There are several important points to remember about gold, notably the fact that it is a safe-haven asset. This means that gold is the go-to asset when equities markets sour. Since capital typically flows into equities, treasuries, fixed-interest-bearing accounts, or gold, there is a massive redirect of resources when a risk-off approach is adopted to equities. We have seen some remarkable changes taking place since November 8, 2016, when Trump was elected President of the United States.

The so-called ‘Trump Bump’ saw equities markets surging to record levels, unprecedented in US history. The Dow Jones Industrial Average quickly exceeded 21,000, while the NASDAQ and S&P 500 index racked up notable gains too. The mania that drove traders to plough money into equities soon fizzled. Whenever markets are rising too quickly, without a strong fundamental basis, a correction is imminent. Markets have witnessed several notable developments taking place since the Fed decision to raise the federal funds rate.

Wall Street Took the Rate Hike in Its Stride, but Dollar Weakness Is a Concern

On Wednesday, 15 March 2017, Fed chair Janet Yellen announced a 25-basis point rate hike. This was generally well received by the financial markets, despite the fear and loathing that typically goes with a rate hike and Wall Street. Remember that equities markets despise uncertainty; they do not react favourably to sudden increases or decreases in interest rates. However, the Fed rate hike was anticipated, as evidenced by the CME Group Fedwatch tool probabilities. In the days leading up to the hike, there was a 90% + probability of rates rising, and Wall Street analysts priced this into their forecasts.

With respect to gold, it’s a no-brainer; gold reacts negatively to interest-rate hikes. Since gold is a dollar-denominated asset, it moves in the opposite direction to a strengthening USD. Gold typically retains some of its value when other asset classes such as equities markets are falling. The most successful way to trade gold is either to speculate on it with things like CFD Trading, or to trade ETFs (exchange traded funds) of gold. The world’s biggest gold ETF is SPDR. This is a useful resource to evaluate when gauging which direction to trade gold contracts for difference.

How Is Gold Performing Lately?

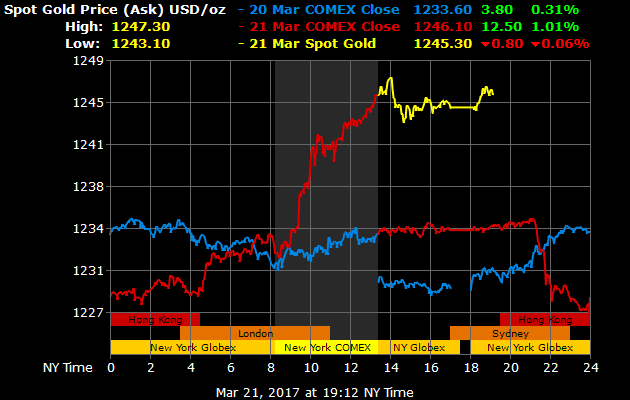

Gold is currently trading at $1,245.59 per ounce, down 0.04% or $0.51. The precious metal is down 0.32% over the past 30 days, and down 6.10% over the past 6 months. The 1-year performance of gold is relatively flat at -0.82%, for a decline of $10.20. On Tuesday, 21 March, gold closed at $1,246.10 on the Comex, up 1.01%, but the spot price of gold was $1,245.35.

Typically, we would expect the gold price to plunge after a Fed rate hike. This didn’t happen because the USD moved in the opposite direction. The USD is going through a soft patch at this time, and there have been surprising movements since the Fed decision was reached. While the Fed alluded to 2 rate hikes – and no more – in 2017, dollar traders took that as a bearish sign and sold the currency en masse.

Gold is priced in dollars, and moves with the strength of the dollar. A weak dollar means that foreign buyers of gold can buy more gold for their currency. A strong dollar means that foreign buyers of gold can buy less gold for the currency. As such, demand and supply move accordingly. Does this mean that the Fed monetary tightening policies will keep the dollar weak? Not at all. The Fed is acting in the best interests of the US economy, and as things stand, the US economy is robust.

Many economists believe that the current performance of the greenback is temporary and that what we are seeing is a short-term weakening of the greenback. Part of the problem is that the projections for the federal funds rate (FFR) remain unchanged from their forecasts in December. In any event, the FFR is going to be significantly higher by the end of 2017, and this is going to invariably lead to a stronger USD as US markets become more attractive to foreign investors.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.