The following interview of Stephen Dunn, President & CEO of Crown Mining Corp. (TSX-v: CWM) was conducted by phone & email over about a 10-day period ended November 21st. Crown Mining has a NI 43-101 compliant mineral resource estimate of 2.1 billion Indicated & Inferred pounds Copper (“Cu“). In about 4 months, management plans to deliver a Preliminary Economic Assessment (“PEA“) on a portion of its 2.1-billion-pound resource.

Steve, please give readers an overview of Crown Mining.

Crown Mining Corp. (TSX-v: CWM) is focused on advancing its 100% controlled Moonlight-Superior Copper project in Plumas County, which is in northeastern California. Moonlight-Superior has a NI-43-101 resource of 2.1 billion pounds Cu, 750,000 ounces Gold and 25,000,000 ounces Silver. At today’s spot prices, the gold & silver ounces equate to more than 400,000,000 pounds Cu Eq. Our property hosts 4 known Cu deposits.

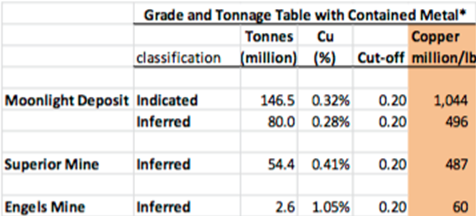

The Moonlight deposit alone hosts a NI 43-101 Indicated mineral resource of ~161 M short tons at an average grade of 0.324%, equal to ~1 billion pounds Cu, and an Inferred mineral resource of ~88 M tons at an average grade of 0.282%, equal to ~ 500 M pounds Cu. So, combined, the Moonlight deposit hosts 1.54 billion pounds Cu [Indicated (68%) & Inferred (32%)].

Two other deposits, Superior & Engels, have a combined NI 43-101 Inferred mineral resource of ~63 short tons at an average grade of ~0.44%, equal to ~ 550 M pounds Cu.

Crown recently had third-party metallurgical testing done and is awaiting final results. Findings will be used in a PEA report that will be started soon and is expected to be finished by the end of March, 2018.

And, how about a brief summary of the history of your controlled property.

Copper was discovered in the 1880’s and the most prolific mining period took place from 1915 to 1930. During that time, 4.7 million short tons of ore were extracted, yielding 161,500,000 pounds Cu, (Cu grade 2.2%), 1,900,000 ounces Silver, and 23,000 ounces Gold. Recoveries were reportedly around 80%.

From 1962 to 1994, Placer AMEX drilled over 400 holes and calculated a (non NI 43-101 compliant) 4-billion-pound Cu resource. We have a lot of the Placer data. Even though our team is not relying on that 4-billion-pound figure, we think it speaks to significant exploration potential.

From 2004 to 2011, various juniors drilled 54 holes and conducted airborne geophysics, which supported a 2007 technical report containing a mineral resource estimate. That report remains NI 43-101 compliant today.

From 2013-2017 we acquired 132 unpatented claims and a lease for the 36 patents covering the Superior and Engels mines. In 2013 we published a third-party NI 43-101 compliant mineral resource report at Superior of about 500 M pounds Cu. In March 2016, we option 300 claims covering the Moonlight deposit and started a scoping study and metallurgical tests this year.

Is Crown Mining’s 2.1 billion pounds of Indicated & Inferred Copper (“Cu“) resource NI 43-101 compliant?

Yes, it is. That 2 billion + pound figure comes from two reports, one from 2013 and one from 2007, but both are NI 43-101 compliant. The reports cover 3 deposits, (Moonlight, Superior & Engels) but they are part of the same system, about 1.5 miles across as the crow flies. There are 4 known deposits in an area of about 7 sq. miles (18 sq. kms) in northeast California.

We hope to find one or more new deposits before it’s all said and done.

We already know we’re sitting on a large, bulk-scale, open-pittible Cu resource that will likely have meaningful Silver credits. We plan to publish a PEA in the first quarter of 2018 that will provide indicative answers to many important questions.

How much capital will you need to raise to deliver a PEA next year?

We run a tight ship, our cash burn is quite manageable. The avoidance of undue equity dilution is very important to us, that’s why we capped our recent capital raise at C$ 200k. [NOTE: Crown Mining has just 34 M shares outstanding]. That, along with cash on hand, will cover us through March or April. So, we don’t need to raise capital anytime soon. If all goes well, our share price will be meaningfully higher next spring after we release the PEA.

I believe we are in the early stages of a multi-year bull market in Copper that will be a tailwind for us next year. Analysts and pundits seem to indicate that a sustained Cu price above US3.50/lb., is an important milestone; a price at which producers are willing to put money to work through investments in new projects and pursue outright acquisitions of juniors like Crown Mining.

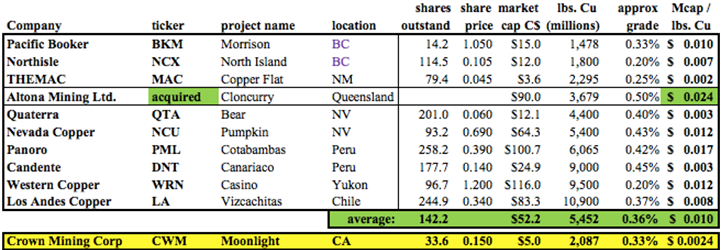

In fact, just a few days ago, Copper Mountain Mining (TSX: CMMC) announced a takeover of Australian-listed Altona Mining Ltd. at a headline valuation of ~ C$0.024 per pound of Cu resource. That valuation is 10x that of ours. {See chart below}. To be fair, Altona is well more advanced than we are, which accounts for some of the premium.

Large-scale, near-surface mineralization, in a safe jurisdiction, with good access to infrastructure is great, but poor metallurgy could end the story. What do you know about the project’s metallurgy?

That’s a good question. We are very much aware of the critical importance of what are recoveries might look like, and how much processing the ore will cost. Historical mining activity from 1915 to 1930 had recoveries around 80%. Placer Amex did various studies in the 1960’s that pointed to recoveries closer to 85%.

Earlier this year we commissioned a round of metallurgical testing by a well-respected third-party. We are awaiting the final detailed results, but I’m happy to report that, generally speaking, recoveries were approximately 85%, similar to the findings of Placer Amex.

Although the U.S. is obviously a safe jurisdiction with many mining friendly attributes, some readers will be concerned about “California permitting risk.” Are investor concerns warranted?

You’re right, we do get asked a lot about permitting risks in California. We believe that that once the permitting process starts, probably not before the 2nd half of 2018 at the earliest, we could be facing a timeline of roughly 3 years.

Most investors don’t understand the permitting process in California. The way in which it proceeds can actually work in favor of a company. The County is the lead agency to collaborate with in presenting proposed projects at the State level. Moonlight-Superior is in a remote, low population density, mining-friendly County near the Nevada State line.

We’ve spoken with a number of people in the area and have received positive feedback, but our main focus is really on delivering a PEA and then attracting a strategic partner.

We covered these topics, but to reiterate, what are the near-term catalysts for Crown Mining over the next 3-6 months?

Near-term catalysts include the release of a PEA around the end of March next year. Before then, we will be putting out a press release that details the results of third-party metallurgical testing done earlier this year. Finally, we expect to be in the position next month to announce a prominent new addition to our team.

Underlying all of this is a strong Cu price, up about 50% from the summer of 2016’s prices near US$2/lb., and down about 4% from a high of US$3.24/lb. a month ago.

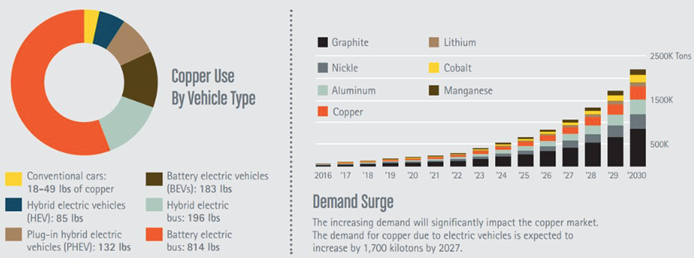

As the chart above clearly shows, Cu demand is very likely to be much stronger than anyone expected even just a year ago. The electrification of the global transportation fleet, grid-scale energy storage and the ongoing transition to renewable energy sources, especially wind power, are Cu intensive.

Yet, global supply constraints — (decades of declining ore grades at existing mines, fewer large Cu discoveries and ever growing geopolitical risks) — suggest that prices need to move higher, possibly a lot higher, to entice companies to invest large sums of capital on big projects.

We think 2018 will be an exciting year for juniors like Crown Mining Corp. (TSX-V: CWM) as more and more investors realize how incredibly important Cu is, and will be, to the world economy over the next few decades.

Thank you Stephen, I think we covered a lot of ground here. Good luck with the PEA!

Disclosures: The content of this interview is for illustrative and informational purposes only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research, [ER] including but not limited to, commentary, opinions, views, assumptions, reported facts, estimates, calculations, etc. is to be considered implicit or explicit, investment advice. Further, nothing contained herein is a recommendation or solicitation to buy or sell any security. Mr. Epstein and [ER] are not responsible for investment actions taken by the reader. Mr. Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Mr. Epstein and [ER] are not directly employed by any company, group, organization, party or person. Shares of Crown Mining are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned shares in Crown Mining and the Company was an advertiser on [ER]. By virtue of ownership of the Company’s shares and it being an advertiser on [ER], Peter Epstein is biased in his views on the Company. Readers understand and agree that they must conduct their own research, above and beyond reading this article. While the author believes he’s diligent in screening out companies that are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.