One of the most common ways investors day trade metals is through a futures contract. But for many investors, day trading stocks are a more feasible alternative to gain superior exposure to metals and commodities.

The case for day trading metal stocks is quite simple: 1) gold is acting more like a stock, 2) trading stocks can be done for free, and 3) trading stocks offer more choice and potential for outsized returns.

Gold Acting Like A Stock

Historically, people buy and hold gold and silver bars or coins for years, if not decades. These investors are unlikely to follow the price of commodities on a daily or even monthly basis.

And this was perfectly fine for most investors throughout history.

But in 2020, gold behaved much more like a volatile stock than a commodity and it should be treated as such. Consider a sample of sensationalist media headlines that have become the new norm in 2020 and so far in 2021:

Bloomberg reporting on March 13: “Gold’s worst week since 1983 strips metal of safe haven status.”

Forbes reporting on July 1:”Gold prices are soaring to the moon. Here’s why.”

Axios reporting on Aug. 12: “Gold had its worst day in 7 years, but investors remain bullish.”

Reuters reporting on Nov. 29: “Gold set for worst month since 2016 amid vaccine optimism.”

Barron’s reporting on Dec. 4: “Gold prices have soared. Expect more of that in 2021.”

Reuters reporting on Dec. 31: “Gold set for best year in a decade with 24% rise.”

Media outlets and investors stopped treating gold as a metal and more like a stock — and for good reason. Gold and stocks rose in unison in 2020 and for the same reason: government stimulus and seemingly endless money printing among global central banks.

So if gold is acting like a stock, it should be treated — and traded as such.

Day Trading Stocks Are A Cheaper Alternative

Day traders that want to trade metals and commodities can easily and conveniently do so through one of the many stockbrokers. Fast-growing brokers like Robinhood and eToro shook up the stock trading universe with zero commission trading in recent years. This forced legacy old-school brokers like Schwab and TD Ameritrade to follow suit in offering zero-commission accounts.

Certainly, the futures market can’t begin to match what brokers are offering stock traders.

Day trading metals can be accomplished in the same fashion as the futures market. The most popular gold exchange-traded fund (ticker $GLD) is a trust that only holds gold bars so its price fluctuates in unison with the price of gold, giving purists in essence a pure-play way to trade a metal through the equities market.

Stock day traders can buy and sell this and many other ETFs for free throughout a trading session. Stock traders are also allowed to hold an ETF overnight or for however long they wish.

Holding the GLD ETF for longer periods of time does come with a small cost, known as an expense ratio of 0.4%. This means that holding a $10,000 investment in the ETF will be subject to a $40 annual fee.

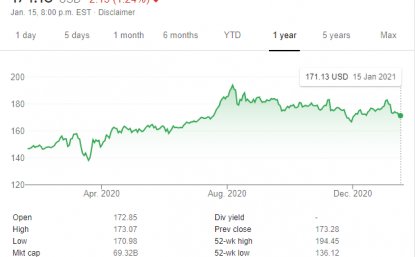

GLD one-year chart.

GLD one-year chart, retrieved Google Finance Jan. 18, 2021.

Trading Stocks: Superior Exposure

Throughout 2020, futures traders missed out on large gains associated with individual company-specific catalysts.

For example, the price of Barrick Gold’s stock surged more than 10% after billionaire investor Warren Buffett reversed a multi-decade long stance on gold. The “Oracle of Omaha” bought more than $500 million worth of the gold and copper miner’s stock.

Futures traders weren’t able to buy the individual stock so they missed out on a fantastic opportunity to profit from gold-related news.

Meanwhile, Barrick Gold’s stock is up more than 25% in the one-year period (as of Jan. 18, 2021) versus gold’s approximate 17% gain. Both these returns are inferior to Newmont’s stock that gained more than 40%.

Gold and other metal purists have a valid reason to avoid trading individual stocks like Barrick as it isn’t part of what they do. They want exposure to a metal — not a metal company.

And that is more than fine. But they are still missing out on what stocks have to offer traders.

There are several leveraged ETFs that offer stock traders outsized returns of two-times (in some cases three times) the return of the underlying asset.

For example, the ProShares Ultra Gold ($UGL) operates as a commodity pool that uses futures-based leveraged long positions in gold. If the price of gold moves higher by 2%, the leveraged ETF will move higher by 4%, thereby giving stock traders magnified returns.

On the flip side, stock traders can buy the ProShares UltraShort Gold ($GLL) that offers the exact opposite exposure. Instead of a long position, the commodity pool uses future contracts to take a short position on gold. If the price of gold falls by 2%, the leveraged ETF will move higher by 4%.

What Else Can Stock Trader’s Trade?

Here are some of the largest commodity stocks that investors should familiarize themselves with:

BHP Group ($BHP)

Rio Tinto Group ($RIO)

Vale S.A. ($VALE)

Newmont Corporation ($NEM)

Freeport-McMoRan Inc. ($FCX)

Barrick Gold Corporation ($GOLD)

ArcelorMittal ($MT)

These are some of the more commonly traded ETFs that offer exposure to one or many metals:

iShares Silver Trust ($SLV)

Aberdeen Standard Platinum Shares ETF ($PPLT)

Aberdeen Standard Physical Palladium Shares ETF ($PALL)

Invesco DB Precious Metals Fund ($DBP)

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.