Solaris Resources (TSX:SLS) (OTC:SLSSF) has announced a highly-anticipated mineral resource update to Warintza Central at the Warintza Project in Ecuador. The company reported in-pit resources of 579 Mt at 0.59% CuEq (Ind) & 887 Mt at 0.47% CuEq (Inf). This also includes an ‘indicative starter pit’ of 180 Mt at 0.82% CuEq (Ind) & 107 Mt at 0.73% CuEq (Inf). Additionally, the company is now targeting high-grade extensions and major growth in cluster.

Daniel Earle, President & CEO of Solaris Resources, commented in a press release: “After only eighteen months of drilling, primarily in Warintza Central, one of the four major discoveries made on the property to date, the MRE establishes baseline credentials for the Project of hosting a robust inventory, featuring a high-grade indicative starter pit and low strip ratio, within a mining district offering major structural advantages from highway access, abundant and low-cost hydroelectric power, fresh water, labour and low elevation. Ongoing drilling is targeting further rapid growth, with an emphasis on the open extensions of near surface, high-grade mineralization at Warintza Central and expanding our recent Warintza East discovery to include it within a shared pit, while testing the further potential within the cluster.”

Highlights from the mineral resource update are as follows:

Highlights

- In-Pit Indicated mineral resources of 579 million tonnes (“Mt”) at 0.59% copper equivalent¹ (“CuEq”) and Inferred mineral resources of 887 Mt at 0.47% CuEq¹ above a 0.3% CuEq cut-off grade

- Includes ‘Indicative Starter Pit’ comprised of Indicated mineral resources of 180 Mt at 0.82% CuEq² and Inferred mineral resources of 107 Mt at 0.73% CuEq² above 0.6% CuEq cut-off grade

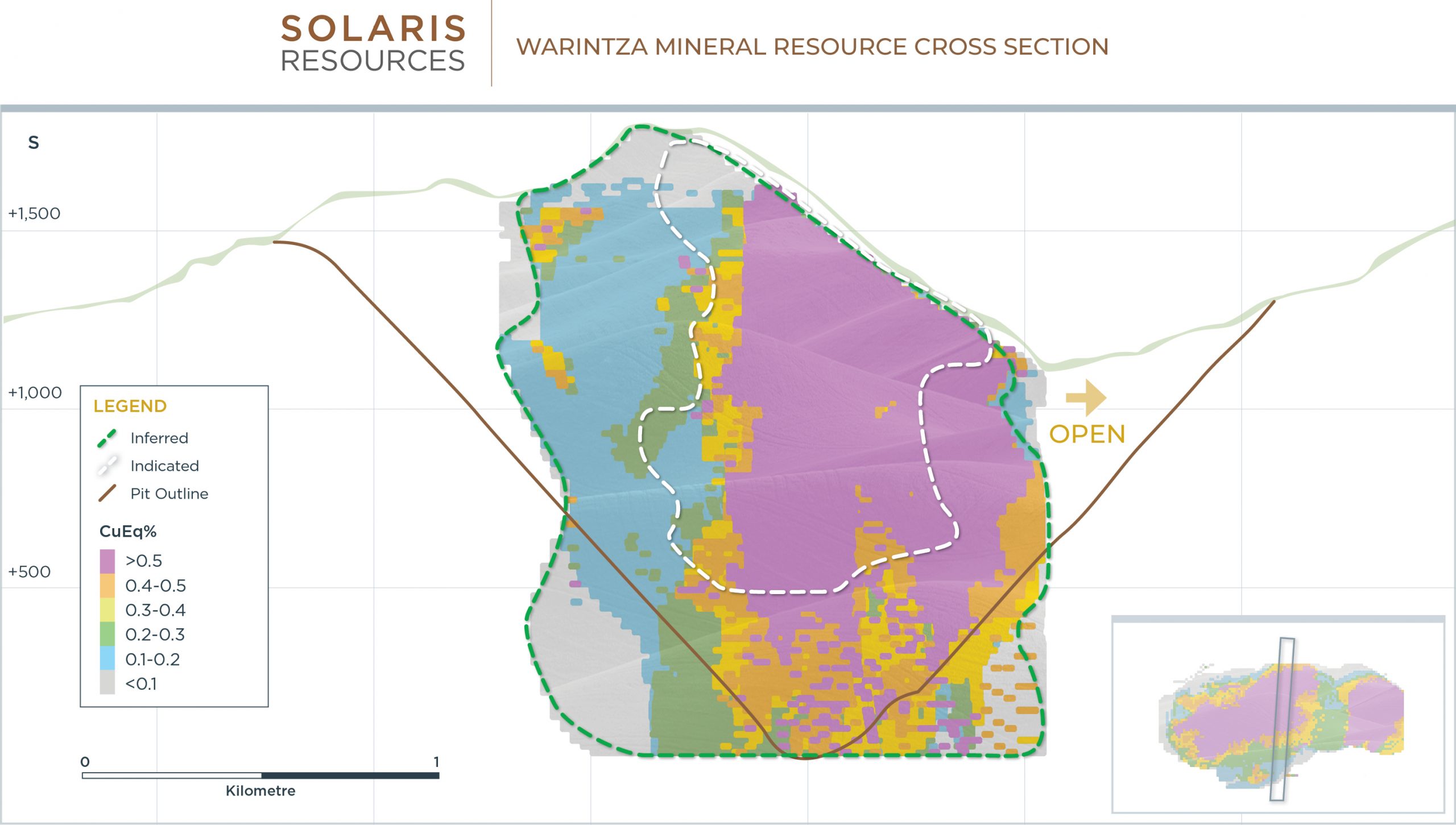

- High Quality – Expected low strip ratio ‘Indicative Starter Pit’ and ultimate pit, zoned from high-grade at surface to low grade at depth, consistent, clean sulphide mineralogy free of deleterious elements

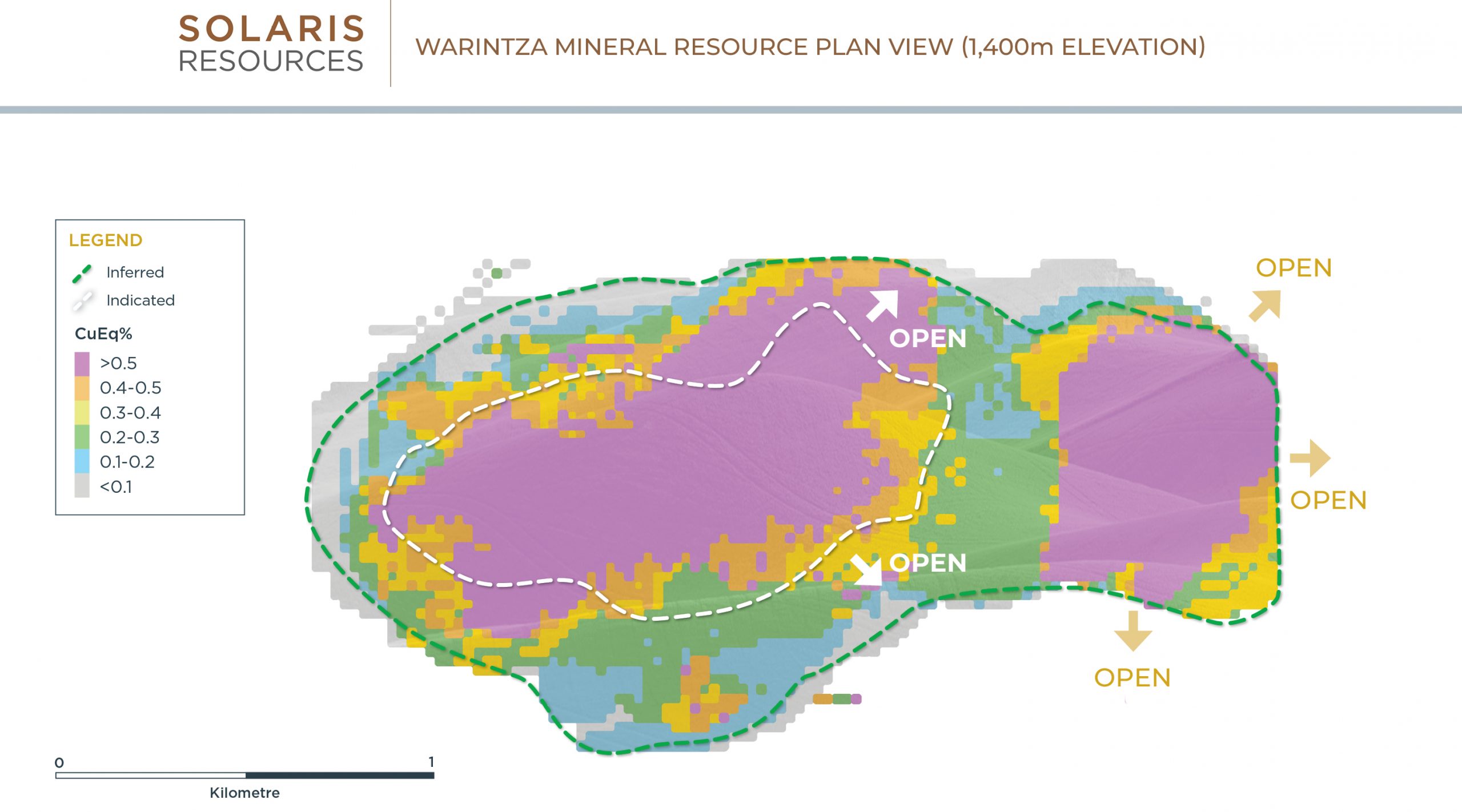

- High-Grade Growth – Ongoing drilling focused on open extensions of near surface, high-grade mineralization to the northeast and southeast of Warintza Central

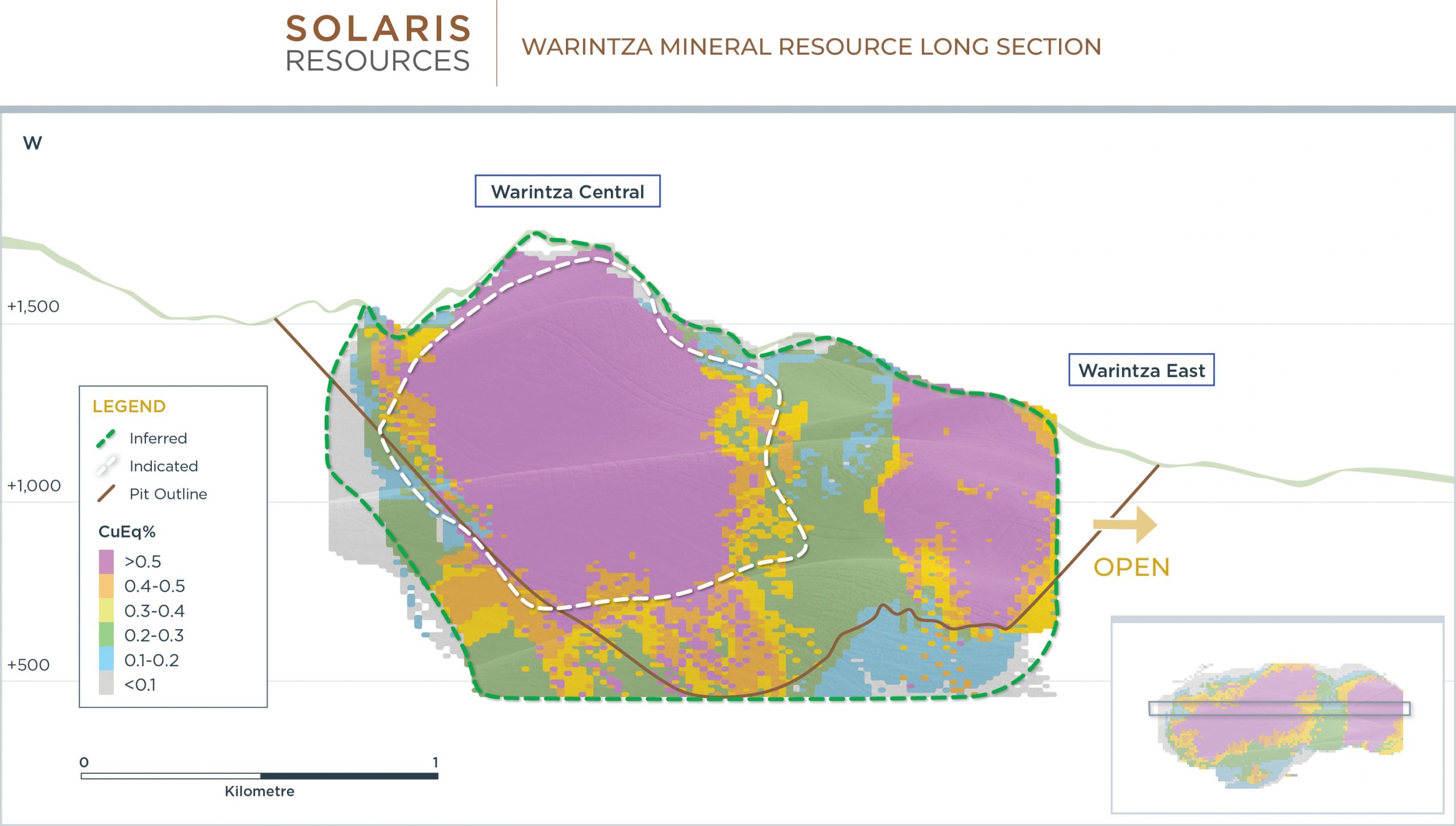

- ‘Super Pit’ Growth – Warintza Central pit shell includes overlapping portion of Warintza East, discovered mid-2021, a target wide open for major growth potential within a shared pit

- Cluster Potential – Warintza Central forms part of a 7km x 5km cluster of porphyry deposits, where in addition to East, recent discoveries at West and South offer major growth potential

- Structural Advantages – Set within mining district featuring access to highway, abundant and low-cost hydroelectric power, fresh water, labour and low elevation

Table 1: Warintza Mineral Resource Estimate Summary and Cut-Off Grade Sensitivity

| Cut-off | Category | Tonnage | Grade | Contained Metal | |||||||

| CuEq (%) |

(Mt) | CuEq (%) |

Cu (%) |

Mo (%) |

Au (g/t) |

CuEq (Mt) |

Cu (Mt) |

Mo (Mt) |

Au (Moz) |

||

| 0.2 | % | Indicated | 736 | 0.52 | 0.40 | 0.02 | 0.05 | 3.84 | 2.95 | 0.18 | 1.11 |

| Inferred | 1,558 | 0.37 | 0.31 | 0.01 | 0.03 | 5.80 | 4.80 | 0.19 | 1.63 | ||

| 0.3% (Base) | Indicated | 579 | 0.59 | 0.47 | 0.03 | 0.05 | 3.45 | 2.70 | 0.15 | 0.93 | |

| Inferred | 887 | 0.47 | 0.39 | 0.01 | 0.04 | 4.17 | 3.48 | 0.13 | 1.08 | ||

| 0.4 | % | Indicated | 442 | 0.67 | 0.54 | 0.03 | 0.05 | 2.97 | 2.38 | 0.12 | 0.77 |

| Inferred | 539 | 0.55 | 0.47 | 0.01 | 0.04 | 2.96 | 2.53 | 0.08 | 0.71 | ||

| ‘Indicative Starter Pit’ | |||||||||||

| 0.6 | % | Indicated | 180 | 0.82 | 0.67 | 0.03 | 0.07 | 1.49 | 1.20 | 0.06 | 0.38 |

| Inferred | 107 | 0.73 | 0.64 | 0.02 | 0.05 | 0.79 | 0.69 | 0.02 | 0.17 | ||

Notes to Table 1:

- The mineral resource estimates are reported in accordance with the CIM Definition Standards for Mineral Resources & Mineral Reserves, adopted by CIM Council May 10, 2014.

- Reasonable prospects for eventual economic extraction assume open-pit mining with conventional flotation processing and were tested using NPV Scheduler™ pit optimization software with the following assumptions: metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au; operating costs of US$1.50/t + US$0.02/t per bench for mining, US$4.50/t milling, US$0.90/t G&A; recoveries of 90% Cu, 85% Mo, and 70% Au.

- Resource includes grade capping and internal dilution. Grade was interpolated by ordinary kriging populating a block model with block dimensions of 25m x 25m x 15m.

- The ‘Indicative Starter Pit’ is based on the same assumptions as the Resource except utilized metal prices of US$1.00/lb Cu, US$7.50/lb Mo, and US$750/oz Au. No economic analysis has been completed by the Company and there is no guarantee than an ‘Indicative Starter Pit’ will be realized or prove to be economic.

- Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- Copper equivalent assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical testwork, and metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au. CuEq formula: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t).

- The Qualified Person is Mario E. Rossi, FAusIMM,RM-SME, Principal Geostatistician of Geosystems International Inc.

- All figures are rounded to reflect the relative accuracy of the estimate.

- The effective date of the mineral resource estimate is April 1, 2022.

The corresponding Technical Report disclosing the MRE in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) will be prepared by Mr. Rossi and available on SEDAR under the Company’s profile at www.sedar.com within 45 days of this news release.

- Copper equivalent assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical testwork, and metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au. CuEq formula: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t).

- The Company anticipates that a near surface, high grade portion of the Resource may form the basis of an ‘Indicative Starter Pit’ once an economic analysis of the Project is complete. No economic analysis has been completed by the Company and there is no guarantee an ‘Indicative Starter Pit’ will be realized or prove to be economic. The ‘Indicative Starter Pit’ is based on the same assumptions as the Resource except utilized metal prices of US$1.00/lb Cu, US$7.50/lb Mo, and US$750/oz Au.

Resource Estimation Methodology and Parameters

Indicated mineral resources were defined where the nominal drill hole spacing is 120m. The classification reflects not only the drill spacing, but the confidence level in the continuity of the grade and the geometry of the deposit. Inferred mineral resources were defined by blocks which were estimated with less stringent requirements within search ellipses defined for each domain to a maximum distance of 350m. Resources include grade capping and internal dilution. Grade was interpolated by ordinary kriging populating a block model with block dimensions of 25m x 25m x 15m. The Indicated and Inferred mineral resources are classified in a manner that is consistent with the May 10, 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. In Mr. Rossi’s opinion, there are currently no relevant factors or legal, political, environmental, or other risks that could materially affect the potential development of the mineral resources.

Source: Solaris Resources

Figure 1 – Warintza Mineral Resource Plan View (1,400m Elevation)

Figure 2 – Warintza Mineral Resource Long Section

Figure 3 – Warintza Mineral Resource Cross Section

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.