Alexander Molyneux grew up with one foot in Australia and the other in Hong Kong, so he had a front-row seat to the rise of Asia and the demand for energy in a rapidly growing world.

The nuclear winter brought on by Fukushima and the accompanying flight of capital afforded him the opportunity to get directly involved in the uranium sector.

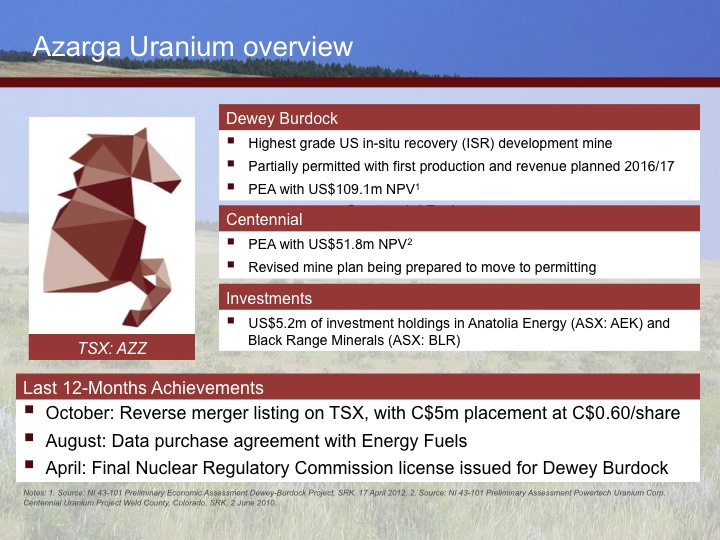

The result is TSX-listed Azarga Uranium (AZZ.TO), which emerged from the combination of privately held Azarga Resources and Powertech Uranium.

The company’s flagship deposit is the advanced-stage Dewey Burdock project in South Dakota, which is in the final stages of permitting on the path to production. Azarga has also assembled projects in Colorado, Wyoming and Kyrgyzstan, and owns stakes in two Australia-listed uranium explorers, Black Range Minerals and Anatolia Energy, with projects in the U.S. and Turkey, respectively.

“In the uranium downturn when no one was looking, we were able to analyze and objectively work out where the best projects on the planet were and try and buy them,” Molyneux, Azarga’s chairman, said in a recent phone interview from Hong Kong.

The timing couldn’t have been better.

The price of uranium has climbed to $43/lb from multi-year lows of $28 in the summer, prompting a rally in the shares of uranium producers, developers and explorers. The spot price has since dropped back to $40/lb but Molyneux is bullish, telling Bloomberg TV in arecent interview he expects the price to climb to the $70 to $80 range.

An NI 43-101 resource estimate for Azarga’s Dewey Burdock shows more than 6.6 million pounds of indicated and another 4.5 million pounds of inferred resources contained in 2.8 million tons averaging 0.198% uranium.

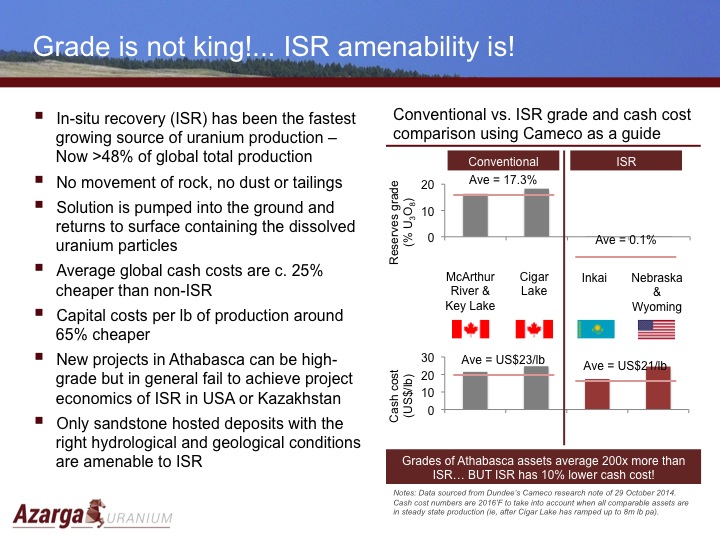

Dewey Burdock would mine the uranium using in-situ-recovery (ISR), a low-cost, low-impact method that gives Azarga an advantage over higher-grade deposits that require much more intensive mining methods, Molyneux says.

“In uranium, grade is not king, uranium mining method is king. And in-situ recovery is the lowest cost.”

In an ISR process, injection wells similar to those used to access water reservoirs are driven down into the fractured host rock containing the uranium. A solution is pumped into the ground and returns to the surface containing the dissolved uranium particles.

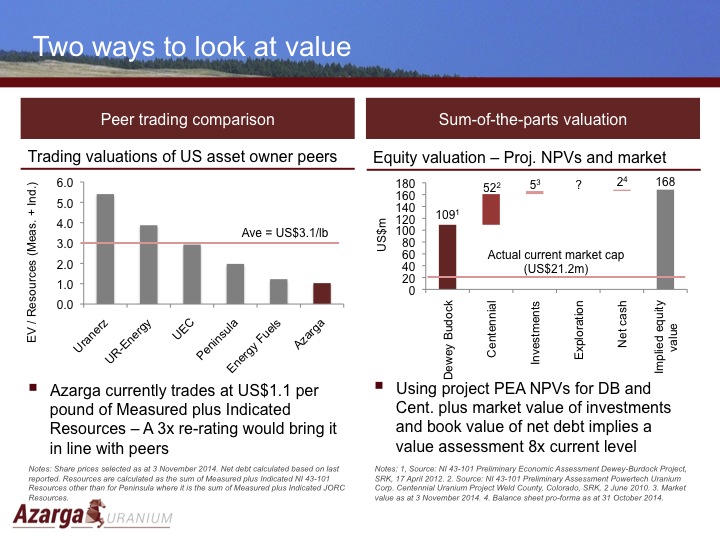

Azarga is currently updating its April 2012 PEA that shows a pre-tax NPV of $109 million (8% discount) with an IRR of 48% based on $65/lb uranium and initial capital costs of $54.3 million. Production costs average about $33/lb.

Even at $50/lb uranium, Dewey Burdock has healthy profit margins, Molyneux says, and capex will be lower in the new PEA.

“We have projects that can be built in the current uranium price environment at the current time. There’s almost nobody else on the planet that has that.”

Molyneux’s connections to high-net-worth individuals and Asian capital pools could come in handy when it comes time to build Dewey Burdock, which has initial capex of $54.3 million according to the current PEA.

Earlier this year, the U.S. Nuclear Regulatory Commission approved an operating licence for Dewey Burdock, but the project still requires environmental permits before it can start mining. Molyneux expects those to land in early 2015.

The Australian entrepreneur views uranium as a big part of the answer to the global energy riddle, where population and economic growth threaten a changing climate.

The big-time move into uranium came after a somewhat messy exit from SouthGobi Resources, the Mongolian coal miner that he grew to a $4-billion-plus market capitalization.

His partners in the new venture include Azarga’s director and VP of international operations Curt Church, formerly SouthGobi’s chief operating officer.

“We decided uranium had to be a core component of our next 30 years,” said Molyneux, former head of metals and mining investment banking, Asia, at Citigroup. “It’s the only energy that can solve the world’s climate crisis in that time horizon.”

The bullish demand outlook for uranium is well-documented. Japanese nuclear reactors are set to slowly come back online, with the first reactors likely restarting in January or February, Molyneux anticipates. More importantly, he says, the psychology of Japan’s return is helping to “normalize” the uranium market.

The growth of nuclear continues apace in China, which represents 40% of new nuclear power plants under construction. Molyneux believes China is actually accelerating their nuclear program, with the possibility of tripling nuclear capacity by 2020.

China is not the only country ramping up nuclear – even the United Arab Emirates is expanding its nuclear capacity – and nuclear still generates 20% of American electricity.

As the price of uranium increases, attention will shift from exploration to production and development stories, Molyneux predicts.

“The Fissions of the world are going to have interesting projects, probably in about 8 years when finished all their exploration and pre-development work. But who knows what uranium prices are going to be in 8 years time,” says Molyneux. “When uranium prices go up, more attention is paid to fundamentals and companies that can generate cash flow from higher uranium prices.”

“Sophisticated investors have been ignoring the sector.”

Access to those investors and to pockets of capital in Asia is another of Azarga’s unique advantages, says the well-connected Molyneux. He describes Azarga as a “hidden story” whose valuation has become disconnected from those of peers including: Uranerz, Ur-Energy, Uranium Energy and Uranium Resources.

Despite the recent sector-wide rally, Molyneux believes uranium equities still offer leverage to the spot price. He thinks uranium will normalize at the $70 level but probably double from current prices to the $80 level.

“The uranium sector revival is a 2015 to 2017 event.”

$AZZ.TO, AzargaUranium.com, and @AzargaUranium for more information. They have put together an impressive web site which is worth checking out here.

The information contained in this article is for informational purposes only. It is not intended to provide legal, accounting, tax, investment, financial or other advice to you, and you should not rely upon the information to provide any such advice. This article is not to be construed as a form of promotion, an offer to sell securities or as a solicitation to purchase our securities. This article has been produced as a source of general information only.

Disclaimer for Forward-Looking Information

Certain statements contained herein constitute “forward-looking statements” within the meaning of applicable United States of America securities legislation and “forward-looking information” within the meaning of applicable Canadian securities legislation. All statements that are not historical facts, including without limitation statements regarding future estimates, plans, objectives, assumptions or expectations of future performance, are “forward-looking statements” or “forward looking information”. Such statements reflect the expectations of management at the time the “forward looking information” was posted; however, there is no assurance that these statements will prove to be true. We caution you that such “forward-looking statements” involve known and unknown risks and uncertainties, including: (1) any negative change in the law, regulatory or political environment which would negatively affect the Company’s ability to obtain all necessary environmental and regulatory approvals. licenses and permits, (2) the inherent uncertainties and speculative nature associated with uranium exploration, including the actual results of current exploration activities, conclusions of economic evaluations, changes in project parameters as plans continue to be refined, possible variations in grade and ore densities or recovery rates, failure of plant, equipment or processes to operate as anticipated, accidents or other risks of the mining industry, (3) a decrease in the demand for and/or a decrease in the price of uranium, (4) an increase in the operating costs associated with the extraction and processing of the uranium, (5) any number of events or causes which may delay or cease exploration and development of the Company’s property interests, such as environmental liabilities, weather, mechanical failures, safety concerns and labor problems, (6) the risk that the Company does not execute its business plan, (7) inability to retain key employees, (8) inability to finance operations and growth, including the inability to raise the funding necessary to commence construction and complete the facility at the Dewey-Burdock Project, (9) an extended downturn in general economic conditions in North America and internationally, (10) an increase in the number of competitors with larger resources, and (11) other factors beyond the Company’s control. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in “forward-looking statements” or information, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended. There can be no assurance that any “forward-looking statements” or information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on “forward-looking statements” or information. The Company expressly disclaims any obligation to update any “forward-looking statements” other than as required by applicable law. For additional information regarding assumptions relied upon in making any “forward-looking statements” and on the risks and uncertainties that may cause actual results to differ materially from those anticipated in any “forward-looking statements”, please refer the our public disclosure filed with Canadian securities regulatory authorities on SEDAR at www.sedar.com under our profile, and in particular to the sections entitled “Disclaimer for Forward Looking Information” and “Risks and Uncertainties” in our most recently filed Management Discussion and Analysis, a copy of which is available on SEDAR.

Cautionary Note Concerning Technical Information

Unless otherwise indicated, technical information on this website regarding the Dewey Burdock Property is derived from the Company’s technical report entitled “Updated Technical Report on the Dewey-Burdock Uranium Project Custer and Fall River Counties South Dakota” with an effective date of March 1, 2010 prepared by Jerry Bush P. Geo. Such information is based on assumptions, qualifications and procedures, which are not fully described herein. Reference should be made to the full text of these technical reports, which were filed under the Company’s profile on SEDAR at www.sedar.com, you may also find the report here. Richard Clement is a Qualified Person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects and is responsible for and has approved the technical disclosure on this website.

Unless otherwise indicated, technical information on this website regarding the Centennial Property is derived from the Company’s technical report entitled “NI 43-101 Preliminary Economic Assessment Powertech Uranium Corp. Centennial Uranium Project Weld County, Colorado” with an effective date of June 2, 2010 prepared by Allan V. Moran, R.G., CPG and Frank Daviess, MAussIMM. Such information is based on assumptions, qualifications and procedures, which are not fully described herein. Reference should be made to the full text of these technical reports, which were filed under the Company’s profile on SEDAR at www.sedar.com, you may also find the report here. Richard Clement is a Qualified Person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects and is responsible for and has approved the technical disclosure on this website.

Unless otherwise indicated, technical information on this website regarding the Aladdin Property is derived from the Company’s technical report entitled “Technical Report on the Aladdin Uranium Project Crook County, Wyoming” with an effective date of June 21, 2012 prepared by Jerry Bush, P. Geo. Such information is based on assumptions, qualifications and procedures, which are not fully described herein. Reference should be made to the full text of these technical reports, which were filed under the Company’s profile on SEDAR at www.sedar.com, you may also find the report here. Richard Clement is a Qualified Person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects and is responsible for and has approved the technical disclosure on this website.

Unless otherwise indicated, technical information on this website regarding the Kyzyl Ompul Property is derived from the Company’s technical report entitled “NI 43-101 Technical Report on the Kyzyl Ompul Licence, Kyrgyz Republic” with an effective date of April 14, 2014, prepared by Stephen Hyland P. Geo. and Samuel Ulrich P. Geo. Such information is based on assumptions, qualifications and procedures, which are not fully described herein. Reference should be made to the full text of these technical reports, which were filed under the Company’s profile on SEDAR at www.sedar.com, you may also find the report here. Curtis Church is a Qualified Person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects and is responsible for and has approved the technical disclosure on this website.

Disclosure of Mineral Reserves and Mineral Resources

Readers are advised that National Instrument 43-101 (“NI 43-101”) of the Canadian Securities Administrators requires that each category of mineral reserves and mineral resources be reported separately. Readers should refer to the most recent annual information form of Azarga Uranium Corp. (“Azarga”) and other continuous disclosure documents filed by Azarga, available at www.sedar.com, for this detailed information, which is subject to the qualifications and notes set forth therein.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

This website uses the terms “Measured”, “Indicated” and “Inferred” Resources. United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. United States investors are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. United States investors are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists, or is economically or legally mineable.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.