Most companies in the mineral exploration industry have stated that their objective was year over year growth, only in recent years has this started to become a marginal struggle. As M. Dogget notes, notwithstanding more efficient production and focus on cost cutting, it is highly unlikely that most companies can grow in an industry where the overall value of production has remained essentially flat over a long period. According to SNL, the total estimated worldwide budget allocation for non-ferrous mineral exploration decreased by 18 percent in 2015 to about $8.8 billion.

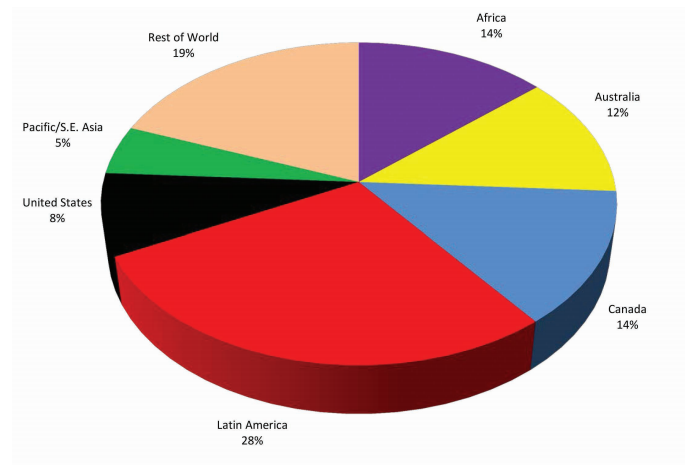

Throughout 2013 and 2014, markets were even less willing to support junior companies, and producers pulled back on capital and exploration spending in order to strengthen financial margins. The USGS 2015 Annual review revealed that the 2015 exploration budgets, in decreasing order, were reported for Latin America, Africa, Canada, Australia, the United States and the Pacific region. Exploration taking place in countries included in the “Rest of World” accounted for 19 percent of the global exploration budget, of which China and Russia accounted for about 57 percent of the regions’ budget total.

The exploration budget in 2015 in all regions was lower than the corresponding budget in 2014.

The largest decreases took place in:

- Africa (with a 30-percent decrease)

- Pacific region (28 percent decrease)

- Canada (20 percent decrease)

The smallest decreases took place in:

- United States (6 percent decrease)

- Latin America (13 percent decrease)

- Australia (15-percent decrease)

Latin America remained the region with the largest mineral exploration budget.

According to SNL’s World Explorations Trend 2016 Report despite five interest-rate cuts since late 2014, and additional measures designed to stabilise domestic markets or stimulate growth, China’s economic slowdown has continued, dragging many resource-based economies down with it. Given the uncertain demand, virtually all metals prices were in full retreat throughout 2015, ensuring that the downturn in exploration continued.

In 2015, companies lowered their budgets by another 18% to US$8.77 billion, marking the first time aggregate budgets had fallen below US$10 billion since the 2008-09 crash. Rarely immune to the traditional boom-and-bust mining cycle, junior companies continue to face considerable near-term uncertainty, with the past decade chronicling the rise and fall of the sector. Despite a modest increase in the funds raised through the first three-quarters of 2014, a dismal December quarter marked the beginning of an extended drought in exploration financings that has continued into 2016.

Lower commodity prices, in large part, owing to an economic slowdown in China and a relatively strong U.S. dollar, market instability and the reduction in available funding for mining projects in 2015 likely resulted in exploration budget cutbacks and reduced the number of junior and specialist companies like Castle Drilling Co. conducting minerals exploration.

Changing mineral commodity prices and commodity demand, relative currency exchange rates and increased exploration costs were among the considerations used by companies in determining exploration targets and development plans for 2015. Lower prices make it more difficult for smaller junior companies to obtain financing in a tight economy, so companies have been focusing available capital on fewer exploration projects.

During the past few years, declining metals prices, massive write-offs and languishing earnings made investors wary of the mining sector. Currency movements were an important consideration for the minerals exploration and mining sector in 2015. The U.S. dollar continued to strengthen against all other major currencies in 2015. A strong U.S. dollar makes U.S. mining-related exports more expensive for other countries and increases the costs associated with foreign projects that purchase goods or supplies using U.S. dollars.

Société Générale analyst, Robin Bhar, noted in mid-January that the negative developments in the financial markets were exacerbated by geopolitical tension. Bhar expects worries over China and the emerging markets to place severe pressure on base metals prices in the current quarter. Further price weakness, he said, should provoke a stronger supply response, eventually leading to a modest recovery. Bhar expects prices to recover gradually over the next two years, based on positive demand trends and reserves depletion that would eventually return the markets to deficit.

Given the existing project pipeline, base metals mine production (with the exception of bauxite) is likely to peak around 2018. Bhar predicts that “output would then decline at an accelerating pace unless higher prices stimulate investments and incentivize output from higher cost projects.” At the end of January, the World Bank published its latest Commodity Markets Outlook, in which it predicts a further 10% decline in metals prices this year due to “stubbornly elevated” metals supplies.

The World Bank’s projections follow an 8% fall in metals prices in the December quarter, which it blamed largely on slower growth in China’s economy and an overall increase in mined material. The Bank’s commodity price index fell 21% in 2015, ending the year 55% below the February 2011 high. The World Bank expects iron ore to suffer the most. Prices are slated to fall another 25% in 2016 and to sink further if China’s economy slows more than anticipated and/or production is higher than expected. Copper is also expected to fall on projected weaker Chinese construction and new supply coming online. For copper prices to improve in 2016, more significant mines may need to close, the World Bank said.

Why Has Gold Stalled?, a feature by A. Hamilton discusses Gold’s unusual performance high despite the current climate. Gold made a strong surge in Q1’16 gaining 16.1% making it Gold’s best quarter in 30 years, since Q3’86. Gold then struggled for the remainder of the year whilst slighted buoyed slightly by the kerfuffle of Brexit.

The up-down performance of minerals seems to be a trend that with confuse and infuriate investors as the industry strives to create more long-term meaningful growth.

Guest Author: Ben Howard

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.