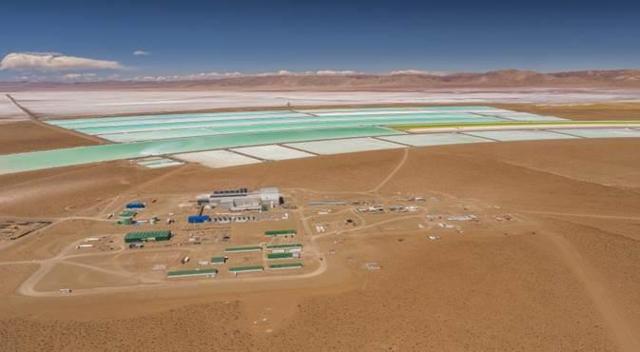

Argentinian lithium producer Orocobre (TSX: ORL) recently reported lower than expected lithium production in its third fiscal quarter because weather interfered with its evaporation rates of its lithium brines. This reveals two problems with lithium brine production: reliability and geography. Another source of lithium is rising to met these problems, hard rock lithium mining.

One analyst pointed out that Orocobre’s production problems “clearly demonstrate” that production is not a straightforward process. “Weather events are beyond the control of Orocobre, but this reaffirms that there is still room to improve on the robustness of operations and reduce production variability from we ather impacts,” the analyst stated.

The company reported a 25-per-cent lower evaporation rate compared with the same quarter in 2017 which caused production problems and lithium output to fall 29 percent to 2,802 tonnes of Lithium Carbonate equivalent, from 3,937 tonnes in the December quarter. Its February rates were the lowest since 2011.

Weather has clear impacts on the production at lithium brine operations and with global demand for lithium on the rise, more reliable and consistent methods of production will be required. Lithium brine operations are limited to select climates and regions that can support sufficient weather to ensure economic processing.

Demand for the metal is set to grow by 600,000-800,000 tonnes of lithium carbonate equivalent over the next 10 years, Daniel Jimenez, senior commercial vice president at SQM, said.

The global lithium industry will need $10 billion to $12 billion of investment over the next decade to meet surging demand amid the electric vehicle boom, Daniel Jimenez of Chilean miner SQM said.

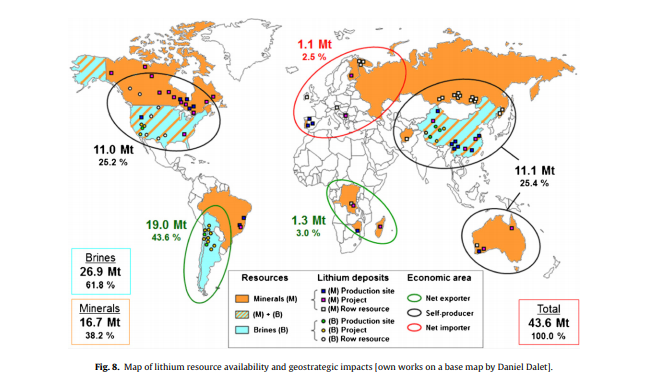

Not all lithium is equal and not all lithium is mined the same way. There are two significant sources of lithium, Lithium Brines and Lithium-Cesium Tantalum Pegmatites (hard rock).

According the United States Geological Survey’s 2018 Mineral Commodity Summaries, Australia was the largest producer of lithium. It produced 18,700 MT of lithium last year, up 3,300 MT from the previous year. The 34-percent increase has been attributed to two new spodumene operations that ramped up production to meet strong demand.

Australia hosts the Greenbushes lithium asset, which is operated by Talison Lithium, a subsidiary jointly owned by Tianqi Lithium (SZSE:002466) and Albemarle (NYSE:ALB). Greenbushes is the longest continuously operating mining area in Western Australia, having been in operation for over 25 years.

These production figures helped to push Australia as the top lithium producing country and it shows how hard rock lithium mines have the potential to disrupt traditional sources of lithium from older operators of lithium evaporation ponds.

Hard rock lithium deposits are not limited to select climates and regions and are going to help fill the demand as they are more evenly geographically distributed across the globe and are less dependant on a changing climate for production.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Lincoln Minerals Limited Lincoln Minerals Limited |

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan