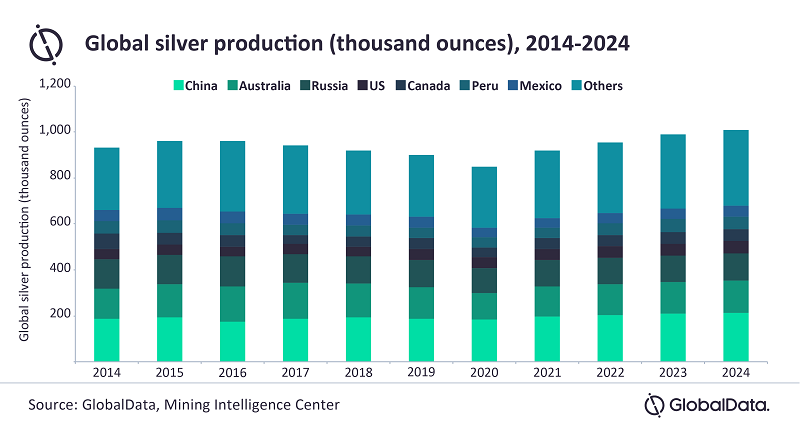

The last four years haven’t been kind to silver production, with four consecutive years of annual decline. 2021 is finally bringing an increase of 8.1% to 918.3 million ounces (Moz), and ultimately silver production should exceed one billion ounces by 2024, according to a report from GlobalData. This notable bump would be a 3.2% compound annual growth rate (CAGR).

Where in the World?

The top contributors to this growth will be Peru, Mexico, and China, with a combined production increase forecast at 393.9Moz in 2021 to 443.9 Moz in 2024. The countries have ramped up their efforts to allow new projects to move forward, and companies have had it easier as these countries either recover from the pandemic (China) or refuse to put more restrictions in place (Mexico and Peru) due to struggling economies.

Hit Hard

2020 saw an estimated global silver mine production decline of 2.4% to 849.7 million ounces, as the lockdown and restrictions in some of the top silver-producing countries hit hard. While those restrictions did crimp growth and production overall, those countries seem to be intent on avoiding any form of lockdown again as fumbling economies in the developing world struggle to regain traction.

The first nine months of 2020 were the hardest, as eight of the top ten silver producers reported a collective 13.9% YoY decrease in output. This had an outsize effect and resulted in lower global production numbers.

According to Vinneth Bajaj, associate project manager at GlobalData: “In Mexico, output was estimated to have fallen by 1.8% in 2020, with mining activities suspended for almost two months through to the end of May. Major silver producers in the country temporarily suspended their mining operations during this period, and production losses were registered at Pan American’s La Colorada and Dolores mines, Fortuna Silver’s San Jose mine, Industria Penoles’ Saucito mine, and Hecla Mining Company’s San Sebastian project, among others. However, these COVID-19-related production losses were partially offset by high production from other key mines, including the Penasquito, Guanacevi, Zimapan, and Ocampo projects, as well as from the commencement of projects in 2020 such as the Red de Plata, Capire, and Tahuehueto projects.”

Depleted Supply

According to the report, depleting ore reserves are also weighing on production and is a major industry concern. As miners work to increase production over the next three years, discovery and exploration will continue to be a prime driver of activity for the sector.

Top Silver Miners 2020

Although 2020 was a challenging year for silver production and the companies mining it, some miners continued to work steadily. The rankings of the top 10 silver producing companies in 2020 based on output reported last year worldwide prove that while production was down globally, some companies could increase production.

| Rank | Company | 2020 Ag output, Moz | 2019 Ag output, Moz | Change, % |

| 1 | Fresnillo | 53.1 | 54.6 | -3 |

| 2 | KGHM | 43.4 | 45.5 | -5 |

| 3 | Glencore | 32.8 | 32 | 2 |

| 4 | Newmont | 27.8 | 15.9 | 75 |

| 5 | CODELCO | 27 | 17.9 | 51 |

| 6 | Vedanta (Hindustan Zinc) | 23.7 | 22.3 | 6 |

| 7 | Southern Copper | 21.5 | 20.3 | 6 |

| 8 | Polymetal | 18.8 | 21.6 | -13 |

| 9 | Pan American Silver | 17.3 | 25.9 | -33 |

| 10 | Hecla | 13.5 | 12.6 | 7 |

Source: Vladimir Basov, Kitco News

The rankings bear out a story that while silver production suffered in 2020, not every company did. Some of them went on to increase production. The most significant gain in production came from Newmont, with a 75% increase YoY from 2019. With the expected production increases of the coming years, these companies will all be maneuvering for market dominance and gains like those seen last year from companies like Newmont.

A silver stone.

A silver stone.

When you think of junior mining companies, what comes to mind? A small business exploring and waiting for their big discovery before finally starting production? Maybe an organization without large capital commitments, land, or other assets? This might be true of most junior miners but is so far from the mark for Honey Badger Silver, that one has to wonder why they are even considered ‘junior’ in the first place.

Honey Badger has shown it can produce year after year and judging by their financial reporting since 2018, you can get the idea that they know where to focus their efforts. The Canadian company has created a strategy centred around a large mine in the Historical Thunder Bay Silver District in Ontario, Canada. Their land position of 16,800 hectares in the region is the dominant one and allows them to take advantage of some of the most productive silver-bearing veins of the Rabbit Mountain group of deposits. Nothing is holding the company back, and competition is thin, to say the least.

Full Speed Ahead

The investment comes with the added benefit of funding an expansion of the exploration of the company’s Thunder Bay silver portfolio and for general working capital purchases. Production increases should follow as well, returning the investment to Sprott’s pocket as well as anyone who is wise enough to jump in with him.

Investors Agree

Beyond management holdings and those buying shares piece by piece, high-profile investor Eric Sprott is also all-in on Honey Badger Silver. A new placement from the investor going all-in on junior mining companies of $1 million is the ultimate vote of confidence from an investor who knows exactly what he’s doing. Investors buying shares now can only be learning from the smart money now and will be able to reap the rewards down the line when it continues to rise.

Making Room

Sprott’s decision to add $1 million to a $3 million placement prompted Honey Badger Silver’s chairman Chad Williams to voluntarily reduce his subscription to the stock, according to him, to, “accommodate high demand from other investors”. He now holds 9.9% of the company, undiluted.

In Good Company

Honey Badger Silver is in good company when it comes to those chosen to be a part of Sprott’s investment portfolio. Going beyond institutions, he placed his faith in another top miner last year, First Majestic Silver. The investment was for 5 million shares worth $78 million, proving that when you know the answer, your portfolio will surely follow.

Buying Up Property

Honey Badger isn’t slowing down, as made evident by their March 15th announcement that they have acquired three advanced silver-focused properties located in southeast and south-central Yukon, Canada. The acquisition will help the company diversify its property portfolio and begin producing in multiple regions of the country. The expectation is that the acquisition will close on or before April 30, proving that the company is ready to continue its expansion and put its capital to good use.

Looking Down The Road

Looking into the future is impossible, but forecasts are made a lot easier by extrapolating from current trends. Let’s take a look at how it’s going so far. The stock has touched all-time highs, acquisitions are en route, and the company is well-capitalized to continue its production and expansion. If the trends of the past few years continue, Honey Badger stock is only at the bottom of a very long upward trend, and even shareholders with relatively small stakes stand to benefit from any more wins.

Although the company is a junior miner in name, it operates like a seasoned and much bigger player, controlling and exploring 100% of one of the most valuable silver properties in the country (and the world). Clearly that isn’t enough for Honey Badger Silver, who we will continue to follow closely.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Lincoln Minerals Limited Lincoln Minerals Limited |

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan