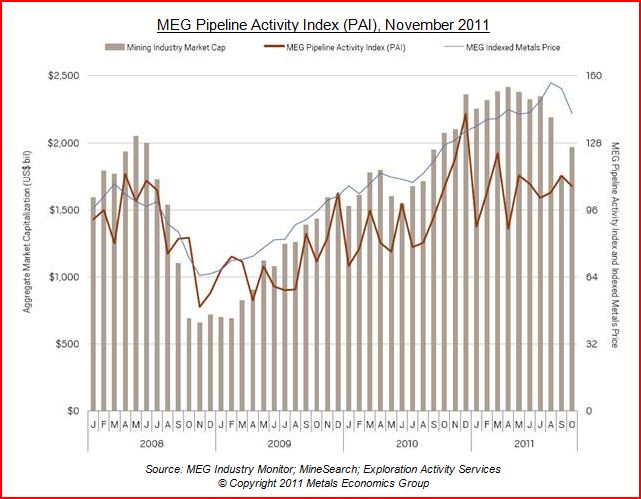

Metals Economics Group Pipeline Activity Index (PAI) increased for the second consecutive month to reach a four-month high in September, driven by impressive numbers of significant drill results and a jump in initial gold resource announcements. In October, however, the increased number of significant drill results was not enough to outweigh poor financing conditions, dropping the PAI slightly.

The industry’s aggregate market cap plummeted during a rough September, falling below $1.8 trillion for the first time since August 2010. Market caps recovered to $1.96 trillion in October—still below 2011’s year-to-date monthly average of $2.23 trillion.

Despite softening metals prices, the number of significant drill results increased in the September-October period. The impact of recently fluctuating metals prices and ongoing market turmoil on explorers—especially juniors—will likely play out during the remainder of 2011 and into early 2012. North America, Latin America, and Australia-Pacific together accounted for 77% of the significant gold results and 86% of the base metals results in September-October—up from 68% and 72% respectively for the corresponding period in 2010.

The number of initial resources announced in September matched 2011’s one-month high. Gold led and September’s numbers presented the second-highest one-month total since 2008, which is not surprising given the steady rise in gold exploration seen throughout most of 2010 and 2011. Latin American projects accounted for four of the top five initial gold resources and two of the top five initial base metals resources, giving the region 57% of the overall in-situ value of resources announced in September-October.

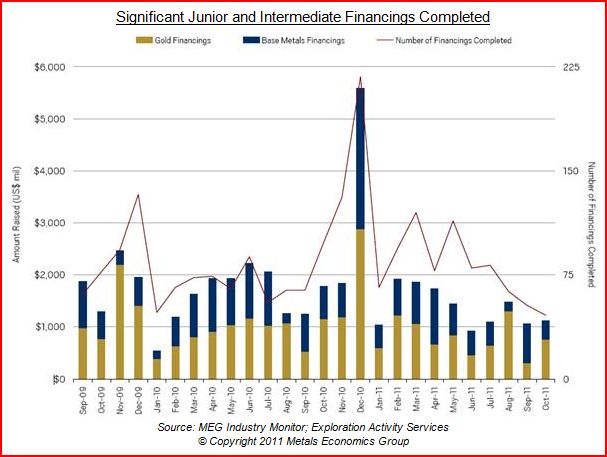

The number of significant financings (US$2 million minimum) completed by junior and intermediate companies slid for the third consecutive month in October, as already-volatile markets continued to be hampered by global growth concerns and sovereign debt problems. With $1.07 billion raised, September-October marks the lowest total for gold financings since January-February 2010. In addition, the number of base metals financings marks the lowest total for this group since May-June 2009.

From the report entitled, “Metals Economics Group Pipeline Activity Index, November 2011” by Metals Economics Group. Metals Economics Group (MEG) is a trusted source of global mining information and analysis. With three decades of comprehensive information and analysis, MEG has an unsurpassed level of experience and historical data. The information provided herein has been provided to MiningFeeds.com by the author and, as such, is subject to our disclaimer: CLICK HERE.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.