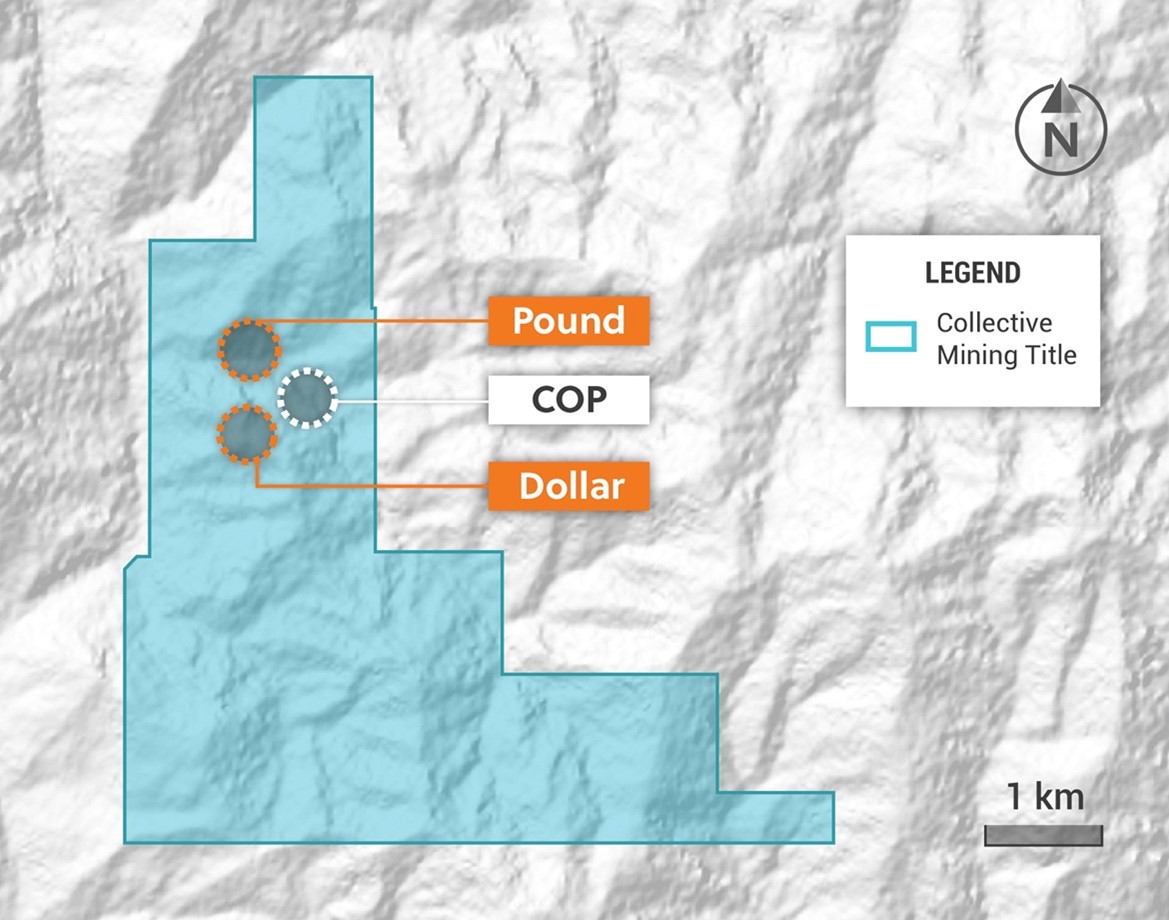

Collective Mining (TSXV:CNL) announced this morning the completion of an Induced Polarization, ground geophysical survey on part of its San Antonio project located in Caldas, Colombia. The survey area covered 2.75 square kilometres and encompasses the previously defined, priority targets named Pound and Dollar. The Company previously announced that it had made a significant grassroot drilling discovery at Pound target as part of its Phase I program at San Antonio.

Ari Sussman, Executive Chairman of Collective Mining, commented: “The IP survey in San Antonio clearly outlines exciting targets for follow up drilling. At the Pound target, there is now a clear opportunity to expand the wide and continuous zones of mineralization previously intersected from surface with further drilling into the mineralized schist and along northern extensions to the breccia. At the Dollar target, our previous drilling only clipped the edge of the highly chargeable western anomaly and internal modelling of grade shells from drilling are pointing directly to the untested eastern anomaly. Drill planning is already underway for a follow up program to begin in the second half of 2022.”

Figure 1: Plan View of the San Antonio Project Highlighting the Pound and Dollar Targets

Highlights from the survey include:

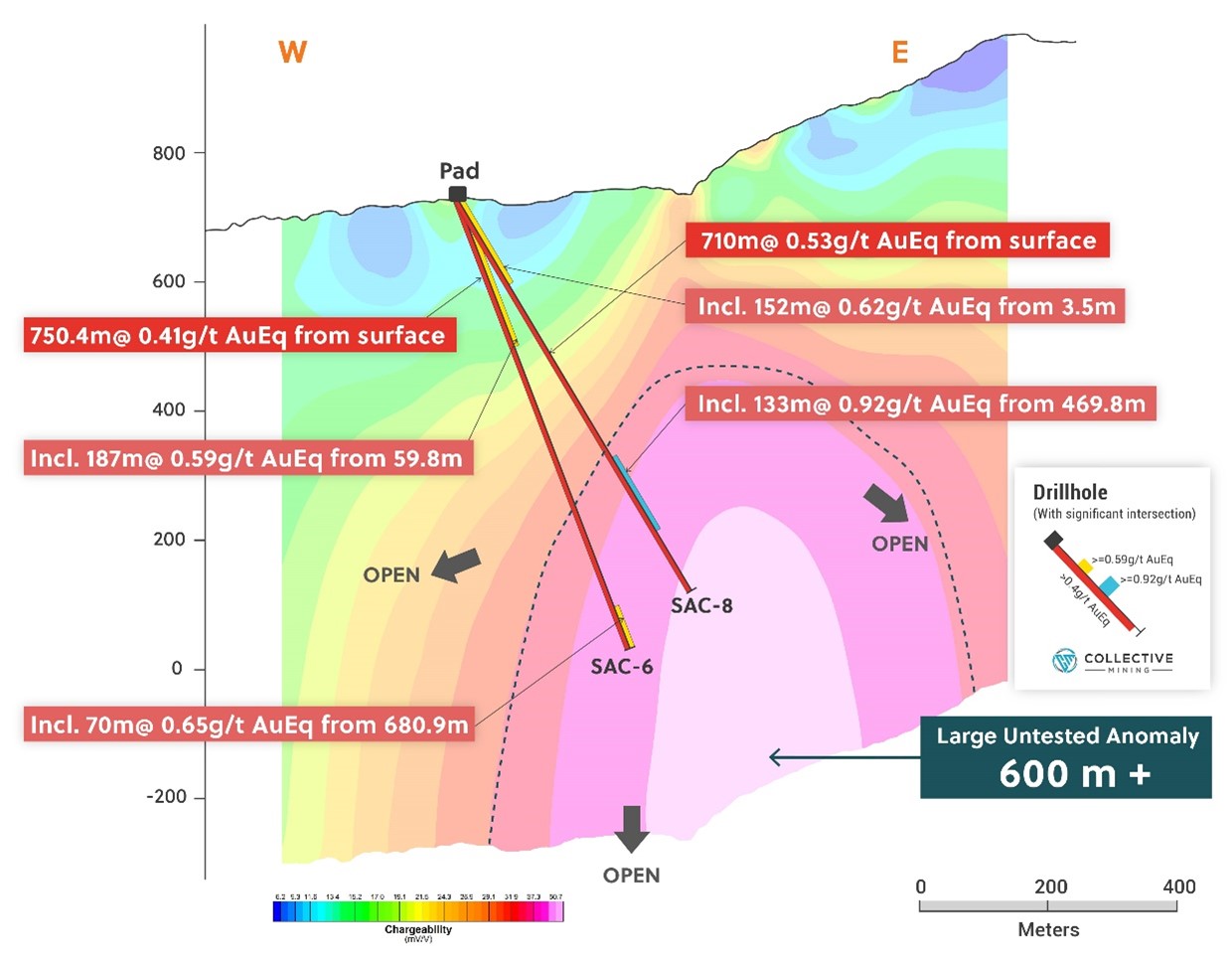

- The Pound target is coincident with a circular chargeability anomaly present at shallow depths and covering a diameter of 600 metres. Previous reconnaissance drilling of two holes returned broad, continuous, mineralized intercepts from surface of 710 metres grading 0.53 g/t AuEq (SAC-6) and 750 metres @ 0.41 g/t AuEq (SAC-8). The Pound intercepts relate to mineralization hosted within breccia, porphyry and schist rocks. The IP work clearly demonstrates that the contact zone and the mineralized schist body are open to the north, south and east and can be tested from relatively shallow elevations.

- Importantly, both drill holes into the Pound target ended in mineralization in the schist body with copper and molybdenum grades increasing at depth and including 70 metres at 0.12% copper in SAC-6 and 133 metres @ 0.15% copper in SAC-8.

- The chargeability IP data at Pound also demonstrates potential extensions of the mineralized breccia body to the NNW for at least another 800 metres.

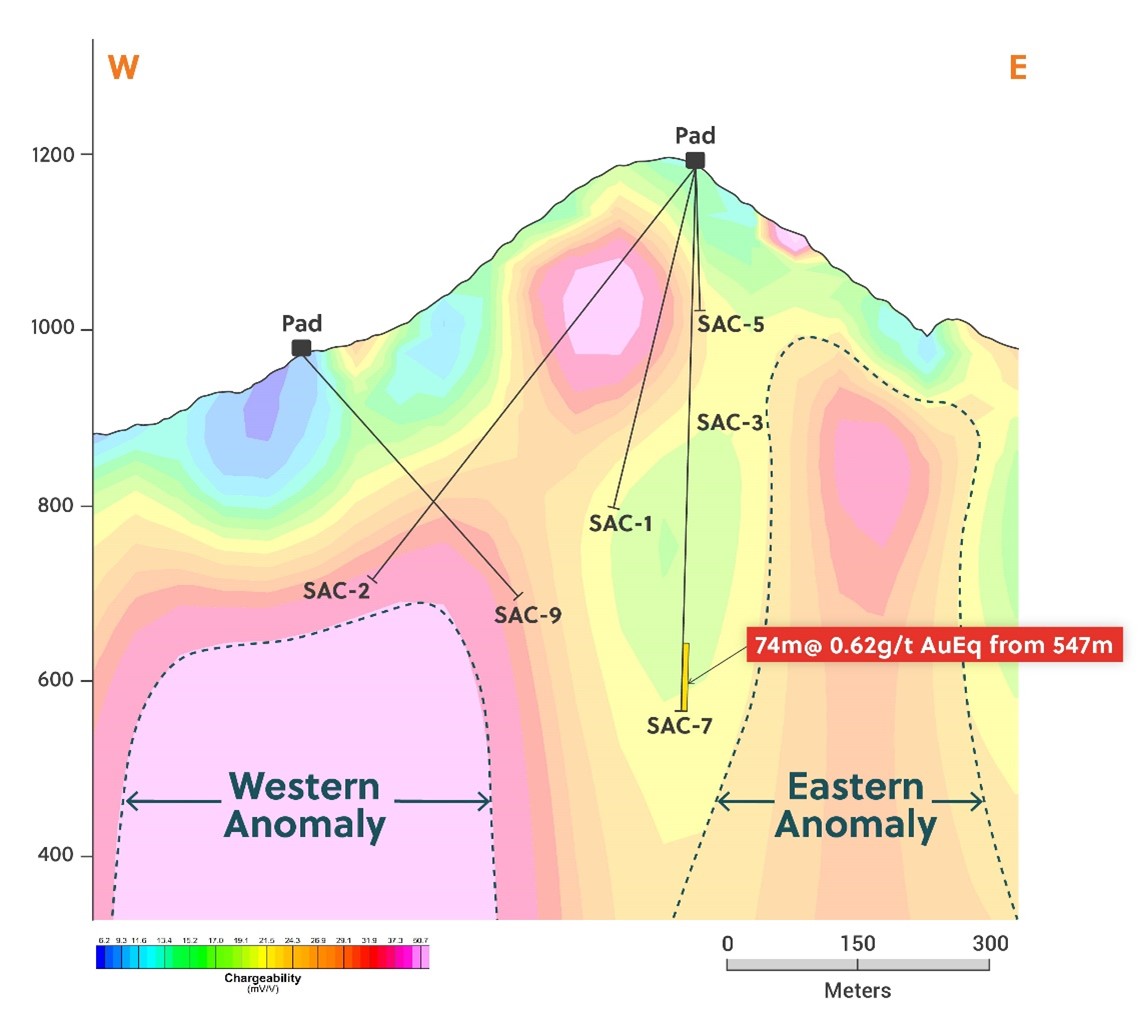

- IP data at the Dollar target highlights chargeability anomalies directly to the west and east of the area previously drill tested in the Phase I campaign.

- The western anomaly is located approximately 300 metres below surface and covers an area measuring 600 metres across by 500 metres vertical. Previous drilling only clipped the edge of this body in two holes; both of which demonstrate increasingly, porphyry related, potassic alteration within a quartz diorite porphyry near the end of each hole. Peripheral drilling at Dollar previously intersected 74 metres grading 0.62 g/t gold equivalent from a quartz magnetite stockwork in the quartz diorite porphyry.

- The more subtle porphyry shaped eastern anomaly is located approximately 75 metres below surface and measures 250 metres across by 900 metres vertical. No previous drill testing was conducted within this anomaly but modelling of grade shells from prior holes indicate an eastern dip to the highest-grade mineralization towards the anomaly.

- The target extensions at Pound and new targets at Dollar will be followed up with diamond drilling programs during the second half of 2022.

Figure 2: Section View of the Pound Target Outlining a Significant Chargeability Anomaly Directly Contiguous to the Bottom of the Two Prior Discovery Drill Holes

Figure 3: Section View of the Chargeability Anomalies at Dollar. The Western Anomaly Was Clipped at the Top by Prior Drilling While the Eastern Anomaly Has Yet to be Drill Tested

Collective Mining is a South American exploration and development firm specializing in identifying and prospecting for prospective mineral project. The team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value is leading the Company’s mission to repeat its past success in Colombia by making a significant new mineral discovery and developing the project to production.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.