100% sustainable energy is the goal of environmentalists and lawmakers alike. However, a sticking point in achieving this goal is finding enough raw materials to create solar panels without damaging the environment. This is where Solaris Resources (TSX:SLS) (OTCQB:SLSSF) comes in. Solaris Resources is a copper mining company that specializes in finding and extracting copper, one of the key metals in the renewable energy transition, with minimal impact on the environment.

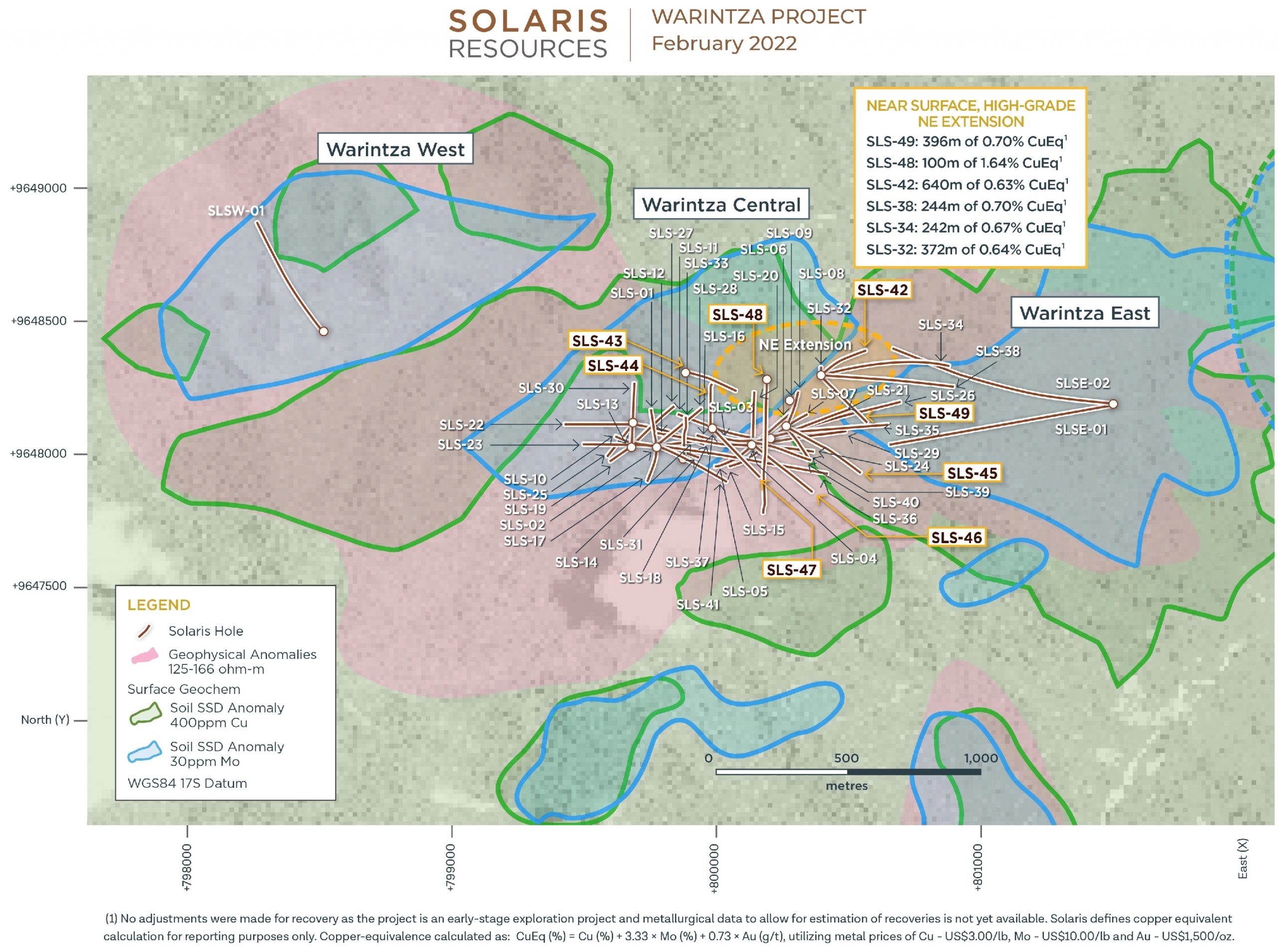

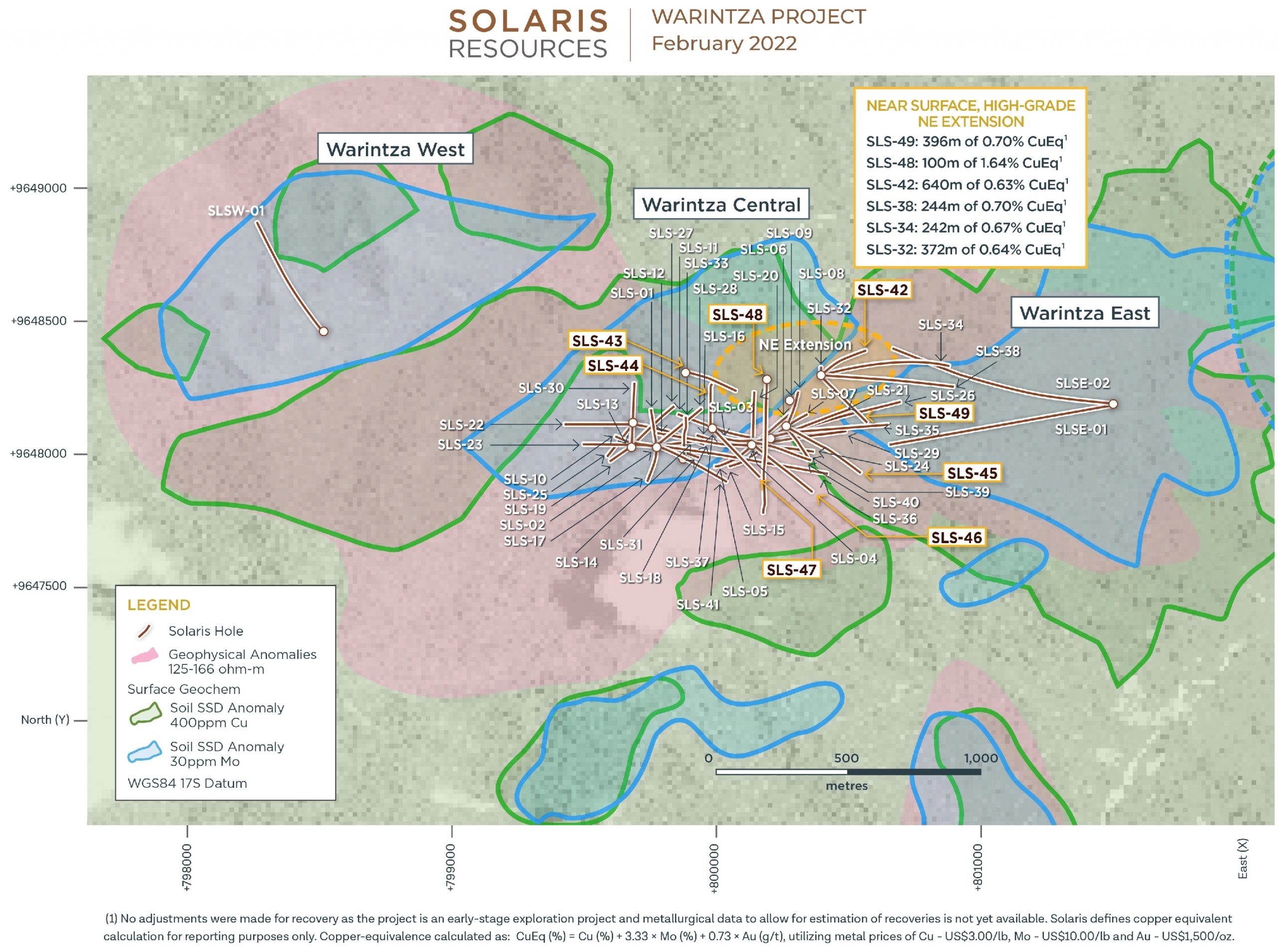

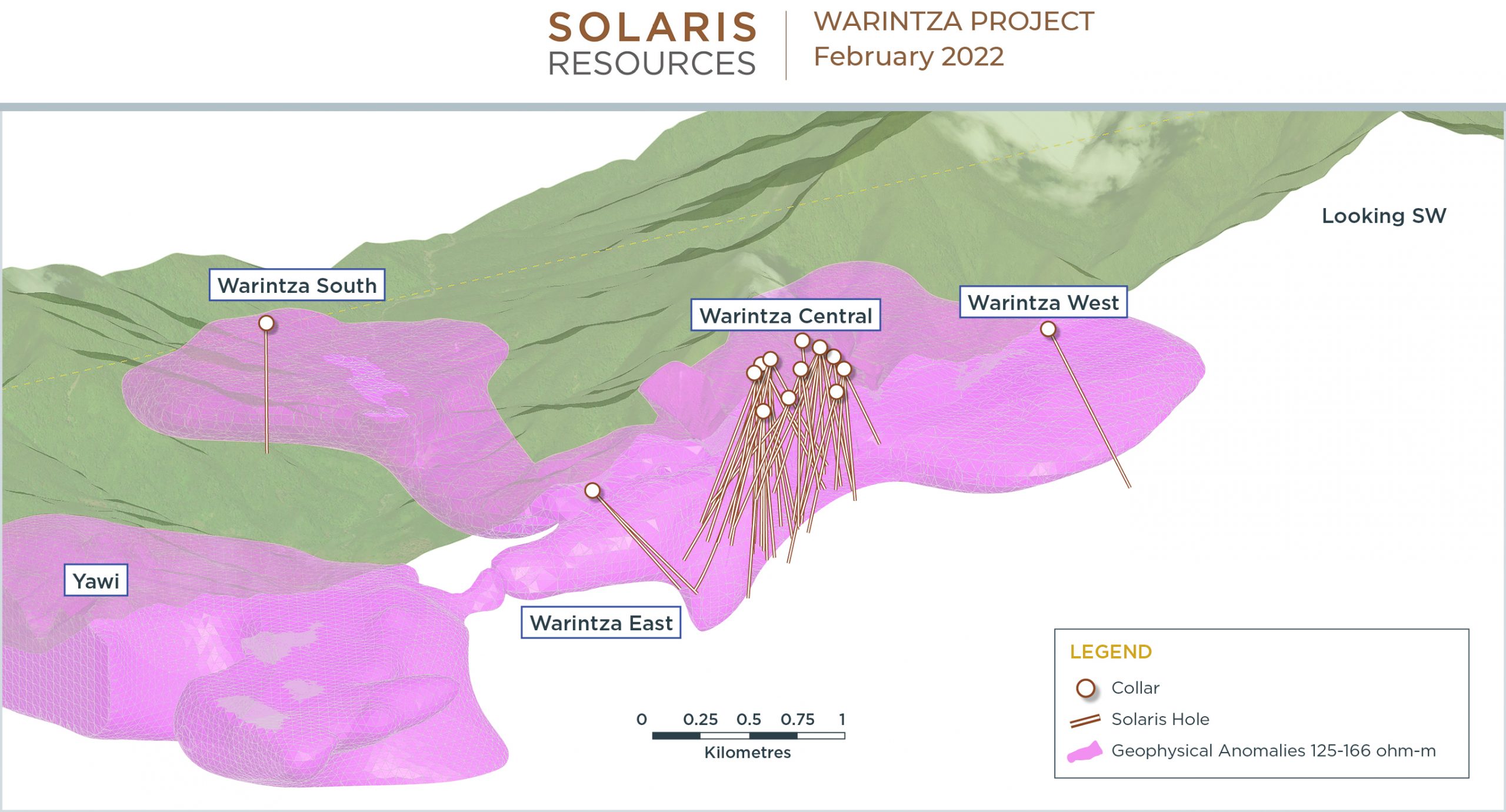

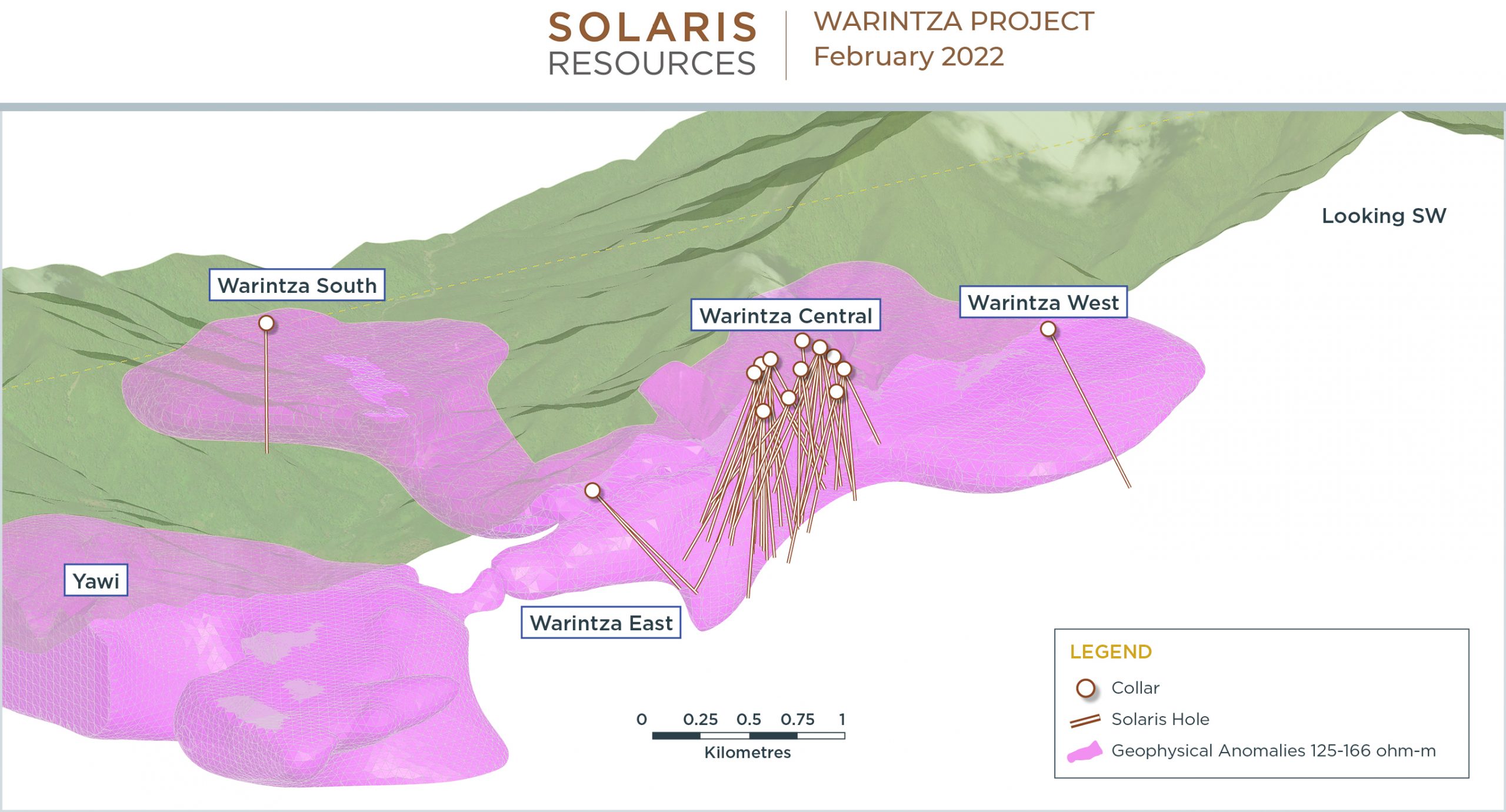

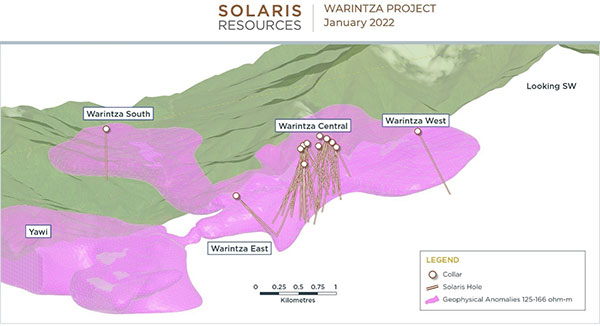

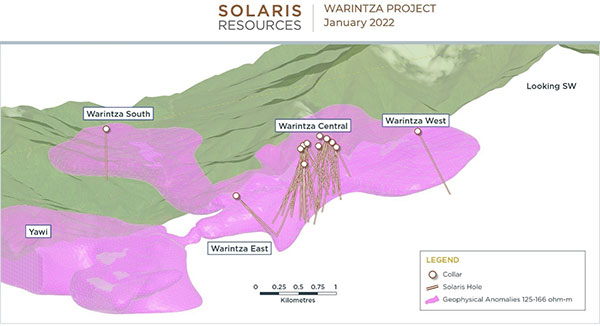

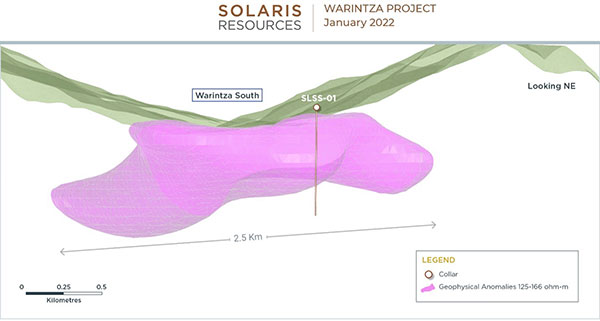

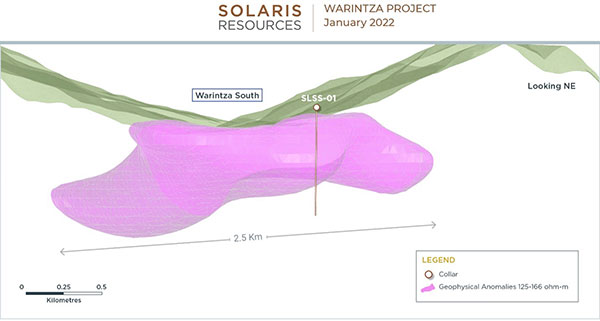

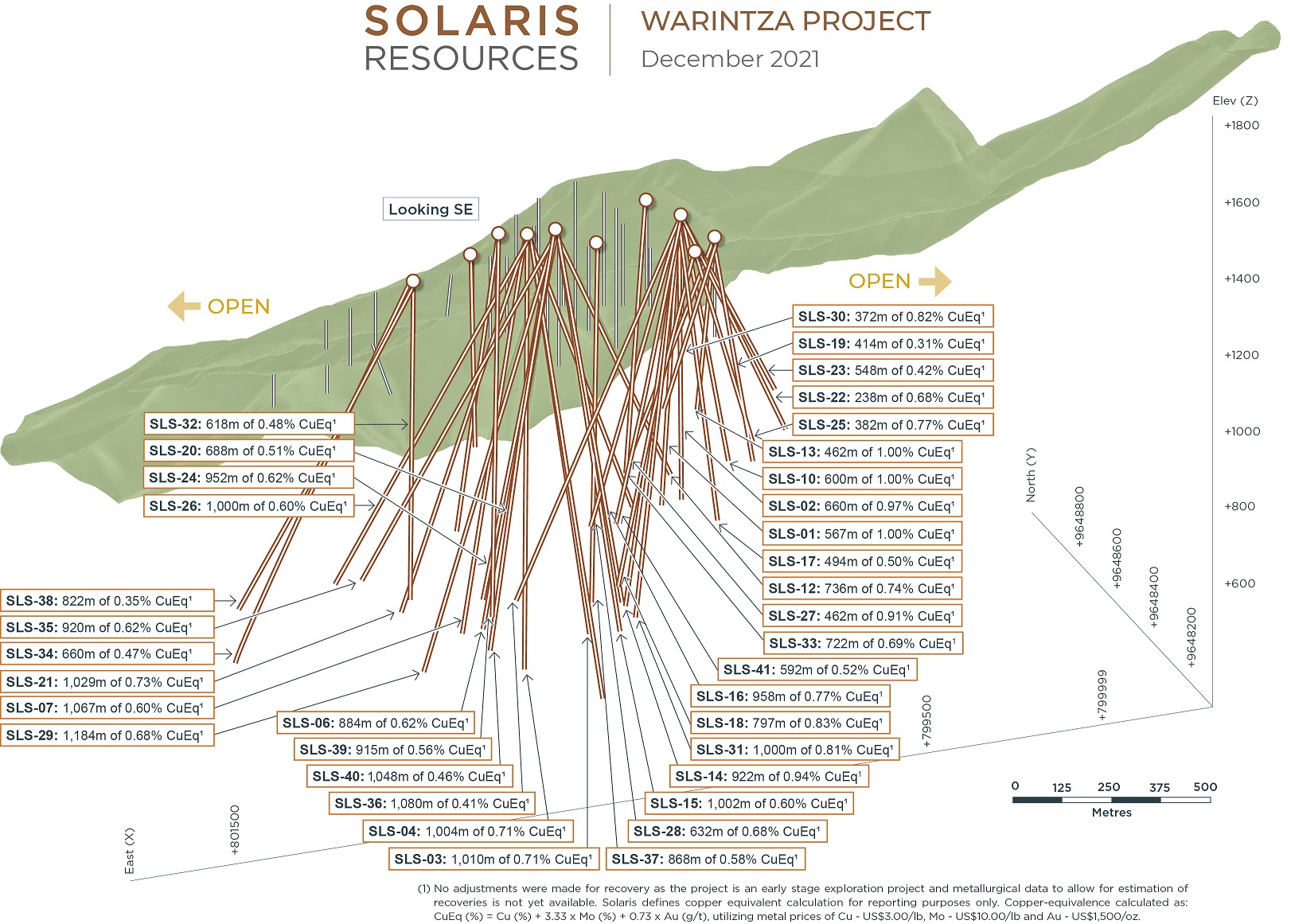

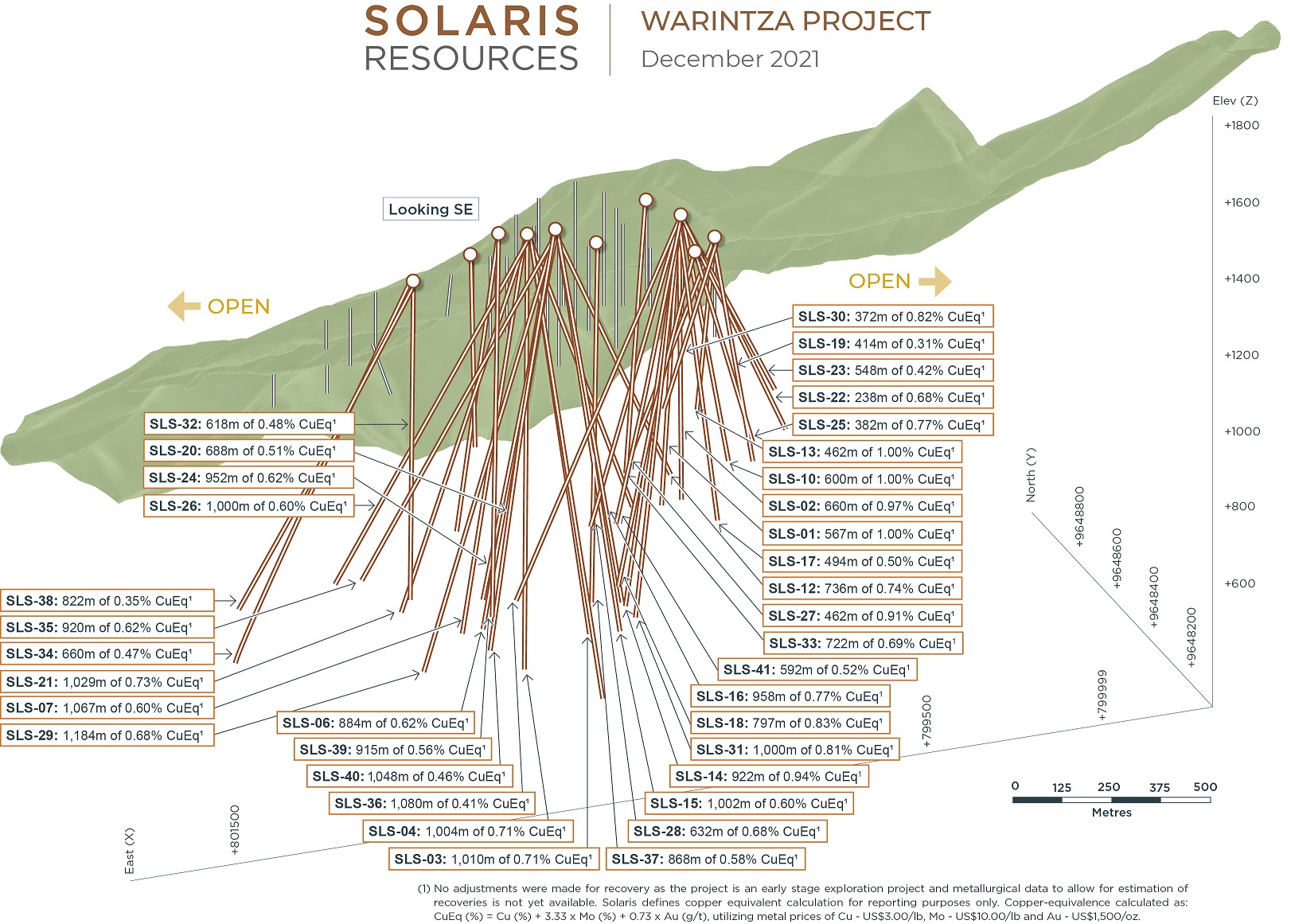

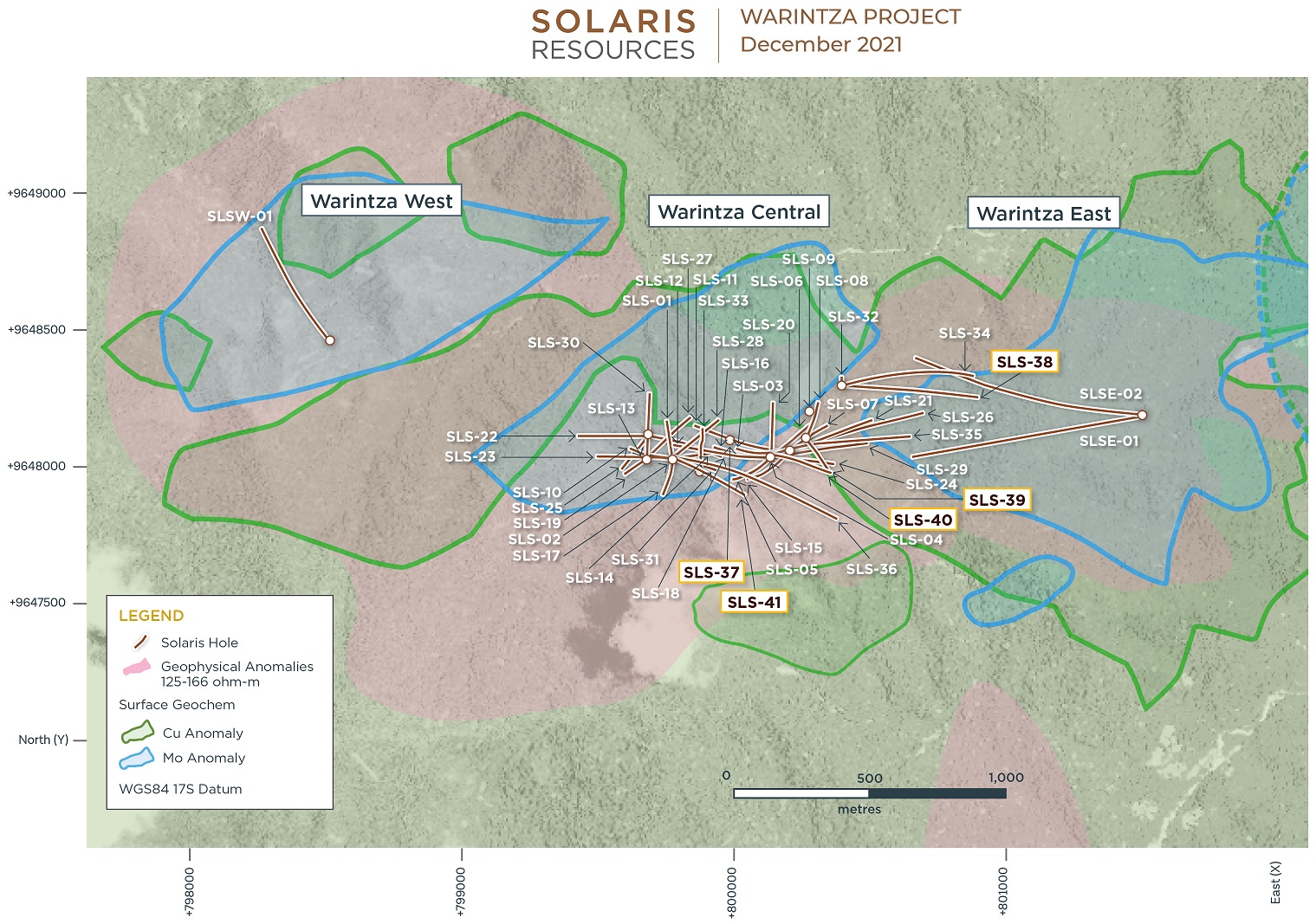

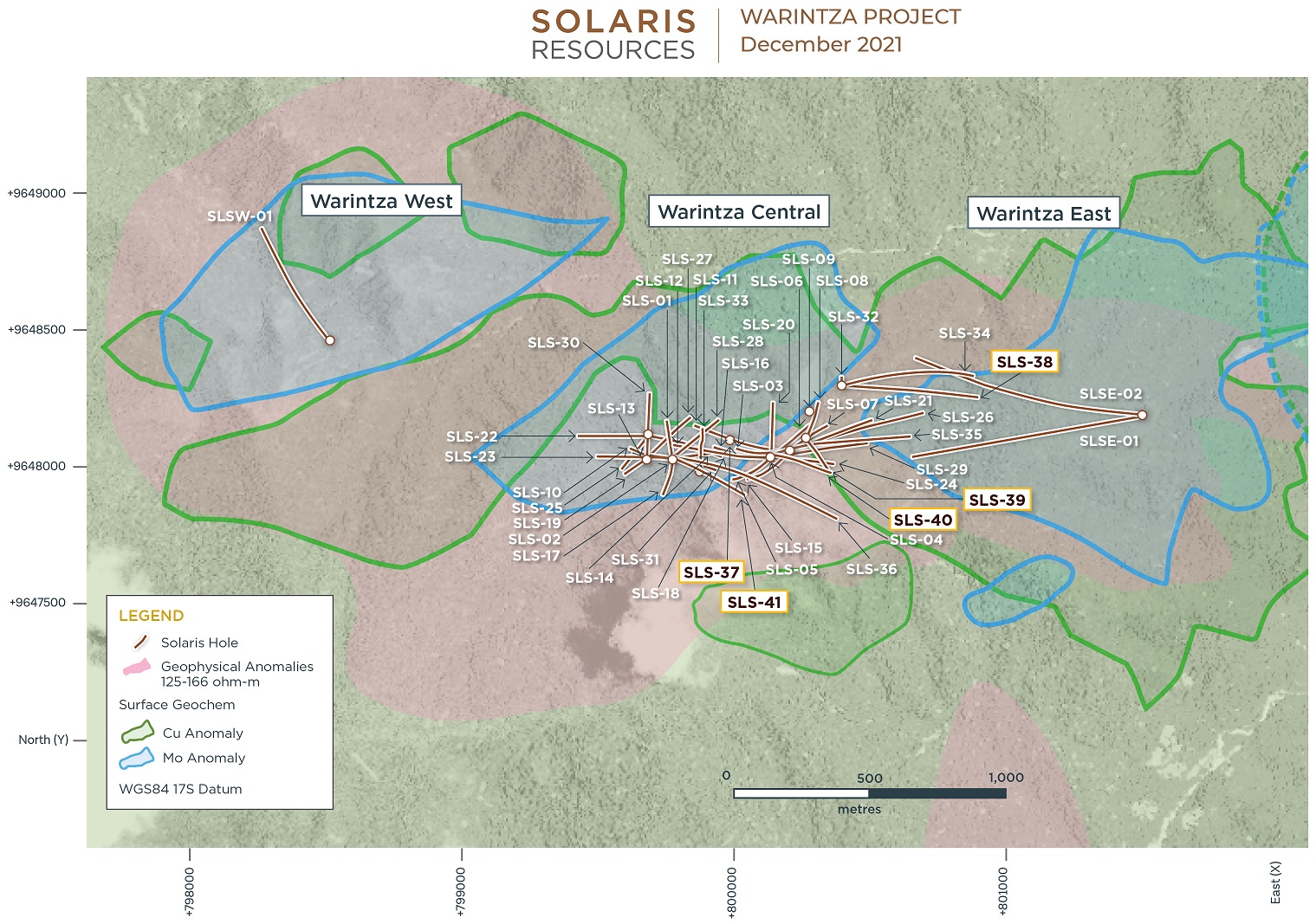

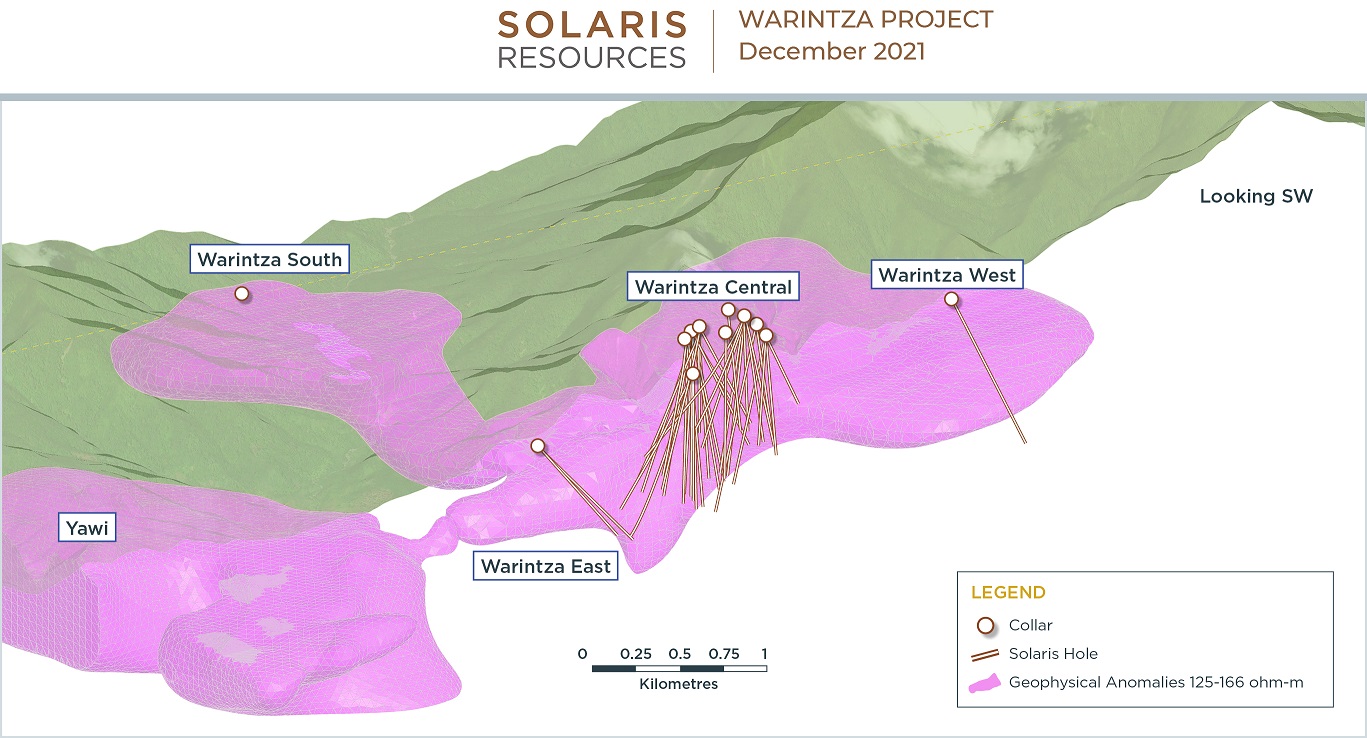

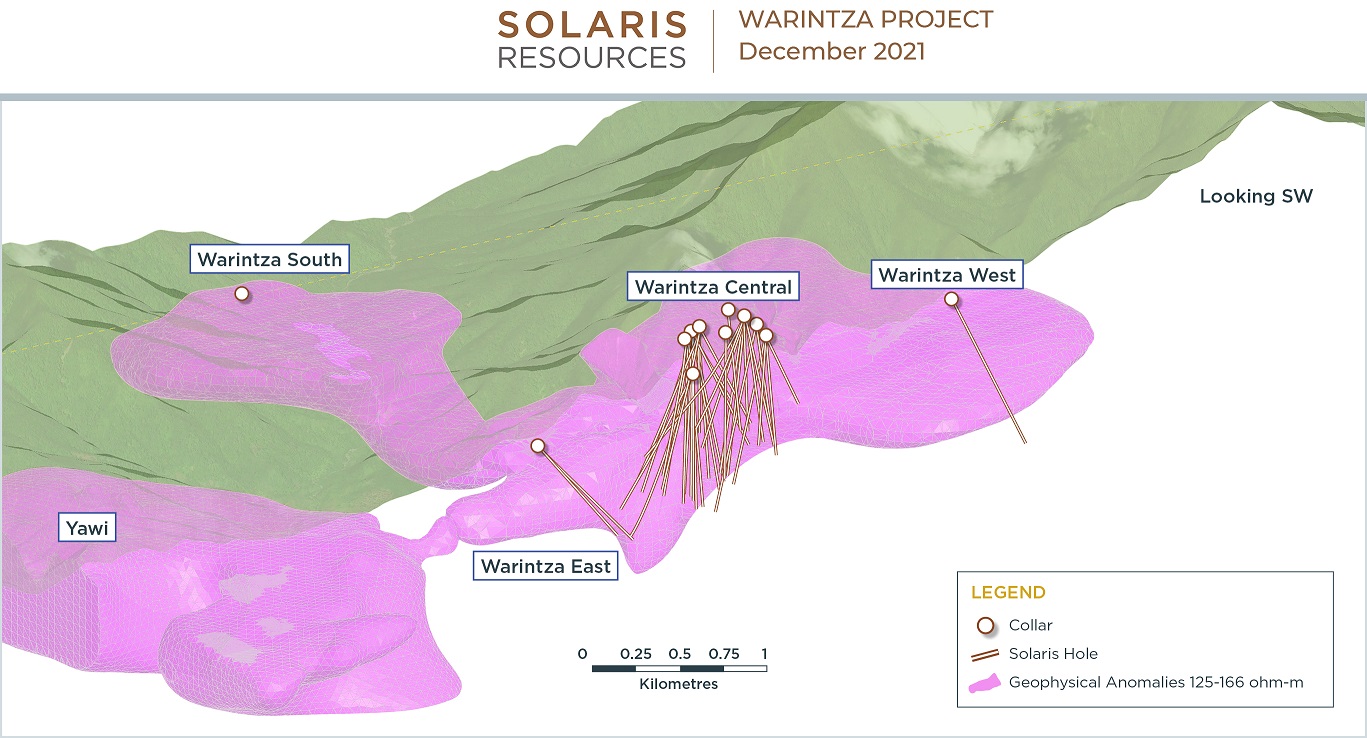

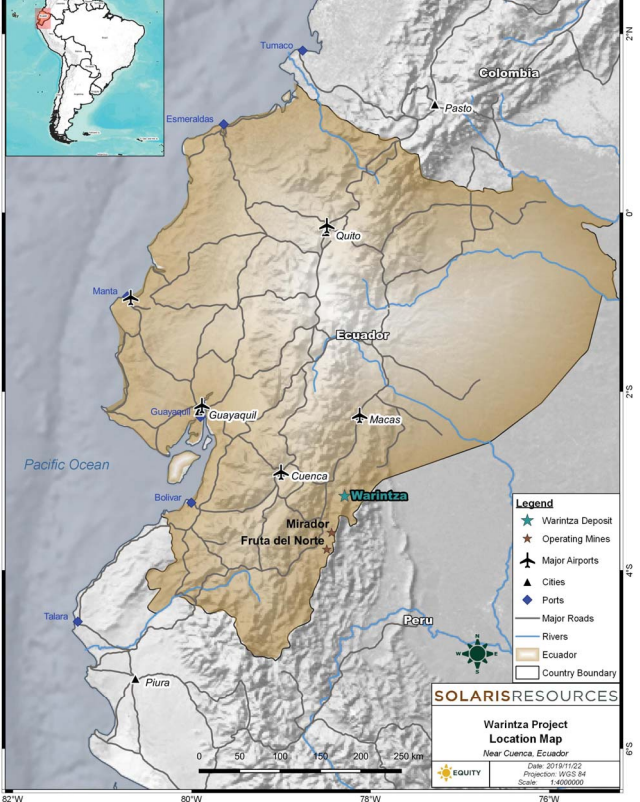

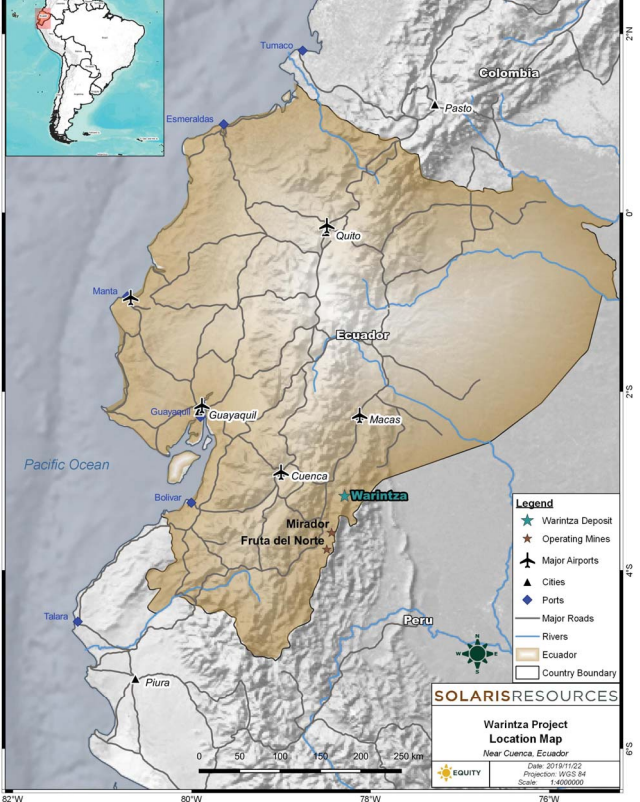

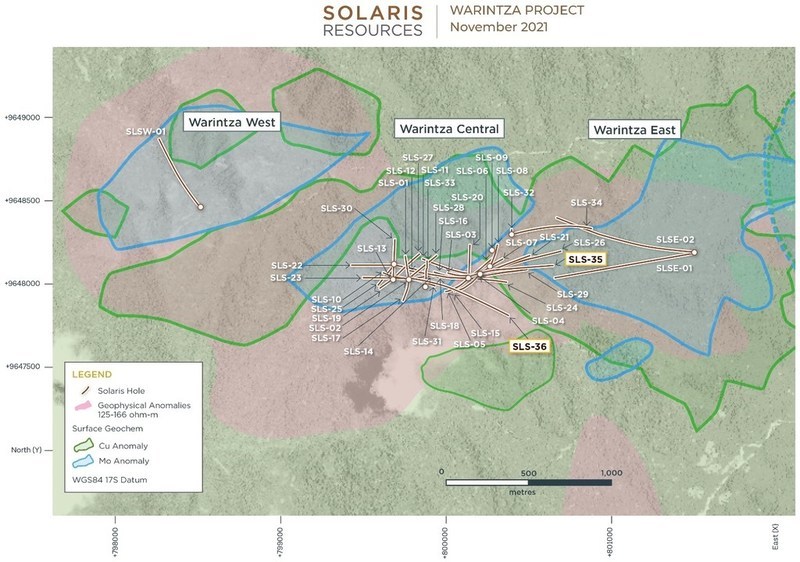

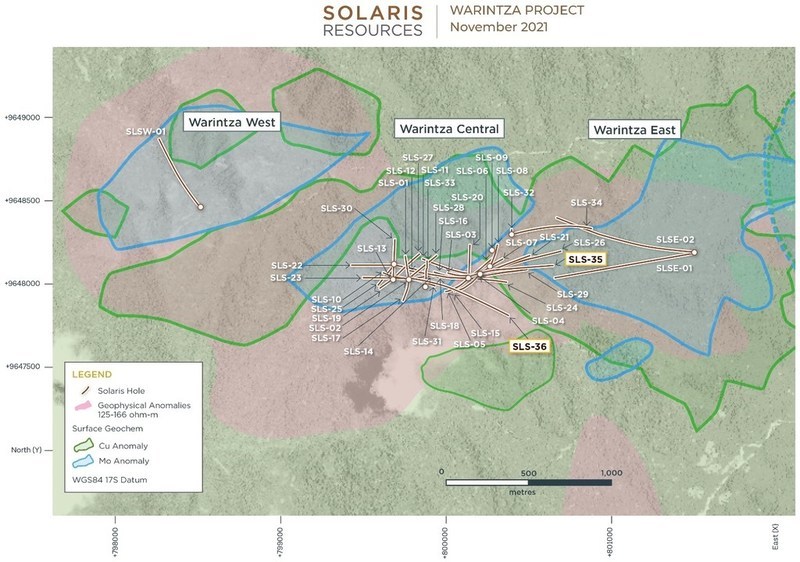

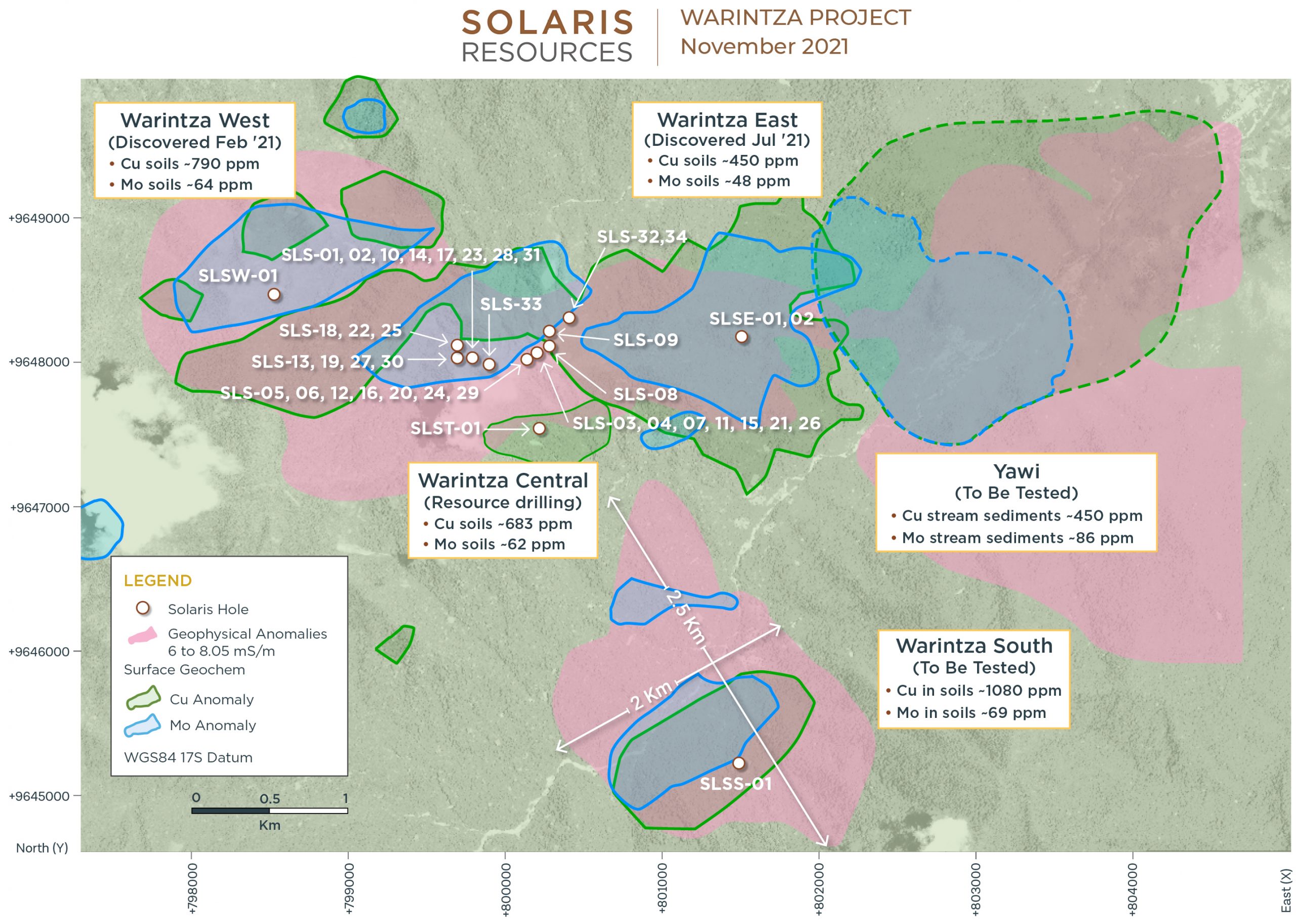

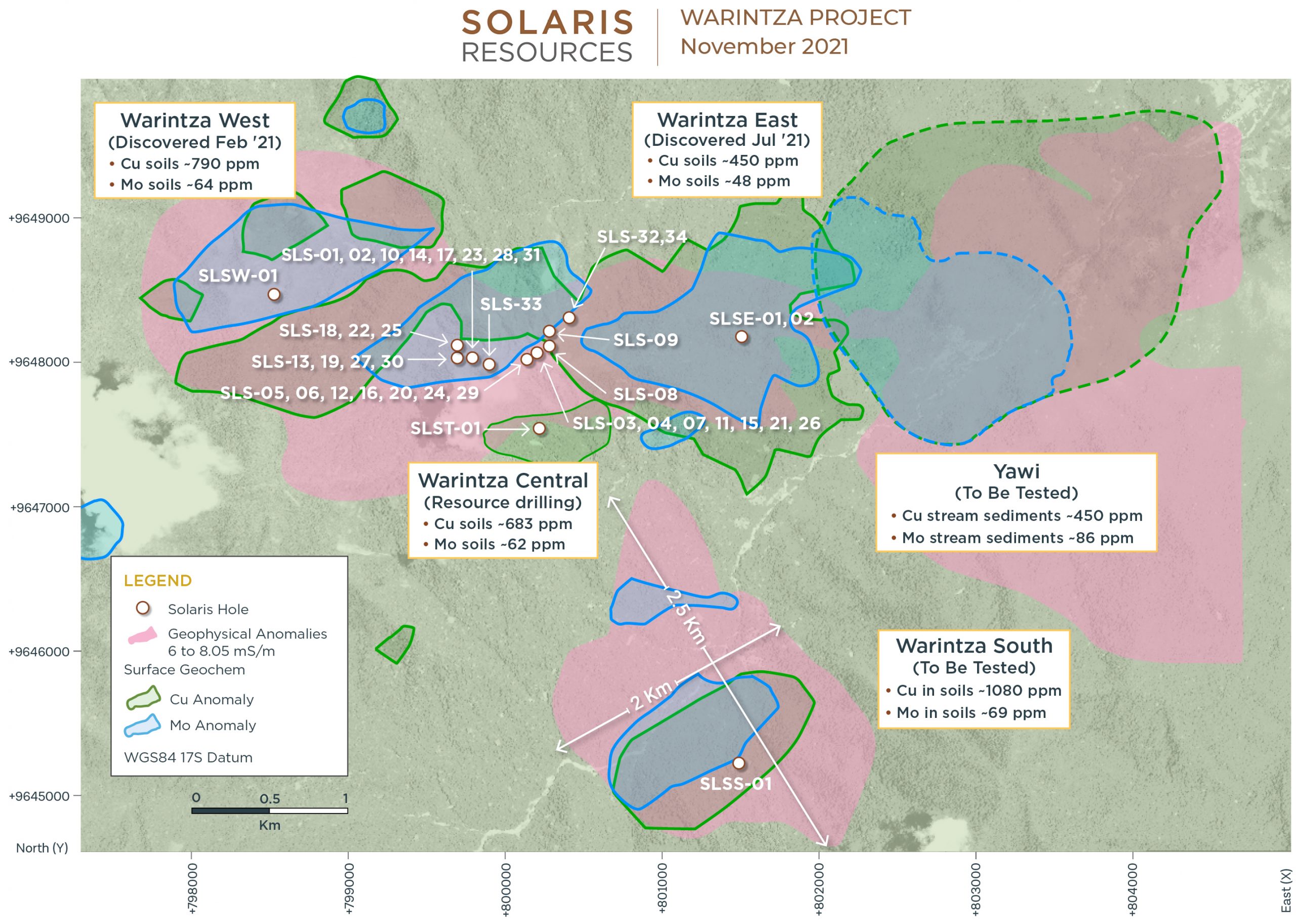

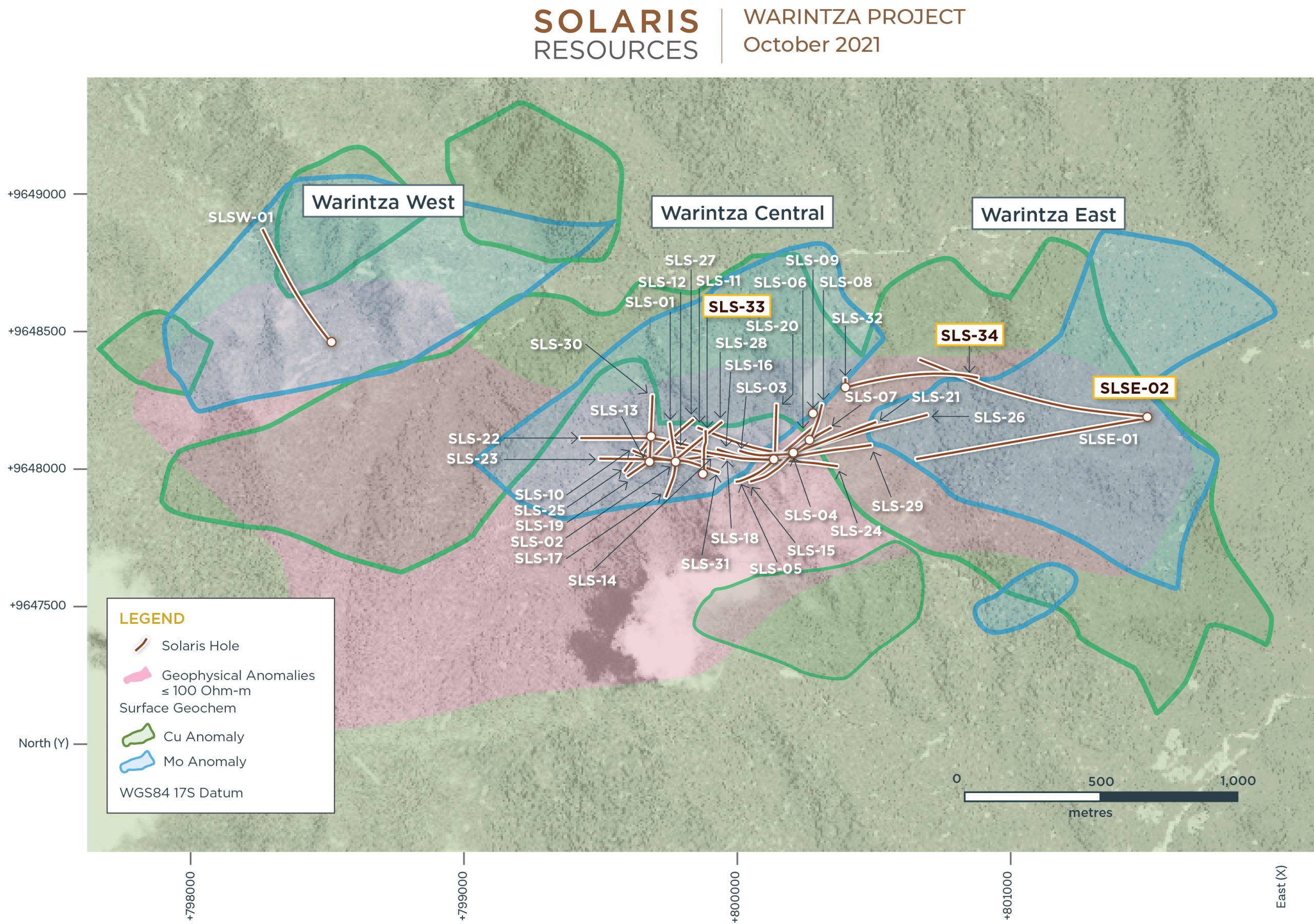

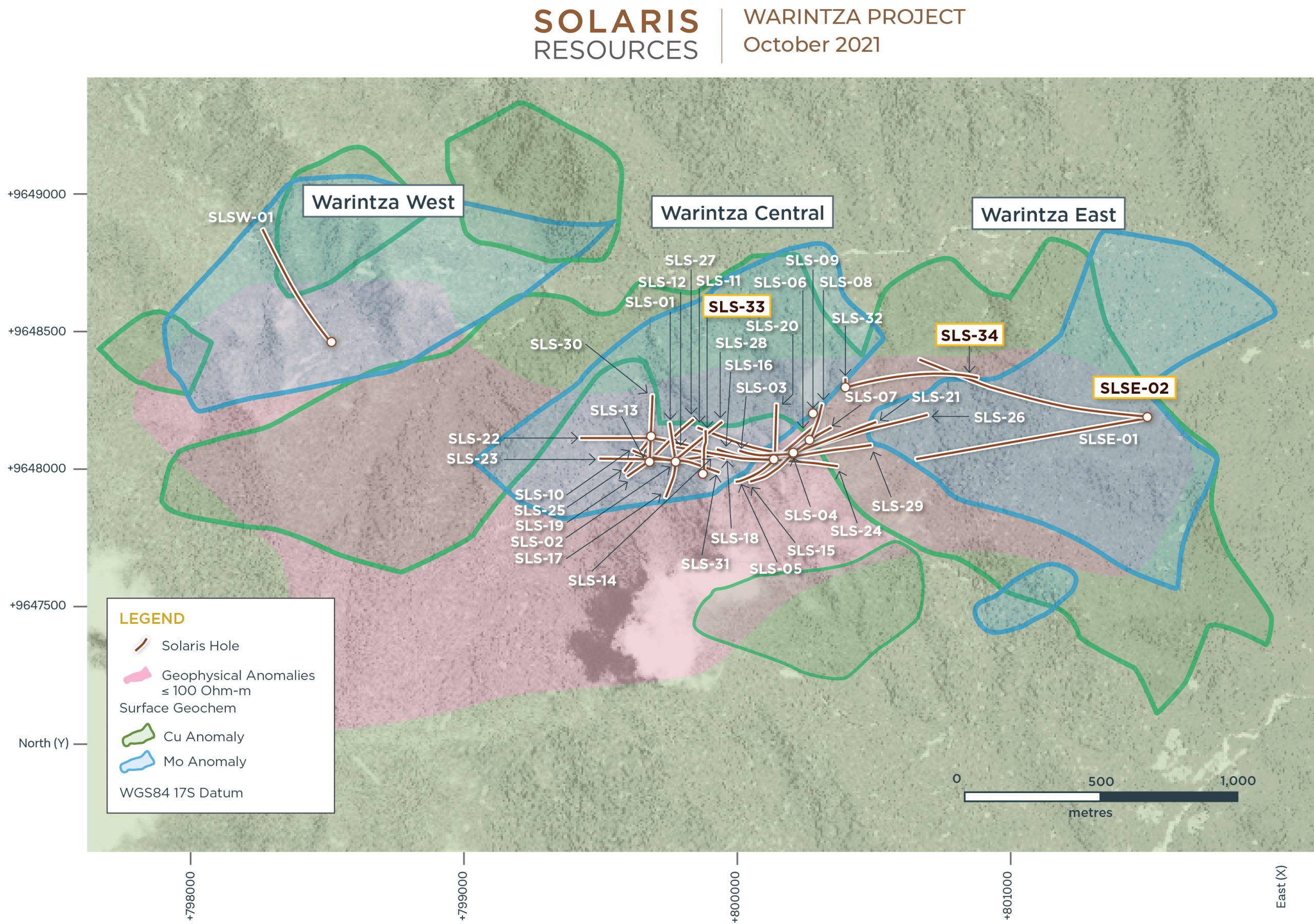

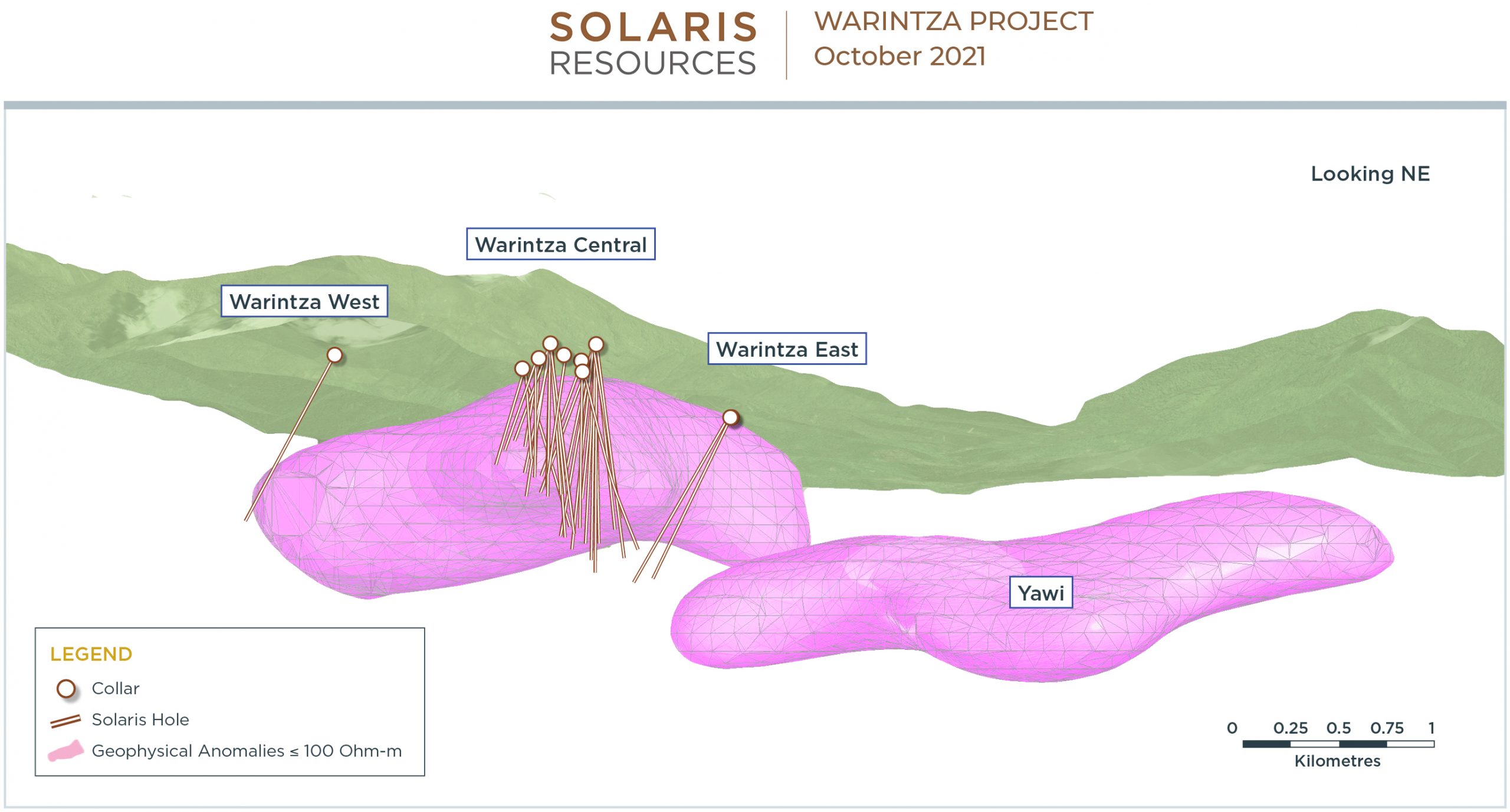

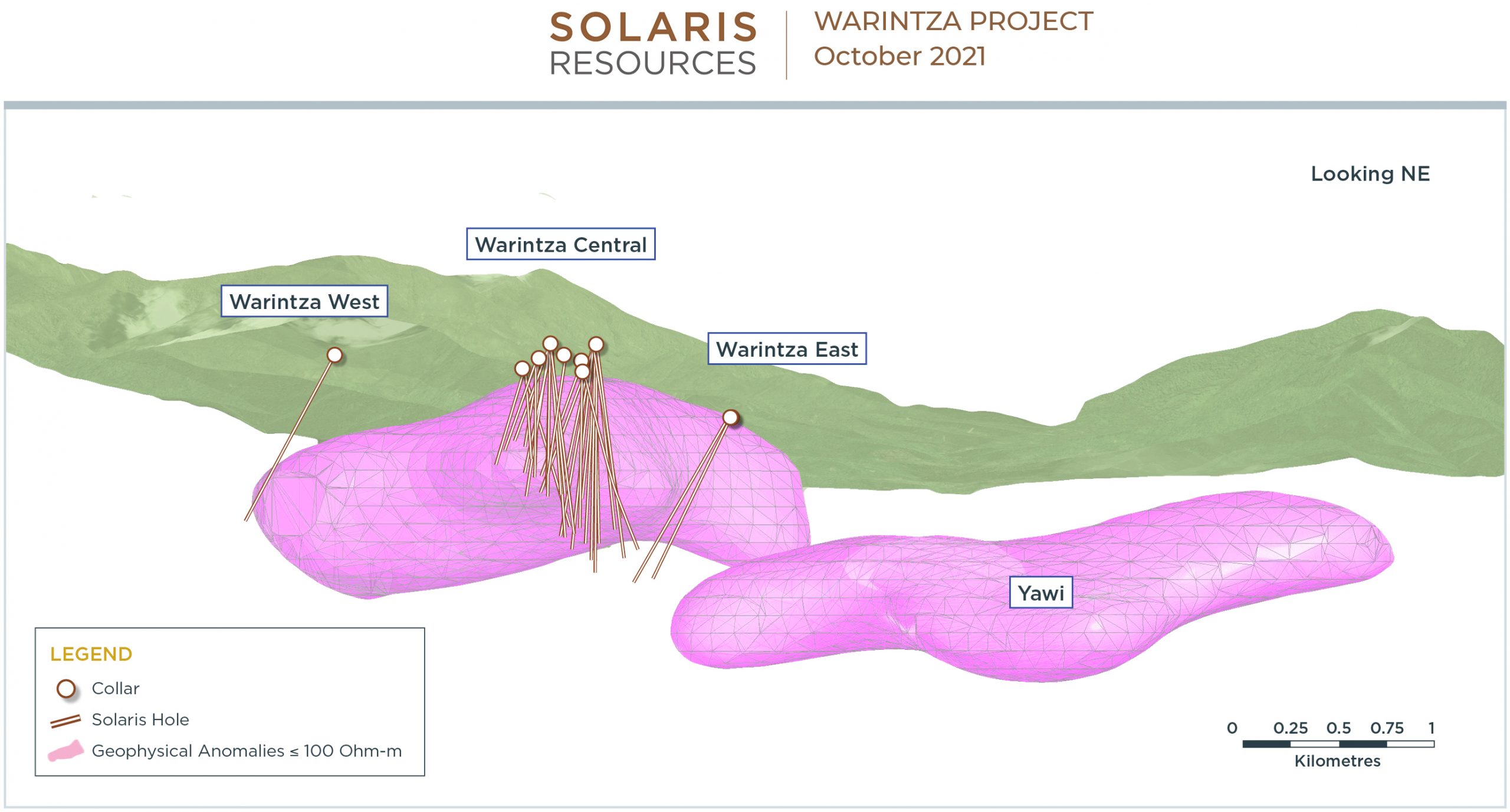

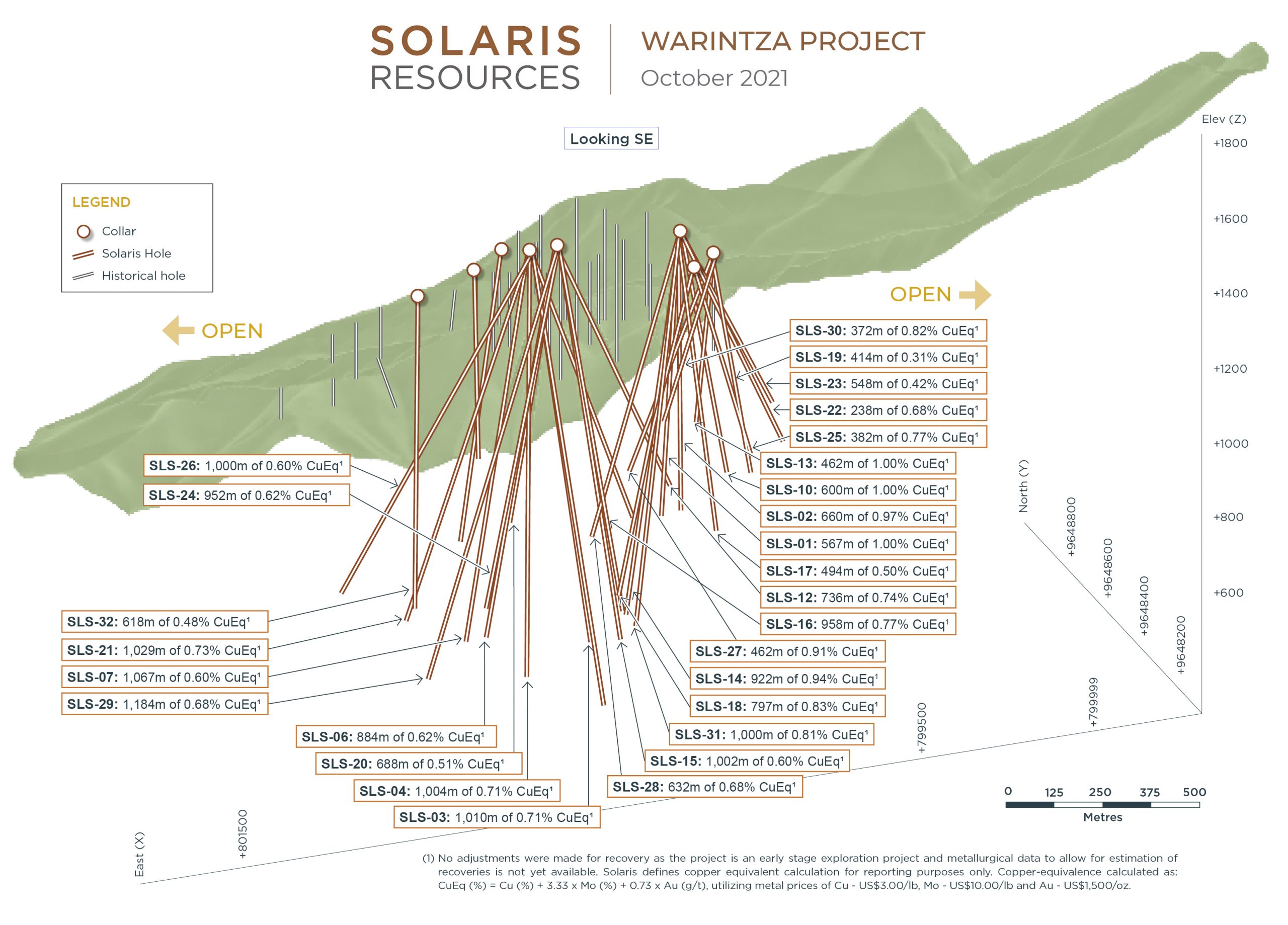

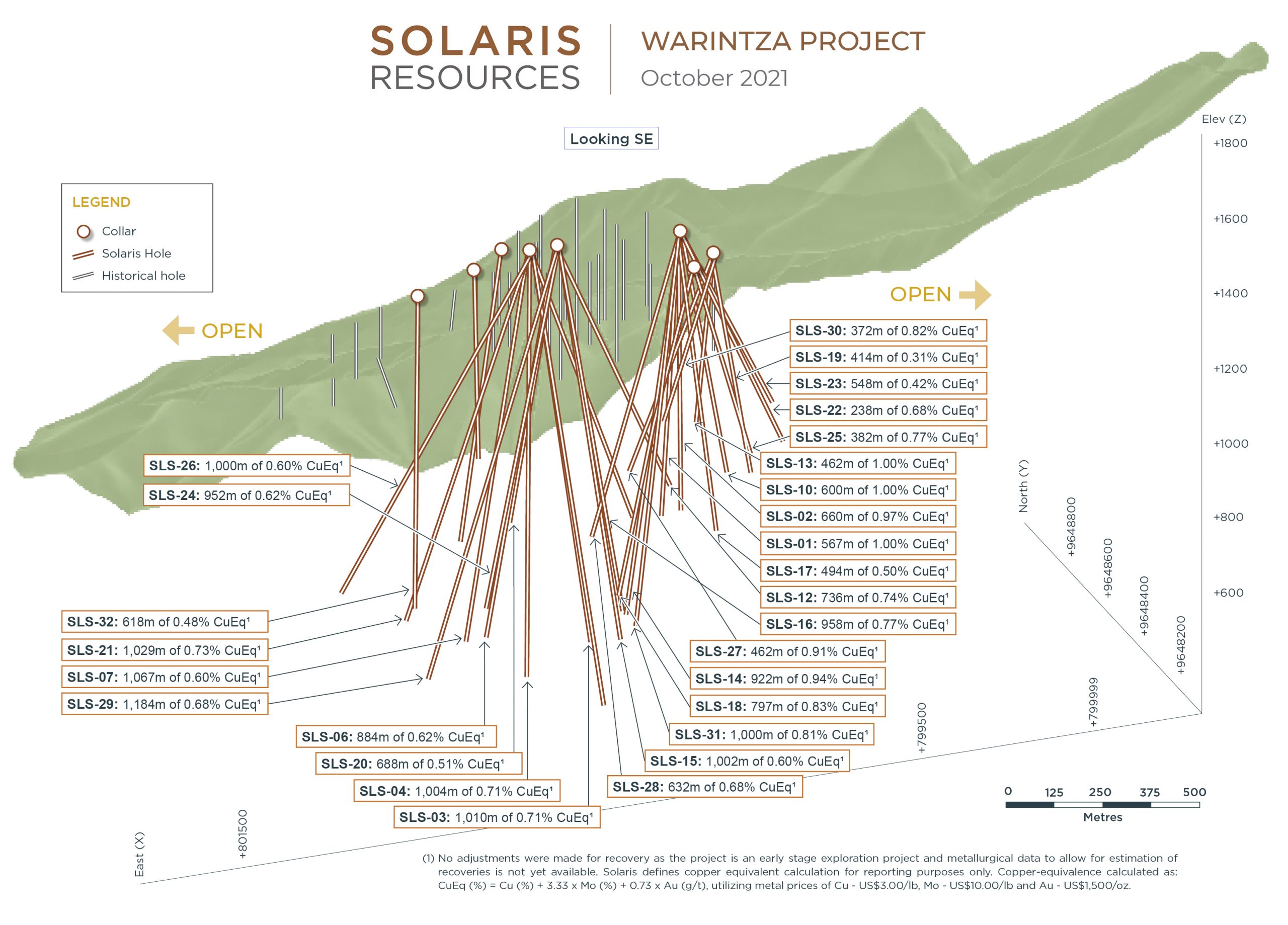

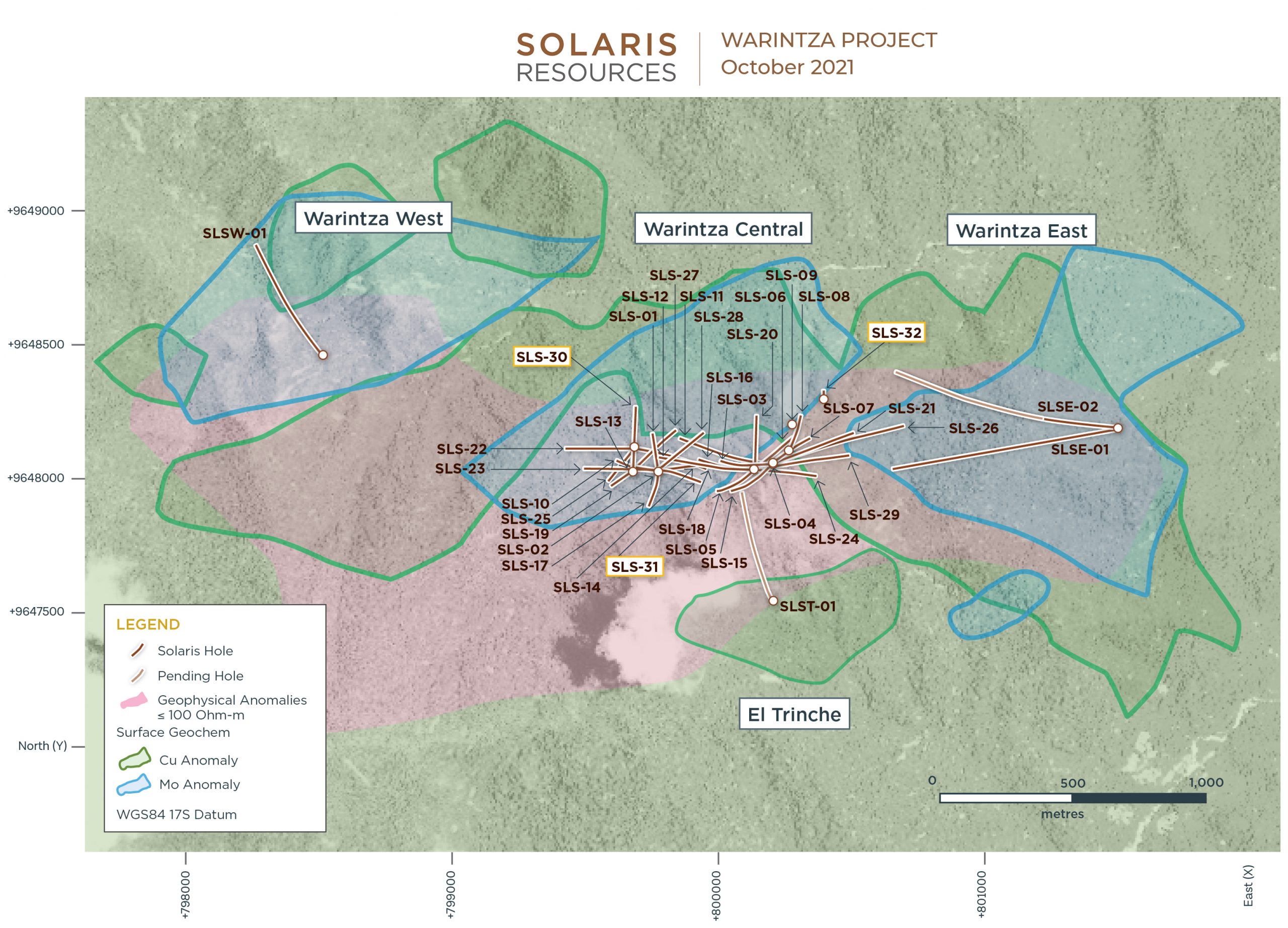

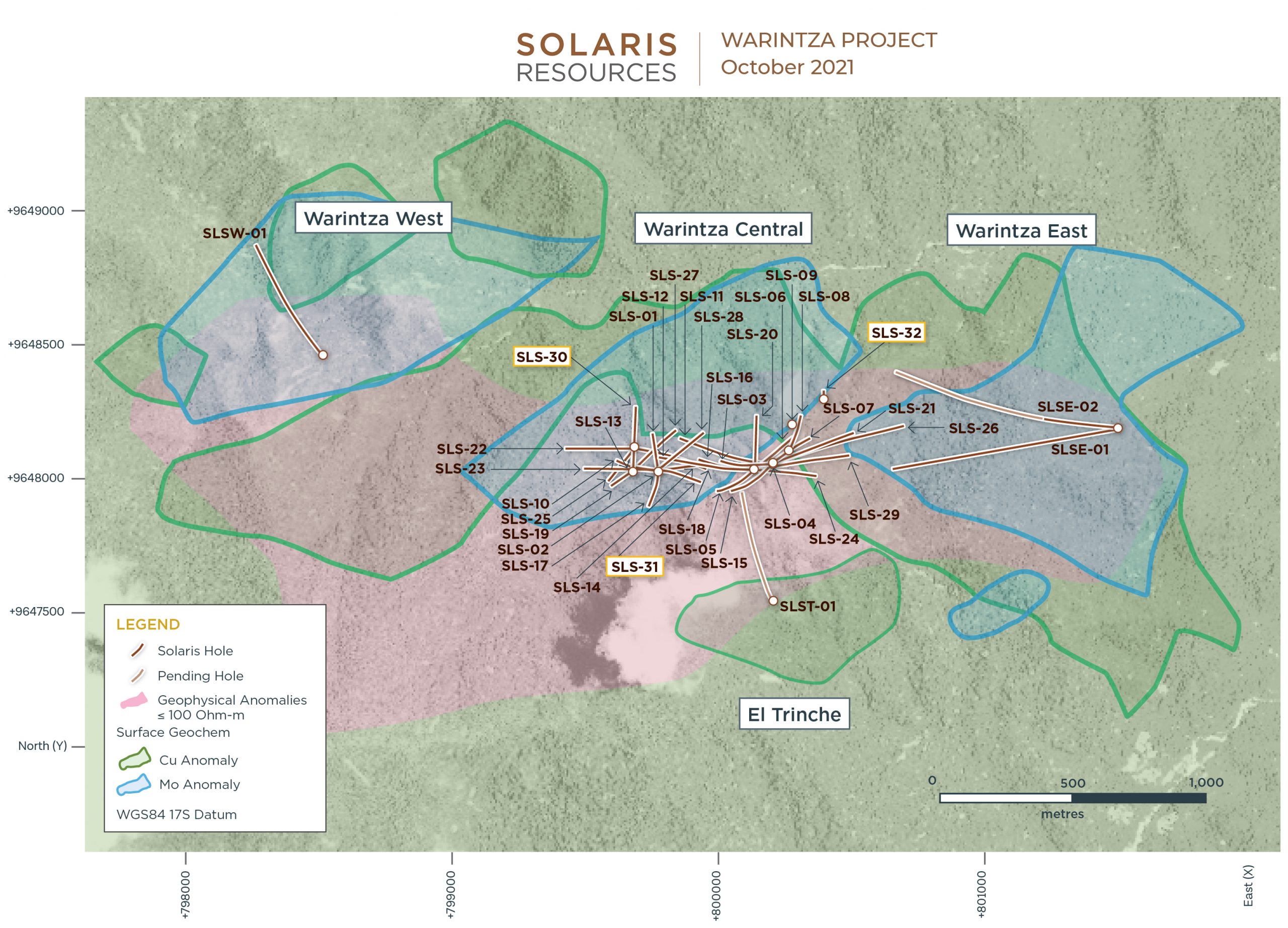

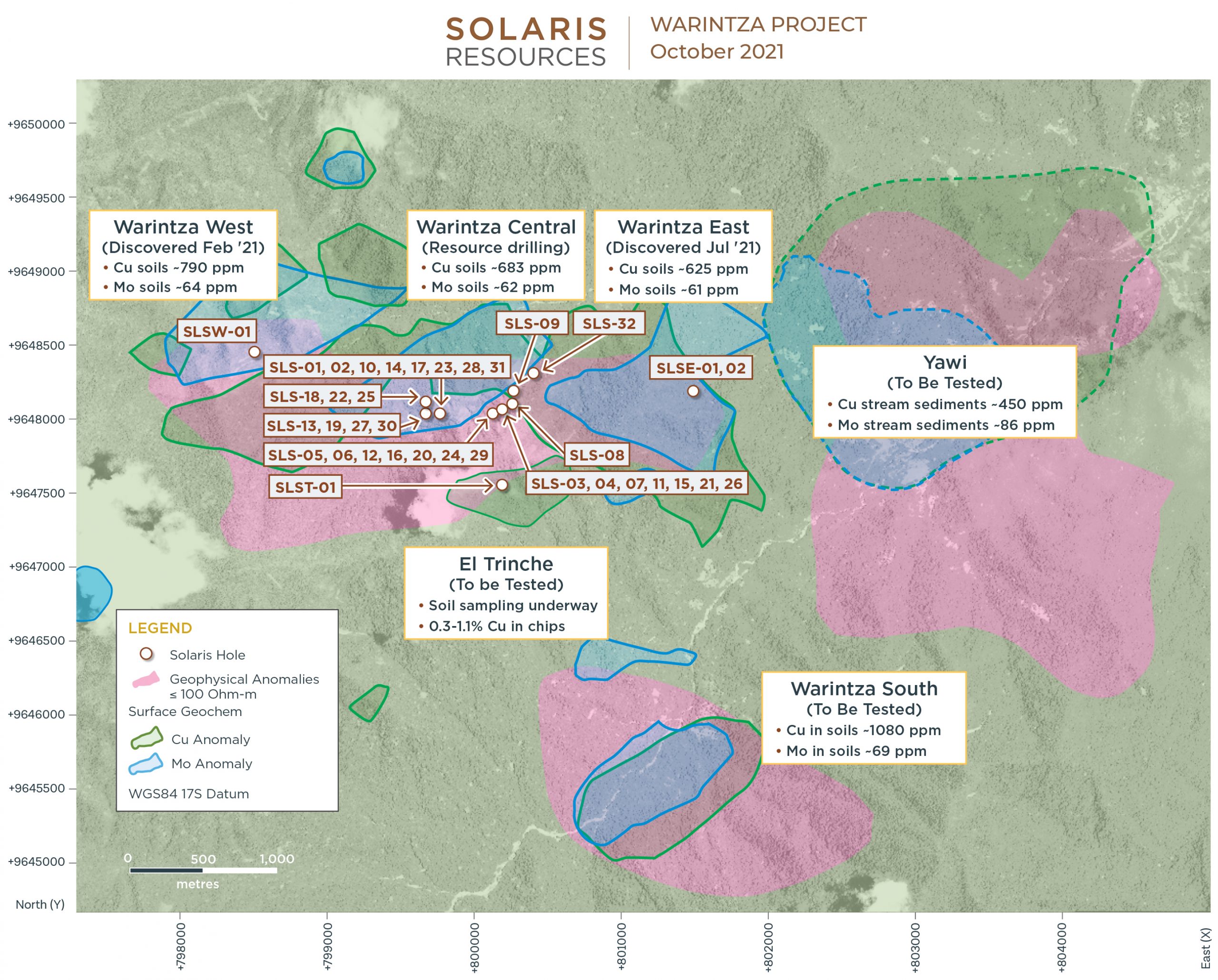

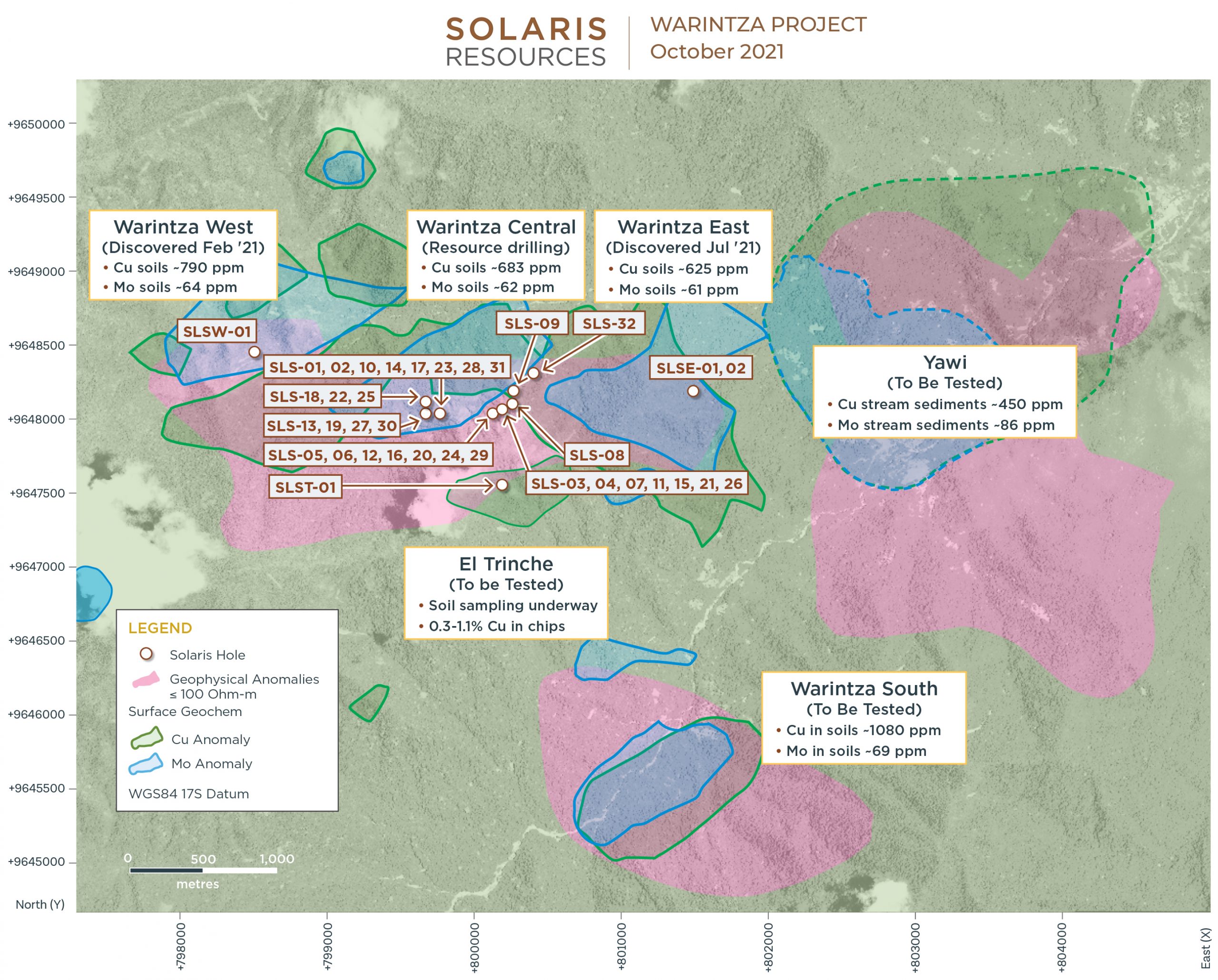

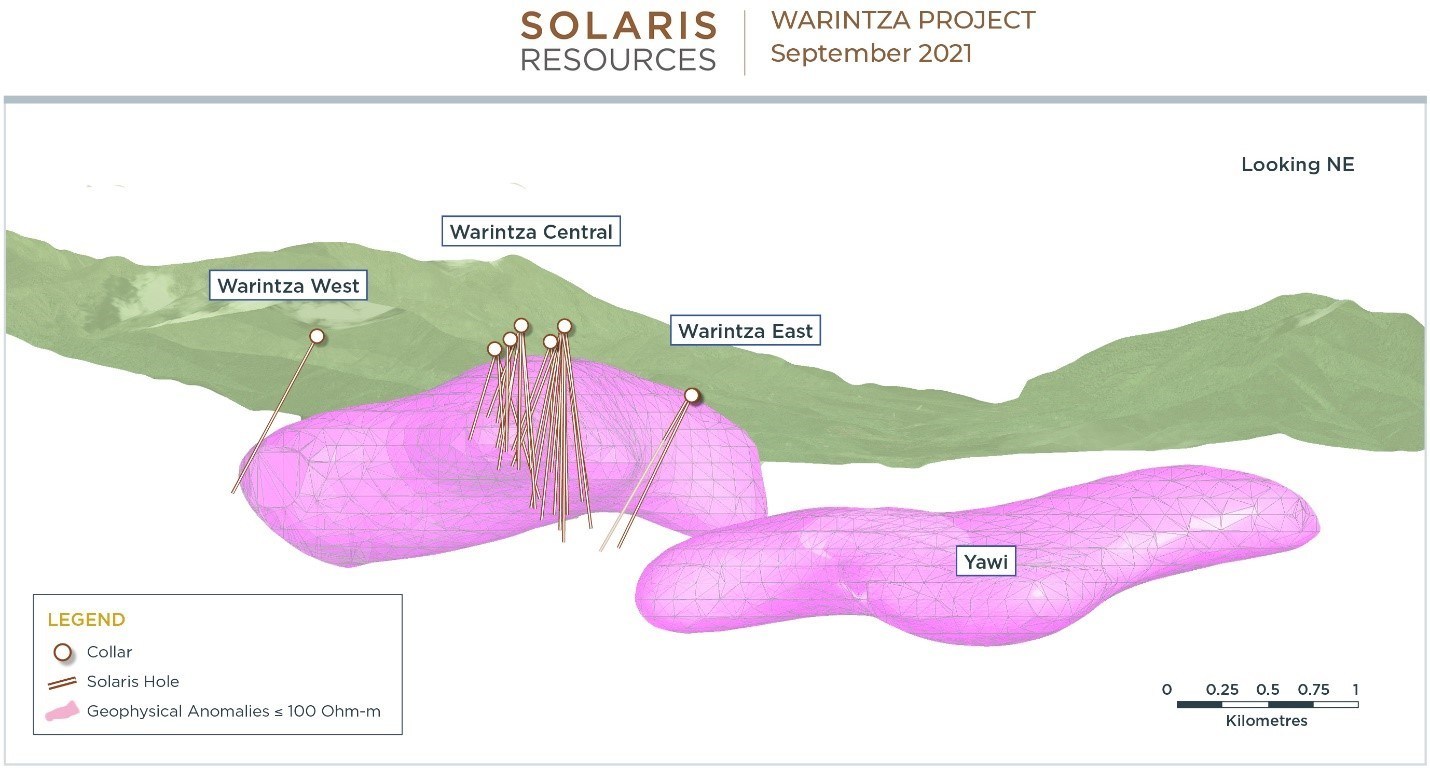

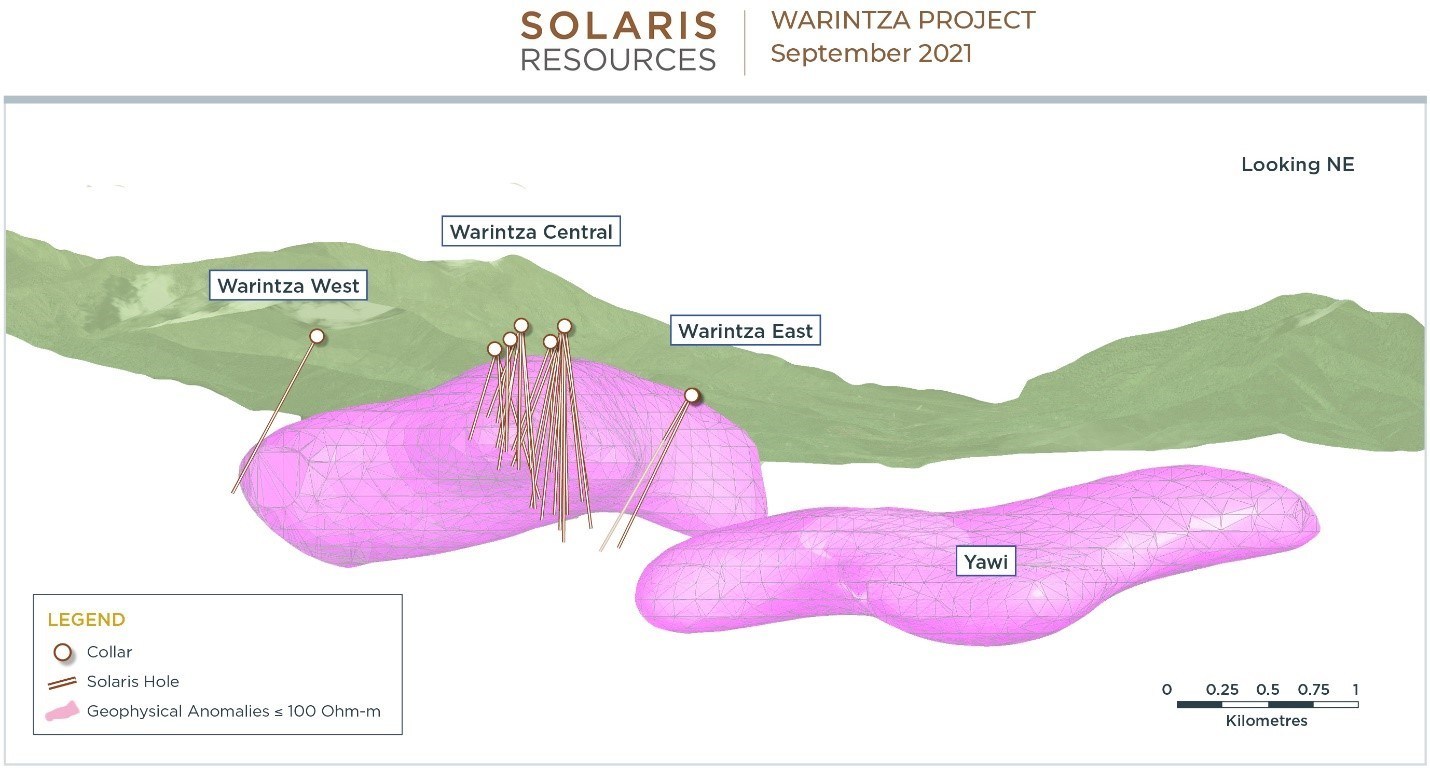

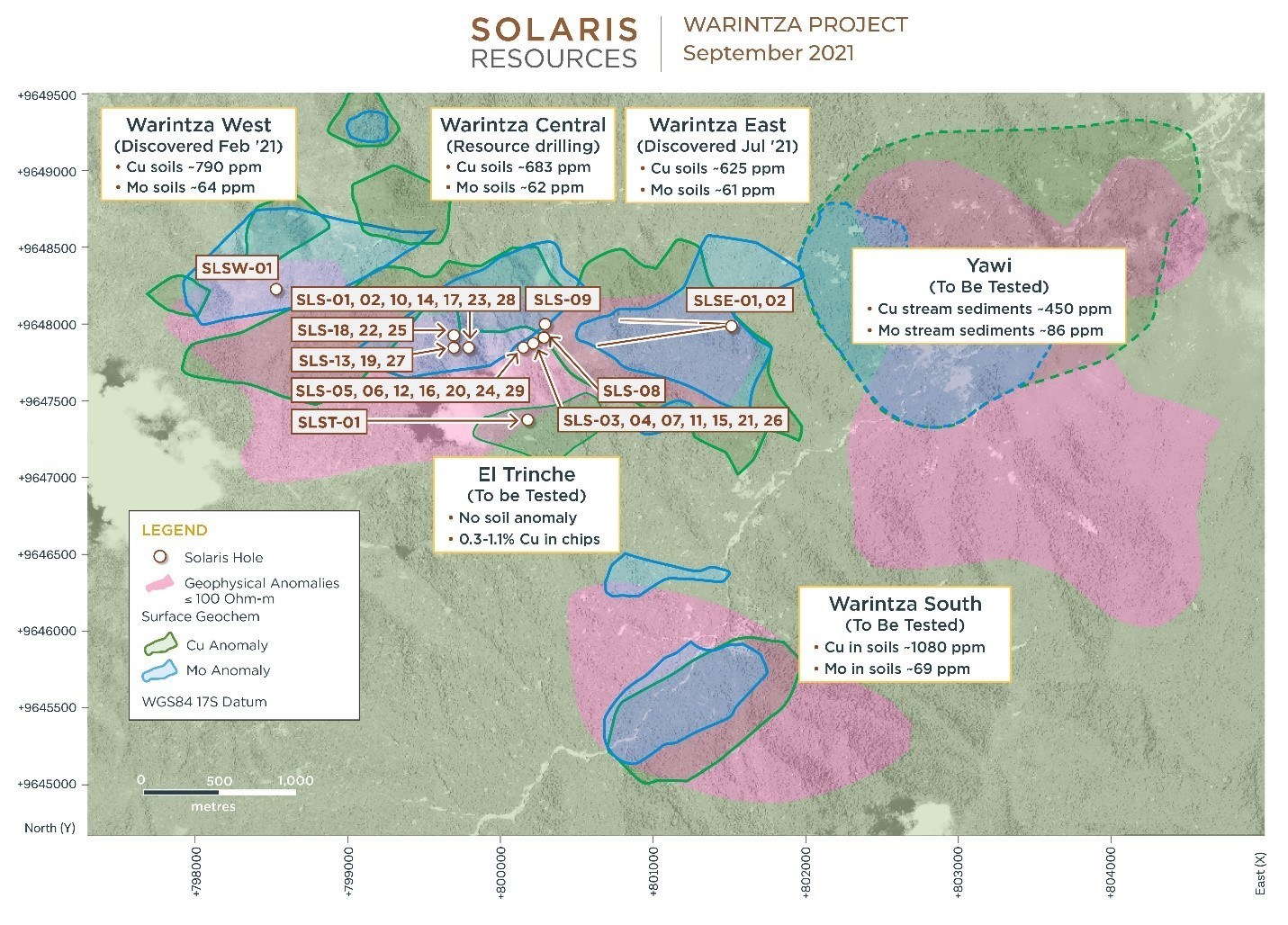

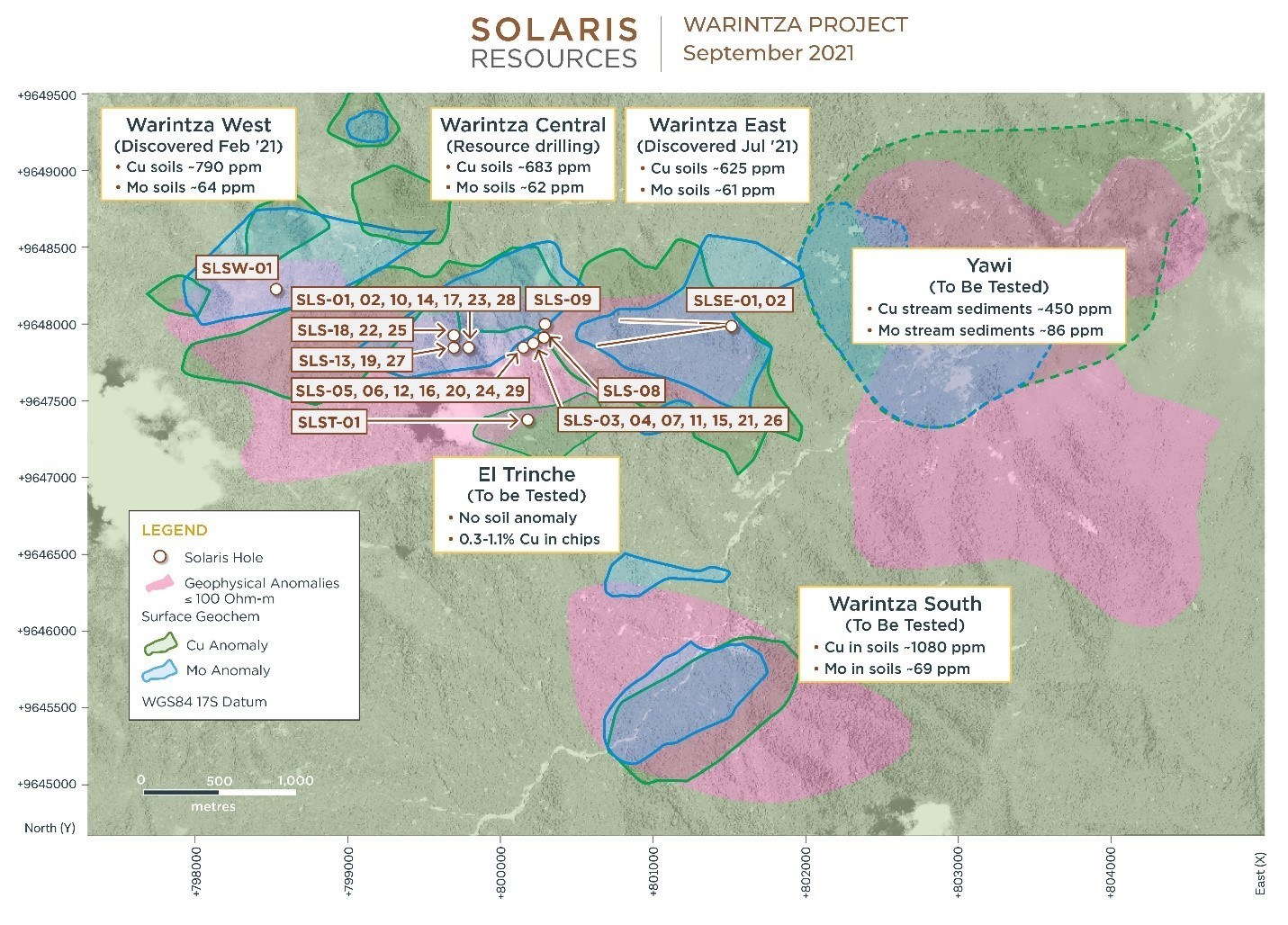

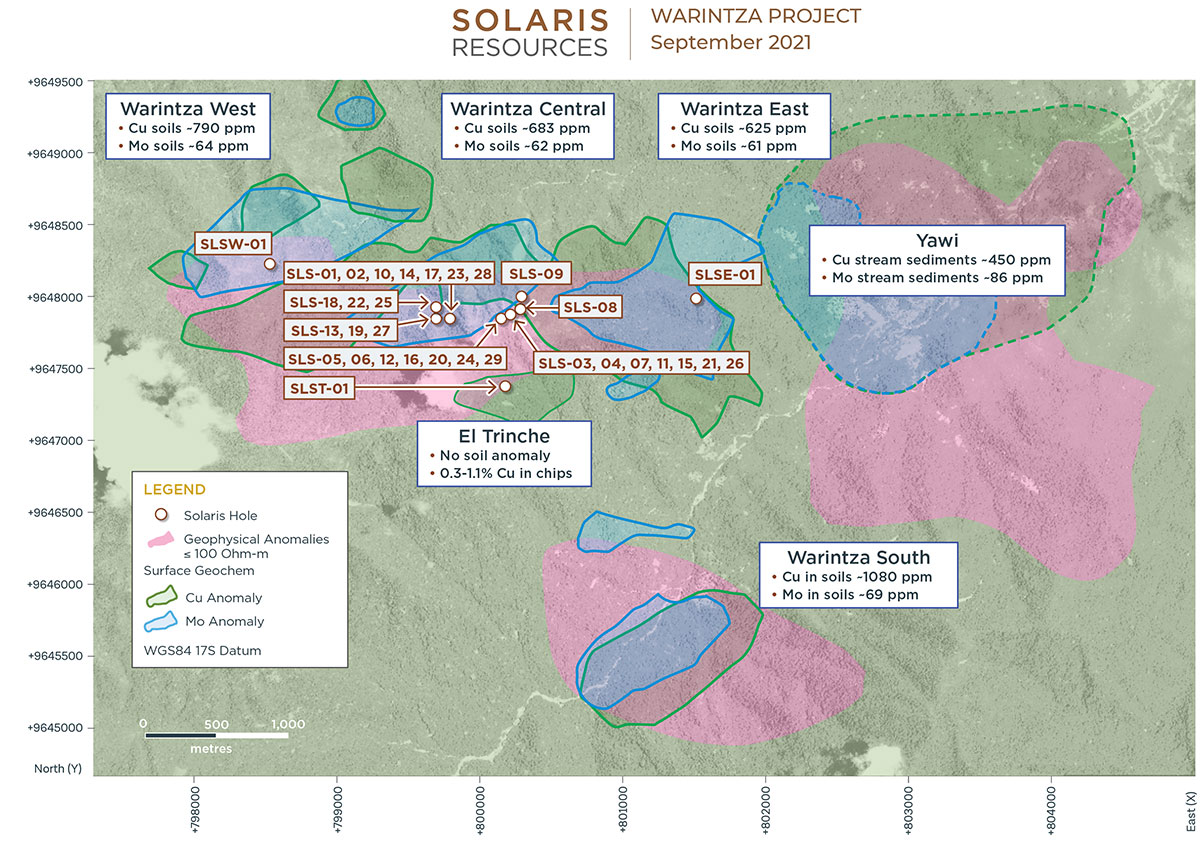

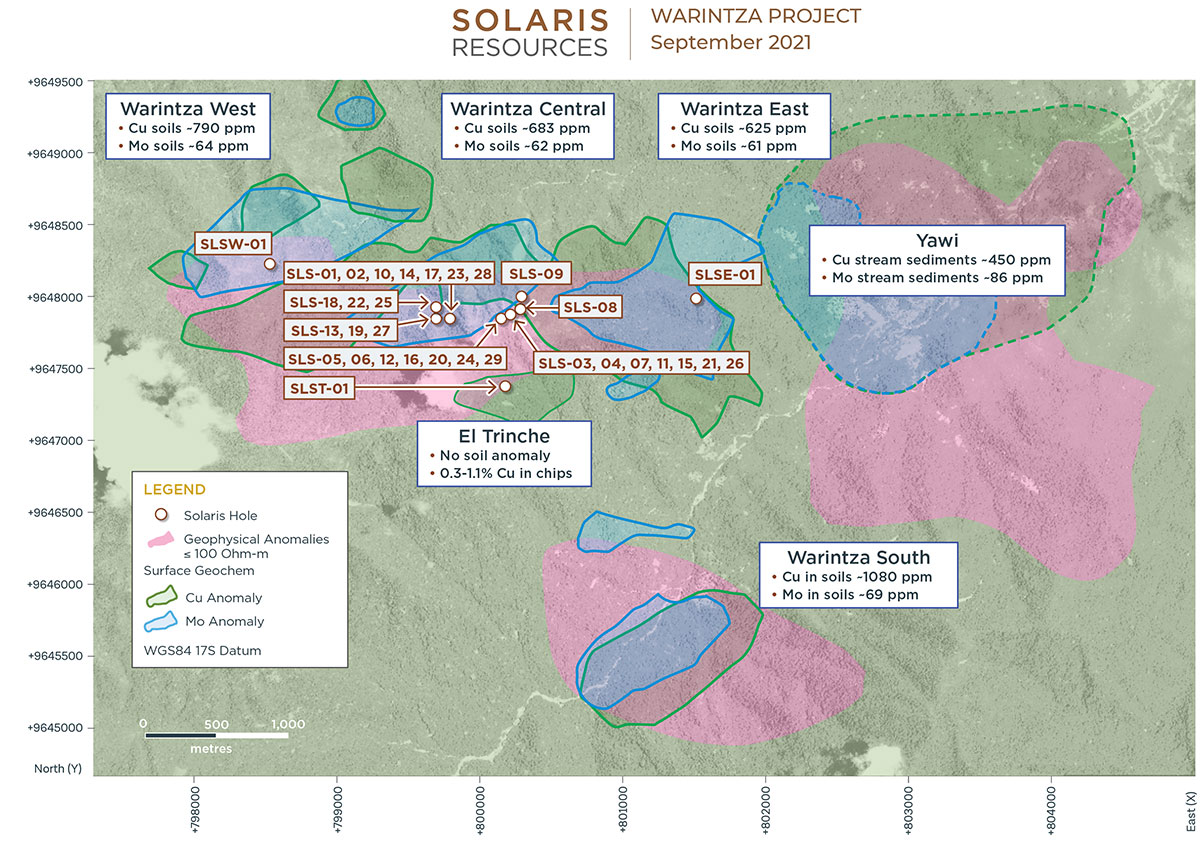

Solaris’ flagship Warintza project in Ecuador is operated according to the most stringent of ESG principles, without compromising the performance of the drill program. The company has just made its fourth discovery at the project of a broad porphyry deposit of at least 900m x 600 m and still open. This deposit is adjacent to and is not included in the Mineral Resource Estimate (MRE) from Warintza Central. The project is also set to be supplied by the Electric Corporation of Ecuador with low-cost, locally-sourced hydroelectric power.

Copper projects are set to power the increase in manufacturing for solar panels, however, new projects are scarce, and shortages threaten to drive up prices. Solaris Resources is working to alleviate this issue by mining copper in a way that is respectful of the environment. Those same shortages could even delay the transition to renewable energy.

Despite this, the growth in solar power has been exponential in recent years, with the market projected to grow by over a hundred billion dollars in the coming years.

Copper at the Crossroads

Renewable energy sources, such as solar and wind, rely on certain metals to create electrical currents. Copper is one of the key metals that is needed in large quantities to make these sources of energy work. Copper is one of the most important metals in this area, as it is not just critical to solar power but all of the energy infrastructure, putting it at an important crossroads.

The infrastructure that is needed to support renewable energy is also reliant on copper. Copper cables, for example, are essential for transmitting power from the solar panels to the places where it is needed. Copper is also used in batteries to store energy.

The material used to create solar panels is also important. Solar panels are made from a variety of materials, but the most common is polysilicon. Polysilicon is a type of plastic that is used to create solar panels. Polysilicon is made from a variety of materials, but the most common is silicon. Silicon is not suffering the same shortages as other minerals and metals.

The shortage of copper has also driven up the price of copper. If the price of copper continues to increase, it could delay the transition to renewable energy.

Mining Industry Scramble

Rising prices, tight markets, and environmental concerns have all contributed to the unprecedented scramble by the mining industry to bring new projects to production. The first way this is being done is through exploration. Exploration is when miners look for new deposits to extract copper from. This is an expensive and time-consuming process, so it is often only done when there is a good chance that a deposit will be profitable.

Another way that the mining industry is trying to bring new projects to production is by renegotiating contracts. When a company has a contract to produce copper, it may be able to renegotiate the contract to produce other materials as well. For example, a company may have a contract to produce copper, but if the price of copper increases, it may be able to renegotiate the contract to produce aluminum.

The mining industry is also trying to bring new projects to production faster by investing in new technologies. This is often done by investing in new mining equipment. For example, the mining industry is trying to bring new projects to production by investing in new hydraulic fracturing technology. hydraulic fracturing is a process that is used to break down rocks to extract minerals.

As the mining industry scrambles to bring new projects to production, it is important that the regulators are aware of these efforts and are able to provide the necessary permits and licenses. If the regulators are not aware of these efforts, it could lead to delays in the production of the new projects. Concerns in the United States that permitting laws are not changing fast enough to move in lockstep with growing investment in battery metal and copper mining projects also remain.

However, projects around the world, including the Warintza Project in southeastern Ecuador, are moving forward with a focus on sustainability and social responsibility. Solaris Resources is one of the few mining companies that have a long track record of operating according to the most stringent of ESG principles, without compromising the performance of its drill programs.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources (TSX:SLS) has reported new assay results today from the first series of drill holes during follow-up drilling on the discovery of Warintza West. The results outline a new deposit that remains open in the Warintza cluster, just adjacent to the Mineral Resource Estimate (MRE) the company published in April 2022.

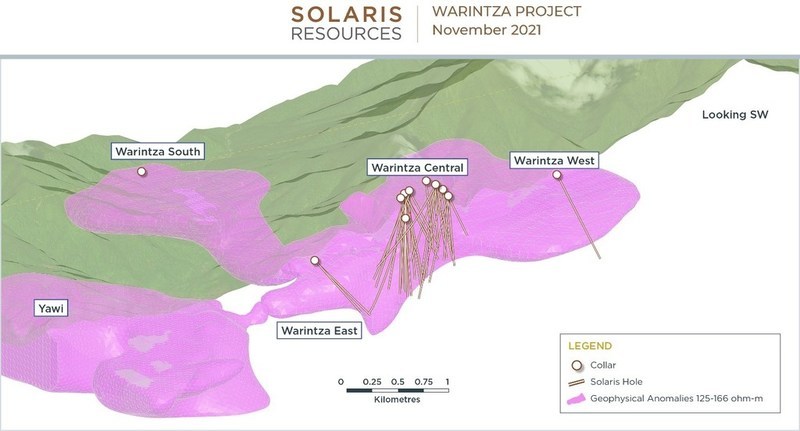

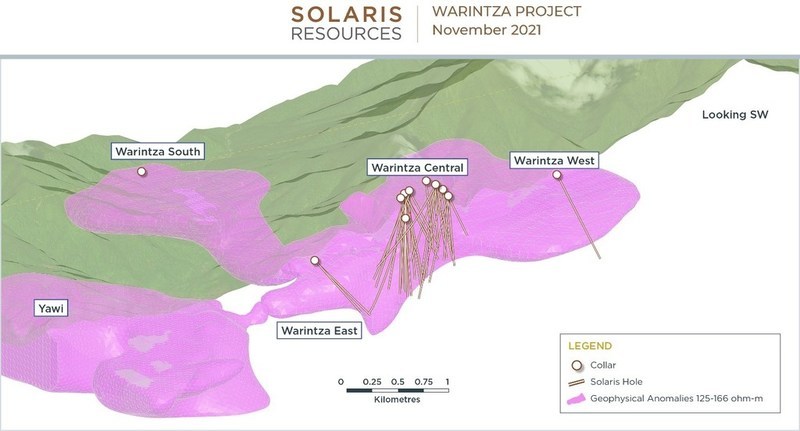

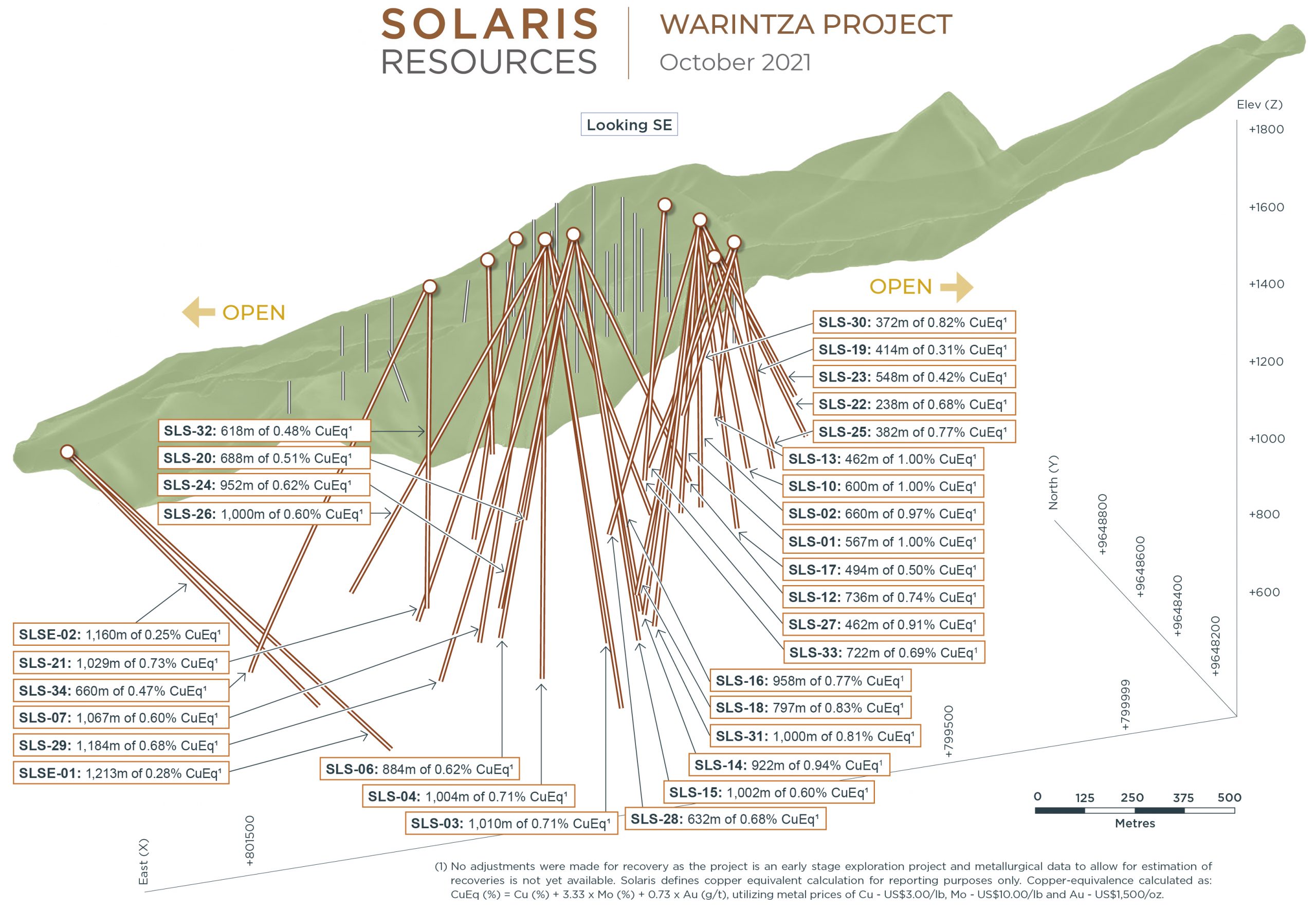

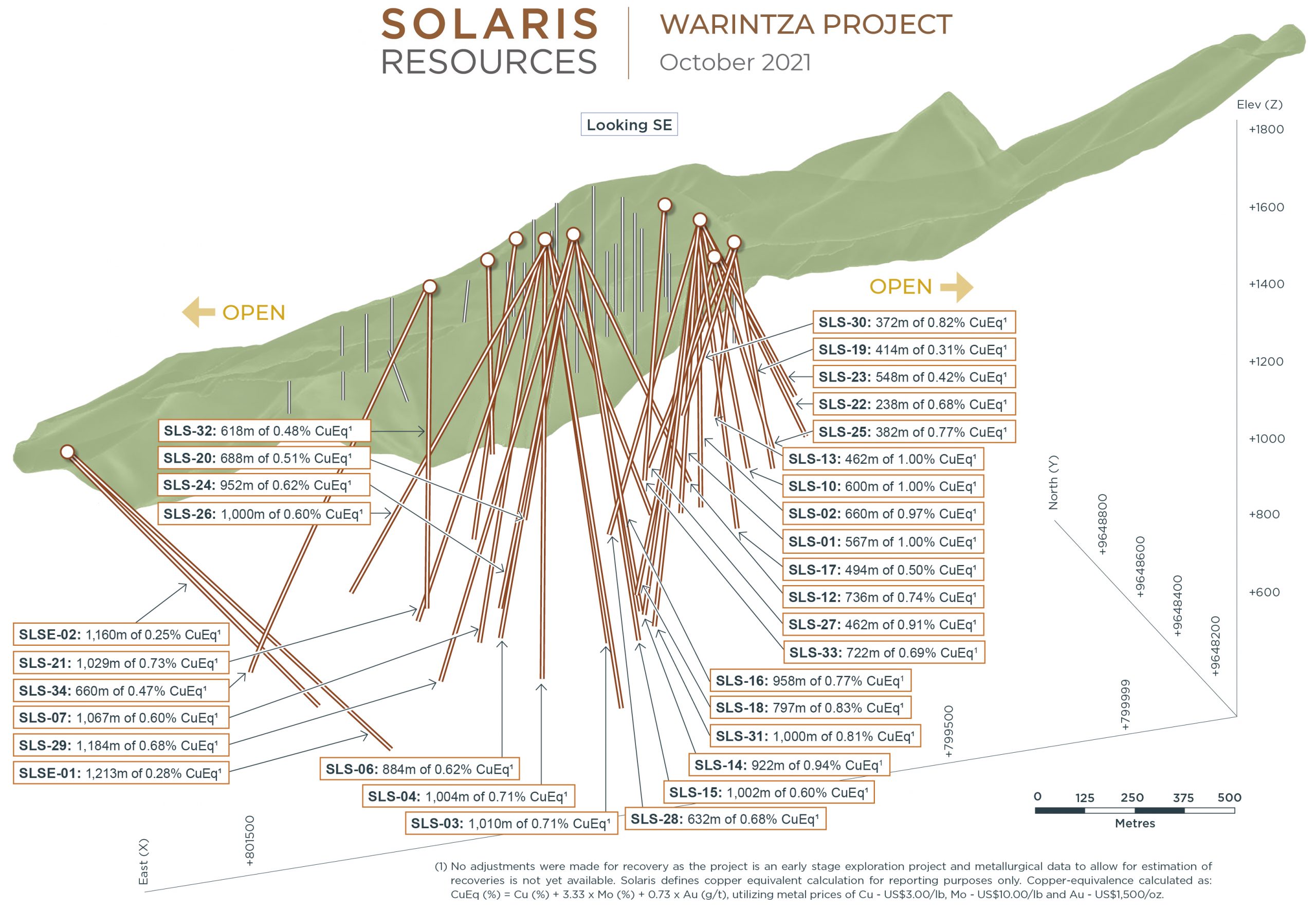

These follow-up holes fan out in all directions, outlining a broad porphyry deposit of at least 900m x 600m and still open and lies adjacent to and not included within the MRE. The company is focusing on targeting growth for the high-grade starter pit at Warintza Central and expanding the Warintza East discovery next while continuing the planned drilling at Warintza West. The Warintza Project is located in southeastern Ecuador, and Warintza West is the fourth and latest discovery at the project.

Highlights from the results are as follows:

Warintza West is one of four discoveries made to date within the Warintza porphyry cluster and is located 1km west of the Warintza Central Mineral Resource Estimate (“MRE”)¹ reported in April. The discovery was reported with the results of SLSW-01 (see press release dated February 16, 2021) – these follow-up holes fan out in all directions, outlining a broad porphyry deposit of at least 900m x 600m and still open and lies adjacent to and not included within the MRE. Follow-up drilling to test the further extent of the deposit is planned after priority drilling at Warintza Central aimed at expanding the starter pit and higher-grade resource expansion potential at Warintza East.

- SLSW-07 (drilled north) returned 686m of 0.46% CuEq¹ within a broader interval of 912m of 0.41% CuEq¹ from near surface

- SLSW-02 (drilled vertically) returned 246m of 0.47% CuEq¹ from near surface

- SLSW-09 (drilled west) returned 202m of 0.45% CuEq¹ within a broader interval of 444m of 0.36% CuEq¹ from near surface

- SLSW-08 (drilled northwest) returned 78m of 0.56% CuEq¹ within a broader interval of 812m of 0.32% CuEq¹ from near surface

- SLSW-04 (drilled northeast) returned 264m of 0.44% CuEq¹ from near surface

- SLSW-10 (drilled southwest) returned 220m of 0.41% CuEq¹ from near surface

- SLSW-03 (drilled southeast) returned 102m of 0.39% CuEq¹ within a broader interval of 911m of 0.24% CuEq¹ from near surface

- SLSW-05 (drilled northeast) returned 272m of 0.38% CuEq¹ within a broader interval of 570m of 0.30% CuEq¹ from near surface

- SLSW-06 (drilled east) returned 732m of 0.32% CuEq¹ from near surface

- Drilling at Warintza West confirms the interpretation of a broad porphyry deposit that remains open in all directions, with assays pending from a series of three additional holes testing the zone further to the west, east and south

- Step-out drilling is planned targeting high-grade surface sampling

Figure 1 – Plan View of Warintza West Drilling Released to Date

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLSW-10 | 24 | 244 | 220 | 0.36 | 0.01 | 0.02 | 0.41 | |

| SLSW-09 | 24 | 468 | 444 | 0.31 | 0.01 | 0.03 | 0.36 | |

| Including | 24 | 226 | 202 | 0.41 | 0.01 | 0.03 | 0.45 | |

| SLSW-08 | 32 | 844 | 812 | 0.26 | 0.01 | 0.02 | 0.32 | |

| Including | 32 | 110 | 78 | 0.51 | 0.01 | 0.02 | 0.56 | |

| SLSW-07 | 24 | 936 | 912 | 0.32 | 0.02 | 0.03 | 0.41 | |

| Including | Oct 13, 2022 | 30 | 716 | 686 | 0.37 | 0.02 | 0.03 | 0.46 |

| SLSW-06 | 34 | 766 | 732 | 0.25 | 0.01 | 0.02 | 0.32 | |

| SLSW-05 | 34 | 604 | 570 | 0.23 | 0.01 | 0.02 | 0.30 | |

| Including | 34 | 306 | 272 | 0.31 | 0.01 | 0.02 | 0.38 | |

| SLSW-04 | 38 | 302 | 264 | 0.36 | 0.02 | 0.03 | 0.44 | |

| SLSW-03 | 38 | 949 | 911 | 0.19 | 0.01 | 0.02 | 0.24 | |

| Including | 40 | 142 | 102 | 0.33 | 0.01 | 0.03 | 0.39 | |

| SLSW-02 | 24 | 270 | 246 | 0.38 | 0.02 | 0.02 | 0.47 |

Notes to table: True widths of the mineralized zone are not known at this time.

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLSW-10 | 798507 | 9648465 | 1519 | 713 | 238 | -51.25 |

| SLSW-09 | 798507 | 9648465 | 1519 | 767 | 260 | -60.31 |

| SLSW-08 | 798507 | 9648465 | 1519 | 974 | 295 | -60.50 |

| SLSW-07 | 798507 | 9648465 | 1519 | 945 | 352 | -70.56 |

| SLSW-06 | 798507 | 9648465 | 1519 | 767 | 70 | -70.72 |

| SLSW-05 | 798507 | 9648465 | 1519 | 807 | 45 | -60.73 |

| SLSW-04 | 798507 | 9648465 | 1519 | 455 | 22 | -60.89 |

| SLSW-03 | 798507 | 9648465 | 1519 | 949 | 140 | -55.50 |

| SLSW-02 | 798507 | 9648465 | 1519 | 1227 | 0 | -90.00 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

Endnotes

- Refer to Solaris’ press release dated April 18, 2022 and technical report titled, “NI 43-101 Technical Report for the Warintza Project, Ecuador” with an effective date of April 1, 2022, prepared by Mario E. Rossi and filed on the Company’s SEDAR profile at www.sedar.com.

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au, and assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical test work.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The global demand for minerals has placed a spotlight on the need for a stronger industrial base, one that includes more domestic production and processing of metals that are critical for a modern society. Energy security is strongly linked to mining, as minerals are essential ingredients in the production of energy technologies. Despite the critical role of minerals in securing economic futures and the protection of our planet, the U.S. continues to delay many high-value mining projects while deepening import dependence on the materials they provide.

Current energy disruptions have made it even more clear that a mineral and metals supply chain that relies heavily on a handful of countries can make the whole chain weak. Since Russia’s invasion of Ukraine, the U.S. and EU have looked for ways to reduce their dependence on Russian natural gas. One promising solution is to develop shale gas resources in the United States, which would help create jobs and reduce greenhouse gas emissions. However, this process requires large amounts of minerals, such as sand, clay, and limestone – all of which are in short supply.

Copper is another tight market being squeezed due to other supply chain issues that were exacerbated during the COVID-19 pandemic. New projects are in short supply, so companies are often eager to acquire new high-grade copper projects when they become available. The Warintza Project in southeastern Ecuador is operated by Solaris Resources (TSX:SLS) a junior mining company that is currently advancing the project towards production.

The Warintza Project has the potential to fill some of the gaps in the current copper market. The project is expected to produce approximately 100 million pounds of copper per year, making it one of the largest copper mines in Ecuador. In addition, the Warintza Project has been called a potential “super pit”, and has released a mineral resource estimate for a significant ‘Indicative Starter Pit’. The company reported in-pit resources of 579 Mt at 0.59% CuEq (Ind) and 887 Mt at 0.47% CuEq (Inf), and 180 Mt at 0.82% CuEq (Ind) and 107 Mt at 0.73% CuEq (Inf) at the time. Most recently, Solaris reported assay results from a series of holes aimed at growing the Northeast Extension of the ‘Indicative Starter Pit’.

Copper is another area the United States and many other countries are looking to lower import dependence. Companies like Tesla, a large consumer of copper for car and battery technology, have been vocal about their desire to source minerals from North America. The Warintza Project could play a role in meeting this demand, as it is located in an area with good infrastructure and a skilled workforce.

The vulnerability of the energy industry has accelerated the calls for renewable energy sources that would reduce or eliminate the dependence on oil and gas from other countries. To bolster domestic supply, it will require projects like the Warintza Project to fill the demand that continues to grow faster than supply. Junior mining companies will play a larger role in a future of energy security than ever before.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

As the world becomes increasingly digitized and reliant on technology, the demand for copper continues to grow. Copper is used in everything from smartphones to power grids, and the mining and production of this valuable metal has a significant environmental impact. However, thanks to recent innovations in mining and production technology, we may be able to meet this growing demand without harming the environment.

Companies engaged in copper exploration are currently leading the charge toward a greener future for the industry. One such company is Rio Tinto, which has been working on developing a new method of extracting copper from ore that doesn’t require smelting. Smelting is a process that releases harmful greenhouse gases into the atmosphere, so eliminating it would be a major step forward in terms of reducing the environmental impact of copper mining.

Another great example is Solaris Resources (TSX:SLS) which has signed a Memorandum of Understanding with Electric Corporation of Ecuador (“CELEC EP”) to supply low-cost, locally sourced hydroelectric power to the Warintza Project (“Warintza” or “the Project”) in southeastern Ecuador.

CELEC EP will source hydroelectric power from the National Transmission System in Ecuador to provide primary power required for the Warintza Project. This initiative is consistent with the “Ecuador Zero Carbon Program” developed by the Ministry of Environment, Water and Ecological Transition and Solaris was the first mining signatory of September 2021.

Solaris wants to make the most of this efficient, renewable, and cheap energy source by investigating how to electrify infrastructure like mobile mining equipment (e.g., drills, trucks), goods transportation (including gravity-assisted solutions), and processing and pumping systems.

Daniel Earle, President & CEO, commented in a press release: “The MOU with CELEC supports our vision to study the potential for electrified operations that maximize the structural benefits of the Warintza Project within an infrastructure-rich mining district with the aim of lowering costs, increasing efficiencies, reducing emissions, and broadly positioning the Project as a leading development opportunity across a range of financial and ESG metrics in the industry.”

Supplying power for the infrastructure and mining activities at Warintza with renewable energy will help to offset the environmental impact of the project, and could set a precedent for other mines in the area.

Other companies have also looked at switching transportation to a net-zero emissions model, in which electric vehicles are powered by renewable energy sources. This would not only reduce emissions from the mining process itself, but also from the transportation of copper ore to processing plants.

Considering copper is one of the key elements powering the transition to renewable energy, it’s encouraging to see the exploration and production industry working hard to reduce its environmental impact. With continued research and development, companies like Solaris Resources are driving the mission toward net-zero forward faster than ever.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

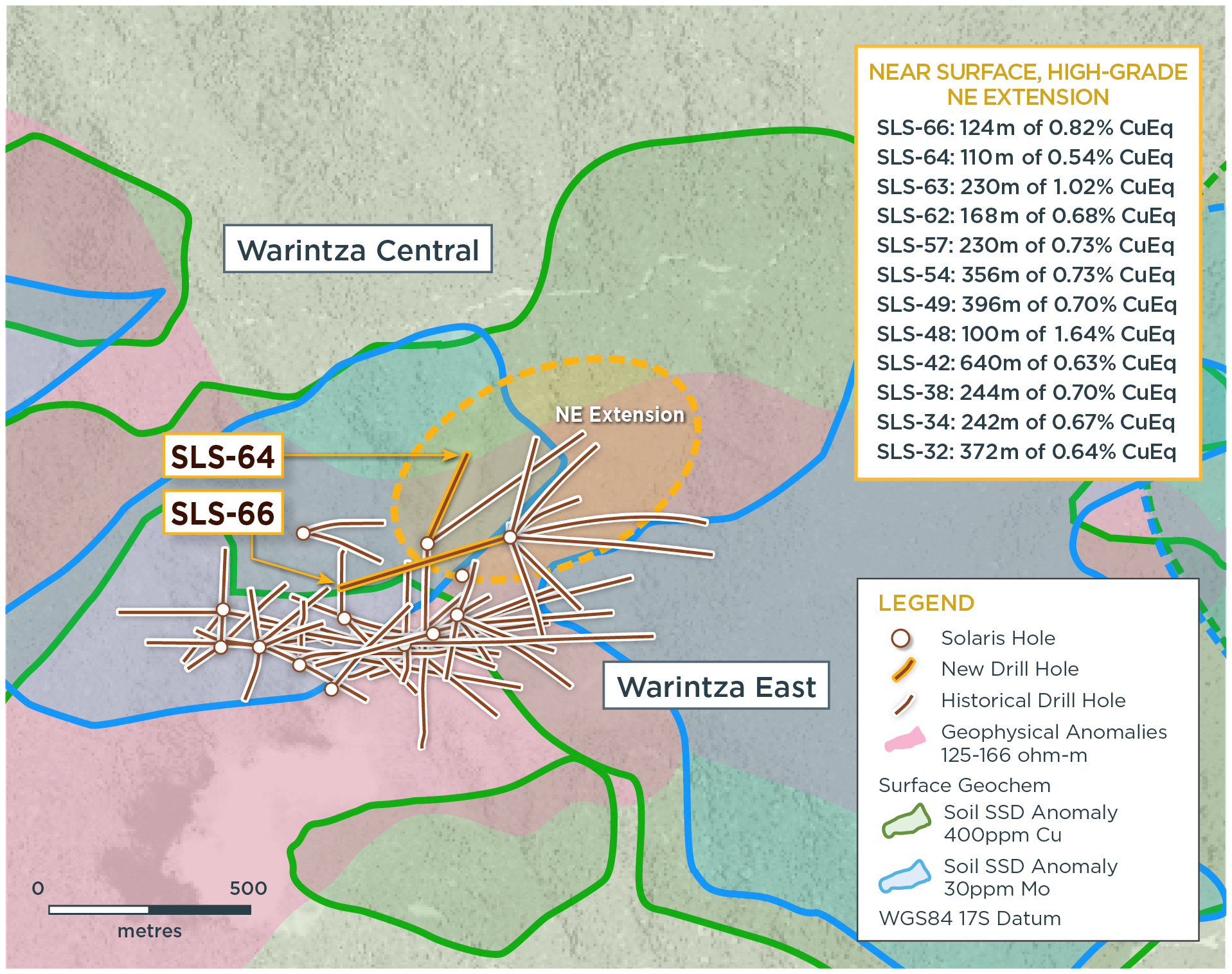

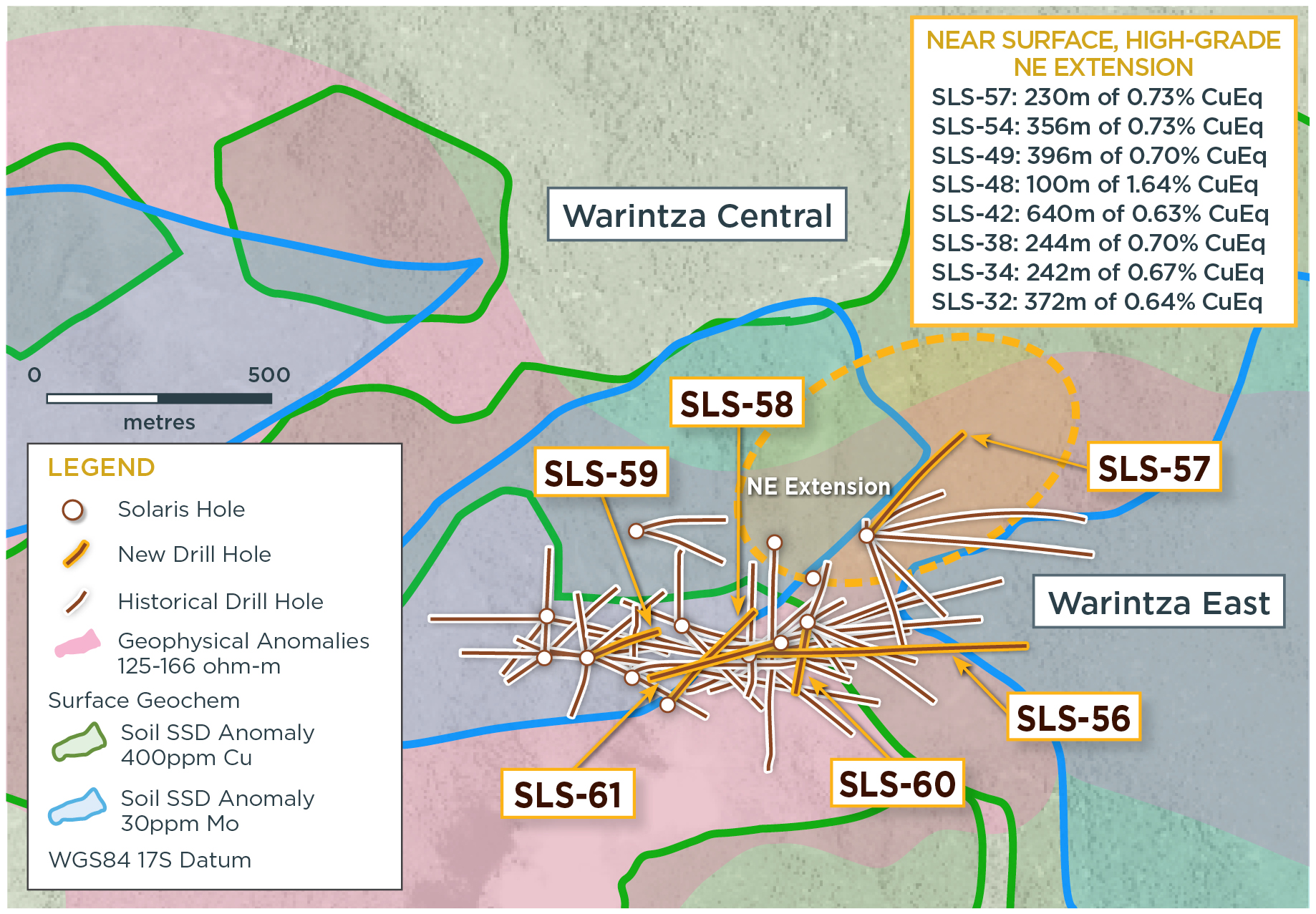

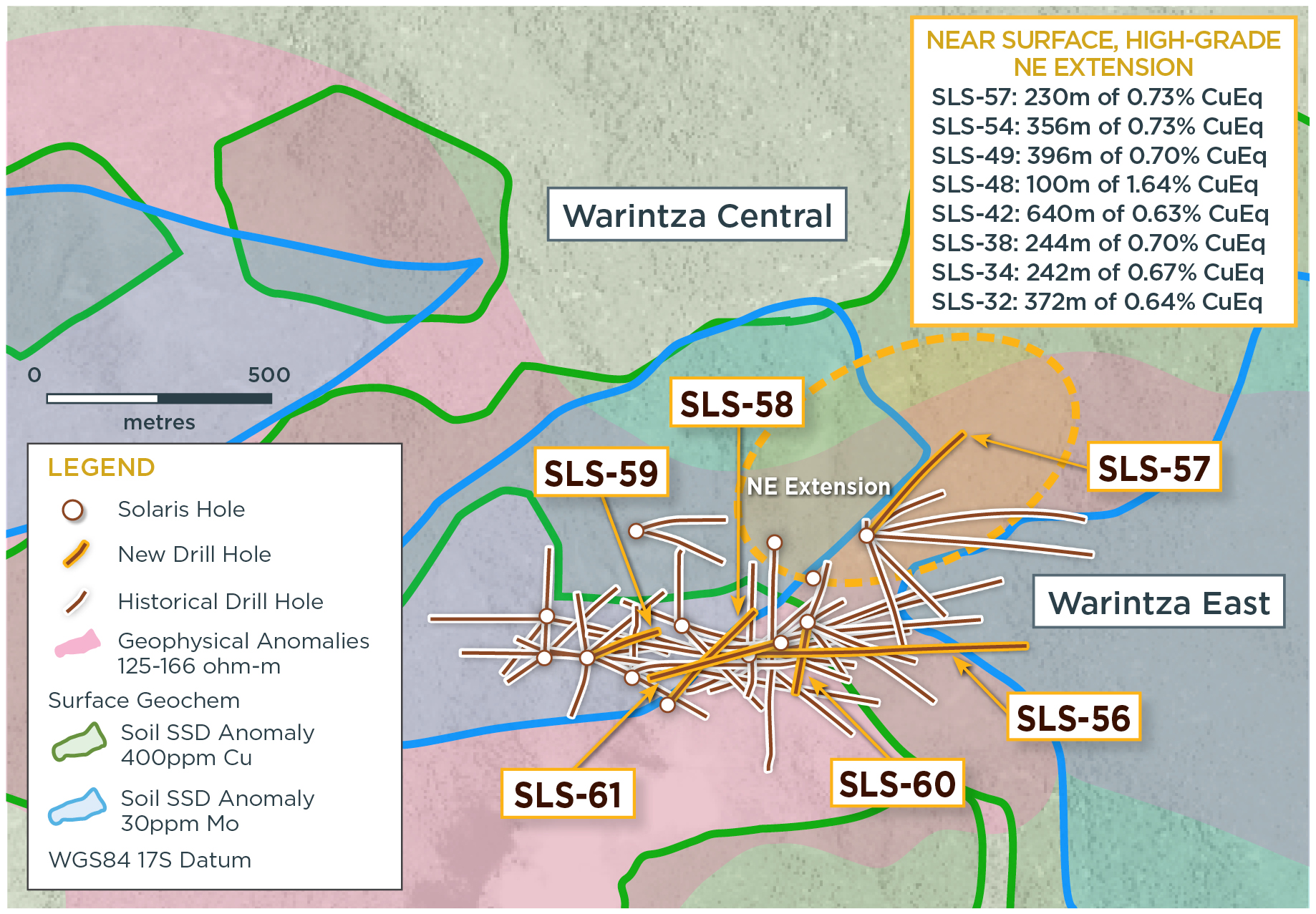

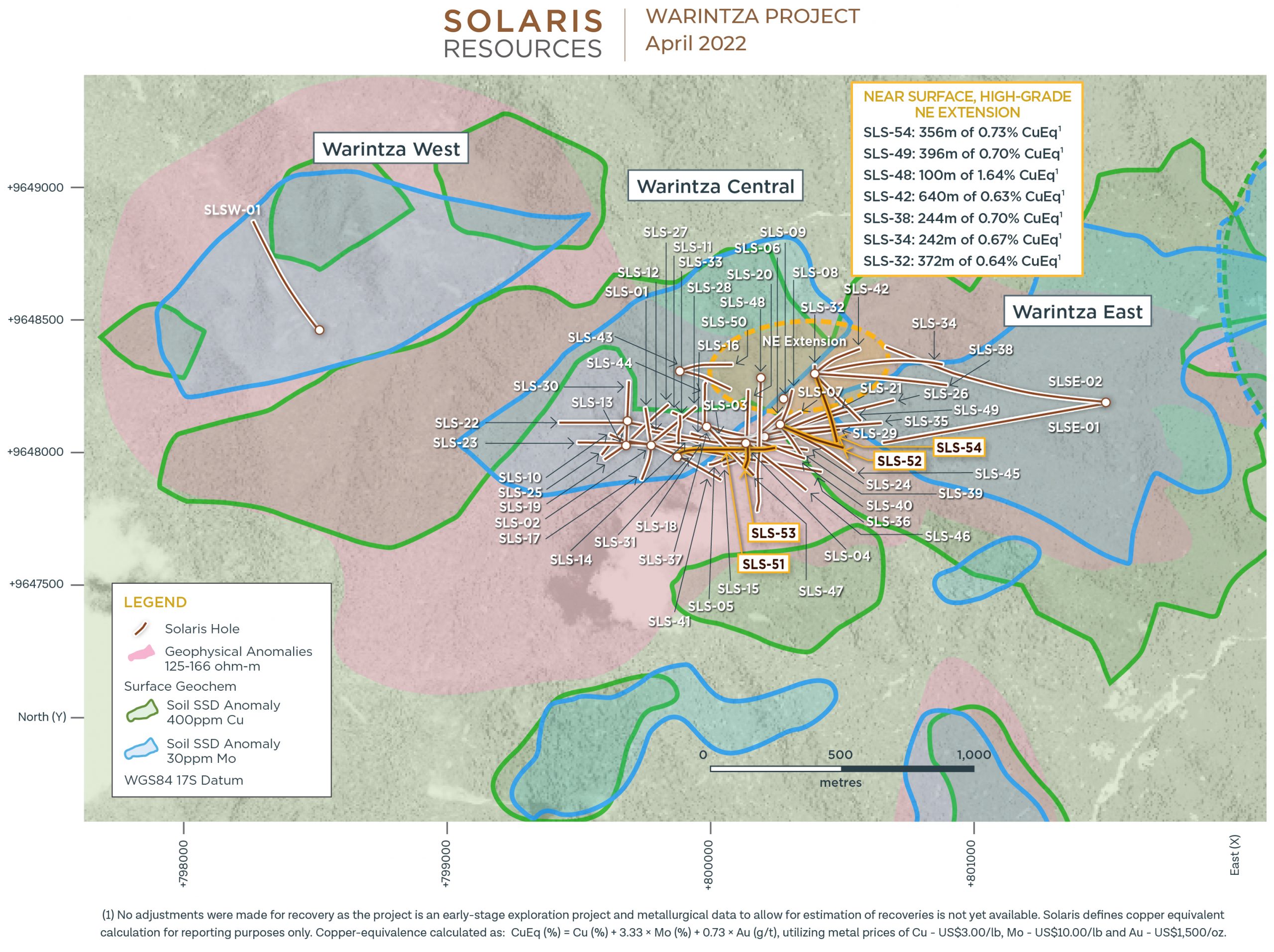

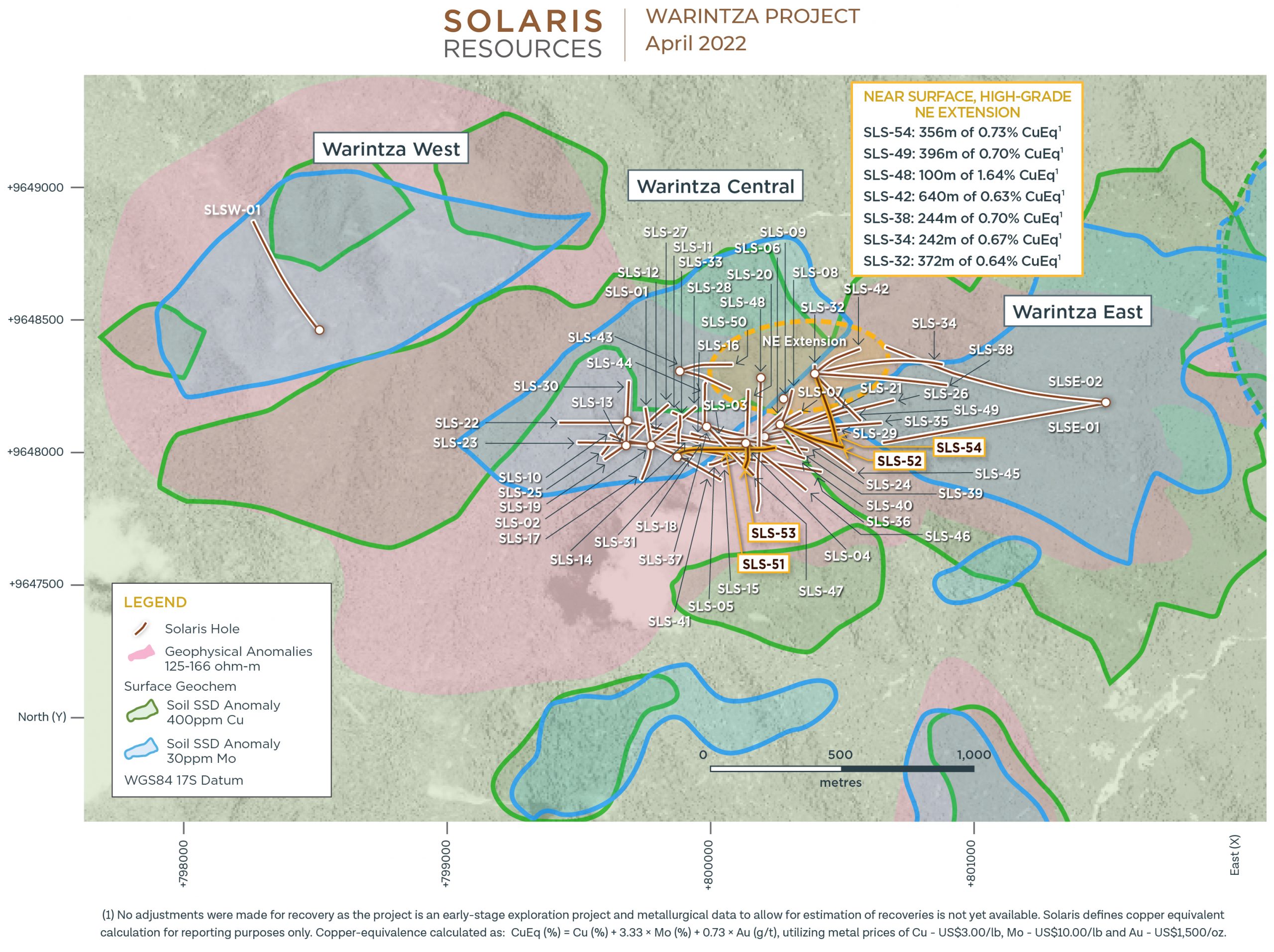

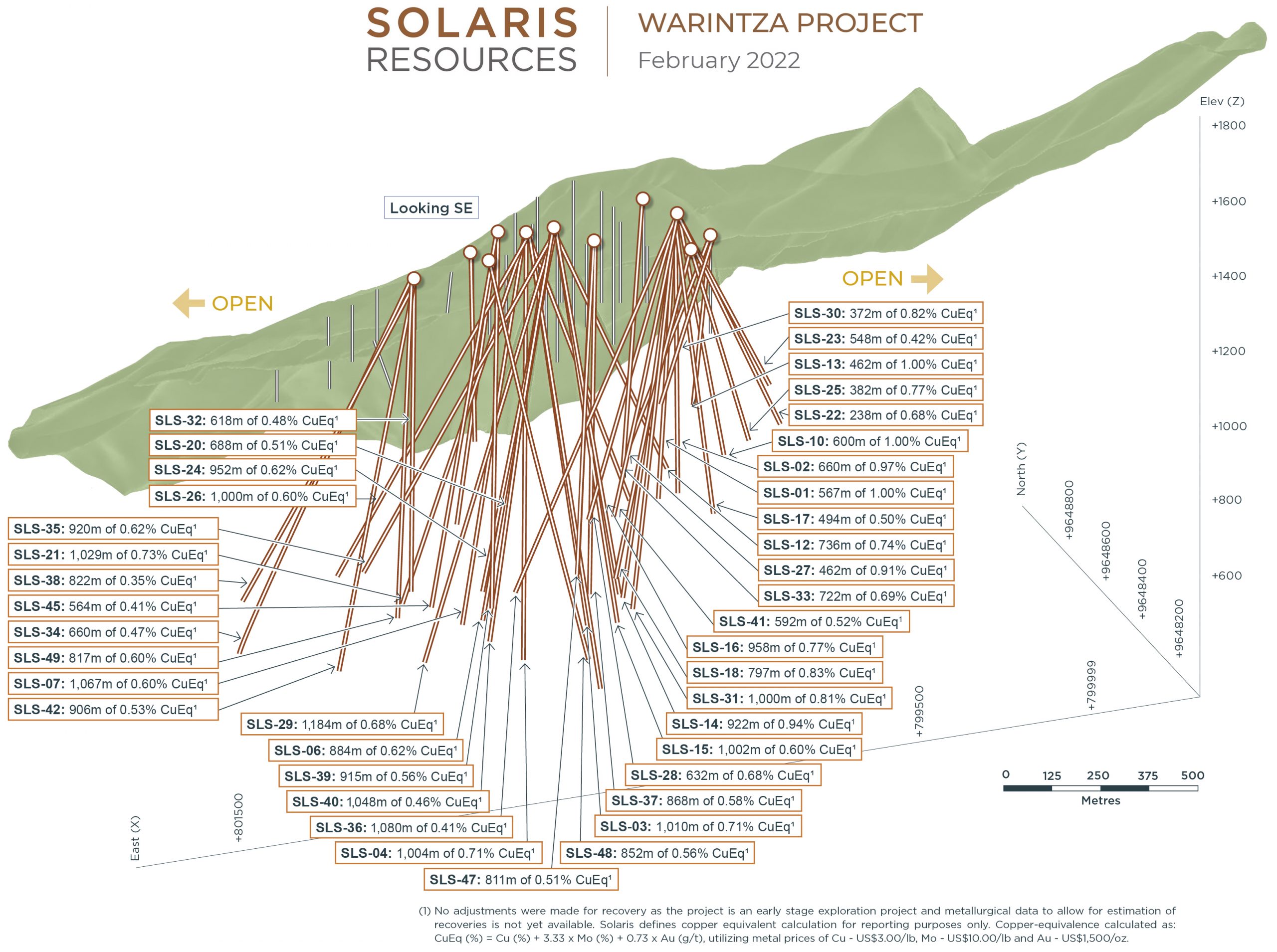

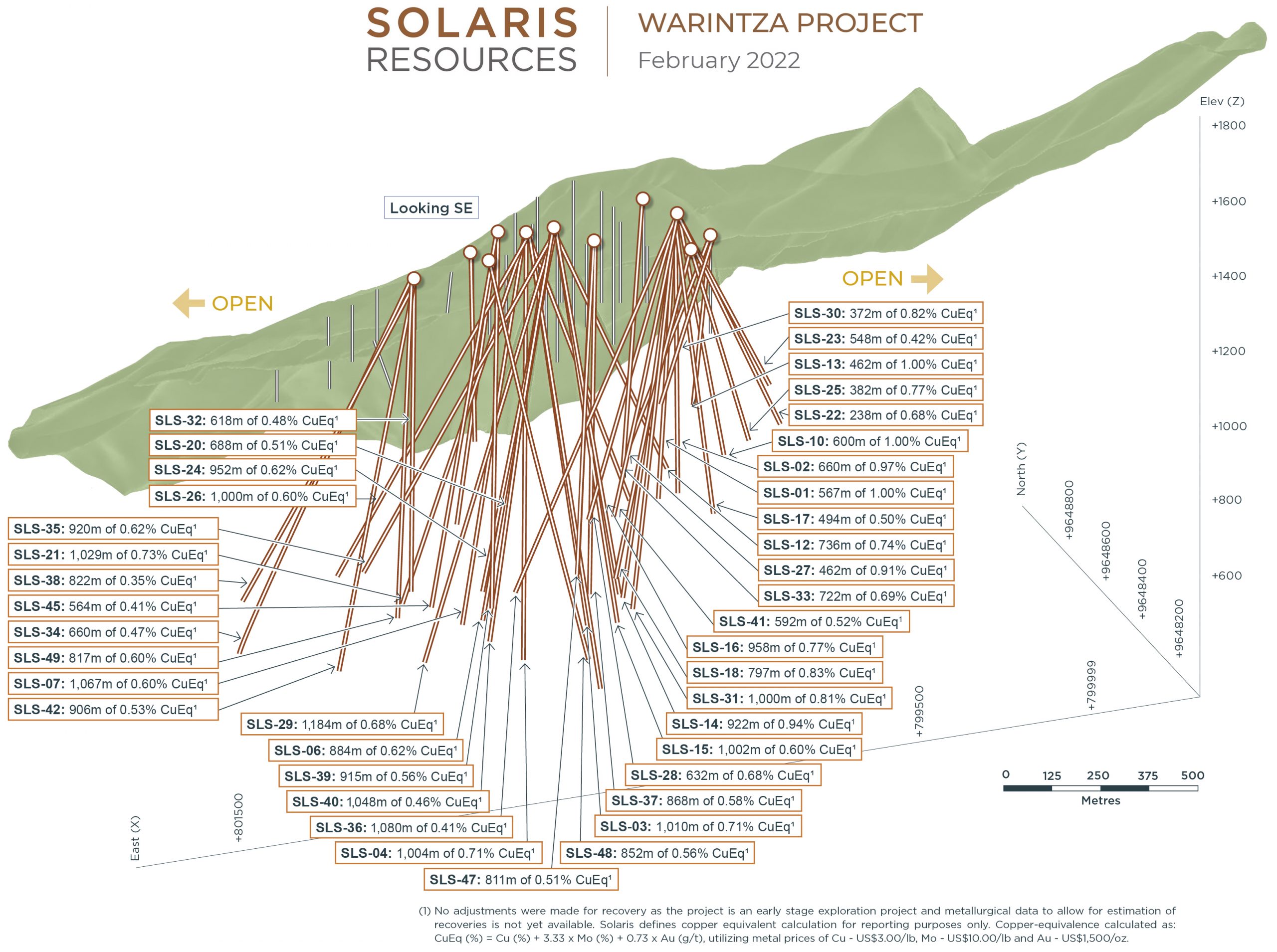

Solaris Resources (TSX:SLS) has reported new assay results from a series of holes at the Warintza Project in southeastern Ecuador. The holes are aimed at growing the Northeast Extension of the previously announced “Indicative Starter Pit”. The company is moving forward with drilling platforms in the Northeast Extention that are set to drive the latest high-grade results from the project.

Mr. Jorge Fierro, Vice President of Exploration, commented in a press release: “Drilling from existing and recently-completed platforms in the Northeast Extension zone is a key driver in the expansion of the ‘Indicative Starter Pit’, and we look forward to reporting the next set of results in the near future as the backlog of assays pending is now resolved.”

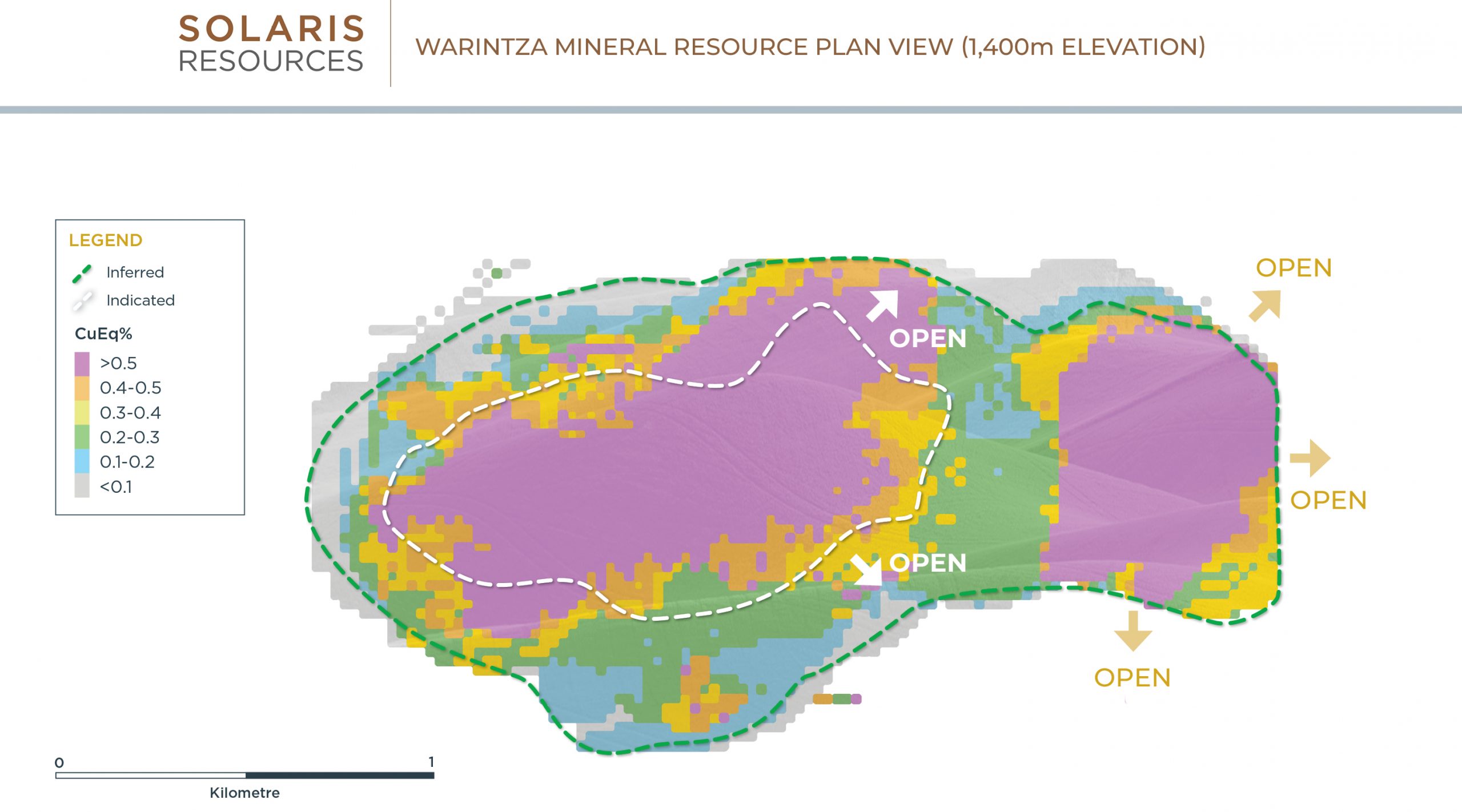

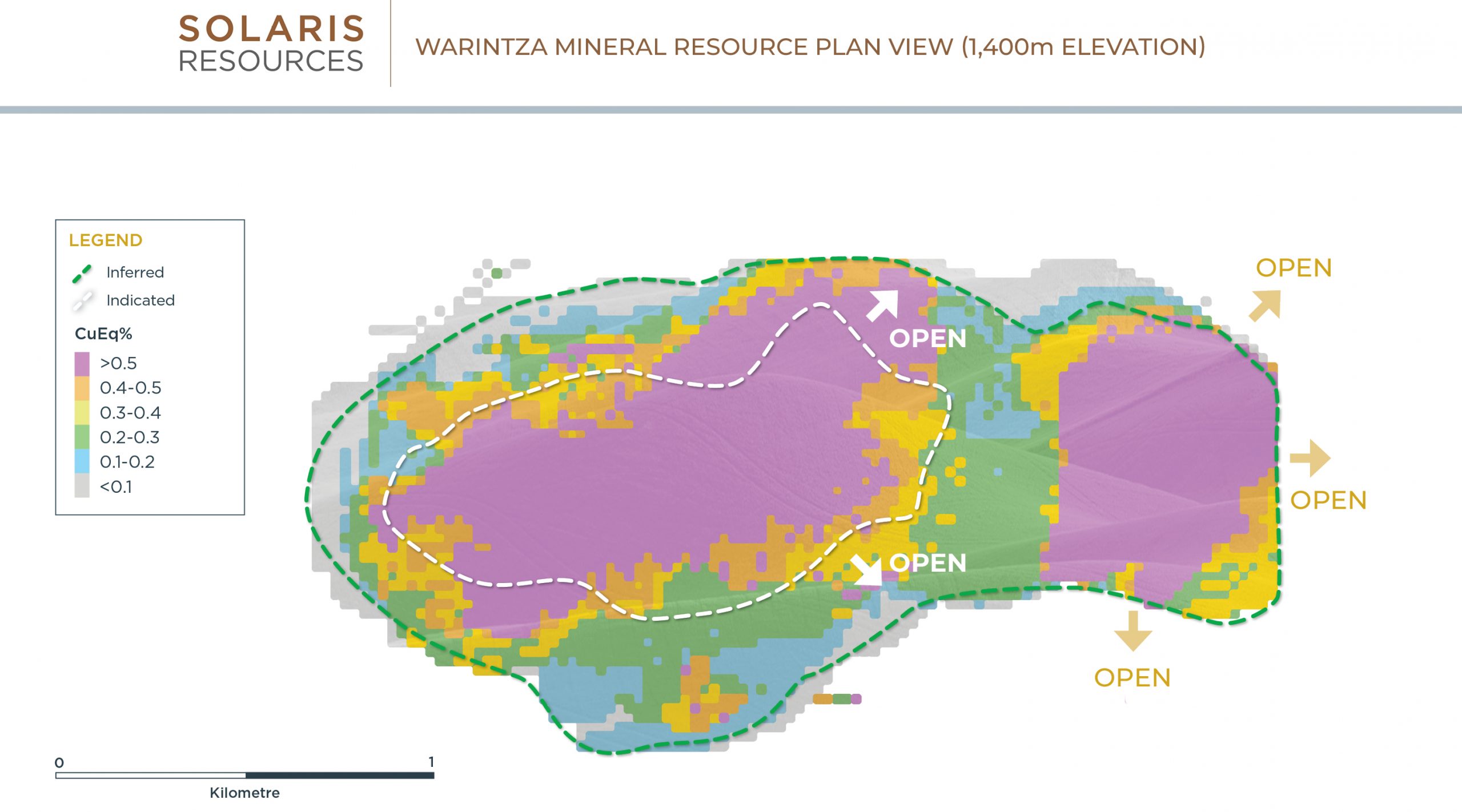

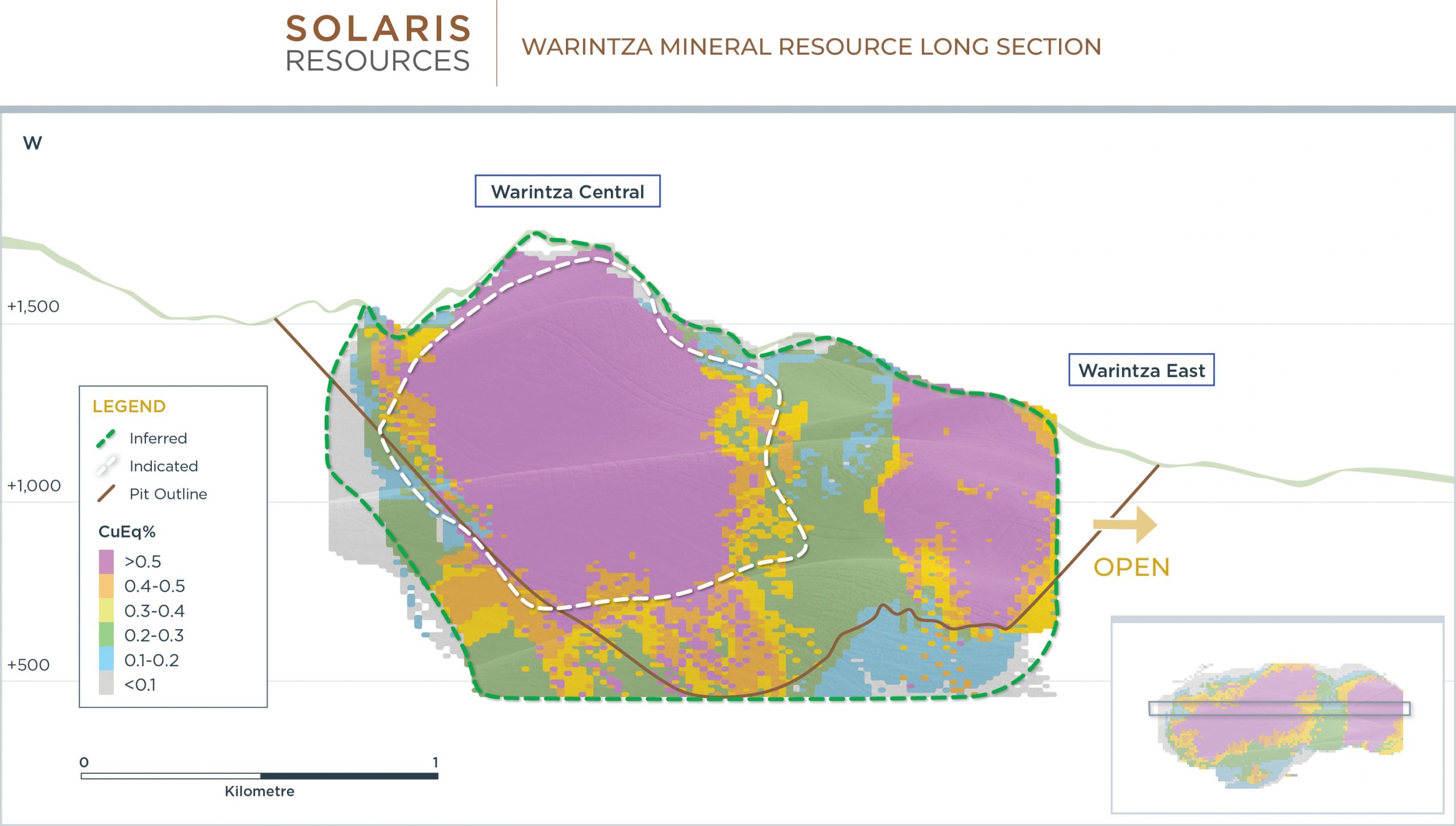

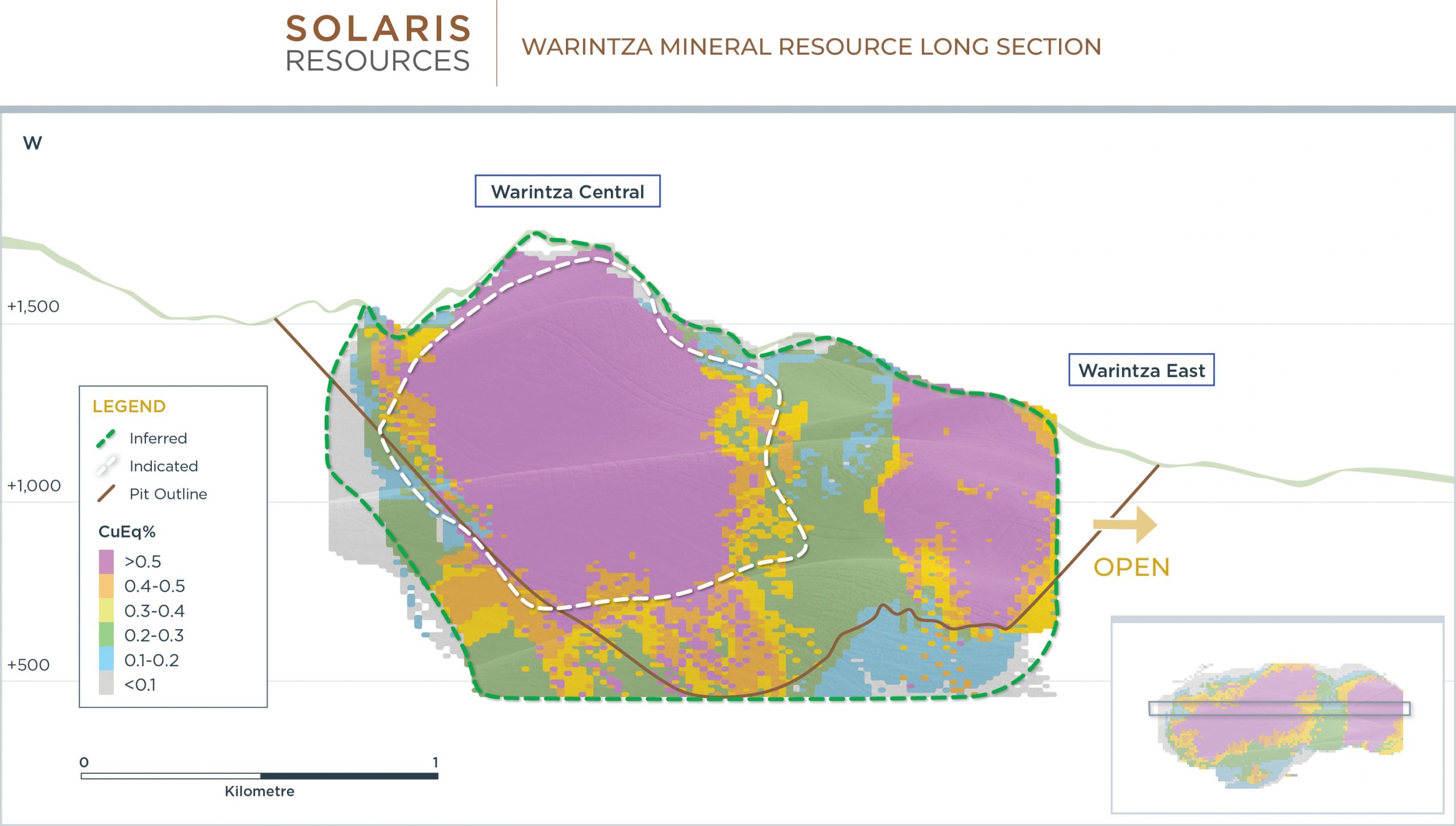

The “Indicative Starter Pit” was noted in an April 18, 2022 announcement from the company in a mineral resource estimate for the Warintza Central Deposit, in which the company reported in-pit resources of 579 Mt at 0.59% CuEq (Ind) and 887 Mt at 0.47% CuEq (Inf), and 180 Mt at 0.82% CuEq (Ind) and 107 Mt at 0.73% CuEq (Inf) for the “Indicative Starter Pit”.

Solaris also intends to spin out its non-core assets in Ecuador outside of the Warintza porphyry cluster, Peru, Chile, and Mexico into a new incorporated wholly-owned subsidiary of Solaris named Solaris Exploration Inc. Following the internal re-organization, it is expected that 100% of the common shares of Solaris Exploration Inc. will be spun out to shareholders of Solaris relative to their shareholdings.

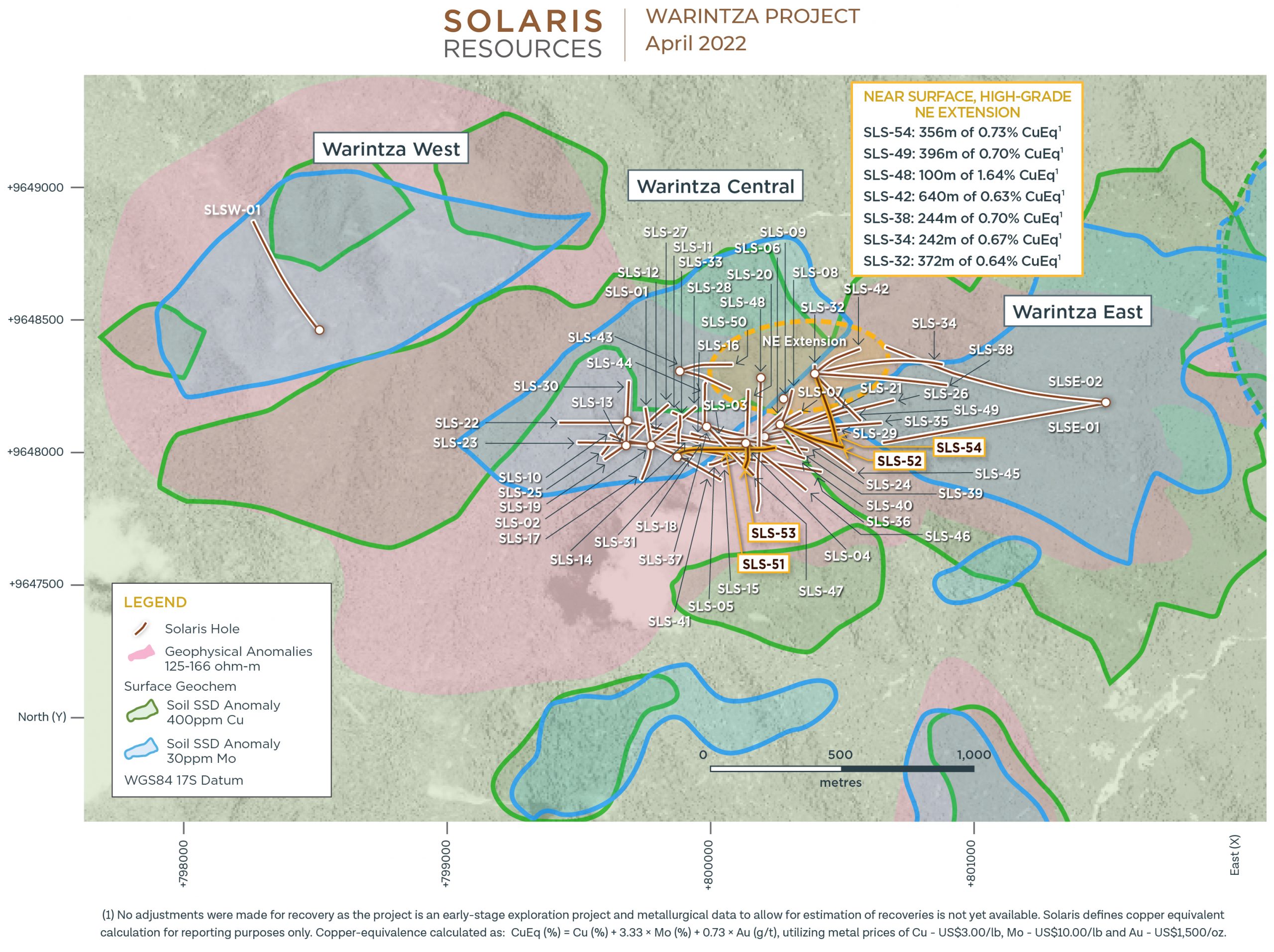

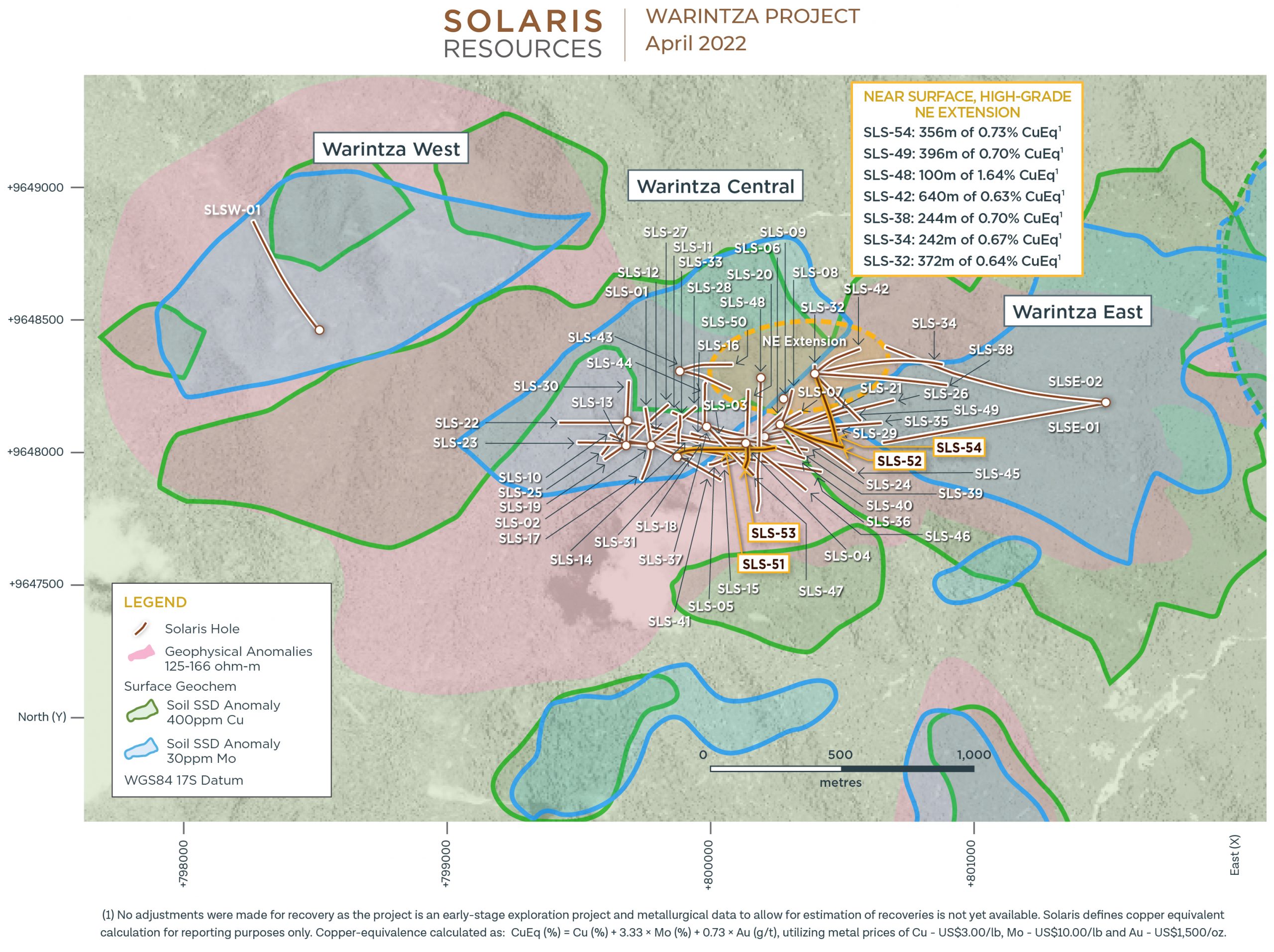

Figure 1 – Plan View of Warintza Central Drilling Released to Date

Highlights from the results are as follows:

Additional drilling has expanded the Northeast Extension of the ‘Indicative Starter Pit’ recently estimated at 180 Mt at 0.82% CuEq¹ (Indicated) and 107 Mt at 0.73% CuEq¹ (Inferred) within the Warintza Mineral Resource Estimate² (“MRE”). This zone is characterized by near surface, high-grade mineralization and remains open for further growth with follow-up drilling underway.

- SLS-66 was collared on a platform at the northeastern limit of the Warintza Central grid and drilled southwest into an open volume, returning 124m of 0.82% CuEq¹ within a broader interval of 622m of 0.42% CuEq¹ starting from surface

- SLS-66 follows from previous holes SLS-63 and SLS-54, which were drilled from the same pad to the north and southeast and respectively returned high-grade intervals of 230m of 1.02% CuEq¹ and 356m of 0.73% CuEq³ within broader intervals (refer to press releases dated Jul 20, 2022 and Apr 4, 2022 for details)

- SLS-64 was collared on a platform at the northern limit of Warintza Central and drilled north-northeast into an open volume, returning 110m of 0.54% CuEq¹ from near surface within a broader interval of 440m of 0.48% CuEq¹, extending and broadening the zone to the north in this area

- SLS-64 follows from previous holes SLS-62 and SLS-48, which were drilled from the same pad to the northeast and south and respectively returned high-grade intervals of 168m of 0.68% CuEq¹ and 100m of 1.64% CuEq³ within broader intervals (refer to press releases dated Jul 20, 2022 and Feb 28, 2022 for details)

- SLS-65, which is a step out hole from a new platform 200m to the north, has now been completed after operational delays with adjustments to the platform for drilling and assays are expected within the next four weeks

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLS-66 | Sep 07, 2022 | 0 | 622 | 622 | 0.32 | 0.02 | 0.05 | 0.42 |

| Including | 66 | 190 | 124 | 0.71 | 0.02 | 0.09 | 0.82 | |

| SLS-64 | 78 | 518 | 440 | 0.32 | 0.04 | 0.04 | 0.48 | |

| Including | 78 | 188 | 110 | 0.38 | 0.04 | 0.03 | 0.54 |

Notes to table: True widths of the mineralized zone are not known at this time.

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-66 | 800383 | 9648303 | 1412 | 689 | 255 | -48 |

| SLS-64 | 800178 | 9648285 | 1439 | 571 | 26 | -66 |

Notes to table: The coordinates are in WGS84 17S Datum.

Endnotes

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au, and assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical test work.

- Refer to Solaris’ technical report titled, “NI 43-101 Technical Report for the Warintza Project, Ecuador” with an effective date of April 1, 2022, prepared by Mario E. Rossi and filed on the Company’s SEDAR profile at www.sedar.com.

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of US$3.00/lb Cu, US$10.00/lb Mo, and US$1,500/oz Au. No adjustments were made for recovery prior to the updated Warintza Mineral Resource Estimate, as the metallurgical data to allow for estimation of recoveries was not yet available. Solaris defined CuEq for reporting purposes only.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

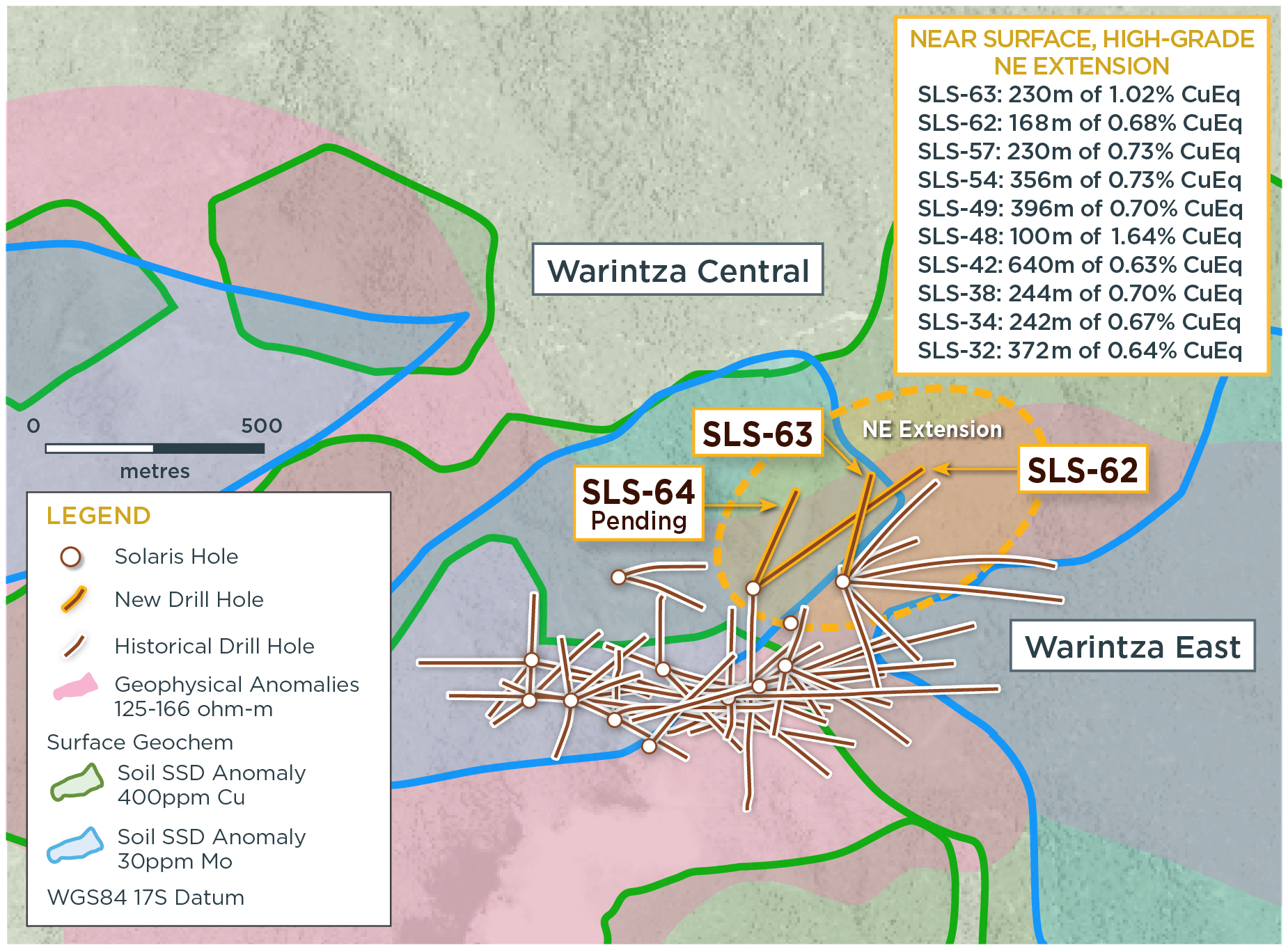

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has announced this morning new assay results from a series of holes aimed at growing the Northeast Extension of the “Indicative Starter pit” at the Warintza Project. The “Indicative Starter Pit” was noted in an April 18, 2022 announcement from the company in a mineral resource estimate for the Warintza Central Deposit, in which the company reported in-pit resources of 579 Mt at 0.59% CuEq (Ind) and 887 Mt at 0.47% CuEq (Inf), and 180 Mt at 0.82% CuEq (Ind) and 107 Mt at 0.73% CuEq (Inf) for the “Indicative Starter Pit”. The company has been targeting high-grade extensions and major growth in cluster at the project, with ongoing drilling focused on open extensions of near surface, high-grade mineralization to the northeast and southeast of Warintza Central.

Mr. Jorge Fierro, Vice President, Exploration, commented in a press release: “Ongoing drilling from existing and newly constructed platforms aims to expand on the Northeast Extension zone, which is one of the key target areas for the expansion of the ‘Indicative Starter Pit,’ along with higher grade, near surface mineralization being targeted at Warintza East, where results are pending.”

Highlights from the results are as follows:

Additional drilling has expanded the Northeast Extension of the ‘Indicative Starter Pit’ recently estimated at 180 Mt at 0.82% CuEq1 (Indicated) and 107 Mt at 0.73% CuEq1 (Inferred) within the Warintza Mineral Resource Estimate² (“MRE”). This zone is characterized by near surface, high-grade mineralization and remains open for further growth with follow-up and step-out drilling underway.

- SLS-62 was collared at the northern limit of Warintza Central and drilled northeast into an open volume, returning 168m of 0.68% CuEq¹ from 102m depth within a broader interval of 900m of 0.45% CuEq¹ from surface, expanding on prior drilling further to the east

- This hole represents the first follow-up to SLS-48, collared from the same pad but drilled to the south, which returned 100m of 1.64% CuEq³ from 50m depth within a broader interval of 852m of 0.56% CuEq³ (refer to press release dated Feb 28, 2022)

- SLS-63 was collared at the northeastern limit of the Warintza Central grid approximately 200m to the east and drilled into an open volume to the north-northeast, returning 230m of 1.02% CuEq¹ from 118m depth within a broader interval of 472m of 0.76% CuEq¹ from surface

- This hole follows on SLS-57, which was drilled northeast from the same pad, returning 230m of 0.73% CuEq¹ from 56m depth within a broader interval of 926m of 0.61% CuEq¹ from surface and SLS-54, drilled to the south and returning 356m of 0.73% CuEq³ from 50m depth within a broader interval of 1,093m of 0.56% CuEq³ from surface (refer to press releases dated May 26 and Apr 4, 2022)

- Follow-up drilling is underway and aims to test the Northeast Extension zone further to the north and northeast, with assays expected shortly for SLS-64, representing a follow-up hole from the same pad as SLS-62 and SLS-48

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLS-63 | Jul 20, 2022 | 0 | 472 | 472 | 0.60 | 0.02 | 0.12 | 0.76 |

| Including | 118 | 348 | 230 | 0.87 | 0.02 | 0.12 | 1.02 | |

| SLS-62 | 10 | 910 | 900 | 0.33 | 0.02 | 0.07 | 0.45 | |

| Including | 102 | 270 | 168 | 0.51 | 0.03 | 0.07 | 0.68 |

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-63 | 800383 | 9648303 | 1412 | 498 | 17 | -61 |

| SLS-62 | 800178 | 9648285 | 1439 | 943 | 55 | -60 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

Endnotes

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au, and assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical test work.

- Refer to Solaris press release dated April 18, 2022, stating updated Warintza Mineral Resource Estimate.

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of US$3.00/lb Cu, US$10.00/lb Mo, and US$1,500/oz Au. No adjustments were made for recovery prior to the updated Warintza Mineral Resource Estimate, as the metallurgical data to allow for estimation of recoveries was not yet available. Solaris defined CuEq for reporting purposes only.

Source: Solaris Resources

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

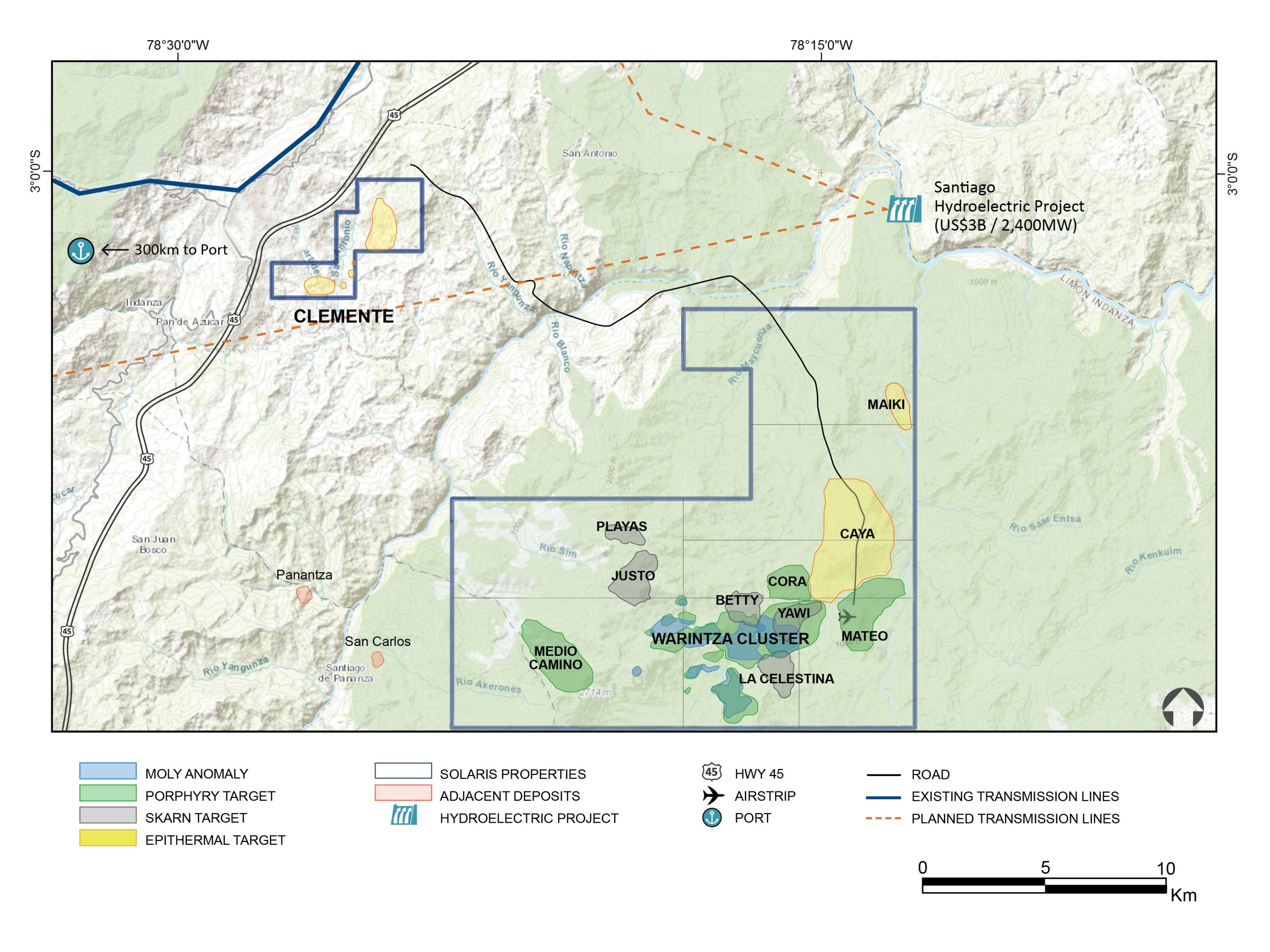

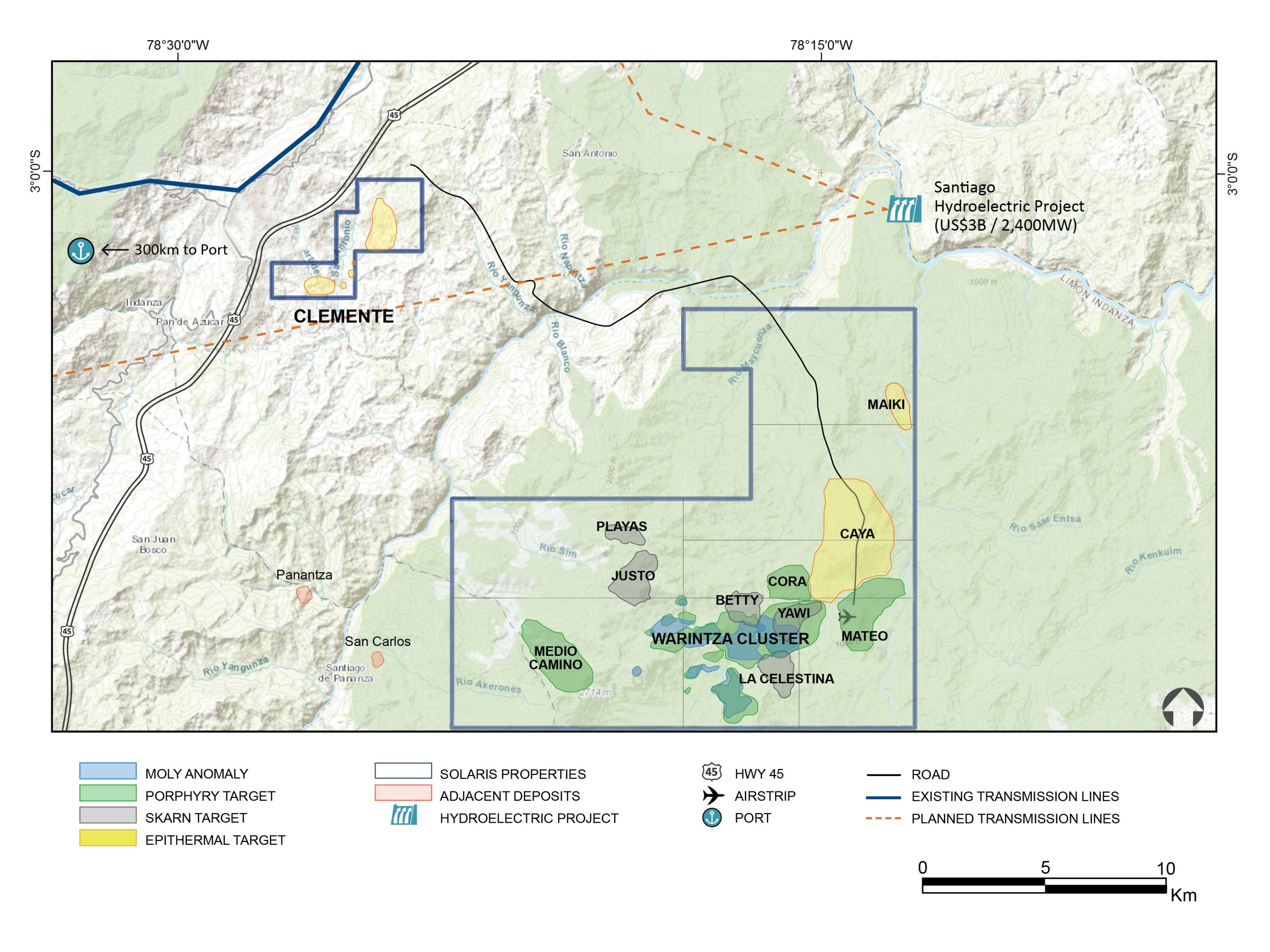

Solaris Resources (TSX:SLS) has provided an update for the Warintza Project in southeastern Ecuador, and announced that it has identified a number of new targets for further exploration in the support of the drill program. The company also provided a report on the progress of the proposed asset spin-out to create Solaris Exploration Inc. Ecuador’s recent protests concluded on June 30, and the company’s samples have now been able to flow from the core processing facility to the prep lab, which has resumed operations. The samples are continuing on for final assays in Lima, Peru, although there is a considerable backlog of assays still pending.

The company is continuing its regional exploration program and identified new porphyry, skarn, and epithermal targets. A large high sulphidation epithermal target was identified adjacent to the Warintza porphyry cluster where overlapping mineralized porphyries have intruded a layered sequence of carbonate and volcanic rocks. This has given the mineralization a very fertile setting to be able to develop.

Solaris also provided an update of the proposed Solaris Exploration spin-out, and when completed, it is expected that 100% of the common shares of Solaris Exploration will be spun out to shareholders of Solaris relative to their current shareholdings. Details of the corporate update are as follows:

Corporate Update on Proposed Solaris Exploration Spin-Out

Solaris continues to advance the proposed spin-out and has made considerable progress with the internal re-organization of the Company, its subsidiaries and mineral concessions including the transfer of its non-core assets held in Ecuador outside of the Warintza porphyry cluster (involving the authorization of the Ministry of Energy and Mines), Peru, Chile and Mexico into a newly incorporated wholly-owned subsidiary of Solaris named Solaris Exploration Inc. Following the internal re-organization, it is expected that 100% of the common shares of Solaris Exploration Inc. will be spun out to shareholders of Solaris relative to their shareholdings (refer to press release dated December 6, 2021).

Source: Solaris Resources

A full update from Warintza and the regional exploration program is as follows:

Warintza Update

Exploration activities at the Warintza Project continue with seven drill rigs targeting high value growth of the recently reported Warintza Mineral Resource Estimate (refer to press release dated April 18, 2022), with drilling at Warintza Central targeting extensions to near surface, high-grade mineralization, and major growth targeted from the expansion of drill coverage at Warintza East within a largely undrilled footprint. With the protests in Ecuador having concluded on June 30, the flow of samples from the Company’s core processing facility to its prep lab, which has now resumed operations, and onward for final assay in Lima has restarted, with a considerable backlog of assays pending.

Regional Exploration Update

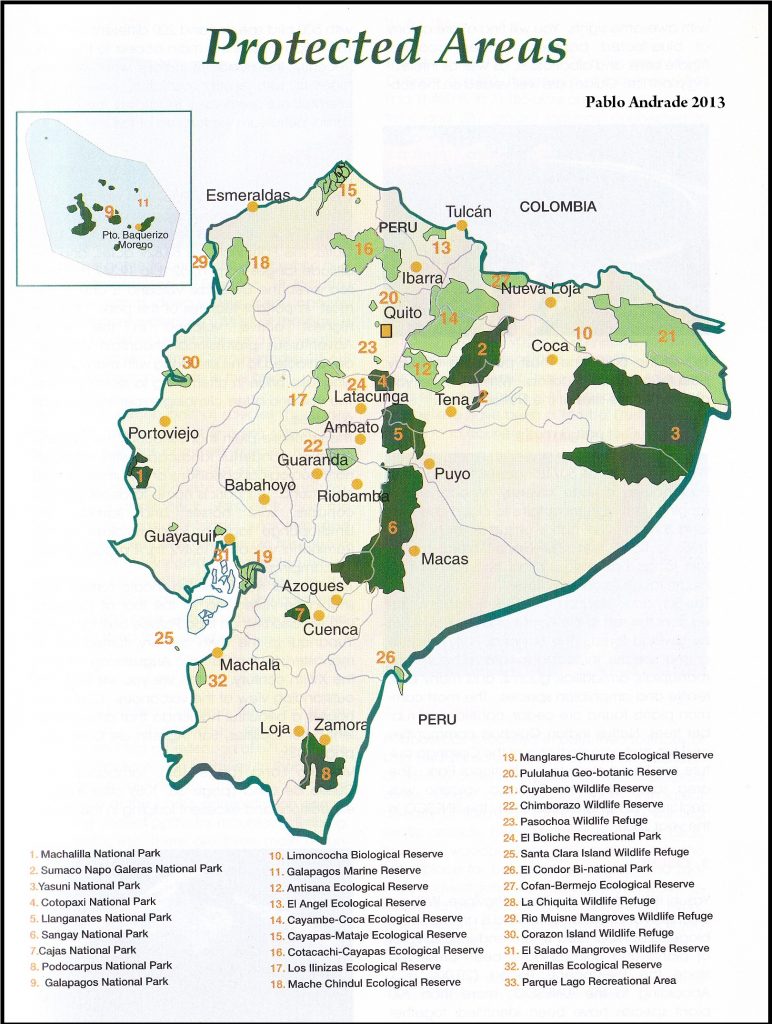

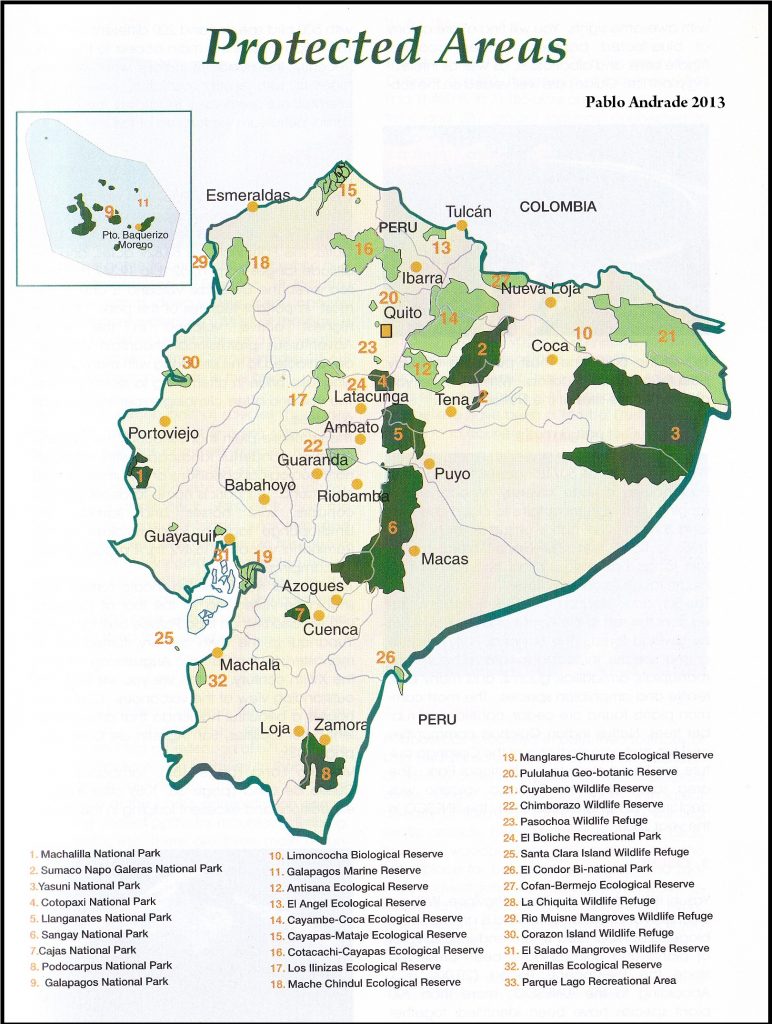

Solaris has undertaken the first significant program of regional exploration at Warintza since the original stream sediment sampling program that identified the Warintza porphyry cluster in the 1990s. This work has identified additional porphyry targets (refer to Figure 1), potentially expanding the footprint of the cluster to the northeast, and possibly a new area of porphyry emplacement to the west, approximately halfway to the adjacent San Carlos copper porphyry deposit.

In addition, this work has established a series of skarn targets, as well as a large high sulphidation epithermal target adjacent to the Warintza porphyry cluster where overlapping mineralized porphyries have intruded a layered sequence of carbonate and volcanic rocks that have provided a fertile setting to develop these styles of mineralization.

Porphyry Targets:

- Mateo: 3km x 1.4km area of copper-molybdenum enrichment in soil samples located approximately 5km to the east of Warintza East. A program of detailed mapping and sampling is underway to refine the target in support of drilling.

- Cora: 1.2km x 1.4km copper-molybdenum-gold soil anomaly in andesitic volcanic sequences cut by porphyry dikes approximately 3km to the northeast of Warintza East. This anomaly resembles those that defined the Warintza East and Warintza South discoveries. Detailed mapping and sampling are planned to refine the target in support of drilling.

- Medio Camino: 3.5km x 1.5km area of porphyry-related alteration, and copper-molybdenum veining 5km to the west of Warintza West and 7km east of the adjacent San Carlos copper porphyry deposit. An extensive program of soil and rock chip sampling has been completed to refine the large target area, with results pending.

Skarn Targets:

Five skarn targets have been identified with three of these forming a partial arc on the northeastern side of the Warintza porphyry cluster, which is typical of skarn mineralization related to porphyry systems.

- Playas and Justo: Extensive mineral alteration typical of skarn systems has been identified in an area of copper mineralization concentrated in a permeable horizon 3.5km northwest of Warintza West. Soil sampling of the 10km2 area surrounding the Justo target has been completed in an effort to refine the target, with results pending. Soil sampling is also planned at the Playas target, along with detailed mapping at both targets based on the results of soil sampling.

- Betty and Yawi: Betty, a 1.2km x 1.4km skarn and potential carbonate replacement target located 0.5km north of Warintza Central, features significant copper values in rock samples in carbonate horizons within volcano-sedimentary sequences. Within the Yawi target, a 2km x 1km skarn/carbonate replacement target features strongly anomalous zinc values in limited soil sampling within a high conductivity anomaly interpreted from ZTEM. Additional soil sampling is planned at both targets.

- La Celestina: Marble exposed in streams in this 1.7km x 1.2km area host copper-zinc veinlets that may represent leakage from a mineralized zone below, with soil geochemistry showing enrichment of pathfinder elements and anomalous copper. Two windows of garnet-bearing skarn containing copper mineralization are exposed through the marble. Detailed mapping and sampling of marble and exposed skarn are underway to help define drill targets.

High Sulphidation Epithermal Gold Target

- Caya: Large 5km x 3km gold anomaly in stream sediments, 6km to the northeast of Warintza East, where recent follow-up soil and rock sampling in the southern part of the anomaly has identified a flat-lying volcano-sedimentary layer that has a high permeability over at least 300m in thickness. In this portion of the anomaly, an area of 0.7km x 1.3km features anomalous gold, copper and pathfinder element values in soil and rock samples, and a concentration of dickite clay and vuggy silica, characteristic of high sulphidation systems.

Figure 1 – Regional Map of Solaris Land Package in Ecuador

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources (TSX:SLS) has announced an agreement with the Government of Ecuador that will secure the stability of its Warintza Project in southeastern Ecuador. The company has signed an Investment Protection Agreement that provides a foundation of certainty for the legal framework governing the Warintza Project. The agreement outlines further affirmation of stable mining regulations, security of title, and investment for the term of the agreement, on top of significant new tax incentives to accelerate development at the project.

Highlights from the agreement:

- The IPA provides a foundation of certainty with respect to the legal framework governing the Project, including stable mining regulations, security of title and investment, and new tax incentives to accelerate development

- 5% reduction of income tax, fixing the income tax rate at 20% (applicable to SLS), exemption from capital outflow tax, and exemption of all import duties for the import of goods needed for new investments

- Specific protections relate to the prohibition of all forms of confiscation, non-discriminatory treatment and equal playing field, legal security, tax stability and international arbitration

- IPA signing ceremony to take place with the Warints and Yawi communities at the Project in July. SLS recently amended its Impact and Benefits Agreement with these communities reaffirming their support for the responsible advancement of Warintza

Ms. Lorena Konanz, Vice Minister of Export and Investment Promotion of the Government of Ecuador, stated, “From day one, our administration has been focused on encouraging sustainable and transparent economic growth in Ecuador with incentives to facilitate major investments in the country. In the mining sector, our most important goal is to ensure that development is responsible, environmentally friendly, and socially-committed, as at the Warintza Project.”

Mr. Vicente Tsakimp, Coordinator of the Warintza Project Strategic Alliance, stated, “We are excited to be part of the successful advancement of Warintza and show the industry that it is possible to develop a mining project in a responsible and inclusive way. The people of Warints and Yawi welcome President Lasso’s approach which promotes the development of remote communities as this has had a direct impact on our families’ economy, living conditions and opportunities.”

Mr. Daniel Earle, President & CEO, commented, “President Lasso´s administration continues to take consequential action to accelerate the development of the formal mining sector in Ecuador. Its positive approach of regulatory reform and meaningful tax relief focused on major new projects like Warintza, which embrace responsible approaches to community development and environmental protection, will pay great dividends to the people of Ecuador for generations to come. We are humbled to operate in service of its vision.”

The agreement will include a 5% income tax reduction, fixing the total income tax rate applicable to Solaris Resources at 20%. There will also be an exemption from the capital outflow tax and all import duties for any import of goods needed for new investments in the Warintza project. The signing ceremony for the agreement will take place with the participation of the Warints and Yawi communities, two important community partners for the Warintza Project and Solaris, in the village of Warintza sometime in July 2022.

The other notable parts of the agreement are the specific protections related to the prohibition of all forms of confiscation, non-discriminatory treatment and equal playing field, legal security, tax stability, and international arbitration if there are any disputes about the Warintza Project. With countries like Peru experiencing upheaval in the mining industry and nationalization of resources and projects in Mexico, Ecuador and the communities of Warints and Yawi have shown that collaborative, collective work is not only possible, but the most beneficial form of business for all stakeholders.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has reported assay results from a series of holes at the Warintza Project. The drilling at the holes is aimed at upgrading and growing mineral resources at the project, which was recently released.

Mr. Jorge Fierro, Vice President, Exploration, commented in a press release: “Ongoing follow-up drilling from existing and newly constructed platforms aims to expand on the Northeast Extension zone and grow the high-grade indicative starter pit, while also targeting areas within Warintza Central where resource classification can be upgraded with targeted drilling. In addition, we have completed a considerable amount of drilling from our recent Warintza East discovery targeting major growth with assays pending.”

Highlights are listed below, with a corresponding image in Figure 1 and detailed results in Tables 1-2.

Northeast Extension

SLS-57 was collared at the northeastern limit of the Warintza Central grid and drilled northeast into an entirely open volume, returning 230m of 0.73% CuEq¹ from 56m depth within a broader interval of 926m of 0.61% CuEq¹ from surface, extending the zone 200m to the northeast where it remains open.

Additional drilling aimed at expanding the zone to the north from this platform and broadening the zone with holes from the platform located 200m to the west where SLS-48 returned 100m of 1.64% CuEq² from 50m depth within 852m of 0.56% CuEq² have been completed with assays pending.

The Northeast Extension zone is characterized by near surface, high-grade mineralization, and represents a priority target for growth of the ‘Indicative Starter Pit’ recently estimated at 180 Mt at 0.82% CuEq1 (Indicated) and 107 Mt at 0.73% CuEq1 (Inferred) within the Warintza Mineral Resource Estimate³ (“MRE”).

Warintza Central

A limited program of follow-up drilling at Warintza Central within the MRE envelope is aimed at upgrading targeted volumes that the geological model predicts hold potential for higher grades than the MRE reflects, as well as increasing the confidence of mineral resources in the Inferred category.

SLS-56 was collared from the southeastern portion of the grid and drilled east, returning 102m of 0.90% CuEq¹ from 48m depth within a broader interval aimed at adding definition to the southern portion of the overlap between the Warintza Central and Warintza East deposits.

SLS-60 was collared from the central portion of the grid and drilled south, returning 154m of 0.90% CuEq¹ from 70m depth within a broader interval of 829m of 0.58% CuEq¹ from 44m depth.

SLS-61 was collared from the south-central portion of the grid and drilled southwest, returning 930m of 0.77% CuEq¹ from surface, successfully infilling data in this area.

SLS-58 was collared from the south-central portion of the grid and drilled northeast into an area that the exploration model predicted could be upgraded, and successfully returned 741m of 0.62% CuEq¹ from 102m depth, improving on the grade modelled in this volume.

SLS-59 was collared from the southwestern portion of the grid and drilled northeast, returning 238m of 0.85% CuEq¹ from near surface within a broader interval of 511m of 0.73% CuEq¹ from surface.

Figure 1 – Plan View of Warintza Central Drilling Released to Date

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLS-61 | May 26, 2022 | 2 | 932 | 930 | 0.62 | 0.03 | 0.07 | 0.77 |

| SLS-60 | 44 | 873 | 829 | 0.50 | 0.01 | 0.04 | 0.58 | |

| Including | 70 | 224 | 154 | 0.81 | 0.02 | 0.05 | 0.90 | |

| SLS-59 | 2 | 513 | 511 | 0.54 | 0.04 | 0.07 | 0.73 | |

| Including | 34 | 272 | 238 | 0.67 | 0.03 | 0.08 | 0.85 | |

| SLS-58 | 102 | 843 | 741 | 0.48 | 0.03 | 0.06 | 0.62 | |

| SLS-57 | 0 | 926 | 926 | 0.49 | 0.02 | 0.08 | 0.61 | |

| Including | 56 | 286 | 230 | 0.59 | 0.03 | 0.08 | 0.73 | |

| SLS-56 | 48 | 606 | 558 | 0.33 | 0.01 | 0.03 | 0.38 | |

| Including | 48 | 150 | 102 | 0.80 | 0.02 | 0.04 | 0.90 |

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-61 | 800191 | 9648065 | 1573 | 967 | 255 | -72 |

| SLS-60 | 800258 | 9648097 | 1559 | 873 | 190 | -80 |

| SLS-59 | 799765 | 9648033 | 1571 | 513 | 65 | -70 |

| SLS-58 | 799942 | 9647932 | 1643 | 843 | 40 | -70 |

| SLS-57 | 800383 | 9648303 | 1412 | 964 | 40 | -71 |

| SLS-56 | 800126 | 9648032 | 1566 | 920 | 88 | -50 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

Endnotes

- Copper-equivalence calculated as: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t), utilizing metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au, and assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical test work.

- Refer to press release dated February 28, 2022. Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of US$3.00/lb Cu, US$10.00/lb Mo, and US$1,500/oz Au. No adjustments were made for recovery prior to the updated Warintza Mineral Resource Estimate, as the metallurgical data to allow for estimation of recoveries was not yet available. Solaris defined CuEq for reporting purposes only.

- Refer to Solaris press release dated April 18, 2022, stating updated Warintza Mineral Resource Estimate.

Source: Solaris Resources

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

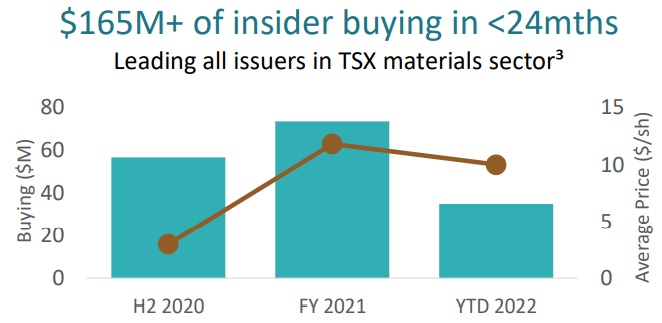

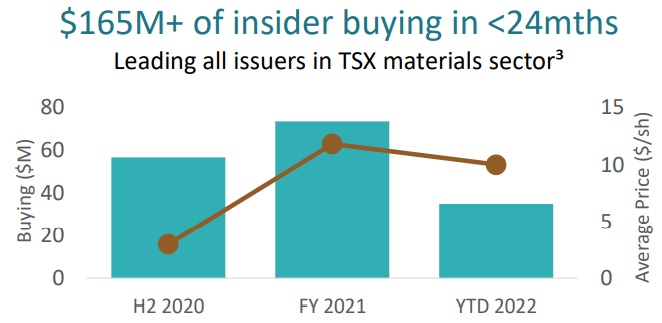

Solaris Resources (TSX:SLS) has had the highest insider buying for its industry group, leading all issuers in the TSX materials sector, and that rate continues to climb. The company has announced that it received about C$30.4 million from the exercise of common share purchase warrants. The company is now fully funded through to mid-2023 for its drill program at the Warintza Project in Ecuador.

Mr. Daniel Earle, President & CEO, commented in a press release: “With last year’s intensive resource drilling program at Warintza Central having established a voluminous mineral resource estimate and robust starter pit, we are now directing our efforts to immediate high-impact drilling aimed at expanding the starter pit in open extensions of near surface, high-grade mineralization at Warintza Central, expanding the minimally-drilled Warintza East discovery, and testing the potential of the nearby Warintza West discovery.”

The total insider buying has now crossed $170 million dollars in the past 24 months, as a portion of the warrants has been exercised by Solaris management. Executive Chairman Richard Warke is the main shareholder exercising the most warrants. In the second half of 2022 and the first half of 2023, more warrant expires will occur. Should holders choose to exercise all of them, the company would bring in another C$54.1 million, with approximately 63% of the still outstanding warrants held by management.

A recent mineral resource update for Warintza Central showed in-pit resources of 579 Mt at 0.59% CuEq (Ind) and 887 Mt at 0.47% CuEq (Inf). This also includes an ‘indicative starter pit’ of 180 Mt at 0.82% CuEq (Ind) & 107 Mt at 0.73% CuEq (Inf). Additionally, the company is now targeting high-grade extensions and major growth in cluster. Warintza East and Warintza West will now become the focus for the company as it advances its flagship project.

Highlights from the Warintza Central mineral resource update are as follows:

- In-Pit Indicated mineral resources of 579 million tonnes (“Mt”) at 0.59% copper equivalent¹ (“CuEq”) and Inferred mineral resources of 887 Mt at 0.47% CuEq¹ above a 0.3% CuEq cut-off grade

- Includes ‘Indicative Starter Pit’ comprised of Indicated mineral resources of 180 Mt at 0.82% CuEq² and Inferred mineral resources of 107 Mt at 0.73% CuEq² above 0.6% CuEq cut-off grade

- High Quality – Expected low strip ratio ‘Indicative Starter Pit’ and ultimate pit, zoned from high-grade at surface to low grade at depth, consistent, clean sulphide mineralogy free of deleterious elements

- High-Grade Growth – Ongoing drilling focused on open extensions of near surface, high-grade mineralization to the northeast and southeast of Warintza Central

- ‘Super Pit’ Growth – Warintza Central pit shell includes overlapping portion of Warintza East, discovered mid-2021, a target wide open for major growth potential within a shared pit

- Cluster Potential – Warintza Central forms part of a 7km x 5km cluster of porphyry deposits, where in addition to East, recent discoveries at West and South offer major growth potential

- Structural Advantages – Set within mining district featuring access to highway, abundant and low-cost hydroelectric power, fresh water, labour and low elevation

Source: Solaris Resources

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

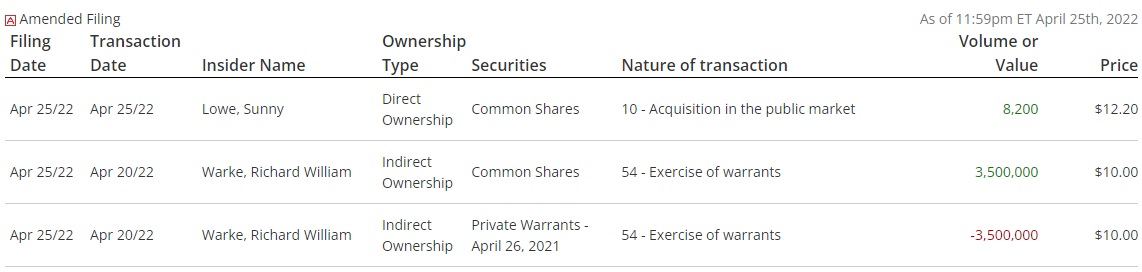

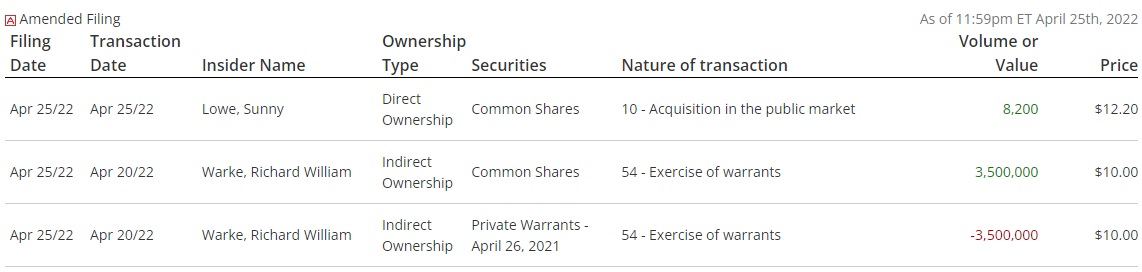

Insider buying at Solaris Resources (TSX:SLS) continues to show a large amount of stock being purchased throughout the last two years. On April 20, 2022, Richard Warke, Executive Chairman, bought C$35 million of Solaris stock through the exercise of 3,500,000 warrants. Warrants were set at $10 to buy 5 million shares of Solaris Resources from Equinox Gold. The warrants would have expired on April 26th, 2022.

Christian Milau, CEO of Equinox Gold, stated: “As a strategic and supportive shareholder, Equinox Gold is pleased to accommodate Solaris in this transaction, which benefits both companies. The proceeds from this sale will further strengthen Equinox Gold’s already solid balance sheet as we continue to execute on our expansion and growth objectives.”

A recent mineral resource update and the ongoing success of the drill program at Warintza may have insiders optimistic about the future of the company since they have been net buyers of shares since the IPO. The total insider shareholding of any given company gives investors an overall view of whether management and other inside investors are aligned with other shareholders.

Sunny Lowe, CFO of Solaris Resources (TSX:SLS), also purchased approximately C$100K in Solaris shares on the open market on Monday, April 25th, 2022. Total insider investment has reached over C$165 million in less than 24 months now, demonstrating a significant amount of confidence in the company by those in charge of its success. In the TSX materials sector, this places Solaris Resources (TSX:SLS) in the lead for insider buying. The company has seen strong interest in the stock since its IPO, up nearly 700%.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

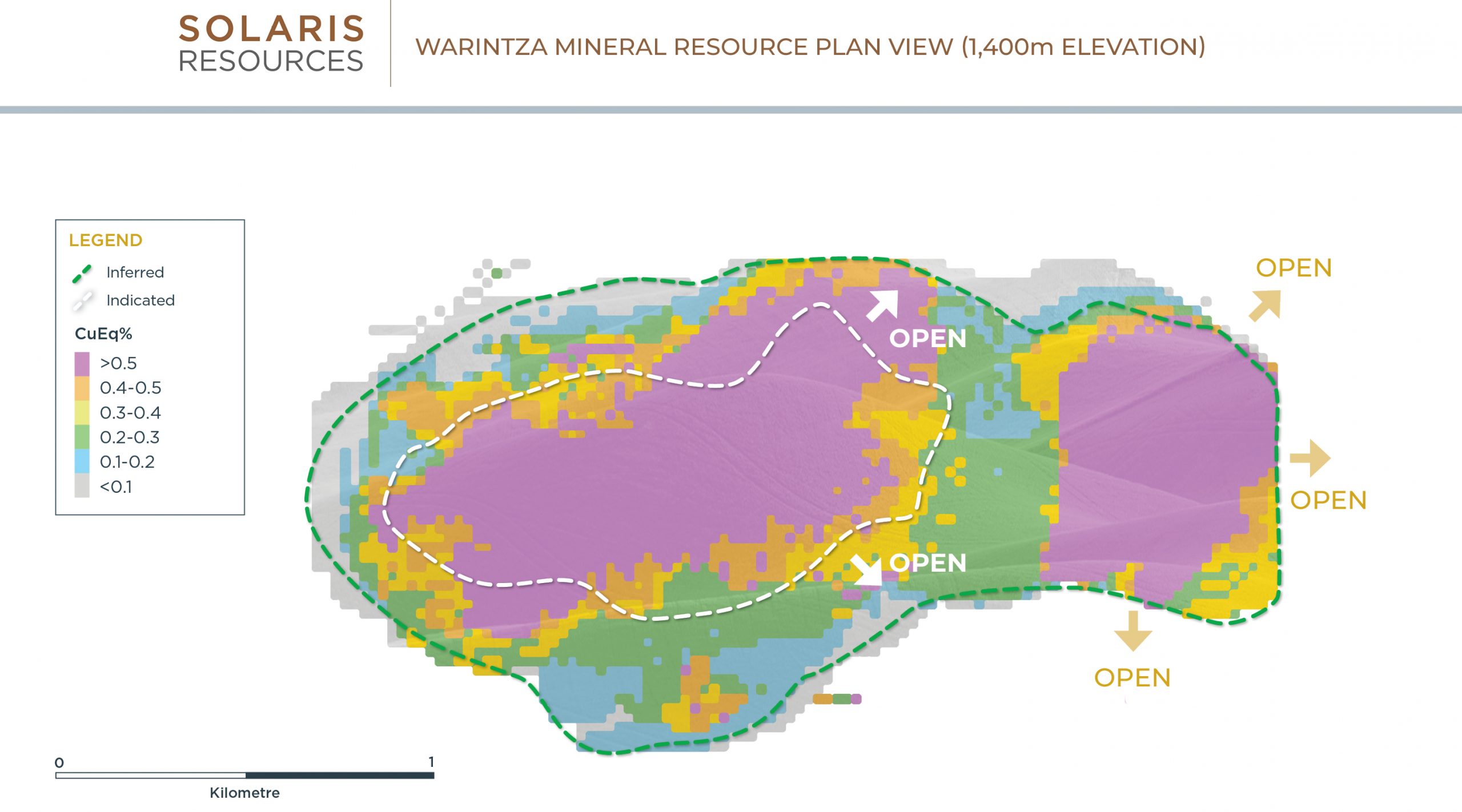

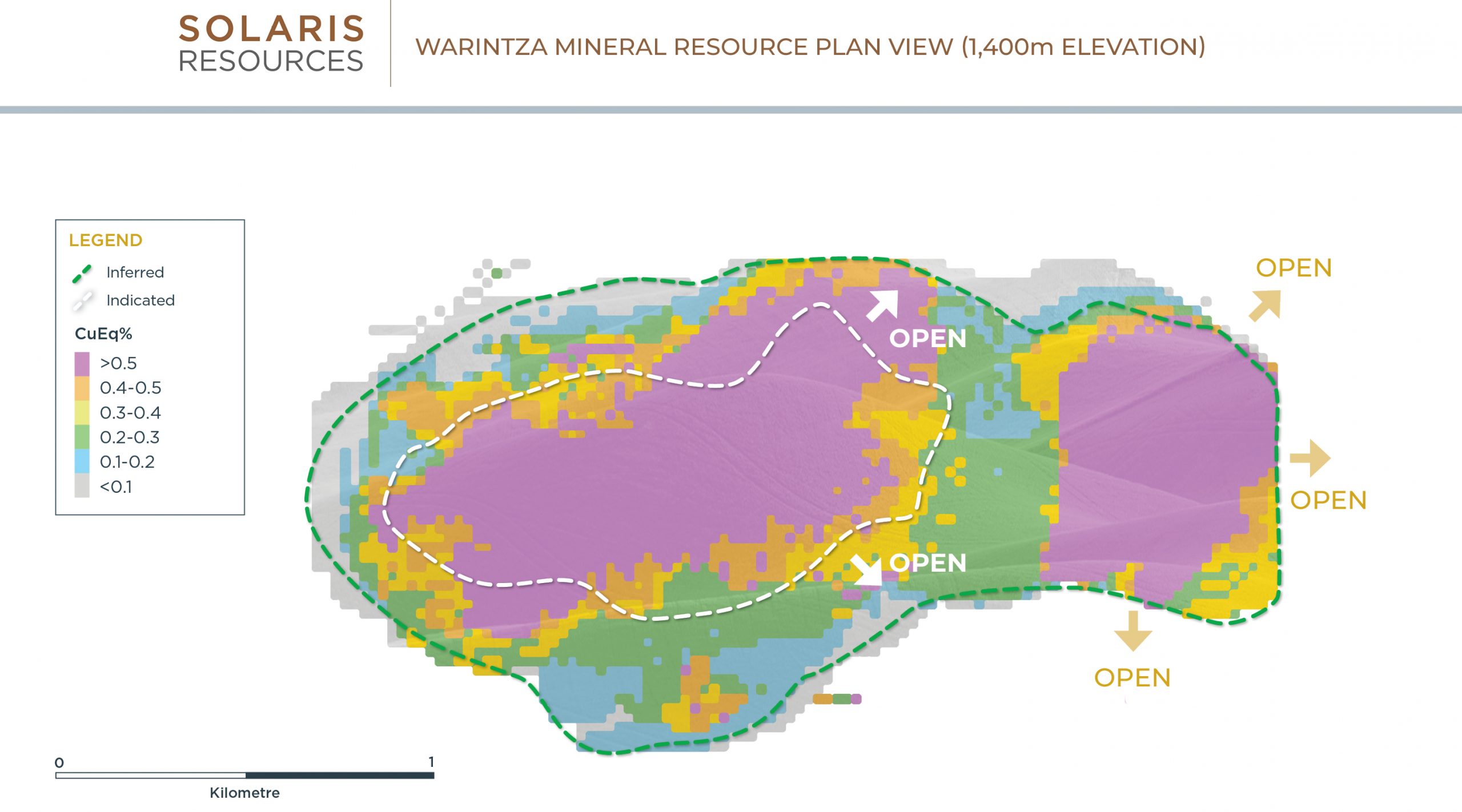

Solaris Resources (TSX:SLS) (OTC:SLSSF) has announced a highly-anticipated mineral resource update to Warintza Central at the Warintza Project in Ecuador. The company reported in-pit resources of 579 Mt at 0.59% CuEq (Ind) & 887 Mt at 0.47% CuEq (Inf). This also includes an ‘indicative starter pit’ of 180 Mt at 0.82% CuEq (Ind) & 107 Mt at 0.73% CuEq (Inf). Additionally, the company is now targeting high-grade extensions and major growth in cluster.

Daniel Earle, President & CEO of Solaris Resources, commented in a press release: “After only eighteen months of drilling, primarily in Warintza Central, one of the four major discoveries made on the property to date, the MRE establishes baseline credentials for the Project of hosting a robust inventory, featuring a high-grade indicative starter pit and low strip ratio, within a mining district offering major structural advantages from highway access, abundant and low-cost hydroelectric power, fresh water, labour and low elevation. Ongoing drilling is targeting further rapid growth, with an emphasis on the open extensions of near surface, high-grade mineralization at Warintza Central and expanding our recent Warintza East discovery to include it within a shared pit, while testing the further potential within the cluster.”

Highlights from the mineral resource update are as follows:

Highlights

- In-Pit Indicated mineral resources of 579 million tonnes (“Mt”) at 0.59% copper equivalent¹ (“CuEq”) and Inferred mineral resources of 887 Mt at 0.47% CuEq¹ above a 0.3% CuEq cut-off grade

- Includes ‘Indicative Starter Pit’ comprised of Indicated mineral resources of 180 Mt at 0.82% CuEq² and Inferred mineral resources of 107 Mt at 0.73% CuEq² above 0.6% CuEq cut-off grade

- High Quality – Expected low strip ratio ‘Indicative Starter Pit’ and ultimate pit, zoned from high-grade at surface to low grade at depth, consistent, clean sulphide mineralogy free of deleterious elements

- High-Grade Growth – Ongoing drilling focused on open extensions of near surface, high-grade mineralization to the northeast and southeast of Warintza Central

- ‘Super Pit’ Growth – Warintza Central pit shell includes overlapping portion of Warintza East, discovered mid-2021, a target wide open for major growth potential within a shared pit

- Cluster Potential – Warintza Central forms part of a 7km x 5km cluster of porphyry deposits, where in addition to East, recent discoveries at West and South offer major growth potential

- Structural Advantages – Set within mining district featuring access to highway, abundant and low-cost hydroelectric power, fresh water, labour and low elevation

Table 1: Warintza Mineral Resource Estimate Summary and Cut-Off Grade Sensitivity

| Cut-off | Category | Tonnage | Grade | Contained Metal | |||||||

| CuEq (%) |

(Mt) | CuEq (%) |

Cu (%) |

Mo (%) |

Au (g/t) |

CuEq (Mt) |

Cu (Mt) |

Mo (Mt) |

Au (Moz) |

||

| 0.2 | % | Indicated | 736 | 0.52 | 0.40 | 0.02 | 0.05 | 3.84 | 2.95 | 0.18 | 1.11 |

| Inferred | 1,558 | 0.37 | 0.31 | 0.01 | 0.03 | 5.80 | 4.80 | 0.19 | 1.63 | ||

| 0.3% (Base) | Indicated | 579 | 0.59 | 0.47 | 0.03 | 0.05 | 3.45 | 2.70 | 0.15 | 0.93 | |

| Inferred | 887 | 0.47 | 0.39 | 0.01 | 0.04 | 4.17 | 3.48 | 0.13 | 1.08 | ||

| 0.4 | % | Indicated | 442 | 0.67 | 0.54 | 0.03 | 0.05 | 2.97 | 2.38 | 0.12 | 0.77 |

| Inferred | 539 | 0.55 | 0.47 | 0.01 | 0.04 | 2.96 | 2.53 | 0.08 | 0.71 | ||

| ‘Indicative Starter Pit’ | |||||||||||

| 0.6 | % | Indicated | 180 | 0.82 | 0.67 | 0.03 | 0.07 | 1.49 | 1.20 | 0.06 | 0.38 |

| Inferred | 107 | 0.73 | 0.64 | 0.02 | 0.05 | 0.79 | 0.69 | 0.02 | 0.17 | ||

Notes to Table 1:

- The mineral resource estimates are reported in accordance with the CIM Definition Standards for Mineral Resources & Mineral Reserves, adopted by CIM Council May 10, 2014.

- Reasonable prospects for eventual economic extraction assume open-pit mining with conventional flotation processing and were tested using NPV Scheduler™ pit optimization software with the following assumptions: metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au; operating costs of US$1.50/t + US$0.02/t per bench for mining, US$4.50/t milling, US$0.90/t G&A; recoveries of 90% Cu, 85% Mo, and 70% Au.

- Resource includes grade capping and internal dilution. Grade was interpolated by ordinary kriging populating a block model with block dimensions of 25m x 25m x 15m.

- The ‘Indicative Starter Pit’ is based on the same assumptions as the Resource except utilized metal prices of US$1.00/lb Cu, US$7.50/lb Mo, and US$750/oz Au. No economic analysis has been completed by the Company and there is no guarantee than an ‘Indicative Starter Pit’ will be realized or prove to be economic.

- Mineral resources that are not mineral reserves do not have demonstrated economic viability.

- Copper equivalent assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical testwork, and metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au. CuEq formula: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t).

- The Qualified Person is Mario E. Rossi, FAusIMM,RM-SME, Principal Geostatistician of Geosystems International Inc.

- All figures are rounded to reflect the relative accuracy of the estimate.

- The effective date of the mineral resource estimate is April 1, 2022.

The corresponding Technical Report disclosing the MRE in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) will be prepared by Mr. Rossi and available on SEDAR under the Company’s profile at www.sedar.com within 45 days of this news release.

- Copper equivalent assumes recoveries of 90% Cu, 85% Mo, and 70% Au based on preliminary metallurgical testwork, and metal prices of US$3.50/lb Cu, US$15.00/lb Mo, and US$1,500/oz Au. CuEq formula: CuEq (%) = Cu (%) + 4.0476 × Mo (%) + 0.487 × Au (g/t).

- The Company anticipates that a near surface, high grade portion of the Resource may form the basis of an ‘Indicative Starter Pit’ once an economic analysis of the Project is complete. No economic analysis has been completed by the Company and there is no guarantee an ‘Indicative Starter Pit’ will be realized or prove to be economic. The ‘Indicative Starter Pit’ is based on the same assumptions as the Resource except utilized metal prices of US$1.00/lb Cu, US$7.50/lb Mo, and US$750/oz Au.

Resource Estimation Methodology and Parameters

Indicated mineral resources were defined where the nominal drill hole spacing is 120m. The classification reflects not only the drill spacing, but the confidence level in the continuity of the grade and the geometry of the deposit. Inferred mineral resources were defined by blocks which were estimated with less stringent requirements within search ellipses defined for each domain to a maximum distance of 350m. Resources include grade capping and internal dilution. Grade was interpolated by ordinary kriging populating a block model with block dimensions of 25m x 25m x 15m. The Indicated and Inferred mineral resources are classified in a manner that is consistent with the May 10, 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. In Mr. Rossi’s opinion, there are currently no relevant factors or legal, political, environmental, or other risks that could materially affect the potential development of the mineral resources.

Source: Solaris Resources

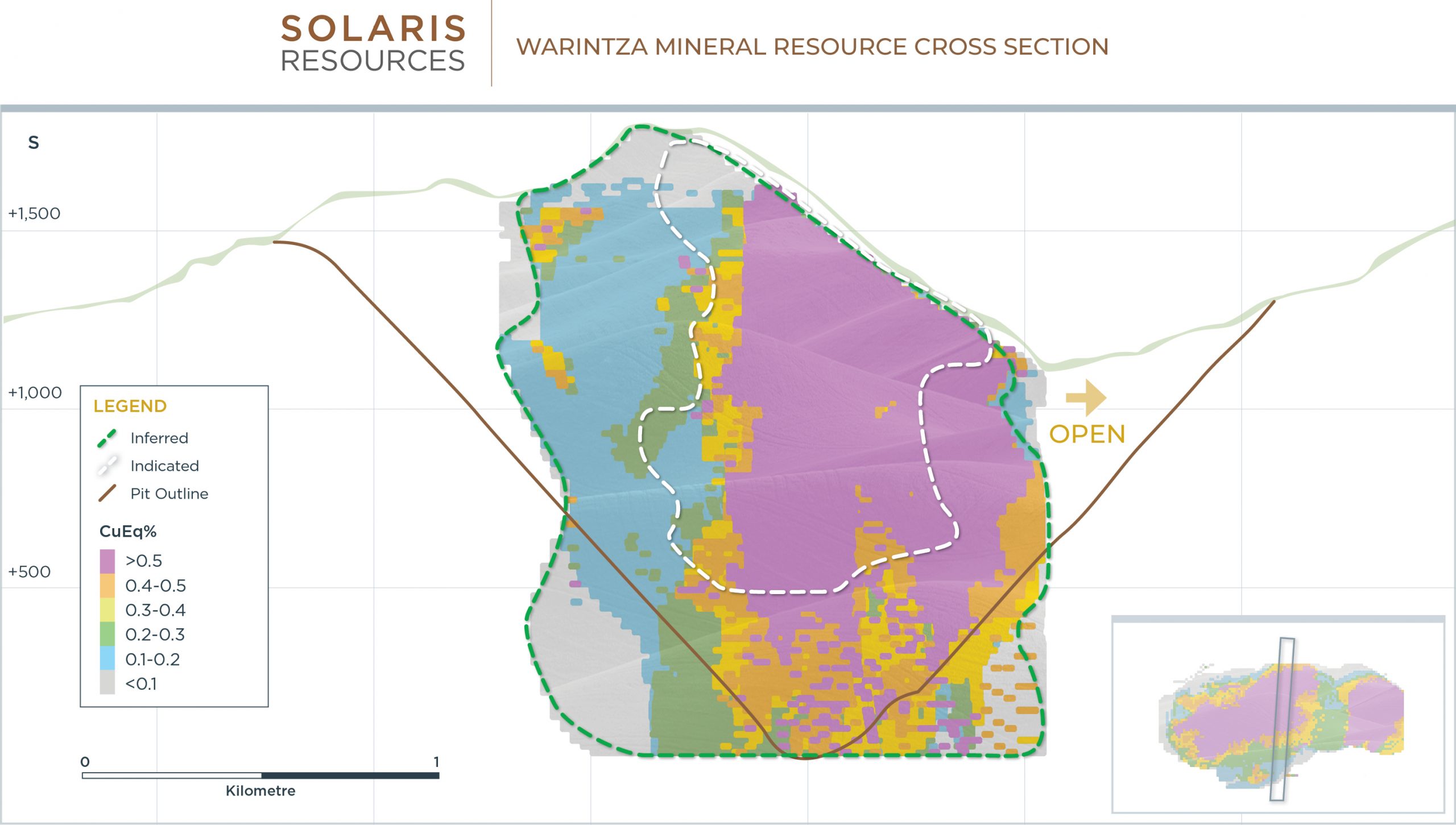

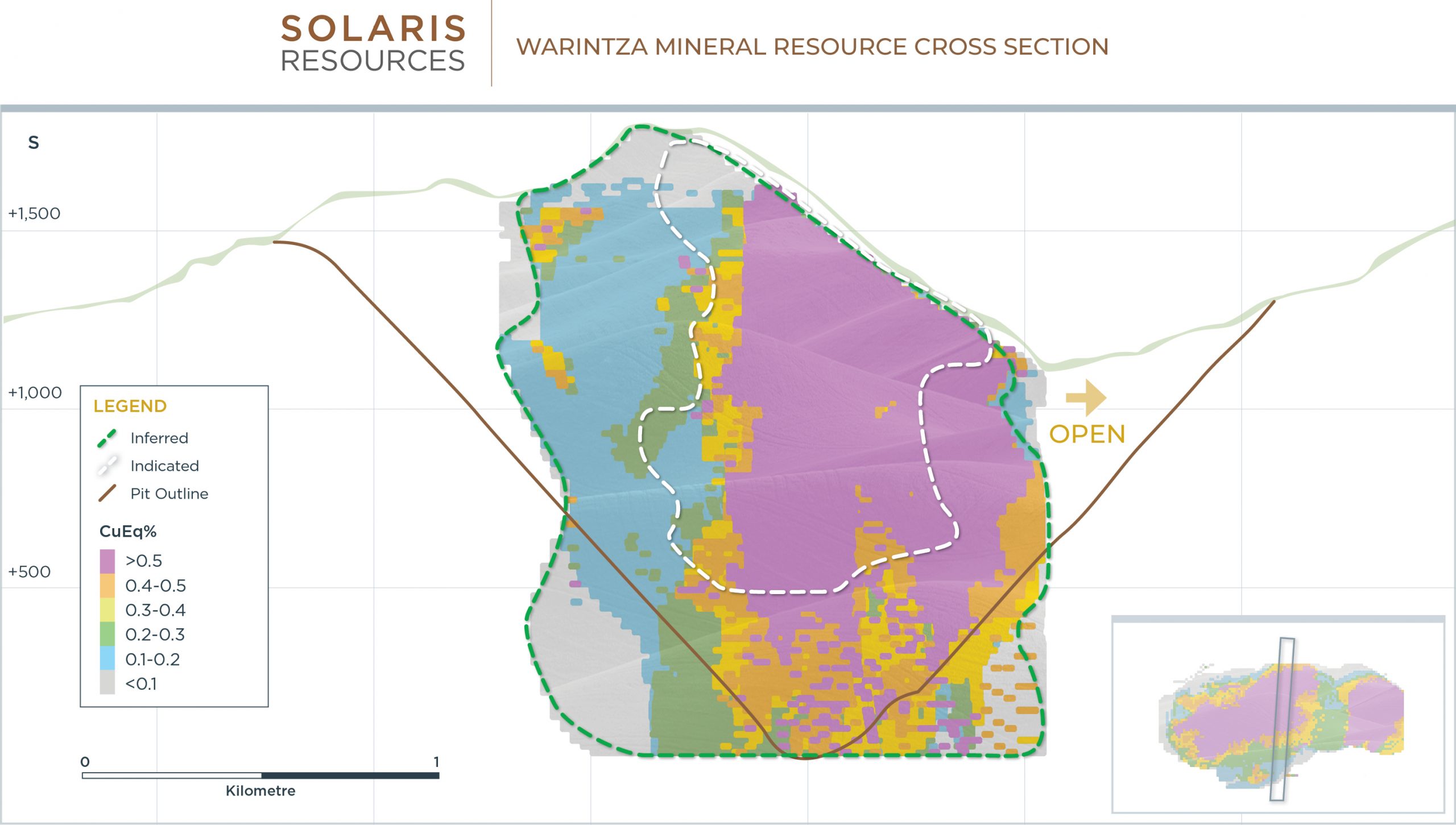

Figure 1 – Warintza Mineral Resource Plan View (1,400m Elevation)

Figure 2 – Warintza Mineral Resource Long Section

Figure 3 – Warintza Mineral Resource Cross Section

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

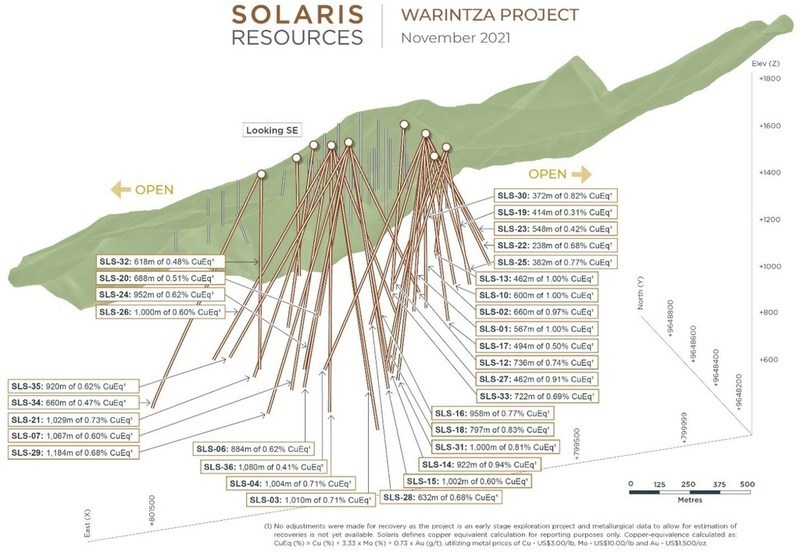

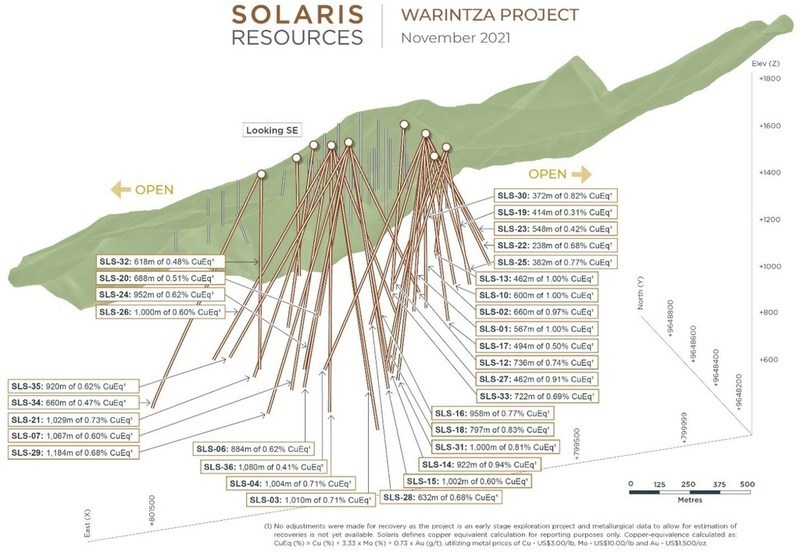

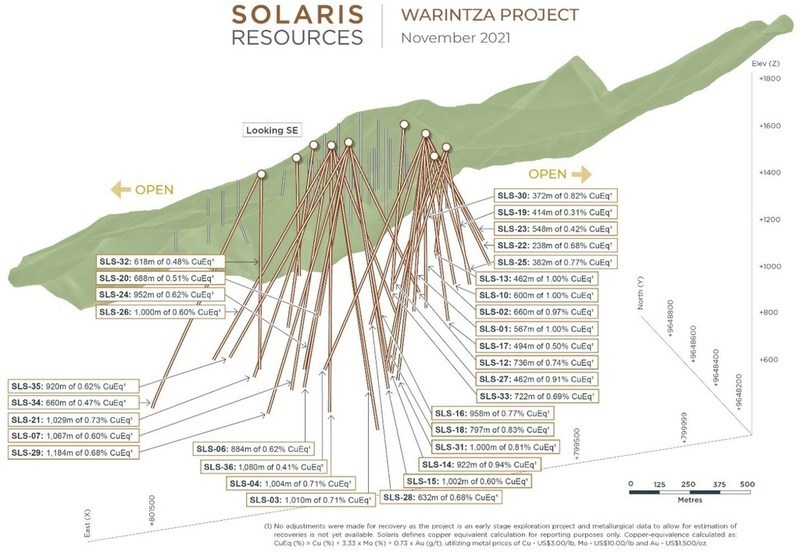

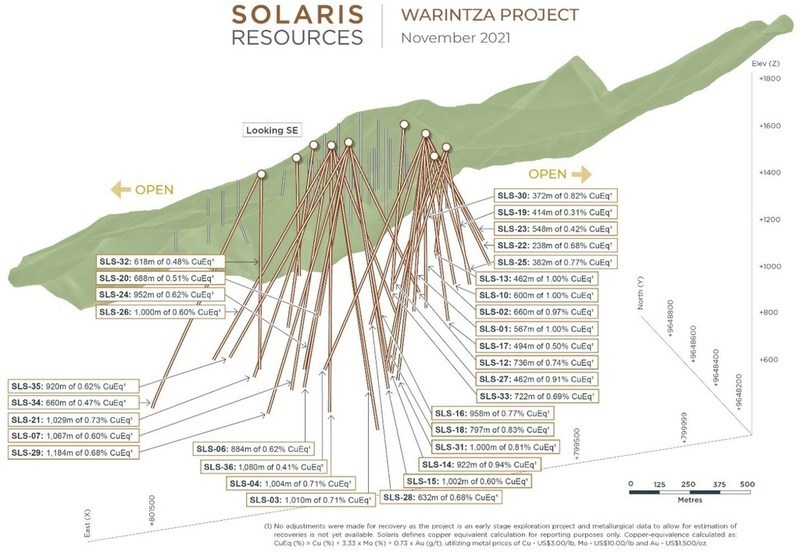

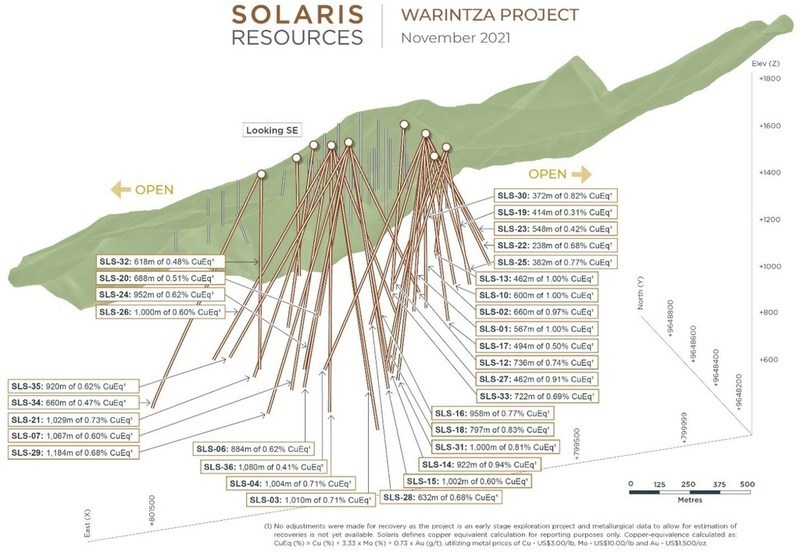

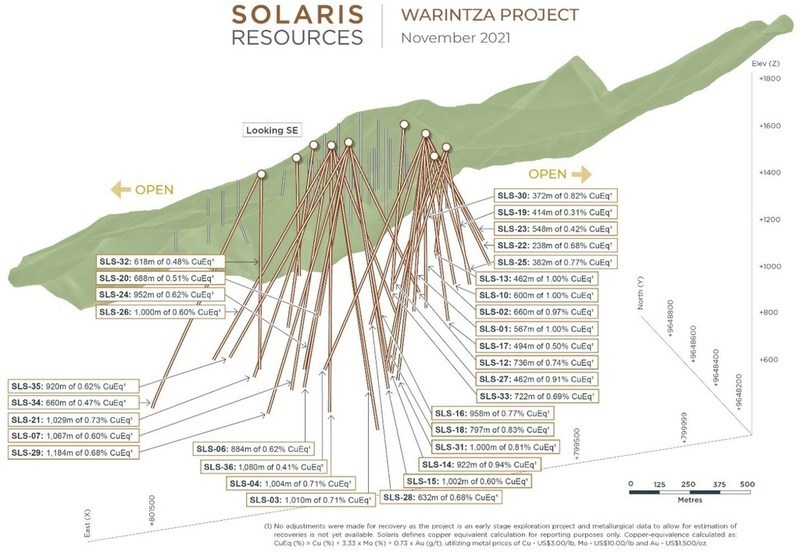

Solaris Resources (TSX:SLS) (OTC:SLSSF) has reported assay results from additional holes at Warintza Project as part of its mineral resources growth drilling. The company also recently added to near-surface, high-grade northeast and southeast extension. Solaris has said that the extension to the northeast and southeast are not priority targets and therefore will be targeted for further growth through step-out drilling.

Highlights from drilling are as follows:

Key Takeaways

Since the discovery of Warintza East in mid-2021, approximately 1km east of Warintza Central, limited drilling has been completed on the open area between the two deposits that would fall into the eastern sector of the conceptual pit design for Warintza Central as uncategorized waste – these results now establish continuity of mineralization between the two deposits with Warintza East remaining entirely open and undrilled to the north, south and east for future potential growth

- SLSE-06 was collared from the original platform in the middle of Warintza East and drilled west-northwest into an entirely open volume, returning 484m of 0.42% CuEq¹ from surface

- SLSE-08 was collared from the same platform and drilled northwest into an open volume, returning 142m of 0.65% CuEq¹ from near surface within a broader interval of 536m of 0.43% CuEq¹ from surface

- SLSE-04 was collared between Warintza Central and Warintza East and drilled west-southwest into a partially open volume, returning 616m of 0.63% CuEq¹ from 276m depth within a broader interval of 892m of 0.50% CuEq¹ from surface, establishing the overlap of the two deposits within the Warintza Central pit shell

- SLSE-03 was collared from the same platform and drilled west-northwest into a partially open volume, returning 326m of 0.62% CuEq¹ from 276m depth within a broader interval of 818m of 0.38% CuEq¹ from 38m depth, further confirming the overlap of the two deposits

- SLSE-05, collared from the same platform, was drilled north-northwest into a partially open area, returning 268m of 0.53% CuEq¹ from 446m depth within a broader interval of 714m of 0.32% CuEq¹ from surface

Updated Warintza Central Mineral Resource Estimate expected to be issued in April

To date, 62 holes have been completed at Warintza Central with assays reported for 54 of these and 8 holes have been completed at Warintza East with results reported for all holes

Mr. Jorge Fierro, Vice President, Exploration, commented: “Following the final Warintza Central results released April 4, these results represent the final holes from Warintza East to be included in the forthcoming mineral resource update, and serve to convert what would otherwise be uncategorized waste within the expected pit shell in the area where Warintza Central and Warintza East overlap.”

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) | ||

| SLSE-08 | Apr 11, 2022 | 8 | 544 | 536 | 0.35 | 0.02 | 0.04 | 0.43 | ||

| Including | 18 | 160 | 142 | 0.56 | 0.01 | 0.06 | 0.65 | |||

| SLSE-07 | 632 | 1069 | 437 | 0.29 | 0.02 | 0.04 | 0.37 | |||

| SLSE-06 | 0 | 484 | 484 | 0.33 | 0.02 | 0.04 | 0.42 | |||

| SLSE-05 | 0 | 714 | 714 | 0.26 | 0.01 | 0.05 | 0.32 | |||

| Including | 446 | 714 | 268 | 0.42 | 0.02 | 0.08 | 0.53 | |||

| SLSE-04 | 0 | 892 | 892 | 0.43 | 0.01 | 0.04 | 0.50 | |||

| Including | 276 | 892 | 616 | 0.54 | 0.02 | 0.04 | 0.63 | |||

| SLSE-03 | 38 | 856 | 818 | 0.29 | 0.02 | 0.03 | 0.38 | |||

| Including | 276 | 602 | 326 | 0.48 | 0.03 | 0.05 | 0.62 | |||

| SLS-54 | Apr 4, 2022 | 0 | 1093 | 1093 | 0.45 | 0.02 | 0.04 | 0.56 | ||

| Including | 50 | 406 | 356 | 0.62 | 0.02 | 0.05 | 0.73 | |||

| SLS-53 | 10 | 967 | 957 | 0.39 | 0.01 | 0.03 | 0.46 | |||

| Including | 16 | 192 | 176 | 0.65 | 0.03 | 0.04 | 0.78 | |||

| SLS-52 | 42 | 1019 | 977 | 0.39 | 0.01 | 0.03 | 0.45 | |||

| Including | 96 | 578 | 482 | 0.55 | 0.01 | 0.03 | 0.62 | |||

| SLS-51 | 36 | 1048 | 1012 | 0.38 | 0.01 | 0.06 | 0.47 | |||

| Including | 130 | 1048 | 918 | 0.41 | 0.01 | 0.05 | 0.50 | |||

| SLS-50 | 336 | 458 | 122 | 0.14 | 0.04 | 0.03 | 0.30 | |||

| SLS-49 | Feb 28, 2022 | 50 | 867 | 817 | 0.50 | 0.02 | 0.04 | 0.60 | ||

| SLS-48 | 50 | 902 | 852 | 0.45 | 0.02 | 0.05 | 0.56 | |||

| SLS-47 | 48 | 859 | 811 | 0.41 | 0.02 | 0.05 | 0.51 | |||

| SLS-46 | 48 | 680 | 632 | 0.27 | 0.01 | 0.03 | 0.31 | |||

| SLS-45 | 44 | 608 | 564 | 0.37 | 0.01 | 0.03 | 0.41 | |||

| SLS-44 | 6 | 524 | 518 | 0.16 | 0.05 | 0.03 | 0.35 | |||

| SLS-43 | 138 | 350 | 212 | 0.17 | 0.03 | 0.03 | 0.30 | |||

| SLS-42 | 52 | 958 | 906 | 0.42 | 0.02 | 0.06 | 0.53 | |||

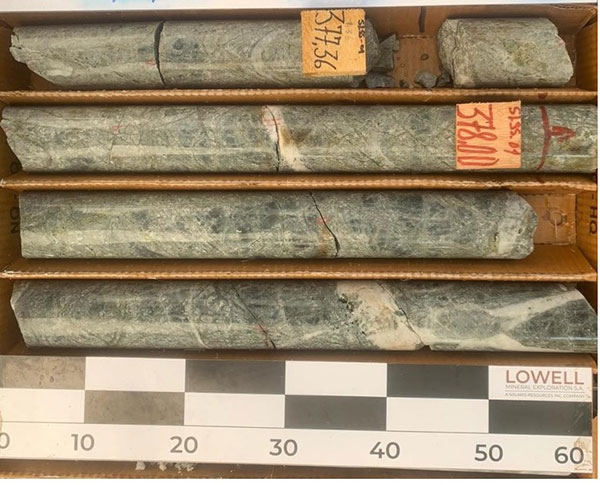

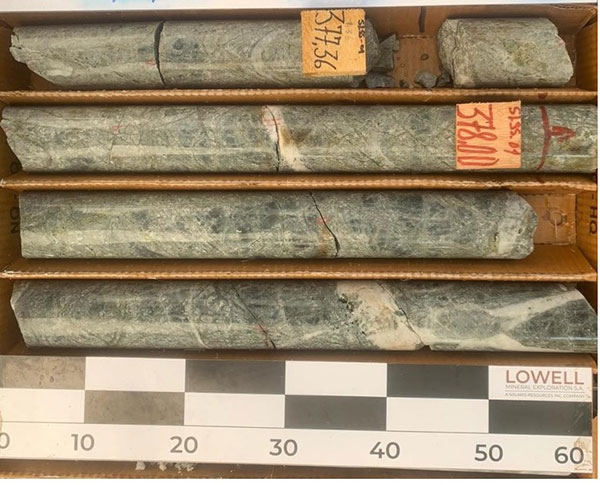

| SLSS-01 | Jan 18, 2022 | 0 | 755 | 755 | 0.28 | 0.02 | 0.02 | 0.36 | ||

| SLS-41 | Dec 14, 2021 | 0 | 592 | 592 | 0.42 | 0.02 | 0.06 | 0.52 | ||

| SLS-40 | 8 | 1056 | 1048 | 0.39 | 0.01 | 0.03 | 0.46 | |||

| SLS-39 | 28 | 943 | 915 | 0.49 | 0.01 | 0.04 | 0.56 | |||

| SLS-38 | 58 | 880 | 822 | 0.28 | 0.01 | 0.05 | 0.35 | |||

| SLS-37 | 28 | 896 | 868 | 0.39 | 0.05 | 0.05 | 0.58 | |||

| SLS-36 | Nov 15, 2021 | 2 | 1082 | 1080 | 0.33 | 0.01 | 0.04 | 0.41 | ||

| SLS-35 | 48 | 968 | 920 | 0.53 | 0.02 | 0.04 | 0.62 | |||

| SLS-34 | Oct 25, 2021 | 52 | 712 | 660 | 0.36 | 0.02 | 0.06 | 0.47 | ||

| SLS-33 | 40 | 762 | 722 | 0.55 | 0.03 | 0.05 | 0.69 | |||

| SLSE-02 | 0 | 1160 | 1160 | 0.20 | 0.01 | 0.04 | 0.25 | |||

| SLS-32 | Oct 12, 2021 | 0 | 618 | 618 | 0.38 | 0.02 | 0.05 | 0.48 | ||

| SLS-31 | 8 | 1008 | 1000 | 0.68 | 0.02 | 0.07 | 0.81 | |||

| SLS-30 | 2 | 374 | 372 | 0.57 | 0.06 | 0.06 | 0.82 | |||

| SLSE-01 | Sep 27, 2021 | 0 | 1213 | 1213 | 0.21 | 0.01 | 0.03 | 0.28 | ||

| SLS-29 | Sep 7, 2021 | 6 | 1190 | 1184 | 0.58 | 0.02 | 0.05 | 0.68 | ||

| SLS-28 | 6 | 638 | 632 | 0.51 | 0.04 | 0.06 | 0.68 | |||

| SLS-27 | 22 | 484 | 462 | 0.70 | 0.04 | 0.08 | 0.91 | |||

| SLS-26 | July 7, 2021 | 2 | 1002 | 1000 | 0.51 | 0.02 | 0.04 | 0.60 | ||

| SLS-25 | 62 | 444 | 382 | 0.62 | 0.03 | 0.08 | 0.77 | |||

| SLS-24 | 10 | 962 | 952 | 0.53 | 0.02 | 0.04 | 0.62 | |||

| SLS-19 | 6 | 420 | 414 | 0.21 | 0.01 | 0.06 | 0.31 | |||

| SLS-23 | May 26, 2021 | 10 | 558 | 548 | 0.31 | 0.02 | 0.06 | 0.42 | ||

| SLS-22 | 86 | 324 | 238 | 0.52 | 0.03 | 0.06 | 0.68 | |||

| SLS-21 | 2 | 1031 | 1029 | 0.63 | 0.02 | 0.04 | 0.73 | |||

| SLS-20 | April 19, 2021 | 18 | 706 | 688 | 0.35 | 0.04 | 0.05 | 0.51 | ||

| SLS-18 | 78 | 875 | 797 | 0.62 | 0.05 | 0.06 | 0.83 | |||

| SLS-17 | 12 | 506 | 494 | 0.39 | 0.02 | 0.06 | 0.50 | |||

| SLS-16 | Mar 22, 2021 | 20 | 978 | 958 | 0.63 | 0.03 | 0.06 | 0.77 | ||

| SLS-15 | 2 | 1231 | 1229 | 0.48 | 0.01 | 0.04 | 0.56 | |||

| SLS-14 | 0 | 922 | 922 | 0.79 | 0.03 | 0.08 | 0.94 | |||

| SLS-13 | Feb 22, 2021 | 6 | 468 | 462 | 0.80 | 0.04 | 0.09 | 1.00 | ||

| SLS-12 | 22 | 758 | 736 | 0.59 | 0.03 | 0.07 | 0.74 | |||

| SLS-11 | 6 | 694 | 688 | 0.39 | 0.04 | 0.05 | 0.57 | |||

| SLS-10 | 2 | 602 | 600 | 0.83 | 0.02 | 0.12 | 1.00 | |||

| SLS-09 | 122 | 220 | 98 | 0.60 | 0.02 | 0.04 | 0.71 | |||

| SLSW-01 | Feb 16, 2021 | 32 | 830 | 798 | 0.25 | 0.02 | 0.02 | 0.31 | ||

| SLS-08 | Jan 14, 2021 | 134 | 588 | 454 | 0.51 | 0.03 | 0.03 | 0.62 | ||

| SLS-07 | 0 | 1067 | 1067 | 0.49 | 0.02 | 0.04 | 0.60 | |||

| SLS-06 | Nov 23, 2020 | 8 | 892 | 884 | 0.50 | 0.03 | 0.04 | 0.62 | ||

| SLS-05 | 18 | 936 | 918 | 0.43 | 0.01 | 0.04 | 0.50 | |||

| SLS-04 | 0 | 1004 | 1004 | 0.59 | 0.03 | 0.05 | 0.71 | |||

| SLS-03 | Sep 28, 2020 | 4 | 1014 | 1010 | 0.59 | 0.02 | 0.10 | 0.71 | ||

| SLS-02 | 0 | 660 | 660 | 0.79 | 0.03 | 0.10 | 0.97 | |||

| SLS-01 | Aug 10, 2020 | 1 | 568 | 567 | 0.80 | 0.04 | 0.10 | 1.00 | ||

| Notes to table: True widths cannot be determined at this time. | ||||||||||

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLSE-08 | 801485 | 9648192 | 1170 | 959 | 305 | -70 |

| SLSE-07 | 800749 | 9648146 | 1282 | 1069 | 84 | -50 |

| SLSE-06 | 801485 | 9648192 | 1170 | 1078 | 285 | -55 |

| SLSE-05 | 800749 | 9648146 | 1282 | 737 | 330 | -65 |

| SLSE-04 | 800749 | 9648146 | 1282 | 893 | 257 | -45 |

| SLSE-03 | 800749 | 9648146 | 1282 | 909 | 270 | -45 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

(1) No adjustments were made for recovery as the project is an early-stage exploration project and metallurgical data to allow for estimation of recoveries is not yet available. Solaris defines copper equivalent calculation for reporting purposes only. Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of Cu – US$3.00/lb, Mo – US$10.00/lb and Au – US$1,500/oz.

Source: Solaris Resources

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

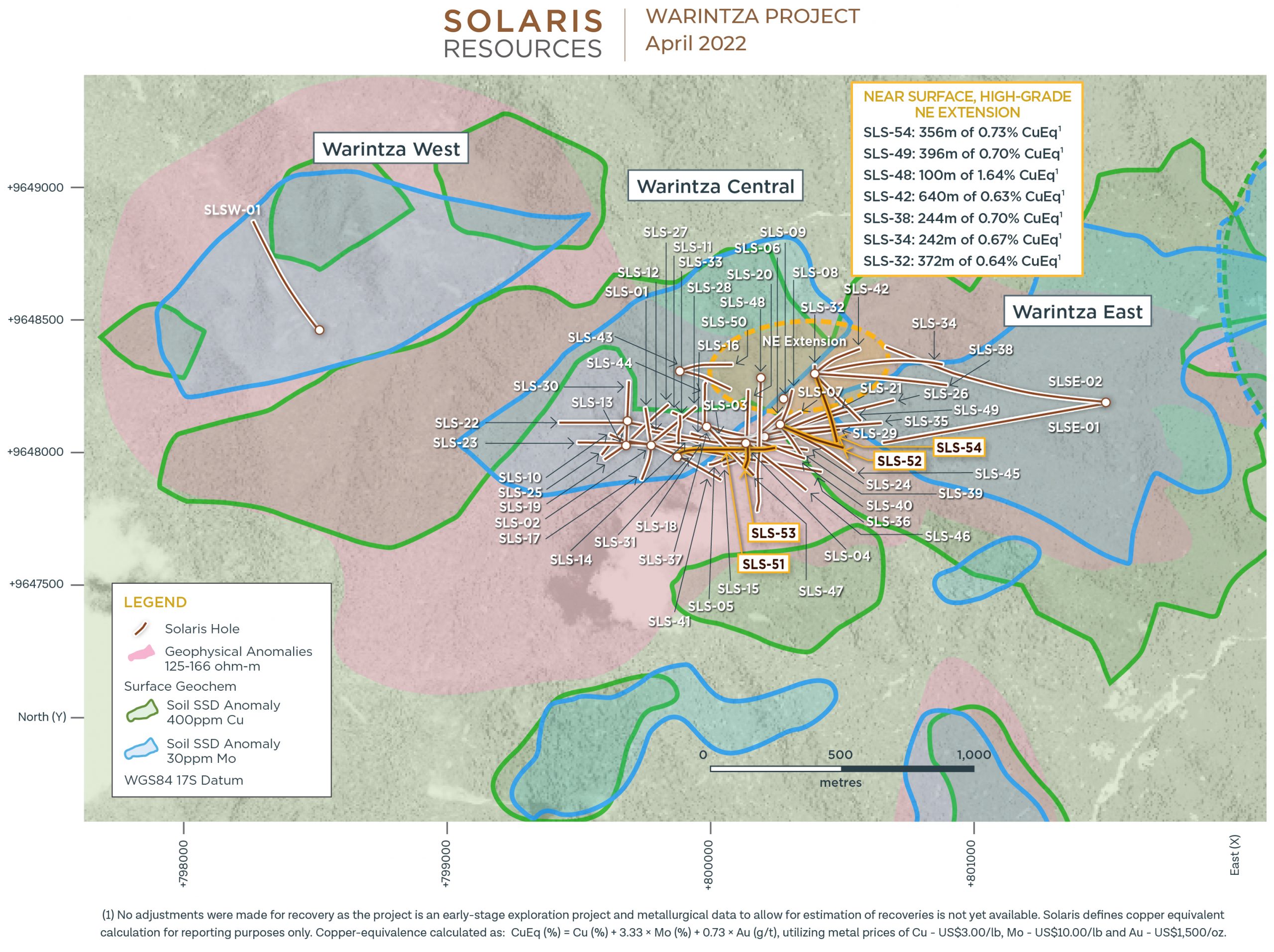

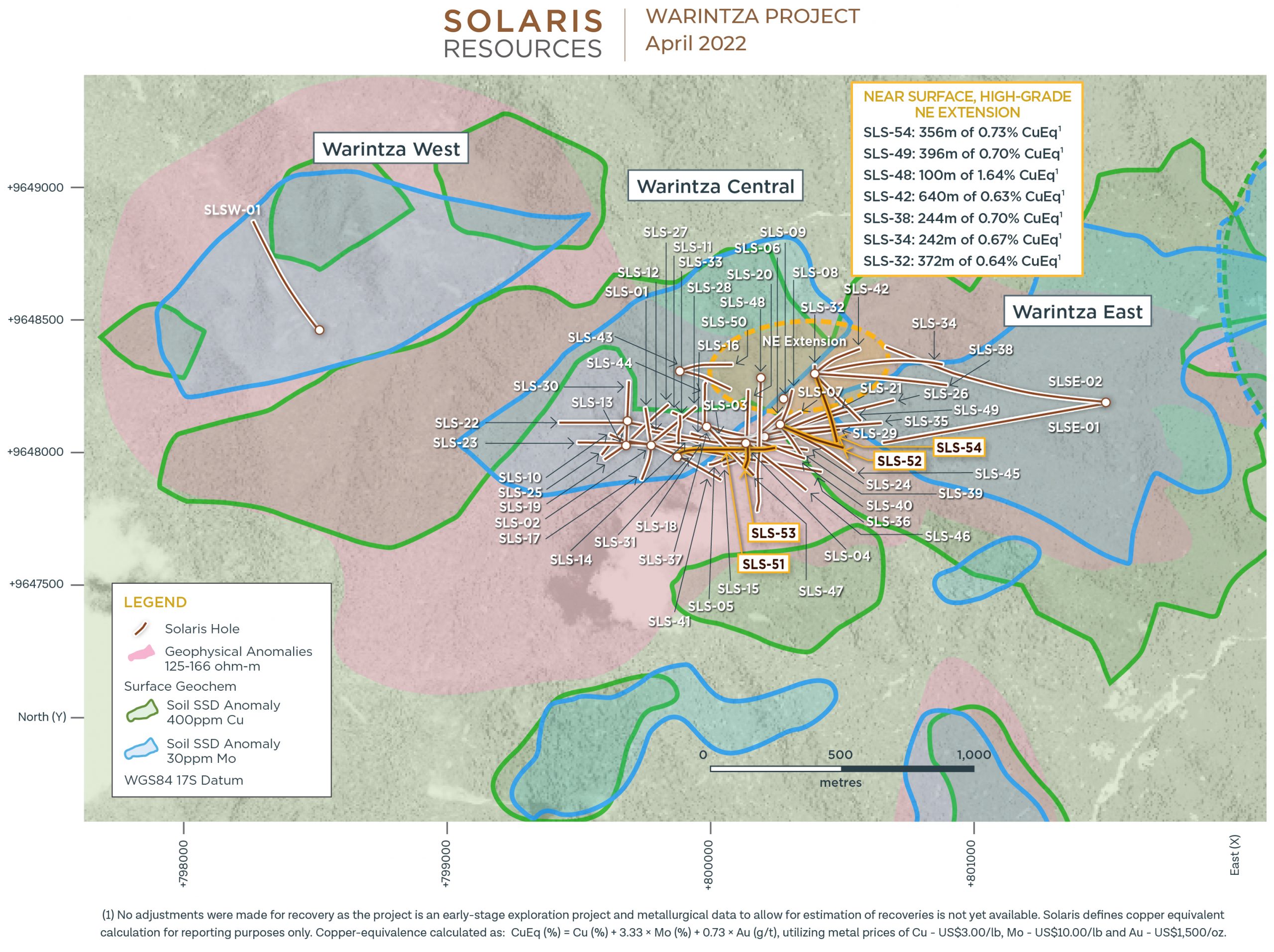

Solaris Resources (TSX:SLS) has reported assay results from a series of additional holes from mineral resource growth drilling at its Warintza Project in southeastern Ecuador. The results highlighted expansion of the growing northeastern extension area, and that drilling has expanded the southeastern extension area. The southeastern extension remains open in near surface, high-grade mineralization.

Mr. Jorge Fierro, Vice President of Exploration for Solaris, said in a press release: “These final holes expand on two key growth areas with near surface, high-grade mineralization on the edge of resource drilling that remains open. These holes will be included in the forthcoming resource update; further extensions to the northeast and southeast represent priority targets for further growth with step-out drilling commencing shortly.”

On top of the exciting assay results, the company has noted that an updated Warintza Central Mineral Resource Estimate is expected to be issued in April. This is a highly anticipated catalyst for the company and the Warintza Project.

Highlights

Additional drilling has expanded the growing northeast extension area, which remains open with follow-up and step-out drilling underway. This zone is characterized by near surface, high-grade mineralization, as detailed below, at the northeastern limit of drilling at Warintza Central and represents a priority target for further growth.

- SLS-54 was collared at the northeastern limit of the grid and drilled into an open volume near surface, returning 356m of 0.73% CuEq¹ from 50m depth within a broader interval of 1,093m of 0.56% CuEq¹ from surface

- This follows from near surface, high-grade mineralization previously reported (refer to press releases dated February 28, 2022, December 14, 2021 and October 25 & 12, 2021) from:

- SLS-49 – 396m of 0.70% CuEq¹ from 50m depth within 817m of 0.60% CuEq¹

- SLS-48 – 100m of 1.64% CuEq¹ from 50m depth within 852m of 0.56% CuEq¹

- SLS-42 – 740m of 0.60% CuEq¹ from 52m depth within 906m of 0.53% CuEq¹

- SLS-38 – 244m of 0.70% CuEq¹ from 58m depth within 822m of 0.35% CuEq¹

- SLS-34 – 242m of 0.67% CuEq¹ from 52m depth within 660m of 0.47% CuEq¹

- SLS-32 – 372m of 0.64% CuEq¹ from 46m depth within 618m of 0.48% CuEq¹

- Follow-up drilling from existing platforms is underway, with a 260m northeast step-out platform recently completed and a second platform stepping out further to the northeast under construction

Additional drilling has expanded the growing southeast extension area, which remains open in near surface, high-grade mineralization.

- SLS-52 was collared on the eastern side of the grid and drilled southeast into an open volume near surface, returning 482m of 0.62% CuEq¹ from 96m depth, within a broader interval of 977m of 0.45% CuEq¹ from near surface that infilled drilling at depth

- SLS-53 was collared from a southeastern platform and drilled south into an open volume near surface, returning 176m of 0.78% CuEq¹ from 16m depth, within a broader interval of 957m of 0.46% CuEq¹ from 10m depth that infilled drilling at depth

- This follows from near surface, high-grade mineralization previously reported (refer to press releases dated February 28, 2022, December 14, 2021 and November 15, 2021) from:

- SLS-45 – 236m of 0.56% CuEq¹ from 44m depth within 564m of 0.41% CuEq¹

- SLS-39 – 368m of 0.73% CuEq¹ from 90m depth within 915m of 0.56% CuEq¹

- SLS-35 – 326m of 0.80% CuEq¹ from 50m depth within 920m of 0.62% CuEq¹

- Additional platform construction to support follow-up and step-out drilling to test the further southeast extension of near surface, high-grade mineralization is planned, following the release of the updated mineral resource estimate

- SLS-51 was collared from the south-central portion of the grid and drilled east into an open volume at surface, returning 918m of 0.50% CuEq¹ from 130m depth within a broader interval of 1,012m of 0.47% CuEq¹ from near surface that infilled drilling at depth

Updated Warintza Central Mineral Resource Estimate expected to be issued in April.

To date, 62 holes have been completed at Warintza Central with assays reported for 54 of these.

Table 1 – Assay Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) | ||

| SLS-54 | Apr 4, 2022 | 0 | 1093 | 1093 | 0.45 | 0.02 | 0.04 | 0.56 | ||

| Including | 50 | 406 | 356 | 0.62 | 0.02 | 0.05 | 0.73 | |||

| SLS-53 | 10 | 967 | 957 | 0.39 | 0.01 | 0.03 | 0.46 | |||

| Including | 16 | 192 | 176 | 0.65 | 0.03 | 0.04 | 0.78 | |||

| SLS-52 | 42 | 1019 | 977 | 0.39 | 0.01 | 0.03 | 0.45 | |||

| Including | 96 | 578 | 482 | 0.55 | 0.01 | 0.03 | 0.62 | |||

| SLS-51 | 36 | 1048 | 1012 | 0.38 | 0.01 | 0.06 | 0.47 | |||

| Including | 130 | 1048 | 918 | 0.41 | 0.01 | 0.05 | 0.50 | |||

| SLS-50 | 336 | 458 | 122 | 0.14 | 0.04 | 0.03 | 0.30 | |||

| SLS-49 | Feb 28, 2022 | 50 | 867 | 817 | 0.50 | 0.02 | 0.04 | 0.60 | ||

| SLS-48 | 50 | 902 | 852 | 0.45 | 0.02 | 0.05 | 0.56 | |||

| SLS-47 | 48 | 859 | 811 | 0.41 | 0.02 | 0.05 | 0.51 | |||

| SLS-46 | 48 | 680 | 632 | 0.27 | 0.01 | 0.03 | 0.31 | |||

| SLS-45 | 44 | 608 | 564 | 0.37 | 0.01 | 0.03 | 0.41 | |||

| SLS-44 | 6 | 524 | 518 | 0.16 | 0.05 | 0.03 | 0.35 | |||

| SLS-43 | 138 | 350 | 212 | 0.17 | 0.03 | 0.03 | 0.30 | |||

| SLS-42 | 52 | 958 | 906 | 0.42 | 0.02 | 0.06 | 0.53 | |||

| SLSS-01 | Jan 18, 2022 | 0 | 755 | 755 | 0.28 | 0.02 | 0.02 | 0.36 | ||

| SLS-41 | Dec 14, 2021 | 0 | 592 | 592 | 0.42 | 0.02 | 0.06 | 0.52 | ||

| SLS-40 | 8 | 1056 | 1048 | 0.39 | 0.01 | 0.03 | 0.46 | |||

| SLS-39 | 28 | 943 | 915 | 0.49 | 0.01 | 0.04 | 0.56 | |||

| SLS-38 | 58 | 880 | 822 | 0.28 | 0.01 | 0.05 | 0.35 | |||

| SLS-37 | 28 | 896 | 868 | 0.39 | 0.05 | 0.05 | 0.58 | |||

| SLS-36 | Nov 15, 2021 | 2 | 1082 | 1080 | 0.33 | 0.01 | 0.04 | 0.41 | ||

| SLS-35 | 48 | 968 | 920 | 0.53 | 0.02 | 0.04 | 0.62 | |||

| SLS-34 | Oct 25, 2021 | 52 | 712 | 660 | 0.36 | 0.02 | 0.06 | 0.47 | ||

| SLS-33 | 40 | 762 | 722 | 0.55 | 0.03 | 0.05 | 0.69 | |||

| SLSE-02 | 0 | 1160 | 1160 | 0.20 | 0.01 | 0.04 | 0.25 | |||

| SLS-32 | Oct 12, 2021 | 0 | 618 | 618 | 0.38 | 0.02 | 0.05 | 0.48 | ||

| SLS-31 | 8 | 1008 | 1000 | 0.68 | 0.02 | 0.07 | 0.81 | |||

| SLS-30 | 2 | 374 | 372 | 0.57 | 0.06 | 0.06 | 0.82 | |||

| SLSE-01 | Sep 27, 2021 | 0 | 1213 | 1213 | 0.21 | 0.01 | 0.03 | 0.28 | ||

| SLS-29 | Sep 7, 2021 | 6 | 1190 | 1184 | 0.58 | 0.02 | 0.05 | 0.68 | ||

| SLS-28 | 6 | 638 | 632 | 0.51 | 0.04 | 0.06 | 0.68 | |||

| SLS-27 | 22 | 484 | 462 | 0.70 | 0.04 | 0.08 | 0.91 | |||

| SLS-26 | July 7, 2021 | 2 | 1002 | 1000 | 0.51 | 0.02 | 0.04 | 0.60 | ||

| SLS-25 | 62 | 444 | 382 | 0.62 | 0.03 | 0.08 | 0.77 | |||

| SLS-24 | 10 | 962 | 952 | 0.53 | 0.02 | 0.04 | 0.62 | |||

| SLS-19 | 6 | 420 | 414 | 0.21 | 0.01 | 0.06 | 0.31 | |||

| SLS-23 | May 26, 2021 | 10 | 558 | 548 | 0.31 | 0.02 | 0.06 | 0.42 | ||

| SLS-22 | 86 | 324 | 238 | 0.52 | 0.03 | 0.06 | 0.68 | |||

| SLS-21 | 2 | 1031 | 1029 | 0.63 | 0.02 | 0.04 | 0.73 | |||

| SLS-20 | April 19, 2021 | 18 | 706 | 688 | 0.35 | 0.04 | 0.05 | 0.51 | ||

| SLS-18 | 78 | 875 | 797 | 0.62 | 0.05 | 0.06 | 0.83 | |||

| SLS-17 | 12 | 506 | 494 | 0.39 | 0.02 | 0.06 | 0.50 | |||

| SLS-16 | Mar 22, 2021 | 20 | 978 | 958 | 0.63 | 0.03 | 0.06 | 0.77 | ||

| SLS-15 | 2 | 1231 | 1229 | 0.48 | 0.01 | 0.04 | 0.56 | |||

| SLS-14 | 0 | 922 | 922 | 0.79 | 0.03 | 0.08 | 0.94 | |||

| SLS-13 | Feb 22, 2021 | 6 | 468 | 462 | 0.80 | 0.04 | 0.09 | 1.00 | ||

| SLS-12 | 22 | 758 | 736 | 0.59 | 0.03 | 0.07 | 0.74 | |||

| SLS-11 | 6 | 694 | 688 | 0.39 | 0.04 | 0.05 | 0.57 | |||

| SLS-10 | 2 | 602 | 600 | 0.83 | 0.02 | 0.12 | 1.00 | |||

| SLS-09 | 122 | 220 | 98 | 0.60 | 0.02 | 0.04 | 0.71 | |||

| SLSW-01 | Feb 16, 2021 | 32 | 830 | 798 | 0.25 | 0.02 | 0.02 | 0.31 | ||

| SLS-08 | Jan 14, 2021 | 134 | 588 | 454 | 0.51 | 0.03 | 0.03 | 0.62 | ||

| SLS-07 | 0 | 1067 | 1067 | 0.49 | 0.02 | 0.04 | 0.60 | |||

| SLS-06 | Nov 23, 2020 | 8 | 892 | 884 | 0.50 | 0.03 | 0.04 | 0.62 | ||

| SLS-05 | 18 | 936 | 918 | 0.43 | 0.01 | 0.04 | 0.50 | |||

| SLS-04 | 0 | 1004 | 1004 | 0.59 | 0.03 | 0.05 | 0.71 | |||

| SLS-03 | Sep 28, 2020 | 4 | 1014 | 1010 | 0.59 | 0.02 | 0.10 | 0.71 | ||

| SLS-02 | 0 | 660 | 660 | 0.79 | 0.03 | 0.10 | 0.97 | |||

| SLS-01 | Aug 10, 2020 | 1 | 568 | 567 | 0.80 | 0.04 | 0.10 | 1.00 | ||

| Notes to table: True widths cannot be determined at this time. | ||||||||||

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLS-54 | 800383 | 9648303 | 1412 | 1093 | 160 | -74 |

| SLS-53 | 800126 | 9648032 | 1566 | 967 | 170 | -82 |

| SLS-52 | 800258 | 9648097 | 1559 | 1019 | 110 | -75 |

| SLS-51 | 799873 | 9648008 | 1632 | 1048 | 85 | -70 |

| SLS-50 | 799870 | 9648315 | 1414 | 768 | 80 | -75 |

| Notes to table: The coordinates are in WGS84 17S Datum. | ||||||

(1) No adjustments were made for recovery as the project is an early-stage exploration project and metallurgical data to allow for estimation of recoveries is not yet available. Solaris defines copper equivalent calculation for reporting purposes only. Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of Cu – US$3.00/lb, Mo – US$10.00/lb and Au – US$1,500/oz.

Source: Solaris Resources

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Solaris Resources (TSX:SLS) announced this morning the signing of a Memorandum of Understanding with Electric Corporation of Ecuador (CELEC) to provide low-cost, locally sourced hydroelectric power to the Warintza Project in southeastern Ecuador.

The Warintza Project is Solaris’ flagship exploration project, for which CELEC will provide locally-sourced hydroelectric power from the National Transmission System in Ecuador. This clean-power initiative will provide the primary power to the entire Warintza Project.

The adoption of this plan is aligned with the “Ecuador Zero Carbon Program” created by the Ministry of Environment, Water and Ecological Transition, as well as the National Decarbonization Pact, for which Solaris was one of the first mining signatories in September 2021.