Q4 production challenges have meant Kinross investors missed out on recent strength in gold mining equities. Kinross (TSX:K) (NYSE:KGC) has underperformed the Gold Miners ETF (GDX) by ~15% YTD.

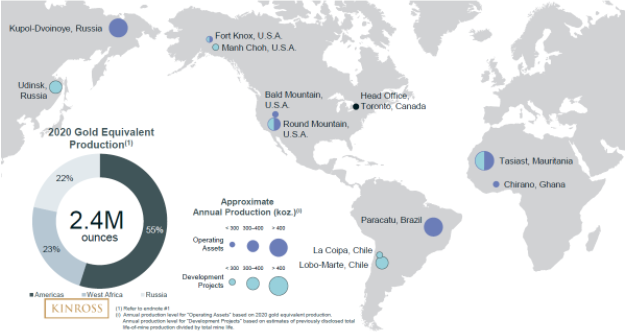

Geopolitics and sanctions may also be near-term headwinds given that Russian operations accounted for 20% of 2021 production. However, 2022 performance is more likely to be driven by their ability to deliver on broader production and capital strategies.

Production interruptions in Q4

Earlier this month, Kinross announced it would book a Q4 loss of $2.7 million due to interruptions which decreased production by 22% compared to Q4 2021. Adjusted Q4 net earnings were $101.8 million, or $0.08 per share, compared with $335.1 million or $0.27 per share for Q4 2020.

The decrease was due to the suspension of operations after a mill fire at the Tasiast mine in Mauritania as well as deferred activity at Round Mountain, Nevada, where wall instability was detected in Q1 2021. Earnings were also hit by a non-cash write-down of $106.1 million from a reduced estimate of recoverable ounces at Bald Mountain, Nevada.

Results included some positive points such as returning $250 million in capital to shareholders and finalizing an agreement with the government of Mauritania regarding licenses near the Tasiast operation. The updated development outlook was also positive with a net reserve increase of 2.7 million oz. In the latest earnings call, CEO Paul Rollinson gave an average annual production estimate of at least 2.5 million oz over the rest of the decade.

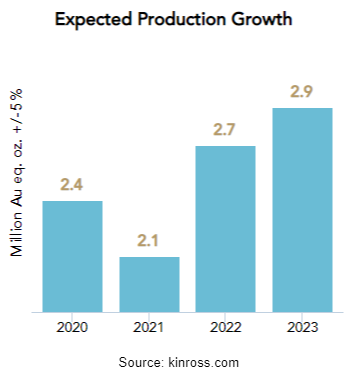

While depressed production will persist into 2022, stronger numbers are expected in the latter half of the year. Annual production estimates were lowered slightly to 2.65 and 2.8 million GEOs for 2022 and 2023, respectively. (Previous estimates were 2.7 and 2.9 million.)

Turning the corner on capital allocation challenges

Some analysts have pointed to Kinross’ capital allocation challenges, including share dilution to finance expensive acquisitions in the post-2008 gold bull market, followed by impairment charges and underperforming assets.

Capital allocation concerns were echoed following the recent $1.42 billion acquisition of Great Bear Resources Ltd. The market punished Kinross in December of last year for what many felt was an expensive bid for Great Bear’s Dixie project, an exploration stage asset that had no resource estimate.

While it remains to be seen whether $1.42 billion was a good investment, other aspects of the capital allocation strategy (such as paying off debt and returning capital to shareholders) could be gauged in the nearer-term. Kinross repaid $500 million of senior debt in 2021 and maintains a low debt-to-equity ratio of 0.21. The company also returned $250 million to shareholders in 2021 through $150 million in dividends and $100 million in buybacks.

The longer-term success of Kinross’ capital allocation strategy will depend on their ability to maintain these trends which, in turn, would require strong sustained cash flows from production and gold prices. To appease the market on the expansion side of the strategy, the Dixie project would need a resource estimate of at least 7-8 million oz.

Russian operations and sanctions

About 20% of 2021 production came from the Kupol mine in Russia. The company issued a statement in response to the February 22 sanctions, maintaining that operations were unaffected. Whether this holds in light of developing events, remains to be seen.

Source: kinross.com

In response to a question in the Q4 earnings call, CEO Paul Rollinson highlighted their 25 year operating success in Russia, as well as the fact that 98% of site employees are Russian and mine supplies are procured regionally. Even if supply chains were disrupted, the remote site is stocked to operate well into 2022.

Rollinson also pointed out that Kinross operations were not affected by sanctions after the 2014 Crimea crisis. In fact, the subsequent decline in the ruble enhanced margins. Moreover, it is expected that Kupol will account for a lower percentage of total production (13%) in 2022 as they transition to mining narrower veins.

Basis for improved equity performance

The silver lining of Kinross’ recent underperformance is a relatively cheap equity price with strong fundamentals. Their relatively favourable ESG rankings could also be a positive should institutional capital reenter the sector.

For 2022, investors will be looking for a return to forecasted production together with a resource estimate indicating Dixie was a good investment.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is an insider or shareholder of one or more of the companies mentioned above.

Companies engaged in exploration, mining, and trading often have good returns and revenues. The past year has seen the VanEck Vectors Gold Miners ETF (GDX) underperform the broad market in the last 12 months, but the 11.8% return was more than solid. It is only against the backdrop of a 46.2% gain for the iShares Russell 1000 ETF or the S&P 500 that comparisons lose steam.

Mining for Gold Value

Gold mining companies within gold indexes, however, have been generating asymmetric returns. Many of the winners have continued to scoop up the gains of a rising gold price and a favorable market. Today we’ll take a look at those stocks which may be undervalued according to it’s P/E for June 2021.

Stock picking is often thought of as the reserve of people who have a special talent or gift, however, value investing is as simple as figuring out whether a business’s stock is cheap compared to its intrinsic value as measured by its price-to-earnings ratio. Taking a look at the 12-month trailing P/E ratio, the best value gold stocks are Centerra Gold Inc. (TSX:CG) (NYSE:CGAU), Jaguar Mining Inc. (JAG.TO), Torex Gold Resources Inc. (TSX:TXG), Karora Resources Inc. (TSX:KRR)), and Kinross Gold Corp. (TSX:K)).

Centerra Gold (TSX:CG) (NYSE:CGAU)

The Canadian gold mining and exploration company operates three mines at the moment producing 824,059 ounces of gold and 82.8 million pounds of copper in 2020 alone. The company ran into a speed bump at its Kumtor Mine in the Kyrgyz Republic when the Kyrgyz Government took control of the mine in mid-May. The company lost control of the mine and suspended previously issued guidance for 2021 due to the uncertainty of the situation. However, with a 12-month trailing P/E ratio of 4.1, the company could be a value play for some portfolios.

Jaguar Mining Inc. (TSX:JAG) (OTC:JAGGF)

Our second Canuck on the list explores and develops gold properties in the Iron Quadrangle in Brazil, a profitable greenstone belt in Minas Gerais, Brazil. With a 12-month trailing P/E of 5.4, Jaguar (TSX:JAG) (OTC:JAGGF) is a technical value play for a company operating in an area of mineral exploration dating back to the 16th century.

Torex Gold Resources (TSX:TXG) (OTC:TORXF)

Torex’s 100% owned Morelos Gold Property comprising 29,000 hectares in the Guerrero Gold Belt in Mexico is the flagship project for the company, in a portfolio that includes two other major mines in Mexico. The company’s P/E of 6.7 may be an indicator of an undervalued company waiting for the right attention from investors.

Karora Resources Inc. (TSX:KRR) (OTC:KRRGF)

Both of the company’s primary gold-producing operations are located in Australia along the Norseman-Wiluna Greenstone Belt. Net earnings for Q1 2021 came in at more than ten times YoY as revenue grew 9.2%. The company’s P/E of 6.7 could be an indication of a value play waiting to be unlocked with the kind of financial results from the first quarter of this year.

Kinross Gold Corp. (TSX:K) (NYSE:KGC)

With a diverse portfolio spanning Brazil, Chile, Ghana, Mauritania, and Russia, and forward guidance of 2.4 million gold equivalent ounces for 2021, Kinross (TSX:K) (NYSE:KGC). Net earnings rose 21% as revenues grew 12.1%, possibly making the company’s P/E of 6.8 a value indicator for 2021.

Hunting for Deals

Undervalued companies can be opportunities to pick up shares at bargain prices before the rest of the market figures it out. Stocks like Centerra Gold (TSX:CG) (NYSE:CGAU), Jaguar Mining Inc. (TSX:JAG) (OTC:JAGGF), Torex Gold Resource (TSX:TXG) (OTC:TORXF), Karora Resources Inc. (TSX:KRR) (OTC:KRRGF), and Kinross Gold Corp. (TSX:K) (NYSE:KGC) could be the value buys for 2021 for investors looking to add some gold stocks to their portfolios.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Mining companies are some of the biggest and most productive economic machines in the world. Mining produces important minerals and metals that are essential to the smooth functioning of society. Without mining, there would be no technology, no buildings, no electricity, and no global economy. For most, mining brings to mind some misconceptions about the industry and how it operates. It’s time to explore some of the positive effects of mining and get into the transformatively powerful effects of responsible mining around the world.

Kinross (NYSE:KGC) (TSX:K) Harvests Water From Snow in Chile

The Maricunga and La Coipa mines, located in the Atacama Desert approximately 4,000 metres above sea level, are some of the driest places on earth. Like everywhere else, water is critical to the ecosystems and wetlands that play host to wildlife including vicuna, flamingo, and guanaco. To ensure those habitats can thrive, Kinross Gold Corporation has implemented measures to improve the area’s water efficiency.

In 2011, the company installed 100-metre lines of wooden snow fencing. The fencing’s goal is to ensure that snowmelt infiltration into the groundwater is more efficient. This is helping to bring meaningful contribution to the local water supply. On top of that, Kinross and the Chilean National Irrigation Commission are exploring a joint research project. The project will investigate and test the snow harvesting tactic for potential use in other water-stress areas of Chile. The mining company is contributing resources and people to the job, and making a serious contribution to the country and the regions they operate in beyond the jobs and economic stimulus that their projects create.

Golden Star Resources (TSX:GSC) Builds a Health Centre

Golden Star Resources (TSX:GSC) has been a busy member of the Ghanaian community, particularly when it comes to healthcare. The company provides National Health Insurance Scheme coverage for every single employee as well as their immediate families. Golden Star was the winner of the PDAC 2018 Environmental and Social Responsibility Award, so it may come as no surprise that the company goes far beyond what is asked. The company has upgraded local clinic to provide services to all of its employees, and even built a health centre at Nsadweso, an Outpatients Department at the Prestea Government Hospital, nurses quarters at Bogoso, a mini-clinic at Brakwaline, and a community health post a Bondaye.

On top of all of the health infrastructure development Golden Star Resources (TSX:GSC) is doing, the company is also a supporter of Project C.U.R.E.. The project has delivered 29 containers of medical equipment, serving over 18 million people since 2003. Golden Star is a great example of how healthcare and wellbeing are integral to positive contributions for stakeholder communities and a company’s employees.

Solaris Resources (TSX:SLS) Flies in To Save a Child

Mining companies often need to operate in remote locations, where they are usually responsible for building and maintaining infrastructure and other services. Companies can be a powerful partner in these areas. Solaris Resources (TSX:SLS), a copper mining company with significant operations at its flagship Warintza Project in Ecuador, was exactly the kind of community partner needed in times of trouble for one 10-year-old patient.

When a child became ill and needed an emergency evacuation to a hospital in the border community of Banderas, near Peru, Solaris allowed for the air transfer of that child immediately and helped coordinate the rest of the transfer once the helicopter landed at Edmundo Carvajal airport in Macas. Since the location was so difficult to access, a helicopter was the only option, and Solaris (TSX:SLS) was able to coordinate the transport quickly, demonstrating that a powerful community partner from the mining industry could make a major difference in the lives of all stakeholders.

A statement from the Integrated Security Service and Lenin Moreno, Ecuadorian president at the time, read, “The work coordinated between security forces, citizens, and private enterprise made it possible to provide assistance at the right moment.”

Miners Continue to Be Strong Allies

While it may not always be obvious what private industry and communities can accomplish together, the results are clear. When government, citizens, and private enterprises in the mining industry come together for a common purpose, the industry is able to consistently demonstrate its ability to step up to the plate and hit home runs.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Lincoln Minerals Limited Lincoln Minerals Limited |

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan