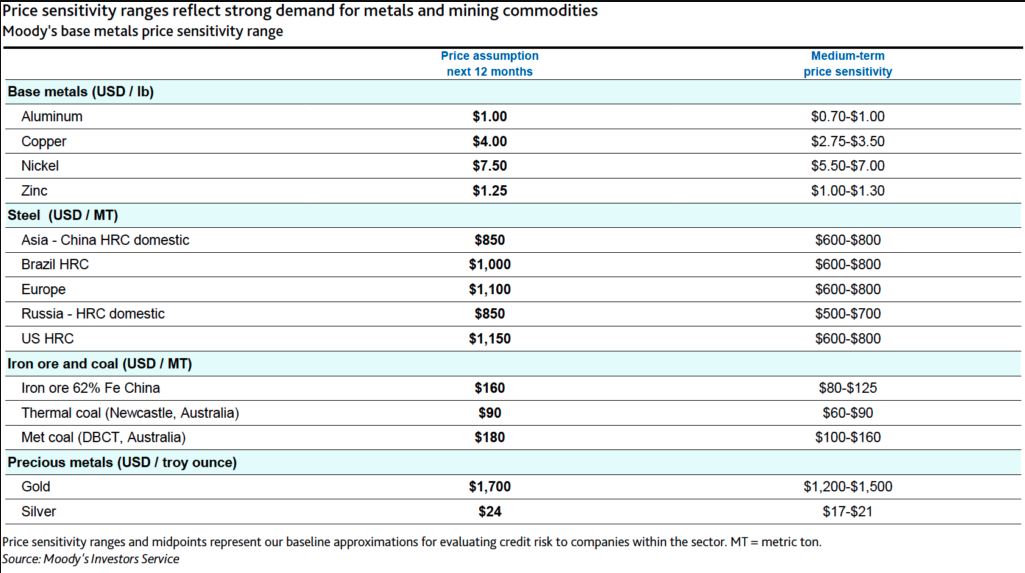

The outlook for the global metal mining industry has changed from positive to stable, with a new report from Moody’s Investors Service concluding that while most metal prices surpass historical highs, this does not mean that they will improve from current levels. Moody’s predicts in the report that most prices will pass historic highs.

The company also sees signs that most commodity prices will remain stable through 2022, reaching historic highs later this year. However, peaks above current price levels are expected to fade while the expected higher aggregate demand for metals and mining is still expected to increase over this period.

The Green Metals

Aluminum prices are expected to remain elevated until at least mid-2022. Aluminum prices will continue to rise in early 2022, after surpassing $2,600 a tonne, or $118 a pound, in mid-2101, the highest level in more than a decade. Copper prices are expected to remain strong relative to historical averages until at least the end of 2022, as long-term structural deficits will keep copper prices high.

Moody’s sees copper prices in the third quarter in the $250 to $300 a pound range compared with the start of the year before the devastating March 2020 pandemic affected many of the world’s economies.

Efforts by governments and industries to reduce carbon emissions have benefited copper production, but copper supply is struggling to keep pace with demand in certain regions, including Chile. Copper prices have remained above $400 a pound since February, after demand rebounded from a peak above $500 a pound and an early retreat when China risked a COVID-19 delta variant that could slow its production and copper imports.

Nickel in the Driver’s Seat

Global industrial activity remains strong, with manufacturing purchasing manager indices above 60% in the US and Europe and above 50% in China. If production recovers to pre-pandemic levels, nickel will be abundant. Moody’s believes that high nickel prices in the first half of 2021 will not be sustainable in 2022 and will remain high at least until the beginning of the year.

Analysts also point out that the supply of nickel pig iron (NPI), an inferior ferronickel that is a cheaper alternative to pure nickel for stainless steel production, will continue to increase as additional plants boost activity in Indonesia. The rise in NPI should offset reduced production in China, which is facing lower ore availability and rising ore prices.

Heavy Metal

While production at the large zinc mines in Peru, Mexico, Bolivia, and other countries is recovering, the global zinc market is shifting from deficit to surplus. This prompted Fitch Solutions to publish a report stating that the global zinc production will grow at the fastest rate of 4.3% between 2012 and 2021 as the disruption caused by COVID-19 subsides. Due to strong demand in the steel sector and reduced zinc production in China, prices will continue to rise in the second half of 2021. Zinc prices will show strength until mid–2021, but in the long run, they will fall to the lower end of the price range as long-term output growth outstrips lower demand growth.

According to Moody’s, prices will retreat from their peak this year as supply increases and demand growth slows. Coal prices are expected to remain high despite easing supply problems as geopolitical disputes ease.

Iron ore prices are likely to return to their average level of $70-80 a tonne between 2016-2019 and 2022. The tight iron ore supply is likely to keep prices below their historic norm in 2022.

Moody’s expects market uncertainty, low real interest rates, and inflation in 2022 to keep gold prices near historic levels and predicts that prices will fall below $1,800 an ounce by the third quarter of the year owing to an ongoing economic recovery, a strong US dollar, and a gradual increase in earnings. Global supply and demand imbalances in steel will return in 2022 and prices will fall to their historical average after unusual highs earlier this year.

What happens next will remain to be seen as investors hold on for the ride of their lives on what has so far been a commodity price rocket ship.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.