Copper’s Demand – It is In Everything We Use and Difficult to Substitute

Anything with an on/off switch uses copper. Our homes, infrastructure and electronics all

require copper as a critical input. Its traditional uses are now amplified with new forms of

electrification which include not only electric vehicles, but the infrastructure needed for solar and wind power generation and storage. Copper is a versatile metal whose conductivity, low cost and difficulty to substitute makes the red metal so integral to business that its price is considered an indicator of economic growth.

Copper’s Short Term Obstacle: US – China Trade War

As a counter measure to China’s aggressive growth plans, the US Trade Representative has

implemented tariffs on certain Chinese imports in 2018, and even accused China of theft of intellectual property. China retaliated by implementing its own tariffs, and this was the start of an on-going trade war—ultimately stunting copper demand as China is the worlds largest consumer.

Impact on Price

The trade war has slowed down Chinese copper demand, keeping copper prices low

(currently ~$2.60/lb). Long-term price will heal once the trade dispute is settled or an

agreement is made.

The Return of Demand & Copper’s Wealth Effect

China is responsible for over 50% of global demand in the form of infrastructure, construction, manufacturing and electrification. A key factor in increasing global copper demand is the global wealth effect and population growth. As populations and GDP per capita continue to grow in developing nations, copper demand will increase in lockstep.

Made in China 2025, China 2035 and China 2049

China’s growth plans are underpinned by copper. Its ‘Made in China 2025’ 10-year goal is to transform the country into the leader for ten high-tech industries, including electric vehicles and technology. The plan focuses on China’s domestic companies becoming self-sufficient and developing core components with the government supporting acquiring the ‘know-how’ (intellectual property) for developing such technology. By 2035, China plans to compete with the world’s manufacturing powers on all fronts, and by 2049 China aims to become the world leader. Ambitious as the plan is, China has set clear goals and as such has been voraciously acquiring the raw materials to achieve their objectives.

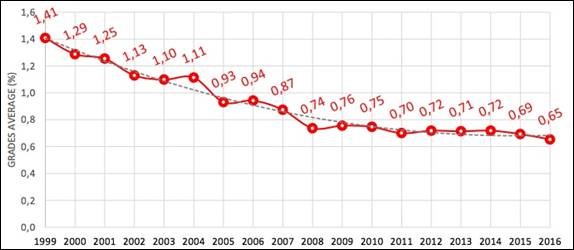

Supply-side Headwinds: Old, Degrading Mines in Risky Jurisdictions

Grades from copper mines in Chile, who in 2018 produced 28% of the world’s copper, are in steep decline and face drastically increased capital expenditures due to the need for

desalination plants, to use sea water as their water source. Furthermore, new large scale

copper mines take decades to become operational and the location of expected future supply in the pipeline remain in high risk jurisdictions.

Copper is Cyclical

Over the past 20 years, copper price has fallen below $1.50/lb during the 2008-2009

recession and has risen to over $3.50/lb multiple times (2005, 2006, 2007, 2010, 2012) and has even reached the $4.00/lb mark in 2010-2011. The current dip in copper prices

provide for an entry opportunity. Long-term fundamentals and structural issues continue

to point towards increasing copper demand coming from China and other developing nations. The world needs secure, established copper supply to meet the demand.

Incentive Pricing

An price of ~$3.20/lb is needed to incentivize development of new copper mines. This price can be higher based on specific government goals. For example, a price of $4.00/lb is

needed to meet the UK government mandated decarbonisation targets by 20301. Under a

more extreme scenario, to achieve complete decarbonisation by 2025 (“Greta Scenario” , a

copper price of ~$9.10/lb is required. Copper is key in decarbonisation. Wind and Solar

energy use anywhere from 3 to 15 times the copper per unit compared to fossil fuels.

Similarly, electric vehicles use anywhere from 4 to 16 times the copper than a traditional

internal combustion engine.

Nearly 50% of Supply at Risk

Apart from Latin America, other large copper producers are in Africa (i.e. Zambia, Democratic Republic of Congo), Indonesia and Russia, accounting for a total of 45% of global production.

These jurisdictions have political and economic risks, including resource nationalization,

implementing increased royalties and overall operational uncertainty. Furthermore, majority of future copper supply is expected to remain focused on these high-risk jurisdictions.

The Perfect Place for a Copper Mine: Quebec, Canada

If you could select the most ideal location for a copper deposit, you’d want it Quebec. Then, you’d want it right beside a highway, a railroad and with access to power supply. Power Ore’s Opemiska checks each of these boxes and is off to a fantastic start with its drill program with twelve 100 metre copper and gold mineralized intervals near surface including several headline drill holes:

Power Ore’s Opemiska Copper Mine Complex is in an easily accessible location where

capital costs can be 2.5x lower for producing mines, and operating costs 60% lower2 as

opposed to more typical remote locations. Opemiska is easily accessible via paved highway

which significantly reduces exploration, development and operating costs.

– Article written by CEO Stephen Stewart of Power Ore Inc.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.