Fortuna Silver’s strong 2021 production and financial results were tainted by permitting issues at the San Jose mine in Oaxaca, Mexico.

Although the San Jose issue was resolved in December, recent political developments in Burkina Faso may mean Fortuna (NYSE:FSM | TSX:FVI) maintains an elevated perceived risk profile into 2022.

Production results and outlook

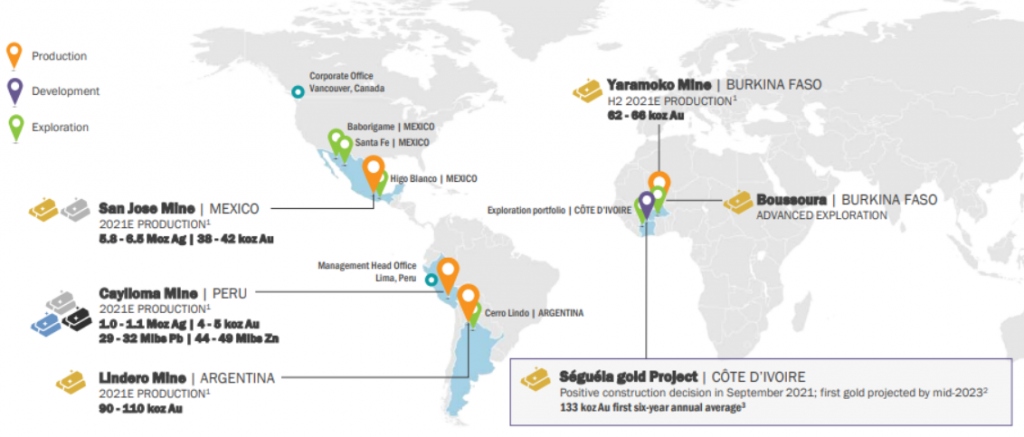

Fortuna has 4 operating mines in Mexico, Peru, Argentina, and Burkina Faso with a total production of about 306,000 oz Au eq.

Gold production surged 274% last year. This was largely due to the Lindero mine in Argentina, which saw its first gold pour in October 2020 and had a full year of production in 2021 with 104,000 oz. The acquisition of the Yaramoko gold mine in Burkina Faso also added 57,500 oz.

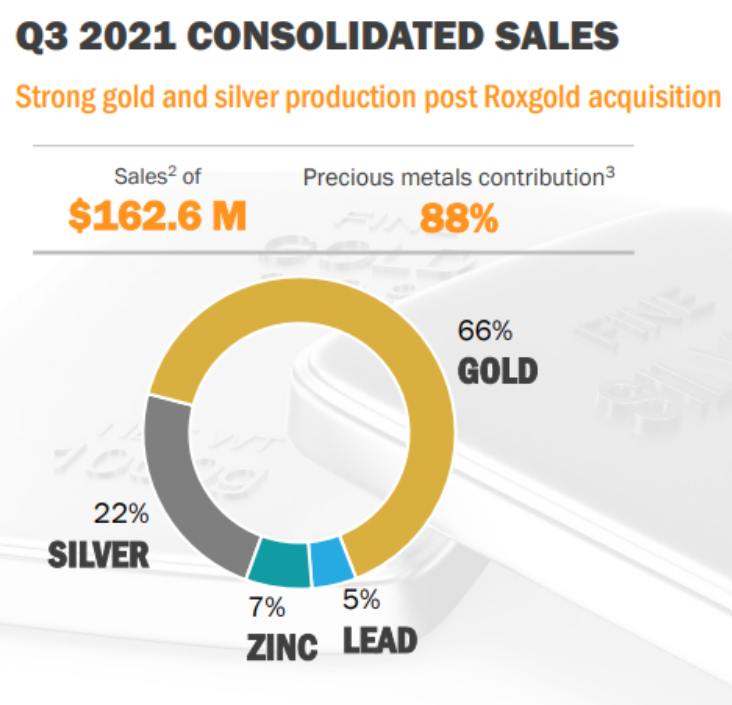

The San Jose mine, among the largest silver mines in Mexico, output over 6.4 million ounces in 2021. The Caylloma Mine in Peru added about 1.1 million ounces as well as lead and zinc production which together accounted for 12% of Q3 sales.

San Jose and Caylloma had AISC of 12.2-14.5 and 19.4-23.0 $/oz Ag eq. respectively. AISC at Lindero and Yaramoko were 1,010-1,190 and 990-1,150 $/oz Au.

A production increase of 7-21% Au eq. is projected for 2022. The Séguéla project in Côte d’Ivoire is expected to start producing in mid-2023 and is forecasted to add 130,000-140,000 oz Au. These assumptions, together with stable precious metal prices, would allow Fortuna to surpass $800M in annual sales within about 2 years.

Possible oversell in reaction to San Jose news

Fortuna’s stock had a sharp selloff in Q4 on the prospect that the 10-year environmental permit for the San Jose mine would not be renewed by Mexican regulators.

With San Jose accounting for roughly 20% of revenues, the market had more than priced in a mine shut down by mid-December 2021. Fortuna was down over 40% from Nov. high to Dec. low, while the Global X Silver Miners ETF (NYSEARCA:SIL) was down about 18% over the same period.

Fortuna recovered somewhat since the San Jose permit was granted on Dec. 20, but remains down about 30% since November highs, which is about a 10% average underperformance versus industry peers. It’s possible the market over-discounted for the San Jose risk. Another consideration is recent events in Burkina Faso, which highlight geopolitical risks for West African producers.

West Africa and post-pandemic resource nationalism

A military coup d’etat ousted the president of Burkina Faso on January 24, continuing a wave of coups in the West African region in recent months.

Some commentators have pointed out that, in comparison with the previous generation of coups culminating in the 1990s, there is a heightened discourse of national sovereignty surrounding more recent events. The prospect that this could lead to assertions of national control over natural resources may lead to a chilling effect on investment. The risks include increased royalties and taxes as well as regulations and capital controls.

However, the surge in post-pandemic resource nationalism is countered by the imperative of policymakers to provide stable jobs and boost foreign currency reserves. Headlines may overshadow the extent to which mining is core to regional economies and will continue regardless of political shifts.

As Fortuna CEO Jorge A. Ganoza points out, “West Africa is an established mining jurisdiction. You have all the industry clusters that support the efficient running of the business…. Even though we have geographic dispersion, that dispersion is in areas where you can effectively and efficiently run mines.”

West Africa is, after China, the second-largest gold-producing region in the world. While others may be questioning investments in the region, Fortuna is doubling down on exploration and production. By establishing itself as a reliable partner in economic development with a long-term stakeholder approach, Fortuna could be positioning itself for the years to come.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.