In early May silver reached a high of nearly $50 an ounce. Then it seemingly hit a psychological brick wall built by the Hunt brothers and beat a hasty retreat to $32.32. But since its sharp correction, silver has been making a slow and steady comeback and now trades at around $41.50. Eric Sprott, the founder of Sprott Asset Management, calls silver “the best recommendation anyone could make this decade” and sees silver going to $100 an ounce within the next 3 to 5 years.

Sprott’s prognostication must be music to Minefinders’ ears. Minefinders is targeting gold and silver producing assets in Mexico and, after years of hard work, the company has Proven and Probable reserves of 2.34 million ounces of gold and 119 million ounces of silver. Minefinders is unhedged and expects to produce at least 65,000 ounces of gold and 3.3 million ounces of silver in 2011.

With approximately $2.30 per share in cash and little long-term debt the company has a strong balance sheet. Minefinders’ solid performance hasn’t gone unnoticed by the financial markets, the company’s shares last closed at a record high of $17.68 valuing the company at over $1.5 billion. We connected with Mark Bailey, President and CEO of Minefinders, for an exclusive one-on-one discussion.

You position Minefinders as a precious metals mining and exploration company as opposed to a gold company, is it your strategy to expand both gold and silver production going forward?

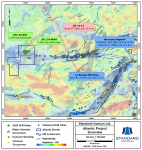

We have always liked both metals and the diversification that focusing on both brings to our business. At our Dolores Mine, we have excellent exposure to both gold and silver, our La Bolsa development project will be primarily a gold operation but we also have other properties that we have not drilled on since 2006 such as Planchas de Plata and Real Viejo which are silver deposits. We plan to recommence drilling on Planchas de Plata by the end of 2011.

The Dolores Mine is your flagship property, please talk about the property and your plans for further development.

Commercial production was declared at our Dolores Mine in May 2009. The current Reserves are about 2 million ounces of gold and 114 million ounces of silver. In 2011 we have guided to produce 65,000 to 70,000 ounces of gold and 3.3 to 3.5 million ounces of silver at a cash cost of $450 to $500 per gold-equivalent ounce. We are currently well on track to meet or exceed this guidance. Now that Dolores is producing, we are currently looking at expansion plans with the addition of a mill to process high-grade open pit ore as well as the development of an underground mine. Studies on both these projects are currently nearing completion and we expect to be able to provide more details on these projects within the next six months.

We reported the results of a draft pre-feasibility study for a 6,500 tonne per day mill in April 2010 and are finalising an optimization study for the mill with the expectation of finalising the mill size and making a construction decision within the next six month. Secondly, we expect to develop La Bolsa and have a second mine in production by the first quarter of 2013.

The development of an underground mine at Dolores will take some time. Based on our current resource model, there are about 800,000 gold equivalent inferred ounces below the current open pit reserves, which we expect to expand and elevate to reserves through the development of the underground and further exploration, expected to take three to four years. Successful development of the underground will lead to production sometime in 2016 which will further enhance our gold and silver production profile.

Regardless, we’re very pleased with the performance of the current heap leach operation and the addition of a mill and underground operations will only help to speed up recovery and increase our production.

The La Bolsa mine is your most advanced development project, what are some of the salient points?

Aside from our flagship Dolores property, La Bolsa is our current development project. La Bolsa was in fact the first property Minefinders staked in Mexico in 1995 but when we realised that Dolores was going to be a much bigger deposit we put La Bolsa on hold to focus on getting Dolores into production.

La Bolsa is located in northern Sonora state in Mexico and is a gold and silver deposit but will primarily produce gold (as the silver will not leach well) and we expect to produce about 40,000 ounces of gold per annum for the life of the mine which is about five and a half years. Logistically it is in a great location, only 32 kilometres from the town of Nogales (so close to a workforce), and is situated on a private ranch.

We filed a National Instrument 43-101 compliant pre-feasibility study in August 2010 which showed the project to be economically sound and given the current price of gold, putting La Bolsa into production looks even more attractive. With Dolores now in production and performing well we have refocused our efforts on getting La Bolsa into production and are currently finalising permitting and detailed engineering. We expect to make a construction decision by the end of the year and could have it in production within 12 months with an expected capital expenditure of US$32 million.

You note in your presentation that Minefinders has one of the more attractive enterprise values to Proven and Probable gold-equivalent reserve ratios, please expand on this for our readers.

Our share value has typically traded at a discount to our peers. We believe that on the basis of our Proven and Probable reserves alone, we are an attractive investment opportunity when compared to our peers. We believe in using reserves for comparisons, because it is what is currently economically mineable and from our perspective, a more compelling case than just comparing resources, which may or may not ever be economically minable.

You have a pretty aggressive exploration program underway at the La Virgina project. How is that progressing and what major milestones are upcoming?

La Virginia is a very exciting project and the results to date have been encouraging. The La Virginia project covers more than 32,000 hectares containing seven separate target areas, very much a grassroots project that had never been drilled before until we started our first drill program on one of the target areas in April 2010. We recently reported 6.46 grams per tonne gold equivalent over 67 metres and have drilled around 40 holes to date. Our plan is to continue exploring on this target area to improve our understanding and expand the mineralization to develop a resource within the next eighteen months. We will continue with our exploration on the other six target areas and if results are encouraging consider increasing our drilling efforts on these other prospective targets.

With gold and silver trading at record levels and competition in your sector increasing, how do you planning on growing the company and expanding its resources base?

We plan to grow our company through the development of existing assets and focused exploration. As mentioned earlier, we are currently examining the addition of a mill at our Dolores Mine as well as the development of an underground mine at Dolores.

Assuming positive construction decisions for the mill at Dolores and for the construction of a mine at La Bolsa, Minefinders expects to increase its gold equivalent production to around 300,000 ounces by 2015. This represents an 80 to 90 percent increase from current production levels.

Finally, we will leverage our strengths as explorers and continue to explore at La Virginia Property, our other exploration projects and revisit properties such as Planchas de Plata, a silver deposit, which with the current price of silver now makes sense.

In the near-term, Minefinders has a very attractive growth profile and the experience to continue to grow its resource base through exploration. Most importantly, we are fully funded to execute our growth plans for Dolores (for both the mill and the underground development) and la Bolsa. We are very excited about the Company’s future.

This interview is featured in the article 10 Most Interesting Gold Stocks – Part 4 – CLICK HERE to read more.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.