Abitibi Metals (CSE:AMQ) has announced the successful completion of the first phase of its maiden drill program at the B26 Polymetallic Deposit. The drill program, which is part of a larger, fully funded 50,000-metre campaign planned for 2024 and 2025, aims to advance the understanding of the deposit and test its open-pit potential.

The B26 Polymetallic Deposit is located within the renowned Abitibi Greenstone Belt, a region known for its rich history of base and precious metal production, including the Detour and Casa Berardi Mines. The project comprises 66 claims covering an area of 3,328 hectares in the Eeyou Istchee Baie-James territory. Abitibi Metals secured an option agreement with SOQUEM Inc., a subsidiary of Investissement Québec, on November 16th, 2023, which grants the company the right to earn an 80% interest in the project over a period of 7 years.

Jonathon Deluce, CEO of Abitibi Metals, commented in a press release: “We are thrilled with these initial results of our maiden drill program at the B26 Polymetallic Copper Deposit. We had initially planned to drill 2,750 metres but with the continued success in drilling and support from our shareholders, we expanded our maiden program to 13,500 metres, larger than our initial total program for 2024. The significance of this program cannot be understated. Part of our thesis when we optioned B26 was to assess the potential open-pit component that could be added to the historical underground resource. Our strategy for this maiden program was to primarily concentrate on high-priority targets within the Main Deposit to a depth of 300 metres, and the results from #293, #294, #300 and #301, which identified significant near-surface high metal factor zones, support our thesis of assessing the open-pit potential at B26 further. With the recently completed financing bringing our total treasury to approximately $19 million, we are well-positioned to build on this maiden program with a further 36,500 metres to be drilled into 2025. I look forward to sharing the remaining results in the coming weeks as we prepare for the next phase of drilling in the Spring of 2024.”

Phase 1 of the drill program consisted of 44 diamond drill holes, totaling 13,502 metres. This initial phase is part of a larger, fully funded 50,000-metre program that the company plans to complete between 2024 and 2025. Assay results from the first 10 holes have already been released, with results from the remaining 34 holes expected to be announced in the coming weeks, once the data has been received and compiled.

Abitibi Metals’ strategy for developing the B26 Deposit in 2024 is centered around five key milestones:

- Expansion of the Drill Program: Building upon the 13,500 metres completed in Phase 1, the company plans to drill an additional 16,500 metres in 2024, contributing to the overall goal of 50,000 metres by 2025.

- Updating the Internal Resource Estimate and 3D Geological Model: The company recently announced its first 3D model of the project, which integrates data from the maiden drill program with over 115,000 metres of historical drilling conducted by SOQUEM. This updated model represents a significant advancement in understanding the geological controls of mineralization within the deposit and is expected to improve confidence in an updated internal mineral resource estimate currently underway.

- Conducting a Gravity Survey: To further enhance the understanding of the deposit’s geology, Abitibi Metals plans to conduct a Gravity Survey grid covering extensions of the VMS contact. This survey will help model the mafic-felsic contacts and sulphide-rich environment, aiding in the targeting of new mineralized extensions and satellites at shallow to moderate depths (300 to 600 metres). The company believes that an integrated geophysics approach could lead to additional discoveries on the property.

- Evaluation of Assay Preparation Protocols: Addressing the recommendations made by SGS in the 2018 resource estimate, Abitibi Metals has implemented a series of assaying protocols to control QAQC issues from the outset of the project. These adjustments include finer crushing of samples (95% passing 1.7 mm) and pulverizing a larger 1 kg split down to 106 µm (150 mesh). The company believes these measures will help to better evaluate higher-grade areas of the deposit, as demonstrated by the results of drillhole 1274-24-293, which highlight the potential for grade increases within specific areas.

- Assaying Historical Unassayed Core: The 2018 resource estimate by SGS identified 8,300 metres of historical unassayed core within the mineralized corridor. Abitibi Metals intends to assay these identified areas to refine the deposit model and better delineate the boundaries of the mineralization.

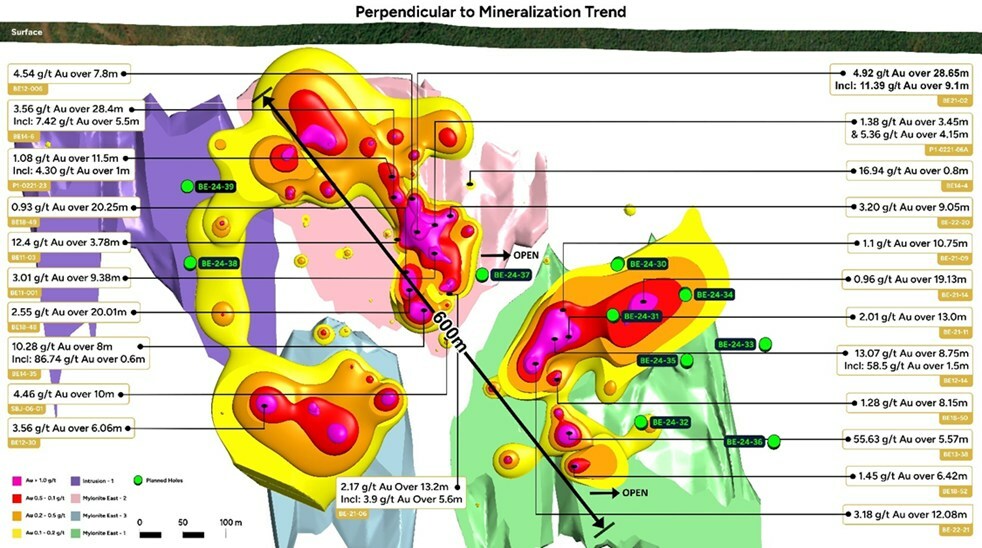

In addition to the ongoing work at the B26 Deposit, Abitibi Metals is also conducting drilling at the nearby Beschefer Gold Project, located just 7 km to the northeast. As of April 22, 2024, the company has completed 5 holes totaling 1,679 metres in the East Zone, which has historically yielded high-grade gold intercepts, including 55.63 g/t gold over 5.57 metres and 13.07 g/t gold over 8.75 metres. The company is on track to complete a total of 2,975 metres across 10 holes at the Beschefer Project.

The B26 Polymetallic Deposit represents a significant opportunity for Abitibi Metals to develop a copper, zinc, gold, and silver resource in a region with a rich mining history. The deposit has a strike length of 1 km and a depth extent of 0.8 km, both of which are open to expansion. With year-round road access and a power line running through the project, Abitibi Metals is well-positioned to advance the exploration and development of this promising asset.

As the first public company to have the option to earn into the B26 Deposit, Abitibi Metals is committed to delivering shareholder value through an aggressive exploration approach. The fully financed 50,000-metre drill program, spanning 2024 and 2025, will focus on advancing the historical 2018 resource while simultaneously testing the deposit’s open-pit potential.

With the successful completion of Phase 1 drilling and assay results pending for the remaining 34 holes, Abitibi Metals is poised to make significant strides in understanding the B26 Polymetallic Deposit. The company plans to recommence drilling activities in early June, once the winter break-up concludes and Phase 2 targeting is finalized. As the exploration program progresses, investors and stakeholders can expect regular updates on the company’s advancements and discoveries at this exciting project in the heart of the Abitibi Greenstone Belt.

Highlights from the results are as follows:

- B26 Main Deposit: 36 holes were completed, totalling 10,469.5 metres, to evaluate the open pit potential and potential up-dip near-surface extensions of the Main Deposit to the north and infill gaps in the model.

- Satellite West: 5 holes were completed, totalling 1,716 metres, targeting the geometric continuity of a potential satellite zone 500 metres to the west of the Main Deposit.

- Eastern Extension: 3 holes were completed, totalling 1,317 metres, targeting the expansion of the main deposit to the east where 2.45% Cu Eq over 26.7 metres, including 4.74% CuEq over 11.7 metres (1274-14-167) was intercepted in historical drilling.

- Phase 1 highlight intervals to date include:

-

- #1274-24-293: 2.6% CuEq over 37.0 metres beginning at 106 metres depth, including 6.3% CuEq over 10.6 metres

- #1274-24-294: 2.5% CuEq over 61.3 metres beginning at 128.6 metres depth, including 11.4% CuEq over 10.6 metres

- #1274-24-300: 5.35% CuEq over 8.1 metres beginning at 251.5 metres depth

- #1274-24-301: 1.47% CuEq over 97.5 metres beginning at 30.5 metres depth, including 3.9% CuEq over 21.9 metres

- Historical 2018 resource prepared by SGS Canada Inc. for SOQUEM Inc. that includes 254 holes over 115,311 meters, advancing the asset to a significant resource that includes, across all categories, 400 million pounds of copper, 286,000 ounces of gold, and significant zinc silver exposure.

- B26 Historical Resource Summary1 (2018)

-

- Indicated: 6.97 Mt at 2.94% Cu Eq (1.32% Cu, 1.80% Zn, 0.60 g/t Au and 43 g/t Ag)

- Inferred: 4.41 Mt at 2.97% Cu Eq (2.03% Cu, 0.22% Zn, 1.07 g/t Au and 9 g/t Ag)

- Historical drilling by SOQUEM has established the continuity down to a vertical depth of 800 meters and the deposit remains open at depth and laterally with strong historical intercepts including:

-

- 2.32% Cu Eq over 89.5 metres (1274-13-117)

- 3.05% Cu Eq over 48.1 metres (1274-16-224)

- 8.95% Cu Eq over 11.5 metres (1274-14-152)

- The B26 deposit is situated within 7 km of the historical Selbaie Mine, a Polymetallic Deposit with a variety of mineralization styles and element combination, that had a historical resource of 56.9 Mt @ 0.87% Cu, 1.85% Zn, 0.55 g/t Au, 39 g/t Ag (CONSOREM 2012). Reference to this nearby property is for information only, and there are no assurances that the Company will achieve the same results at the B26 Deposit.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.