MiningFeeds previously wrote about Bonterra Resources (TSX-V: BTR) and its Gladiator Gold Project in Quebec. The company has steadily advanced through an extensive resource development program expand and define its geological resource model for an updated 43-101 Mineral Resource technical report that will likely prove to be significantly larger than its dated 2012 resource estimate.

In 2012, using a 4 g/t Au cut-off grade and comprised of approximately 15,600 meters of drilling, the Gladiator Gold Deposit contained an inferred resource of 905,000 tonnes, grading 9.37 g/t Au for 273,000 ounces of gold. On average, 90% of operating mines have a grade of less than 8 g/t gold. This ranks Gladiator in the top 10% of the world, when discussing the grade nature of the mineralization. The company has invested significantly since 2015 to expand this resource in the Abitibi Gold Belt, known as one of the world’s most prolific gold belts.

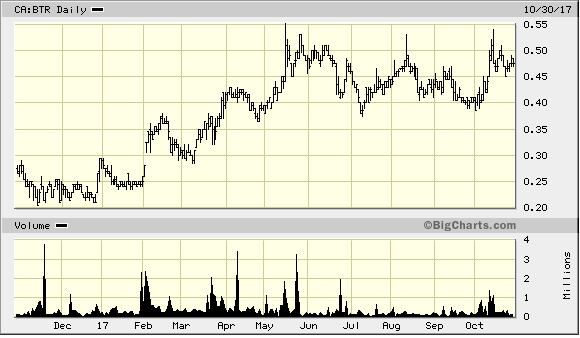

Bonterra has continued to drive shareholder value over the past three years by focusing on putting shareholder dollars in the ground and completing over 100,000 meters since 2016, most recently by continuing drilling through an infill/definition winter camp drill program. Bonterra’s share performance has beat Gold, TSX Venture Index, TSX Index and even the GDXJ Index, which tracks all miners:

Drilling has delivered recent headlines such as:

- Bonterra Continues to Demonstrate Continuity of the Gladiator Gold Deposit Intersecting 16.9 g/t Gold over 6.5 m

- Bonterra Extends Gladiator Gold Deposit Further Westward 17.8 g/t Au Intersected over 3.0 Meters

- Bonterra’s Winter Drill Program Discovers 6th Parallel Gold Zone at the Gladiator Gold Deposit.

- Bonterra Extends Multiple Zones at Gladiator Gold Deposit

This work is part of the company’s 70,000-metre drill program planned for 2018 and has consistently intersected gold mineralization in every hole, and is clearly proving up the company’s deposit in Quebec. There will be more results for an updated resource

Dale Ginn, VP Exploration for Bonterra Resources, stated:

“Initial results from the winter drilling campaign continue to highlight the predictability of the mineralized zones and the validity of the geological model. The positive results from the large diameter drilling will contribute to the success of the preliminary metallurgical work at the deposit. Bonterra continues to successfully execute its aggressive resource development program with seven active drills on site, and five drills at work on the Gladiator Gold Deposit.”

The company is clearly improving its confidence in the resource, and highlighting to the market how predictable the zones have become for targeting drilling to intersect gold mineralization. Another important milestone was to demonstrate that the resource they are drilling has the potential to be economic, which they have done with a recent press release that states the mineralization found at Gladiator is 99% recoverable. By industry standards, their rock is as clean as it gets, and indicates the quality of the deposit in regards to extraction of the gold, and how they stand well above their peers in regards to metallurgical extraction.

Peter Ball, the vice president of operations for Bonterra recently gave an interview to outline these results.

The market is slowly realizing the robust nature of the project, and potential economic nature of the rock when highlighting the high grade resource and metallurgical recovery.

Bonterra is likely pushing towards to a significant re-rate upwards to align with other more advanced peers, and thus the current valuation of the share price represents an opportunity for investors.

——–

Bonterra Resources Inc. (TSX-V: BTR, OTCQX: BONXF, FSE: 9BR1)

Telephone: 1-(844)-233-2034

Email: ir@bonterraresources.com

Website: www.bonterraresources.com

by: Northern Miner Staff Writer, SEPTEMBER 27, 2017

The geological model Bonterra Resources (TSX-Venture: BTR) is applying to its Gladiator gold project in the Abitibi belt of Quebec is proving to be a reliable predictor of where extensions of the already substantial deposit will appear.

As a result, the Vancouver-based company has been able to quickly expand the known gold mineralization along strike and at depth and is finding multiple new mineralized horizons within the 105 square kilometre land package.

“We let the deposit do the talking,” says Dale Ginn, Bonterra’s Vice-President of Exploration. “It’s a classic stacked vein system that responds well to a combination of till sampling, magnetics, and LIDAR (remote sensing using lasers).”

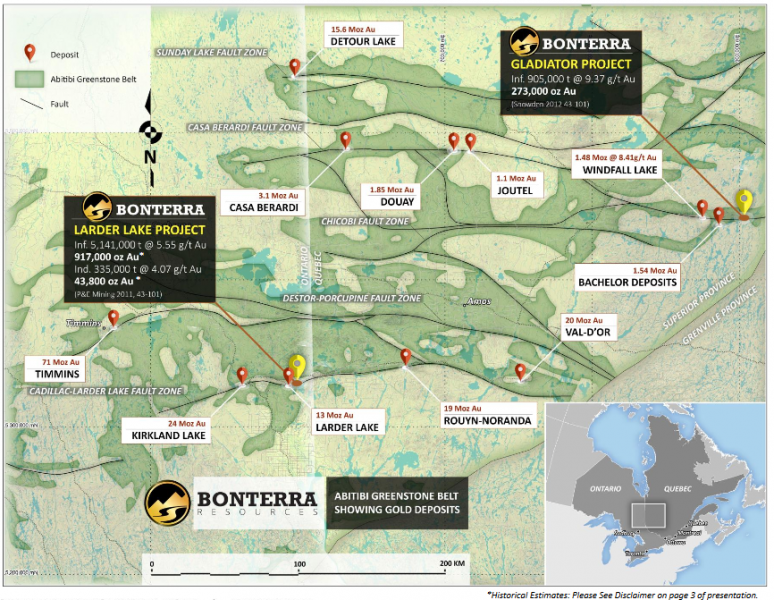

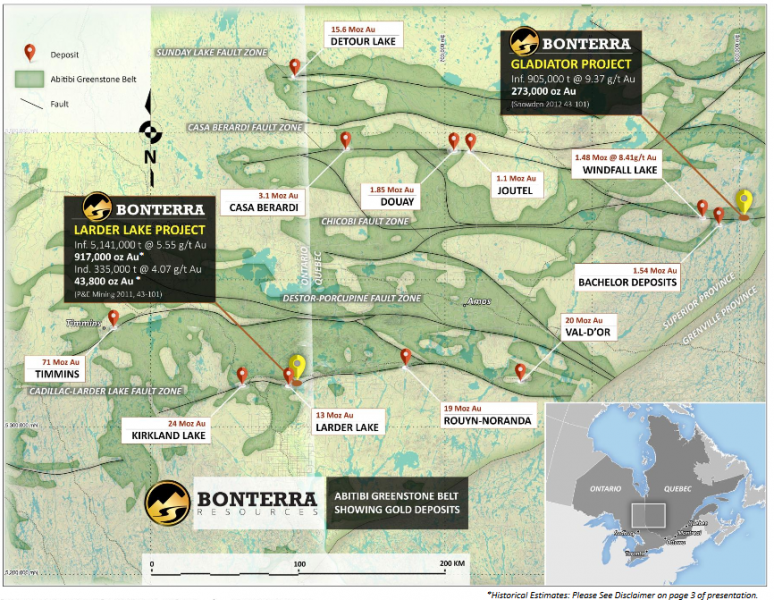

Location map of Bonterra Resources’ gold projects in the Abitibi gold belt of Ontario and Quebec. Credit: Bonterra Resources.

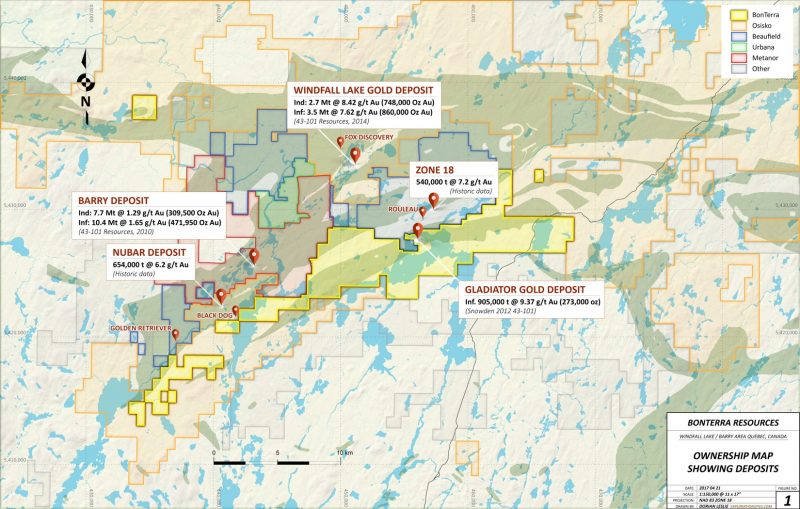

An ownership map outlining Bonterra Resources’ Gladiator gold property and surrounding area in Quebec. Credit: Bonterra Resources.

The Gladiator gold deposit occurs within highly silicified, altered and sheared mafic volcanics, with local intrusions of syenite and quartz porphyry. Smoky quartz veins contain most of the mineralization including free gold, minor pyrite, chalcopyrite and sphalerite, especially in or near the vein contacts.

In 2012 Snowden Mining Industry Consultants identified an inferred resource of 905,000 tonnes grading 9.37 grams gold per tonne (273,000 contained oz.) within a relatively small deposit.

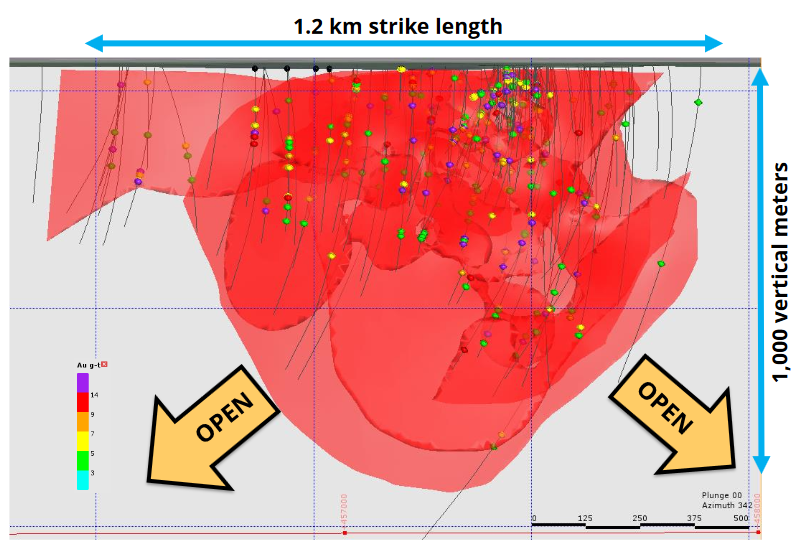

Since then, Bonterra has extended mineralization to a strike length of 1,200 metres and a depth of 1,000 metres below surface. The deposit remains open in all directions and drilling has identified at least five distinct sub-parallel zones.

A gold-rich core sample from Bonterra Resources’ Gladiator gold project in Quebec. Credit: Bonterra Resources.

The Abitibi greenstone belt straddling the mining-friendly jurisdictions of Ontario and Quebec is receiving a great deal of attention these days because of its potential to host more gold deposits such as Gladiator within an already prolific camp with excellent infrastructure. A relatively high gold price, at roughly US$1,300 per oz., is an added incentive.

The Urban-Barry sub-belt that hosts the Gladiator deposit is an underexplored section of the Abitibi. Encouraged by progress at Gladiator, Bonterra has more than doubled its land position along the northeast trending shear structure and its exploration team is consistently intersecting high-grade zones at mineable widths with step out drilling.

“Bonterra has found a new high-grade deposit that looks like it will have some size and that’s a very rare thing, especially within a jurisdiction that is open for business,” says Ginn, an experienced geologist and mine executive who has participated in several gold and base metal discoveries. “Every single drill hole is adding ounces and the mineralization is becoming predictable.”

High profile investors have taken note. In March, Kinross Gold (TSX: K; NYSE: KGC) purchased a 9.5% stake in the company for $5.2 million. Other major shareholders include Eric Sprott, Kirkland Lake Gold (TSX: KL; NYSE: KL) and New York-based Van Eck. Their confidence in the junior has had a domino affect, allowing Bonterra to raise another $35 million through two oversubscribed bought deal financings and one private placement.

As a result of the recent deals, Bonterra now has about 162 million shares outstanding and a market capitalization of $65 million. Shares have been trading in a 52-week range of 21-55 cents with recent trades closer to 40 cents.

With exploration financing secured, Bonterra will ramp up its drill program at Gladiator, adding two drills to the four already turning. Some of the work will focus on infill drilling in preparation for an updated National Instrument 43-101 resource estimation in the first half of 2018. The rest will test exploration targets identified along the company’s extensive land package.

If Bonterra continues to demonstrate continuity in the 800 metre long gap (the “Rivage Gap”) between the Rivage Zone — once thought to be a distinct, separate deposit to the west — and Gladiator, resources would increase significantly from the 273,000 ounces identified by Snowden. Recent drill results within the gap include 3.8 metres grading 16.8 gpt and three metres grading 21.5 gpt gold.

Bonterra also has a 100% stake in the Larder Lake project in the Abitibi belt, acquired in 2016 for $4 million in cash and shares, or approximately $4 per ounce of gold in historical resources. The property hosts the Bear Lake, Cheminis and Fernland deposits that occur along 10 kilometres of the Cadillac-Larder break between Kirkland Lake and Virginiatown in Ontario.

Various groups have drilled more than 100,000 metres at Bear Lake over the years and the deposit remains open at depth. It has two shafts and mine development extends to a depth of 330 metres. With access to such an extensive database for modelling, Bonterra intends to conduct a thorough geological review of the historical data and conduct further exploration based on the results.

But for now, all eyes are focused on Gladiator, where an aggressive drilling program is confirming and adding ounces to a gold deposit that drew the attention of sophisticated investors early on and continues to reward them.

— The preceding Joint Venture Article is promoted content sponsored by Bonterra Resources Inc. and written in conjunction with The Northern Miner. Visit bonterraresources.com to learn more

— Bonterra is an advertiser with MiningFeeds.com. MiningFeeds was compensated in cash for marketing services. This article was published with permission from management at Bonterra Resources.

Sitting in one of the most prolific mining camps, there is a company that has been aggressively expanding its resources through good times and bad. Now with renewed interest in gold mining projects, it is time to look at teams and resources that have weathered the storm and learned discipline to advance their project with current drilling underway.

Bonterra Resources Inc. (BTR: TSX-V) ( BONXF: US) (9BR:FSE) is one such company that exemplifies determination and dedication to their deposit. Bonterra is a Canadian gold exploration company focused on expanding its NI 43-101 compliant gold resource on its properties in the Abitibi Greenstone Belt in the mining-friendly jurisdiction of Quebec.

The company is currently drilling at its 10,541-hectare Gladiator Project. The drill program comprises over 50,000 meters utilizing a minimum of four drill rigs. Using a 4 g/t Au cut-off grade, the project currently contains an inferred resource of 905,000 tonnes, grading 9.37 g/t Au for 273,000 ounces of gold according to a Mineral Resource Estimate and technical report filed July 27, 2012, prepared by Snowden Mining Consultants. The company plans on completing 70,000 metres of drilling this year. With this drilling, expect the resource to expand when the company puts out its updated NI 43-101 Mineral Resource Estimate in mid-2018

Recent drilling from Gladiator has impressed the market by reaching a year high of 72 cents. On Dec. 12, 2017, the company released drill results of 18.5 g/t Au over 4.0 m and 11.9 g/t Au over 3.2 m in the south zone which increased and further defined the size of the high-grade core area. Holes BA-17-42A and BA-17-48 improved the definition of the high-grade core of the footwall zone, with significant grade and width in hole BA-17-48, which intersected 10.1 g/t Au over 6.3 m. Holes BA-17-42, BA-17-43B and BA-17-46 confirmed the eastern continuity of the north zone, with an intersection of 9.6 g/t Au over 3.0 m. This recent drilling also extends the north zone down plunge to the east. Results from these seven recent drill holes have expanded the size and demonstrate the continuity of the north, footwall and south zones.

According to Dale Ginn, vice-president of exploration: “Drill results from Gladiator continue to demonstrate superior widths and grades in all five of our defined zones to date. These mineralized zones are not only visible with sharp contacts, but are continuous and highly predictable. Stand-alone high-grade gold deposits in Canada, especially with extensive infrastructure and easy access, are extremely rare and valuable and we look forward to demonstrating that Gladiator is among that class.”

The company can follow up on these results year round and access some of the more difficult ground with the recent upgrade to its camp to an all-season exploration camp at the Gladiator gold project. The expansion to a larger year-round exploration camp will help advance the company during at time when most explorers are taking time off and their share prices are dropping due to lack of activity. Furthermore, drilling in the winter firms up the ground and allows for improved access and drilling.

Ginn stated, “The expansion and construction of a year-round camp provides the key infrastructure required to ensure we execute our resource development program at the Gladiator gold project on budget and on time to meet the market’s expectations of a mineral resource update in 2018.”

Bonterra plans to mobilize two additional drills (totalling six) in early 2018 for a winter drilling campaign. In an interview with Jay Talyor, President Nav Dhaliwhal stated that they have about $8 to $10 million to spend on the winter campaign.

The Gladiator project has good neighbors with deep pockets and active projects on the go. In addition to good ground and neighbors, the company has a solid shareholder base with Eric Sprott holding 10%, Van Eck Gold Fund with 12% and Kirkland Lake Gold with 9.5%. The company has a cash position of $24,554,809 CAD as of its August 31, 2017 financials. The company has never been in a better cash position.

Ian Telfer once said that he invests in projects that have management who have an unshakable faith in their deposits. Bonterra has demonstrated this faith by weathering one of the longest bear markets for gold; not just weathering the storm, but advancing its project and growing the resource. With depressed gold prices, winter drilling to support share price and prove up the property, and an upcoming resource estimate due in mid-2018, right now presents an attractive entry point for investors to consider acquiring shares.

*Bonterra Resources Inc. is an advertiser with MiningFeeds.com. MiningFeeds was compensated for the creation and distribution of this article. MiningFeeds was paid a fee and does not hold any shares in Bonterra Resources. This is for informational purposes only and should not construed as investment advice.

Bonterra Resources, Inc. (Bonterra) was a story I wanted to bring to your attention a few years back but it rose in price so rapidly I left it behind in favor of others that appeared to offer better price-to-value opportunities at that time. However, based on the company’s aggressive drill program this year, which will continue aggressively through the winter months with six drills turning, Bonterra should soon be reporting a dramatic increase from its Gladiator Deposit in Quebec. In addition, its secondary project, the Larder Lake Deposit in Ontario, which has a resource of 917,000 ounces of gold grading 5.55 g/t, should also increase in size simply by factoring in past drill data that had not been factored into the existing resource. So Bonterra has two very worthwhile projects. But with the magnitude of success on the Gladiator Project, management is focusing its resources there for the time being. When tax loss selling is out of the way and as we enter a new year, I believe Bonterra’s shares have the potential to double or triple from their current level through 2018.

The Gladiator Deposit

The reason I am so optimistic about this company’s shares is because I’m convinced the Gladiator Deposit is going to become much larger than the current 273,000 ounces grading 9.37 g/t. I say that because the existing resource is based on a strike length of 200 meters to a depth of 200 meters. Ongoing drilling since then has expanded the dimensions of gold mineralization over 1.2 km to a depth of 1,000 meters in this high-grade multiple vein system. At this stage, six vein sets have been identified and this mineralization is open along strike at below the 1,000 meters intercepted to date. The grades remain high and mining widths are good. In addition, management states that this steeply dipping mineralized system with sharp contacts have excellent rock mechanics for underground mining.

In its latest press release relating to the Gladiator deposit, management reported that it has extended these multiple gold zones by an additional 300 meters along strike and to depth by another 300 meters, thus expanding the deposit to its current size of 1.2 km along strike by 1 km at depth. But with the deposit remaining open at depth and along strike, and with drilling taking place all through the winter, investors should have a lot to look forward to in the way of high-grade assays and eventually a new, much larger high-grade gold deposit at Gladiator.

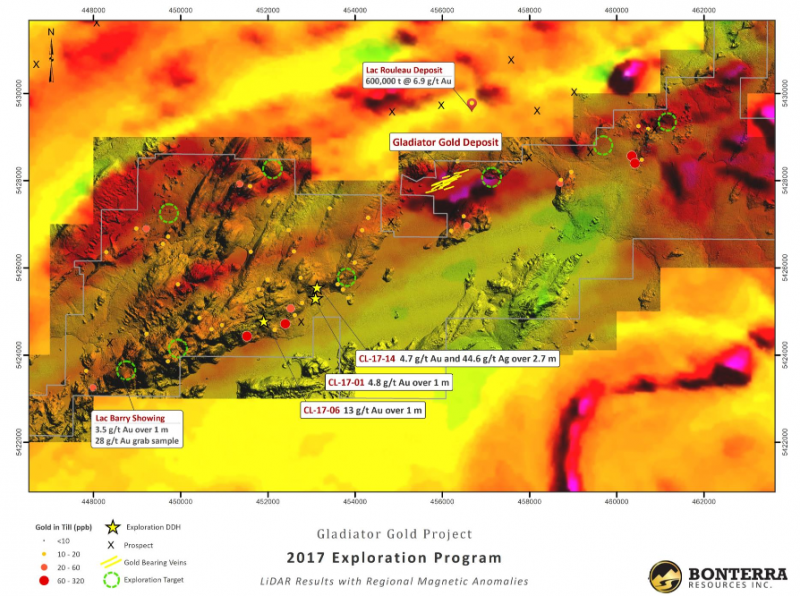

Ongoing drill success has not only confirmed continuity of gold mineralization along strike and at depth as drilling moves westward, but management believes that its geological model is proving to be very dependable in predicting the location of mineralization. Moreover, management stated in its last press release that “Our geological model has demonstrated additional success up to eight km westward, in the southern part of our Coliseum property.” (Note the green circles to the northeast and in particular to the southwest of the growing Gladiator Gold Deposit. Also note the three assays denoted by yellow stars in the illustration below with nice grades of gold and one with 44.6 g/t silver.)

As you can see from the illustration above, mineralization either from surface samples or drill holes has been traced from about 4 km west of the existing deposit for another 6 km along trend to the southwest. It’s my understanding that some drilling will take place in this area during the winter when this marshland freezes over. I don’t expect any drilling to add to the existing resource when a new resource is announced in mid 2018. But it clearly provides a potentially large blue-sky prospect toward the end of 2018 and into 2019.

What might the picture above left mean in terms of a gold resource at the Gladiator Project? The initial resource of 273,000 ounces was calculated from a small area measuring 200 by 200 meters denoted by the very dense areas of drilling pictured toward the top of the mineralized zone. With ongoing drill assays holding with the 9.37-g/t grade in the maiden resource, I believe it is fairly safe to get an idea of the extent of gold mineralization through extrapolating a value in line with the increased dimensions known to date, to something like 2.7 million ounces. I’m not saying enough drilling will be carried out to meet 43-101 specifications. But by the end of this drill season through the end of March 2018, some 40,000 more meters of drilling beyond those shown in the diagram above will have been drilled, leaving the total drill program this year for the Gladiator at 60,000 or 65,000 meters.

The bottom line for me is that Bonterra is on to a multimillion-ounce high-grade discovery. While the several veins that host the gold are too far apart to be mined together, the high grade of these veins means that the amount of ounces per vertical depth is very high, which is an important economic consideration. Also positive for the economics is the fact that mining widths are a reasonably good 2½ to 3 meters, and they begin on surface. So while access is likely to be via a ramp, the cost of ramping down to pay dirt shouldn’t be overly expensive.

Regarding metallurgy, a standard milling operation is anticipated. At this time or in the very near future, a more specific recovery process will be determined from wide core drill samples that will be drilled solely for that purpose. As far as infrastructure and geopolitical jurisdiction, it doesn’t get much better than operating in the Abitibi Gold Belt of Quebec. All of what I can see for now bodes well for a gold deposit considerably in excess of this company’s current market cap likely being developed.

Larder Lake

The first illustration shown on this report under the stock chart is a map showing the Gladiator Property in Quebec and the Larder Lake Property across the border in Ontario. This project has a 43-101 resource of 43,800 ounces in the indicated category grading 4.07 g/t and an inferred resource of 917,000 ounce grading 5.55 g/t. Although this project actually has more ounces than the Gladiator, management has prioritized and stayed focused on the higher-grade Gladiator. But make no mistake. Larder Lake is a very strong project. In fact, it is my understanding that the ounces on this project will likely grow without putting another drill hole down because there is a large amount of drill core previously drilled by Goldfields that Bonterra is in possession of that has been assayed but never factored into the existing resource. With management’s focus strictly on Larder Lake in quest for a multimillion-ounce high-grade gold deposit, I’m not sure when this project will be worked on in a serious manner. But it’s a very good second project that, as long as the bull market persists, is an asset worth holding.

MANAGEMENT

Nav Dhaliwal, President & Chief Executive Officer – Mr. Dhaliwal brings a wealth of entrepreneurial, sales, and financing experience. He is particularly adept at nurturing early stage companies through their critical phases of evolution, having founded a number of companies over his career. Mr. Dhaliwal is also very experienced in corporate development, corporate communications and investor relations, bringing valuable business relationships with international analysts, brokers and investment bankers from Canada, the United States and Asia.

Dale Ginn, B.Sc., P.Geo., VP of Exploration & Director – Mr. Ginn is an experienced mining executive and geologist of nearly 30 years. He is the founder of a number of exploration and mining companies and has led and participated in numerous gold and base metal discoveries, many of which are in production today. While specializing in complex, structurally-controlled gold deposits, he also has extensive mine-operations, development and startup experience. Mr. Ginn is recognized as an advocate of First Nations and local community participation in mining and exploration.

Mr. Ginn’s career has included mine and exploration geology, mine management and various executive roles. Dale has held senior positions with Sprott Mining, Jerritt Canyon Gold and was a founder of San Gold Corporation. Prior to that, he held positions with Harmony Gold Mining, Hudbay, Westmin, Goldcorp and Granges Exploration. Mr. Ginn is a registered professional geologist in Manitoba and Ontario and is a graduate of the University of Manitoba.

Richard Boulay, B.Sc, Director – Over 40 years of experience in the exploration and mining industries in Canada and internationally, including 15 years of mining and infrastructure financing experience gained with Bank of Montreal, Royal Bank of Canada and Bank of Tokyo. He has extensive experience in the management and financing of public companies in Canada and the United States. He is a also a Director of Moneta Porcupine and Latin American Minerals Inc.

Robert Gagnon, Geo., Director, Mr. Gagnon has +10 Years as a professional geologist, earning his Mining Techniques Diploma from the Collège de la Région de l’Amiante (1995) . Ordre des géologues du Québec (circa 2002), Board of Directors of the Quebec Mineral Exploration Association (circa 2009). President of the Association des prospecteurs du Nord du Québec (circa 2012) BSc., Geology from the University of Quebec (1999)

Joseph Meagher, Chief Financial Officer & Director – Mr. Meagher is a Director at Triumvirate Consulting Corp., a financial consulting firm, where he specializes in accounting and financial reporting. Mr. Meagher currently serves as the Chief Financial Officer and a Director for several publicly listed companies. Prior to joining Triumvirate, Mr. Meagher worked at Smythe Ratcliffe LLP as a manager focusing on publicly listed and private company audits, as well as staff training and development. He was a member of Smythe Ratcliffe’s IFRS conversion team as well as a technical reviewer for complex accounting topics. Mr. Meagher holds a CPA, CA designation and a Bachelor of Commerce from the University of British Columbia.

Allan J. Folk, Director – Mr. Folk brings over 35 years of extensive leadership experience in the Canadian mining finance industry. During his career, he has financed and advised both junior and advanced Canadian companies at the senior board or executive level. Mr. Folk is a graduate of the University of Wisconsin, and currently is Vice President of Brant Securities Ltd. He is also a director of Barkerville Gold Mines Ltd., Interim CEO of Monarca Minerals Inc. and is the Chairman of Atlanta Gold Inc.

THE BOTTOM LINE

Having a high regard for the geological and exploration skills of geologist Dale Ginn, I wanted to follow this company when the markets turned in early 2016. Some good drill results early in that year drove the stock to levels that made it less attractive at the time compared to some others stories I was following. So I put Bonterra on the back burner. However, given the fact that the stock has not risen much at all despite the fact that so much has been accomplished since early 2016, I view this as a good time to pick up shares. By mid 2018, I anticipate a 2+ million-ounce high-grade deposit will have been outlined with the potential for much more upside from the new discoveries along trend to the southwest.

I believe a very strong high-grade underground mine at Gladiator is in the making. But that does not dismiss the company’s second very good asset, the Larder Lake Project, which will likely rise well over 1 million ounces once the Goldfields data is baked into the resource. With a lot of drill results to be reported between now and mid 2018 when a new and much larger resource will be reported, and with no need to raise additional capital until a new resource is reported, I believe this is a stock you may want to pay attention to, and pick up some shares during this period of weakness due to tax loss selling.

Business: Exploration and development of gold mining projects in Quebec and Ontario

Traded Toronto: BTR

USOTC: BONXF

Price 11/3/17: US$0.36

Shares Outstanding: 161.8 million

Market Cap: US$58.2 million

Insiders & Institutional Holdings: ~44%

- Eric Sprott 5%

- Kinross 5%

- Kirkland Lake 5%

- Van Eck Gold Fund 5%

- Osisko Gold Royalty 0%

Progress Rating: A3

Telephone: 604 678 5308

Website: www.Bonterraresources.com

________

J Taylor’s Gold, Energy & Tech Stocks (JTGETS), is published monthly as a copyright publication of Taylor Hard Money Advisors, Inc. (THMA), Tel.: (718) 457-1426. Website: www.miningstocks.com. THMA provides investment ideas solely on a paid subscription basis. Companies are selected for presentation in JTGETS strictly on their merits as perceived by THMA. No fee is charged to the company for inclusion. The currency used in this publication is the U.S. dollar unless otherwise noted. The material contained herein is solely for information purposes. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice. The information contained herein is based on sources, which the publisher believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available information. Any opinions expressed are subject to change without notice. The editor, his family and associates and THMA are not responsible for errors or omissions. They may from time to time have a position in the securities of the companies mentioned herein. No statement or expression of any opinions contained in this report constitutes an offer to buy or sell the shares of the company mentioned above. Under copyright law, and upon their request companies mentioned in JTGETS, from time to time pay THMA a fee of $250 to $500 per page for the right to reprint articles that are otherwise restricted solely for the benefit of paid subscribers to JTGETS.

To Subscribe to J Taylor’s Gold, Energy & Tech Stocks Visit: https://www.miningstocks.com/select/gold

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

Lincoln Minerals Limited Lincoln Minerals Limited |

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan