While some analysts continue to lean bearish when it comes to gold lately, Goldman Sachs is not one of them. In fact, they’ve recently raised their year-end gold price target to $2500/oz, signalling a strong finish to the year for the precious metal.

This latest move comes after gold prices ended 2021 down approximately 4% despite a strong economic recovery and growth throughout the year. Many investors moved towards riskier assets, but concerns of a potential US recession in the coming year could lead to increased demand for gold.

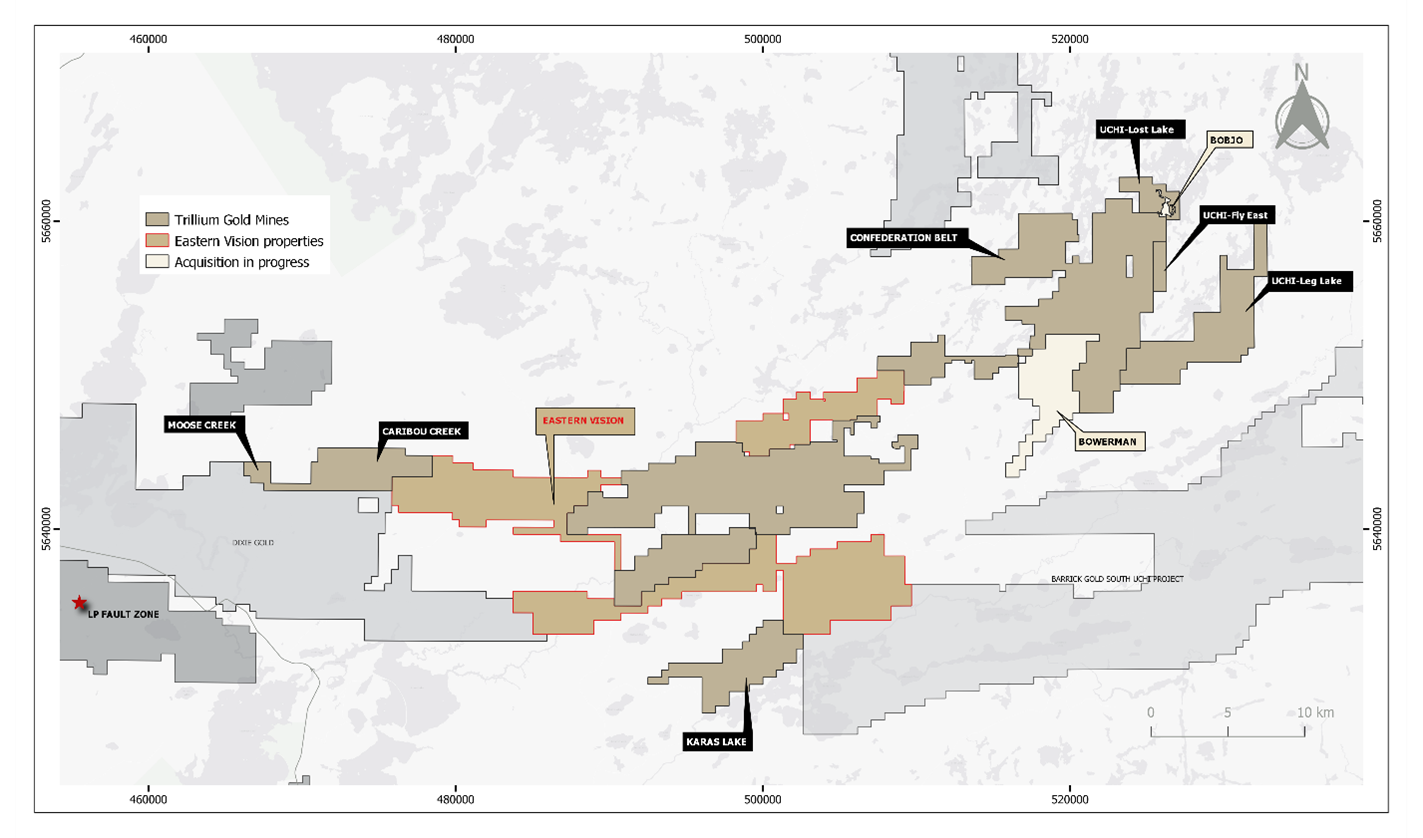

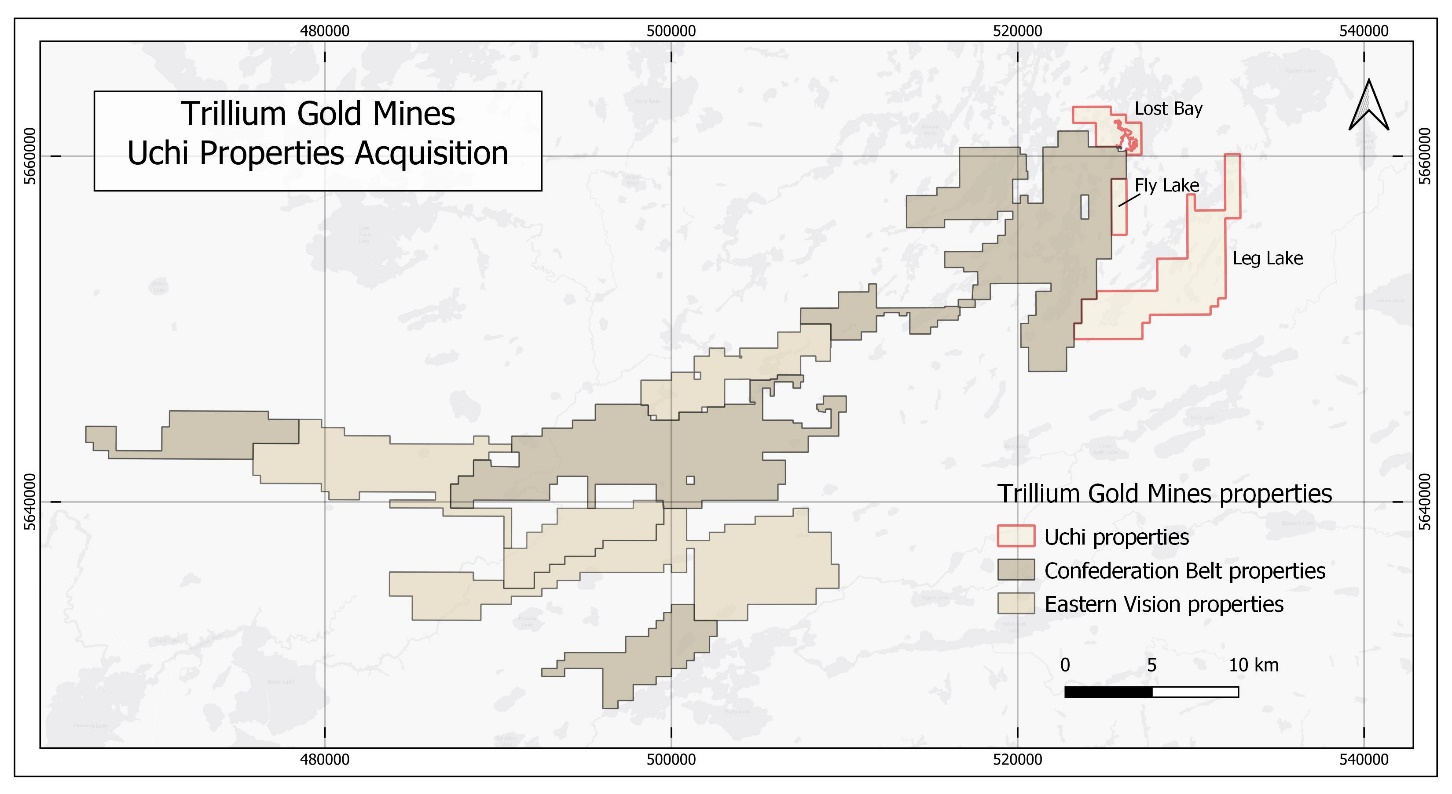

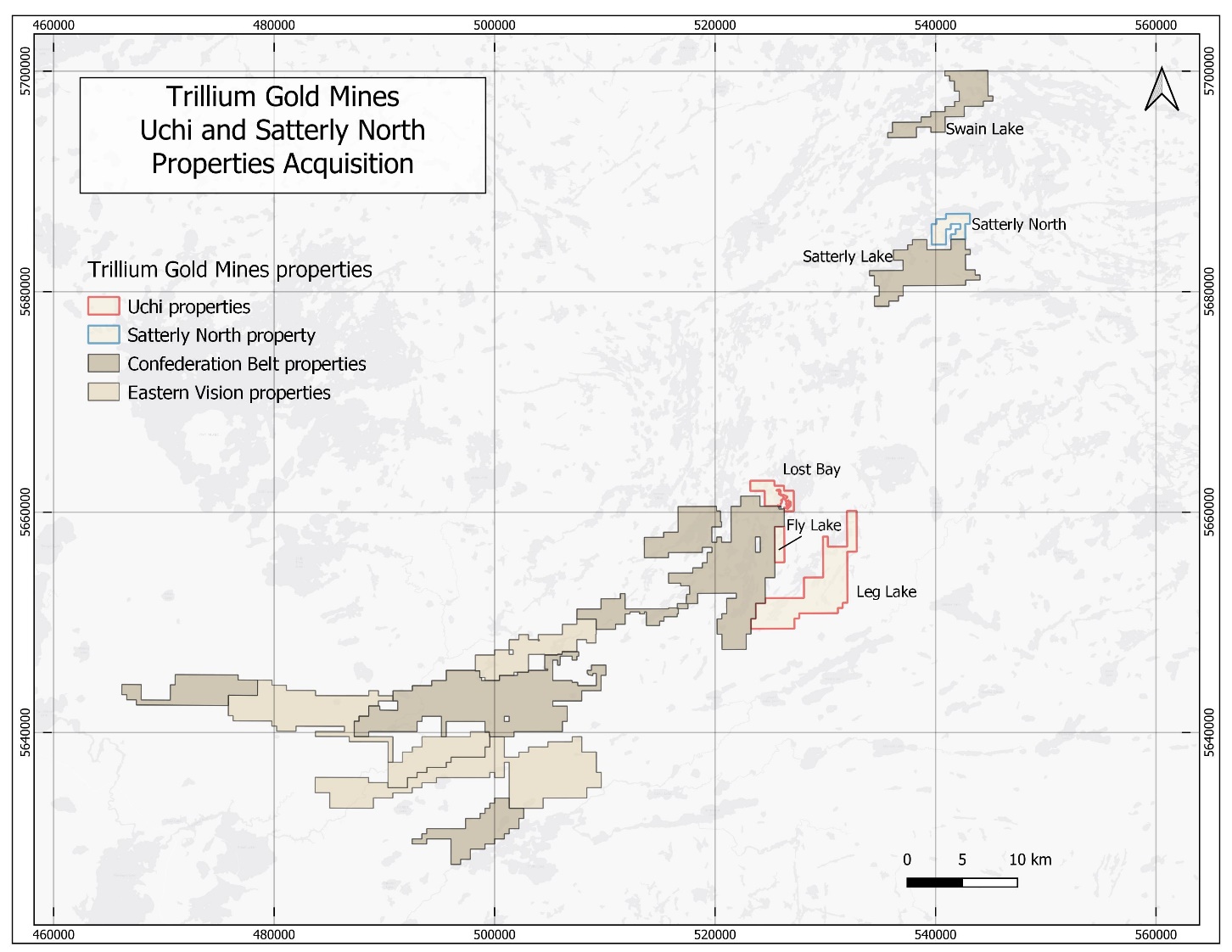

Mining companies will also benefit from a higher gold price, with more attention swinging to companies in the industry as gold becomes more valuable. Trillium Gold Mines (TSXV:TGM) is a Canadian gold exploration company with highly prospective properties in the Red Lake Mining District, Ontario. The company recently announced that it had closed the acquisition of the Eastern Vision property holdings in the Confederation Lake assemblage, acquired from Imagine Lithium.

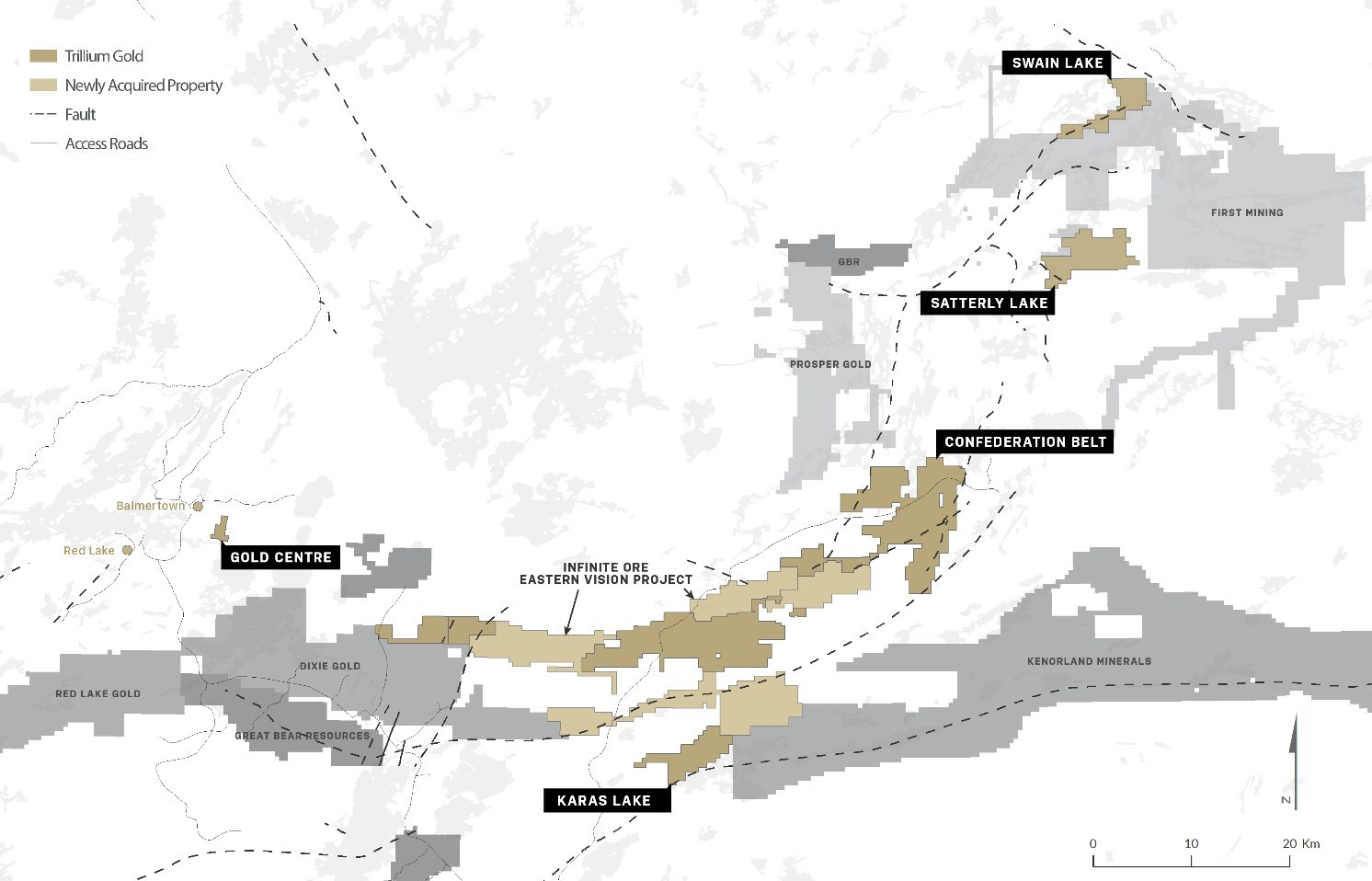

The total land package is 13,958 hectares between the Fredart, Confederation North and Confederation South properties. Trillium Gold now has a dominant contiguous land package over more than 100 kilometres of favourable structure on trend with Kinross Gold’s Great Bear Project and Evolution Mining’s Red Lake Mine. The company has built a dominant land position in the Red Lake Mining District when asset values have continued to climb, and future gold prices could be set to move far higher.

The strong recovery in 2021 meant that gold prices slumped for some time, losing some of the momentum gained in the first year of the pandemic. Investors moved to riskier assets as the vaccine rollout continued and economies reopened.

However, the coming year has investors worried about a recession, which would lead to higher gold prices if the case. The other side of this dynamic is a rising inflation rate that has consumers, investors, and central banks concerned. Goldman Sachs believes those fears are exaggerated and that inflation will ultimately remain contained.

Risk appetite is often influenced by several global factors that can be difficult to predict. One of them is the strength of the jobs market in the United States.

Currently, the US job market is looking strong with unemployment at a pandemic low. This has been the case for some time now, showing strength in the real economy. At the same time, asset prices have taken quite a haircut, spooking some investors into safer havens, including gold. The other ongoing risk is the Russian invasion of Ukraine, which has created supply chain issues inflating food and energy prices, and presenting significant challenges for the European bloc and North America.

Russia is a major exporter of food and commodities, so the situation is especially being scrutinized by those in the industry. A new plan to contain some of the risks of the sanctions placed on the Russian economy may not protect the U.S. or Canadian economies in perpetuity, and that has sparked a selloff in equities, trimming gains from 2021.

If the slide continues, or buyers prove apathetic to ease some of the pressure, investors will assuredly turn their attention to gold and particularly those gold mining companies with assets that offer discovery and development potential.

Overall, Goldman Sachs’ bullish stance on gold is predicated on global factors that continue to generate uncertainty. With a higher gold price target, mining companies are poised to benefit from growing attention and investment. Trillium Gold Mines is one company that is ideally positioned to benefit from a higher gold price.

The stock has sold off with a range of other mining stocks and may present a compelling buying opportunity for deep value investors with a keen eye. And even as the share price has drifted precipitously from its two-year highs, the company has forged ahead in consolidating strategic holdings under the radar; a sign that investors may not be seeing the whole picture yet.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

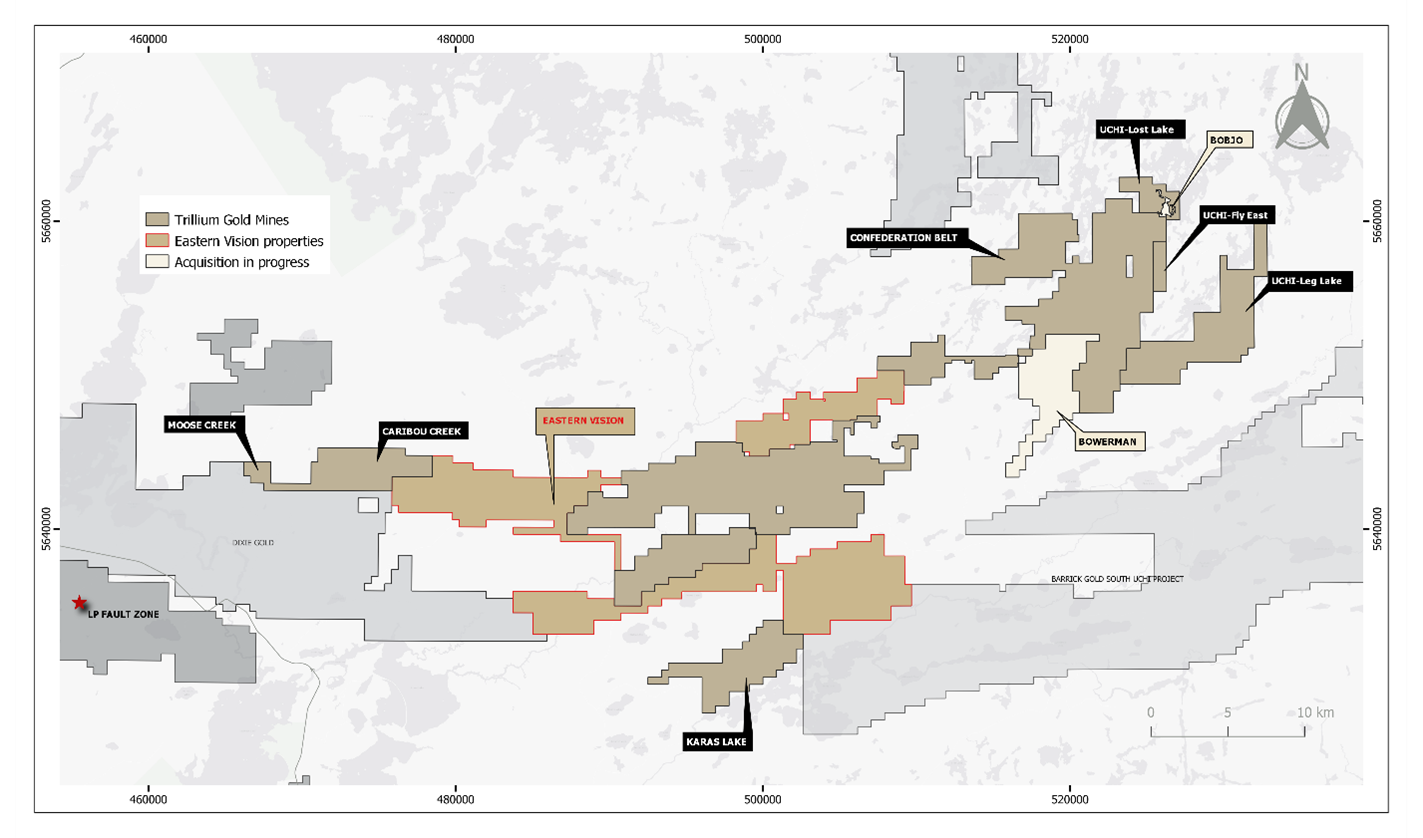

Trillium Gold Mines (TSXV:TGM) has announced that it has closed the previously announced acquisition of Imagine Lithium’s Eastern Vision property holdings in the Confederation Lake assemblage. The properties lie within the Birch-Uchi greenstone belt in the Red Lake Mining District where Kinross’ Dixie Deposit is located.

Some of the properties have been acquired directly and the company has assumed option agreements as optionee for others. Trillium Gold’s total land package covers 13,958 hectares between the Fredart, Confederation North and Confederation South properties. The company now has control over a significant portion of the Confederation Lake assemblage, creating a contiguous land package over greater than 100km of favourable structures on trend with Kinross Gold’s Dixie Deposit and Evolution Mining’s Red Lake Operation.

Transaction Details

As part of the transaction, Trillium Gold issued 2,800,000 common shares in the capital of the Company together with a cash payment of $175,000 to Imagine Lithium. In addition, the Company has agreed to assume Imagine Lithium’s cash payment commitments under its existing option agreements, while Imagine Lithium retains its original share issuance obligations.

Concurrent with the closing, Trillium Gold paid $20,000 in cash to Pegasus Resources Inc. (“Pegasus”), together with 100,000 common shares in the capital of the Company, to earn into certain option agreements that Trillium has agreed to assume as optionee from Imagine Lithium. The cash consideration represented the remaining option payments under said option agreements, while the equity consideration purchased Pegasus’ carried interest in the relevant properties such that 100% of those properties are now held by Trillium Gold.

Pursuant to the remaining option agreements that it is assuming as optionee, Trillium Gold must pay a total of $186,000 in option payments over approximately two years in order to earn in to and exercise the options.

Also concurrent with the closing, Trillium Gold purchased a 2.0% NSR royalty on the Fredart property from prospector Perry English in consideration for the issuance of 60,000 common shares in the capital of the Company and $50,000 in cash.

Source: Trillium Gold Mines

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

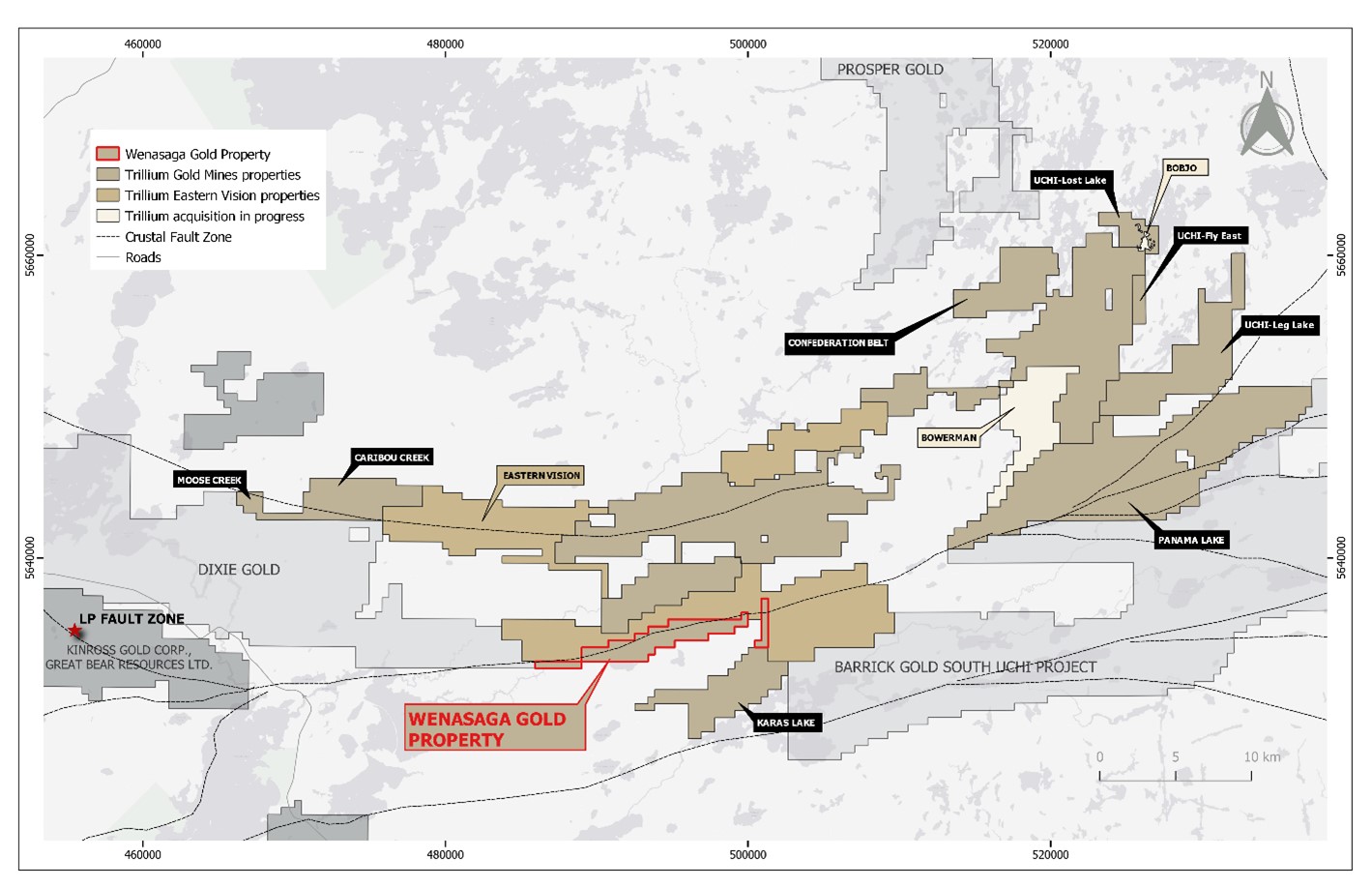

Trillium Gold Mines (TSXV:TGM) has signed an option agreement to acquire a 100% interest in Bounty Gold Corp.’s Wenasaga Gold Property. The acquisition extends Trillium Gold’s dominant land position along the Confederation belt and is on trend with Kinross Gold’s LP Fault Zone of the Dixie Deposit. The Wenasaga Gold Property spans 1,692 hectares and is located 30 kilometres northeast of Ear Falls and 55 kilometres southeast of Red Lake, a prolific mining district.

Historical drilling at the property to the west and on strike along the crystal fault structure intercepted highly deformed, chloritic and carbonate altered green basic metavolcanic rocks. It contains similar regional geology to the Dixie Project; it is underlain with felsic intrusive and metasedimentary rocks in the north. Trillium Gold’s exploration program at the property will be focused on delineating the fault structure transecting the Wenasaga Gold Property.

The Option Agreement

Pursuant to the terms of the Agreement, in order to keep the option thereunder in good standing, Trillium is required to pay Bounty Gold an aggregate amount of Cdn $25,500 over a period of two years, issue an aggregate 64,500 common shares in the capital of Trillium over a period of two years, and grant to Bounty Gold a 2.0% Net Smelter Returns royalty on the claims comprising the Property upon exercise of the option. The Company has the right to repurchase 50% of the royalty (being 1.0%) by paying the holder an aggregate amount equal to $1,000,000. The Common Shares of Trillium Gold issued under the Agreement will be subject to a four-month holding period from the closing date. The Agreement is subject to the approval of the TSXV and other applicable regulatory authorities, as well as the approval of the Ontario Mining Recorder to extend the due dates for assessment work.

Source: Trillium Gold

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

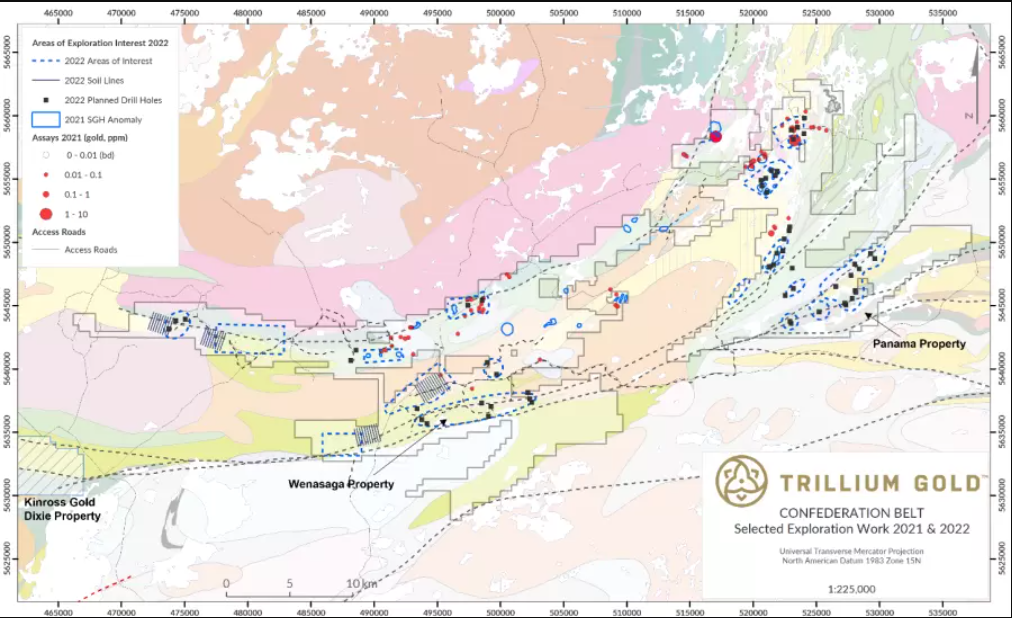

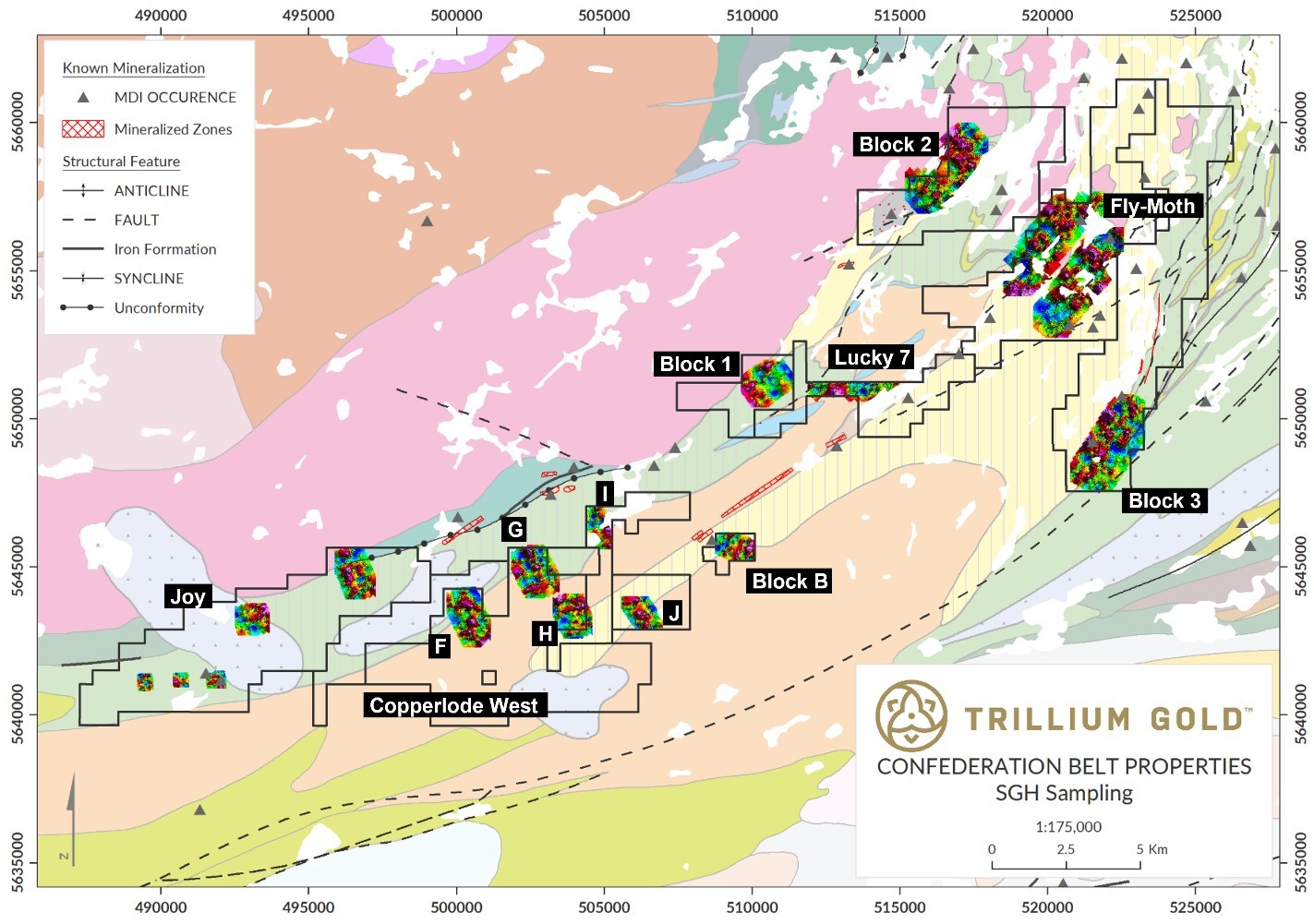

Trillium Gold Mines (TSXV:TGM) has begun its comprehensive exploration program on its recently-consolidated Confederation Belt Project. From the separately held properties, the company has consolidated them into one 54,362-hectare, contiguous land package that spans 72 kilometres from east to west. Crews are mobilizing, and work has begun on the project. The Confederation Project is not just the company’s most significant project – it is the most significant exploration project in the Red Lake District. It has the potential to contain further Dixie LP Fault analogues, other Red Lake-style gold mineralization and critical minerals.

Trillium has initiated early exploration permit applications for drilling and trenching, and the company expects to receive them sometime in early summer 2022. The company has planned an initial 6,000 metres of drilling throughout the project area for targets that have already been systematically researched, prioritized, and deemed drill-ready. It will consider further drilling once results from the exploration are received.

Russell Starr, President and CEO of Trillium Gold commented in a press release: “Our strategy to consolidate the Confederation belt properties has positioned Trillium Gold as the dominant exploration company in the Red Lake District today. Many former VMS-rich districts are well endowed with gold, and the Dixie LP Fault deposit, lying on the same stratigraphic trend as Trillium’s contiguous claim block, is possibly another example. A large portion of the property is accessible via long-standing logging roads. We believe we are at the nexus of a new era in this rapidly developing gold camp.”

William Paterson, Trillium Gold’s Vice President of Exploration also commented: “Our geological team has now begun the exploration work with reconnaissance traverses, drill hole sighting and ground-truthing of work performed by previous operators. We have an unprecedented opportunity to explore for LP Fault-type gold deposits along a structure that is many times larger and equally as prospective as Dixie.”

Some important attributes of the property include:

- Over 110 linear kilometres along the eastern extensions of both the major crustal Red Lake and Dixie LP Fault structures.

- Several high-potential mafic-to-felsic structural contacts on-strike to the east of the Kinross Dixie Project associated with the eastern continuation of the LP fault zone.

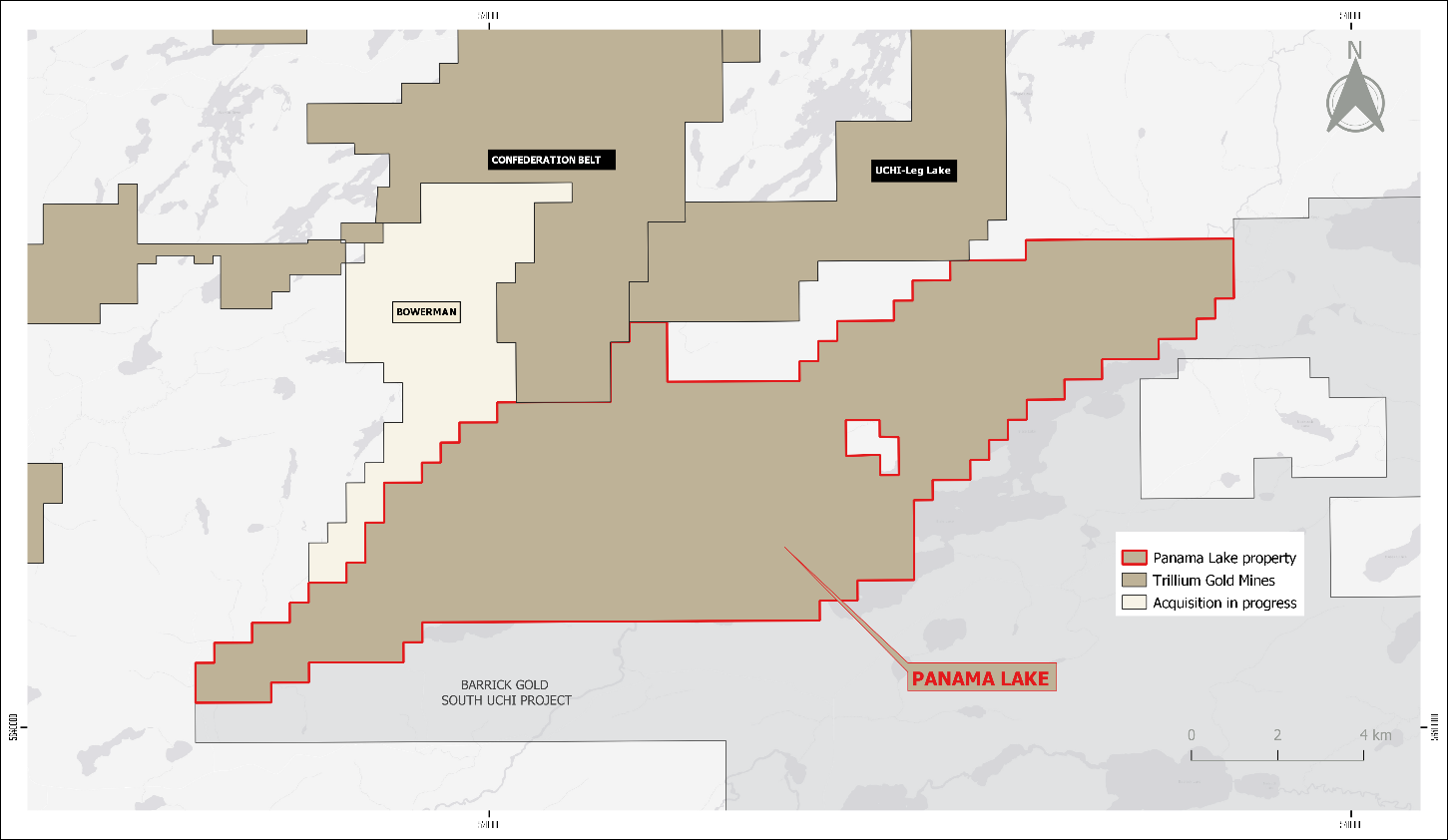

- The Panama Lake portion of the property shows gold potential in three identified zones while further compilation work has identified other structural and lithological dislocations that warrant priority follow-up work.

- Other high-potential areas to be tested along the northern margin of the Project area, associated with the major structure hosting Evolution Mining’s Red Lake Operations.

- Demonstrated gold and historic base-metal deposits; importantly, strategic metal occurrences will be additional target elements for exploration in 2022.

- Comprehensive data collection, compilation and interpretation have generated many gold and base-metal targets for follow-up in the 2022 exploration program.

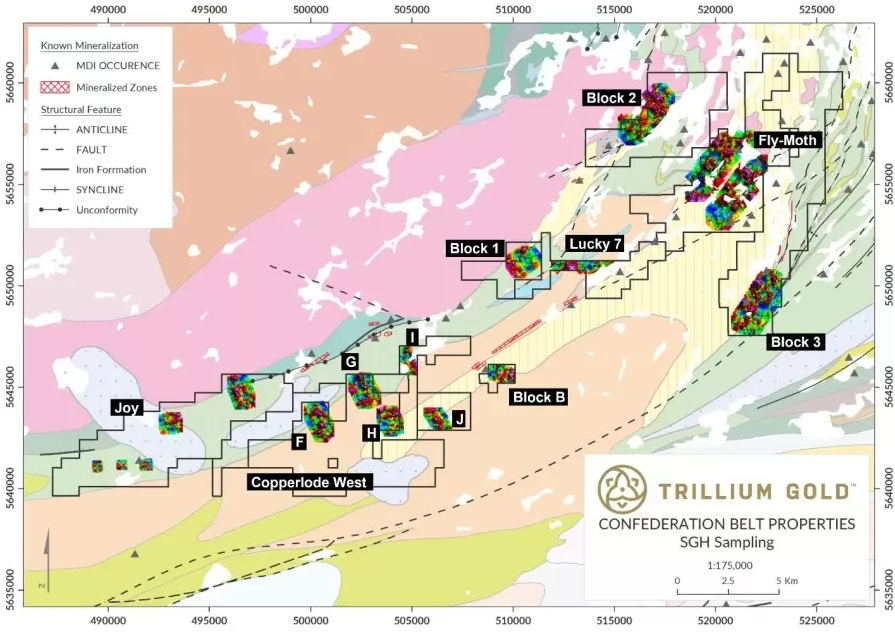

Figure 1: Trillium Gold’s Confederation Belt Project showing areas of focus for 2022 and planned activities, selected 2021 exploration results, and major structures (some interpreted). Geology from Geological Survey of Canada.

Throughout the Confederation Belt property, work will be performed to follow up on the high priority SGH anomalies from 2021. This planned work includes further soil sampling, lithogeochemical sampling and assaying of historical drill holes that were never previously assayed for gold (this is a very cost-effective activity where historical base-metal focused drilling has already been performed in those areas identified as having high gold potential). Systematic prospecting and mapping programs across the Project area are designed to explore for new deposits and further follow up on results from the 2021 field work (Figure 1).

Geology & Mineral Potential

The geology throughout the Project area shows several features key to gold mineralization: felsic-intermediate volcanic and volcaniclastic rocks, mafic to felsic transitions, iron formations and chemical sediments, unconformities, large regional structures with known association to gold mineralization (e.g. the Dixie Project and Red Lake Mine), and, locally, on lower-order structures, complex structurally prepared ground that focus fluid flows and develop mineral deposits.

The Company’s exploration work and results from 2021 combined with exhaustive compilation work of historical data recently acquired, have identified several prospective areas hosting a variety of styles of gold targets including elevated gold content coincident with volcanogenic massive sulphide alteration halos. Often these halos are associated with structures and prospective lithology, suggesting the possibility of a later-stage gold enrichment mechanism or hybrid-style signatures.

A key area of focus will be the recently acquired Wenasaga Property, spatially associated with a dilation zone identified on the LP Fault extension. This deep-rooted structure would provide a conduit for gold-bearing fluids and the dilation zone creates the conditions for this gold to be deposited, whether rheological or chemically through widespread alteration. Preliminary work has already begun on this portion of the property.

Further east, the Panama Property contains two highly prospective gold-mineralized trends that remain largely untested. Major structures that transect the property appear to be splays from or are the eastern extension of the Dixie LP Fault. There are multiple gold and VMS-style mineralization occurrences identified on the property and a field program has been designed to expand on and evaluate the lateral continuity of these mineralized trends.

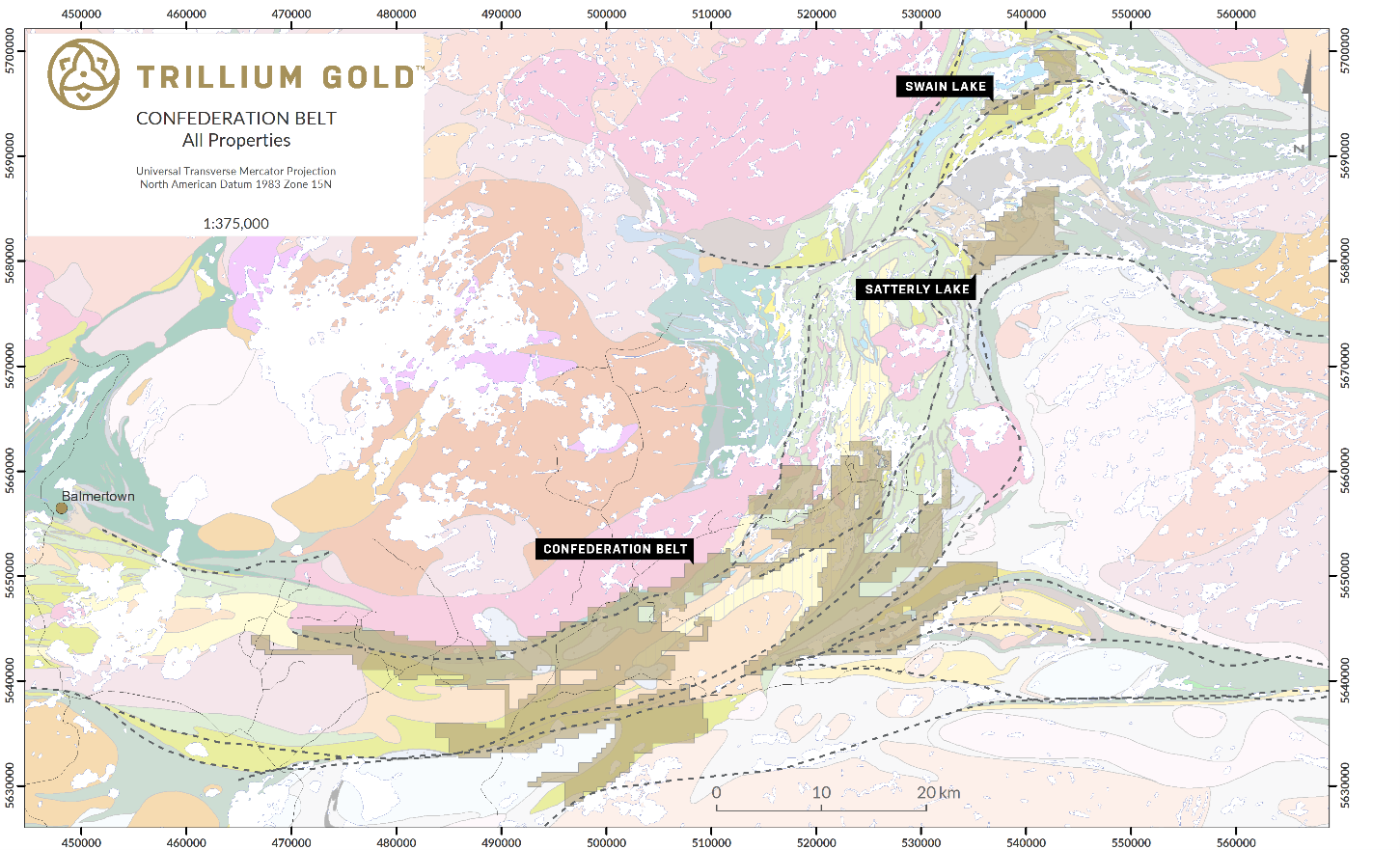

Figure 2: Trillium Gold’s Confederation Belt, Satterly Lake and Swain Lake Projects with major faults shown (some interpreted). Geology from Geological Survey of Canada.

Satterly Lake and Swain Lake

These properties, located approximately 20 km and 35 km northeast of the Confederation Project and 90 km east of Red Lake, host structural, lithological and geophysical features important to gold mineralization (Figure 2). Initial field work will be performed on these projects utilizing floatplane-supported remote camps and will consist of prospecting and sampling. Historically, there has been little ground-based work performed on these properties. Trillium flew a high resolution helimagnetic survey over the then-current Satterly Lake property in 2021.

The Satterly Lake property is relatively unexplored, but several mineral occurrences are documented in the area. The Hanson (Au) and Loydex (Cu/Zn) occurrences are found on the property, the past producing Sol D’Or Mine (ore grading 19.2 g/t Au) lies immediately west and Falcon Gold’s Springpole West property to the east, with a diamond drill hole intercept of 19.4 g/t Au over 30cm within a property-wide fault zone hosted in a quartz vein-stockwork system.

The Swain Lake property encompasses a nine-kilometre stretch of the Swain Lake Deformation Zone (SLDF), over a gentle flexure point where the strike changes from a northeast trend to more easterly. Numerous gold occurrences are documented along the strike of this regional-scale structure. The property is located 8 km northwest of First Mining’s Springpole Lake property, which is reported as one of the largest undeveloped gold projects in Canada (Preliminary Economic Assessment, completed in November 2019, reported an Indicated Resource of 4,670,000 oz of gold and 24,190,000 oz of silver).

Within a six-kilometre radius of the Swain Lake property there lies the Argosy Mine (101,875 oz Au produced), the Richardson Lake Mine (1,126 oz of gold produced grading 60.7 g/t Au with an unclassified historical resource of 140,051 oz Au published in the Northern Miner [June 20, 1988]), the MacIntyre Mine reported to have produced 23 oz of gold in 1934-35 and First Mining’s Horseshoe Island prospect with a historical unclassified resource of 125,093 oz Au (OGS MDI record 52N08NW00020).

Source: Trillium Gold Mines

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Trillium Gold (TSXV:TGM) has signed a purchase and sale agreement to acquire the rights and title to the Panama Lake Property owned by St. Anthony Gold Corp. The project is located on the same structural trend as Kinross Gold’s Dixie Deposit, only 80 kilometres away, and extends Trillium’s dominant contiguous land package in the Confederation belt by an additional 9,882 hectares.

Figure 1: Map showing Trillium Gold’s Panama Lake Gold Project

The details of the agreement are as follows:

Pursuant to an assignment and assumption agreement to be entered into on the closing of the transactions contemplated by the Purchase Agreement (the “Assignment Agreement” together with the Original Option Agreement, the “Option Agreement”), among Trillium Gold and St. Anthony Gold, St. Anthony Gold will assign all of its rights and obligations under the Original Option Agreement to Trillium Gold. In addition, pursuant to the Assignment Agreement, Benton Resources Inc. (“Benton Resources”) will agree to consent to the assignment and will agree to register 100% of the Property’s title to Trillium Gold while retaining its 50% ownership interest in the Property until such time as Trillium Gold fulfils its option to earn 100% interest.

Terms of the Agreement

Pursuant to the terms of the Purchase Agreement, at closing, Trillium Gold will pay St. Anthony Gold, Cdn $500,000 in cash and issue 1,000,000 common shares in the capital of Trillium Gold (the “Common Shares”). In the event Trillium Gold acquires a 100% interest in the Property, St. Anthony Gold may cause Trillium Gold to exercise its Buy-Back Right under the Option Agreement (as further discussed below) to repurchase from Benton Resources one-half of the 2% Net Smelter Royalty on the Property and convey such repurchased 1% Net Smelter Royalty to St. Anthony Gold in exchange for a cash payment by St. Anthony Gold to Trillium Gold of $1,000,000.

Pursuant to the terms of the Option Agreement, in order for Trillium Gold to earn a 70% interest in the Property, it will pay to Benton Resources Cdn $100,000 in cash or the equivalent in Common Shares, based on the 10-day value weighted average price (“VWAP”) of Trillium Gold’s Common Shares traded on the TSXV prior to issuance by October 24, 2022, and complete $250,000 in exploration expenditures on the Project by April 24, 2023. Trillium Gold has the option to earn 100% ownership of the Property by paying Benton Resources a further $300,000 in cash or the equivalent in Common Shares, based on the 10-day VWAP of Trillium Gold’s Common Shares traded on the TSXV prior to issuance and complete $300,000 in exploration expenditures on the Project in each case by October 24, 2023. Benton Resources has the right to retain a 2.0% NSR on the Project, subject to the option of Trillium Gold to buy back one-half of such royalty (being 1.0%) for Cdn $1,000,000 (the “Buy Back Right”). In the event that Trillium Gold completes a NI 43-101 compliant resource estimate for the Property, Trillium Gold will issue to Benton Resources Common Shares with the amount of Common Shares issuable to be determined based on the number of ounces of gold in the NI 43-101 report and the market price of the Common Shares at the time.

The Common Shares of Trillium Gold issued under the Purchase Agreement will be subject to a four-month holding period from the closing date. The Purchase Agreement is subject to the approval of the TSXV and other applicable regulatory authorities.

Source: Trillium Gold Mines

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

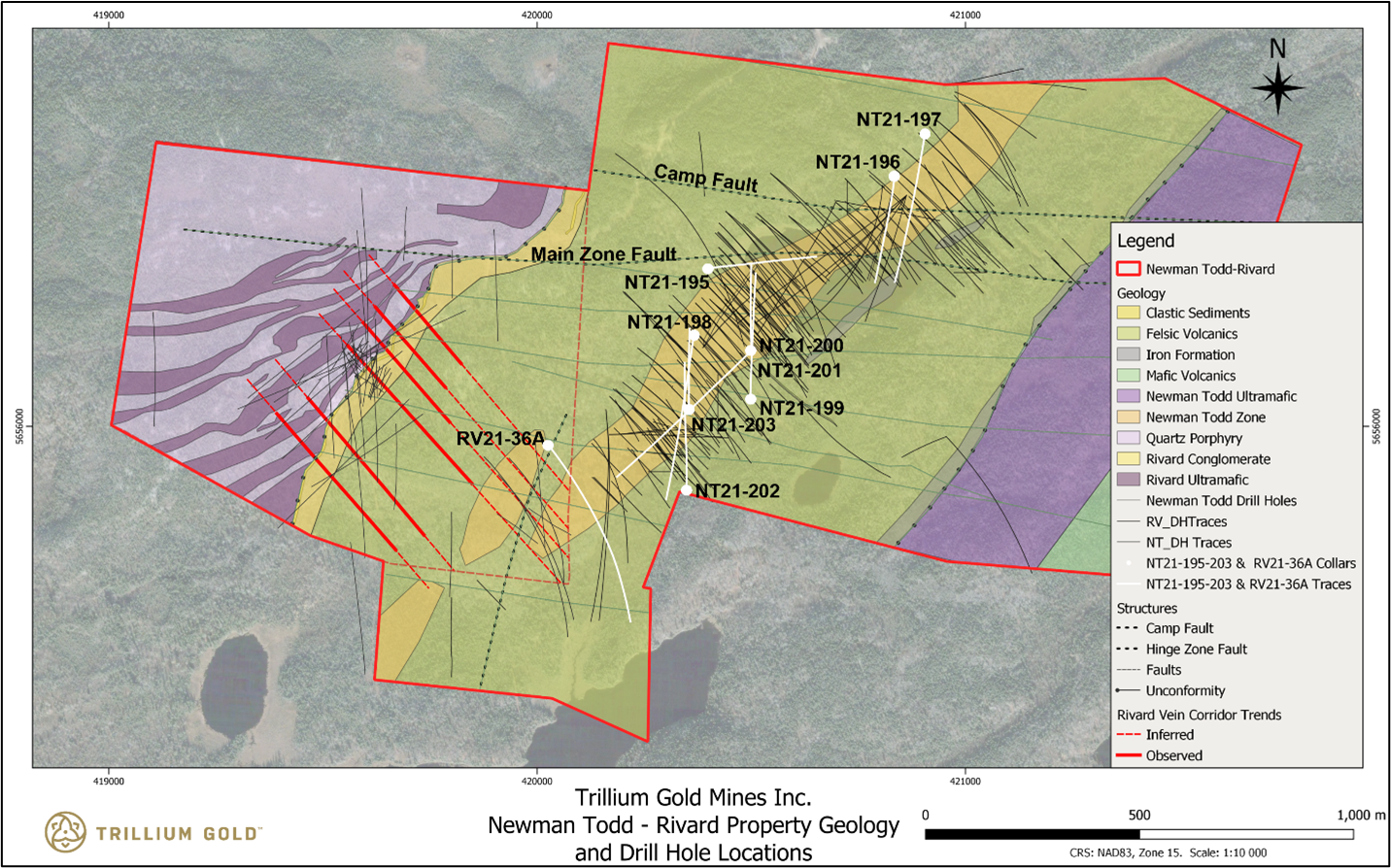

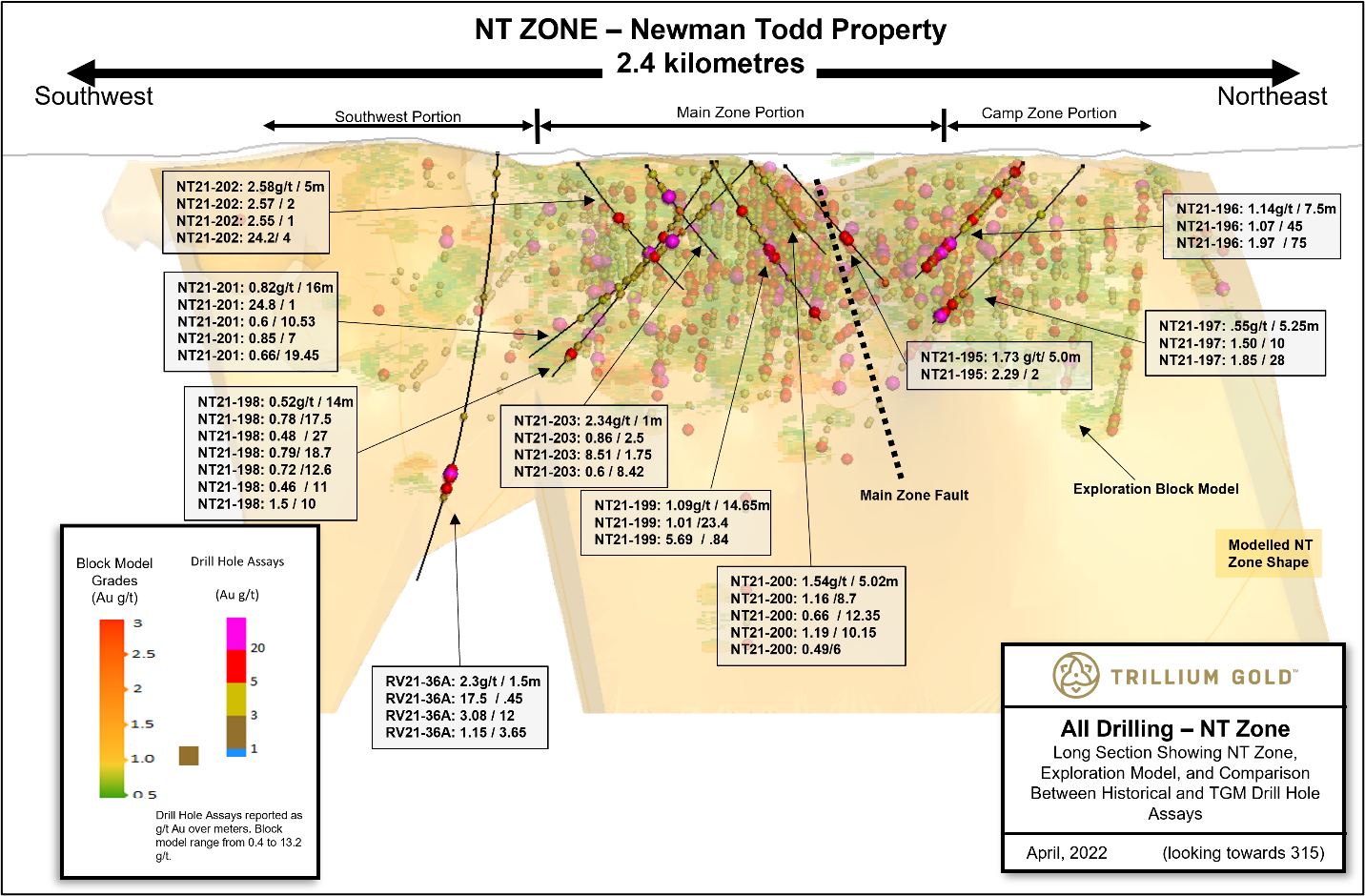

Trillium Gold Mines (TSXV:TGM) (OTC:TGLDF) has reported new results from the Newman Todd Complex from drill holes NT21-195 to -203 and RV21-36A. The holes were last drilled in the final quarter of 2021, but due to a general backlog in assay laboratory turnaround, final results were only received in late March 2022.

This group of drill holes were intended to follow up on previous results and begin testing of newly interpreted east-west structural corridors cutting through the NT Zone.

William Paterson, Trillium Gold’s Vice President of Exploration commented in a press release: “We continue to intersect significant mineralization as we follow up on the known east-west structures within the NT Zone and have received additional significant results as we begin to test new interpreted structures further southeast along the NT Zone. Our structural model and interpreted controls on the gold mineralization seem to be holding up well. Further work is necessary, but we are confident that subsequent drilling will yield similar results as we continue our work. We also feel it is time to commence testing high-priority structural targets both east and west of the NT Zone in order to begin expanding the resource footprint in the greater project area.”

Highlights from the results are as follows:

- 4 metres @ 24.2 g/t gold including 1.15 metres @ 73.67 g/t gold from NT21-202 in a new east-west fault corridor more than 400 metres southwest along the NT Zone from the Main Zone Fault

- Wide zone of 15.5 metres @ 4.6 g/t gold containing 1.45 metres @ 35.86 g/t Au from 247 metres downhole in NT21-196

- Testing and confirming gold mineralization on multiple east-west structures cutting through the NT Zone

Hole NT21-195 targeted high-grade Rivard-style quartz vein mineralization along the footwall contact of the NT Zone where two of the more significant results were found in siliceous NT Zone breccia segments offset into the footwall along E-W faults.

Holes NT21-196 and -197 followed up on previous significant intersections associated with hole NT21-194 (9m @ 19.73 g/t Au) and the Camp Zone Fault (see NR dated September 23, 2021). Hole NT21-196 was drilled above hole NT21-194 and intersected mineralized portions of the NT Zone with veining containing visible gold (VG) associated with galena and sphalerite, located in the footwall contact area. Hole NT21-197 stepped back to collar in the Camp Fault area testing the down-dip continuity of mineralization and the E-W Main Zone Fault structure. Both holes returned numerous significant assay results; NT21-196 throughout the hole, with VG seen in quartz veins between 257.8m and 259.4m, and in the lower portion of NT21-197, in the Main Zone Fault area. See Figures 1 and 2.

Figure 2: Long Section view (looking northwest) showing NT Zone model, exploration block model, historical results and significant intersections from NT21-195 to NT21-203 and RV21-36A.

In the south region of the Main Zone portion of the NT Zone, a series of holes (NT21-198 to -203) were drilled to the north and south across known and newly interpreted E-W breccia fault corridors crossing the NT Zone, often seen associated with better grade mineralization and Rivard-style quartz vein clusters along the fault trends. The Rivard-style vein intersected in NT21-202 at 262.25 – 264.2m contained multiple specks of VG and assayed 4m @ 24.2 g/t Au. All the holes returned grades and widths as expected, supporting the interpretation that these E-W structural corridors are influencing and focusing gold in the NT Zone.

In the southwest portion of the NT Zone, hole RV21-36A was drilled to assist in refining the model for the south portion of the NT Zone, as well as the SW Zone, and greatly extends the depth and extents of known mineralization. The hole first intersected the SW Zone showing patchy mineralization followed by a second breccia zone, towards the southeast, correlating to the NT Zone proper. In addition, the VG located in a sheared felsic volcanic section (at 695.5m) and in a quartz lens (at 705.5m), in the lower portion of the hole, expands the limits of VG occurrences cored in the project area. The E-W fault corridor associated with this gold mineralized zone is a new addition into our model for future targeting. Two very significant intercepts were received from this hole of 0.45m @ 17.5 g/t Au from 695.35m and 12m @ 3.08 g/t Au from 704m (including 1m @ 22.6 g/t Au). This hole was only stopped due to diminishing drill productivity.

Table 1: Highlights of significant intercepts from holes NT21-195 to -203 & RV21-36A. A full listing of Significant Intercepts can be found on Trillium Gold’s website (www.trilliumgold.com).

| Hole ID | From (m ) | To (m) | Width (m) | Au (g/t) | |

| NT21-195 | 200 | 200.5 | 0.5 | 15.2 | |

| NT21-196 | 25.25 | 25.6 | 0.35 | 13.1 | |

| 147 | 192 | 45 | 1.07 | ||

| Incl. | 155.5 | 162 | 6.5 | 3.02 | |

| and | 160 | 162 | 2 | 5.35 | |

| 224 | 236 | 12 | 2.23 | ||

| Incl. | 226 | 232 | 6 | 4.18 | |

| and | 231 | 232 | 1 | 21.8 | |

| 241 | 316 | 75 | 1.86 | ||

| Incl. | 242 | 243 | 1 | 12.2 | |

| Incl. | 247 | 262.5 | 15.5 | 4.6 | |

| and | 258 | 259.45 | 1.45 | 35.86 | |

| Incl. | 266 | 268 | 2 | 4.58 | |

| Incl. | 283.3 | 291 | 7.7 | 2.43 | |

| and | 283.3 | 284 | 0.7 | 6.38 | |

| NT21-197 | 420 | 448 | 28 | 1.85 | |

| Incl. | 421.8 | 424.8 | 3 | 2.95 | |

| Incl. | 437.55 | 442 | 4.45 | 5.08 | |

| and | 439.4 | 440.15 | 0.75 | 24.3 | |

| NT21-198 | 506 | 508 | 2 | 5.14 | |

| NT21-199 | 223 | 257 | 34 | 1.14 | |

| Incl. | 224.8 | 230 | 5.2 | 2.53 | |

| and | 224.8 | 225.65 | 0.85 | 6.67 | |

| and | 229.4 | 230 | 0.6 | 9.85 | |

| and | 247 | 247.6 | 0.6 | 6.33 | |

| NT21-201 | 215 | 216 | 1 | 24.8 | |

| NT21-202 | 151 | 156 | 5 | 2.58 | |

| Incl. | 152 | 153 | 1 | 11.1 | |

| 262 | 266 | 4 | 24.2 | ||

| Incl. | 262.85 | 264 | 1.15 | 73.67 | |

| NT21-203 | 83.25 | 85 | 1.75 | 8.51 | |

| Incl. | 83.85 | 84.53 | 0.68 | 21.4 | |

| RV21-36A | 695.35 | 695.8 | 0.45 | 17.5 | |

| 704 | 716 | 12 | 3.08 | ||

| Incl. | 705 | 706 | 1 | 22.6 | |

| Incl. | 713 | 714 | 1 | 8.67 | |

Table 2: Drill collar details for drill holes NT21-195 to -203 and RV21-36A – UTM zone 15, NAD 83.

| Hole ID | Easting | Northing | Elevation | Length (m) | Dip | Azimuth |

| NT21-195 | 420400 | 5656370 | 359 | 342 | -45 | 86 |

| NT21-196 | 420835 | 5656584 | 365 | 336 | -45 | 190 |

| NT21-197 | 420905 | 5656679 | 359 | 462 | -45 | 190 |

| NT21-198 | 420366 | 5656216 | 366 | 570 | -49 | 188 |

| NT21-199 | 420498 | 5656071 | 367 | 422 | -51 | 1 |

| NT21-200 | 420500 | 5656177 | 367 | 272 | -45 | 1 |

| NT21-201 | 420500 | 5656177 | 365 | 572 | -47 | 224 |

| NT21-202 | 420349 | 5655855 | 358 | 383 | -45 | 1 |

| NT21-203 | 420354 | 5656037 | 360 | 263 | -47 | 1 |

| RV21-36A* | 420025 | 5655958 | 384 | 947 | -62 | 135 |

* Note: Drillhole RV21-36 was abandoned at 21m.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Trillium Gold (TSXV:TGM) has announced that it has signed a Definitive Agreement to acquire most of Imagine Lithium’s Eastern Vision properties in the Confederation lake assemblage. This sits within the Birch-Uchi greenstone belt in the Red Lake Mining District of Ontario. The property package now comprises 13,958 hectares between the Fedart, Confederation North, and Confederation South properties.

Trillium Gold has been acquiring and assembling a dominant land package at Confederation Lake, and has created a strategic contiguous land package. This land package is more than 100km of favourable structure on trend with Kinross Gold’s important Dixie Deposit and Evolution Mining’s Red Lake Operation.

Details of the agreement are as follows:

Concurrent with the closing of the Definitive Agreement, Trillium Gold will pay to Pegasus Resources Inc. (“Pegasus”) $20,000 in cash, as well as 100,000 common shares in the capital of Trillium Gold to earn into certain option agreements that Trillium is assuming as options from Imagine Lithium under the Definitive Agreement. The cash consideration represents the remaining option payments under said option agreements, while the equity consideration purchases Pegasus’ carried interest in the relevant properties such that Trillium Gold will be transferred 100% of those properties upon closing of the Definitive Agreement.

Trillium Gold has also entered into a Royalty Purchase Agreement under which it will, concurrently with the closing of the Definitive Agreement, purchase a 2.0% NSR royalty on the Fredart property from prospector Perry English in consideration for the issuance of 60,000 common shares in the capital of Trillium Gold and $50,000 in cash.

The Definitive Agreement and the transactions contemplated thereunder, including purchasing Pegasus’ carried interest in properties covered by certain option agreements and entering into the Royalty Purchase Agreement, remain subject to TSXV approval.

Source:Trillium Gold Mines

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Trillium Gold Mines (TSXV:TGM) has announced that it has closed the previously reported purchase option agreements for the Satterly Gold Project and the Uchi Gold Projects. This is a major step for the company in building its dominant land position in the Confederation belt and Birch-Uchi greenstone belts within the Red Lake Mining District.

Uchi Gold Agreement

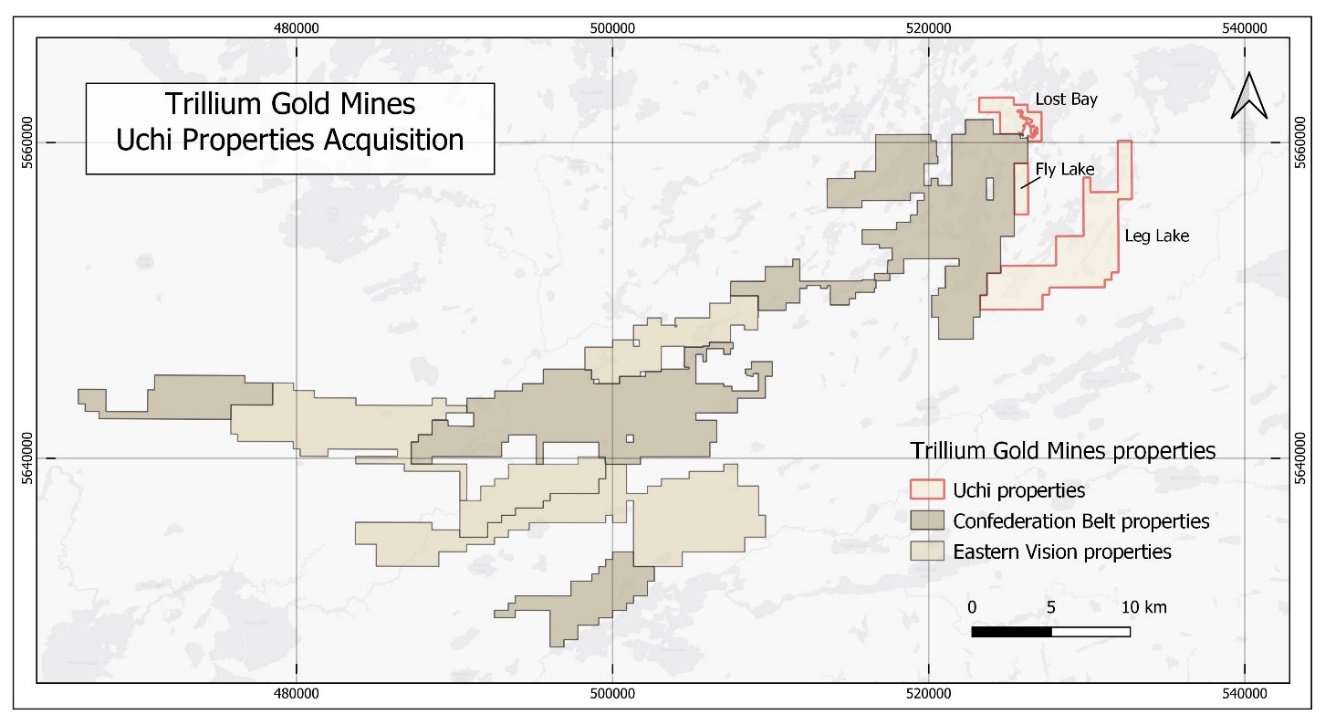

The Uchi Gold Agreement comprises one hundred and eighty-two (182) unpatented mining claims covering 4,189 hectares immediately adjacent to and adjoining the Company’s Confederation belt land position. They consist of the contiguous and complementary Lost Bay, Fly East and Leg Lake mining claims that extend the Company’s existing Confederation belt property assemblage to the northeast towards the Satterly Lake property, and add to Trillium’s dominant position over 100km of favourable structure on trend with Kinross Gold’s Dixie deposit (see Figures 1 & 2 below).

In order to keep the option in good standing, Trillium Gold is required to pay aggregate consideration of $115,000 over a period of three years, issue an aggregate 300,000 common shares, and grant to the vendors a 2.0% net smelter returns royalty on each purchased asset. The Company has the right to repurchase 50% of each royalty (being 1.0%) by paying the holders an aggregate amount equal to $1,000,000.

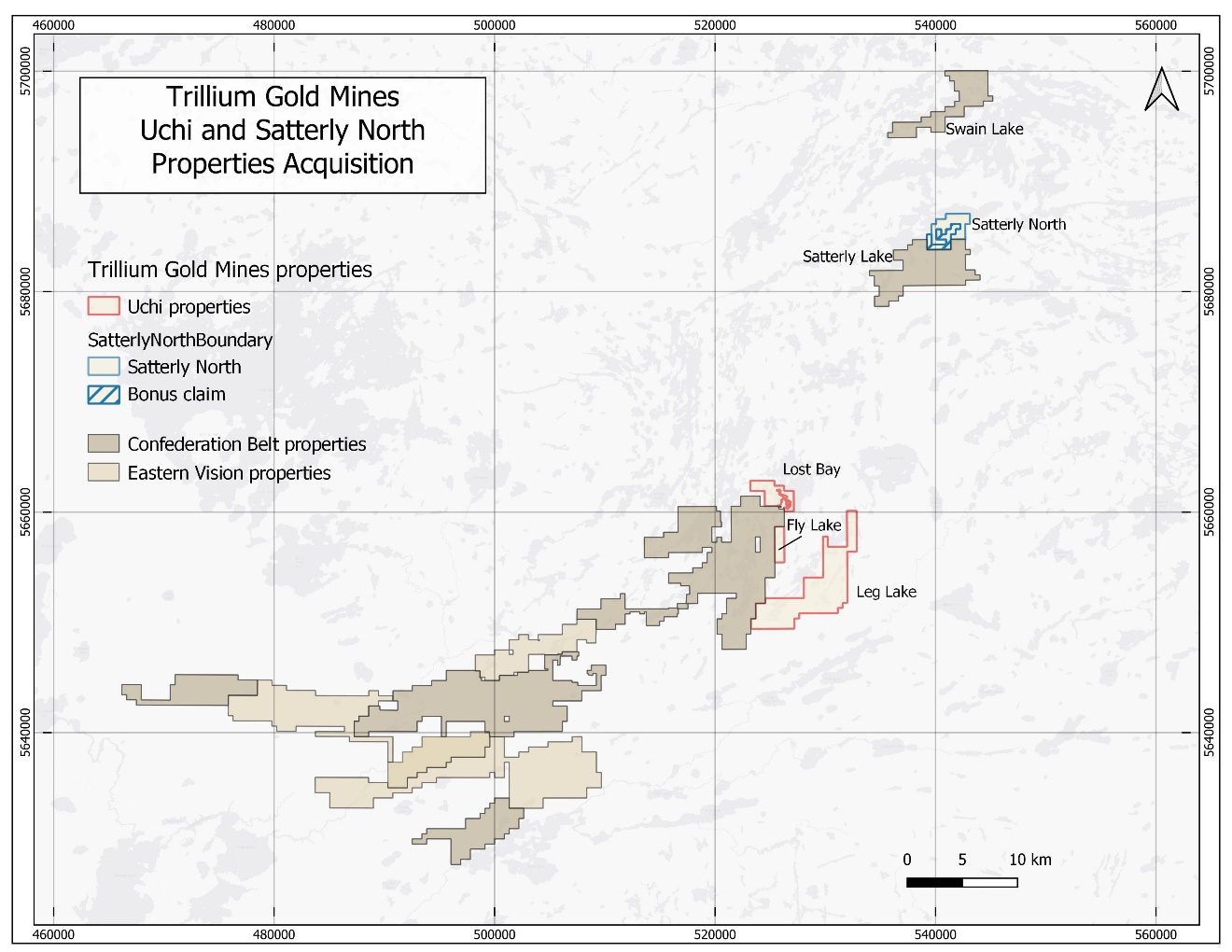

Satterly Gold Agreement

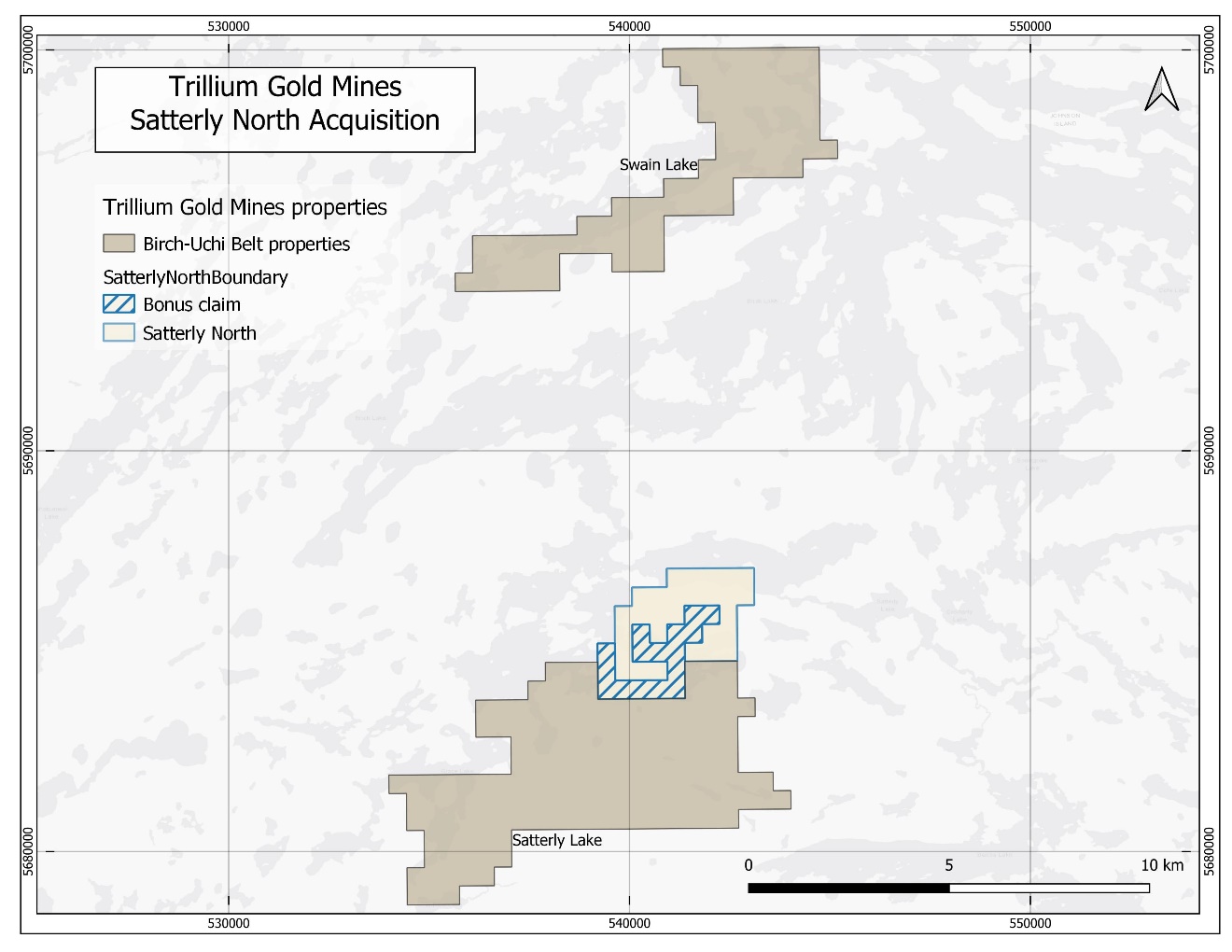

The Satterly Gold Agreement comprises twenty-eight (28) claim cells in five (5) claims covering 565 hectares (called Satterly North). The area has seen sporadic exploration from the 1930’s with renewed gold exploration in the 1990’s and again from 2009. (see Figure 2 below).

In order to keep the option in good standing, Trillium Gold is required to pay aggregate consideration of $63,500 over a period of three years, issue an aggregate 100,000 common shares, and grant to the vendors a 1.5% net smelter returns royalty on each purchased asset. The Company has the right to repurchase 1/3 of each royalty (being 0.5%) by paying the holders an aggregate amount equal to $500,000.

In addition, the vendors have successfully acquired sixteen (16) recently staked cells in one (1) claim covering 323 hectares at a cost equal to the costs of staking (see Figure 3 below).

Source: Trillium Gold Mines

Figure 1: Uchi Gold Option Properties

Figure 2: Uchi and Satterly Gold Option Properties

Figure 3: Satterly Gold Option Property showing sixteen (16) recently staked cells in one (1) claim

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Trillium Gold Mines Inc. (TSXV:TGM) (OTCQX:TGLDF) announced that it has entered into two purchase option agreements for the Uchi Gold Project and Satterly Gold Project, to acquire a 100% undivided interest in each area within the Confederation greenstone belt. The agreements further Trillium Gold’s strategic objective to consolidate the Confederation belt and Birch-Uchi greenstone belt, positioning it as the dominant exploration company in the Red Lake Mining District.

Uchi Gold

Figure 1: Uchi Gold Option Properties

The Uchi Gold Agreement covers 4,189 hectares of unpatented mining claims immediately adjacent to and adjoining the Company’s Confederation belt properties which already stretch over 100km of favourable structure on trend with Kinross Gold’s Dixie deposit.

The Uchi Gold agreement brings a whole other set of favourable mining claims into the company’s portfolio. Properties include the contiguous and complementary Lost Bay, Fly East, and Leg Lake mining claims. By adding these properties, Trillium extends its Confederation belt property assemblage to the northeast towards its Satterly Lake property. Most notably, the deal boosts Trillium Gold’s foothold in a contiguous land position along the same structural trend that has attracted major mining companies.

Vast, Untapped Potential

The new properties also hold a vast amount of untapped potential, considering how underexplored they are. The Fly East and Leg Lake properties have previously seen limited reconnaissance type exploration, with the majority of exploration having focused on base metals in the 1970s and 1980s. Only eight drill holes were conducted over the properties during that time period.

Then in the early 2000s, platinum group mineralization was targeted, with results of up to 1g/t PGMs and 1.8% copper. At Fly East, some minor gold exploration took place but only indirectly. Considering that both of these properties contain favourable structures and lithologies for both gold and base metals, Trillium Gold has snapped up a strategic package that could be more prospective than envisioned.

To top it off, as part of the Uchi agreement, the company gains the Lost Bay property. This is particularly significant being located close to the historic Bobjo Mine, which in 1929 produced 362 ounces of gold.

The Lost Bay property contains felsic and mafic volcanic rocks with gold mineralization that appears to follow a preferred west-northwest orientation. In the mid-1930s some gold and base metal exploration was performed, targeting South Bay Mine analogues, but these structures were not deemed to be important in the base metal context. Today Trillium Gold has the opportunity to unlock the potential of these structures prospective for gold, base metals (copper/zinc) and PGMs.

Satterly Gold

Figure 2: Uchi and Satterly Gold Option Properties

The Satterly Gold Agreement consists of 5 unpatented mining claims covering 565 hectares adjoining the company’s existing Satterly Lake properties located to the northeast of the Confederation belt land package.

Like the other properties, this area has seen sporadic exploration in the 1930s, recommencing gold exploration in the 1990s, and then again in 2009.

The region is underlain by a variety of rock types, including mafic volcanics and intrusives, sediments, and lamprophyre dykes. In the northeast corner of the property, Cominco carried out a local basal till sampling program, which revealed several anomalous results.

These aforenoted purchase option agreements have effectively furthered Trillium Gold’s regional-scale consolidation strategy which has resulted in a dominant land position in the Confederation and Birch-Uchi belts. The potential of the combined property is vast, and the company is ideally positioned to explore and unlock that potential in 2022 and beyond.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

As global investor confidence continues to wane contributing to volatility in the equities markets, commodities are running their own course –supply concerns are pushing oil prices to their highest levels in over a decade while the precious metals sector characteristically responding to geopolitical uncertainty has driven up gold and silver prices dramatically.

And whereas strengthening gold and silver prices would be expected to boost senior mining firms’ profits, inevitably one would expect this to trickle down to the juniors in the form of M&A, JVs and equity investments. For that very reason, it may well be the perfect time for investors to add some gold equities and particularly junior golds to their portfolios. Let’s consider three Canadian gold stocks that may be worth a closer look.

Trillium Gold Mines (TSXV:TGM) (OTC:TGLDF), a Canadian gold exploration company, has amassed one of the greatest land packages in and around the Red Lake mining district, adjacent to major mines and deposits, as well as over 100 kms along the highly prospective Confederation Lake greenstone belt. The company is currently trading at a fraction of its 2-year high despite the quantifiable advancement of its projects.

Trillium recently reported results from surface channel sampling and mapping at its Rivard property, located near the world-class Red Lake Operations, which has shown huge high-grade potential. Rivard is located adjacent to Trillium’s 100%-owned Newman Todd complex.

The Rivard Property has historically contained significant alteration and widespread gold mineralization in narrow high-grade veins in outcrops and trenches. This 90-hectare tract of land is immediately adjacent to Newman Todd and hosts oxidized quartz veins ranging up to 561 g/t that was mined by the Rivard family for over two decades. The company is currently drilling and advancing the Newman Todd to an open-pit mining scenario. Another property that holds tremendous promise is the 80%-owned Gold Centre located within a mere 350 metres from the world-famous Campbell-Red Lake Mine where Trillium is currently drilling to prove that Gold Centre is the extension of that prolific mine.

Centerra Gold (TSX:CG)(NYSE:CGAU) is a Toronto-based gold mining company with a market capitalization of about $3.8 billion. Its Mount Milligan mine in British Columbia accounted for almost 56% of its total revenue in 2021. The remainder of Centerra’s income for the year came from other operations.

Last year, the firm experienced several difficulties following Kyrgyzstan’s seizure of control of its Kumtor Gold Mine. This is one of the major reasons its revenues have dropped by almost 47% year over year to around $900 million in 2021. However, the company is currently engaged in discussions and negotiations with Kyrgyzstan’s government to help resolve the disputes as quickly as possible.

SSR Mining (TSX:SSRM) (NASDAQ:SSRM) is the last gold stock on the list that might be worth checking out. Last year’s revenue bump by nearly 73% last year to about US$1.5 billion was a big driver of its success.

SSR Mining’s strong revenue and production growth helped it post a solid 88.5% increase in adjusted net profits from the previous year, to about US$402 million. Its adjusted net profit margin also improved significantly in 2021, increasing to around 27.3 percent from 25 percent in the prior year.

A Banner Year Ahead

Despite the abundant geopolitical risks and challenges the global markets are facing, precious metals demand has been skyrocketing. This has caused prices for gold and silver to surge, which bodes well for companies in the precious metals mining industry.

That said, Trillium Gold Mines, Centerra Gold, and SSR Mining may be worth considering as potential additions to your portfolio right now. All three stocks have reported encouraging results recently and continue to look to a future full of prospective discoveries, higher revenues, and profits.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

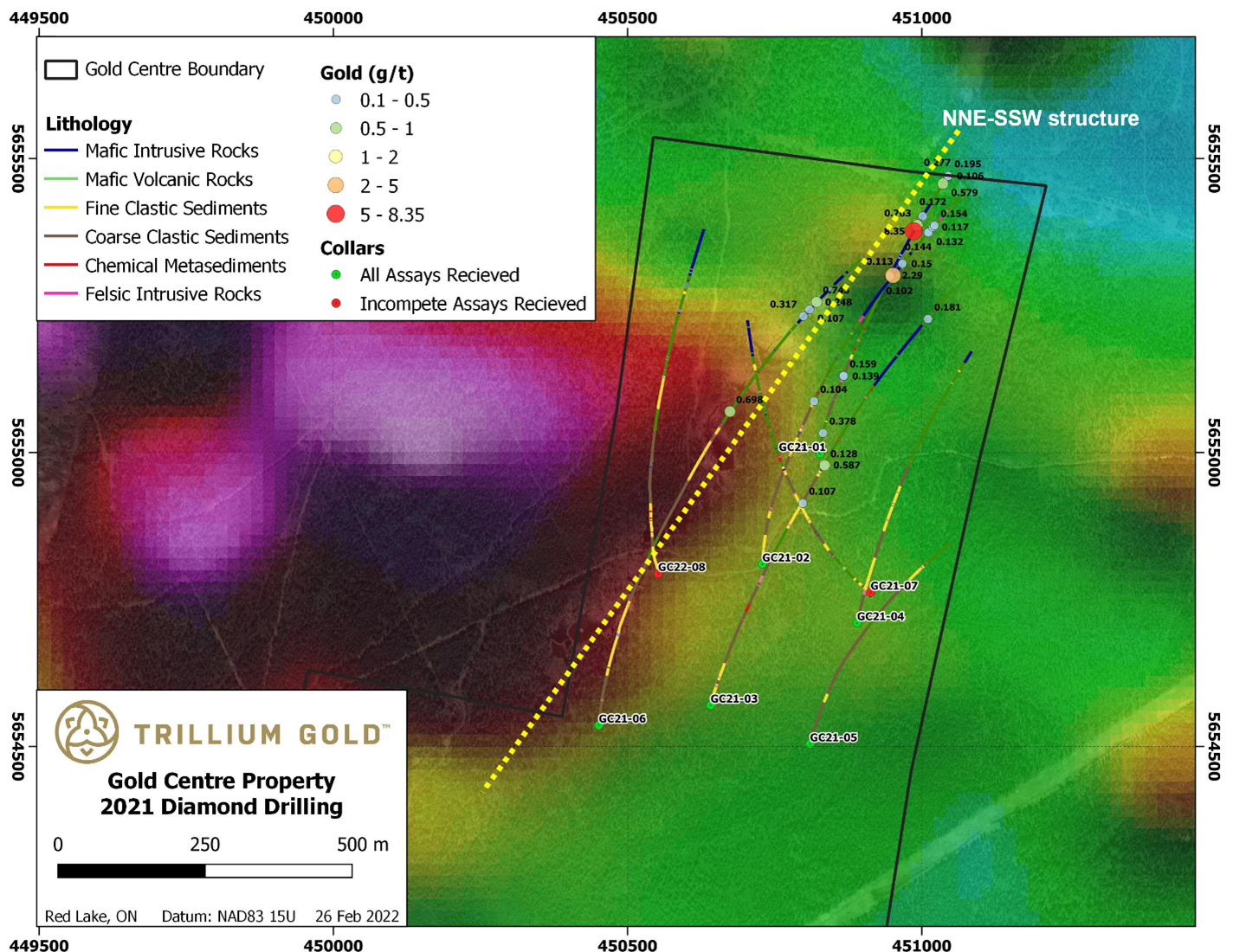

Trillium Gold Mines Inc. (TSXV:TGM) has reported drilling progress on the company’s 80% owned Gold Centre property. Trillium has received six of eight drill results from the 2021, 9,329-metre drill program focused on the north end of the property targeting the Red Lake mine stratigraphy.

Gold Centre consists of 16 contiguous historic mining concessions over 253 hectares and is located just 350 metres from Evolution Mining’s (EVN-RLO) Red Lake operations. The Company believes that the southeast plunging mine trend extends onto its Gold Centre property and may represent the continuation of the world-class mine.

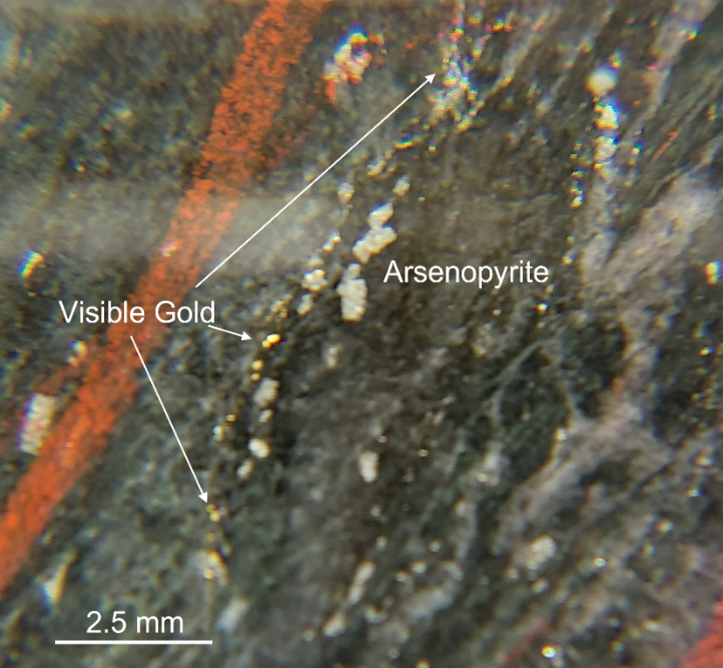

Figure 1: Close-up of visible gold in sheared and altered gabbro associated with arsenopyrite.

The mineralization encountered to date is estimated to be similar to that found on the adjoining property in terms of rocks, vuggy alteration and mineralization. Results identified visible gold (VG) at 782.2 metres in a shear parallel to the foliation associated with arsenopyrite and hosted in a silica-altered gabbro unit of the Balmer assemblage, the host rock of the Red Lake mine.

William Paterson, Trillium Gold’s Vice President of Exploration commented in a press release: “Proving Gold Centre’s continuity to the EVN-RLO has always hinged on identifying the Balmer host rocks at depth which we have achieved. The results to date have been positive and we are assembling vital evidence that will allow us to focus on the high-grade gold mineralization believed to be present. We have observed all the key components on this property that are analogous to the gold mineralization next door.”

Figure 2: Plan showing holes GC21-01 through GC22-08 at north end of the Gold Centre Property, significant gold values above 0.1 g/t Au and regional magnetics survey.

For Trillium Gold, a discovery at Gold Centre would be tantamount to a windfall or lottery. Finding the underground extension of a world-class, high-grade producing mine in a stable jurisdiction such as Red Lake, Ontario is a once in a lifetime situation.

The 2022 drill program will be focused on a fifth gold trend found deeper in adjoining Red Lake. Results have only been received from the first six drill holes due to industry-wide delays in receiving assay results from the labs.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Kinross (NYSE:KGC), the senior Canadian gold producer, announced in on February 24, 2022 the completion of the plan of arrangement to acquire all of the issued and outstanding shares of Great Bear Resources for C$1.8 billion. The company’s primary asset, the Dixie project, where drilling has revealed world-class structures, includes 9.14 ha of contiguous deposits extending over 22km and is one of the largest and most exciting discoveries in recent years.

J.Paul Rollinson, president and chief executive officer of Kinross said, “The closing of the acquisition of Great Bear Resources represents a milestone for Kinross as we advance our future growth strategy. We are excited to add such a high-quality asset in a top mining jurisdiction to our global portfolio.”

“The Dixie project represents an exciting opportunity to develop a potentially world-class deposit into a large, long-life mining complex.”

Trillium Gold’s Dominant Land Package

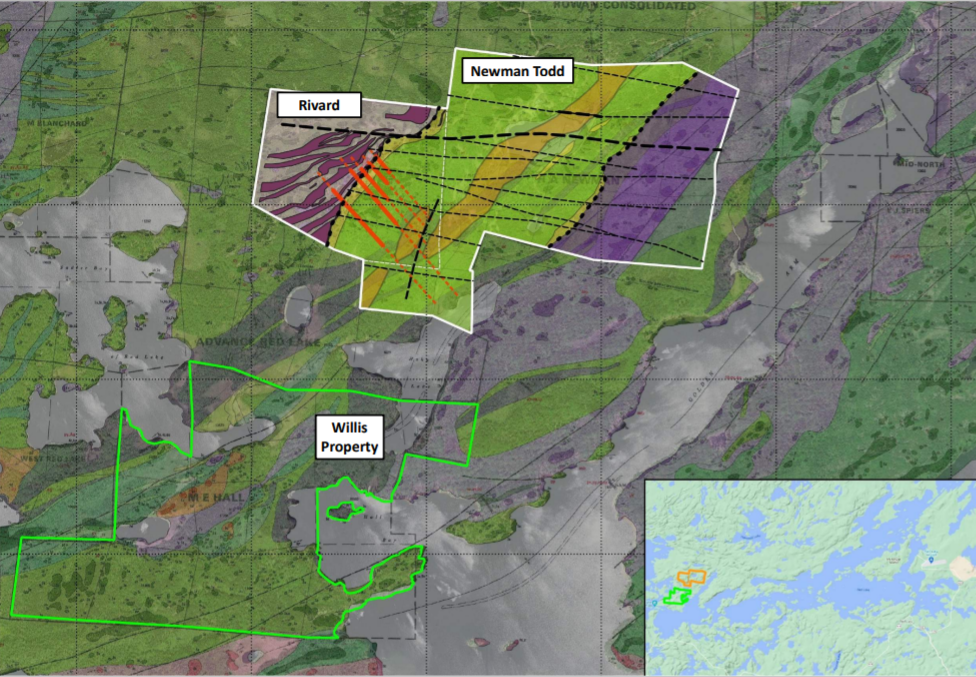

The massive deal underscores the importance and potential of the Red Lake Mining District, an area where Trillium Gold Mines (TSXV:TGM), a gold exploration company with a dominant land package in the area is operating.

Along the same structural trend as the Dixie deposit, Trillium Gold recently announced a definitive agreement to acquire a massive contiguous land package over a major part of the Confederation Belt that covers more than 100 km of structure. Trillium’s land package is not only on-trend, but is the largest land assemblage in the area. Considering the size and potential of the Confederation Belt land package, the potential for multiple Dixie-size discoveries is within the company’s midst. The definitive agreement is seen as an important step in strengthening the Company’s strategic advantage to consolidate the greenstone belt and position it as the most dominant exploration company in the Red Lake Mining District.

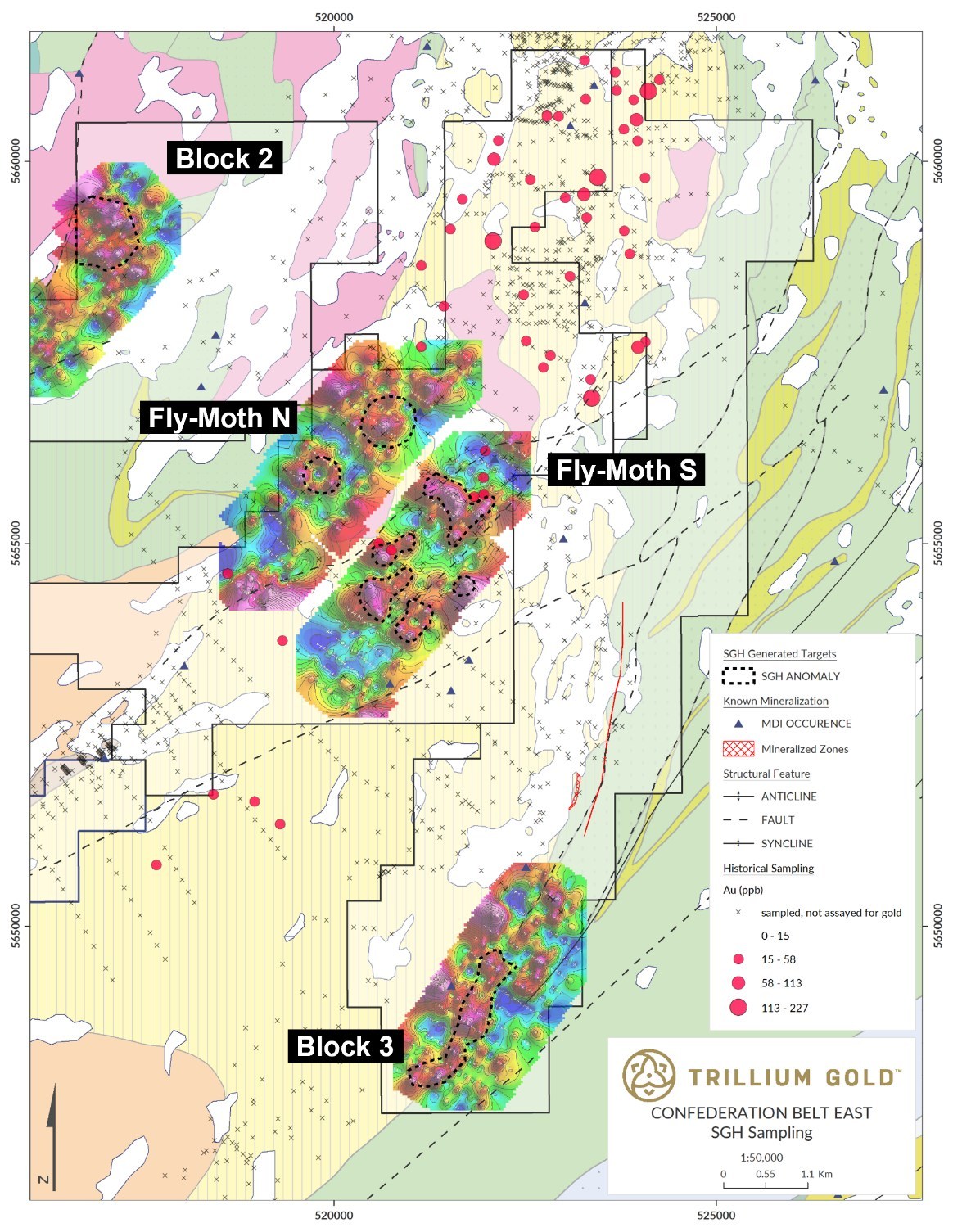

In January 2022, the Company reported results from 17 SGH (spaciotemporal geochemical hydrocarbon) regional soil sampling grids on its Confederation belt properties which identified numerous gold pathfinder anomalies that will serve as priority targets for Trillium Gold’s second phase of exploration work in the 2022 field season. The newly identified relationships among SGH-generated gold targets, historical gold assays and possible structural and lithological controls, effectively launch Trillium Gold’s Confederation belt properties into a new era in gold exploration.

The Willis Property

In addition, Trillium recently acquired a key land package southwest of its 100% owned Newman Todd Complex, a project initially being advanced towards open-pit mining, with depth potential to the southwest known as the Willis Property, comprising thirteen patented mineral licenses totalling 229 hectares.

As with the Newman Todd Property to the north, Willis shows many similarities to the major eastern gold mines: namely, rock types, structures, mineralization and alteration. Despite these attributes, the property has seen very little exploration since the 1930s and is one of the few remaining unexplored properties in the Red Lake greenstone belt.

As Trillium Gold continues to settle into its position as the most dominant exploration company in Red Lake, investors will continue to watch closely for the high potential at its Red Lake property portfolio the company has amassed over the past 12 months.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Trillium Gold (TSXV:TGM) has announced that the company has increased the offering of the private placement announced on February 4, 2022. Investor demand has been significant and the offering has been oversubscribed. Accordingly, the company expanded the offering from C$5.0 million to up to C$6.5 million for the sale of any combination of the following:

- Units of the Company (each, a “Unit”) at a price of C$0.53 per Unit;

- Flow-through Units of the Company (each, a “FT Unit”) at a price of C$0.60 per FT Unit; and;

- Charitable FT Units to be sold to charitable purchasers (each, a “Charity FT Unit”) at a price of C$0.75 per Charity FT Unit.

Source: Trillium Gold Mines

Red Cloud Securities Inc. who is acting as bookrunner and agent under the offering, will have an option, exercisable in whole or in part, until 48 hours prior to the closing of the offering, to sell up to an additional C$1,000,000 in any combination of offered securities at the offering prices.

The total proceeds from the sale of FT Shares will be invested in “Canadian exploration expenses”. Specifically, the company intends to explore the Red Lake properties to utilize the net proceeds raised from the offering, among other general working capital purposes. Around February 28, 2022 is the scheduled closing date of the Offering which is subject to certain conditions. Among them, TSX Venture Exchange approval, and the Unit Shares, FT Shares, and Warrant Shares will have a hold period of four months and one day from the closing date.

Trillium Gold Discovers Multiple Gold Anomalies Along Confederation Belt Properties

Earlier this month Trillium Gold reported findings from the spatiotemporal geochemical hydrocarbon (SGH) sampling program completed during the summer on the Company’s Confederation Belt properties.

Independent results and interpretations provided by Actlabs from the 17 SGH regional soil sampling grids highlighted significant gold probability anomalies over multiple target types. These encouraging anomalies will serve as priority targets for Trillium Gold’s second phase of exploration work in the 2022 field season and, together with the sampling and prospecting program carried out concurrently, are expected to generate multiple drill targets.

The newly identified relationships among SGH-generated gold targets, historical gold assays and possible structural and lithological controls, effectively launch Trillium Gold’s Confederation belt properties into a new era in gold exploration.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Trillium Gold Mines (TSXV:TGM) has announced a major change in its team. To attend to other commitments, Mr. Robert Schafer is stepping down from his position as non-executive chairman of the company.

In his stead, Russell Starr, President & CEO of Trillium has taken over as Chairman. Russell Starr stated, “Bob has served as a Director of the Company since July 2020, during which time he has made countless contributions to the growth of the Company. We wish to express our sincere gratitude for his dedicated commitment as we look ahead to launch Trillium Gold into a new era in gold exploration in the Red Lake Mining District.”

Russell Starr is an entrepreneur and financial professional with over 20 years of experience with major financial institutions such as RBC, Scotia Capital, and Orion Securities in corporate finance and mergers & acquisitions, as well as with public mining and exploration companies in senior corporate advisory and development roles. He was previously in the Ph.D program for Economics and co-founded a large Canadian investment dealer.

In the position of Vice-President of Exploration is Bill Paterson, a professional geologist with several years of experience with Goldcorp Inc. in Red Lake Ontario as Exploration Superintendent and managed the ultra-deep surface drilling program and underground development of the world-class Cochenour Mine. He is considered an expert on Confederation Greenstone Belts.

Ian McNeilly, a chartered accountant with over 20 years of executive financial management and leadership experience in the global mining industry, serves as CFO and Corporate Secretary of Trillium Gold. An expert in strategic planning, financial controls, capital funding and metal trading, Ian was in charge of Treasury and Operations at BMO Nesbitt Burns in Toronto and London, UK.

Donna Yoshimatsu is Vice President, Corporate Development and Investor Relations. Her extensive experience spans more than 25 years in the mining sector. She has held senior investor relations positions with some of the TSX’s most successful companies including Franco-Nevada and SNC-Lavalin.

Trillium Gold Mines Inc. has a dominant land position in the Red Lake mining district of Northern Ontario, one of the world’s premier mining areas.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Every day, we come across the news that a new electronic device has been released and users are wondering if the battery performance will be sufficient for their daily use. Battery durability has become an important buying motive as users expect the batteries in their devices to offer them optimal performance for all-day use over an extended period of time. Undoubtedly, the need for much lighter and longer-lasting batteries is increasing and meeting this demand is a major challenge for manufacturers.

The batteries we know today derive their energy from liquid lithium and it has been difficult to find materials that match or exceed the conductivity, electrode potential and charging flexibility offered by batteries built from this alkaline element. Now, researchers are also turning to gold for use in high-capacity batteries with better energy density. It might be up to mining companies to fill in the supply gaps to fuel further research, and potentially production for gold use in batteries.

Trillium Gold Mines Inc.(TSXV:TGM) is a mining company engaged in the exclusive exploration and development of high-grade gold. The company has the second largest land holdings in the Red Lake District, one of the world’s most prolific and concentrated gold mining areas. Mines in the region have produced a cumulative total of 29.5 million ounces of gold at an average grade of 15.41 grams of gold per tonne of resource (g/t).

The company recently announced the acquisition of the Willis Property, which consists of thirteen contiguous patented mining concessions covering a total of 229 hectares located southwest, contiguous to Trillium’s flagship property, Newman Todd (NT) in Todd Township, Red Lake Mining District, Ontario.

Trillium Gold acquired a 100% interest in the property, subject to a 2% net smelter return royalty, completing payments totaling $420,000 and a total of 400,000 common shares in the capital of the company.

Trillium Gold CEO, Russell Star commented “The Willis property represents a significant addition to Trillium’s suite of properties in the western Red Lake area. It covers both the southwest extension of the NT Zone and other ground that has proven to be highly prospective for gold with visible gold observed in outcrop sampling. As with the NT Property, the Willis Property shows many similarities to the major gold mines to the east. Despite these attributes, the property has seen very little exploration since the 1930s and is one of the few remaining unexplored properties in the Red Lake greenstone belt.”

Gold Battery Rush?

In the battery industry, gold has not been given prominence as a candidate material for battery construction but now the importance of gold for this purpose has come to the forefront. The gold rush is here to stay.

The University of California, Irvine has been looking for a way to replace liquid lithium in batteries with a more robust and safer alternative. Now, researchers have found a way to create batteries with higher capacities than lithium with the use of gold nanowires to see if they can extend the lifespan of batteries as we know them.

Mya Le Thai, a study leader, as an experiment, added an additional layer of polymethyl methacrylate (PMMA) and charged and discharged it numerous times to test its durability. To their surprise, the researchers found that these batteries withstood more than 200,000 charge cycles. Reginald Penner, an advisor in the chemistry department at the University of California irvine said, “This is incredible because these things typically die dramatically after 5,000 or 6,000 cycles, 7,000 at the most.”

The research results are a strong indication of the importance of gold not only as an essential material for battery construction but also as an indispensable element in being able to take battery performance to the next level.

Although these super batteries require very little gold to build them, it is extremely expensive to meet the enormous demand. The mining industry will be the number one source for this material that might be the key in advanced battery performance for EVs, mobile devices, and more.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Canadian mining company Trillium Gold Mines Inc. (TSXV:TGM) recently reported that it has identified numerous gold pathfinder anomalies on its Confederation Belt properties, one of the 10 different projects it has on the go within the Red Lake Mining District. The company believes these anomalies establish the “great gold potential” for the 39,300 hectares of Confederation Belt properties, and will serve as priority targets for Trillium’s second phase of exploration work in 2022.

This follow up field work is expected to generate multiple drill targets, which will “effectively launch Trillium Gold’s Confederation belt properties into a new era in gold exploration,” said the company’s VP of Exploration William Paterson in a recent press release.

Trillium Gold has catapulted into the consciousness of many mining industry watchers and investors with its latest land acquisition.

Trillium also recently announced the approval of all the items presented at its annual general and special meeting of shareholders, including the re-election of the Directors of the Company being Robert Schafer, Russell Starr, David Velisek, Robert Kang and Krisztian Toth, which was held on December 21, 2021.

The company is advancing projects in the Red Lake Mining District, which is located in Northern Ontario and known to be one of the most premier gold mining districts in the world. There has been over 60,000 meters of historical drilling performed on the district, including multiple targets that have yet to be tested, and access to essential infrastructure.

Just last December Trillium’s project list grew even more as it acquired all of Infinite Ore Corp.’s Eastern Vision property holdings in the Confederation Lake assemblage of the Birch-Uchi greenstone belt in the Red Lake Mining District. The agreement will also include the issuance of 4,000,000 common shares in the capital of Trillium Gold including payment of $175,000 in cash to Infinite Ore.

The property covers 16,991 hectares between the Fredart, Garnet Lake, Confederation North and Confederation South properties, and will give the company control over a significant portion of the Confederation Lake assemblage.

Other operations the company runs include the Gold Centre located in “the heart of the highest-grade gold camp in North America,” Shining Tree in Matachewan -Kirkland Lake mining district, and multiple properties including the Fenelon property in Quebec.

Throughout all of their operations, Trillium Gold stands by their socially and environmentally responsible values, including creating employment opportunities, boosting the communities economical performance, and making an overall positive impact on the community. Energy and the use of emissions are monitored closely, along with proper waste management in place to help preserve the ecosystem and biodiversity, which the company recognizes as a top priority.

Out of all of the projects the company operates, one of the most highlighted projects is the Newman Todd project, which the company is just scratching the surface of in terms of the future potential. Early exploration back in the 1930’s and 1940’s was carried out with little information recorded from these explorations, and until now it has only been sparsely drilled or tested at depths below 400 meters.

Some drilling that has been completed on the project has concluded excellent potential with over 40% of the holes intercepted greater than 10g/t Au over various interval lengths. 56 holes drilled in 2011 identified zones of high-grade gold mineralization along the northeast of the project, and as of November 15, 2021 the total drilling stands at 15,927 meters on both the Newman Todd and Rivard Projects combined.

Future updates will be watched closely as the new land acquisition opens tens of thousands of available hectares to the company, and investors watch to see whether Trillium Gold might be the next Great Bear Resources, and a potential takeout target for the future.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

After acquiring a significant land package and consolidating its position in the Red Lake Mining District in Canada, Trilliium Gold Mines Inc (TSXX:TGM) (OTC:TGLDF) has announced this morning it has discovered multiple gold anomalies along its Confederation Belt Properties in Red Lake.

A spaciotemporal geochemical hydrocarbon sampling program was completed during the summer of 2021 at the Confederation Belt properties. This survey unveiled numerous gold pathfinder anomalies with rating categories ranging from 1-6. This has now confirmed and established the gold exploration potential of Trillium’s properties. These properties form a 39,300 hectare contiguous land position directly on trend with other discoveries currently unfolding in the district and therefore makes Trillium Gold’s position highly valuable.

The gold pathfinder anomalies identified by the survey conducted by Activation Laboratories will now serve as the priority targets for the company’s second for of exploration work in the 2022 field season. Trillium can use the sampling and concurrent prospecting program to generate multiple drill targets.

Red Lake Mining District has already produced 29 million ounces of high-grade gold. Red Lake is one of the country’s premier mining districts, and has infrastructure, million, and roads in place for efficient drilling and exploration. The survey focused on some key blocks at the properties, to focus on known base metal and minor gold mineralization intersected in historical drilling, including the Joy Block. A significant portion o the Joy-Copperlode Blocks are covered by variably conductive outwash and deglaciation sediments.

Information from the surveys according to the press release includes:

The three smaller grids in the southwest of the Joy Block were designed as orientation surveys over known base metal and minor gold mineralization intersected in historical drilling. A large portion of the Joy-Copperlode Blocks are covered by variably conductive outwash and deglaciation sediments (not locally derived) and despite no outcrop identified in these areas, all three returned anomalies, the western-most two confirming the method over known drill hole results.

Based on a synthesis of previous work reviewed to date by Company geologists, these anomalies appear likely spatially associated with more than one type of control (i.e., late-stage structural, lithological, as well as possible earlier structures (syn-volcanic?), as previously interpreted in historical work). The location of the anomalies is directly on trend with regional-scale faults (as at Great Bear’s Dixie Project) and provide a new framework on which to focus gold exploration in the belt and region.

Several new target areas have also been confirmed where historically very little exploration work has been conducted (e.g., the northern-most anomaly on the Copperlode property, I-anomaly, Figure 1). These new discoveries provide exciting new targets for follow-up work.

On the Copperlode West block, the F-anomaly is a highly-rated anomaly cut by a NW-SE trending magnetic lineament (possibly D2 orientation?) and represents one of the more encouraging targets in the area. Also of high-rating is the I–anomaly which lies on the western extension of an EM conductor in an area with no known historical geological, geochemical or geophysical surveys. The J-anomaly was identified as a potential Redox zone by Actlabs, similar to that at the Dixie Hinge and Limb zones sampled by Great Bear Resources (news release August 1, 2019).

The Block B anomaly is also highly rated and shows parallel responses coincident with a magnetic high trend, and coincident with or flanking a NE trending EM conductor.

The Block 1 anomalies lie within stratigraphy representing the eastern extension of that hosting the copper-molybdenum mineralization near Fredart Lake. The two geochemical signatures appear to be on strike from one another, hosted by iron formation or ferruginous sediments. There has been very little historical work in this area. The Lucky 7 anomaly lies within an EM conductor trend that has been drilled, off-property, intersecting gold values up to 4 g/t over 1.5ft. Grab samples in the drilled area also ran up to 13 g/t gold.

The Block 2 anomaly, among the highest rated by Actlabs, shows a significant number of high contrast peaks over a large, 600m x 450m area. Actlabs identify it as a segmented nested-halo anomaly coincident to that of the Redox zone. The potential for gold mineralization here is believed to possibly exist directly below this anomaly.

The Fly-Moth N and S grids serve as extensions to exploration work on known prospective and mineralized trends associated with the past-producing South Bay Mine. There are anomalous gold values in historical lithogeochemical samples in the general area around the mine; however, samples further towards the southwest were not assayed for gold. The SGH grids fill in the data gaps and successfully highlight new gold anomalies. These anomalies are highly rated and show characteristics of Redox Zones as well.

Here, the controls on processes responsible for the development of these anomalies likely reflect a complex interplay between lithology and structure. There appears to be some, but not exclusive, spatial lithological control locally (e.g., near Triangle Lake) as the anomalies are associated with minor intrusive rocks which themselves were previously interpreted as fault controlled. However, one anomaly coincides directly with a previously mapped rhyolite tuff unit suggesting the possibility of lithologically hosted gold.

Equally, the geometry of elevated gold in this package of rocks could be suggestive of syn-volcanic fault-controlled mineralization. At the southern edge of Triangle Lake, historical work identified anomalous gold that coincides with a previously mapped fault. These types of relationships bear investigating for refinement or confirmation of ideas with follow-up exploration work planned for 2022.

The Block 3 anomaly coincides with several important features: a regional-scale fault trace, a major volcanic break (cf. Thurston et al, 1980), and a property scale transition from felsic to mafic volcanic rocks. Historical work on the property identified several sulphide zones and/or geophysical conductors. The few historical drill holes in the general area, inconsistently sampled for base metals and even more infrequently for precious metals, do show elevated copper, zinc and gold in these sulphide horizons.

Conversely, in the direct vicinity of the anomaly, virtually no geochemical work has been performed, and there are only two known drill holes, the locations of which remain uncertain.

Source: Trillium Gold Mines

After recently acquiring the Confederation Lake assemblage from Infinite Ore Corp., the company has become one of the dominant explorers in the Red Lake Mining District. The Eastern Vision property holdings at Confederation Lake include 16,991 hectares, and give Trillium control over a large portion of the assemblage. Most importantly, it gives the company control over a contiguous land package that now covers over 100 km of favourable structure on trend with Great Bear Resources’ Dixie Deposit.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Trillium Gold Mines Inc. (TSXV:TGM) has announced this morning it has signed a definitive agreement to acquire all of Infinite Ore Corp.’s Eastern Vision property holdings in the Confederation lake assemblage of the Birch-Uchi greenstone belt in the Red Lake Mining District, Ontario.

The property holdings include 16,991 hectares between the Fredart, Garnet Lake, Confederation north, and Confederation South properties. Red Lake is the company’s focus, and this acquisition gives Trillium control over a significant portion of the Confederation Lake assemblage and creates a contiguous land package covering over 100 kilometers of favourable structure on trend with Great Bear Resources’ Dixie Deposit.

Red Lake Hotspot

Great Bear was recently acquired by Kinross for C$1.8 billion, a huge acquisition in the Red Lake Mining District. The key focus for the acquisition with the Dixie project, which has shown exciting recent discoveries and the characteristics of a top-tier deposit.

Trillium Gold’s acquisition is on trend with Dixie, placing it in good company in one of Canada’s premier gold mining districts.

The Dominant Exploration Company

Trillium Gold has is focused on properties in the Red Lake Mining District, in particular, its Newman Todd project being advanced toward open-pit mining. The company has assembled on the most extensive property packages in the Confederation Lake assemblage of the Birch-Uchi greenstone belt, and this latest acquisition adds an additional 16,991 hectares to its portfolio. This is a major step in strengthening the company’s strategic advantage to consolidate the greenstone belt and makes the company the most dominant exploration company in the Red Lake Mining District.

Beyond the Red Lake Mining District, Trillium Gold has interests in highly prospective properties in Larder Lake, Ontario, and the Matagami and Chibougamou areas of Quebec.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Trillium Gold Mines Inc. (TSXV:TGM), a gold mining company focused on acquisition, exploration, and development at the Red Lake Mining District of Northern Ontario, has been busy in 2021.

Trillium has assembled the largest prospective land package in and around the Red Lake mining district in Northern Ontario. Red Lake has many major mines and deposits, and the greenstone belts of Confederation Lake and Birch-Uchi. The company is advancing drill programs at multiple properties including Willis, Newman Todd, a significant portion of the Confederation Lake Greenstone Belt, and properties in Larder Lake, Ontario, and Matagami and Chibougamou areas of Quebec.

New Results Continue to Pour In

The company announced on September 8 that the majority of assays from drilling at the Newman Todd Complex had been received, with assay reporting over two months. The company was able to process and summarize samples representing 6,708 metres across 15 drill holes at the property.

The Rivard and Newman Todd properties were explored in isolation and not systematically drilled for an integrated structural understanding.

Highlights

| Newman Todd | ||

| NT21-185: | 17.6m @ 1.35 g/t Au | |

| 13.2m @ 1.24 g/t Au incl. 0.5m @ 20.5 g/t Au | ||

| NT21-187: | 6.97m @ 7.5 g/t Au incl. 1m @ 45.9 g/t Au | |

| 4.75m @ 4.95 g/t Au incl. 0.65m @ 33.88 g/t Au and 0.35m @ 54.7 g/t Au | ||

| 6.2m @ 5.4 g/t Au incl. 0.3m @ 61.9 g/t Au | ||

| NT21-188: | 52.3m @ 1.07 g/t Au incl. 0.7m @ 11.5 g/t Au | |

| NT21-190: | 3.3m @ 8.06 g/t Au incl. 0.4m @ 61.9 g/t Au | |

| NT21-192: | 21.3m @ 3.55 g/t Au incl. 4.3m @ 13.8 g/t Au (includes 1m @ 35.15 g/t Au) | |

| Rivard | ||

| RV21-31: 0.3m @ 28.0 g/t Au | ||

| RV21-32: 0.3m @ 15.9 g/t Au | ||

| RV21-33: 0.7m @ 54.49 g/t Au incl. 0.4m @ 95.3 g/t Au | ||

| RV21-34: 2.2m @ 25.23 g/t Au incl. 0.3m @ 116 g/t Au and 0.3m @ 67.7 g/t Au | ||

Source: Trillium Gold Mines

Expanding the Property Portfolio

Trillium Gold (TSXV:TGM) also announced on October 26 that it had closed the acquisition of the of the Willis Property. Willis consists of thirteen patented mineral claim totalling 229 hectares. The company now holds a 100% interest in the Willis property, which is subject to a 2% net smelter returns royalty, half of which Trillium Gold has retained the right to repurchase for $1.2 million. If the holders of the royalty decide to sell the royalty in the future, Trillium also holds the right of first refusal.

MiningFeeds will begin covering news and insights from Trillium Gold (TSXV:TGM) as it continues to advance its drill programs in some of the best gold mining districts in the world, in one of the best mining jurisdictions in the world, Canada.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Trillium Gold (TSXV:TGM) (OTCQX:TGLDF) (FRA:0702) announced today that it signed an agreement to acquire the thirteen contiguous patented mineral claims at the “Willis Property”. The Willis Property combines the thirteen claims for a total of 229 hectares, which are situated southwest of and contiguous to Trillium Gold’s Newman Todd (NT) Property in Todd Township. The properties are both found in the Red Lake Mining District in Ontario.

This is a big step for Trillium as it has acquired a 100% interest in the Willis Property upon the completion of the transaction. Russell Star, CEO of Trillium Gold commented: “The Willis Property represents an important addition to Trillium’s property package in the western Red Lake area. It covers both the southwest extension of the NT Zone as well as other ground proven to be highly prospective for gold with visible gold noted in outcrop sampling. As with the NT Property, the Willis Property displays many similarities to the major gold mines to the east: namely rock types, structures, mineralization, and alteration. Despite these attributes, the property has seen very little exploration since the 1930s and is one of the few remaining unexplored properties in the Red Lake greenstone belt.”

Newman Todd

While the new acquisition is sure to expand the company’s exploration plans, the Newman Todd (NT) Property is the company’s flagship asset and has been the focus of the company’s efforts thus far. Previous exploration at the site suggested over 20 individual high-grade zones along the current strike length of the northeast-trending Newman Todd Structure (NTS). This could be traced for 2.2km+ along strike, with a network of gold-rich veins.

The property was only drilled sparsely before Trillium Gold took over, and was only drilled and tested at depths below 400 metres. With mineralization open along strike and depth, and possibly also in the postulated parallel features, the project has some of the biggest potential for the company’s portfolio.

The history of the property goes way back, with early exploration beginning in the 1930s on the southwest extension of the property, and then again in the 1940s. Due to the mining practices at the time, there is very little drill data from those periods. There are some reports about trenching, drilling, and bulk sampling, but the property has largely been a blank slate for Trillium.

New Goals

With the new property acquisition, Trillium has its work cut out for it. With the properties sharing similar potential and the company extending the NT Zone with this purchase, Willis Property could be the land needed to make the company’s work in the western Red Lake area profitable. The total property package for Willis was acquired for $420,000, and 400,000 common shares of the company. The property is also subject to a 2% net smelter returns (NSR) royalty.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Lincoln Minerals Limited Lincoln Minerals Limited |

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan