Kenorland Minerals (TSXV:KLD) has announced that an earn-in agreement with Antofagasta (LSE:ANTO) has been signed for the Tanacross copper-gold project in eastern Alaska. Antofagasta is granted the option to acquire a 70% interest in the Tanacross project by spending US$30,000,000 over 8 on exploration. As part of the agreement, the company will need to deliver a NI 43-101 compliant preliminary economic assessment report for the project.

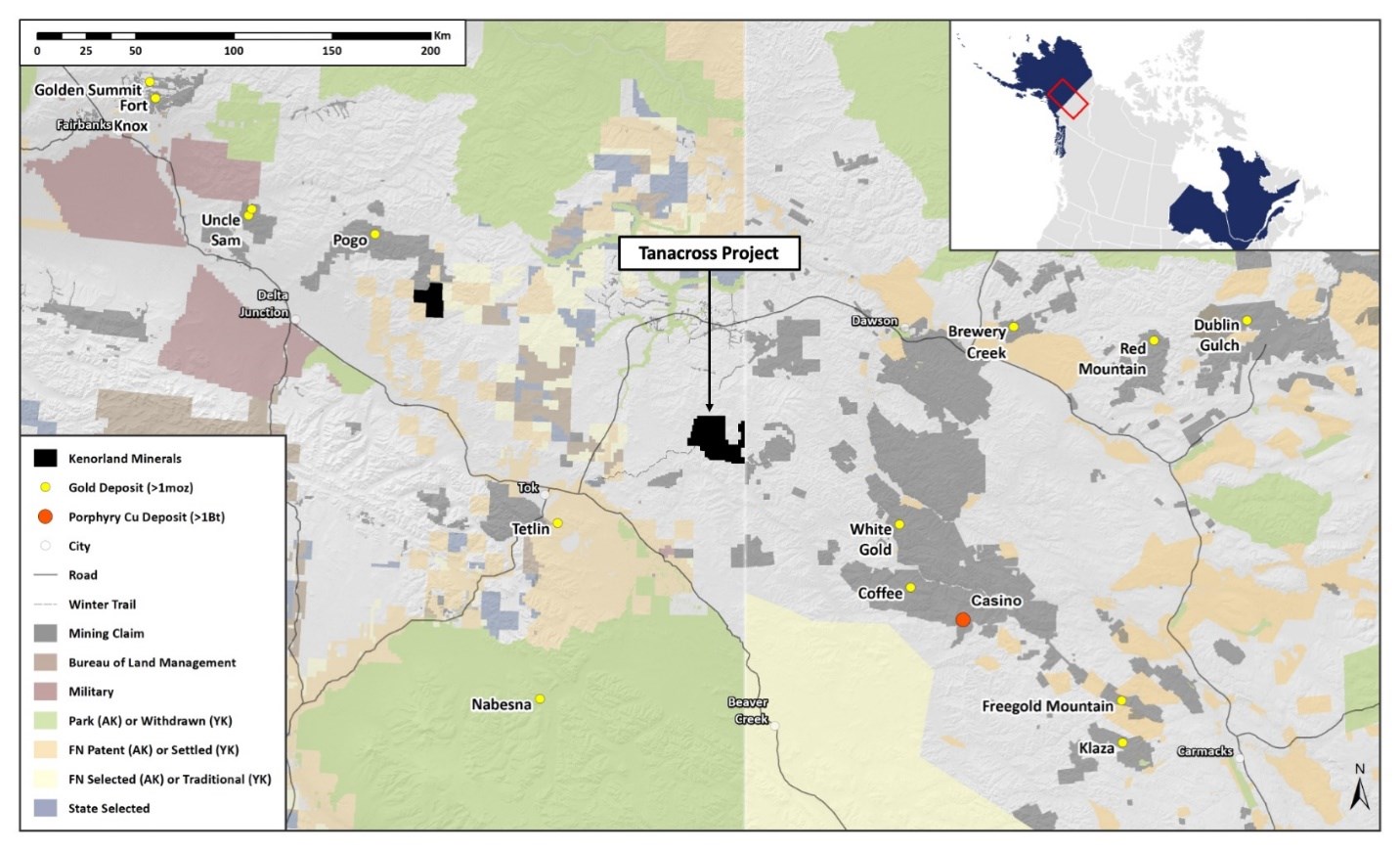

The Tanacross project is 45,000 hectares of Alaskan state-owned land roughly 70 kilometres northeast of Tok. Located near the Alaska Highway, Tanacross hosts a cluster fo late Cretaceous porphyry coper occurrences. These are spread out across West Taurus, East Taurus, and Bluff. The region is known for similar systems, locating the project in an advantageous zone. Tanacross has already had 17,076 metres of drilling over 67 drill holes since 1971 when the initial discovery of East Taurus was made by the Duval Corporation.

Zach Flood, CEO of Kenorland, commented in a press release: “We’re very excited to be working with Antofagasta on the Tanacross Project. The property, which covers numerous mineralised systems and target areas, warrants significant exploration to unlock the discovery potential that we believe exists. We look forward to getting back on the ground as soon as possible to begin work which will lead towards drill-target definition.”

Agreement Terms

Antofagasta can earn a 70% interest in Tanacross by making cash payments in an aggregate amount of US$1,000,000 plus a success payment of US$4,000,000 upon exercise of the option and spending US$30,000,000 on exploration over eight years, with a firm commitment to spend US$1,000,000 in year one, and delivering the Report. During the option period, Antofagasta will fund all exploration and Kenorland will be the initial operator.

Once Antofagasta has earned its 70% interest, Kenorland and Antofagasta will form a 30:70 joint venture. If either party’s interest in the joint venture falls below 10%, that party’s interest will be converted to a 2% NSR, one quarter of which can be purchased by the other party for US$2,000,000.

Source: Kenorland Minerals

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.