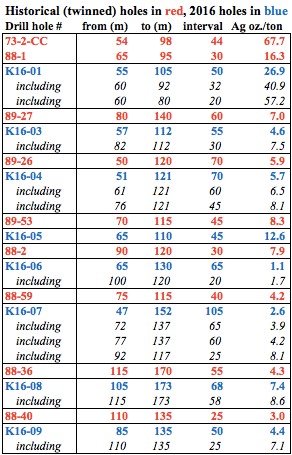

Viscount Mining (TSX-V: VML) / (OTCQB: VLMGF) is a project generator with 2 silver (“Ag“) / gold (“Au“) properties in the Western U.S., Silver Cliff and Cherry Creek. Silver Cliff in south-central Colorado consists of 2,029 acres that were host to high-grade silver, gold & base metal production from 1878 to the early 1900’s. A Pre-Feasibility Study (“PFS“) was completed in the 1980s, but that report is not NI 43-101 compliant. The PFS contained very-high grade assays including an interval of 68 troy oz./ton Ag (2,125 grams/tonne) over 44 ft. (13.4 m). Late last year, management twinned several of the holes from the 1980’s and was quite pleased with the results. See table of twinned holes below

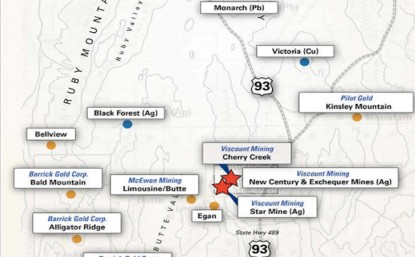

The Cherry Creek property in northeastern Nevada consists of over 400 un-patented and patented claims as well as mill rights. There was a robust 2-year exploration program (at no cost to Viscount) in 2015-16 by a former earn-in party that yielded detailed and positive results that the Company plans to follow up on this year. Interested parties are looking at Silver Cliff and Cherry Creek. A farm-out agreement on one or both properties could be a 2017 event and would represent important investment catalysts. A Phase 2 drilling program at Silver Cliff is expected to start in September / October.

Looking more closely at Viscount, I discovered that there are in fact a number of near-term catalysts, so I reached out to Viscount’s Chairman Kaare Foy to learn more. The following interview was conducted from August 3-8 by phone and email.

Kaare, can you give readers a brief overview of your background?

Yes, of course. l was born in New South Wales, Australia, earned a Bachelor of Economics Degree from Monash University and received a Green Beret with the Australian Commando Regiment. I worked in the construction materials industry in Melbourne, Switzerland & Saudi Arabia before emigrating to Canada in 1995. I was appointed Hon. Consul of Montenegro to British Columbia in 2010 and awarded the Queen Elizabeth II Diamond Jubilee Medal in 2012. Since 2008 I’ve been a Director of Golden Prospect Metals Ltd. of the UK.

I have more than 35 years’ experience in senior management and Board roles for both public & private companies in Australia, Canada and the UK. Most pertinent to your readers might be my 18 years at Great Panther Silver (NYSE: GPL) / (TSX-V: GPR), a producer operating the Guanajuato Mine Complex, which includes the San Ignacio and Topia Mines, both in Mexico.

I became a Director in 1994 and Executive Chairman in 2003, the position I held until I retired in 2012. I led the company from a one-person start-up to a successful mid-tier producer. In the year before my retirement, Great Panther’s share price reached US$5, and its market cap US$600 million.

CEO and Founder Jim MacKenzie convinced me to come out of retirement in July 2013 to become Chairman of Viscount. I was particularly impressed with his forthrightness and his vision for the Company – one of generating multiple projects, having mid-tiers and Majors earn-in and subsequently acquire the properties, and distributing (via special dividend) the resultant sale proceeds to shareholders.

Please tell us about the people on Viscount Mining’s team.

First off there’s Jim our CEO, a Director & Founder of Viscount in 2010. He brought me in, but more importantly he brought in the Cherry Creek and Silver Cliff projects and assembled our excellent team. Jim’s a skilled deal maker and negotiator of joint ventures, land acquisitions & exploration agreements. He has demonstrated strong results through strategic planning, high quality acquisitions & partnerships.

Dr. James Robinson B.S., M.S., [Ph.D] joined our Technical Board in April. He has deep knowledge of Nevada, structural geology, precious-metals deposit models & exploration techniques. Jamie was a senior consulting geologist to the former earn-in party involved in all aspects of their 2-years of exploration of Cherry Creek. His experience is proving especially valuable as he accompanies interested parties on site visits.

Dr. Gilles Arseneau has been retained to complete a NI 43-101 Technical Report on our Silver Cliff project. Dr. Arseneau has more than 25 years’ experience and holds a Ph.D Geology, from the Colorado School of Mines.

Mark Abrams B.Sc., M.Sc. is a Director & senior Technical Advisor. He has more than 30 years’ of domestic & international mineral exploration experience. Most recently he was responsible for exploration & acquisitions in the U.S. for Golden Predator Corp., Prior, he worked for 12 years for Agnico-Eagle (USA), where he led his exploration team to a gold discovery in northeastern Nevada.

Dr. Howard Reino Lahti, B.Sc., M.Sc., Ph.D. is our VP of Exploration. He has 45 years’ of mineral exploration experience. Dr. Lahti has managed mineral exploration projects in Canada, Thailand, Brazil, Peru, Chile, Panama, the Artic & Ecuador, and has prepared several NI 43-101 technical reports.

Mr. Dallas Davis MA, P.Eng., FEC brings over 40 years’ expertise to the table as a geologist & consultant to the mining industry, during which time, he has participated in several notable discoveries. He’s been designated a “Qualified Person,” (“QP“) under NI 43-101 Standards. See full bios here

Can you describe Viscount Mining’s Cherry Creek property?

Our 100% owned Cherry Creek property is ~30 miles north of the town of Ely in northeastern Nevada. The district produced mainly high-grade silver, and some gold, from the mid-1800’s to 1920. We have 2,600 acres of patented and 7,200 acres un-patented claims, a property that’s host to more than 20 past-producing mines. Since 2011, we’ve painstakingly consolidated nearly 10,000 acres, plus mill rights, for the first time, all under one roof.

Last December a former earn-in party completed a 2nd year of comprehensive geologic mapping, surveying soil & rock-chip sampling, including 2 full RC drilling programs. They spent several million US dollars completing extensive exploration that required a lot of time & coordination. All that data has been logged and integrated with a significant amount of historical information, allowing us to identify several really exciting areas.

How much exploration was done at Cherry Creek in 2015-16 and what do you expect to accomplish this year?

A great deal of valuable work was completed (at no cost to us) in 2015-16 including; geologic maps, multi-element analyses of surface samples and drill cuttings, lithologic logs from drill holes, digital maps & databases, subsurface interpretations & comprehensive summary reports. As I said, several million (US dollars) was invested over that 2-year period. That’s a significant work commitment on a single project controlled by a company our size. If not for the earn-in party, we would probably have spent that and issued tens of millions of shares to fund the exploration. Instead, we were able to meaningfully advance Cherry Creek and maintain a tight capital structure. Today we have just 41 M shares outstanding and zero debt.

In May we announced some very promising gold & silver exploration target areas. We found key characteristics similar to sediment-hosted gold mines in eastern Nevada like Newmont’s Long Canyon and projects similar to Liberty Gold’s Kinsley Mountain.

Please describe the Silver Cliff project.

The Silver Cliff property is a very high-grade silver deposit in Colorado. It consists of 96 claims on 2,029 acres that were host to high-grade silver, gold & base metal production from numerous mines in the late 1800s. The property underwent substantial exploration in the 1960’s 70’s & 80’s by companies including Freeport, Hecla, Homestake & Tenneco Minerals.

We think Silver Cliff might overlie a large caldera & porphyry system. We have an ‘exploration target’ of 40 to 50 M ounces of silver. NOTE: the quantity is conceptual in nature as there has been insufficient exploration to date to define a mineral resource. The genesis of the target is drilling in the 1980s by Tenneco that resulted in a (historical) Pre-Feasibility Study (“PFS“) with reported silver grades as high as 2,125 g/t silver (68 oz./t) over 44 ft. (13.4 m).

What are the plans for Silver Cliff this year?

We’re not relying on the conclusions of the non–NI 43-101 compliant PFS. Instead, we did a Phase I drill program late last year that consisted of 10 holes (~610 m / 2,000 ft.), twinning holes found in the PFS. The objective of the program, and a phase II drill program coming this Fall, is to prove out a NI 43-101 maiden mineral resource estimate. We are quite happy with the results of the twinned holes. One of the best results, the assay for confirmation hole K16-01, contained an interval of 1,778 g/t silver (equal to about 57 oz./t), over 20 ft. (6.1 m).

What are the key corporate catalysts over the next 6 months? Why should readers consider buying shares of Viscount Mining?

There are many reasons to buy our stock! In terms of near-term catalysts, we have multiple interested parties looking at both Cherry Creek and Silver Cliff. News of an agreement with a strategic funding partner on at least one, possibly both projects is likely within 6 months. Subject to lining up partners and funding, we should have initial results from the drill program and a NI 43-101 Technical Report by Dr. Arseneau on Silver Cliff. After that Technical Report, we should be able to deliver a maiden mineral resource estimate. And finally, within 6 months, we should be well on our way to completing a PEA on Silver Cliff.

Readers should consider buying our shares ahead of these and other important milestones. We think our shares offer an attractive investment opportunity for the following reasons:

+ Valuation – market cap is just C$11 M / US$ 8.5 M for 2 potential blockbuster assets

+ Multiple parties, incl. mid-tier & Majors, actively looking at partnering on Cherry Creek & Silver Cliff

+ Maiden resource estimate in 4th qtr. or early 2018 [conceptual target of 40 – 50 M ounces of Silver]

+ Shallow, very high-grade Ag deposit at Silver Cliff, potentially amenable to open pit mining

+ Long-term, explicit strategy to pay success-based special dividends to shareholders upon closing of portfolio asset sales

+ Strong management, Board & technical team, especially for a company our size

+ Near-term catalysts to attract attention to the Viscount Mining (TSX-V: VML) / (OTCQB: VLMGF) story

Kaare, thanks so much for your time and thoughtful answers to my questions. I look forward to seeing news from your company in coming weeks and months.

Disclosures: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Viscount Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Viscount Mining are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares in Viscount Mining and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.