by Robert Kientz

Summary

- I discuss the recent streaming deal with Northern Vertex CEO Ken Berry.

- We also go over the $8 million private placement.

- During the interview, we cover extensively the accomplishments for 2018 as well as the options the company has to expand production and acquire new assets.

- I analyze the optionality for both companies, Maverix and Northern Vertex.

- I discuss why this deal, along with the Sprott relationship, says a lot about confidence in Northern Vertex to deliver the goods on their project.

Author’s note: I have covered Northern Vertex (NHVCF) previously in 2018 in these articles here, here, and here.

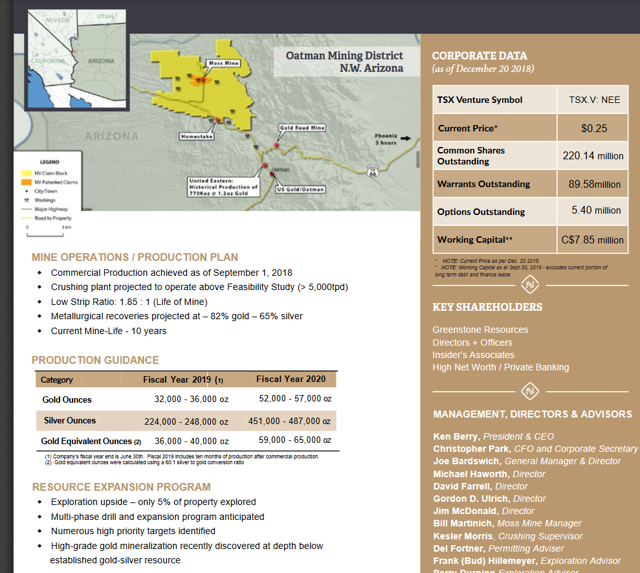

The purpose of this article is to update you on the recent streaming deal with Maverix Metals (OTCPK:MACIF) as well as the $8 million funds earned through a private stock placement. Both deals were aimed at cleaning up the debt on the balance sheet as well as providing cash for operations and some further exploration of the Moss mine area.

I interviewed Kenneth Berry who is President, CEO, and a Director with the company. CFO Christopher Park and Communications Manager Chris Curran were also in attendance.

Video Interview:

Here are some key takeaways from the interview.

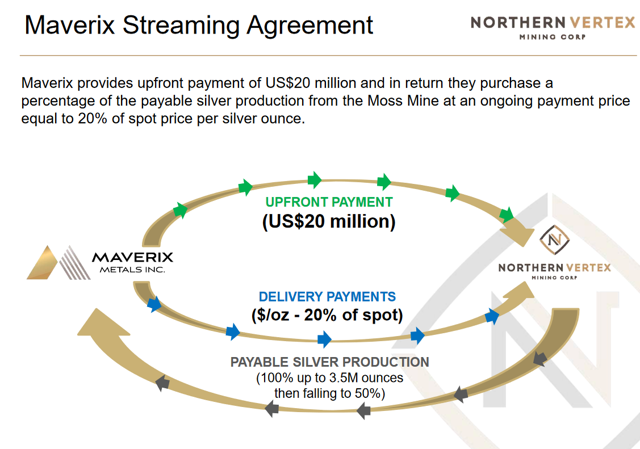

Source: Northern Vertex

- Northern Vertex has retired the debt they had with Sprott.

- Maverix gives $20 million up front for the opportunity to purchase up to 3.5 million ounces of silver at 20% of the spot price.

- After those ounces are purchased, Maverix maintains the ability to purchase up to 50% of future silver production using the same terms.

- Both companies profit from the deal and it offers optionality on a potentially rising silver price for both parties.

- The $8 million private placement provides the company money to fund operations and should solidify the balance sheet for 2019 while the company works on optimizing the gold and silver recovery from their mine.

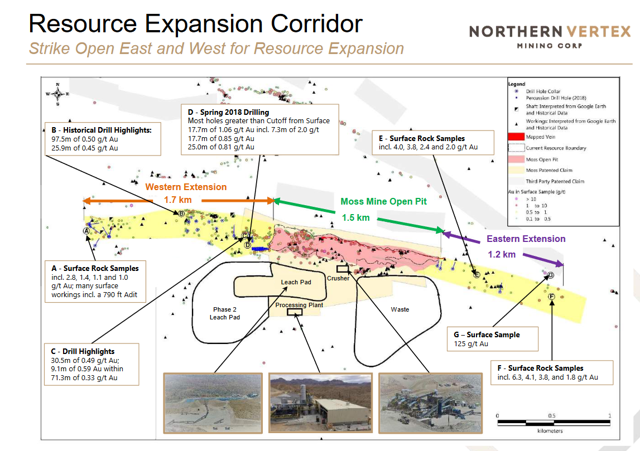

In addition to those points, Northern Vertex has options to increase exploration of the Moss mine area in the Oatman district with award winning exploration team Perry Durning and Bud Hillemeyer.

Source: Northern Vertex

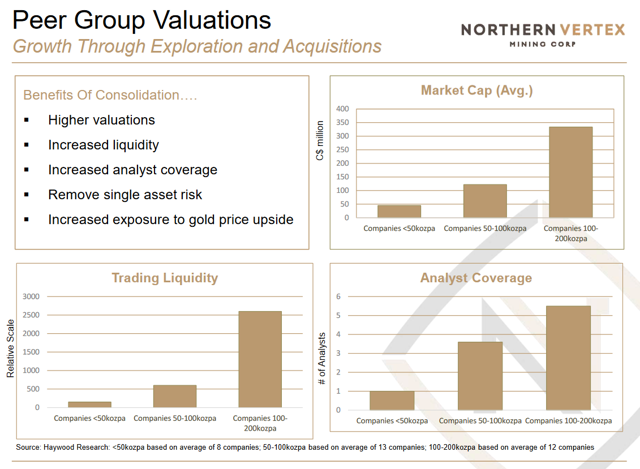

In addition to the exploration upside, now that Northern Vertex has solidified their financial standing, the company is positioned to take advantage of possible expansion. Some research provided to the company shows the power of increasing both production rates and reserves in terms of market liquidity, higher market capitalization, and more analyst coverage.

Source: Northern Vertex, Haywood Research

Optionality Analysis for Maverix and Northern Vertex

Here is my optionality analysis for both companies given different possible silver prices, including spot price as of time of writing the article.

| Northern Vertex Project Feasibility, Moss Mine | |

| Project Silver Ounces (M&I) | 4,610,000 |

| Silver Recovery Rate | 65.00% |

| Recoverable Ounces, Initial | 2,996,500 |

| Gold Ounces (M&I) | 377,000 |

| Maverix Agreement | |

| Tranche 1 Stream Ounces | 3,500,000 |

| Difference to be found through expanded exploration | 503,500 |

| Maverix spot-based payments ($14.81 silver spot as of 12-24-2018) | $8,875,633.00 |

| Initial Payment to Northern Vertex | $20,000,000.00 |

| Total Payments to Northern Vertex | $28,875,633.00 |

| Maverix Total Cost of Silver per ounce | $9.64 |

| Maverix Optionality Analysis | |

| Silver @ $17.50/ounce, total project silver value | $52,438,750.00 |

| Maverix 20% spot payment | $10,487,750.00 |

| Maverix Total Cost of Silver per ounce | $10.17 |

| Northern Vertex – per gold ounce byproduct credit from silver stream | $80.87 |

| Silver Rises to $20/ounce (2016 high) | $59,930,000.00 |

| Maverix 20% spot payment | $11,986,000.00 |

| Maverix Total Cost of Silver | $10.67 |

| Northern Vertex – per gold ounce byproduct credit from silver stream | $84.84 |

| Silver Rises to $25/ounce | $74,912,500.00 |

| Maverix 20% spot payment | $14,982,500.00 |

| Maverix Total Cost of Silver | $11.67 |

| Northern Vertex – per gold ounce byproduct credit from silver stream | $92.79 |

Source: Author Calculations

Maverix is making out pretty well on this deal, staying under the current floor for the silver price. If silver price does rise substantially, Maverix’s total cost of silver as a percent of the spot price falls precipitously.

Northern Vertex gets immediate partial monetization of their silver and higher byproduct credits, per project gold ounce, as the price of silver rises. The original project feasibility study had the AISC (all in sustaining cost) of gold at $603 given the silver byproduct credits. Since this deal was put into place, we can expect the AISC to rise somewhat due to sharing the silver profits with Maverix.

However, the project is still low cost with respect to the average gold mining costs found in the industry. And Northern Vertex just eliminated a lot of risk from their balance sheet by eliminating the Sprott debt and adding to their cash reserves. This move should provide plenty of runway to optimize their mine and get to their expected production rates without having to take on additional debt.

What the Deal Says About Confidence in the Project

The new financing shows that streaming companies such as Maverix Metals have confidence in the company to deliver on production targets.

Source: Northern Vertex

Maverix Metals has an established streaming agreement with Pan American Silver at La Colorada in Mexico and Endeavour Mining in Burkina Faso, so it is no stranger to making deals with strong, established precious metals mining companies.

But Maverix’s strategy also seems to be financing smaller development projects with solid price upside. In the case of this deal with Northern Vertex, they saw an opportunity to finance a new operator and obtain undervalued silver assets that give them a very cash flow positive optionality play on the upside price for silver.

The best time to make this deal was right after Northern Vertex began production, had some debts to pay for developing the mine, and had not delivered the bulk of the metals in the project yet.

Further, the Maverix option includes total mine output well beyond the initial 2.99 million recoverable silver ounces. The agreement agrees to purchase 100% of silver ounces up to 3.5 million. Also, the deal gives Maverix the ability to purchase 50% of silver beyond the 3.5 million ounces, suggesting Maverix thinks there is more gold and silver to be found on the property, perhaps in the Western and Eastern extensions as shown in the graphic above.

Maverix is not the only company that has shown confidence in Northern Vertex to produce on the project. Sprott had provided a $100 million line of credit initially which Nortern Vertex had drawn $20 million against. I am told by management that the possibility of further financing with Sprott, should the company want to expand, is still an option as they have maintained their positive relationship. Paying off the debt early and strengthening the balance sheet certainly helps the case if they needed to use that option.

What are the Risks?

The main risk that I took away from the conversation with Ken Berry was that Northern Vertex is not ready to estimate their current AISC. To be fair, they have not had enough production time to calculate actual production costs plus additional expenditures to expand operations. It will take more time for data to be made available to come up with a tangible, reliable AISC number.

Further, he stated that the initial production costs of gold are above the feasibility number, which was $603 per gold ounce. I am not overly worried about that right now for two reasons:

- a) they are early in production, and it is not abnormal to have higher costs while operations are fine tuned and

- b) the AISC is so low that it could rise substantially and still be way below current gold spot price of $1271.70 at time of this writing.

However, there is still a risk that the costs are substantially higher than the feasibility study would indicate, which would drive the overall project value down. Northern Vertex’s current market cap is currently valued well below their project NPV.

The research provided in the graphic above from Haywood Research shows that overall sector market caps are priced within ranges and not tied directly to project NPVs, but more on sentiment indicators like analyst coverage and overall project size. Investors have not appeared to spent enough time in precious metals sector to appropriately value projects and make their bets.

As the general stock market volatility continues into 2019, I believe investors will spend time analyzing their options and find that the precious metals markets are sorely undervalued.

I believe this to be an arbitrage opportunity right now for smart value investors looking at cheaply priced assets, and perhaps licking their wounds from falling stock values in the wildly popular technology sector which has been punished since October.

I think the market scenario has played into Northern Vertex’s hands as it has allowed them to develop the mine largely unnoticed, while still showing the ability to finance their operations with two established industry partners who know how precious metals mining works.

When the broad market takes notice of the sector, Northern Vertex will likely be one of the companies that catches some of that new investor money coming in due to their relatively low level risk factors.

Stay Tuned

We are much closer to the Renaissance in precious metals markets than we have been since the last major market crash. The macro story is playing into the hands of precious metals, and will reward the miners and investors with key positions.

Therefore, for 2019 I will be adding coverage for more companies in the precious metals sector that I also believe are undervalued. And lastly, I will continue to provide coverage for Northern Vertex throughout 2019 as production continues to ramp up and major news events happen.

Robert Kientz, January 3, 2019

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.