The global demand for minerals has placed a spotlight on the need for a stronger industrial base, one that includes more domestic production and processing of metals that are critical for a modern society. Energy security is strongly linked to mining, as minerals are essential ingredients in the production of energy technologies. Despite the critical role of minerals in securing economic futures and the protection of our planet, the U.S. continues to delay many high-value mining projects while deepening import dependence on the materials they provide.

Current energy disruptions have made it even more clear that a mineral and metals supply chain that relies heavily on a handful of countries can make the whole chain weak. Since Russia’s invasion of Ukraine, the U.S. and EU have looked for ways to reduce their dependence on Russian natural gas. One promising solution is to develop shale gas resources in the United States, which would help create jobs and reduce greenhouse gas emissions. However, this process requires large amounts of minerals, such as sand, clay, and limestone – all of which are in short supply.

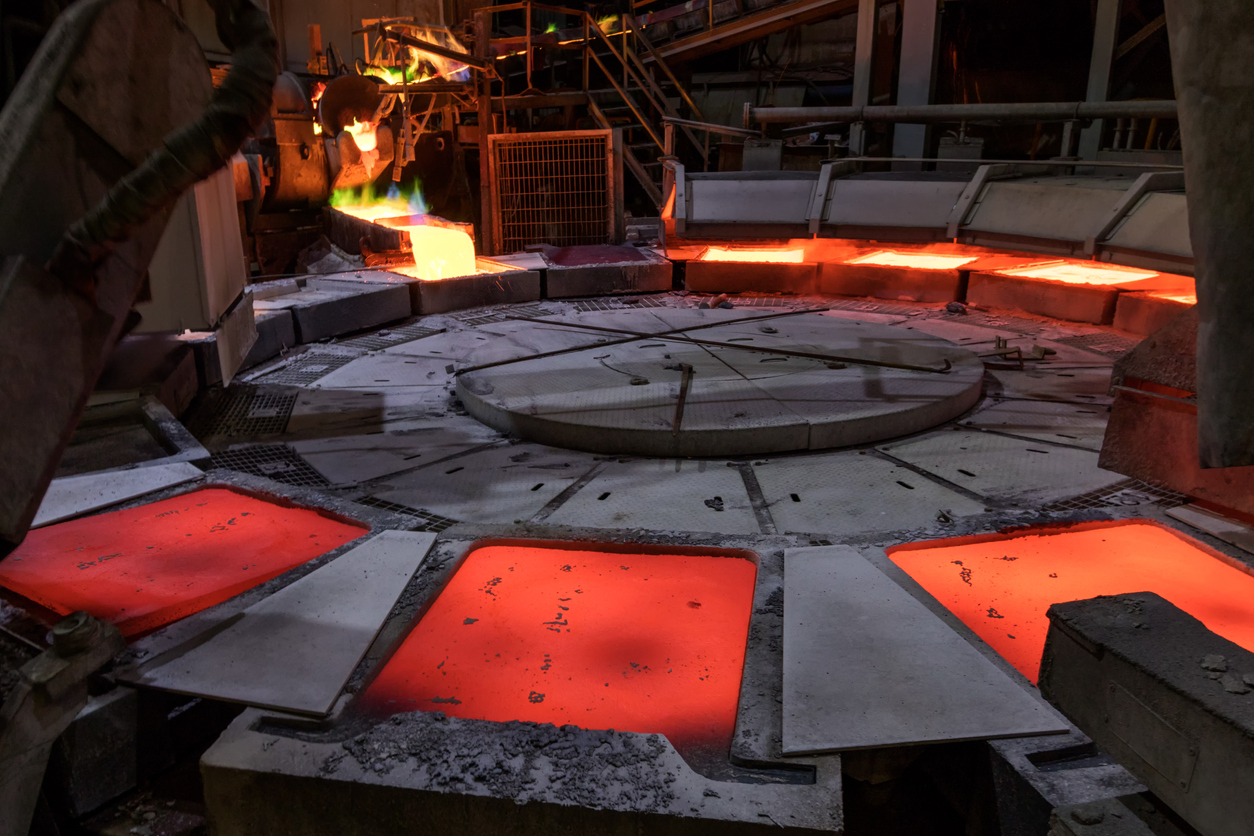

Copper is another tight market being squeezed due to other supply chain issues that were exacerbated during the COVID-19 pandemic. New projects are in short supply, so companies are often eager to acquire new high-grade copper projects when they become available. The Warintza Project in southeastern Ecuador is operated by Solaris Resources (TSX:SLS) a junior mining company that is currently advancing the project towards production.

The Warintza Project has the potential to fill some of the gaps in the current copper market. The project is expected to produce approximately 100 million pounds of copper per year, making it one of the largest copper mines in Ecuador. In addition, the Warintza Project has been called a potential “super pit”, and has released a mineral resource estimate for a significant ‘Indicative Starter Pit’. The company reported in-pit resources of 579 Mt at 0.59% CuEq (Ind) and 887 Mt at 0.47% CuEq (Inf), and 180 Mt at 0.82% CuEq (Ind) and 107 Mt at 0.73% CuEq (Inf) at the time. Most recently, Solaris reported assay results from a series of holes aimed at growing the Northeast Extension of the ‘Indicative Starter Pit’.

Copper is another area the United States and many other countries are looking to lower import dependence. Companies like Tesla, a large consumer of copper for car and battery technology, have been vocal about their desire to source minerals from North America. The Warintza Project could play a role in meeting this demand, as it is located in an area with good infrastructure and a skilled workforce.

The vulnerability of the energy industry has accelerated the calls for renewable energy sources that would reduce or eliminate the dependence on oil and gas from other countries. To bolster domestic supply, it will require projects like the Warintza Project to fill the demand that continues to grow faster than supply. Junior mining companies will play a larger role in a future of energy security than ever before.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.