The recent stock-market selloff is persisting, fueling mounting worries among investors. The intensifying volatility and lack of a quick rebound higher is strangling euphoric sentiment, spawning self-reinforcing selling pressure. Scoffed at a few months ago, the notions that a young bear market is underway and a recession looms are gaining traction. The great beneficiary of this ominous stock-market downturn will be gold.

Gold has always been an essential asset class for prudently diversifying investment portfolios. Uniquely it tends to rally when stock markets weaken, offsetting some of the losses in typical stock-heavy portfolios. Gold acts like portfolio insurance, usually soaring when stock markets plunge on unforeseen news. All throughout history, wise investors have recommended everyone have 5% to 10% of their portfolios in gold.

But like insurance in general, the important role gold plays in portfolios is gradually forgotten when it isn’t needed. Just a few months ago, the U.S. stock markets seemed invincible. The flagship S&P 500 broad-market stock index (SPX) had powered 333.2% higher over 9.5 years by late September. That made for the 2nd-largest and 1st-longest stock bull in U.S. history! Investors were convinced that would last indefinitely.

The SPX had surged 9.6% year-to-date by that latest peak, while gold had slumped 7.3%. Thus investors felt no need to allocate virtually any capital to gold, they were and are radically underinvested in it. This is especially true of American stock investors, who were wildly optimistic after long years of big stock-market gains. Their effective portfolio exposure to gold was vanishingly small back in late September.

The 500 elite stocks of the SPX had an extreme collective market capitalization way up at $26,141.4b as that topping month waned. It is interesting contrasting that with the physical gold bullion holdings of the world’s dominant gold exchange-traded fund, the American GLD SPDR Gold Shares. GLD has long been the go-to destination for American stock investors looking to allocate capital for gold exposure in their portfolios.

At the end of September as stock euphoria peaked, GLD’s total holdings were merely worth $28.4b. That implies American stock investors were running trivial gold allocations around 0.11%! That’s on the order of only 1/50th the minimum 5% that’s been universally advised for centuries if not millennia. So it’s not much of a stretch to argue American stock investors had zero gold exposure, they were effectively all-out.

The sharp stock-market selloff in the few months since those halcyon all-time record highs has surprised most, but it shouldn’t have. As Q4’18 dawned, something ominous happened that was unprecedented in stock-market history. The US Federal Reserve upped its quantitative-tightening campaign necessary to start unwinding its $3625b of quantitative-easing money creation over 6.7 years to its terminal velocity.

October 2018 would be the first month ever to see the Fed’s monetary destruction ramp to a staggering $50b-per-month pace. And even to unwind just half of the Fed’s radical QE, QT would have to keep on destroying $50b per month of QE-conjured money for 30 months! At the end of September when the SPX was just 0.6% off its all-time record high, I explained all this in depth warning it was this bull’s death knell.

And indeed within a week of Fed QT going full-throttle, the SPX started to slide. There was no way QE-levitated stock markets could ignore QT obliterating that QE money. Every daily selloff since had its own unique story and specific drivers, which I discussed and analyzed in our subscription newsletters. These all added up to enough selling to spawn an ongoing stock-market correction, an SPX selloff exceeding 10%.

Blame it on Fed QT, stock-market bubble valuations, mounting US-China trade-war threats, Republicans losing the House, or whatever you want, but by Black Friday the SPX had fallen 10.2% over 2.1 months since that euphoric record peak. The stock markets staged some sharp rallies within that span, but they quickly fizzled proving to be dead-cat bounces. This recent action is ominously looking very bear-market like.

We can’t know for sure whether the long-overdue new bear market driven by epic record Fed tightening is indeed upon us until the SPX falls 20%+ on a closing basis. This recent correction would still have to double to hit that bear-market threshold. But gold has certainly been the main beneficiary of the recent stock-market weakness. Investors are starting to remember the ages-old wisdom of diversifying into gold.

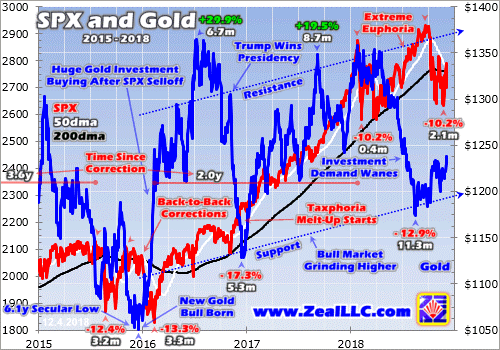

This week’s chart looks at the US-dollar gold price superimposed over the SPX during the past 4 years or so. Despite gold being forgotten in recent years as the stock markets surged ever higher, it remains in a young bull market. And that was spawned by the last set of back-to-back corrections in the SPX, which catapulted gold sharply higher. We’re likely on the verge of another stock-selloff-driven major gold upleg!

GLD’s physical-gold-bullion holdings held in trust for its shareholders reveal how American stock investors feel about gold. This past spring they started slumping as gold was sold to move even more capital into the lofty US stock markets. For 5 months in a row ending in September, GLD’s holdings retreated as investors dumped GLD shares faster than gold was falling. By early October GLD’s holdings hit a 2.6-year low.

I penned a whole essay on this stock-euphoria-driven gold exodus in late September, explaining why it was happening and why it was likely to soon reverse. And that shift in gold-investment sentiment began the very day the SPX started plunging in mid-October! Up until October 9th the stock markets looked totally normal, the SPX had only drifted a trivial 1.7% lower from its peak. Everyone remained wildly bullish.

But something snapped on October 10th, that fateful day the SPX plunged 3.3% out of the blue on no catalyst at all. Heavy technically-motivated selling accelerated led by the market-darling mega tech stocks. For years investors had believed them bulletproof, their businesses so good they could weather any stock selloff or economic slowdown. Fears surged on the worst SPX down day since back in early February.

That very day American stock investors started returning to gold. They poured capital into GLD shares so aggressively they forced a major 1.2% holdings build. GLD’s mission is to track the gold price, but it has its own supply-and-demand profile independent from gold’s. So when GLD shares are being purchased faster than gold is bought, GLD’s share price threatens to decouple to the upside on that excess demand.

So GLD’s managers must vent that differential buying pressure directly into the physical gold market in order to equalize it and maintain tracking. They do this by issuing enough new GLD shares to satisfy all the excess demand, and then plow the cash proceeds into gold bullion. Thus rising GLD holdings show American stock-market capital is flowing into gold. That proved to be GLD’s biggest build in 6.7 months.

That fateful day proved a major inflection point for both near-record US stock markets and the extremely-unpopular gold. As the SPX continued to weaken over the next couple months, GLD continued to enjoy modest builds on investment gold buying. By late November GLD’s holdings had climbed a considerable 4.5% over 6 weeks. That has helped push gold 5.5% higher since its mid-August lows, a solid young upleg.

Odds are that gold buying via GLD by American stock investors is only beginning. The longer this stock-market weakness persists, the deeper their worries will grow. And the more their stock-heavy portfolios bleed, the quicker they will remember they should’ve allocated 5% to 10% to gold. Once gold investment demand is kindled by falling stock markets, it tends to balloon dramatically and take on a life of its own.

Gold’s young bull market today that was forgotten this summer began as 2016 dawned. Much like this year, in the first half of 2015 the US stock markets were powering to dazzling new record highs. Since it seemed like stocks could do nothing but rally indefinitely, gold was forgotten and shunned. It slumped to a brutal 6.1-year secular low by mid-December 2015, with investors really wanting nothing to do with it.

But their ironclad euphoria started to crack soon after the stock markets corrected. In mid-2015 the SPX finally suffered its first correction in an incredibly-extreme 3.6 years after being levitated by relentless Fed money creation from its third quantitative-easing campaign. Gold caught a bid on that 12.4% SPX selloff over 3.2 months, but then faded again into the expected first Fed rate hike in 9.5 years in mid-December.

Then the SPX fell into another 13.3% correction over 3.3 months into early 2016. Seeing menacing back-to-back corrections after long years without one really deflated gold-suppressing stock-market euphoria. So in early 2016 American stock investors began prudently rediversifying their stock-dominated portfolios into gold. That birthed today’s gold bull, and the gold-buying momentum fed on itself to drive a powerful upleg.

Gold went from being left for dead in mid-December 2015 to surging 29.9% higher in just 6.7 months solely on American stock investors returning! This is no generalization, the hard numbers prove it without a doubt. The world’s best gold fundamental supply-and-demand data comes from the venerable World Gold Council. It releases fantastic quarterly reports detailing the global buying and selling happening in gold.

Gold blasted higher on SPX weakness in Q1’16 and Q2’16. According to the latest data from the WGC, total world gold demand climbed 188.1 and 123.5 metric tons year-over-year in those key quarters. That was up 17.1% and 13.2% YoY respectively! But the real stunner is exactly where those major demand boosts came from. It wasn’t from jewelry buying, central-bank buying, or even physical bar-and-coin investment.

In Q1’16 and Q2’16, GLD’s holdings alone soared 176.9t and 130.8t higher on American stock investors redeploying into gold after back-to-back SPX corrections. Incredibly this one leading gold ETF accounted for a staggering 94% of overall global gold demand growth in Q1’16 and 106% in Q2’16! So there’s no doubt without American stock investors fleeing into gold via GLD this gold bull never would’ve been born.

Gold was holding those sharp gains throughout 2016 until Trump’s surprise presidential victory unleashed a monster stock-market run on hopes for big tax cuts soon. Gold was pummeled in Q4’16 as American stock investors pulled capital back out to chase the newly-soaring SPX. That quarter total global gold demand per the WGC fell 103.4t YoY or 9.0%. GLD’s 125.8t Q4’16 holdings draw accounted for 122% of that!

Gold’s fortunes are being driven by American stock investors’ collective buying and selling of GLD shares. And nothing motivates them to redeploy capital into gold to diversify their stock-heavy portfolios like major SPX selloffs. Recent months’ one has already proven serious enough to rekindle differential GLD-share buying. And as H1’16 proved, once investors start driving gold higher its rallies tend to become self-feeding.

The more physical gold bullion American stock investors buy via GLD shares, the more gold climbs. The higher gold rallies, the more investors want to buy it to ride the momentum and chase its gains. So buying begets buying, driving gold higher fairly rapidly. And when stock markets are sliding, gold is often the only asset class rallying. That makes it even more attractive to investors getting pounded by sliding stocks.

This latest SPX correction is even more damaging to sentiment because it is 2018’s second one. Back in early February the SPX plunged 10.2% in 0.4 months, which started to crack sentiment. Back when this gold bull was born it was the second of back-to-back SPX corrections that proved the coup de grâce in hurting stock-market sentiment enough to unleash a reallocation into gold. This scenario is playing out again.

Provocatively seeing the three major US stock indexes suffer two 10%+ corrections within any single calendar year is itself a super-bearish omen. 2018 joined 1973, 1974, 1987, 2000, 2001, 2002, and 2008 as the SPX’s only other dual-correction years. Those coincided with a 48.2% SPX bear, a 20.5% single-day SPX crash, another 49.1% SPX bear, and a third 56.8% SPX bear! All three bears triggered recessions.

This stock-market weakness isn’t only likely to persist, but the odds really favor it snowballing into another major SPX bear market. Gold investment demand will naturally surge as stocks burn, fueling a strong bull market. Gold’s 29.9% gain over 6.7 months at best so far in this bull is nothing. Gold’s last secular bull from April 2001 to August 2011 saw it soar 638.2% higher! Gold’s gains as the SPX rolls over should be massive.

With a trivial 0.1% portfolio allocation to gold, what happens to gold prices if American stock investors just return to a still-immaterial 1.0%? That’s still way under the 5% to 10% recommended in normal times, and plenty of great investors believe 20% gold allocations are necessary during stock bears. Gold’s upside from here with virtually-zero US-stock-market capital allocated to it is vast. And it could accelerate rather fast.

The timing of this current SPX correction is likely to magnify bearish psychology. It has occurred entirely within Q4’18. The SPX exited Q3’18 just 0.6% off its record peak from a week earlier. So I suspect a lot of American retirement investors have no idea just how much carnage their precious capital has suffered. When they get their quarterly statements from their money managers in January, they could really freak out.

Even worse, far too much of this retirement capital was allocated to the market-darling mega techs which were the biggest holdings across most funds. Their losses have far outpaced the SPX’s. As of that latest correction low on Black Friday when the SPX was down 10.2%, Apple, Amazon, Microsoft, Alphabet, Facebook, and Netflix had collapsed 25.8%, 26.4%, 10.8%, 19.9%, 39.4%, and 38.2% from their all-time highs!

The mega techs that nearly single-handedly pushed the SPX higher for years averaged 26.8% losses, or 2.6x the SPX’s! When investors who don’t closely follow the stock markets figure that out next month, the investment demand for rallying gold ought to explode. The first half of 2019 has a setup much like H1’16, where gold essentially powered 30% higher. A similar upleg from mid-August’s lows isn’t a stretch at all.

Another 30% run from $1174 would leave gold at $1525. And once gold climbs decisively back over its bull-to-date high of $1365 from early-July 2016, investment interest and demand will soar. Just like the mega tech stocks, the higher gold prices the more investors want to buy it. A mere 16% gold upleg off August’s lows, or another 10% higher from this week’s levels, would near that psychologically-huge bull breakout!

All investors should always have 5% to 10% of their investable capital allocated to gold. But almost none do today as a long-overdue bear market fueled by epic record Fed QT looms. If you don’t have that core gold allocation, you need to get it in place before stocks fall much farther and gold surges much higher. The gold miners’ stocks will greatly leverage gold’s gains too, their leading index soared 182.2% largely in H1’16!

Absolutely essential in bear markets is cultivating excellent contrarian intelligence sources. That’s our specialty at Zeal. After decades studying the markets and trading, we really walk the contrarian walk. We buy low when few others will, so we can later sell high when few others can. While Wall Street will deny the coming stock-market bear all the way down, we will help you both understand it and prosper during it.

We’ve long published acclaimed weekly and monthly newsletters for speculators and investors. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. As of Q3, we’ve recommended and realized 1045 newsletter stock trades since 2001. Their average annualized realized gain is +17.7%! That’s double the long-term stock-market average. Subscribe today and take advantage of our 20%-off holidays sale!

The bottom line is this stock selloff is boosting gold. Flagging gold investment demand turned on a dime when the stock markets started plunging in mid-October. Gold has rallied on balance since as American stock investors start redeploying capital. Their buying alone via GLD shares was fully responsible for gold’s sharp 30% upleg in 2016’s first half. That followed the last back-to-back corrections in US stock markets.

And between record Fed tightening running full-throttle, continuing dangerous bubble valuations, and the mounting trade wars, this recent stock selling is likely to persist on balance. So gold investment will look far more attractive. Coming from virtually-zero gold portfolio allocations, investors have massive buying to do. The higher they push gold, the more other investors will chase it. Especially as US stock markets weaken.

Adam Hamilton, CPA

Copyright 2000 – 2018 Zeal LLC (www.ZealLLC.com)

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.