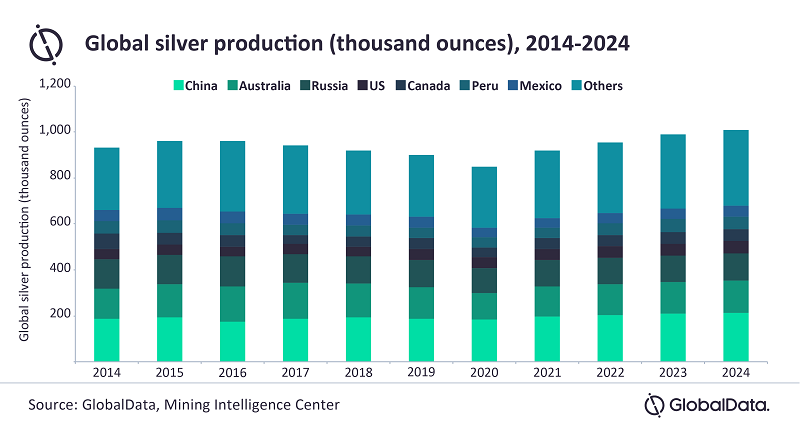

The last four years haven’t been kind to silver production, with four consecutive years of annual decline. 2021 is finally bringing an increase of 8.1% to 918.3 million ounces (Moz), and ultimately silver production should exceed one billion ounces by 2024, according to a report from GlobalData. This notable bump would be a 3.2% compound annual growth rate (CAGR).

Where in the World?

The top contributors to this growth will be Peru, Mexico, and China, with a combined production increase forecast at 393.9Moz in 2021 to 443.9 Moz in 2024. The countries have ramped up their efforts to allow new projects to move forward, and companies have had it easier as these countries either recover from the pandemic (China) or refuse to put more restrictions in place (Mexico and Peru) due to struggling economies.

Hit Hard

2020 saw an estimated global silver mine production decline of 2.4% to 849.7 million ounces, as the lockdown and restrictions in some of the top silver-producing countries hit hard. While those restrictions did crimp growth and production overall, those countries seem to be intent on avoiding any form of lockdown again as fumbling economies in the developing world struggle to regain traction.

The first nine months of 2020 were the hardest, as eight of the top ten silver producers reported a collective 13.9% YoY decrease in output. This had an outsize effect and resulted in lower global production numbers.

According to Vinneth Bajaj, associate project manager at GlobalData: “In Mexico, output was estimated to have fallen by 1.8% in 2020, with mining activities suspended for almost two months through to the end of May. Major silver producers in the country temporarily suspended their mining operations during this period, and production losses were registered at Pan American’s La Colorada and Dolores mines, Fortuna Silver’s San Jose mine, Industria Penoles’ Saucito mine, and Hecla Mining Company’s San Sebastian project, among others. However, these COVID-19-related production losses were partially offset by high production from other key mines, including the Penasquito, Guanacevi, Zimapan, and Ocampo projects, as well as from the commencement of projects in 2020 such as the Red de Plata, Capire, and Tahuehueto projects.”

Depleted Supply

According to the report, depleting ore reserves are also weighing on production and is a major industry concern. As miners work to increase production over the next three years, discovery and exploration will continue to be a prime driver of activity for the sector.

Top Silver Miners 2020

Although 2020 was a challenging year for silver production and the companies mining it, some miners continued to work steadily. The rankings of the top 10 silver producing companies in 2020 based on output reported last year worldwide prove that while production was down globally, some companies could increase production.

| Rank | Company | 2020 Ag output, Moz | 2019 Ag output, Moz | Change, % |

| 1 | Fresnillo | 53.1 | 54.6 | -3 |

| 2 | KGHM | 43.4 | 45.5 | -5 |

| 3 | Glencore | 32.8 | 32 | 2 |

| 4 | Newmont | 27.8 | 15.9 | 75 |

| 5 | CODELCO | 27 | 17.9 | 51 |

| 6 | Vedanta (Hindustan Zinc) | 23.7 | 22.3 | 6 |

| 7 | Southern Copper | 21.5 | 20.3 | 6 |

| 8 | Polymetal | 18.8 | 21.6 | -13 |

| 9 | Pan American Silver | 17.3 | 25.9 | -33 |

| 10 | Hecla | 13.5 | 12.6 | 7 |

Source: Vladimir Basov, Kitco News

The rankings bear out a story that while silver production suffered in 2020, not every company did. Some of them went on to increase production. The most significant gain in production came from Newmont, with a 75% increase YoY from 2019. With the expected production increases of the coming years, these companies will all be maneuvering for market dominance and gains like those seen last year from companies like Newmont.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.