Ambition is a difficult thing to balance with expectations, and luck changes so quickly. After a blockbuster year in 2020 for lithium shares on the ASX, 2021 got off to a rocky start. The January blues kicked in and shares looked a little directionless. It seems that there was plenty to be optimistic about, and investors were waiting for the catalyst.

Spring Forward

A few things have made April a great month for ASX lithium shares, with prices about 5% to 10% higher and within 20% of all-time highs. The beginning of 2021 was a little dull for lithium miners, but between Joe Biden’s new position on climate change, higher lithium prices, and even a surging Tesla share price, there was enough messaging that lithium miners will be chugging along in the coming months.

Most of the excitement comes from the electrification trend that is being accelerated by electric vehicles and battery makers, but the ASX lithium listings have a second tailwind going for them. The Australian government’s new roadmap lays out a special place in the plan for energy and resources, making sure that miners have the capital and regulatory support to expand and advance.

The March announcement was welcome news for the whole industry, but miners like Galaxy Resources have done particularly well since this announcement and a few of their own.

Winning

Since their March 25th news that piloting and testwork at their Sal de Vida Project in Argentina have improved its flowsheet for producing battery-grade lithium carbonate through the addition of a simple process, shares have risen 28%. Recent test results that incorporated those minor enhancements to the flowsheet have returned 99.83% purity, and the company is pushing for more positive test results on all of its projects.

This outstanding development achievement is unique to conventional evaporation processes. Galaxy CEO Simon Hay had some confident words about the combination of tailwinds pushing the company and share price along: “Galaxy remains on track to execute and deliver a highly competitive, low-cost project to the market in time for the forecast lithium demand surge.”

Favourable Conditions

Lithium companies have been buoyed by a strong lithium price that has continued to push higher in March driven by a general demand increase. According to Fastmarkets:

- Asian seaborne lithium prices were steady against a backdrop of tight availability and firm demand. Meanwhile, Chinese suppliers have made aggressive offers for battery-grade lithium carbonate.

- Spot trades in domestic Chinese market remained slow with consumers conducting “hand-to-mouth” purchases, but supply continued to be tight.

- Europe, US battery-grade lithium spot prices continued to trend higher with deals reported at higher levels.

As long as this trend continues, there will be good support for further buying and investment in the space for some time. It’s unclear whether and when this trend will run out, although price stabilization is eventually inevitable in the distant future.

Losers and Winners

Galaxy Resources and other Australian lithium miners on the ASX like Pilbara Minerals and Orocobre Limited will continue to benefit from the positive mining and industry environment, but headwinds remain. The Global X Lithium and Battery ETF fell more than 25% between February 17th and March 25th. The ETF invests in companies along the complete lithium cycle from mining to refining, and even battery production.

The broad exposure of the ETF and its recent drop has shown that although future trends have put all the companies in the fund in the right position, not everyone will win at the same time. The competition to grab as much market share as possible will produce more losers than winners and choosing the right miners and producers that partner with them in battery production or energy storage will be the key to a strong lithium portfolio.

For now, lithium mining companies on the ASX can expect to find strong support from both the government and investors, as favourable regulatory, financial, and broader economic conditions push capital into the mining and resources sector this year.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Prime Minister Scott Morrison has been dealing with attacks on all fronts lately, with tense diplomatic relations with China, a standoff with tech companies over privacy and news data, and even domestic issues like the economy and social conflict. With everything going a little haywire for the island nation, there is still a spot of calm in the storm when it comes to the mining industry.

The government has a world-leading critical mineral and resources sector that has buoyed the economy for decades. Jobs and economic opportunities are the two things Morrison needs to balance the scales of minor chaos in Australia, and the mining industry is prepared to deliver both.

Proclamations

On March 4th, the Prime Minister’s office announced a 10-year plan to capitalise on Australia’s access to resources, particularly metals like lithium, which will be needed to manufacture many new technologies. Battery manufacturers, electric vehicles, and every device being made around the world require these metals to be mined and processed for use in their products.

The countries and companies that best take advantage of this opportunity are the ones that will see revenues from mining activities soar over the coming decades as demand only continues to accelerate. With this plan, Morrison is planning to make humble and often unassuming, but ever-important Australia a key player in the fight for resource dominance in the industry.

The Plan

It’s called The Resources Technology and Critical Minerals Processing road map, which probably could have been shortened for a cool acronym (Americans do that best: CARES Act). The plan lays out how businesses will be an important piece in rebuilding the economy post-pandemic, and that manufacturing should play a key role in that process.

Making Things

This plan is important because it will create jobs, and make things. Countries the world over are trying to figure out how they might jumpstart their economies the right way, and quickly, pumping stimulus into the economy and even handing out cash. That works for some time, but at some point, someone has to make something.

One of the misconceptions about the modern economy in the developed world is that everything runs smoothly even if we just make software and consult. Services are important, but in the words of Elon Musk: “If you don’t make stuff, there is no stuff.” The mining industry makes a LOT of stuff, and it is extremely valuable for all of the key products shaping the future of the world, particularly the technologies enabling us to work from home, drive around without emitting greenhouse gases, and storing the energy needed to power our homes, offices, and everything else.

Central Tenets

The plan highlights that manufacturing businesses and jobs will be central to Australia’s National Economic Recovery Plan as the country builds it back from the COVID-19 recession. Australia wants to make a lot of lithium and other technology metals, and they’re prepared to back any miner willing to step up to the plate.

The government is making it clear that the mining industry is a particular priority: Minister for Resources, Water and Northern Australia Keith Pitt said it also complements the Government’s Critical Minerals Strategy.

“The Government is committed to bringing on new supplies of critical minerals and developing this emerging sector to meet growing global demand,” he said.

“Developing our critical minerals processing capability will ensure Australian companies can move down the value chain, getting greater value out of the products they produce.”

The Roadmap also identifies how we can develop our resources technology to maximize efficiencies in our high-performing resources sector.

“Our focus on resource technology will also support the development of new ideas to improve mine productivity, process efficiency, and safety. As the sector’s productivity grows so does the Australian economy, benefiting all Australians,” Minister Pitt said.

Two-Pronged Approach

On top of this 10-year roadmap for resources that will boost the mining industry, the $1.3 billion Modern Manufacturing Initiative will be providing funding for manufacturers to scale up production, commercialise products, and tap into global supply chains. Lithium miners like Galaxy Resources will be able to tap into the funding if needed, and with the taps turned on in this way, the important mineral will be available for export and use in the high-technology and electrification industries.

Changing Tides

With the electrification of the global economy picking up, lithium is of particular interest for its use in batteries (lithium-ion), and other electricity-conducting needs. Companies like Tesla have called for increased clean and socially responsible mining of nickel, copper, and lithium, putting Australia and the companies operating in the country in a great position. All of the lithium mining companies preparing or ramping up their operations will surely see the benefits trickle down to every part of their company for stakeholders at every level. Now they just have to start.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

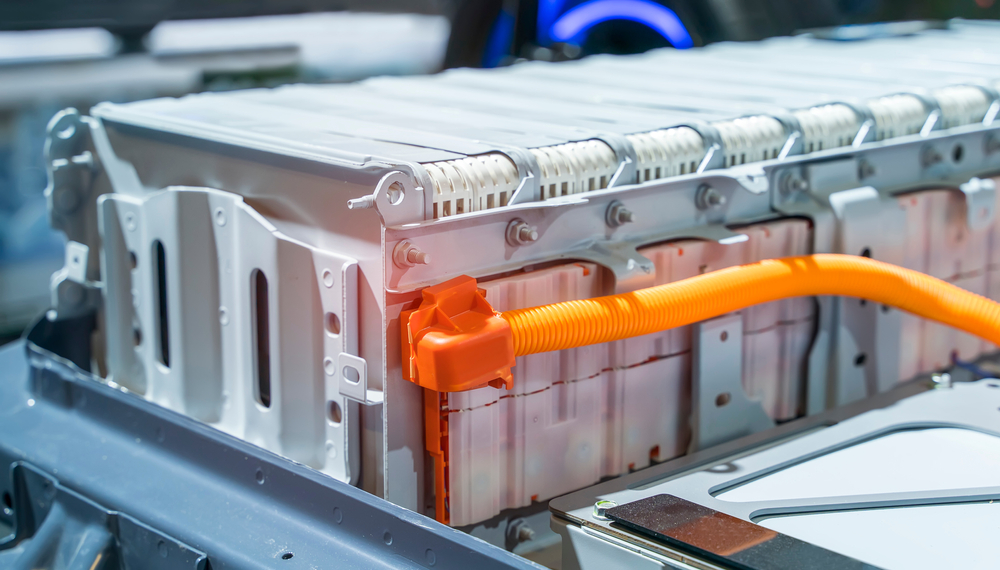

Electric car lithium battery pack.

Electric car lithium battery pack.

It’s going to sound like a slogan by now, but lithium is the future. The metal’s most important use is in rechargeable batteries for electric vehicles, but the applications go so much further. Lithium-ion (Li-ion) batteries are the most popular battery being made today. Research and development teams are scrambling to increase lithium-ion battery density so device manufacturers, car companies, and anyone making an electric-powered product can take advantage of this technology.

Lithium is also used for producing optics, glassware, ceramics, HVAC systems (lithium chloride), lubricants (lithium stearate), pharmaceuticals (lithium carbonate), armour plating, aircraft, trains, and bicycles (lithium alloys). While the use case everyone is talking about and the one that will be the most important for the next decade is battery technology, lithium is not limited to tech use and has applications in every industry.

Batteries

Energy storage is now one of the most important areas of industry and innovation as the world moves to an electrically-powered model to accommodate developing technology and environmental concerns. The batteries of old were heavy, filled with chemicals, and didn’t hold a charge for very long periods. Lithium-ion batteries have changed all of that.

Li-ion batteries can be recharged hundreds of times and are more stable than other types. Their energy density is higher, voltage capacity is higher, and they have a lower self-discharge rate than other rechargeable batteries. It’s no wonder everyone is scrambling to create the best batteries.

Battery Competition

At the dawn of the microprocessor, the industry raced to see who could get the most processing power out of the smallest and most efficient chips. This led to some of the legendary tech companies we have today like Intel and AMD, as they raced each other to see who could put together the best product faster. This competition brought out the best in the industry and gave us the computers, tablets, and smartphones we have today.

Batteries are in a similar stage now as the world is paying attention to the companies that are looking to provide us with energy storage solutions that have become necessary for the modern economy. The result is a race to produce the lightest, most powerful, densest, and longest-lasting battery possible. The result? Lithium-ion batteries continue to get denser and more powerful, allowing us to store more energy for longer periods for use in our devices, cars, and even homes.

The competition happening now is driving innovation forward faster than ever before, and batteries are getting pretty good. You can now buy an electric car from Elon Musk’s Tesla with a range to take you from Toronto to Montreal with a quick recharge on the way, and all without worrying about running out of juice because of a denser and more powerful lithium-ion battery.

You can charge your smartphone from 0% to 100% in about an hour thanks to lithium-ion batteries and fast charging technology. Once you have your battery charged, it will last you the whole day, and then some. The batteries we have now are so good that they can store energy for homes to use as a backup in case of emergency.

Products installed in homes can store energy so that when the main electricity lines go out, the battery can power a home instead. Paired with a solar roof, a home can generate, store, and use its own electricity without ever pulling from the grid. All thanks to lithium-ion batteries.

Mining Competition

The competition to develop and produce the best and most batteries has driven another area of the industry just as fast: production. Battery-makers and innovators can’t get their hands on enough lithium and demand is soaring as car manufacturers, tech companies, and battery innovators continue to race each other for supremacy.

As a result, lithium prices have continued to rise exponentially, particularly in China due to the heavy demand for lithium-ion phosphate batteries that it seems every industry is clamoring for. This has been great for lithium miners, and most analysts and industry watchers agree that the driving forces for lithium demand are only getting started. According to Deloitte’s Electric Vehicle Trends, EV sales are forecast to grow from 2.5 million in 2020 to 11.2 million by 2025, and to 31.1 million by 2030. Lithium demand from the car industry alone is expected to drive prices at a steady rate for the next five years, and rising prices will benefit every company mining the tech metal.

Last year, in the middle of an economic crisis, lithium continued its drive higher, and the domino effect that has had for 2021 is a supported and stable lithium price for the first quarter. This is expected to continue for the rest of the year and positions miners for comfortable gains through the next 12 months.

Off to the Races

Where there is smoke, there is fire, and miners are scrambling to compete for the lucrative lithium market. As big as it and the demand for lithium are now, this is still the infancy of the lithium mining boom, with decades of expansion to come on the backs of the electrification of the global economy.

The Long Haul

This is just the start of a race that is sure to be a marathon instead of a 100-yard dash. Companies are only just gearing up for higher production of energy storage solutions, and the starting line is only just being crossed. Look back to the early days of Intel, AMD, or Apple, and imagine getting on the ground floor of those investments.

As the microprocessor race has done before, the battery technology race will create an industry driving the fundamental needs of multiple other industries, as everything from transportation and logistics, to technology companies, and down to manufacturing and heavy industry require energy storage solutions.

Key Players

The best of the best are throwing their efforts into mining lithium to match the demand coming at them now, and down the line as growth continues. Some of the top lithium miners right now include Galaxy Resources, Piedmont Lithium, Jiangxi Ganfeng Lithium, and Albemarle.

Galaxy Resources

Australian lithium miner Galaxy Resources has quite possibly given investors the most unexpected ROI in the industry over the past year. The share price return of 202% over the past 12 months is impossible to ignore, and although profits remain in progress, revenue continues to grow and prospects are bright. The Australian government has also shown a willingness to support this growing industry, by developing a 10-year roadmap for critical minerals to lower dependence on China for raw materials used in electronics and advanced manufacturing, like lithium.

Piedmont Lithium

Another Aussie miner focused on lithium, Piedmont is currently focused on establishing an integrated lithium business that will convert lithium resources found in the region into a critical component for electric vehicle manufacturing in the United States. The company’s mission statement makes it clear that they are setting themselves to capitalize on a specific area of demand (EVs) over the next decades, and they are sure to be a top pick for investors looking for exposure to the emerging and expanding demand.

Jiangxi Ganfeng Lithium

This Chinese company is a giant in the lithium mining space, and both manufactures and sell lithium products in Mainland China, Hong Kong, the rest of Asia, the EU, North America, and in many other regions. Jiangxi is poised to be the dominant player taking advantage of the growing export market for lithium as they consistently eat up more market share every year.

Albemarle Corporation

Mining lithium, bromine, and catalysts, this US company has a foothold around the world and competes toe-to-toe with Jiangxi Ganfeng Lithium. They have been a top lithium miner for some time now, and a favourite for mining portfolios around the world. With a market cap of $17.54 billion at the time of writing and a steady dividend, Albemarle only stands to benefit from the growing demand for lithium from every market segment they serve.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Lincoln Minerals Limited Lincoln Minerals Limited |

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan