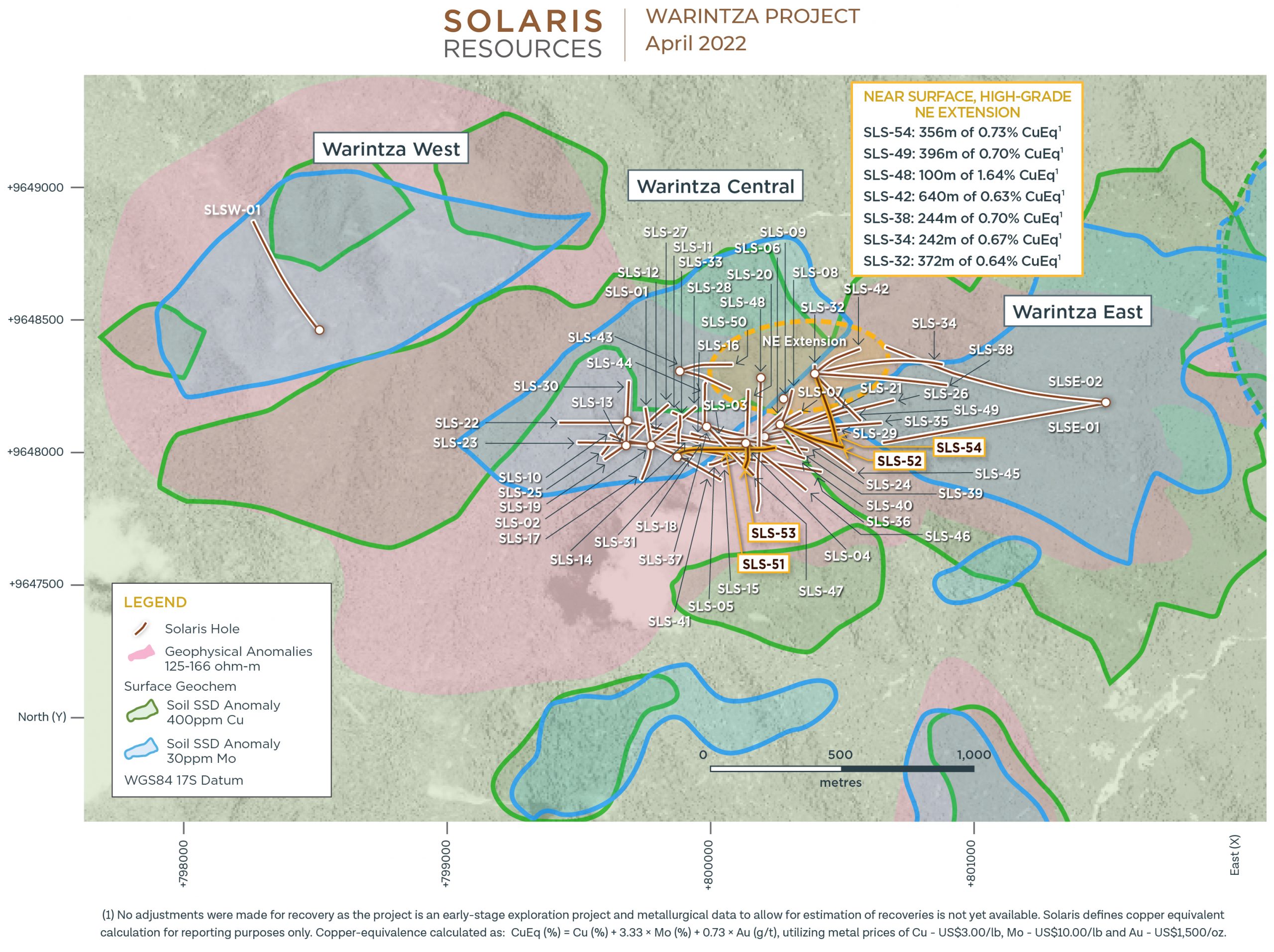

Solaris Resources (TSX:SLS) (OTC:SLSSF) has reported assay results from additional holes at Warintza Project as part of its mineral resources growth drilling. The company also recently added to near-surface, high-grade northeast and southeast extension. Solaris has said that the extension to the northeast and southeast are not priority targets and therefore will be targeted for further growth through step-out drilling.

Highlights from drilling are as follows:

Key Takeaways

Since the discovery of Warintza East in mid-2021, approximately 1km east of Warintza Central, limited drilling has been completed on the open area between the two deposits that would fall into the eastern sector of the conceptual pit design for Warintza Central as uncategorized waste – these results now establish continuity of mineralization between the two deposits with Warintza East remaining entirely open and undrilled to the north, south and east for future potential growth

- SLSE-06 was collared from the original platform in the middle of Warintza East and drilled west-northwest into an entirely open volume, returning 484m of 0.42% CuEq¹ from surface

- SLSE-08 was collared from the same platform and drilled northwest into an open volume, returning 142m of 0.65% CuEq¹ from near surface within a broader interval of 536m of 0.43% CuEq¹ from surface

- SLSE-04 was collared between Warintza Central and Warintza East and drilled west-southwest into a partially open volume, returning 616m of 0.63% CuEq¹ from 276m depth within a broader interval of 892m of 0.50% CuEq¹ from surface, establishing the overlap of the two deposits within the Warintza Central pit shell

- SLSE-03 was collared from the same platform and drilled west-northwest into a partially open volume, returning 326m of 0.62% CuEq¹ from 276m depth within a broader interval of 818m of 0.38% CuEq¹ from 38m depth, further confirming the overlap of the two deposits

- SLSE-05, collared from the same platform, was drilled north-northwest into a partially open area, returning 268m of 0.53% CuEq¹ from 446m depth within a broader interval of 714m of 0.32% CuEq¹ from surface

Updated Warintza Central Mineral Resource Estimate expected to be issued in April

To date, 62 holes have been completed at Warintza Central with assays reported for 54 of these and 8 holes have been completed at Warintza East with results reported for all holes

Mr. Jorge Fierro, Vice President, Exploration, commented: “Following the final Warintza Central results released April 4, these results represent the final holes from Warintza East to be included in the forthcoming mineral resource update, and serve to convert what would otherwise be uncategorized waste within the expected pit shell in the area where Warintza Central and Warintza East overlap.”

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) | ||

| SLSE-08 | Apr 11, 2022 | 8 | 544 | 536 | 0.35 | 0.02 | 0.04 | 0.43 | ||

| Including | 18 | 160 | 142 | 0.56 | 0.01 | 0.06 | 0.65 | |||

| SLSE-07 | 632 | 1069 | 437 | 0.29 | 0.02 | 0.04 | 0.37 | |||

| SLSE-06 | 0 | 484 | 484 | 0.33 | 0.02 | 0.04 | 0.42 | |||

| SLSE-05 | 0 | 714 | 714 | 0.26 | 0.01 | 0.05 | 0.32 | |||

| Including | 446 | 714 | 268 | 0.42 | 0.02 | 0.08 | 0.53 | |||

| SLSE-04 | 0 | 892 | 892 | 0.43 | 0.01 | 0.04 | 0.50 | |||

| Including | 276 | 892 | 616 | 0.54 | 0.02 | 0.04 | 0.63 | |||

| SLSE-03 | 38 | 856 | 818 | 0.29 | 0.02 | 0.03 | 0.38 | |||

| Including | 276 | 602 | 326 | 0.48 | 0.03 | 0.05 | 0.62 | |||

| SLS-54 | Apr 4, 2022 | 0 | 1093 | 1093 | 0.45 | 0.02 | 0.04 | 0.56 | ||

| Including | 50 | 406 | 356 | 0.62 | 0.02 | 0.05 | 0.73 | |||

| SLS-53 | 10 | 967 | 957 | 0.39 | 0.01 | 0.03 | 0.46 | |||

| Including | 16 | 192 | 176 | 0.65 | 0.03 | 0.04 | 0.78 | |||

| SLS-52 | 42 | 1019 | 977 | 0.39 | 0.01 | 0.03 | 0.45 | |||

| Including | 96 | 578 | 482 | 0.55 | 0.01 | 0.03 | 0.62 | |||

| SLS-51 | 36 | 1048 | 1012 | 0.38 | 0.01 | 0.06 | 0.47 | |||

| Including | 130 | 1048 | 918 | 0.41 | 0.01 | 0.05 | 0.50 | |||

| SLS-50 | 336 | 458 | 122 | 0.14 | 0.04 | 0.03 | 0.30 | |||

| SLS-49 | Feb 28, 2022 | 50 | 867 | 817 | 0.50 | 0.02 | 0.04 | 0.60 | ||

| SLS-48 | 50 | 902 | 852 | 0.45 | 0.02 | 0.05 | 0.56 | |||

| SLS-47 | 48 | 859 | 811 | 0.41 | 0.02 | 0.05 | 0.51 | |||

| SLS-46 | 48 | 680 | 632 | 0.27 | 0.01 | 0.03 | 0.31 | |||

| SLS-45 | 44 | 608 | 564 | 0.37 | 0.01 | 0.03 | 0.41 | |||

| SLS-44 | 6 | 524 | 518 | 0.16 | 0.05 | 0.03 | 0.35 | |||

| SLS-43 | 138 | 350 | 212 | 0.17 | 0.03 | 0.03 | 0.30 | |||

| SLS-42 | 52 | 958 | 906 | 0.42 | 0.02 | 0.06 | 0.53 | |||

| SLSS-01 | Jan 18, 2022 | 0 | 755 | 755 | 0.28 | 0.02 | 0.02 | 0.36 | ||

| SLS-41 | Dec 14, 2021 | 0 | 592 | 592 | 0.42 | 0.02 | 0.06 | 0.52 | ||

| SLS-40 | 8 | 1056 | 1048 | 0.39 | 0.01 | 0.03 | 0.46 | |||

| SLS-39 | 28 | 943 | 915 | 0.49 | 0.01 | 0.04 | 0.56 | |||

| SLS-38 | 58 | 880 | 822 | 0.28 | 0.01 | 0.05 | 0.35 | |||

| SLS-37 | 28 | 896 | 868 | 0.39 | 0.05 | 0.05 | 0.58 | |||

| SLS-36 | Nov 15, 2021 | 2 | 1082 | 1080 | 0.33 | 0.01 | 0.04 | 0.41 | ||

| SLS-35 | 48 | 968 | 920 | 0.53 | 0.02 | 0.04 | 0.62 | |||

| SLS-34 | Oct 25, 2021 | 52 | 712 | 660 | 0.36 | 0.02 | 0.06 | 0.47 | ||

| SLS-33 | 40 | 762 | 722 | 0.55 | 0.03 | 0.05 | 0.69 | |||

| SLSE-02 | 0 | 1160 | 1160 | 0.20 | 0.01 | 0.04 | 0.25 | |||

| SLS-32 | Oct 12, 2021 | 0 | 618 | 618 | 0.38 | 0.02 | 0.05 | 0.48 | ||

| SLS-31 | 8 | 1008 | 1000 | 0.68 | 0.02 | 0.07 | 0.81 | |||

| SLS-30 | 2 | 374 | 372 | 0.57 | 0.06 | 0.06 | 0.82 | |||

| SLSE-01 | Sep 27, 2021 | 0 | 1213 | 1213 | 0.21 | 0.01 | 0.03 | 0.28 | ||

| SLS-29 | Sep 7, 2021 | 6 | 1190 | 1184 | 0.58 | 0.02 | 0.05 | 0.68 | ||

| SLS-28 | 6 | 638 | 632 | 0.51 | 0.04 | 0.06 | 0.68 | |||

| SLS-27 | 22 | 484 | 462 | 0.70 | 0.04 | 0.08 | 0.91 | |||

| SLS-26 | July 7, 2021 | 2 | 1002 | 1000 | 0.51 | 0.02 | 0.04 | 0.60 | ||

| SLS-25 | 62 | 444 | 382 | 0.62 | 0.03 | 0.08 | 0.77 | |||

| SLS-24 | 10 | 962 | 952 | 0.53 | 0.02 | 0.04 | 0.62 | |||

| SLS-19 | 6 | 420 | 414 | 0.21 | 0.01 | 0.06 | 0.31 | |||

| SLS-23 | May 26, 2021 | 10 | 558 | 548 | 0.31 | 0.02 | 0.06 | 0.42 | ||

| SLS-22 | 86 | 324 | 238 | 0.52 | 0.03 | 0.06 | 0.68 | |||

| SLS-21 | 2 | 1031 | 1029 | 0.63 | 0.02 | 0.04 | 0.73 | |||

| SLS-20 | April 19, 2021 | 18 | 706 | 688 | 0.35 | 0.04 | 0.05 | 0.51 | ||

| SLS-18 | 78 | 875 | 797 | 0.62 | 0.05 | 0.06 | 0.83 | |||

| SLS-17 | 12 | 506 | 494 | 0.39 | 0.02 | 0.06 | 0.50 | |||

| SLS-16 | Mar 22, 2021 | 20 | 978 | 958 | 0.63 | 0.03 | 0.06 | 0.77 | ||

| SLS-15 | 2 | 1231 | 1229 | 0.48 | 0.01 | 0.04 | 0.56 | |||

| SLS-14 | 0 | 922 | 922 | 0.79 | 0.03 | 0.08 | 0.94 | |||

| SLS-13 | Feb 22, 2021 | 6 | 468 | 462 | 0.80 | 0.04 | 0.09 | 1.00 | ||

| SLS-12 | 22 | 758 | 736 | 0.59 | 0.03 | 0.07 | 0.74 | |||

| SLS-11 | 6 | 694 | 688 | 0.39 | 0.04 | 0.05 | 0.57 | |||

| SLS-10 | 2 | 602 | 600 | 0.83 | 0.02 | 0.12 | 1.00 | |||

| SLS-09 | 122 | 220 | 98 | 0.60 | 0.02 | 0.04 | 0.71 | |||

| SLSW-01 | Feb 16, 2021 | 32 | 830 | 798 | 0.25 | 0.02 | 0.02 | 0.31 | ||

| SLS-08 | Jan 14, 2021 | 134 | 588 | 454 | 0.51 | 0.03 | 0.03 | 0.62 | ||

| SLS-07 | 0 | 1067 | 1067 | 0.49 | 0.02 | 0.04 | 0.60 | |||

| SLS-06 | Nov 23, 2020 | 8 | 892 | 884 | 0.50 | 0.03 | 0.04 | 0.62 | ||

| SLS-05 | 18 | 936 | 918 | 0.43 | 0.01 | 0.04 | 0.50 | |||

| SLS-04 | 0 | 1004 | 1004 | 0.59 | 0.03 | 0.05 | 0.71 | |||

| SLS-03 | Sep 28, 2020 | 4 | 1014 | 1010 | 0.59 | 0.02 | 0.10 | 0.71 | ||

| SLS-02 | 0 | 660 | 660 | 0.79 | 0.03 | 0.10 | 0.97 | |||

| SLS-01 | Aug 10, 2020 | 1 | 568 | 567 | 0.80 | 0.04 | 0.10 | 1.00 | ||

| Notes to table: True widths cannot be determined at this time. | ||||||||||

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLSE-08 | 801485 | 9648192 | 1170 | 959 | 305 | -70 |

| SLSE-07 | 800749 | 9648146 | 1282 | 1069 | 84 | -50 |

| SLSE-06 | 801485 | 9648192 | 1170 | 1078 | 285 | -55 |

| SLSE-05 | 800749 | 9648146 | 1282 | 737 | 330 | -65 |

| SLSE-04 | 800749 | 9648146 | 1282 | 893 | 257 | -45 |

| SLSE-03 | 800749 | 9648146 | 1282 | 909 | 270 | -45 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

(1) No adjustments were made for recovery as the project is an early-stage exploration project and metallurgical data to allow for estimation of recoveries is not yet available. Solaris defines copper equivalent calculation for reporting purposes only. Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of Cu – US$3.00/lb, Mo – US$10.00/lb and Au – US$1,500/oz.

Source: Solaris Resources

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.