A few weeks ago we wrote that precious metals were at risk of a correction.

First, they powered higher. But last week they ran into technical resistance levels that date back well beyond only a few years.

This is true for Gold, Silver as well as the miner ETFs: GDX and GDXJ.

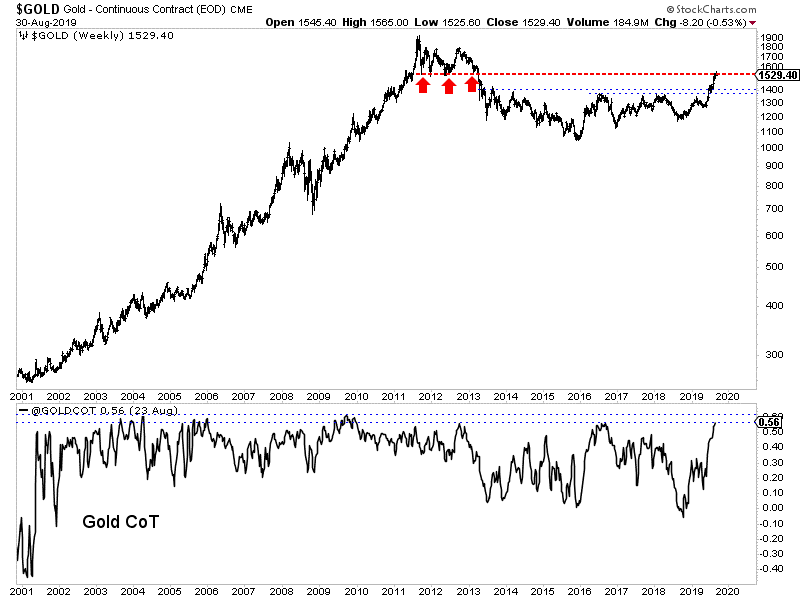

Starting with Gold, we can see that it has struggled to get through $1550/oz. That’s not a surprise as we pointed out this level as resistance since Gold surpassed $1370/oz.

The combination of multi-year resistance at $1550/oz and the current high net speculative position could force Gold down to a retest of $1400/oz.

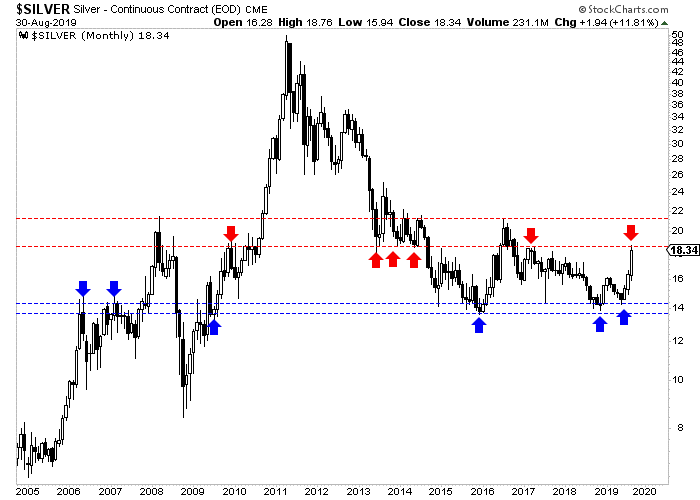

Meanwhile, Silver has been the strongest component of the sector in the short-term.

It closed the month of August right at major resistance in the mid $18s, which as you can see, has been a key level for the last 11 years. A monthly close above $18.50 would be significant but it may not happen until October or November.

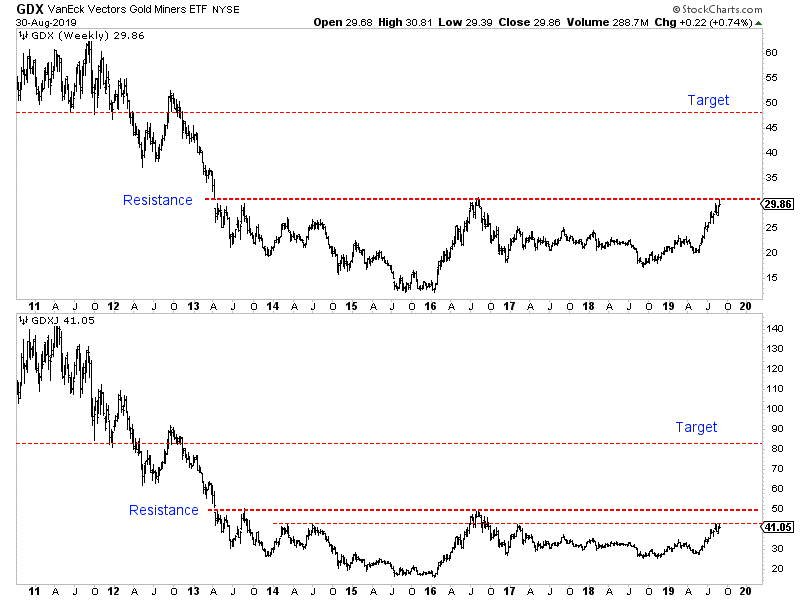

Turning to the stocks, we see that GDX has reached its 2016 high and 6-year resistance. A correction or consolidation for weeks or even a few months would be perfectly normal.

GDXJ has lagged much like Silver as it has yet to reach its 2016 high near $50. However, it is dealing with important resistance at $42 which dates back to 2014.

As summer winds down, the excitement in precious metals is building.

The retail crowd is looking to jump back in for the first time in years and the same can be said for many institutions.

In the big picture, this is the time to jump back in. You do want to get in before the sector makes its next break higher and before GDX and GDXJ surpass multi-year resistance.

However, the immediate risk appears to be to the downside.

Gold, Silver and gold stock ETFs all are at multi-year resistance levels. A correction and consolidation is perfectly normal and should be expected here.

If you missed the recent run then don’t panic. It’s best to exercise patience and wait for weakness. Better value and new opportunities will emerge. To learn the stocks we own and intend to buy that have 3x to 5x potential, consider learning more about our premium service.

By Jordan Roy-Byrne CMT, MFTA

September 5, 2019

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.