Trillium Gold (TSXV:TGM) has announced that the company has increased the offering of the private placement announced on February 4, 2022. Investor demand has been significant and the offering has been oversubscribed. Accordingly, the company expanded the offering from C$5.0 million to up to C$6.5 million for the sale of any combination of the following:

- Units of the Company (each, a “Unit”) at a price of C$0.53 per Unit;

- Flow-through Units of the Company (each, a “FT Unit”) at a price of C$0.60 per FT Unit; and;

- Charitable FT Units to be sold to charitable purchasers (each, a “Charity FT Unit”) at a price of C$0.75 per Charity FT Unit.

Source: Trillium Gold Mines

Red Cloud Securities Inc. who is acting as bookrunner and agent under the offering, will have an option, exercisable in whole or in part, until 48 hours prior to the closing of the offering, to sell up to an additional C$1,000,000 in any combination of offered securities at the offering prices.

The total proceeds from the sale of FT Shares will be invested in “Canadian exploration expenses”. Specifically, the company intends to explore the Red Lake properties to utilize the net proceeds raised from the offering, among other general working capital purposes. Around February 28, 2022 is the scheduled closing date of the Offering which is subject to certain conditions. Among them, TSX Venture Exchange approval, and the Unit Shares, FT Shares, and Warrant Shares will have a hold period of four months and one day from the closing date.

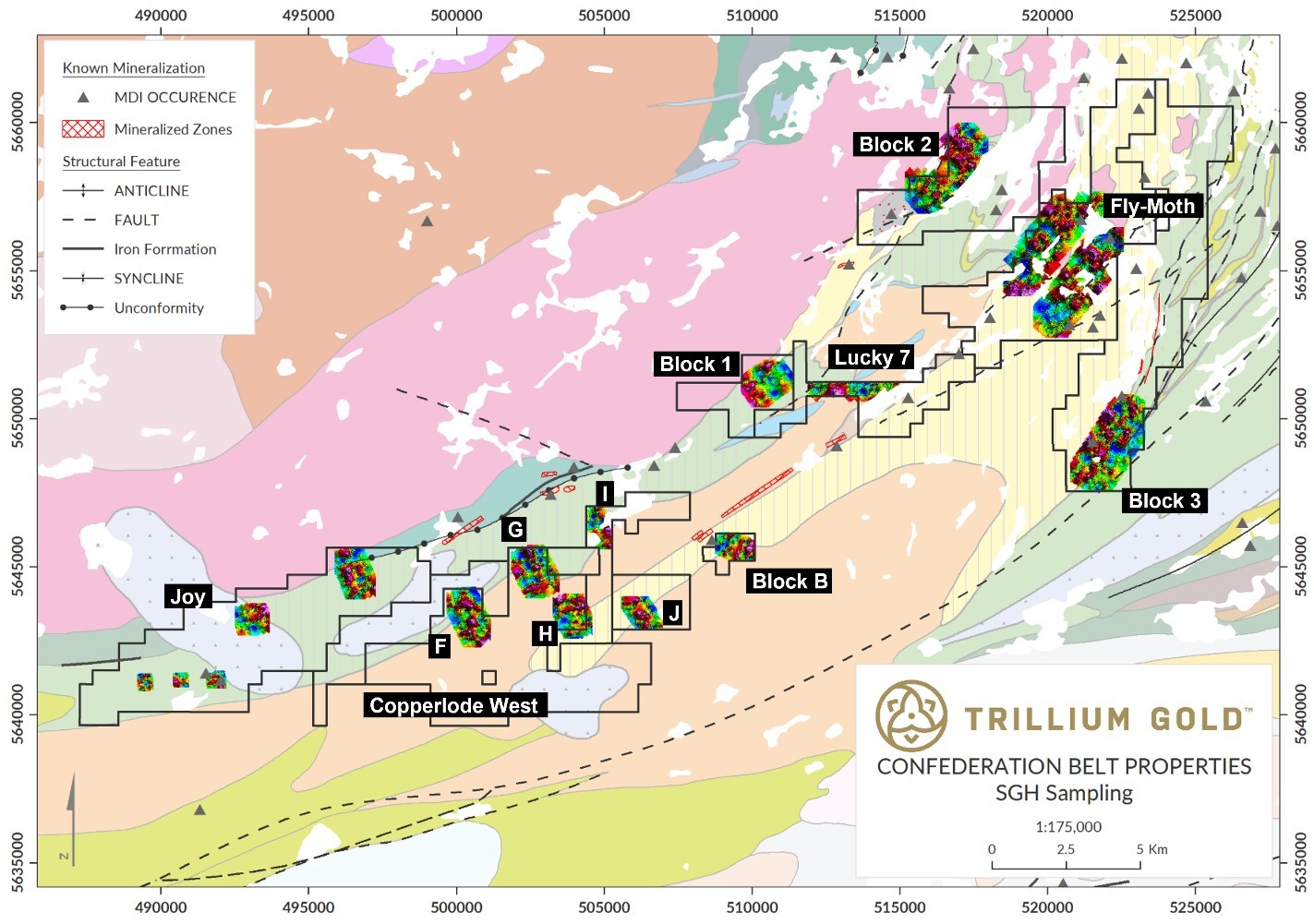

Trillium Gold Discovers Multiple Gold Anomalies Along Confederation Belt Properties

Earlier this month Trillium Gold reported findings from the spatiotemporal geochemical hydrocarbon (SGH) sampling program completed during the summer on the Company’s Confederation Belt properties.

Independent results and interpretations provided by Actlabs from the 17 SGH regional soil sampling grids highlighted significant gold probability anomalies over multiple target types. These encouraging anomalies will serve as priority targets for Trillium Gold’s second phase of exploration work in the 2022 field season and, together with the sampling and prospecting program carried out concurrently, are expected to generate multiple drill targets.

The newly identified relationships among SGH-generated gold targets, historical gold assays and possible structural and lithological controls, effectively launch Trillium Gold’s Confederation belt properties into a new era in gold exploration.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.