AbraSilver Resource (TSXV:ABRA) has reported assay results from the final set of drill holes conducted under its Phase III drilling program at its wholly-owned Diablillos property in Salta Province, Argentina. The drill holes were aimed at defining the scope of the JAC zone ahead of an upcoming Mineral Resource Estimate (MRE) and Pre-Feasibility Study (PFS) on the Diablillos project.

John Miniotis, President and CEO, commented in a press release: “We are delighted with the results of our highly successful Phase III drill campaign. The consistent, high-grade drill results encountered throughout the past year clearly demonstrate the large-scale silver-gold mineralization potential at our flagship Diablillos project. The completion of this drill campaign represents another major milestone for the Company and reinforces our belief in the tremendous value remaining to be unlocked through our ongoing exploration efforts.”

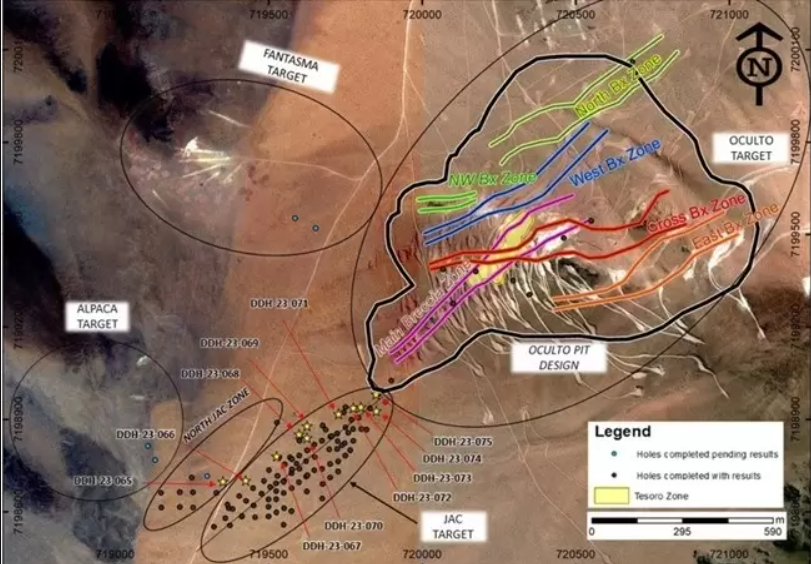

Drill holes DDH 23-066 to DDH 23-070 focused on mapping the northwestern edge of the JAC zone and consistently showed signs of silver mineralization. Notably, hole DDH 23-070 recorded a 64-meter intercept grading 148 grams per tonne (g/t) of silver at a downhole depth of 41 meters. Further, holes DDH 23-071 to DDH 23-075 were drilled to explore the northeastern edge of the JAC zone and also revealed varying degrees of silver mineralization. For example, hole DDH 23-075 intersected 15 meters grading 93 g/t of silver and 0.78 g/t of gold.

Results from DDH 23-075 were particularly noteworthy for demonstrating a continuity of mineralization between the JAC zone and the main Oculto deposit, raising the possibility of a combined open pit. Meanwhile, hole DDH 23-065 was drilled into the recently discovered JAC North zone, situated beyond the northwestern edge of the JAC zone. The hole intersected a near-surface layer of 7 meters grading 119 g/t of silver and 0.14 g/t of gold at a downhole depth of 85 meters, confirming a new significant mineralized structure in the area.

As of August 9, 2023, the JAC North zone is located over 900 meters beyond the conceptual open pit’s current Mineral Resource estimate at Oculto and approximately 100 meters northwest of the high-grade JAC zone. The company has also drilled six additional holes at nearby exploration targets, including JAC North, Alpaca, and Fantasma, the results of which are expected in the coming weeks.

With the successful completion of the Phase III drill program, AbraSilver Resource Corp. is now preparing an updated MRE, scheduled for completion within the next few weeks. This will be followed by a PFS on the Diablillos project. The Phase III program aimed to systematically grid drill the silver-dominant mineralization at the JAC zone, delineate its margins, and conduct necessary geotechnical drilling for a conceptual open-pit design. It also included reconnaissance drilling at other targets on the Diablillos land package.

The next phase of drilling, Phase IV, will prioritize targets based on a range of factors including distance from the probable porphyry progenitor beneath Oculto and structural trends revealed in magnetic surveys. Targets in the area west of Oculto such as JAC North, Alpaca, and Fantasma are currently the focus, with additional targets being developed to the east and north of Oculto.

Highlights from the results are as follows:

Table 1 – Summary of Diablillos Drill Results

| Drill Hole | Area | From (m) | To (m) | Type | Interval (m) | Ag g/t | Au g/t | ||||||

| DDH-23-065 | JAC North | 85.0 | 92.0 | Oxides | 7.0 | 119.1 | 0.14 | ||||||

| DDH-23-065 | 101.0 | 117.0 | Oxides | 16.0 | 63.4 | – | |||||||

| DDH-23-066 | JAC | 140.0 | 159.0 | Oxides | 19.0 | 68.9 | – | ||||||

| DDH-23-068 | JAC | 36.0 | 44.0 | Oxides | 8.0 | 175.4 | – | ||||||

| DDH-23-068 | 62.0 | 91.0 | Oxides | 29.0 | 69.6 | – | |||||||

| DDH-23-069 | JAC | 39.0 | 42.0 | Oxides | 3.0 | 58.4 | – | ||||||

| DDH-23-069 | 46.0 | 50.0 | Oxides | 4.0 | 36.4 | – | |||||||

| DDH-23-070 | JAC | 41.0 | 105.0 | Oxides | 64.0 | 148.1 | – | ||||||

| DDH-23-070 | 135.0 | 139.0 | Oxides | 4.0 | 93.9 | – | |||||||

| DDH-23-071 | JAC | 72.0 | 76.0 | Oxides | 4.0 | 32.2 | – | ||||||

| DDH-23-072 | JAC | 90.0 | 96.0 | Oxides | 6.0 | 56.1 | – | ||||||

| DDH-23-073 | JAC | 94.5 | 112.0 | Oxides | 17.5 | 68.9 | 0.20 | ||||||

| DDH-23-074 | JAC | 163.0 | 165.0 | Oxides | 2.0 | 41.8 | – | ||||||

| DDH-23-075 | JAC/Oculto | 94.5 | 102.0 | Oxides | 7.5 | 42.7 | – | ||||||

| DDH-23-075 | 112.0 | 127.0 | Oxides | 15.0 | 93.1 | 0.78 | |||||||

Note: All results in this news release are rounded. Assays are uncut and undiluted. Widths are drilled widths, not true widths. True widths are estimated to be approximately 80% of the interval widths for oxides.

Table 2 – Highlights of Phase III High-Grade Intercepts at JAC Zone

| Drill Hole | From (m) | To (m) | Type | Interval (m) | Ag (g/t) | Au (g/t) | AgEq1 (g/t) |

| DDH-22-019 | 89.0 | 176.0 | Oxides | 87.0 | 346.0 | 0.15 | 356.5 |

| DDH-22-044 | 121.0 | 179.0 | Oxides | 58.0 | 208.8 | 0.20 | 222.8 |

| DDH-22-046 | 123.0 | 165.5 | Oxides | 42.5 | 400.5 | 0.11 | 408.2 |

| DDH-22-052 | 139.5 | 164.5 | Oxides | 25.0 | 754.4 | 0.12 | 764.2 |

| DDH-22-053 | 140.5 | 168.5 | Oxides | 28.0 | 266.4 | 0.64 | 318.8 |

| DDH-22-056 | 110.0 | 167.5 | Oxides | 57.5 | 141.4 | 0.27 | 163.5 |

| DDH-22-057 | 144.0 | 164.0 | Oxides | 20.0 | 498.6 | 0.10 | 506.8 |

| DDH-22-060 | 114.0 | 154.0 | Oxides | 40.0 | 203.4 | – | 203.4 |

| DDH-22-061 | 65.0 | 168.0 | Oxides | 103.0 | 138.7 | – | 138.7 |

| DDH-22-062 | 119.0 | 170.0 | Oxides | 51.0 | 169.4 | 0.20 | 185.8 |

| DDH-22-063 | 56.0 | 85.0 | Oxides | 33.0 | 143.4 | – | 143.4 |

| DDH-22-063 | 135.0 | 169.0 | Oxides | 34.0 | 118.6 | 0.08 | 125.2 |

| DDH-22-067 | 143.0 | 179.0 | Oxides | 36.0 | 463.3 | 0.71 | 521.5 |

| DDH-22-067 | 179.0 | 206.0 | Sulphides | 27.0 | 745.0 | 1.54 | 871.1 |

| DDH-22-075 | 151.0 | 167.0 | Oxides | 16.0 | 604.4 | 0.82 | 671.5 |

| DDH-22-076 | 147.0 | 169.0 | Oxides | 22.0 | 476.8 | 0.20 | 493.2 |

| DDH-22-076 | 169.0 | 177.5 | Oxides | 8.5 | 1,952.8 | 6.66 | 2,498.3 |

| DDH-22-077 | 60.0 | 92.0 | Oxides | 32.0 | 121.9 | – | 121.9 |

| DDH-22-078 | 58.0 | 99.0 | Oxides | 41.0 | 103.5 | – | 103.5 |

| DDH-22-079 | 144.0 | 179.0 | Oxides | 35.0 | 199.2 | 0.36 | 228.7 |

| DDH-22-080 | 50.0 | 102.0 | Oxides | 52.0 | 125.1 | – | 125.1 |

| DDH-22-081 | 128.0 | 165.0 | Oxides | 37.0 | 179.3 | – | 179.3 |

| DDH-22-082 | 154.5 | 181.0 | Transition | 26.5 | 311.4 | 0.43 | 346.6 |

| DDH-22-083 | 159.0 | 184.0 | Transition | 25.0 | 773.8 | 0.28 | 796.7 |

| DDH-22-086 | 158.0 | 167.0 | Sulphides | 9.0 | 342.3 | – | 342.3 |

| DDH-23-002 | 148.0 | 165.0 | Transition | 17.0 | 288.6 | 0.14 | 300.1 |

| DDH-23-003 | 155.8 | 161.5 | Sulphides | 5.8 | 502.2 | – | 502.2 |

| DDH-23-004 | 136.0 | 150.0 | Oxides | 14.0 | 3,024.5 | 0.21 | 3,041.7 |

| DDH-23-007 | 115.0 | 119.0 | Oxides | 4.0 | 2,320.0 | – | 2,320.0 |

| DDH-23-009 | 161.0 | 169.5 | Oxides | 8.5 | 479.2 | 0.15 | 491.5 |

| DDH-23-010 | 132.0 | 177.5 | Oxides | 45.5 | 233.4 | – | 233.4 |

| DDH-23-014 | 127.0 | 173.5 | Oxides | 46.5 | 185.0 | 0.50 | 226.0 |

| DDH-23-017 | 92.0 | 104.0 | Oxides | 12.0 | 876.1 | – | 876.1 |

| DDH-23-021 | 161.5 | 193.5 | Oxides | 32.0 | 530.8 | 0.60 | 579.9 |

| DDH-23-024 | 144.0 | 161.0 | Oxides | 17.0 | 828.9 | – | 828.9 |

| DDH-23-025 | 100.0 | 179.0 | Oxides | 79.0 | 237.6 | 0.15 | 249.9 |

| DDH-23-036 | 140.0 | 150.0 | Oxides | 10.0 | 520.0 | 0.04 | 523.3 |

| DDH-23-039 | 105.0 | 124.0 | Oxides | 19.0 | 253.4 | – | 253.4 |

| DDH-23-046 | 157.0 | 160.0 | Oxides | 3.0 | 2,070.0 | 0.27 | 2,092.1 |

| DDH-23-061 | 134.0 | 153.5 | Oxides | 19.5 | 272.8 | – | 272.8 |

| DDH-23-070 | 41.0 | 105.0 | Oxides | 64.0 | 148.1 | – | 148.1 |

Note: All results are rounded. Assays are uncut and undiluted. Widths are drilled widths, not true widths. True widths are estimated to be approximately 80% of the interval widths.

1 AgEq based on 81.9(Ag):1(Au) calculated using long-term prices of US$25.00/oz Ag and US$1,750/oz Au, and 73.5% process recovery for Ag, and 86.0% process recovery for Au as demonstrated in the Company’s PEA in respect of Diablillos dated January 13, 2022, using formula: AgEq g/t = Ag g/t + Au g/t x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery).

Collar Data

| Hole Number | UTM Coordinates | Elevation | Azimuth | Dip | Depth (m) | |

| DDH 23-065 | E719351 | N7198699 | 4,141 | 0 | -60 | 152 |

| DDH 23-066 | E719425 | N7198702 | 4,147 | 0 | -60 | 182 |

| DDH 23-067 | E719526 | N7198780 | 4,155 | 0 | -60 | 155 |

| DDH 23-068 | E719599 | N7198852 | 4,162 | 0 | -60 | 170 |

| DDH 23-069 | E719625 | N7198879 | 4,164 | 0 | -60 | 152 |

| DDH 23-070 | E719625 | N7198840 | 4,165 | 0 | -60 | 191 |

| DDH 23-071 | E719728 | N7198918 | 4,173 | 0 | -60 | 175 |

| DDH 23-072 | E719250 | N7198710 | 4,135 | 0 | -60 | 173 |

| DDH 23-073 | E719800 | N7198941 | 4,178 | 0 | -60 | 170 |

| DDH 23-074 | E719850 | N7198928 | 4,182 | 0 | -60 | 176 |

| DDH 23-075 | E719849 | N7198982 | 4,182 | 0 | -60 | 179 |

About Diablillos

The 80 km2 Diablillos property is located in the Argentine Puna region – the southern extension of the Altiplano of southern Peru, Bolivia, and northern Chile – and was acquired from SSR Mining Inc. by the Company in 2016. There are several known mineral zones on the Diablillos property, with the Oculto zone being the most advanced with over 120,000 metres drilled to date. Oculto is a high-sulphidation epithermal silver-gold deposit derived from remnant hot springs activity following Tertiarty-age local magmatic and volcanic activity. Comparatively nearby examples of high sulphidation epithermal deposits include: Yanacocha (Peru); El Indio (Chile); Lagunas Nortes/Alto Chicama (Peru) Veladero (Argentina); and Filo del Sol (Argentina).

The most recent Mineral Resource estimate for the Oculto Deposit is shown in Table 3:

Table 3 – Oculto Mineral Resource Estimate – As of October 31, 2022

| Category | Tonnage (000 t) | Ag (g/t) | Au (g/t) | Contained Ag (000 oz Ag) | Contained Au (000 oz Au) |

| Measured | 19,336 | 98 | 0.88 | 60,634 | 544 |

| Indicated | 31,978 | 47 | 0.73 | 48,737 | 752 |

| Measured & Indicated | 51,314 | 66 | 0.79 | 109,370 | 1,297 |

| Inferred | 2,216 | 30 | 0.51 | 2,114 | 37 |

Notes: Effective October 31, 2022. Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. The Mineral Resource estimate is N.I. 43-101 compliant and was prepared by Luis Rodrigo Peralta, B.Sc., FAusIMM CP(Geo), Independent Consultant. The mineralization estimated in the Mineral Resource is sub-horizontal with sub-vertical feeders and a reasonable prospect for eventual economic extraction by open pit methods.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.