Gold bullion prices rallied to a one-week high at $1720 an ounce Wednesday morning in London, though they still looked set to record a loss on the month, while European stocks opened higher before losing some ground and US markets prepared to re-open after being closed for two days.

Silver bullion climbed to $32.37 an ounce, also up on the week, while oil and copper ticked higher and US Treasury bonds fell.

By Wednesday lunchtime in London, gold bullion looked set to record its first monthly loss since May, with spot gold trading nearly 3% below where it started October.

“There are those who are still looking for another dip, perhaps one that offers an opportunity to jump in sub-$1700, between now and year-end,” says a note from UBS. “The clear downtrend from earlier in the month has now been replaced by this consolidation phase. But the possibility of another attempt on the downside certainly cannot be ruled out.”

“There are a lot of event risks [for the gold market],” one trader in Singapore told newswire Reuters this morning. “Nonfarm payrolls, the US election, a change of power in China, plus the routine policy meetings of various central banks.”

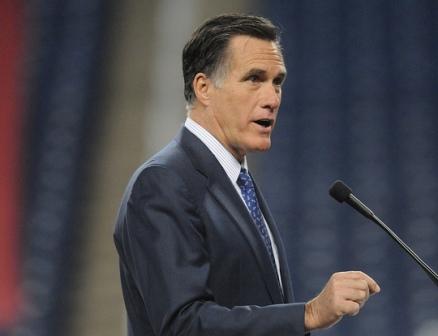

“People wonder if Romney is going to be in power and what kind of monetary policy we will have,” adds UBS analyst Dominic Schnider, adding that the Republican candidate would likely replace Ben Bernanke as chairman of the Federal Reserve. “[Romney] is clearly not in favor of what the Fed is doing.”

A piece published by the Financial Times yesterday argued that a change in fed leadership following a Romney win would be bad for gold bullion prices, since the US dollar would strengthen.

“There’s really no clear indication that Republican presidents are better or worse for the Dollar than the Democrats,” counters a note from Standard Bank currency analyst Steve barrow this morning. “We don’t doubt that a strong Romney win, with victory in the Senate as well, would boost the Dollar while, if Obama narrowly hangs on to the presidency and loses the Senate, it would probably produce the worst possible knee-jerk response in the Dollar. However, in terms of the longevity of these reactions we’d be somewhat skeptical.”

US markets are set to reopen Wednesday, following two days of closure caused by Superstorm Sandy. Wednesday marks the end of the financial year for many US mutual funds, which have been unable to trade many securities since last Friday.

“That could be the wild card, how much [trading] they have to cram in,” says Donald Selkin, chief market strategist at National Securities, which manages around $3 billion.

Eurozone finance ministers meantime, who meet today, may grant Greece extra time to meet its austerity commitments, although disagreement remains on whether to write off more Greek debt, Bloomberg reports.

“The decisive phase for Greece has started,” reckons Carsten Bzerski, Brussels-based senior economist at ING Group.

An earlier deal to restructure Greece’s debt was agreed back in February. Losses were imposed on private sector creditors with the aim of bringing Greece’s debt-to-GDP ratio down to around 120% by 2020. Since then, however, Greece has missed a series of deficit targets.

“Filling the funding gap for Greece will again require some creativity,” says Bzerski. “A possible way out, at least in the short term, could be a combination of several options, such as lowering the interest rates on the first two Greek packages and front-loading parts of the funding of the second package. This could again kick the Greek can further down the road.”

Elsewhere in Europe, German retail sales rose 1.5% month-on-month in September, significantly more than many analysts forecast, although year-on-year sales were down 3.1%, official figures published Wednesday show. The Euro rallied against the Dollar following the release.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.