BHP (ASX:BHP) is reportedly thinking about increasing its A$8.4 billion ($5.6 billion)offer for OZ Minerals Ltd. If they go through with this, it would mean that the leading miner in the world would have a bigger role in providing metals that are necessary for the transition to green energy sources.

In August, BHP rejected OZ Minerals’ first approach, claiming it undervalued the company’s prospects in precious metals like copper and nickel. On Friday, shares in OZ Minerals finished at A$25.25.

If this large acquisition goes through, it will be just one more in a series of big changes at the world’s biggest miner since Mike Henry became CEO in early 2020. The company has revived its interest in major deals, exited the oil and gas industry, and is pouring billions of dollars into a new potash mine in Canada.

According to the individuals, BHP may raise its A$25 per share offer for OZ Minerals as soon as this month. It wasn’t immediately clear what amount BHP would raise its bid, or whether OZ Minerals would accept a new offer from BHP.

Deliberations are ongoing and there’s no certainty that BHP will decide to return with a higher price, according to the people. A representative for BHP declined to comment, while a spokesperson for OZ Minerals couldn’t immediately be reached for comment outside regular business hours in Australia.

BHP’s strategies include diversifying into commodities that are linked to trends such as low-emissions travel and clean energy — particularly copper for solar power and nickel for lithium-ion batteries. It continues to be a major iron ore and steelmaking coal producer, as well as a significant iron ore miner, this year deciding to keep its last energy coal mine.

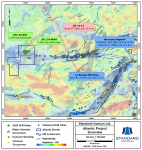

BHP has interests in mining copper along with OZ Minerals, which runs copper mines in South Australia, where BHP maintains its enormous Olympic Dam operation and Oak Dam prospect.

BHP’s desire to buy OZ Minerals is indicative of the company’s return to large-scale transactions, with its last major one being the $12.1 billion acquisition of Petrohawk Energy Corp. in 2011. However, it has made more modest purchases of copper and nickel assets since then.

Last year, the firm was defeated in its attempt to acquire nickel after losing a large sum of money on its six-month pursuit of Canadian miner Noront Resources Ltd., which was outbid by Australian billionaire Andrew Forrest.

The world’s largest producers are all optimistic about copper, anticipating increasing demand in cities and electric cars as the global economy decarbonizes. Rio Tinto Group reached a final agreement to acquire all remaining shares of Turquoise Hill Resources Ltd., which owns a large copper mine in Mongolia, earlier this month.

The long-term prospects for copper remain encouraging, but the metal’s price has plummeted dramatically since earlier this year, with concerns growing that Europe’s energy crisis, a tighter monetary policy by the Federal Reserve, and China’s Covid Zero plan will continue to weigh on demand.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.