six) in early 2018 for a winter drilling campaign. In an interview with Jay Talyor, President Nav Dhaliwhal stated that they have about $8 to $10 million to spend on the winter campaign.

The Gladiator project has good neighbors with deep pockets and active projects on the go. In addition to good ground and neighbors, the company has a solid shareholder base with Eric Sprott holding 10%, Van Eck Gold Fund with 12% and Kirkland Lake Gold with 9.5%. The company has a cash position of $24,554,809 CAD as of its August 31, 2017 financials. The company has never been in a better cash position.

Ian Telfer once said that he invests in projects that have management who have an unshakable faith in their deposits. Bonterra has demonstrated this faith by weathering one of the longest bear markets for gold; not just weathering the storm, but advancing its project and growing the resource. With depressed gold prices, winter drilling to support share price and prove up the property, and an upcoming resource estimate due in mid-2018, right now presents an attractive entry point for investors to consider acquiring shares.

*Bonterra Resources Inc. is an advertiser with MiningFeeds.com. MiningFeeds was compensated for the creation and distribution of this article. MiningFeeds was paid a fee and does not hold any shares in Bonterra Resources. This is for informational purposes only and should not construed as investment advice.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.