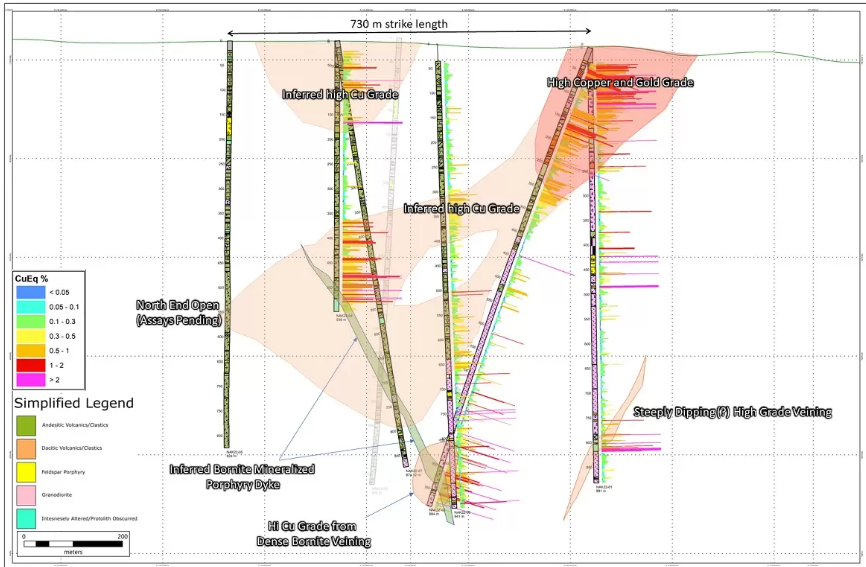

American Eagle Gold (TSXV:AE) has reported new assay results from its NAK copper-gold porphyry project of significant high-grade surface and depth zones. The results come from the third and fourth holes from the 2022 drill program at the project.

Anthony Moreau, American Eagle’s CEO, commented in a press release: “This fourth drill hole is our best intercept to date and encountered a new higher-grade copper-rich zone 500 metres from our discovery hole. Hole NAK22- 04 ended within a wide high-grade zone but was unfortunately terminated early for technical reasons; however, holes NAK22-06 and – 07 successfully intersected the continuation of the same zone at depth and hit similar mineralization. We anticipate that the pending assays from those two holes will show similar results. Our step-out drilling continues to demonstrate a substantial footprint for this system.”

Highlights from the results are as follows:

- NAK22-04 returned 527 m @ 0.45% copper equivalent (“CuEq”) from surface, including 185 m @ 0.74% CuEq, and ended in high-grade mineralization (88 m @ 0.98% CuEq), representing the best deep intercept to date in the 2022 drill program

- NAK22-04 appears to have intersected a new copper-rich zone at depth, 500 metres north of discovery hole

- NAK22-03 and NAK22-04 are very widely spaced step-out holes from:

- NAK22-01: 126 m @ 1.05% CuEq from surface within 851 m @ 0.37% CuEq

- NAK22-02: 301 m @ 0.61% CuEq from surface within 956 m @ 0.37% CuEq

- Footprint is 1.5 km X 1.5 km and 1 km deep and is open in all directions

- Large bulk tonnage potential with high-grade surface and depth zones developing

- All holes show widespread mineralization, including high-grade zones

- Assays for holes NAK22-05, -06 & -07 are pending

Highlights of NAK’s 2022 Drill Program:

- NAK22-01 returned 851 m of 0.37% CuEq, including 126 metres of 1.05% CuEq from surface

- NAK22-02 returned 956 m of 0.37% CuEq, including 301 metres of 0.61% CuEq from surface

- NAK22-03 returned 906 m of 0.21% CuEq from surface, including 645 metres of 0.24% CuEq

- NAK22-04 returned 527 m of 0.45% CuEq from surface, including 89 metres of 0.98% CuEq

NAK22-04 Assay Results: Table 1

| From (m) | To (m) | Length (m) | Au (g/t) | Cu (%) | Ag (g/t) | Mo (ppm) | Cu Eq % |

| 20.28 | 548 | 527.72 | 0.11 | 0.32% | 1.55 | 63 | 0.45% |

| Including | |||||||

| 20.28 | 166.59 | 146.31 | 0.07 | 0.44 | 1.4 | 27 | 0.51% |

| And Including | |||||||

| 439.2 | 528.0 | 88.8 | 0.27 | 0.69% | 4.5 | 98 | 0.98% |

| Within | |||||||

| 363.0 | 548.0 | 185.0 | 0.23 | 0.49% | 2.8 | 91 | 0.74% |

*Copper Equivalent (CuEq) % calculated using copper and gold length weighted assay results, with commodity prices assumed at Cu = 3.50 USD/lb, Au = 1700 USD/oz, Ag = 20 USD/oz, and Mo = 21 USD/lb. CuEq grade, including copper, gold, silver, and molybdenum based on 100% recoveries, is calculated using the following equation: CuEq. = Cu % + (Au grade in g/t x [Au price ÷ 31] / [Cu price x 2200]) + (Ag grade in g/t x [Ag price ÷ 31] / [Cu price x 2200] + (Mo grade in % x [Mo price x 2200] / [Cu price x 2200]). The assays have not been capped.

NAK22-03 Assay Results: Table 2

| From (m) | To (m) | Length (m) | Au (g/t) | Cu (%) | Ag (g/t) | Mo (ppm) | Cu Eq % |

| 35 | 941 | 906 | 0.06 | 0.14% | 0.87 | 38 | 0.21% |

| Including | |||||||

| 296 | 941 | 645 | 0.07 | 0.17% | 1.1 | 32 | 0.24% |

| Within | |||||||

| 296 | 433.77 | 137.77 | 0.11 | 0.20% | 0.84 | 36 | 0.30% |

| And Including | |||||||

| 502.67 | 672 | 169.33 | 0.10 | 0.20% | 1.2 | 38 | 0.30% |

| Within | |||||||

| 502.67 | 941 | 438.33 | 0.06 | 0.17% | 1.3 | 33 | 0.24% |

Collar details for holes drilled in the 2022 drill program: Table 3

| Hole | UTM_Grid | UTM_East | UTM_North | Azimuth | Dip |

| NAK22-01 | NAD83_Z9 | 675281 | 6129359 | n/a | -90 |

| NAK22-02 | NAD83_Z9 | 675281 | 6129359 | 340 | -70 |

| NAK22-03 | NAD83_Z9 | 675201 | 6129658 | n/a | -90 |

| NAK22-04 | NAD83_Z9 | 675181 | 6129862 | n/a | -90 |

| NAK22-05 | NAD83_Z9 | 675105 | 6130067 | n/a | -90 |

| NAK22-06 | NAD83_Z9 | 675376 | 6129782 | 260 | -77 |

| NAK22-07 | NAD83_Z9 | 675181 | 6129862 | 170 | -81 |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.