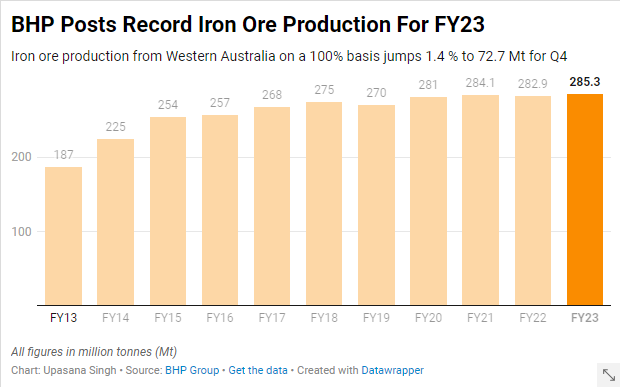

BHP (ASX:BHP) has announced a record high in its annual iron ore production, bolstered by steady operations at its South Flank mine in Western Australia. However, the company has noted that it is preparing for higher operational costs.

BHP also reaffirmed that production at South Flank would reach full capacity of 80 million metric tons per annum, on a 100% basis, by the end of fiscal 2024. Iron ore production was augmented by an improved rail performance at the mines in Western Australia, albeit the company did experience a slight setback due to adverse weather conditions from tropical Cyclone Ilsa in the quarter.

Iron ore output from Western Australia was reported to be 72.7 million metric tons (Mt) in the three months leading up to June 30. Although impressive, this number fell slightly short of Visible Alpha estimates of 73 Mt, according to UBS.

BHP, the world’s leading miner by market capitalization, disclosed that unit costs at its Western Australian iron ore operations, along with its Chilean copper mine, Escondida, are likely to reach the higher end of predicted ranges. Despite this, capital and exploration expenditure is set to be below the annual guidance due to foreign exchange fluctuations.

BHP also release an exciting forecast for fiscal 2024, predicting an iron ore output of between 282 and 294 million metric tons from Western Australia. The mid-point forecast shows a 0.9% increase over the annual production of 285.3 million metric tons for fiscal 2023.

The company highlighted a boost in copper production, following its $6.4 billion acquisition of OZ Minerals in May. Copper production rose by 9% to 1,716.5 thousand metric tons in the fiscal year, and the outlook for fiscal 2024 is promising, with production estimated between 1,720 and 1,910 thousand metric tons.

This surge in copper production is largely attributable to the anticipated higher grades at the world’s top copper mine and the successful integration of OZ Minerals into BHP’s South Australian operations.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.