South America is home to some of the largest copper deposits in the world, and several exploration companies are working hard to discover new resources and expand existing ones. Here are the top three copper exploration companies in South America, along with some of their most notable intercepts.

Solaris Resources (TSX:SLS) (OTCQB:SLSSF)

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) is a Canadian copper exploration company focused on the discovery and development of copper and gold deposits in the Americas. The company has a strong presence in South America, where it is actively exploring for copper and gold deposits in Ecuador and Peru.

The company continues to report regular exploration results expanding on its discoveries at what has been called a potential “superpit”.

Warintza is considered a take-out target as the Company has defined a large 1.5Bt copper inventory, featuring a high-grade starter pit and low strip ratio, within a mining district offering major structural advantages from highway access, abundant and low-cost hydroelectric power, fresh water, labour and low elevation. The Company has de-risked the project by locking in a social license through an IBA signed with the communities, and freezing in place the regulatory and fiscal framework by signing an Investment Contract with the Government in December. The final de-risking item is completing project permitting, which is ongoing and expected in 2024 with the project being designated a “strategic priority project” by the Government.

First Quantum Minerals (TSX:FM)

First Quantum Minerals (TSX:FM) is a Vancouver-based mining company with operations in Africa, Australia, and South America. Its flagship copper mine is the Cobre Panama project, located in Panama. The company has been exploring the region for years and has made several significant copper discoveries.

First Quantum has reported several impressive drill intercepts at Cobre Panama. One of the most notable was a 136-meter intersection of copper and gold mineralization, grading 0.63% copper and 0.35 grams per tonne of gold. This intercept was found in the southeast extension of the Cobre Panama deposit, and the company believes it has the potential to significantly increase the mine’s resources.

Anglo American (LSE:AAL)

Anglo American (LSE:AAL) is a multinational mining company with operations in Africa, Europe, and the Americas. Its copper operations are located in Chile, where it owns a 50% stake in the Los Bronces mine and a 100% stake in the Mantoverde mine.

Anglo American has reported several impressive drill intercepts at Los Bronces. One of the most significant was a 95-meter intersection of copper and molybdenum mineralization, grading 0.67% copper and 0.022% molybdenum. This intercept was found in the north zone of the mine, and the company believes it has the potential to increase the mine’s resources.

Teck Resources (NYSE:TECK)

Teck Resources (NYSE:TECK) is a Canadian mining company with operations in Canada, the United States, and Chile. Its copper operations are located in Chile, where it owns a 90% stake in the Quebrada Blanca mine.

Teck reported several intercepts at Quebrada Blanca since exploration began. One of the most biggest was in 2021; a 129-meter intersection of copper mineralization, grading 0.39% copper. This intercept was found in the QB2 deposit, which is currently under construction and expected to begin production in 2022. The company believes that QB2 has the potential to become a significant copper producer, with a projected mine life of over 25 years.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Peru’s Ministry of Energy and Mines recently reported that mining investments increased through November 202 to an accumulated total of $4.6 billion, up from $4.4 billion in 2021. The country has focused on attracting more investments in the sector, which has been a major contributor to its economy.

The final month of the period, November, was the best performing month with the most inflows with a total of $467 million, 7.8% higher than October’s total of $434 million, as reported in the Mining Statistical Bulletin.

The biggest investor was Anglo American (LON:AAL) which invested $964 million in the country in 2022, bringing its share of mining investments to 20.9% for the year. The company’s share is the biggest in the sector in Peru. The runner-up was Minera Antamina, owned by BHP, Glencore, Mitsubishi, and Teck Resources, investing $394 million. Third place was given to Minera Yanacocha, owned by Newmont (NYSE:NEM), with $332 million invested, and fourth was Southern Peru, with $238 million invested. Those four mining companies comprised 42.7% of all mining investment in Peru for 2022.

The report is important to the country, which has long been dependent on the mining sector, as it demonstrates that the sector is still a major driver of Peru’s economy and that investors are confident in the industry’s future. The investments also represent a major source of revenue for the government, with the majority of investments going toward infrastructure and operations.

Exploration activities were also a highlight in 2022, where $383 million in investments flowed from January to November 2022, up 33.9% from the previous year. For existing projects and accumulated mine development investments, the total reaches $778 million, up 49.5% from the same period the previous year.

Peru’s copper production is second only to Chile, which is the world’s largest producer of the metal. The country is also a major producer of silver, zinc, lead, and gold. The mining sector has been a major contributor to the Peruvian economy for many years, and the recent investments show that this trend will likely continue for years to come. The further boost to the industry from the ongoing green energy transition accelerated by factors including the pandemic, rising demand for metals and minerals, and technological advancements should further support the sector’s growth in the years to come.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

De Beers has extensive experience in diamond exploration, mining and trading and produces 40% of the world’s diamonds at its mines in Botswana, Canada, Namibia and South Africa and is considered the world’s largest diamond producer by value.

De Beers’ diamond production increased significantly to meet the recently recovering demand. Its production increased by 15% to7.7 million carats during the last quarterly period of 2021. De Beers said Namibian production was up 16% y/y at 400 000 carats for the fourth quarter, reflecting shorter scheduled maintenance for the marine fleet.

South African production reached 1.29 million carats in the quarter and production from the Canadian mine on the other hand was little changed due to planned plant maintenance. Canadian production fell from 776 000 carats in the fourth quarter of 2020 to 771 000 in the same period of 2021.

As a result of planned processing of higher grade ore at the Jwaneng mine, the Anglo American (LSE:AAL) unit’s diamond production increased by 23% to 5.2 million carats in the months to December 31. Which was partially offset by lower production at Orapa due to the plant’s closure at the end of 2020.

De Beers increased overall diamond production by 29% to 32.3 million carats in 2021. The producer is expected to achieve production of between 30 million and 33 million carats during 2022.

During much of 2021, De Beers increased the price of its rough diamonds in order to recover from the industry’s lull during the first year of the pandemic. Prices for its diamonds increased by 23% in “just over a year” said Mark Cutifani, CEO of Anglo American. This strategy allowed De Beers a steady recovery during the year. The price increase applied to stones over 1 carat.

Russia’s Alrosa, the world’s largest diamond producer by production, like De Beers, increased its prices, which prompted complaints in the industry. Some industry players claim that the price increase has gotten out of control mainly because polished prices must also increase in order to justify the higher prices of rough stones.

The global fine jewelry market is dominated by gem-quality diamonds, however, demand for diamonds has been driven by other sectors including computer chip production, construction and natural resource drilling, and machinery manufacturing.

A Resource-Rich Nation

South Africa is a resource-rich nation for which copper is also abundant. This metal is critical for much of the electrification happening in the economy right now, and South Africa may see further developing of its copper mines and assets. One of the companies named for the mine it operates is Palabora Mining Company Ltd.

Palabora is a copper mine based in the town of Phalaborwa in the Limpopo province of South Africa. The mine also operates a smelting and refinery complex. Its origin is associated with a unique rock formation in the region known as the Palabora Igneous Complex.

Palabora Copper is South Africa’s sole producer of refined copper, supplying mainly the local market and exporting the remainder. Palabora has been in operation since its incorporation in 1956 and is the country’s leading refined copper producer, producing approximately 45,000 tonnes of copper per year.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Vale (NYSE:VALE), the international mining giant, may be looking to buy a 30-40% in Anglo American’s (LSE:AAL) Minas-Rio iron ore project in Minas Gerias, Brazil, according to some reports. If the deal happens, Vale could look to acquire an operatorship stake in the project as well.

Located in the states of Minas Gerais and Rio de Janeiro in the south-eastern region of Brazil, Minas-Rio is an iron ore project 100% owned by Anglo American. The project is estimated to produce more than 26.5 million tonnes of iron ore per year.

The area is also known for hosting the world’s largest iron ore mine by reserves, Carajas, which belong to the Brazilian mining company Companhia Vale do Rio Doce (CVRD). Minas-Rio and Carajás work together in areas such as logistics and rail transportation. It also consists of a 529 kilometre pipeline, filtering plants, and export terminal location in the Atlantic port of Acu in Rio de Janeiro state.

Anglo American (LSE:AAL) bought the rights from MMX back in 2008. While annual production for phase one of operations is expected to be below 30 million tonnes, probable reserves have been estimated at 1.45 billion run-of-mine (ROM) tonnes back in February 2013. This would leave plenty of production capacity for Vale if the miner decides to acquire a stake in the project. Considering the billion-plus tonnes in probable reserves, this project could bring Vale much closer to its production target. It would also solidify the company’s position as a dominant global supplier of premium iron ore.

Vale’s (NYSE:VALE) Dominant Position in Iron Ore

Vale (NYSE:VALE) is one of the biggest mining companies in the world, and one of the most dominant suppliers in the global iron ore market. The company is set to produce close to 350 million tonnes of iron ore this year, making it by far the biggest producer of all top mining companies. Vale produces more than twice as much raw material in comparison to number two, Rio Tinto.

If the deal goes through in Minas Gerais, Vale could have access to a significant portion of Anglo American’s production at the project, with no signs of slowing down their expansion plans anytime soon. However, there are some concerns over how this would affect Vale’s own stock prices if they were actually buying another project at a time when commodity demand has been declining due to slower economic growth in China, which is also reducing volumes sold through major iron ore suppliers into that market.

The deal has not been confirmed yet and is subject to some speculation, but it could help Vale with its key production targets in the short term if they do sign off on a deal.

Vale buying Minas-Rio would certainly be good news for both companies involved, as Minas-Rio has proven reserves and an existing infrastructure so it’s easier and faster for Vale to get the product to market than starting from scratch.

Take an Operatorship Stake

When a mining company takes an operatorship stake in a project, it means the company is taking the responsibility for mining and selling all of the product from that project. The owner of a project with an operatorship agreement usually gives its partners access to a set amount of raw material each year depending on agreed-upon rates, but a mine under operatorship has 100% control of production and sales going forward.

This can be very profitable for both parties because the operator can control production and sales without having to pay the owner any additional fees for taking on operatorship. It’s also beneficial to both parties because the mining company is now able to focus on making money from its own mine instead of renting out part of it.

Iron Ore Gaining Traction

Iron ore production is gaining traction again after the pandemic slowed production due to a demand dearth. The largest importer of iron ore is China, and there was a significant reduction in China’s imports of iron ore as the country started importing less coal and steel to cope with the pandemic.

China has recently increased its coal and steel production, which means it will likely increase raw material demand as well. This is good news for Vale because increased demand from China should help push prices up significantly even if it doesn’t acquire Minas-Rio.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Anglo American PLC (LSE:AAL) has appointed a female chief executive for the first time to run its South African iron ore business as it restructures its top commodity branch management. The change comes at a time when mining continues to be dominated by men despite efforts by some companies, including the BHP Group, to increase the presence of women in their boardrooms. Mpumi Zikalala, the chief executive of De Beers, will become chief executive of South Africa’s Kumba Iron Ore Ltd., starting January 1, the company said in a statement on Tuesday.

She replaces Themba Mkhwanazi, who will take over as head of the bulk commodities division following the departure of Seamus French. The appointment comes after Anglo American appointed Natasha Viljoen as CEO of its platinum-group metals business, Anglo American Platinum Ltd, last year.

Ruben Fernandes, CEO of Base Metals, will assume responsibility for the iron ore and nickel business in Brazil, Anglo has announced. He will also oversee the Quellaveco copper operation in Peru, although it is still awaiting commission.

Zikalala, 42, was appointed head of De Beers’ South African and Canadian operations in 2019. She joined De Beers in 2007. Although she lacks bulk commodity experience, her background at Anglo and extensive management experience and technical qualifications in engineering offset all of investors’ immediate concerns, an analyst at Bloomberg Intelligence commented.

Chinese demand for high-grade iron ore from Kumba has made it one of Anglo’s most profitable assets. Its shares fell 2.1% in Johannesburg on Tuesday, extending its decline this year to 23%. This will ultimately be a turnaround operation for Zikalala.

While Kumba benefited in recent years from rising prices, Zikalala faces the challenge of finding new deposits to expand the open-pit Sishen mine in South Africa’s North Cape province.

Iron Ore Comes to the Forefront

According to the World Bank, the pullback in prices is the result of persistent oversupply, owing to weak demand from China’s steel-producing sector and the depletion of iron ore inventories by Chinese factories. Prices have risen slightly in recent weeks, but are still only a fraction of their May 2021 peak of $229.50.

Trade in iron ore makes it the second-largest commodity market after crude oil, and Australia has a significant share of these markets, accounting for more than half of the iron ore market by exported sea. Australia’s Pilbara region is one of the largest deposits of iron ore in Australia, and major investments were made to ensure that production and processing costs are low. Magnetite ore has an established presence in global production and contributes to Australia’s EDR iron ore with established operations such as Savage River in Tasmania, Sino Iron in Pilbara, and other magnetite deposits in Western Australia and South Australia.

The slowdown in the Chinese economy is taking its toll on iron ore supply. Commonwealth Bank of Australia found that Australia’s maritime supplies fell in its most recent measurement, while China’s iron ore stocks contracted for two weeks in a row. Chinese stocks of iron ore and steel manufactured products, which were built on the expectation of a large stimulus package, have materialized and are running out, exacerbating downward swings in prices.

Economic Indicators

Iron ore has taken on a role as a global proxy and indicator of economic health, competing against copper. The reason for this is the growing interest of investors in steel raw materials, because they are linked to the industrial economic cycle and China is the world’s largest consumer, acting as a global economic driving force.

Given the ubiquity of steel – steel accounts for 95% of the world’s metal production – iron ore, the raw material from which steel is made, will likely always be a critical piece of the mining industry’s output.

Many meteorites contain large quantities of iron ore, and modern society relies on metallic ores to supply industry, infrastructure, and miners in search of new ore. Iron is used in glass, fertilizer, and solid-fuel rockets and was used in the space shuttle before it left Earth’s atmosphere. The challenge for steel production is to produce iron ore that enables sustainable growth while reducing greenhouse gas emissions from the production process itself.

An Uphill Battle for Zikalala

As Kumba begins its trek to a turnaround, Zikalala will have an uphill battle to contend with. However, optimism over economic rebounds post-pandemic as well as an ambitious infrastructure spending bill in the United States could see demand spike again along with iron ore prices.

The recent turmoil caused by Evergrande’s debt crisis has also thrown iron ore prices into the middle of a volatile storm. The Chinese government will likely look to settle the issue and assuage investors’ doubts to reestablish stability for the steel industry which is the primary driver of iron ore prices.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Nickel is an indispensable compound in steel production and is known as the “silent saviour” because it plays a role in the global transition to clean energy and is one of the key metals for battery assembly in electric vehicles for companies like Tesla, Volkswagen, Mercedes, and more. In 2020, despite the global pandemic, global nickel production totalled 22 million tonnes. Global nickel mining production is expected to rise again this year, with GlobalData estimating an increase of 6.8% to 25 million tonnes.

According to the US Geological Survey, total nickel reserves are estimated at 94 million tonnes. That total counts Australia and Indonesia as holding some of the largest reserves in the world, with big production numbers as well.

Production slowdowns were not a particular problem for the nickel mining industry, and the industry was more than able to make up for lockdowns and restrictions by keeping operations running in multiple countries using caution and the right safety measures. The total 22 million tonnes produced in 2020 is a testament to the resiliency of the industry and the fact that while demand may have shrunk temporarily in the period, production must continue to keep up with ongoing demand that continues to rise.

The Top 10 Nickel Producers

Russia Norilsk Nickel (OTC:NILSY)

Russia Norilsk Nickel (Nornickel) was the top nickel producer with approximately 178 kilotons (kt) of production, up from 172 kn in 2019. The Nornickels Kola Division, which includes five mines, is being reviewed for its environmental footprint and has pledged $5 billion over the next decade to clean up the pipelines on the Kola Peninsula.

Vale (NYSE:VALE), Glencore (OTC:GLNCY)

From its Brazilian proejcts, Vale (NYSE:VALE) is in second place with 167.6kt, down from about 171kt the year before. PT Vale Indonesia says it plans to begin construction of its Pomalaa nickel project next year. The mining giants in third, fourth and fifth place are Glencore (OTC:GLNCY), which has assets in Australia, Canada and Europe and collectively produced 101.6kt and 108kt in 2019 ; followed by BHP (ASX:BHP) with 74.8kt from its nickel west business in Australia, and Anglo American (LSE:AAL) with 43.6kt from its Brazilian business.

The Chinese company MCC JJJ Mining, whose production is based on its ownership of 85% of Ramu Mine in Papua New Guinea, rounds out the top ten and is one point behind Finnish Terrafame with 28.6 kts of nickel production in 2020. Perth-based IGO produced 29.5kts and Terrafames followed close behind with 28.7kTS.

A Metal for an Electric Future

Nickel is known as the “silent saviour” because it plays a role in the global transition to clean energy and is one of the key metals for battery assembly in electric vehicles. The nickel group is of extreme importance to the global economy and the mining industry in countries in every corner of the globe.

Metallic mineralization occurs in the hard nickel group, which includes nickel, cobalt, copper and chromium. The economic concentration of nickel is found in sulphide and laterite-rich deposits in Australia, Indonesia, South Africa, Russia and Canada which together account for more than 50% of the nickel resources in the world. Nickel mining has increased significantly over the last three decades, and known nickel reserves and resources are growing rapidly.

Due to the enormous use and demand for Canada’s nickel specifically, nickel-related products are exported to more than 100 countries. Nickel and its compounds are indispensable for the manufacture of countless products on which we depend.

Nickel, long used as a corrosion-resistant material in the steel industry, has exploded due to the mass production of cheap electronic equipment, most of which uses nickel in manufacturing. Demand for nickel has also increased in recent years and is becoming increasingly important in the electric vehicle industry. As demand for renewable energy increases, electric cars are increasingly dependent on copper, nickel, cobalt and other metals.

As the world moves away from fossil fuels, the demand for copper, nickel, cobalt and other metals will continue to rise. A 2017 World Bank report says that the industry will demand copper and nickel by 2050 at an increase of 250% if the world builds enough wind technology to keep global warming below 2 degrees – an increase over the Paris climate agreement benchmark. With the additional need from energy storage technologies, the demand for nickel will increase by 1,200 percent.

The same applies to cobalt, which is needed for lithium-ion batteries and can be degraded. According to a report by the World Bank on a low carbon future, there will be strong demand for a wide range of base and precious metals. In addition to the usual suspects such as cobalt and lithium-ion, the list includes aluminium, silver, steel, nickel, lead and zinc.

Cobalt is a silver-grey metal that was developed as a by-product of copper and nickel mining and is an important component of the cathode of lithium-ion batteries. Nickel is another ingredient needed in batteries and is expected to account for a large proportion of future batteries.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Teck Resources Ltd. (NYSE:TECK) is exploring options for its metallurgical coal business including a sale or spin-off that could mark the unit up to $8 billion, sources with knowledge of the matter said. Teck is working with consultants to explore strategic alternatives for the coal block, insiders said to Bloomberg News, citing confidential information.

Teck isn’t the only company to reconsider its assets. Major commodity producers are under increasing pressure to reduce fossil fuels in response to investor concerns about climate change. BHP Group (ASX:BHP) recently agreed to sell its oil and gas assets to Australian company Woodside Petroleum Ltd last month and is attempting to exit the coal business.

This is a recurring and growing trend in the industry as coal mining falls out of favour for the critical tech and other metals needed for a carbon-neutral economy. Copper, aluminum, lithium, nickel, and cobalt are some of the preferred business units that are seeing investment from mining companies.

Each of them is critical to the battery supply chain, electric vehicle (EV) manufacturing, or energy industries and will be required in massive amounts. This is also driving the need for clean steel and other metals while simultaneously reducing the size of coal divisions.

Anglo American PLC (LSE:AAL) produced more than 21 million tonnes of steel coal last year at four sites in western Canada. The company spun off its South African coal division in a separate IPO in June. Consultations are still at an early stage and the company has yet to decide whether to retain the South African unit, it said.

Anglo American accounted for about 35% of gross profit before depreciation and amortization in 2020, according to its website. An exit from coal would free up resources for Anglo American (LSE:AAL) to accelerate its plans for commodities like copper for which demand is accelerating on the powerful tailwind of a coming electrified global economy.

Metallurgical coal, a key raw material for steel production, remains one of the world’s most polluting industries and is under considerable pressure from policymakers to clean up their act. China, the world’s largest metal producer, has even hinted at curbing steel production to reduce carbon emissions. Still, metallurgical coal prices have continued to rise this year as investors fuel steel demand on a global economic recovery and sustained needs as the transition to cleaner sources continues.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

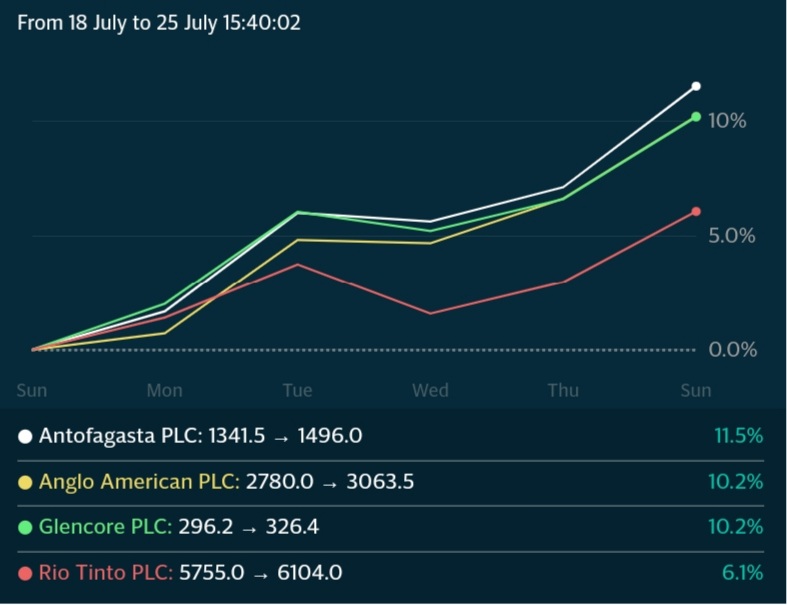

This is set to be a big week for mining earnings, as some of the world’s biggest mining companies will begin to show the market exactly how much this commodity boom is helping. This week will see the top five western diversified mining companies report earnings, and investors should be watching for record profits that could drive dividend payouts to match.

Analysts estimates show that the top five miners may have raked in a combined $85 billion in the first half of 2021, double the number from 2020. Of course, lockdowns and supply chain meltdowns had serious effects on earnings last year. As processes slowed to a halt and demand dropped off a cliff, mining companies mainly were sitting on their hands like the rest of the economy.

However, the latter part of 2020 saw engines start up and restrictions lifted in many mining-friendly jurisdictions, and 2021 has accelerated the commodity price gains from last year.

The first to report on Wednesday will be Rio Tinto Group and is expected to announce $22 billion in profits for the first half of the year, equalling the same amount as its total profits in 2020.

Other companies such as Glencore, Anglo American, and Vale SA were also expected to post massive profits for the first six months of 2021, and possibly their highest-ever numbers for the six months to June period, according to estimates from analysts compiled by Bloomberg.

The sector has seen a revival of its activities faster than most other sectors of the economy as the industry has been one of the primary beneficiaries of the recovery stimulus injected into the global economy. With trillions of dollars in recovery packages going out, demand for commodities has bounced off 2020 lows to skyrockets higher every single month. Demand for commodities like iron ore, aluminum, steel, and copper are driving prices higher every week while inflation pressures continue to spread through the economy.

This bull run for commodities has been a huge gift for mining companies who have the tailwind of demand and higher prices for their production to account for big profits.

Ben Davis, an analyst at Liberum Capital, said, “This should be a pretty much stellar set of results all round. We’re expecting record dividends from BHP and Rio, while Anglo and Glencore also have the potential to surprise.”

Stocks have been on a tear lately, up double digits in some cases in a single week, so there may be room to move higher on earnings news. Freeport-McMoRan already hinted at its blockbuster results when it announced it had wiped out $5 billion in debt over the last 12 months, blasting past a target month ahead of the planned schedule.

A record dividend was also paid out by Anglo American Platinum Ltd. (79% owned by Anglo American) on Monday of $3.1 billion, equal to 100% of first-half headline earnings. In a significant understatement, CEO Natascha Voljoes said the company was in a “strong financial position” and that the company was able to deliver “industry-leading returns.”

Everyone is set to benefit from higher profits from miners this year, beyond stakeholders and investors in the companies themselves. Government should also see higher tax receipts from miners, who contribute significantly to the global economy and often up to a third of any given domestic economy in many regions like South and Central America, and Africa.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

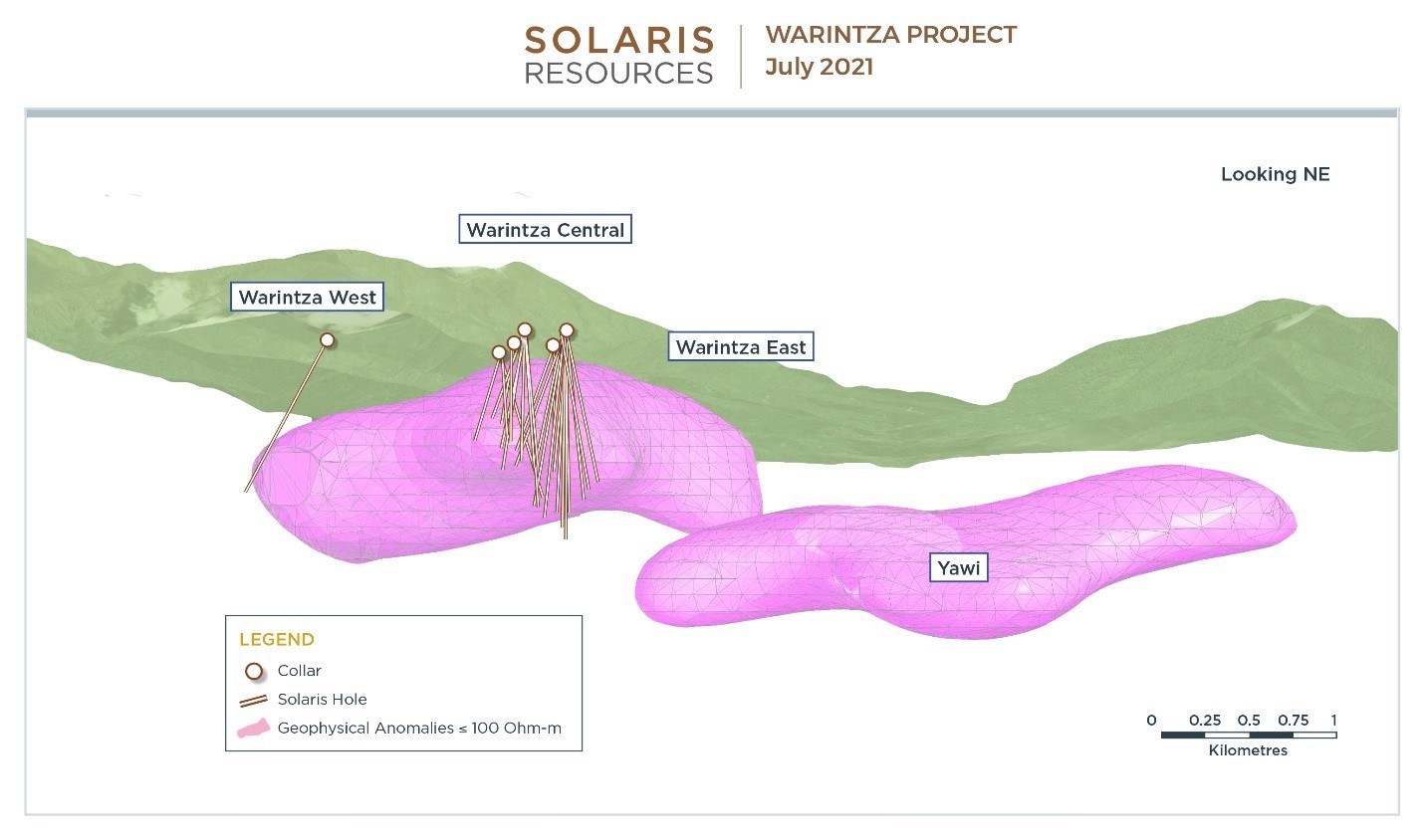

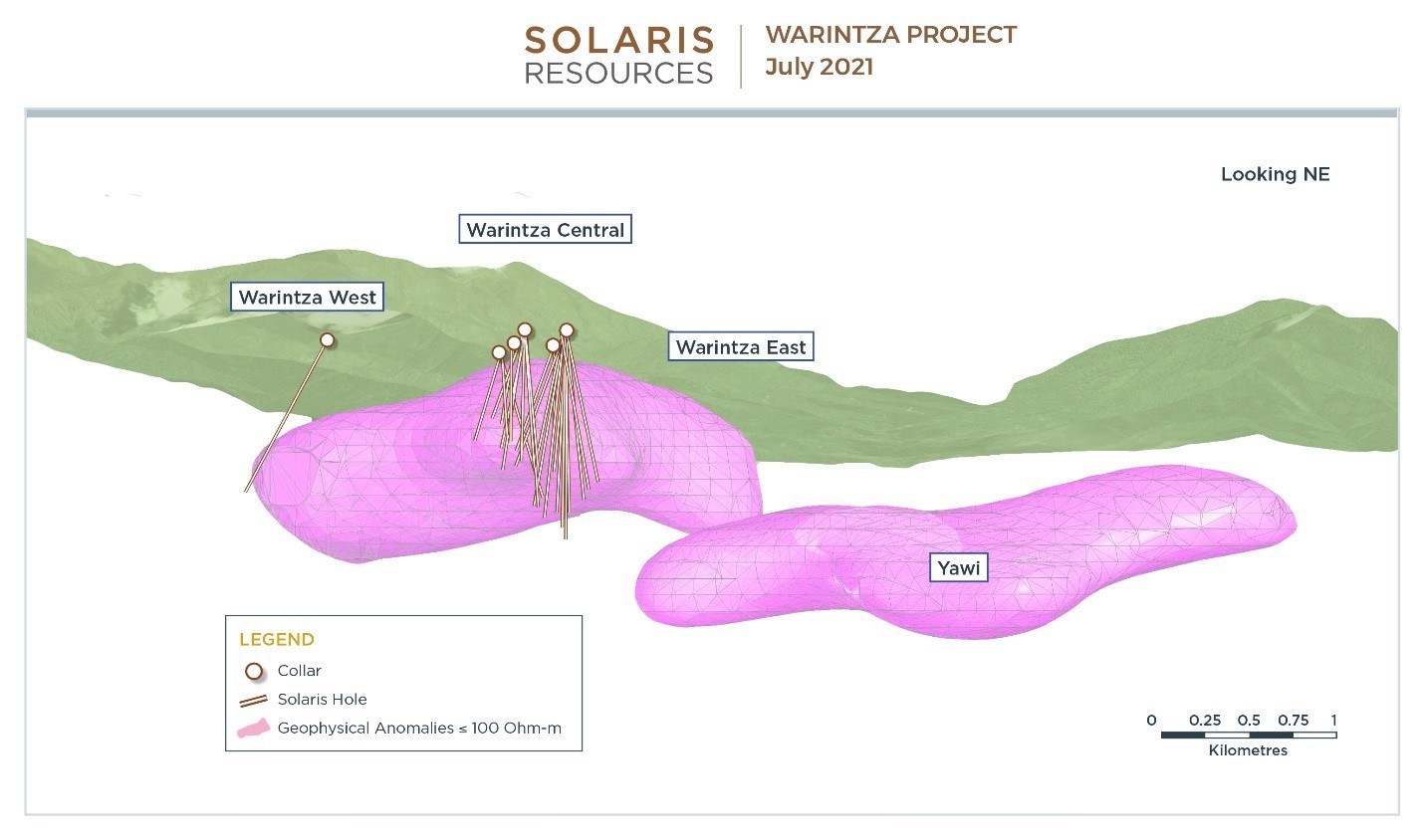

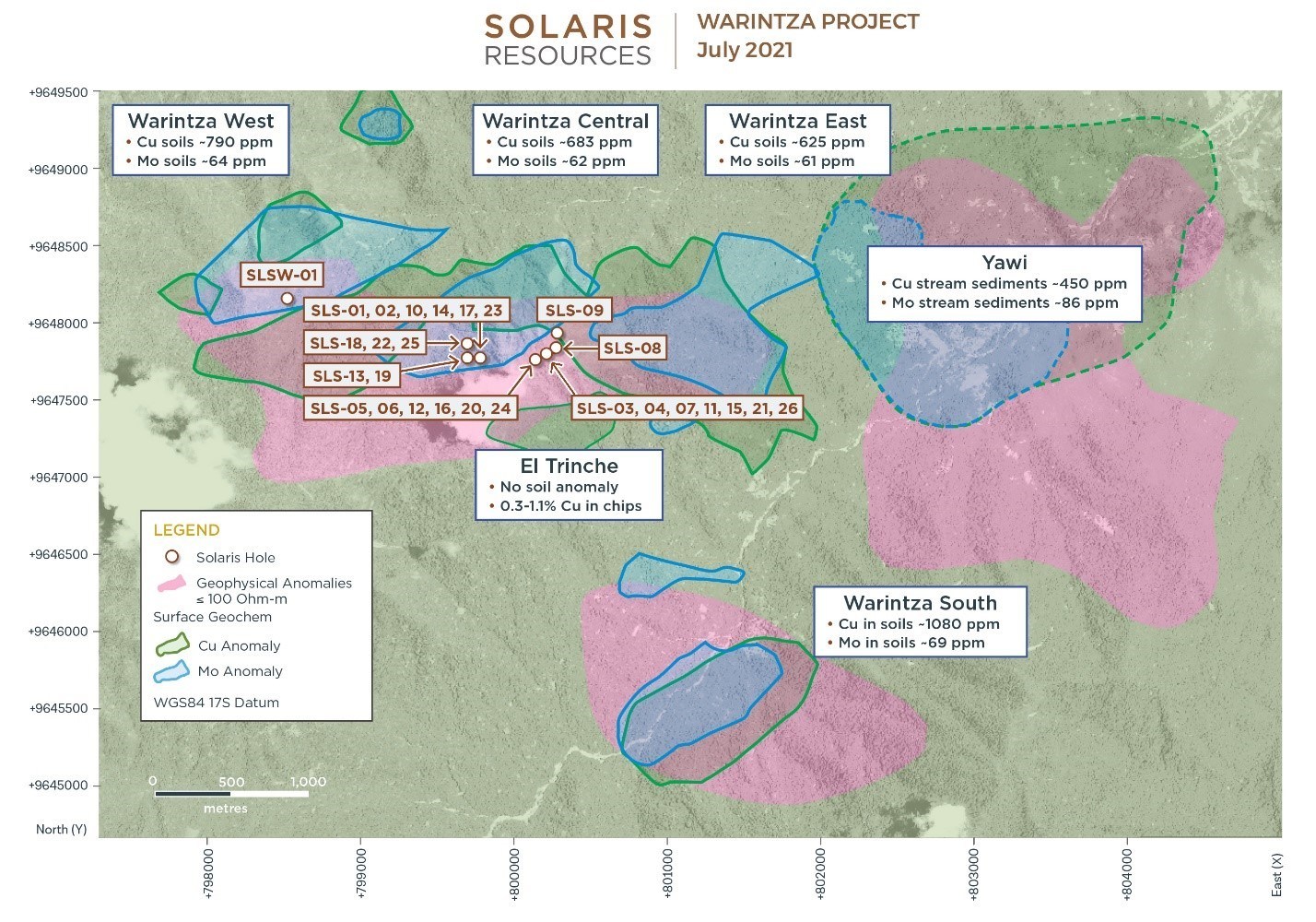

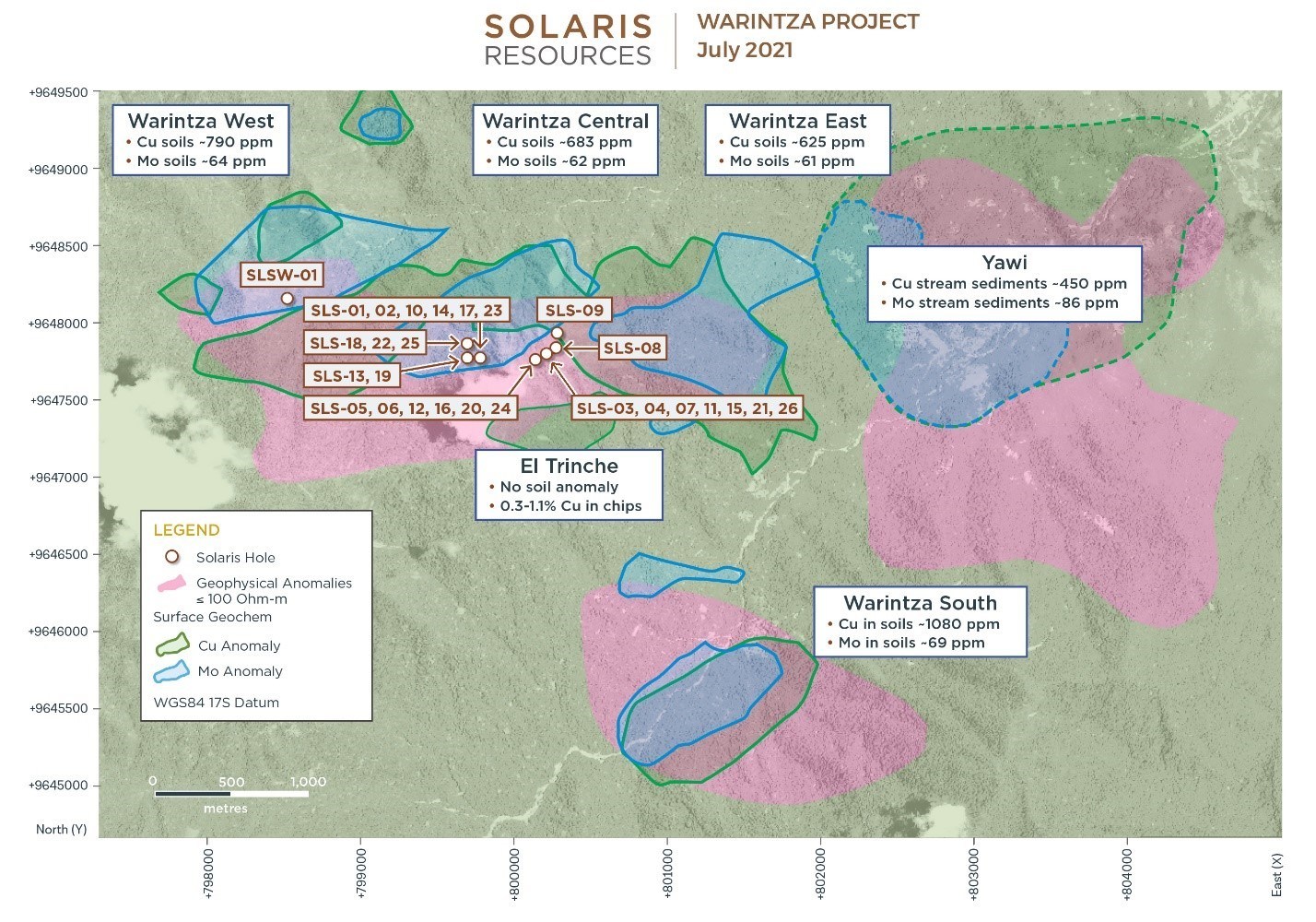

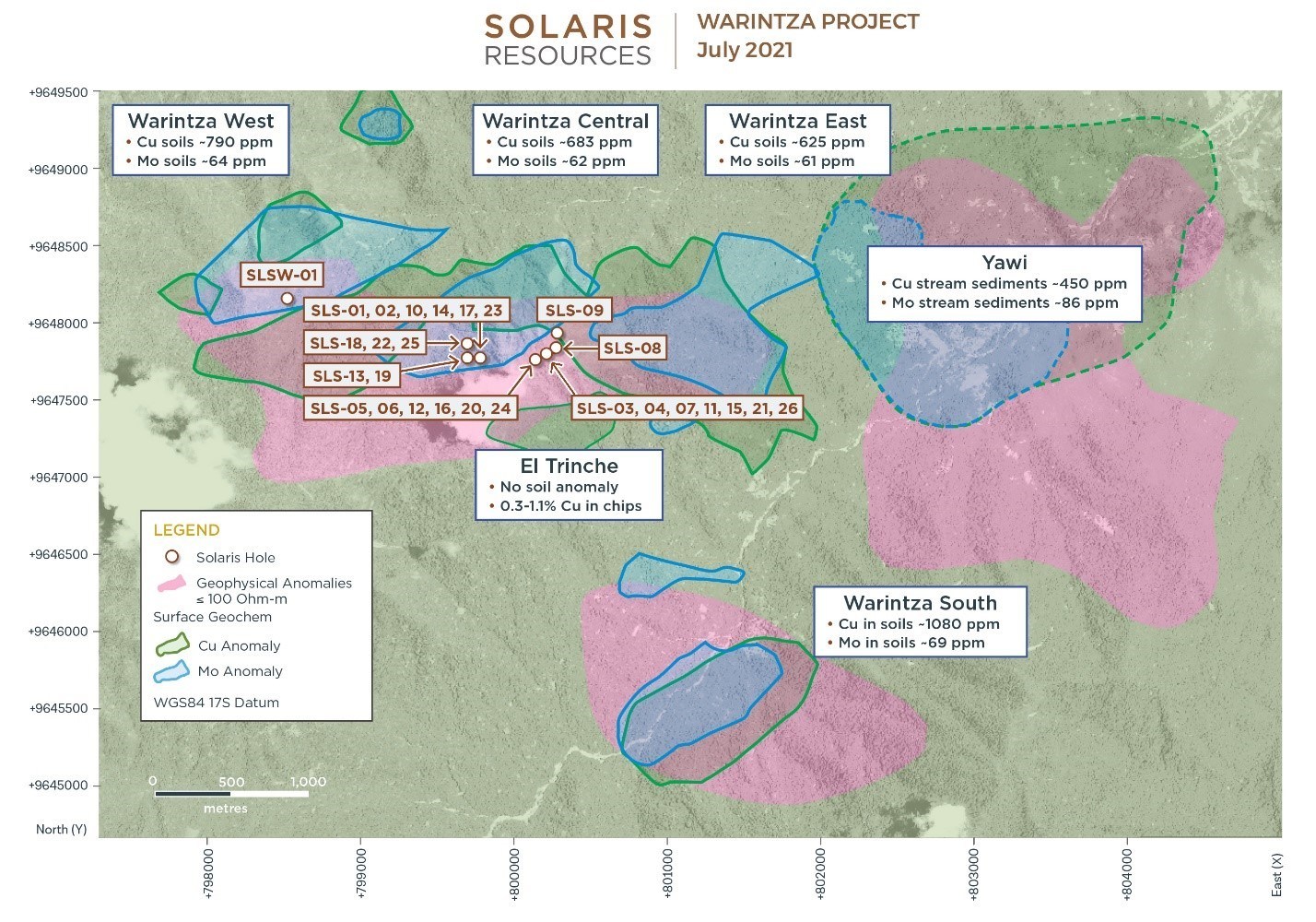

On Tuesday, Solaris Resources (TSX:SLS made significant gains in their Warintza drilling campaign in southeast Ecuador and announced a new discovery at Warintza East, located ~1km east from their Warintza Central deposit where resource expansion drilling is ongoing. Warintza East is part of a more extensive copper mining campaign in the Warintza area that spans over a 35 square kilometre region and comprises five main mining targets.

Solaris Resources has been a massive player in the South American copper drilling industry for some time now, with copper and gold projects in Ecuador, Chile, Peru, and Mexico. However, their recent work in the Cordillera del Condor Mountain region of Ecuador is one of their more exciting and promising projects to date. The area is known to be ripe with tens of millions of tonnes of contained copper and millions of ounces of gold and hosts nearby mines of Lundin Gold’s Fruta del Norte mine and a Chinese consortium’s Mirador mines.

We spoke with Daniel Earle, CEO of Solaris Resources, on the results at the Warintza project and took a look at some of the biggest reasons why this company is set for the next major leap.

So far, each stage of the drill program has continued to yield positive results with discoveries. Three discoveries have been made so far, with two more targets still left to drill. Mr. Earle said, “We drilled a hole at what we call Warintza West in February, which resulted in a discovery there, and then just yesterday we drilled a hole at Warintza East, which resulted in a new discovery there. So now three discoveries within this cluster of copper deposit targets, and that leaves two more major targets to drill in the future.”

“All of our drill holes, and all of the historical drill holes, have all hit economic copper mineralization, so there is nothing drilled on this property that hasn’t resulted in economic copper.”

With Warintza South and Yawi next up on the list of discovery drilling as well as expanding Warintza Central and East, more results seem likely to continue the trend of fruitful discoveries as every single target has been a success so far.

Cash balances will allow for a very long runway for the company, with about $60 million on the balance sheet right now and approximately $20 million needed for the remaining 2021 capex: “We will be testing Warintza South and Yawi targets before the end of the year. And all of that will be covered by the $20 million budget.”

That will leave a sizable remainder for the company as it looks toward its next possible major milestone, a sale.

“By the time the calendar rolls over to 2022, we are going to be looking at a process to sell this entire company. We will still be in a very strong cash position.”

With the stock breaking above $13 recently and showing no signs of abating, the company is still not at a valuation that might match the scale of the current drilling at the Warintza Central deposit and existing and potential discoveries at the other regions.

The Company is undergoing a resource expansion drill campaign at Warintza Central which hosts a historical inferred resource of 124 million tonnes grading 0.7% copper equivalent, based on very limited, shallow historical drilling. An updated resource estimate is expected in Q4 2021 and drilling has already demonstrated that the new resource will be an order of magnitude larger. The company’s target at Warintza Central alone is to define a copper resource of 1 billion tonnes, which could ultimately see Solaris Resources triple its current valuation, not inclusive of any additional discoveries made on the property.

Mr. Earle pointed out that the Augusta Group track record bears out a pattern that may serve as a useful model for its exit strategy: “Our last company within the Augusta Group, we sold for $2.1 billion in 2018, that was at a multiple of essentially 100 percent of the net asset value of the primary assets. In Solaris today, we are trading at approximately one-third of that level.”

“So we have a lot of work to do to extract a representative evaluation here at Solaris.”

Pushing that valuation is another tailwind the market is providing: “This copper price cycle is going to be much more powerful because of greater fiscal and monetary stimulus, and number two, we have these megatrends in place of decarbonization and electrification.”

“Electrification of the residential sector, of the industrial sector, smart grids, grid storage, all these other kinds of areas of growth that are all incredibly copper intensive.”

That need is bigger than ever, possibly pointing to something bigger than just the effects of a price cycle. While copper price behaviour has matched expectations, the effect is also being multiplied by current conditions and the grand expectations of an electric future beyond anything anyone has ever seen before.

In understanding the scale and importance of Warintza, Daniel Earle notes that it is important to consider the context within which it resides and possible comparables for the project and company, “I think the key is just to understand the context around what we have here and what we are going to achieve, and to look at the global comparables for an asset like this.”

“You have to look at some of the best copper development assets in the world if you want to understand the context of what we are trying to do.”

A key copper project in Peru – Anglo American’s (LN:AAL) Quellaveco, may be a potential future comparable once the resource estimate is released. While that mine has a long proven track record, Warintza may be the project to match or surpass it. Solaris holds some other key advantages with its project that may allow the company to get a higher return out of its exploration efforts.

“We’re going to do it at much lower elevation, adjacent to a highway, adjacent to a power grid that is supplied by low cost, emission-free, renewable power, with abundant freshwater, with a low-cost and skilled labor force in Ecuador.”

“You realize that this is something totally unique.”

First Results Are In

Highlights are listed below, with corresponding images in Figures 1 and 2 and detailed results in Tables 1-2. A dynamic 3D model is available on the Company’s website.

Highlights

- SLSE-01 was the first hole ever drilled at Warintza East and collared approximately 1,300m east of Warintza Central, where recent eastern extension drilling intersected 1,000m of 0.60% CuEq¹ from surface (see press release dated July 7, 2021), with the Central zone still open in this direction

- SLSE-01 was drilled to a total depth of 1,213m with assays reported herein for the first 320m of core from surface, which were given priority in transport, cutting, preparation and assaying – results for the balance of the hole are expected in late August/early September

- SLSE-01 returned 320m of 0.46% CuEq¹ from surface, including 54m of 0.70% CuEq¹, in an open interval, marking a significant new discovery from surface at Warintza East, one of the five main targets within the 7km x 5km cluster of porphyry targets defined on the property

- Warintza East is defined by coincident overlapping copper and molybdenum soil anomalies, measuring approximately 1,200m in strike, and a high-conductivity geophysical anomaly that extends from the target through Warintza Central (refer to Figure 1)

- Further drilling will target the expansion of Warintza East, with a focus on the open area between Warintza Central and this new discovery (refer to Figure 2)

Table 1 – Warintza East Partial Results

| Hole ID | Date Reported | From (m) | To (m) | Interval (m) | Cu (%) | Mo (%) | Au (g/t) | CuEq¹ (%) |

| SLSE-01 | July 20, 2021 | 0 | 320 | 320 | 0.36 | 0.02 | 0.05 | 0.46 |

| Including | 0 | 54 | 54 | 0.49 | 0.01 | 0.05 | 0.56 | |

| Including | 162 | 216 | 54 | 0.60 | 0.02 | 0.04 | 0.70 | |

| Notes to table: True widths cannot be determined at this time. | ||||||||

Table 2 – Collar Location

| Hole ID | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (degrees) | Dip (degrees) |

| SLSE-01 | 801485 | 9648192 | 1170 | 1212 | 260 |

Source: Solaris Resources

Figure 1

Figure 2

Source: Solaris Resources

Future Plans

In the upcoming weeks, the company plans to continue resource expansion drilling at Warintza Central, with the updated resource estimate expected in Q4 2021, as well as continue discovery drilling at Warintza West and East and undrilled targets at Warintza South and Yawi. Solaris’ VP Exploration commented on the drilling campaign, “The discovery at Warintza East marks the third major copper discovery within the voluminous 7km x 5km Warintza porphyry cluster. Importantly,the footprint of Warintza East overlaps conceptual pit designs for Warintza Central, which itself continues to grow eastward with recent results. Future drilling will focus on the open, undrilled area between these two zones.”

Copper prices have been on a rapid rise and have even recently hit all-time highs. With global demand for copper predicted to only rise further, the Warintza project’s expected ROI seems to have one direction – higher.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

Junior mining companies are the prime drivers of new IPOs for the mining industry. The rewards for investing in these companies often far outweighs the risks, as getting in on the ground floor of a junior mining company can mean triple digit percentage point gains or more. Still, there are many questions on investors’ minds before they invest in a mining company, including the company’s plan for exploration, and how to evaluate whether the junior miner has a good chance of success.

Due diligence and risk management are just as essential when investing in junior mining companies, but factors as wide ranging as the strength of the management team and technical advisors, as well as the company’s ability to finance its exploration with a strong balance sheet, to the viability and potential of its chosen drill sites. Paying attention to the financials, operations, and the drill plan and results are all required to make better decisions when investing in junior mining companies. To get a better understanding of this potentially highly lucrative investment strategy, we spoke with Lennin Munoz, a geo engineer and mining industry veteran.

Mr. Munoz was able to provide us with some of his insights into why it is important to take a broad overall look of the company, as well as a detailed assessment of its drilling results and management philosophy.

Taking a deep dive into a junior mining company means going beyond the headlines and getting in the financials, and using critical analyses like NAV, IRR, CAPEX, and more to make an informed decision.

What are the critical analysis points you use to determine the strength and viability of a project?

Desirability, Viability, Feasibility and Sustainability. Inside the desirability angle for example if I look for a tier 1 or 2 deposit, I’ll definitely start with geology, for me the ORE BODY IS ALL! So good tonnage and grade is a key factor (e.g 1 Bt 1%Cu or 200 Mt 2g/t Au), then I analyze the viability of the project, for example, potential to be developed, metal production profile, CAPEX intensity, All in Sustaining Cost position in the cash cost curve. Then, I incorporate the feasibility perspective for example, mining methods, high grading programs in first years (payback), Geotech & hydrogeology, metallurgy, processing, tailings and water management, etc. This review helps me to complete my SWOT analysis, so at the end I include the sustainability framework to have a clear map of risks and opportunities, so I can at least measure which is my main risk and what the company is doing about it.

All of this process is summarized in a model where I define the metrics to rank investment opportunities, for example, NAV, IRR, payback, CAPEX, others. I like to calculate NAV/share since this is a comparable metric with the market value and I could make decisions according to my risk/reward ratio.

How important is the environment, social, and governmental (ESG) aspect for a junior mining company? How important is it for you as an investor, and are the companies doing this right changing views on the mining industry?

ESG is here and these important three letters are a must in any project valuation, for example, I use to review assets using a mining economics framework split in desirability, viability, feasibility, and sustainability (I used the Hutton model), is in this last point that ESG plays a key role, a decisive point that can determine any GO or No GO; my experience in the industry tells me that you can have the best skarn deposit, with a tremendous mine plan, already approved by your company’s board and be in a BFS stage, but without an environmental view, a social acceptance, will not fly. Or it can, but is this sustainable in the long term?

It’s difficult, will not be easy, net zero emissions as an example will be a very expensive initiative, but is here, I’ll try to be in Minexpo this September, I’ve reading very interesting material about new technologies in different vendors, thinking in carbon emissions, green energy, or any other idea aligned with the ESG framework.

Last but not least, and by the way I think the most important part, the social aspect, is that the industry is turning mindsets and thinking about how you can work in the same environment for mutual benefit. Learning from other’s mistakes through history is a very powerful tool in this sector. I think most of the developers are changing the strategy to implement a real social, and sustainable model.

Which companies are proving out those ESG commitments and critical analysis points the best right now?

Particularly, I really like what Solaris Resources (SLS.TO) is doing in Warintza, Ecuador. This is not an easy task, a lot of effort on the ground is required, and of course you need a tier 1 team to do that, a very skillful one that can understand what is happening and what are the needs of all the stakeholders. This level of envelopment is so incredible that Lasso and Arauz mentioned the project in public interviews, so the relevance of the project is across the country.

Let’s continue with what Anglo American (AAL.L) is doing, for example they are clear about the feasibility of 100% renewable energy for the Quellaveco Project; this is a very important greenfield development for Peru, first autonomous project, 100% renewable!

Another example is Vale (VALE), after Brumadinho in 2018 and all the facts down the road, they are turning to dry stacking tailings facilities, we are at an inflection point about waste management. Going to dry stacking is not cheap but thinking in long term and safety for stakeholders as a crucial factor to put the project in the feasibility side, could be invaluable.

Which mining jurisdictions do you feel are providing the strongest advantage for junior mining companies right now?

I like stable jurisdictions like the USA or Canada, my gold positions for example are there but I think more work on the permitting front should be improved.

I like what Ecuador is doing now, when you listen to a president (Lasso) talking about mineral resources development plans for the long term? They want to be a main exporter of commodities, like Chile or Peru.

I like Chile too, but this situation about the mining tax program proposal should be solved ASAP. In the same line, Peru, I think we’ll be good, we need to work more on the ESG front and establish long term plans to develop greenfield projects, but without a social view, it will be difficult. I like these countries but for sure stability is needed.

With copper’s coming supercycle, should the industry be concerned about supply/demand dynamics?

No, we are in a middle of a stock/global consumption rate amber alerts, but this is driven as a consequence of lower production rates from previous periods, I think big players will join the party during 2021 and 2022 and the price will correct – I expect a pullback in base metals in the next quarters, I expect a support range of $3.5 – $4.0/lb in the long term as new consensus. However, if we consider the current stress scenario in LATAM I’d say that if in the short term the situation in Peru and Chile is not solved, copper prices can expect a lot of volatility without precedents.

How might this tailwind play out in the short/long-term?

In my experience this situation is split in 2 channels, short term, where operations are printing cash at these prices, and operations in the early stage can be more flexible to run high grading programs, at the end the ones sitted in the first quartile of the cost curve like Southern are having a good year.

In the long term, the increase in copper price assumption has a direct impact in the cutoff calculation, this item is used to define the mineral reserves or in practical terms, the profitable ore, the lower cutoff, the higher reserves inventory you have (if the modifying factors allows this upgrade), so, if you present an annual information format (AIF) with additional reserves, it’s very probable you submit in parallel an update technical report (e.g NI 43 101) and therefore your valuation will be different, you expect to see an extension of the life of mine, more metal production, potential upsides, etc.

So it sounds like a positive environment for junior copper mining companies exploring over the next decade?

Absolutely, let’s take the long term explanation bove, marginal projects at $3/lb can be considered now in the development pipeline at these prices, which will depend on metrics but yes, upside is at hand.

Which companies/metals are on your watchlist or your prime investment candidates?

I like asymmetrical investments, and I think junior companies can provide that. Right now, a junior copper company is my favorite one. I like the “cost opportunistic” view, so if one thing is good, why gamble on things you don’t know? I think speculation is part of the markets but in my portfolio or watchlist, at least I consider companies where I can understand what they are doing, but if I can calculate the NAV under my method, that is a place where I will wait patiently.

The Mining Stocks Lennin Muñoz is Watching

Solaris Resources: (SLS.TO)

This junior copper mining company has driven forward recently with positive assay results, the expansion of drill holes at its flagship Warintza Project in Ecuador, and stock growth generating massive investor value.

The stock’s uninterrupted climb has been pushed along since the company went public last year by strong results and the addition of drill holes. The company’s expansion to its Warintza East with the first drill hole is contributing to the optimism around the company, and Solaris (SLS.TO) is number one on Mr. Munoz’s mining stock picks.

Anglo American (AAL.L)

Anglo American’s (AAL.L) Quellavaco mine in Peru is a shining beacon of what a new copper mine can be, and the site is one of the largest undeveloped copper deposits in the world. It’s commitment to operating with ESG principles at the forefront of the project’s philosophy means that Quellavaco is, according to Mr. Munoz, a “very important greenfield development for Peru, first autonomous project, 100% renewable!

With one of the best mining jurisdictions in the world, Peru affords Anglo American the perfect opportunity to develop this massive project while keeping it cost and energy-efficient.

Vale (VALE)

Vale’s (VALE) commitment to improving the maintenance and safety of its dams gives it a unique advantage in the industry right now. The company’s plans to increase the share of dry processing in its production to 70% by 2023 will allow it to reduce the use of dams in its operations.

By investing in the implementation of dry stacking disposal technology, this initiative shows that we “are at an inflection point about waste management, “said Mr. Munoz. “Going to dry stacking is not cheap but thinking in long term and safety for stakeholders as a crucial factor to put the project in the feasibility side, could be invaluable.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

For countries to reap the rewards of their natural resources, they need to make sure there is a favourable climate for miners and businesses operating within their borders. For Ecuador’s new president Guillermo Lasso, that means welcoming mining companies with open arms as they work to build a sector that is critical to Ecuador’s national economy. Chile hosts some of the biggest mining companies in the world, including BHP Group Ltd. (NYSE:BHP), Anglo American Plc (LSE:AAL.L), Glencore Plc (GLNCY), Antofagasta Miners (LSE:ANTO.L), and Freeport-McMoRan Inc. (NYSE:FCX).

Walking a Tightrope

Recent discussions by lawmakers in Chile could throw the country’s status as a mining hotspot into question. If investors or companies get spooked by the new tax, it could hamper efforts to invest in new projects or expand the ones currently operating in the region. Particularly for proposed royalty deals on copper and lithium sales, the ongoing discussions now could throw a wrench into the works of years of planning and investment.

Foreign investment in the country is an essential source of stimulus and job creation. The mining industry contributes massively to the national economy, and it has made Chile the biggest copper-producing nation in the world. With the new bill approved just last week imposing higher taxes on sales, and cash generated based on the current running price of copper, those contributions could begin to dry up.

A Painful Tax

Initially, lawmakers wanted to impose a 3% flat royalty for mining companies extracting copper and lithium. The valuable metals have seen steady price increases over the years, and with the coming electrification of the global economy, this trend shows no signs of abating.

A new version of the bill proposes a marginal rate of 15% on sales with copper prices between $2 and $2.50 per pound and up to 75% on any revenue generated from fees about 4%. This sliding scale has miners concerned about the future of their operations in the country, as copper’s price seems to have no slowdown in sight. If the bill were approved today, with current copper prices, the royalty rate would be 21.5%. Miners would be able to discount refining costs and some other tax write-offs for any copper sold as refined cathode, but the cut would be almost prohibitive for them.

“You can absolutely try and take more from the golden goose…”

This proposed tax would hit the biggest mining companies the hardest, with the bill affecting miners that produce more than 12,000 tonnes of copper and 50,000 tonnes of lithium per year. One of the companies that would be affected is speaking out against the proposed bill, as it would cut into the country’s status as a mining partner for some of the largest mining companies in the world. According to Ragnar Udd, President of BHP Minerals Americas, “You can absolutely try and take more from the golden goose but you just need to be very clear on what the implications are on that long term. The sort of reforms that are being put forward at the moment will be really quite damaging to the industry.”

“These are tax levels akin to expropriation…”

Even though the proposed tax has miners worried for the future of their operations, it is unlikely that the bill will be passed, especially in its current form. He believes the current system is fine, under which miners are charged a variable rate of up to 14% on operating profit. This rate only applies to large producers and does not affect the less competitive mines, giving them a shot at growth and keeping the country competitive for international investors.

For now, worry and outright opposition are the state of play, as one prominent mining group president has already touched on. Resistance is strong, and this is unlikely to let the bill pass as is. Sonami president Diego Hernandez issued a statement calling the project unconstitutional. He made it clear that the consequences of the proposed bill on the industry and the country would be severe and damaging. With this bill, Sonami (an organization representing copper miners in Chile) predicts that 12 of the 15 biggest miners operating in the country would end up operating at a loss.

Diego Hernandez himself has made it clear that the bill is unacceptable: “These are tax levels akin to expropriation and this is going to inhibit investment immediately.”

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

If you would like to receive our free newsletter via email, simply enter your email address below & click subscribe.

CONNECT WITH US

Tweets

Tweet with hash tag #miningfeeds or @miningfeeds and your tweets will be displayed across this site.

MOST ACTIVE MINING STOCKS

Daily Gainers

|

LML.AX | +125.00% |

|

GCR.AX | +33.33% |

|

CASA.V | +30.00% |

|

AHN.AX | +22.22% |

|

ADD.AX | +22.22% |

|

AZM.V | +21.98% |

|

NSE.V | +21.05% |

|

DYG.V | +18.42% |

|

AAZ.V | +18.18% |

|

GLA.AX | +17.65% |