Investors are only starting to fully grasp the implications of the copper boom we are in right now. As they continue to snap up copper mining stocks as fast as possible, there is always a temptation to pick up the most prominent names first. After all, those names often produce the most, invest the most, and generate solid returns for investors. However, most of the growth plays still seem to be in the companies that fly under the radar for the time being.

A Producer and Explorer

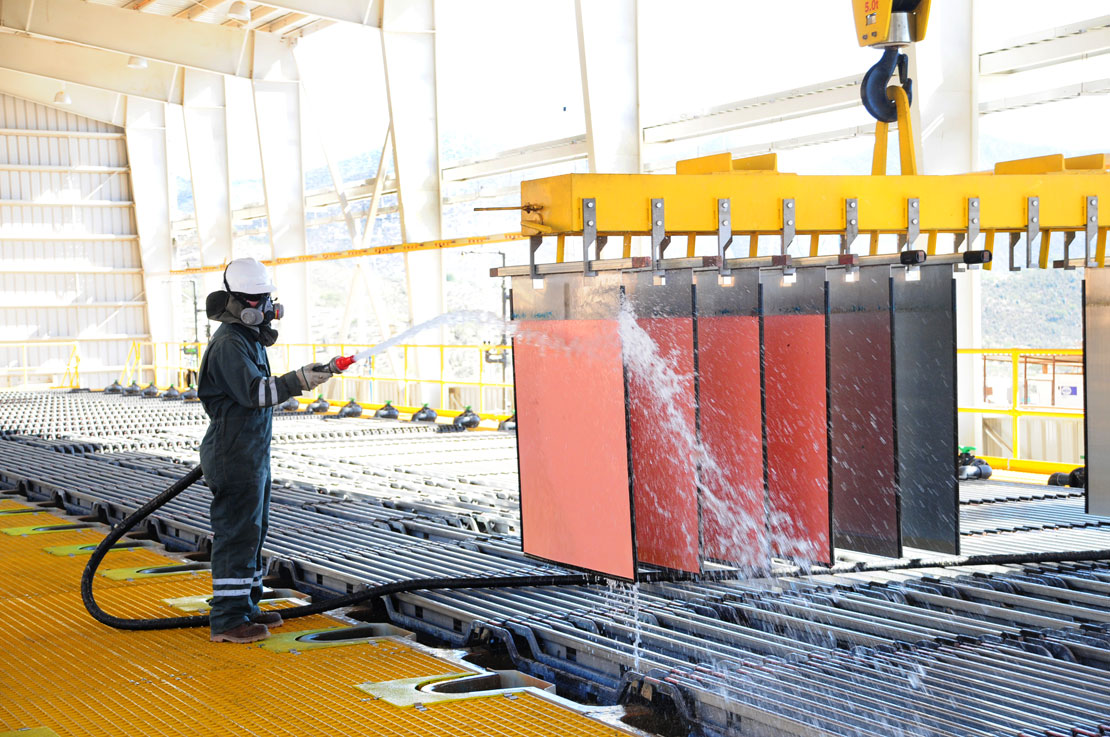

One of the companies investors might be turning their attention to soon is Three Valley Copper (TSXV:TVC). The Canadian copper mining company’s project is located in the prolific Cretaceous belt of Chile that hosts a large number of rich deposits. The company produces Electrolytic Copper Cathodes (Grade A) of 99.999% purity. That copper is often used in electric equipment like technology, battery parts, and the copper can easily be drawn and formed into wires.

With the current focus on global decarbonization efforts, this particular type of copper is seeing massive demand growth. Electrolytic copper undergoes refining or purification through the process of electrolysis. That purification is by far the simplest method of achieving purity levels 99.999% in copper and makes Three Valley Copper’s (TSXV:TVC) product particularly valuable in a world that is rapidly going electric.

Two-Pronged Approach

The company has two main deposits: Papomono Masivo and Don Gabriel. The company’s strategy is to produce ECC, while simultaneously exploring its property to increase the visibility of the mine and extend the life of the mine. Both deposits are located in a 10 kilometre wide corridor of middle to upper Cretaceous volcanic rocks. This property is bounded by north-south-trending faults and stands as examples of stratabound, manto-type copper deposits.

To focus efforts and ensure the maximization of the property, the company has divided each deposit into some main areas. The Papomono deposit has seven:

- Papomono Masivo

- Papomono Norte

- Manto Norte

- Papomono Sur

- Papomono Mantos Conexión

- Papomono Cumbre

- Epitermal

The Dan Gabriel deposit has two:

- Don Gabriel Manto

- Don Gabriel Vetas

Both deposits sit in one of the most copper-rich regions in the world, in Chile, the number one global copper producer and the number one country in copper reserves. While production has started and the company is operating at regular capacity as pandemic restrictions lift, less than 10% of the property has been explored. This gives Three Valley Copper plenty of room for expansion through exploration of a property that Vale once explored, expanded, and then sold. The mining giant invested $250 million in construction and infrastructure build-out before selling the deposits to a private family business.

A Rich Project History

Three Valley Copper (TSXV:TVC) purchased 70% of the property in October 2017 for $40 million and then increased its ownership to 90% in 2021. Currently, technical studies have been completed, with a technical report issued, and the company has set its sights on its more than 46,000+ hectares of land for the future.

Papomono

Three Valley Copper has begun the Papomono Masivo underground development with construction already underway. The company expects to complete the construction phase by the end of 2021, positioning itself for more expansion the following year.

Don Gabriel

Open-pit expansion is currently underway at the Don Gabriel deposit, with expectations of both deposits bringing the company to full utilization of the facilities by 2023. This strategy will allow Three Valley to increase revenues and drive down unit costs.

Three Valley Copper’s (TSXV:TVC) strategy of producing the purest copper on the market (Electrolytic Copper Cathodes) by mining its own deposits and purchasing third-party ore to fill in any supply gaps when needed is positioning the company as a premier destination for future tech and battery companies. With calls from the United States for a massive infrastructure plan and companies like Tesla begging for more nickel and copper for their production, mining companies like Three Valley are set for the next leg of copper price runs.

The added bonus of the company’s potential for further discoveries on its massive property means that Three Valley’s (TSXV:TVC) production and stock may be one of the best value propositions in the copper space. The sub-$1 price today seems to be highly attractive in a space where copper miners are seeing gains in the hundreds if not thousands of percentage points, and the price of copper is on a serious run.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.