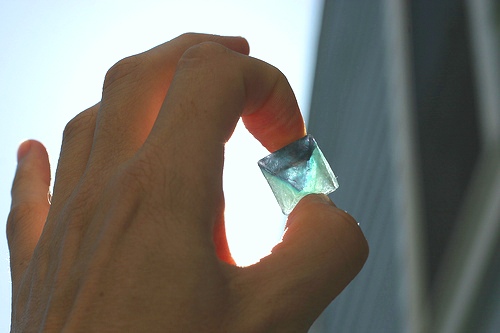

Fluorspar is the commercial name for the mineral fluorite and was included in the list of 14 raw materials labeled as “critical” by an expert group chaired by the European Commission of the European Union (EU).

World reserves of fluorspar resources are approximately 500 million tons of contained fluorspar.

Globally, the annual consumption of fluorspar is approximately 5.6 million tonnes with an estimated value of US $1.6 billion. Pricing for 97% fluorspar is currently estimated at US$400 per ton.

Fluorspar is a halide mineral composed of calcium fluoride and is derived from the Latin root “fluo” (meaning “to flow”) because the mineral was discovered to decrease the viscosity of slag in iron smelting. In 1852, fluorite gave its name to the phenomenon of fluorescence. Today, fluorspar is also used in aluminium production, fire-retardant protective clothing, Teflon for non-stick frying pans, refrigerants and air conditioning, lithium batteries and as a component of environmental technologies.

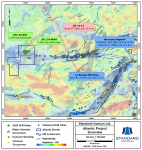

In the last few years market conditions improved enough that some African fluorspar mines, which were forced to shut down in 2009 because of low demand and low prices, were able to resume production in 2010. Coupled with a recent decrease in fluorspar exports from China, companies outside of China are attempting to replace lost Chinese export supplies by expanding capacity at current mines or by developing new fluorspar mining projects. It is estimated that unless China finds new reserves of fluorspar, at their current rate of extraction, they would run out of domestic supply within 7 years.

In Mexico, the world’s second largest fluorspar producer accounting for 18.4% of global supply, companies are developing new fluorspar mining concessions. Development work also continues in the U.S., and Canada and exploration activities are ongoing, particularly in Sweden.

Western Kentucky, which until the 1970’s the Kentucky-Illinois Fluorspar District produced more than 75% of the world’s supply, has seen a rebirth in activity in the past year. While north of the border, Canada Fluorspar (Stock Profile – TSXV: CFI) is getting close to reopening the St. Lawrence fluorspar mine in southeastern Newfoundland, Canada with planned output of 126,000 tonnes of acid grade fluorspar per year.

Some additional publicly traded producers of fluorspar related products include:

- Mosaic (Stock Profile – NYSE: MOS).

- DuPont (NYSE:DD) – a world leader in fluorine chemistry.

- Arkema S.A. (OTCPK: ARKAY).

- The Linde Group (OTC: LNEGY) – a leading fluorine gas producer.

- Mexichem SAB (OTC:MXCHF).

- Fluormin (LON:FLOR)

Finding publicly traded companies with an exposure to fluorspar is as difficult as spelling the word “fluorspar”. If supply constraints continue out of China, with a limited number of publicly traded companies available to investors in the space, a number of new exploration juniors may very well shine a fluorescent light on the sector in the coming months.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.