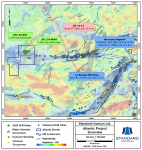

What’s in a name? A lot, apparently. When Ucore Uranium last summer changed its name to Ucore Rare Metals (TSXV:UCU) shares of the company were floundering. Today, the company’s stock is five times higher, and it’s one of the heaviest traders on the TSX Venture Exchange. But other companies thinking a name change could be a cure all tonic should note that Ucore added something else to the mix. Drilling on their Bokan-Dotson Ridge rare earth project in southeast Alaska showed, as management reported, “an unusually high skew in the Dotson zone toward heavy rare earths”.

Just last year Ucore was, to the uninitiated, in the business of looking for Uranium at their Bokan property. Today, they are looking for dysprosium and terbium. Scratch the surface a bit and you’ll find the name change is somewhat academic; uranium and rare earth metals are often found together. The bigger change is the what has happened outside of Alaska; an renewed awareness of the importance of rare earth metals that is approaching a frenzy.

Rare earth metals came to the public’s attention when China begin to restrict their export. This past July, that country announced a 72% year over year reduction in exports. With 97% of the world’s current supply under their control, China’s hold over this sector is making people nervous. Despite the fact that China says it won’t use rare earths as a bargaining tool, concern about the global supply and demand balance of rare earths has driven their prices through the roof. One report said as much as 20,000 tonnes or one third of total exports of them were smuggled out of China recently.

In the US, there is increasing concern over the supply of rare earths to the defense industry. Rare earths are critical to the production of things such as night vision goggles and guided bombs. A recent report by the U.S. Government Accountability Office says that “rebuilding an independent U.S. supply chain to wean the country off that foreign dependency could take up to 15 years”

So with a heightened awareness of the importance of rare earth metals, an increasingly political environment and a property located on US soil delivering promising results, does Ucore sound like the perfect takeover target for a major mining company? Not exactly, says John Kaiser, editor of the Bottom Fishing Report. Kaiser, who recommended the stock in 2009 thinks a more likely candidate might be defence contractor proxy for the US Department of Defence, who could see the property as “valuable from a strategic perspective.”

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.