On Wednesday, Rio Tinto (ASX:RIO) upped the ante in its attempt to acquire the entire Turquoise Hill Resources it does not already own, offering an additional $400 million in cash.

With the intention of gaining direct ownership of the large Oyu Tolgoi copper-gold mining project in Mongolia, Rio Tinto’s new offer means Turquoise Hill’s minority shareholders would receive $40 per share. The board of Turquoise Hill, a company that owns 66% of one of the world’s largest copper and gold deposits 550 km south of Mongolia’s capital Ulaanbaatar, said the company’s board is reviewing the proposal now.

After appointing an independent committee to determine if the offer was in the best interests of minority shareholders, last week the Canadian company rejected it as too low. They had received an offer of $26.57 per share back in March. Rio’s first offer was met with dissent from some of its largest shareholders, Turquoise Hill, including activist investor Pentwater Capital Management (with a 10% stake) and SailingStone Capital Partners (2.2% stake).

Copper’s demand is projected to increase as the world transitions away from fossil fuels. This is because copper wiring is necessary for electric vehicles, charging stations, and other renewable energy infrastructure. The increased bid reflects this potential value.

Turquoise Hill’s stock shot up in trading Wednesday on news of the increased bid.

Rio’s improved offer is contingent on Turquoise Hill not raising more than $1 billion in equity to pay for the project. Rio has committed to providing interim debt financing worth up to $400 million for the project.

Rio Tinto’s offer also reflects an M&A environment that is trying to keep up with demand through acquisitions. One of the biggest factors affecting the industry right now is the lack of new projects when demand is growing. This has created an environment of rising prices, which is encouraging consolidation.

It is also encouraging companies to increase production by any means necessary, even if it means reopening old mines or taking on more debt. In the case of Rio Tinto’s offer for Turquoise Hill, the company is willing to take on more debt to increase its ownership stake in a project with high potential. This is a sign that companies are becoming increasingly desperate to secure resources and output for the future.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The Lithium Americas Corporation (TSX:LAC) has announced the opening of its new Technical Development Center in Nevada. The new center was built to demonstrate the chemical process designed for the company’s Thacker Pass lithium project. Last month, initial production successfully produced 5 kg of battery-quality lithium carbonate. This is a major step forward for Lithium Americas, as it continues to move towards the production of its lithium carbonate product.

Lithium carbonate is a key ingredient in the production of lithium-ion batteries, which are used in a wide range of applications including electric vehicles, laptops, and cell phones. The new Technical Development Center will allow Lithium Americas to further optimize the process flowsheet for the Thacker Pass project and produce larger quantities of lithium carbonate product.

This is not the only U.S. initiative to advance battery metal tech for the supply chain. Ford and Rio Tinto (ASX:RIO) announced an initiative to build out a mining and battery metals supply chain for electric vehicles that could help the automaker secure supplies at a time when demand is expected to surge. The two companies will work together to develop battery minerals including lithium, cobalt, and nickel in the United States and around the world.

The official opening of the Lithium Technical Development Center marks the beginning of a new period of test work and production. The facility is 2800m2 and the company will use it to test new target ores and brines. The Center has a state-of-the-art analytical laboratory which can analyze ultra-pure lithium compounds. For the commercial work done at the facility, Lithium Americas will work with UNV Reno.

The processing facility is fully commissioned and operational, with state and federal permits already in place, and so the company will move ahead with planned construction on the Nevada lithium operation. Jonathan Evans, president and CEO of Lithium Americas stated: “As we prepare to break ground on Thacker Pass, we have never lost sight of our broader responsibility in developing the largest and most advanced new source of lithium in the U.S.”

Thacker Pass is moving toward the feasibility phase of the project with a target initial production capacity of 40,000 tonnes of lithium carbonate per year. The project will then move to a second stage expansion with an annual production capacity target of 80,000 tonnes. The second half of 2022 should see the release of feasibility study results from the project.

Highlights from the Lithium Technical Development Center are as follows:

- Official opening of Lithium Technical Development Center. Inauguration of the Company’s 30,000 ft2 lithium process testing facility in Reno, Nevada.

- Facility commissioned and operating as planned. Production commenced in June 2022 to replicate Thacker Pass’ flowsheet from raw ore to final product in an integrated process.

- Lithium carbonate samples achieve battery-quality. Facility achieving battery-quality specifications with product samples being produced for potential customers and partners.

- Early-works construction on track to commence in 2022. Federal appeal moving forward with briefings scheduled to be complete August 11, 2022, and oral arguments and a final decision expected shortly thereafter. The Company has all permits to commence construction. During construction, Thacker Pass is expected to employ over 1,000 workers.

- Process underway to appoint engineering construction contractor. The Company has issued a request for proposal (“RFP”) from short-listed engineering, procurement and construction management firms (“EPCM”) to perform detailed engineering, execution planning and manage Thacker Pass’ construction.

- Cultural assessment work was successfully completed in mid-July. Members of the Fort McDermitt Paiute and Shoshone Tribe (“Tribe”) were hired as cultural monitors to perform archeological mitigation work in collaboration with Far Western Anthropological Research Group.

- Completing carbon intensity and water utilization analysis. Analysis prepared with a leading international environmental engineering consulting firm indicates Scope 1 and Scope 2 carbon emission intensity per tonne of lithium carbonate produced from Thacker Pass’ process is expected to be competitive to South American-based brine operations and substantially lower than US and Australian-based spodumene operations.

- Continuing to advance Thacker Pass financing discussions. Formal application submitted to U.S. Department of Energy (“DOE”) in April 2022 through the Advanced Technology Vehicles Manufacturing (“ATVM”) loan program which is expected to fund the majority of Thacker Pass’ capital costs.

Source: Lithium Americas

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Ganfeng Lithium, China’s largest lithium compounds producer, has announced it is buying Lithea Inc. for up to $962 million. Lithea’s Argentina-focused property portfolio which includes the rights to two lithium salt lakes in the mineral-rich Salta province will help Ganfeng secure access to lithium and more resources for battery metal production. Lithea Inc. is privately owned.

Securing lithium resources has become a priority for China’s top producer, but also for the country as a whole. As worries about electric vehicle battery supply chains grow, Beijing has been stockpiling the metal and investing in mines and chemical plants around the world. China consumes about two-thirds of the world’s lithium, according to estimates. It is also expected to be a major competitive player in the electric vehicle market, beginning with a strong domestic market.

Argentina is one of the countries included in what is called the “lithium triangle”, and is looking to attract more foreign investors through accessible mining infrastructure and favourable tax cuts. However, the country is not without its risks as political instability in Latin America can be a deterrent to some companies.

Ganfeng’s move is the latest in a series of acquisitions by Chinese firms looking to gain a foothold in Argentina’s growing lithium industry. From the western hemisphere, U.S.-based Lithium Americas Corp. has a lithium project in the same area as Lithea’s, and Rio Tinto (ASX:RIO) has announced that it will buy the Rincon lithium project in the same Salta province for $825 million. Rio Tinto has also begun to build its battery materials division, investing in new projects and preparing for a future where demand remains high for these minerals and metals.

Lithium prices have risen even while production has increased. In 2021, lithium products increased 21%, mainly from the demand for industry-standard lithium-ion batteries. According to the U.S. Geological Survey, this increase can be attributed to these batteries which are used in electric vehicles and energy storage systems, as well as consumer electronics.

As the world moves away from fossil fuels and towards renewable energy sources, demand for lithium is only expected to increase. Companies like Ganfeng Lithium are positioning themselves to be at the forefront of this transition.

The battle is also playing out on a geopolitical level, as countries jockey for position in a market that is expected to be worth hundreds of billions of dollars. The United States has put forth a plan to secure the electric vehicle battery supply chain and has been investing in domestic mines and chemical plants. Japan and South Korea, two other major players in the industry, have also been working to increase their share of the lithium market.

Major automakers and EV-focused companies like Tesla have noted the dire need for more lithium, and Tesla has not ruled out building or buying its own mines and chemical plants.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Mining companies are ramping up their investments in battery technologies and mining for battery metals. Due to the increase in electric vehicles and other battery-powered devices, the demand for these materials is expected to rise. Rio Tinto (ASX:RIO), one of the world’s largest mining companies, has invested $10 million in Nano One Materials, a Canadian company that is developing new battery technologies. The investment will be used to purchase the Candiac facility in Québec, and will give Rio Tinto a 4.9% stake in Nano One. Nano One will issue 4.6 million shares at C$2.70 in a non-brokered private placement.

Following the transaction, Nano One will acquire the Candiac facility in Quebec, Canada. The investment will also be used for working capital purposes, commercialisation, technology, and supply chain development. The investment represents a partnership that will go beyond just the purchase of the facility. The companies will study Rio Tinto’s battery metal products which include iron powders from its Fer et Titane facility in Sorel-Tracy, Quebec. Then Nano One will be able to use those iron powders as part of its feedstock to make cathode materials.

Nano One CEO Dan Blondal commented: “The global transition to a low-carbon electrified economy will require millions of tonnes of battery materials, so it is critically important to produce these materials efficiently and with the lowest environmental footprint. Rio Tinto’s partnership and support complement our recent announcement to acquire Johnson Matthey’s LFP business in the nearby community of Candiac, Québec and amplifies the Government of Canada’s Mines-to-Mobility initiative, which aims to encourage a localised battery ecosystem to serve the broader North American market.”

Rio Tinto will also be partnering with Nano One for its technical and business issues around design, development, construction, and operations at cathode facilities. Both companies bring expertise from both sides of the supply chain. In return, Rio Tinto is going to provide its expertise from the company’s Critical minerals and Technology Centre in the partnership, to support the manufacturing of cathode active materials in Canada.

Cathodes are a critical component of lithium-ion batteries and the use of Rio Tinto’s products will help Nano One to improve its performance and reduce the cost of its cathode materials. This is an important step in developing new battery technologies that can be used in a variety of applications, including electric vehicles.

Rio Tinto Battery Materials portfolio managing director Marnie Finlayson commented: “Localised, clean and secure supply chains are critical for the success of the energy transition that is now underway and this requires partnerships with innovative companies like Nano One to help us differentiate, disrupt and accelerate the path to a net-zero future.”

Partnerships like this one are essential to the development of new battery technologies and the growth of the electric vehicle market. With the increase in demand for these materials, it is important to have a secure and reliable supply chain. These types of partnerships will help to ensure that there is a steady supply of battery metals and that new technologies can be developed quickly and efficiently.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The nickel shortage and growing demand is pushing miners to expand exploration and production. This also comes on the heels of companies like Tesla (NASDAQ:TSLA), that have announced plans to source more nickel for their electric vehicle batteries from environmentally sound projects.

Talon Metals (TSX:TLO) is one of the latest miners to announce expansion plans at their Minnesota-based nickel project. Tesla is a client of Talon’s and the Tamarack nickel-copper-cobalt project is one of the company’s major projects, of which is holds a 51% interest. Rio Tinto (ASX:RIO) holds the remaining 49%.

The Tamarack North and South projects are located in an 18-kilometer stretch of strike length with a significant land position (18 kilometers of strike length) and numerous high-grade intercepts outside the current resource area. The new rigs will be utilized outside of the main resource zone. If Talon chooses, it has an earn-in option to increase its interest to 60%.

The goal is for the firm to make staggered payments worth $22.5 million in cash and shares to partner Rio Tinto, invest $10 million in exploration and development, and complete a feasibility study in order to reach it.

The Supply Race is On

Rising demand from EV companies is driving automakers to secure steady supply of battery metals which include nickel, cobalt, and lithium. While most of the world’s nickel is used in stainless steel production, an increasing amount is being gobbled up by the battery sector as the production of EVs ramps up.

The market for electric vehicles is expected to grow rapidly in coming years, alongside the demand for these metals.

Nickel is beneficial to the development of lithium-ion batteries, which are increasingly being used in automobiles. It allows EVs to charge faster and farther between plug-ins by increasing the energy density of battery packs.

The price of nickel has increased to previously unseen heights in recent months, not surprisingly. In March, the price rose by an unprecedented 250 percent in a day, forcing the London Metal Exchange (LME) to halt trading in the metal.

EV Giants Scramble

Tesla CEO Elon Musk has noted that nickel supply is one of the company’s top concerns because of the amount used in each battery pack. The company is also eying a move into more direct control of raw materials, which would give it more control over its supply chain.

For now, however, miners are benefiting from the electric vehicle boom as they race to increase exploration and production. Talon Metals is just one of the many firms looking to take advantage of the perfect climate for them.

The sanctions against Russia resulting from the invasion of Ukraine have further heightened the need for nickel, which it holds about 17% of global capacity for refined Class 1 nickel, the type used for EVs.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

As the war in Ukraine continues, and sanctions against Russian business continue to expand, mining companies have been exiting businesses in the country. Rio Tinto (ASX:RIO), BHP (NYSE:BHP), and more have been selling assets in Russia as they mak their exit.

Canada’s Kinross Gold (NYSE:KGC) is the latest company to dump holdings there, selling the Kupol and Dvoinnoye operating mines; exploration assets, including the Chulbatkan project; and related infrastructure to Highland Gold Mining and other associates in a $680 million cash deal. Under the agreement, Kinross will receive $400 million in cash for the Kupol mine and surrounding exploration rights.

When the transaction closes, Kinross will receive $100 million, with another $150 million to be paid out before the end of 2023, an additional $100 million before the end of 2024, and a final payment of $50 million before the end of 2025.

Highland Gold CEO Vladislav Sviblov commented in a press release: “Our largest mining hubs are located in the Khabarovsk and Chukotka regions, precisely where these mines are located, and we, therefore, anticipate operational, logistical and management synergies. We also intend to maintain the high operating standards of the previous owner, and to invest in employee development.”

Deals in the country are tightly linked with government approval and oversight considering the stakes, and the Russian Federation Ministry of Industry and Trade, Denis Manturov, commented: “Kinross Gold followed the second of the three options proposed by the government for foreign investors with choosing a civilised way out of Russian projects. Therefore, we support the execution of such a deal: the result will be a stable flow of tax revenues, save of working places and support for social projects in the regions of presence.”

A Civilized Way Out

For mining companies with assets in Russia, the path out of the country has been swift. The largest mining companies in the world have all pulled out or are in the process of selling assets, and while the reasons behind it vary, sanctions and political risk are the primary drivers.

Kinross Gold is the latest company to sell its Russian assets, with the sale totaling $680 million, and many other companies are in discussions to exit their businesses in the country.

The European Union has likewise stated that in response to Russia’s invasion of Ukraine, the European Commission will impose a ban on Russian coal and other items. A potential EU ban on Russian coal import, according to a Reuters source, would be worth around €4bn per year.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Due to rising iron ore prices and high demand in China, Rio Tinto (ASX:RIO) recently achieved its best annual performance and boosted its an annual dividend to $16.8 billion.

These extraordinary results represent the culmination of a mixed year for the company. Demand for iron ore rebounded as the economy slowly recovered from the effects of the pandemic, despite the hurdles imposed by inflation and Chinese scrutiny of prices.

As if that were not enough, Rio Tinto also faced the consequences of a scandal in which it became embroiled due to a damaging work culture that affected its reputation. At the same time, it resolved a multi-year dispute over a copper and gold mining project in Mongolia.

Even with the obstacles the company faced, the miner achieved earnings of $21.38 billion at the end of the fiscal year, up 72% from the previous year. Earnings disappointed slightly as the company expected underlying earnings of $21.63 billion.

Rio Tinto CEO Jakob Stausholm stated, “Our balance sheet is the strongest in at least 15 years.” The Anglo-Australian company declared a special final dividend of 62 cents per share and a final dividend of $4.17 resulting in a record dividend of $10.40 per share for 2021.

2022 May See Futher Headwinds

However, restrictions implemented due to the COVID-19 pandemic have affected Australian mining and Rio Tinto predicted a drop in iron ore shipments by 2022.

China, on the other hand, said it would prevent excessive hoarding of iron ore, which could hit the industry hard, but China’s move is not entirely clear.

Analysts questioned CEO of Rio Tinto Stausholm regarding M&A negotiations and opportunities, to which Stausholm responded, “Be very cautious right now. Because we are pretty high up in the cycle and I would dream about looking back one day and say that we invested counter-cyclically and making acquisitions right now could be very much pro-cyclical.”

Rio Tinto reported that it is committed to exploring options in Serbia, which closed its $2.4 billion Jadar lithium project. In this regard Stausholm said it was reviewing the legal basis for the decision and the implications for its activities in Serbia.

“Ultimately, it is for the government of Serbia to decide whether they want to see this opportunity happening,” Stausholm said, “Right now what we are offering is to have meaningful engagement with stakeholders.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Investors in the mining sector are preparing for what should be another strong year for the industry by adding a total of $86.3 billion of market capital to the top mining companies in the Top 50 ranking in 2021.

The overall value of the Top 50 ended 2021 at just under $1.4 trillion after peaking a little above that. This amount represents an increase of about $100 billion since the beginning of the year and double the market capitalization they had during March and April 2020, i.e., the peak of the pandemic.

Coal Doesn’t Go Cold

With no exposure to iron ore other than trading, Glencore (OTC:GLNCY) and its investors bucked the trend by closing the year with $25 billion.

The Swiss multinational company, Glencore, a commodity trading and production company, has not abandoned coal mining. Like its peers, its coal, gas and oil trading arm is benefiting from rising energy prices.

The performance of coal miners in 2021, especially in China, is the clearest evidence of the volatility of commodity markets. Although only a short time ago, towards the end of the year coal miners and their coal divisions in the diversifieds were threatening to drop out of the ranking altogether.

The rest of the three remaining coal companies (the ranking excludes power companies that operate their own mines such as Shenhua Energy) rose and Coal India halted its decline. The world’s largest coal miner, Coal India was number 4 in the rankings four years ago.

Lithium on the Rise

The high demand for electric cars has caused lithium prices, used for the motors and battery technology, to remain high, and their rebound has been prolonged. At the moment, the top three lithium producers, listed in the Top 50 ranking, have a global value of more than $66 billion.

Tianqi Lithium briefly dropped its position in the rankings in 2019, due to its market value being below $5 billion. However, China’s Shenzhen-listed Lithium producer is now ranked in the top 20 of the majors, with a value of about $25 billion surpassing SQM.

For its part, Albemarle (NYSE:ALB), the world’s number one producer, has risen 59% since the year began which made its investors $10 billion richer. Charlotte, North Carolina-based Albemarle announced that it intends to buy, with the aim of expanding downstream, a Chinese lithium producer.

Ganfeng, the leading manufacturer of lithium chemicals (a company not ranked as mining is not a major part of its business) is striving to secure investment in that sector of production. For its part, copper producer Codelco is advancing work on its lithium project. However, concessions in Chile could become scarce or disappear altogether in the decades to come.

Pilbara Minerals is currently ranked 54th but Pilbara is expected to enter the top 50 mining rankings very soon, as the company continues to post record highs and operations at the Pilgangoora project are ramping up to supply the huge demand for spodumene for Chinese transformers.

Rio Tinto’s (ASX:RIO) Jadar project is not off to a good start in Serbia. The Anglo-Australian company’s lithium business is likely to start to look up in the rankings in the next few years as well as Sibanye’s entry into battery metal with an acquisition in Nevada.

Iron Ore, and More

Falling iron ore prices and the decline of copper in the market in the last months of 2021 affected the ranking position of the big three companies, BHP (NYSE:BHP), Rio Tinto (ASX:RIO) and Vale (NYSE:VALE). Over the course of last year, they lost a total of $56 billion.

Last year, BHP had a valuation of almost $200 billion being worth slightly more than oil company Royal Dutch Shell for some time. This made it the most valuable stock in the UK.

A sign of the belief investors have in the effect on mining for the green energy transition is the fact that BHP has lost almost $50 billion despite activating the search for nickel for battery manufacturing. Rio Tinto, for its part, has lost $43 billion since its peak. These losses are indicators that iron ore mining remains central to the sector.

The fall in iron ore caused South Africa’s Kumba Iron Ore to have its worst valuation of the year, plummeting 30%. Australia’s Fortescue Metals, the world’s fourth largest iron ore producer, plunged by $13 billion over the year. While its ranking fell six places as its trading arm, Fortescue Future Industries, got off to a slow start.

CSN Mineração, one of the biggest mining IPOs since Glencore’s in 2011, dropped out of the 50 ranking in its first quarter debut. But thanks to last year’s 87% rise, the Cleveland-Cliffs company is ranked in the top 50 after spending years in obscurity.

Uranium

For the first time after many years, the value of uranium producers is once again ranked in the top 50.

Kazakhstan’s Kazatomprom expanded its stock exchange listing beyond Almaty. As a result, the company has doubled in value this year. Kazakhstan, responsible for about 40% of uranium production, despite the turmoil in the country, has not affected the fortunes of the state-controlled company.

AngloGold Ashanti, Cameco’s main rival, has been overtaken by Cameco leaving Cameco out of the rankings at the end of the year. However, the stock’s performance since the Dec. 31 close would see the Saskatoon-based company move back up the rankings in the hope that it can take advantage of the revival of uranium mining and the problems in Kazakhstan.

A Banner Year

Overall, the mining industry had a banner year with record investor inflows. The bullishness of 2021 is likely to continue as the pandemic recedes and producers get back to normal with production targets as well as a more balanced and predictable supply chain.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

As the shift towards electric vehicles (EVs) gears up to full speed, rising opposition towards new mines in regards to the environment has started to become louder in recent months. The United States has plenty of reserves of copper, lithium, and other important metals to build millions of EVs, but looming concerns surrounding existing and future mines may end up delaying this transition.

The tension between environmentalists and miners won’t be going anywhere as we head into 2022, when US policymakers are expecting groundbreaking moves from big names such as Ford Motor Co, General Motors, and more.

Just earlier this year, President Joe Biden danced around the idea that he prefers to rely on outside allies to supply EV parts in an effort to calm down environmentalists. For U.S automakers, this choice could result in stressful competition with international suppliers as everyone seems to be ready to go electric. Biden also issued an executive order to ideally create half of all new vehicles electric in 2030.

Choosing to import metals rather than getting them from the US is somewhat counterproductive from an environmental standpoint. It could end up boosting greenhouse gas emissions when shipping overseas to the US processing facilities, which defeats the purpose of building EV’s in an effort to combat these climate issues.

An analysis done by Reuters found that “proposed U.S. mining projects could produce enough copper to build more than 6 million EVs, enough lithium to build more than 2 million EVs and enough nickel to build more than 60,000 EVs.”

Those estimates were made based on the volume of minerals used to make the world’s most popular EV, the Tesla Model 3, according to a study by Benchmark Mineral Intelligence. Other EV models and companies may use a different volume depending on their make and design.

James Calaway, executive chairman of Ioneer Ltd, a lithium-boron supplier, said “If we don’t start getting some mining projects under construction this coming year, then we will not have the raw materials domestically to support EV manufacturing.”

Many states have chosen to or are on the fence about opposing future mining projects and reversing decisions already made regarding building new mines. Washington is one of the places still figuring out how to balance regulating mining and the environment. For example, the U.S Fish and Wildlife are adamant about labelling a rare flower that lives on Ioneer’s Nevada lithium site as endangered. Simultaneously, The U.S Department of Energy is deciding if they are going to lend the company over $300 million to build the mine.

Conflicting Agendas

That is just one recent example of the confusion surrounding wanting to combat climate change while also not wanting to build new mines to create necessary materials to build EV’s in an effort to combat climate change.

In Minnesota, state regulators are debating whether or not to revoke or reissue permits to PolyMet Mining Corp, which is controlled by giant miner Glencore. In early 2022, judges will decide whether or not to reverse mines that were already approved by Former President Donald Trump to Lithium Americas (TSX:LAC) and Rio Tinto PLC (ASX:RIO).

Even Biden chose to block Antofagasta Plc’s (LSE:ANTO) Twin Metals copper and nickel mine project in Minnesota for 20 years this past October. The future underground mine would have been a major copper supplier towards EV’s in the US.

Despite that decision, the White House is working towards showing its support for the mining industry, including Lithium Americas’ proposed lithium mine, and a California geothermal lithium project funded in part by GM.

Biden’s EV goal “means good-paying union jobs for working people in responsible mining operations that will both supply battery minerals and protect the environment,” Tom Conway, head of the United Steelworkers recently said.

It will be a long-lasting challenge trying to balance what is best for the environment and what needs to happen for the economy in order to support the mining industry and green transition.

The major diversified Rio Tinto (ASX:RIO) and Canadian junior Star Diamond have terminated their long-standing and controversial dispute. As part of the resolution Rio Tinto and Star Diamond reached agreements that were jointly reviewed in order to advance the development of a diamond mining operation on the Fort a la Corne property in Saskatchewan, Canada.

The dispute originated in 2017 by virtue of Rio Tinto Exploration Canada (RTEC) spending $75 million to acquire 60% of what would be Saskatchewan’s first operating diamond mine, Star-Orion South. In addition Star diamond also claimed that RTEC overspent on the project while exercising its earn-in options prior to completing and delivering the results of its bulk sampling program.

When RTEC exercised its options, Star Diamonds objected claiming that RTEC, was attempting to increase its stake below market value. Thus the junior Star Diamond initiated legal action against RTEC.

Among the new points agreed in the dispute resolution are:

- All Fort å la Corne project expenditures incurred between November 9, 2019 and December 31, 2021 will be the sole responsibility of Rio Tinto Exploration Canada’s (RTEC) subsidiary.

- Star Diamond will have no obligation to fund or contribute to accrued interest costs until the commencement of commercial production, which will not occur until after the completion of construction of the diamond mine

- RTEC will own 75% of the project, and Star diamond will own the remaining 25%. In the event that Star Diamond sells more than 50% of its shares to any other person, RTEC will have five business days to match such proposed acquisition.

- Star Diamond will have six months to begin contributing to the costs and capital expenditures necessary to build the mine once a decision has been made to develop it.

- Star Diamond shares rose 58% to C$0.36, the highest level they have traded this year. This puts the company’s market capitalization at C$138.25 million.

A decision on whether or not to build the diamond operation will be made after the completion of a feasibility study. Next year’s investments will initially be advanced by RTEC.

Both parties to the agreement said Star Diamond will not be obligated to begin reimbursing RTEC for its share of the costs until commercial production has been achieved.

Ewan Mason, chairman of the board of Star Diamond said, “We are very pleased to have reached a constructive resolution with Rio Tinto that puts our differences in the past, fully aligns our interests, and allows both of us to focus singularly on moving forward together quickly.”

For his part, Rio Tinto’s Head of Exploration, Dave Andrews, said, “These new arrangements and our alignment with Star Diamond represent an important milestone in the continued development of the Fort à la Corne property. We are very pleased to now be working in cooperation with Star Diamond on a diamond project that we believe has the potential to be a significant contributor to both the local communities around the Fort à la Corne property and the broader Saskatchewan economy.”

A 2018 preliminary economic assessment estimated that 66 million carats can be recovered from the project, generating $3.3 billion ($2.6 billion) in revenue. This could be a huge project for both parties and illustrates the power of a major mining company taking a stake in a junior mining company’s project.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Lucara Diamond (TSX:LUC), a leading independent producer of exceptional quality type IIa diamonds, said on wednesday that the global market for diamond jewelry and rough diamonds is at one of the healthiest places it has been in several years.

The Vancouver-based miner believes it is a trend it can expect to see continue into 2022 as targets are being set accordingly. These positive market changes were spurred on by an improvement in global supply and demand fundamentals, Lucara said in a statement.

Lucara anticipates producing up to 340,000 carats which are planning to be sold through its multi sales channel approach and could generate revenues up to between $185 and $215 million. The following 2022 year also marks the tenth year their 100% owned Karowe mine in Botswana has been in operation.

These figures do not include any estimated contributions of revenue from large, exceptional diamonds that have historically formed a regular part of Karowe’s production profile, the company said.

The Karowe mine, which actually means precious stone in the local Botswana language, began operations in 2012. It is one of world’s most well known producers of large, high quality, Type IIA diamonds, mostly 10.8 carats, including the famous and historic 1,758 Sewelô, the 1,109 carat Lesedi La Rona and the 813 carat Constellation.

The only other major diamond ever unearthed at that site was discovered in South Africa in 1905, the Cullinan Diamond. The huge diamond was then cut into smaller stones, and some were even placed in the British royal family’s crown.

“The business environment for diamonds and diamond jewelry is the healthiest we’ve seen in several years,” CEO Eira Thomas said in the statement.

Big Names With Big Prices

The diamond market faced some difficulties over the last year due to the global COVID-19 pandemic, with some folks having increasing concerns that the market may take years to recover. However, intermediaries who polish, cut and trade stones seem to be purchasing every miner’s supply, even as big names such as Alrosa and Anglo American’s De Beers raise their prices.

According to the company website, over 6,900 diamonds of +10.8 carats have been discovered, as well as 25 +300 carat diamonds and three huge +1000 carat diamonds. The forecast for 2022 revenue assumes that 100% of the stones and carats recovered will come from the higher value M/PK(S) and EM/PK(S) units within the South Lobe, which is in accordance with their mine plan.

Diamonds that have a higher value than +10.8 will continue to enter the manufacturing pipeline at HB, allowing the company to gain exposure to polished prices and regular cash flow as these larger diamonds are of the highest value.

Open-pit operations will finish by 2026 at Karowe, however, Lucara also has an underground mining expansion project that was supported by the completion of a supplemental debt financing package in 2021. The company says it was a “significant de-risking milestone” for themselves and the mine.

“The underground expansion at Karowe provides access to the richest portion of the orebody and will extend mine life to at least 2040. The project remains on schedule and budget, with a forecasted spend of up to $110 Million in 2022,” Thomas said in the statement.

The underground expansion will focus on the commencement of shaft sinking activities, the commissioning of power, and detailed engineering for the underground development. Sustaining capital and project expenditures are expected to be up to $17 million with a focus on completion of a community sports facility, dewatering activities, and an expansion of the tailings storage facility, the company said.

BMO Capital Markets analyst Ray Raj touched on the importance of the future of the expansion, saying “the continued recovery of the significant high-value stones from the South Lobe further highlights the importance of the Karowe underground expansion.”

Thomas touched on the underground expansion updates in a previous press release, saying “These developments have significantly de-risked Lucara’s outlook on growth and has positioned the Company to benefit from a stronger, more stabilized diamond price environment as global rough diamond supply remains constrained.”

The decision to move the Karowe mine underground comes after Botswana renewed Lucara’s mining license in early January for another 25 years. The total cost of moving the mine is around $514 million and will take about five years to complete and extend the mine’s life up to 20 more years.

Next year, Lucara expects to process 2.6 million to 2.8 million tonnes of ores, which should yield between 300,000 and 340,000 carats.

Lucara owns 100% of the Karowe mine in Botswana and owns 100% interest in Clara Diamond Solutions, a sales platform designed to bring the existing diamond supply chain digital and more accessible in the modern era.

Pushing Digital First

The company highlighted its digital sales platform in the statement as it continues to help the company grow and expand in terms of volumes traded and customer participation. Lucara plans to continue platform trials and discussions with third-party suppliers of rough diamonds to build supply.

“The rationale for a web-based digital sales platform for the transaction of rough diamonds has never been stronger, sparked by industry’s need for increased transparency, global restrictions on travel, and a new openness to the use of innovation and technology to create a more efficient supply chain,” Thomas said.

Quarterly tenders and regular sales through Clara, primarily for stones less than 10.8 carats in size will continue, consistent with the practise from previous years, the company said.

Although Lucara is optimistic about the diamond market going into 2022, DeBeer’s is experiencing the opposite of what Lucara is claiming. The world’s largest diamond miner by value reported on Wednesday it has sold $430 million worth of rough diamonds this month, compared to the $492 million in sales obtained in the previous cycle.

Lucara’s shares fell 4.6% in early trading in Toronto to C$0.62. The company has a market capitalization of about C$287 million ($226m).

The diamond miner is based out of Vancouver and was originally incorporated in 1981. In 2018, Lucara completed the acquisition of Clara, their digital sales platform that “uses proprietary analytics together with cloud and blockchain technologies to revolutionize and modernize the diamond sales process.”

Lucara issued 13.1 million shares to the former shareholders of Clara upfront along with equity payments totaling 13.4 million shares which become payable upon the achievement of performance milestones related to total revenues generated by Clara.

The company agreed to a profit-sharing mechanism whereby the founders and facilitators of the Clara technology, and management of Clara, will retain 13.33% and 6.67%, respectively, of the annual EBITDA generated by the platform, to a maximum of US$25 million per year, for 10 years.

Full Ownership Acquired by Rio Tinto

In other recent diamond news, Rio Tinto (ASX:RIO) just became the sole owner of the Diavik Diamond Mine in the Northwest Territories in Canada. The transaction follows a 19-month process prompted in April 2020 by Dominion Diamond Mines ULC filing for insolvency protection under the Canadian Companies’ Creditors Arrangement Act. The mine employs over 1100 employees, of which 17% are Northern Indigenous people, and in 2020 it produced 6.2 million carats of rough diamonds. Production is expected to finish in 2025.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Rio Tinto (ASX:RIO), the world’s second-largest miner, just became the sole owner of the Diavik diamond mine in Canada’s Northwest Territories on Thursday. Despite saying in the past the Company was not interested in taking full control of the aging arctic mine, Rio Tinto ended up buying the 40% share held by Dominion Diamond Mines for a total stake of 100%.

Part of the transaction includes Rio Tinto releasing Dominion and its lenders from any outstanding liabilities or obligations involving funding the operation or the closure of the joint venture. On the other end, Rio Tinto will receive all remaining Diavik assets held by Dominion including a security cash collateral for the potential future closure for the mine and unsold production.

Why the Buyout Now?

Dominion, which used to be the fourth-largest diamond producer, suffered some financial troubles which played out in court over several months last year. These troubles ultimately led Dominion to sell its other Canadian mine, Ekati in December 2020. In 2017, The Washington Companies ended up buying the Company for $1.2 billion.

This deal follows a 19 month long process beginning in April 2020 by Dominion Diamond Mines filing for insolvency protection under the Canadian Companies’ Creditors Arrangement Act.

Diavik has been in production since 2003 and is eventually facing closures in 2025 which will cost hundreds of millions of dollars to fully clean up. Diavik is Canada’s largest diamond mine, and yielded 6.2 million carats of rough diamonds in 2020.

Rio Tinto Minerals boss Sinead Kaufman said in a statement, “Diavik will now move forward with certainty to continue supplying customers with high quality, responsibly sourced Canadian diamonds.”

Worries and concerns began to surround the diamond market due to production coming to a

halt during the global COVID-19 pandemic, with some people worried the market would never recover. However, Alrosa, the world’s top diamond miner by output, claims the market has fully recovered from the effects of the global pandemic, and sales of jewelry and rough diamonds are up 23% this year compared to 2020.

Rio Tinto Invests US$87 Million to Boost Low-Carbon AP60 Aluminum Production

In other recent news, Rio Tinto (ASX:RIO) decided to invest US$87 million in order to increase capacity at its Canadian low-carbon aluminum production project. The company is creating 16 new smelting cells in the Saguenay-Lac-Saint-Jean region of Quebec at its AP60 smelter in the which will increase the production by about 45%, or 26,500 metric tonnes of primary aluminum per year.

This will increase capacity up to 86,500 metric tonnes. Not only will production increase, but this upgrade will secure the futures of up to approximately 100 employees who work at the smelter by extending the life of the project.

Rio Tinto Aluminium chief executive Ivan Vella commented: “Rio Tinto is committed to strengthening its position as a leader in low-carbon, hydro-powered aluminum production to meet the clear demand from our customers in North America and Europe. Our AP60 technology is one of the most energy-efficient, environmentally friendly and cost-effective systems in commercial production today. It produces some of the world’s lowest carbon aluminum with renewable hydropower here in Quebec. We are assessing options for further investments, as we progress development of the ELYSIS zero-carbon smelting technology with our partners.”

Rio Tinto predicts the aluminum market will grow at an average rate of about 3.3% per annum over the next decade as strong demand for the metal comes from green energy transition and decarbonization.

The AP60 technology building generates seven times fewer greenhouse gases than the average building in the industry and was created by Rio Tinto’s research and development teams. Since 2013, the initial AP60 technology pots have produced more than 465,000 tonnes of low-carbon aluminum.

The new work will begin in 2022 and should be completed by the end of 2023. The new pots will be built in the existing building of the Complexe Jonquière’s AP60 technology centre, which currently has 38 pots. As the new pots are being built, Rio Tinto will also be looking into potentially installing AP60 cells at the site in the future.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Mining companies have become some of the biggest companies to make sweeping, rapid changes to their business models, operations, and social responsibility charters in the last five years. With net-zero emissions goals being set around the world for the developed world from anywhere from 2030 to 2050, companies will need to keep up.

The mining industry’s renewed commitment to ESG (environmental, social, governance) principles has meant that a new operational standard is in place. For many, that means reducing emissions to zero.

Canadian gold mining company IAMGOLD (TSX:IMG) is taking the pledge to achieve net negative greenhouse gas emissions (GHG) emissions by 2050 at the latest. This is a challenging task, but one that can be accomplished with the right amount of investment and commitment.

Gordon Stothart, President, and CEO of IAMGOLD (TSX:IMG) said on Monday, “In our view, reversing the effects of climate change does not mean stabilising emissions; it demands that we reduce the total volume of greenhouse gases going into the atmosphere and the world’s oceans year over year. We know that we are losing habitat at an unsustainable pace.”

The company’s strategy will be two-pronged, with the first target focused on GHG reduction from scope 1 and scope 2 emissions. This largely focused on heavy and light vehicle fleets and power generation and supply. This is the easiest to accomplish because the technology exists, and investment will only be needed for implementations.

The second prong of the strategy includes the second target of GHG removals. This is done by supporting the effects of climate change by supporting net positive biodiversity and protecting carbon sinks. To do this, IAMGOLD (TSX:IMG) will use nature-based solutions, creating habitat for flora and fauna at a faster rate than it disturbs. This net-zero approach will ultimately cancel out any of the effects of disturbance in local habitats from mining operations.

Stothart continued, “Absolute reductions form a critically important part of IAMGOLD’s strategy in actively combating climate change, with investments in nature-based carbon offset projects supporting greenhouse gas removals.”

Mining companies are held to a much higher standard these days, and reporting is necessary at every step of the process. In 2022, an external verification will be completed on its emissions reporting, the company will develop and announce medium-range time targets for reductions and removals for targets 1 and 2, and publish a solid roadmap and timelines for how the company will achieve its ultimate goal by 2050 of net negative emissions.

How the Industry is Adapting

The mining industry is adopting ambitious and ambitious sustainability targets to promote safer and more sustainable mining activities that will have a positive impact on society. It is cutting CO2 emissions as fast as possible for projects, with the aim of increasing their overall value to society.

Most companies have targets set for 2030, and 2050, that create a step-by-step process for achieving net-zero or net negative emissions by those dates. Many companies are reducing emissions and compensating for CO2 emissions that can’t be avoided to create a sustainable world for future generations. The best way to help the mining industry meet its emissions targets is to improve its operational efficiency in the short term and invest in renewable energy sources in long term.

The need for change is increasingly permeating the mining sector and technological advances offer miners opportunities to reduce their direct and indirect emissions. Looking to the future, feasibility studies of new and existing mine extensions will be assessed according to the impact on emissions and the way in which mines can achieve sustainability.

Electrification of the plant and other operations is a crucial way to reach zero in mining, processing, and transport. Many of the hardest-to-electrify heavy industries and mining processes have emissions that are difficult to eliminate and are part of the energy mix over which miners have no direct control. Consider the steel industry which over the next 20 years must eliminate 17 billion tonnes of direct and indirect CO2 emissions. This is a challenge, but one that the industry is taking on, head-on.

Removing 6.1 billion litres of diesel from copper mines per year – equivalent to 105,000 barrels per day – would reduce a quarter of all greenhouse gas emissions produced. The copper mining industry is pushing hard for net-zero emissions, as a metal that can be used for electric energy storage and transportation. This green technology metal is critical to the future of net-zero emissions, and so mining companies are committing to making the production process green as well.

Most diversified miners have set bold net-zero targets in oil and gas. The major benefit of all of these goals is that miners can provide the supply growth and demand for the energy transition they need to decarbonize their own sector. Mining is the key to the refinement of metals that can be used in wind, solar, electric vehicles, storage, and transmission, and will be essential if the world is to achieve the Paris target of net emissions by 2050.

For them, the route to eliminating their own operational greenhouse gas emissions by 2050 is feasible if not attractive. The world’s largest mining companies by market capitalisation, BHP Group (ASX:BHP), and Rio Tinto (ASX:RIO), have espoused ambitions for net-zero emissions, as has been noted in previous analyses of mining companies as serious and feasible targets.

As a result, many mining companies have set ambitious carbon emissions targets that are consistent with the Paris climate agreement from 2015 and strive to attain net emissions zero.

Net CO2 emissions occur when greenhouse gas emissions released by an organization are offset by an equivalent amount of carbon capture from the atmosphere. For many mining companies, this means determining a baseline level of GHG emissions and then looking for ways to reduce these emissions, commonly called decarbonization.

Although there are practical limits to how much GHG emissions can be reduced in mining, several innovative approaches that will be explored in the future are promising. New technologies, better use of data and smart automation are helping mining companies to become more energy efficient around the world.

Vale, one of the world’s largest mining companies, has been outlining its greenhouse gas reduction commitments for some time. Having the industry giants committing to this goal is a signal to the rest of the industry, no matter what size company, that it is a real and possible target.

The World Bank estimates that the transition to a net-zero emissions economy will require demand growth of up to 500%. On an individual raw material basis, demand for cobalt is estimated to increase by 20% by 2040. Copper, nickel, and other metals necessary for electric technologies for infrastructure and in particular EVs will share in that demand growth as well. If demand grows by many multiples as predicted, then this trend is one that will grow to be unstoppable in the near term, and perpetually inevitable in the long term.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

A US House committee voted to include the language in a broader budget reconciliation package that would prevent Rio Tinto Ltd from building its Resolution copper mine in Arizona. Elected officials in nearby Superior, Arizona, have said the mine is crucial to the region’s economy. The tribe of San Carlos Apaches and other Indians say the mine would destroy the sacred land where they hold religious ceremonies. Conflict has stalled a decision until now, but the committee’s vote finalizes the language that will determine the future of the mine.

The House Natural Resources Committee on Thursday passed the Save Oak Flat Act, a $3.5 trillion compensation measure. Should the House reverse the move, the measure faces an uncertain fate in the US Senate. Approval of the measure would reverse a 2014 decision by former President Barack Obama that Congress began a complex process to hand over more than 40 billion pounds of copper owned by Rio Tinto in exchange for acreage Rio owns nearby. Former President Donald Trump gave final approval to the process before leaving office in January, but his successor Joe Biden could reverse it and leave the project in limbo.

A final reconciliation budget should also include funds for solar, wind, and other renewable energy projects that require tremendous amounts of copper. Electric vehicles consume much of the metal, as do internal combustion engines. The Resolution mine would cover about 25% of the demand for U.S. copper.

Mayor Mila Besich, a Democrat, said the project appeared stuck in “bureaucratic purgatory”. She hopes the House will not allow the language to remain in the final bill. The move “seems contradictory to what the Biden administration is trying to do to address climate change”, Besich said.

Rio said it would continue consultations with local communities and tribes. Rio Tinto chief executive Jakob Stausholm plans to visit Arizona later this year.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Komatsu is forming an alliance with some of its mining customers Rio Tinto, BHP, Coldelco, and Boliden called the Komatsu Greenhouse Gas (GHG) Alliance. The hope is that this will give Komatsu the chance to essentially supervise and guide these companies through a transition to zero-emission mining equipment and infrastructure. They plan to collaborate with these customers on their products, project development, and assaying. Komatsu’s President of Mining and Business Division Masayuki Moriyama said:

“We are honoured that our customers, several of the largest mining companies in the world, have agreed to participate in the Komatsu GHG Alliance and work in partnership with us to develop sustainable solutions for mining “We look forward to close collaboration with these industry leaders to accelerate development and deployment of the next level of equipment designed to reduce greenhouse gases from mining operations and ultimately achieve the goal of zero-emission mining.”

Komatsu has been investing in zero-emission technology for quite some time now through the development of electric diesel dump trucks, electric power, shovels, and regenerative energy storage equipment.

The goals of this partnership are two-fold. Firstly, they hope to work with these 4 companies to develop a haulage truck that can run on different power sources including diesel, electric, and hydrogen powered fuel cell tech. They hope to demo this product at the MINIExpo in Las Vegas this September. In the long-run, Komatsu hopes to reduce its products carbon footprint by 50% and perhaps even achieve carbon neutrality by 2050.

This alliance will hopefully help achieve these goals, and Komatsu also has to expand the alliance still further.

Rio Tinto and BHP plans to test trucks and purchase them first

Rio Tinto plans to purchase some of the first haulage trucks once Komatsu clears them for sale. Rio Tinto Chief Commercial Officer Alf Barrios said:

“Rio Tinto and Komatsu have a shared history of partnership on innovation going back to when we built the world’s largest Komatsu autonomous haulage fleet in 2008.”

“Our support of a trial, and the option to buy some of the first trucks from Komatsu, underscores our shared commitment to actively collaborate on product planning, development, testing and deployment of the next generation of zero-emission mining equipment and infrastructure as we look to decarbonise our business.”

On the other hand, BHP also will have access to the first edition of the trucks and will play a key role in their development. BHP plans to provide Komatsu with the key engineering and technical background needed for the haulage truck model’s development. It also plans to form a partnership with Komatsu via the BHP FutureFit Academy so that future users will be able to operate and maintain the equipment.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Rio Tinto (NYSE:RIO) announced record earnings and dividends today as commodity prices continue to surge as the global economy starts to reopen. The company paid out over $9.1 billion in dividends to shareholders. The company’s stock also showed massive signs of growth, rising by 3% in the same day and moved up to a $138 billion market capitalization.

The rise in profits for the Anglo-Australian iron-ore mining company has been spurred on by rising demand for raw materials over the past year. According to recent reports, the average iron ore price rose to nearly $168.40 per dry metric ton, a near doubling from the raw price in 2020. This massive growth in price helped the miner’s yearly earnings increase from $4.75 billion in 2020 to nearly $12.17 billion in 2021, which was much higher than any analyst predicted.

Success Amid Disruption

Rio Tinto specializes in iron ore production, the key raw material necessary for the production of steel. The demand has been particularly from high China, who is one of the largest iron ore consumers on the planet. This is only projected to increase as China pushes for massive infrastructure development projects and as Brazil continues to struggle with supply problems, driving the price of steel through the roof.

The results on Wednesday also came during a transitional period for the company, after its former chief executive Jean Sebastian Jacques controversially stepped down last year. Since the new Chief Executive Officer Jakob Stausholm took over, the surge in prices have boded well for Rio Tinto’s future even as it struggled with some internal production issues.

Many of these production issues are similar to the ones many other manufacturers have dealt with during the COVID-19 pandemic. Due to restrictions on non-essential labour in numerous countries, the company has often found it difficult to get their workforce on site, which led to massive issues in its copper development project in Mongolia and its iron ore mining production in Western Australia.

Rio Tinto’s CEO recently stated: “In the first half we experienced too much operational instability. We have to sharpen the consistency of our performance. While today’s results clearly demonstrate the underlying quality of our asset base, our operational performance clearly is not where it has been in the past or where we want it to be.”

Green Vision

The company aims to further use their profits not only to fill the pockets of shareholders, but to invest in production capabilities in newer green energy projects. Just this Tuesday, it announced a massive $2.4 billion spending initiative for a lithium mine in Serbia. Lithium is one of the primary materials used for rechargeable batteries and aims to diversify their product lines.

Jefferies analyst Christopher La Femina commented on the company’s plans, saying: “Rio appears to be shifting from austerity and capital returns to more of a focus on growth. While Rio had some operational issues in the period, the big picture here is that these are stellar financial results.”

With the promising dividends and growth in raw materials prices and their increased infrastructure investment, Rio Tinto’s massive profits could continue to grow for 2021.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

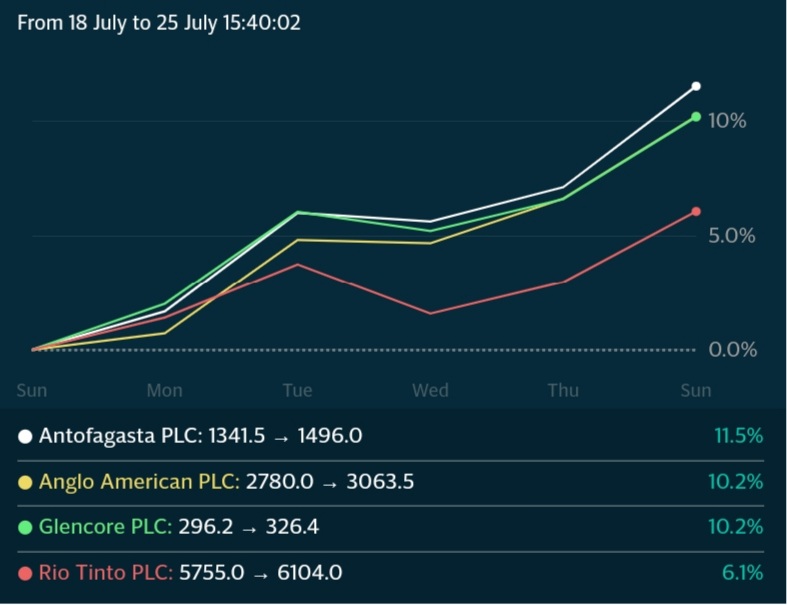

This is set to be a big week for mining earnings, as some of the world’s biggest mining companies will begin to show the market exactly how much this commodity boom is helping. This week will see the top five western diversified mining companies report earnings, and investors should be watching for record profits that could drive dividend payouts to match.

Analysts estimates show that the top five miners may have raked in a combined $85 billion in the first half of 2021, double the number from 2020. Of course, lockdowns and supply chain meltdowns had serious effects on earnings last year. As processes slowed to a halt and demand dropped off a cliff, mining companies mainly were sitting on their hands like the rest of the economy.

However, the latter part of 2020 saw engines start up and restrictions lifted in many mining-friendly jurisdictions, and 2021 has accelerated the commodity price gains from last year.

The first to report on Wednesday will be Rio Tinto Group and is expected to announce $22 billion in profits for the first half of the year, equalling the same amount as its total profits in 2020.

Other companies such as Glencore, Anglo American, and Vale SA were also expected to post massive profits for the first six months of 2021, and possibly their highest-ever numbers for the six months to June period, according to estimates from analysts compiled by Bloomberg.

The sector has seen a revival of its activities faster than most other sectors of the economy as the industry has been one of the primary beneficiaries of the recovery stimulus injected into the global economy. With trillions of dollars in recovery packages going out, demand for commodities has bounced off 2020 lows to skyrockets higher every single month. Demand for commodities like iron ore, aluminum, steel, and copper are driving prices higher every week while inflation pressures continue to spread through the economy.

This bull run for commodities has been a huge gift for mining companies who have the tailwind of demand and higher prices for their production to account for big profits.

Ben Davis, an analyst at Liberum Capital, said, “This should be a pretty much stellar set of results all round. We’re expecting record dividends from BHP and Rio, while Anglo and Glencore also have the potential to surprise.”

Stocks have been on a tear lately, up double digits in some cases in a single week, so there may be room to move higher on earnings news. Freeport-McMoRan already hinted at its blockbuster results when it announced it had wiped out $5 billion in debt over the last 12 months, blasting past a target month ahead of the planned schedule.

A record dividend was also paid out by Anglo American Platinum Ltd. (79% owned by Anglo American) on Monday of $3.1 billion, equal to 100% of first-half headline earnings. In a significant understatement, CEO Natascha Voljoes said the company was in a “strong financial position” and that the company was able to deliver “industry-leading returns.”

Everyone is set to benefit from higher profits from miners this year, beyond stakeholders and investors in the companies themselves. Government should also see higher tax receipts from miners, who contribute significantly to the global economy and often up to a third of any given domestic economy in many regions like South and Central America, and Africa.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Rio Tinto’s Richards Bay mineral sands mine has seen multiple violent incidents over the years. The South African Police Service has been involved in numerous incidents in which workers, families, and subcontractors have dealt with difficult circumstances.

After a senior manager at RBM was assassinated in late May, the company was forced to halt operations at the site. In late June, the company made the decision to keep the Richards Bay Minerals mining and smelting operations in South Africa’s KwaZulu-Natal province shuttered so that safety and security could be improved for workers.

A Cold-Blooded Assassination

The late May tipping point was the assassination of Nico Swart, RBM’s general manager of operational services. While driving to work on a Monday morning, more than 20 high-caliber bullets were fired into his vehicle. The incident is being investigated by the South African Police Service, who hope to find some answers for Swart’s family, friends, and coworkers. Multiple setbacks have hindered progress at the project, as in April, RBM officials said that they were talking with government authorities to “permanently address violent protests around its operations before resuming work on the Zulti South project.” However, things have not improved since, and the company is taking final steps.

On Monday, Rio Tinto announced that its operations at the Richards Bay Minerals (RBM) project in South Africa would remain shut despite further talks with the government. The murder of one of their top managers and the unsolved case has proven too difficult to overlook for all parties, it seems.

Regular Violence From Protestors

The project employs about 5,000 people and will be a hit to Rio Tinto’s bottom line as well as the good the project does for the local economy. The Minerals Council of South Africa condemned the violence and the “failures” of law enforcement up to this point. The government had tried to prevent the suspension of activity at the minerals sands project. It is an integral part of the local economy, and Rio Tinto represents a strong economic partner for the country.

However, the council said in a statement that, “Continued acts of lawlessness including blockages of roads, burning of equipment and intimidation of staff at mining operations are not only unacceptable and damaging to the country’s reputation as an investment destination, but also impact the lives and livelihoods of mining employees, their families, and surrounding communities.” The untenable situation is expected to calm down now that the project is halted.

Optimistic Tone, But a Long Uphill Battle

Rio Tinto also commented on Monday, stating that everyone is looking forward to the resumption of operations as soon as possible. The optimistic outlook from the company may suggest it intends to broker a deal with local communities or create a new project. “But the safety of our people and the security of our operations must be assured before we can return to work,” a spokesperson said.

The company owns a 75% interest in the mine, which has been plagued by violent incidents related to violent protests. In 2018, Rio Tinto had to freeze operations twice because of violent protests by contractors and then stopped work at the mine again in 2019 when one of its employees was shot. This latest event makes it unclear whether Richards Bay will ever be able to resume normal operations, which includes mining, refining, and smelting of heavy minerals or ore deposits. A joint venture Rio Tinto and Blue Horizon (owns 24%), the remaining shares are held in an employee trust.

RBM produces ilmenite, rutile, and zircon, some of which are highly valuable and used in things such as sunscreen, paint, and even smartphones.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Lincoln Minerals Limited Lincoln Minerals Limited |

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan