US manufacturing sales on a seasonally-adjusted basis have fallen for 17 consecutive months and are now down more than 8% below the July 2014 peak. December 2016 manufacturing sales were at the same level as November 2011, obviously a story of stagnation rather than the economic recovery the Fed keeps yammering about. Total sales in 2015 were $258 billion less than 2014–$5.738 trillion vs. $5.996 trillion. That’s despite record car sales in 2015. And what’s worse, inventory at the manufacturing level continues to pile up despite declining production.

Now, the main stream economists will admit these numbers aren’t great but they argue that they don’t matter because “manufacturing is only 12% of the economy”. But it’s all in how you measure things. GDP measures final sales and manufacturing accounts for 12% of final sales. But that leaves out all the intermediate goods sold by one business to another. You buy a car and that is a final sale captured in GDP. The car maker bought seat belts and tires from other companies but those sales don’t count in GDP.

The US GDP is currently estimated at about $18 trillion. Manufacturing sales are estimated at $5.7 trillion. So, really, manufacturing represents around 32% of the economy, or maybe a little less after eliminating double counting.

Now, can you have a recession in 32% of the economy and not be in a recession economy-wide? Oh, and by the way, manufacturing pays higher-than-average wages and accounts on average for about 60% of S&P 500 corporate earnings. The answer is no, you cannot have an 8% downshift in US manufacturing sales without an economy-wide recession. Employment, wages, retail sales…all of it goes down, maybe not all at once, but in fairly quick succession.

The Fed says there is minimal chance of a recession this year. But I think we are already in one. Let’s compare against past recessions.

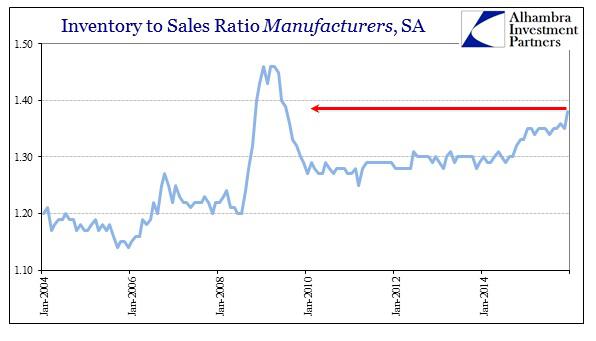

Manufacturing sales fell by a little more than 10% during the 2001-2 dot-com recession. The decline spanned 14 months from peak to trough. Inventory levels fell during that period so the decline in sales came to a halt. By the middle of 2002, both sales and inventories were back on the upswing although very slowly at first. The problem now is much greater. Sales are already down 8%, orders and production volumes have all declined and have been for almost a year and a half but inventories are still growing.

The December 2015 inventory data was released last Friday (February 12, 2016). Manufacturing inventories rose another 0.2 percent in the month. In fact, inventory levels have been rising since 2011 and the rate of growth is actually accelerating. This cannot continue.

Only in the Great Recession were manufacturing inventories in worse shape. Manufacturers are going to cut inventories by producing less than they sell, to restore balance. That’s what recessions are all about. Investors beware. The stock market does not do well in recessions.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.