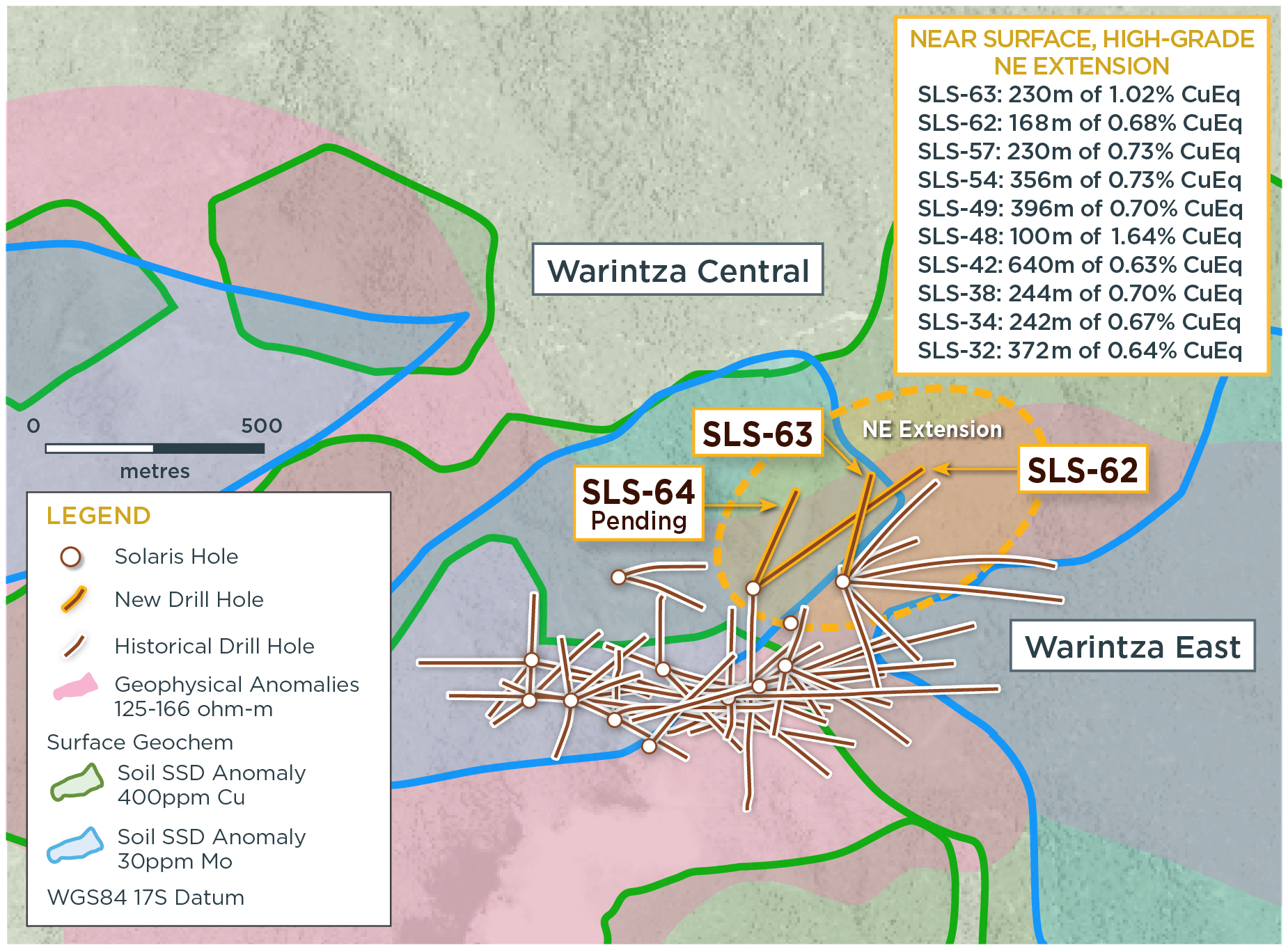

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has announced this morning new assay results from a series of holes aimed at growing the Northeast Extension of the “Indicative Starter pit” at the Warintza Project. The “Indicative Starter Pit” was noted in an April 18, 2022 announcement from the company in a mineral resource estimate for the Warintza Central Deposit, in which the company reported in-pit resources of 579 Mt at 0.59% CuEq (Ind) and 887 Mt at 0.47% CuEq (Inf), and 180 Mt at 0.82% CuEq (Ind) and 107 Mt at 0.73% CuEq (Inf) for the “Indicative Starter Pit”. The company has been targeting high-grade extensions and major growth in cluster at the project, with ongoing drilling focused on open extensions of near surface, high-grade mineralization to the northeast and southeast of Warintza Central.

Mr. Jorge Fierro, Vice President, Exploration, commented in a press release: “Ongoing drilling from existing and newly constructed platforms aims to expand on the Northeast Extension zone, which is one of the key target areas for the expansion of the ‘Indicative Starter Pit,’ along with higher grade, near surface mineralization being targeted at Warintza East, where results are pending.”

Highlights from the results are as follows:

Additional drilling has expanded the Northeast Extension of the ‘Indicative Starter Pit’ recently estimated at 180 Mt at 0.82% CuEq1 (Indicated) and 107 Mt at 0.73% CuEq1 (Inferred) within the Warintza Mineral Resource Estimate² (“MRE”). This zone is characterized by near surface, high-grade mineralization and remains open for further growth with follow-up and step-out drilling underway.

- SLS-62 was collared at the northern limit of Warintza Central and drilled northeast into an open volume, returning 168m of 0.68% CuEq¹ from 102m depth within a broader interval of 900m of 0.45% CuEq¹ from surface, expanding on prior drilling further to the east

- This hole represents the first follow-up to SLS-48, collared from the same pad but drilled to the south, which returned 100m of 1.64% CuEq³ from 50m depth within a broader interval of 852m of 0.56% CuEq³ (refer to press release dated Feb 28, 2022)

- SLS-63 was collared at the northeastern limit of the Warintza Central grid approximately 200m to the east and drilled into an open volume to the north-northeast, returning 230m of 1.02% CuEq¹ from 118m depth within a broader interval of 472m of 0.76% CuEq¹ from surface

- This hole follows on SLS-57, which was drilled northeast from the same pad, returning 230m of 0.73% CuEq¹ from 56m depth within a broader interval of 926m of 0.61% CuEq¹ from surface and SLS-54, drilled to the south and returning 356m of 0.73% CuEq³ from 50m depth within a broader interval of 1,093m of 0.56% CuEq³ from surface (refer to press releases dated May 26 and Apr 4, 2022)

- Follow-up drilling is underway and aims to test the Northeast Extension zone further to the north and northeast, with assays expected shortly for SLS-64, representing a follow-up hole from the same pad as SLS-62 and SLS-48

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLS-63 | Jul 20, 2022 | 0 | 472 | 472 | 0.60 | 0.02 | 0.12 | 0.76 |

| Including | 118 | 348 | 230 | 0.87 | 0.02 | 0.12 | 1.02 | |

| SLS-62 | 10 | 910 | 900 | 0.33 | 0.02 | 0.07 | 0.45 | |

| Including | 102 | 270 | 168 | 0.51 | 0.03 | 0.07 | 0.68 |

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-63 | 800383 | 9648303 | 1412 | 498 | 17 | -61 |

| SLS-62 | 800178 | 9648285 | 1439 | 943 | 55 | -60 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

Endnotes

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au, and assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical test work.

- Refer to Solaris press release dated April 18, 2022, stating updated Warintza Mineral Resource Estimate.

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of US$3.00/lb Cu, US$10.00/lb Mo, and US$1,500/oz Au. No adjustments were made for recovery prior to the updated Warintza Mineral Resource Estimate, as the metallurgical data to allow for estimation of recoveries was not yet available. Solaris defined CuEq for reporting purposes only.

Source: Solaris Resources

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.