Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has reported assay results from a series of holes at the Warintza Project. The drilling at the holes is aimed at upgrading and growing mineral resources at the project, which was recently released.

Mr. Jorge Fierro, Vice President, Exploration, commented in a press release: “Ongoing follow-up drilling from existing and newly constructed platforms aims to expand on the Northeast Extension zone and grow the high-grade indicative starter pit, while also targeting areas within Warintza Central where resource classification can be upgraded with targeted drilling. In addition, we have completed a considerable amount of drilling from our recent Warintza East discovery targeting major growth with assays pending.”

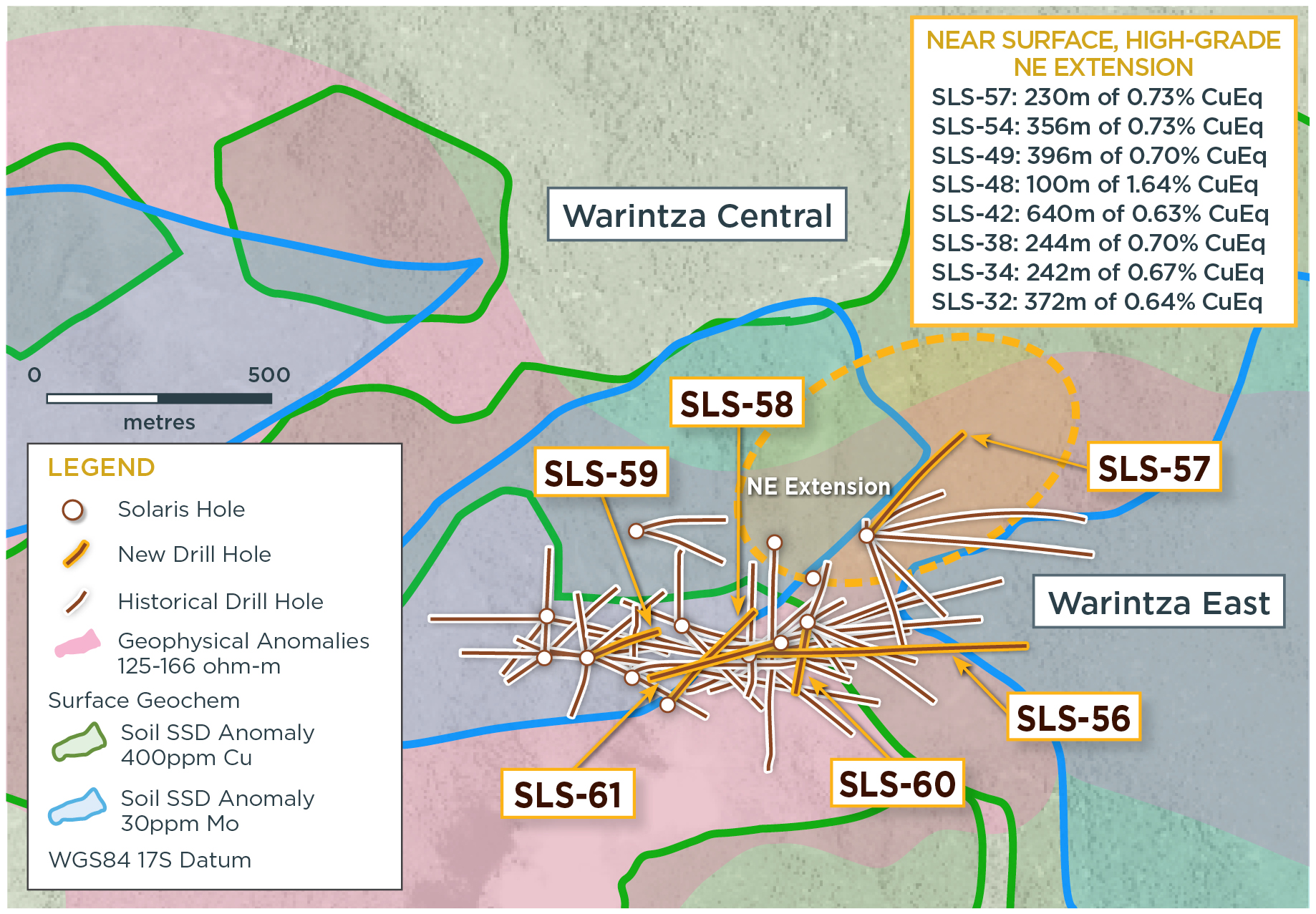

Highlights are listed below, with a corresponding image in Figure 1 and detailed results in Tables 1-2.

Northeast Extension

SLS-57 was collared at the northeastern limit of the Warintza Central grid and drilled northeast into an entirely open volume, returning 230m of 0.73% CuEq¹ from 56m depth within a broader interval of 926m of 0.61% CuEq¹ from surface, extending the zone 200m to the northeast where it remains open.

Additional drilling aimed at expanding the zone to the north from this platform and broadening the zone with holes from the platform located 200m to the west where SLS-48 returned 100m of 1.64% CuEq² from 50m depth within 852m of 0.56% CuEq² have been completed with assays pending.

The Northeast Extension zone is characterized by near surface, high-grade mineralization, and represents a priority target for growth of the ‘Indicative Starter Pit’ recently estimated at 180 Mt at 0.82% CuEq1 (Indicated) and 107 Mt at 0.73% CuEq1 (Inferred) within the Warintza Mineral Resource Estimate³ (“MRE”).

Warintza Central

A limited program of follow-up drilling at Warintza Central within the MRE envelope is aimed at upgrading targeted volumes that the geological model predicts hold potential for higher grades than the MRE reflects, as well as increasing the confidence of mineral resources in the Inferred category.

SLS-56 was collared from the southeastern portion of the grid and drilled east, returning 102m of 0.90% CuEq¹ from 48m depth within a broader interval aimed at adding definition to the southern portion of the overlap between the Warintza Central and Warintza East deposits.

SLS-60 was collared from the central portion of the grid and drilled south, returning 154m of 0.90% CuEq¹ from 70m depth within a broader interval of 829m of 0.58% CuEq¹ from 44m depth.

SLS-61 was collared from the south-central portion of the grid and drilled southwest, returning 930m of 0.77% CuEq¹ from surface, successfully infilling data in this area.

SLS-58 was collared from the south-central portion of the grid and drilled northeast into an area that the exploration model predicted could be upgraded, and successfully returned 741m of 0.62% CuEq¹ from 102m depth, improving on the grade modelled in this volume.

SLS-59 was collared from the southwestern portion of the grid and drilled northeast, returning 238m of 0.85% CuEq¹ from near surface within a broader interval of 511m of 0.73% CuEq¹ from surface.

Figure 1 – Plan View of Warintza Central Drilling Released to Date

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLS-61 | May 26, 2022 | 2 | 932 | 930 | 0.62 | 0.03 | 0.07 | 0.77 |

| SLS-60 | 44 | 873 | 829 | 0.50 | 0.01 | 0.04 | 0.58 | |

| Including | 70 | 224 | 154 | 0.81 | 0.02 | 0.05 | 0.90 | |

| SLS-59 | 2 | 513 | 511 | 0.54 | 0.04 | 0.07 | 0.73 | |

| Including | 34 | 272 | 238 | 0.67 | 0.03 | 0.08 | 0.85 | |

| SLS-58 | 102 | 843 | 741 | 0.48 | 0.03 | 0.06 | 0.62 | |

| SLS-57 | 0 | 926 | 926 | 0.49 | 0.02 | 0.08 | 0.61 | |

| Including | 56 | 286 | 230 | 0.59 | 0.03 | 0.08 | 0.73 | |

| SLS-56 | 48 | 606 | 558 | 0.33 | 0.01 | 0.03 | 0.38 | |

| Including | 48 | 150 | 102 | 0.80 | 0.02 | 0.04 | 0.90 |

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-61 | 800191 | 9648065 | 1573 | 967 | 255 | -72 |

| SLS-60 | 800258 | 9648097 | 1559 | 873 | 190 | -80 |

| SLS-59 | 799765 | 9648033 | 1571 | 513 | 65 | -70 |

| SLS-58 | 799942 | 9647932 | 1643 | 843 | 40 | -70 |

| SLS-57 | 800383 | 9648303 | 1412 | 964 | 40 | -71 |

| SLS-56 | 800126 | 9648032 | 1566 | 920 | 88 | -50 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

Endnotes

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au, and assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical test work.

- Refer to press release dated February 28, 2022. Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of US$3.00/lb Cu, US$10.00/lb Mo, and US$1,500/oz Au. No adjustments were made for recovery prior to the updated Warintza Mineral Resource Estimate, as the metallurgical data to allow for estimation of recoveries was not yet available. Solaris defined CuEq for reporting purposes only.

- Refer to Solaris press release dated April 18, 2022, stating updated Warintza Mineral Resource Estimate.

Source: Solaris Resources

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.