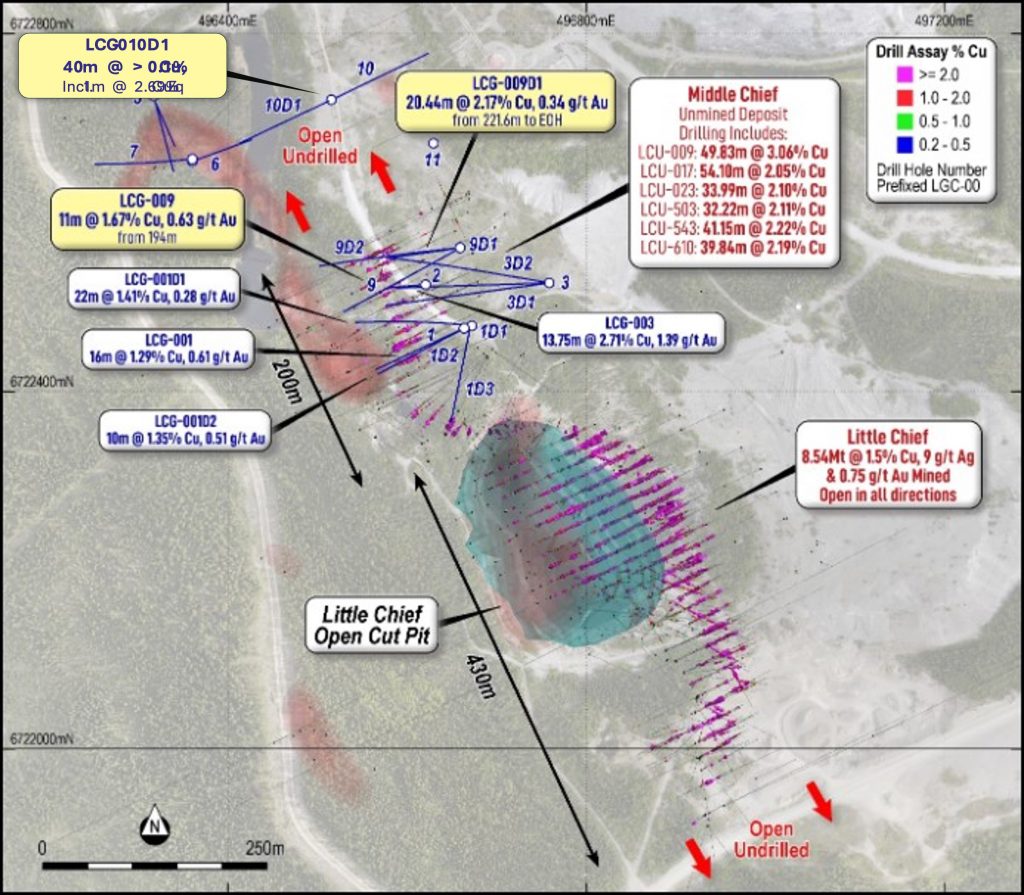

Gladiator Metals Corp. (TSXV:GLAD) has provided an update on drilling at the Whitehorse Copper Project, targeting significant widths of unmined, copper-gold skarns over more than 700m of strike at the historic Chiefs Trend.

Assay results have been returned from 20 holes, totaling 3,581m, at the Middle Chief and Big Chief Prospects within the Chiefs Trend. These results confirm the extensive high-grade mineralization previously highlighted by Gladiator’s data compilation of historical drilling. Copper-gold mineralization remains open in all directions, with some holes finishing in high-grade mineralization due to difficult ground conditions.

Gladiator CEO, Jason Bontempo commented in a press release: “Gladiator has received further assays from its ongoing, 10,000m diamond drill program at the Chiefs Trend. These results confirm and support the significant widths of high-grade copper skarn mineralization identified from Gladiator’s data compilation of historical datasets and point to further extensions of the defined mineralised bodies. Mineralization remains open in all directions with some holes finishing in high-grade copper-gold mineralization.

These results continue to confirm the extent of unmined mineralization and highlight the near-term, high-grade copper resource potential of the Chiefs Trend. Initial step out drilling on the Chiefs Trend, 200m to the north of Middle Chief has also encountered significant widths and grades of copper mineralization pointing to the exploration potential of the trend which is being followed up by ongoing drilling.

The significant gold assays coincident with high-grade copper mineralization identified in these initial assay results point to the upside potential of the Chiefs Trend with the historic drilling only assaying for copper”.

Some of the copper-gold intercept highlights include:

- LCG-009: 11m @ 1.67% Cu and 0.63 g/t Au from 194m

- LCG-009D1: 20.44m @ 2.17% Cu and 0.34 g/t Au from 221.6m to end of hole

- LCG-009D2: 8.7m @ 2.06% Cu and 0.13 g/t Au from 167m

In addition to these high-grade intercepts, significant exploration upside remains, with extensive widths of anomalous copper intersected in initial 200m spaced step-out drilling north of the known Middle Chief Mineralization. Drillhole LCG-010D1 intersected over 40m of anomalous copper (>0.1% Cu), including 1m @ 1.28% Cu and 1.61 g/t Au, which is interpreted as being immediately distal to the mineralized trend. Gladiator plans to complete Down-Hole Electromagnetic (DHEM) surveys prior to recommencing drilling targeting extensions to the known Middle Chief Mineralization.

The recent results are in addition to analytical results reported on March 5, 2024, which included:

- LCG-003: Recovered core @ 2.71% Cu and 1.39 g/t Au within a 13.75m mineralized zone from 256m to end of hole (approximately 270 m) that failed in 0.25m @ 2.76% Cu and 0.28 g/t Au

- LCG-001D1: 22m @ 1.41% Cu and 0.28 g/t Au from 208m

- LCG-001: 6m @ 1.56 % Cu and 1.06 g/t Au from 213m and 16m @ 1.29% Cu and 0.61 g/t Au from 249m

- LCG-001D2: 10m @ 0.83% Cu and 0.19 g/t Au from 62m, 4m @ 1.03 Cu and 0.19 g/t Au from 84m, and 10m @ 1.35% Cu and 0.51g/t Au from 196m

Drilling has now defined unmined, near-surface magnetite-copper skarn mineralization over more than 600m of strike north of the historical mining operations at Little Chief. The mineralization is associated with magnetite alteration, as indicated in the recently completed drone-borne magnetic survey, where magnetic anomalism is reported over 500 meters at Middle Chief extending into Big Chief.

Historical drilling at the Chiefs Trend prospects was selectively sampled for copper only. Given the recent significant gold intervals returned from these initial assay results, Gladiator intends to assay all future drilling and sampling for additional credits, including gold, silver, and molybdenum, which were proven significant contributors to the economics of historic operations at Little Chief.

Other highlights from the results are as follows:

- Results continue to confirm continuity of high-grade copper skarn mineralization at the Chiefs Trend with assays now received for 20 holes for 3,581m of drilling.

- High-grade copper skarn mineralization has now been intersected over at least 600m of strike at the Chiefs Trend and remains open in all directions.

- Assays returned significant copper and gold mineralization, including:

- LCG-009: 11m @ 1.67% Cu and 0.63 g/t Au from 194m.

- LCG-009D1: 20.44m @ 2.17% Cu and 0.34 g/t Au from 221.6m to EOH.

- LCG-009D2: 8.7m @ 2.06% Cu and 0.13 g/t Au from 167m.

- In addition, exploration upside indicated by significant widths of anomalous mineralization in initial, 200m spaced step out drilling north of Middle Chief in drillhole LCG-010D1.

- The above results are in addition to those previously reported on March 5, 2024, including:

- LCG-001D1: 22m @ 1.41% Cu and 0.28 g/t Au from 208m;

- LCG-001: 16m @ 1.29% Cu and 0.61 g/t Au from 249m and 6m @ 1.56 % Cu and 1.06 g/t Au from 213m;

- LCG-001D2: 10m @ 1.35% Cu and 0.51g/t Au from 196m, 10m @ 0.83% Cu and 0.19 g/t Au from 62m and 4m @ 1.03 Cu and 0.19 g/t Au from 84m; and

- LCG-003: Recovered core @ 2.71% Cu and 1.39 g/t Au within a 13.75m mineralised zone from 256m to end of hole (approximately 270m) that failed in 0.25m @ 2.76% Cu and 0.28 g/t Au.

| Hole ID | Target | Depth | East | North | Dip | Azim | Note | From | To | Interval (m) |

CuEq (%) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

Mo (ppm) |

CuPCM (Cu* Int) |

Remarks |

| LCG-001 | MC | 338.33 | 496,665 | 6,722,472 | -68 | 245 | 67.00 | 69.00 | 2 | 2.08 | 0.01 | 2.66 | 0 | 6.0 | 0.02 | ||

| 183.00 | 221.00 | 38 | 0.98 | 0.66 | 0.35 | 5.32 | 11.0 | 25.08 | |||||||||

| Incl. | 185.00 | 193.00 | 8 | 1.64 | 1.16 | 0.51 | 8.63 | 2.0 | 9.28 | ||||||||

| And | 213.00 | 219.00 | 6 | 2.51 | 1.56 | 1.06 | 13.47 | 1.0 | 9.36 | ||||||||

| 237.00 | 241.00 | 4 | 0.61 | 0.59 | 0.01 | 1.15 | 34.0 | 2.36 | |||||||||

| 249.00 | 273.00 | 24 | 1.41 | 0.99 | 0.44 | 8.33 | 38.0 | 23.76 | |||||||||

| Incl. | 249.00 | 265.00 | 16 | 1.87 | 1.29 | 0.61 | 10.88 | 55.0 | 20.64 | ||||||||

| LCG-001D1 | MC | 273.19 | 496,671 | 6,722,474 | -66 | 245 | 204.00 | 236.00 | 32 | 1.41 | 1.11 | 0.27 | 9.24 | 113.0 | 35.52 | ||

| Incl. | 208.00 | 230.00 | 22 | 1.74 | 1.41 | 0.28 | 11.84 | 21.0 | 31.02 | ||||||||

| LCG-001D2 | MC | 301.75 | 496,671 | 6,722,473 | -65 | 275 | 62.00 | 76.00 | 14 | 0.85 | 0.69 | 0.15 | 5.14 | 179.0 | 9.66 | ||

| Incl. | 62.00 | 72.00 | 10 | 1.04 | 0.83 | 0.19 | 6.18 | 193.0 | 8.3 | ||||||||

| 84.00 | 88.00 | 4 | 1.23 | 1.03 | 0.19 | 5.35 | 0.0 | 4.12 | |||||||||

| 196.00 | 206.00 | 10 | 1.84 | 1.35 | 0.51 | 10 | 4.0 | 13.5 | |||||||||

| LCG-001D3 | MC | 215.8 | 496,671 | 6,722,473 | -58 | 190 | 147.00 | 149.00 | 2 | 1.13 | 0.66 | 0.5 | 8.9 | 1.0 | 1.32 | Hole Failed to reach Target | |

| LCG-002 | MC | 196.6 | 496,621 | 6,722,518 | -76 | 266 | 179.00 | 193.00 | 14 | 0.89 | 0.76 | 0.1 | 5.07 | 11.0 | 10.64 | Hole Failed in Fault Zone, prior to target | |

| LCG-003 | MC | 269.75 | 496,759 | 6,722,521 | -50 | 270 | 256.00 | 269.75 | 13.75 | 4.04 | 2.71 | 1.39 | 26.9 | 16.0 | 37.26 | EOH – Weighted Average Result – Calculated over the recovered Intervals, Includes 9m of core loss | |

| Incl. | 269.50 | 269.75 | 0.25 | 3.13 | 2.76 | 0.28 | 16.2 | 11.0 | 0.69 | EOH Sample | |||||||

| LCG-003D1 | MC | 301.75 | 496,759 | 6,722,521 | -55 | 271 | 249.00 | 251.00 | 2 | 0.91 | 0.70 | 0.14 | 10.9 | 7.0 | 1.41 | ||

| LCG-003D2 | MC | 265.18 | 496,759 | 6,722,521 | -55 | 262 | NSA | ||||||||||

| LCG-004 | MC | 205.74 | 496,296 | 6,722,773 | -60 | 155 | NSA | ||||||||||

| LCG-005 | BC | 169.16 | 496,318 | 6,722,727 | -60 | 165 | 6.10 | 9.00 | 2.9 | 0.95 | 0.54 | 0.51 | 1.83 | 1.0 | 1.57 | Big Chief | |

| 57.00 | 62.00 | 5 | 1.02 | 0.76 | 0.31 | 2.54 | 39.0 | 3.80 | |||||||||

| 97.00 | 106.00 | 9 | 0.42 | 0.35 | 0.08 | 1.28 | 431.0 | 3.15 | |||||||||

| LCG-006 | BC | 203 | 496,359 | 6,722,657 | -70 | 65 | 3.6 | 12.5 | 8.90 | 0.48 | 0.32 | 0.20 | 0.65 | 4.0 | 2.81 | ||

| LCG-007 | BC | 277.37 | 496,359 | 6,722,658 | -68 | 283 | NSA | ||||||||||

| LCG-008 | MC | 164.59 | 496,625 | 6,722,473 | -50 | 235 | NSA | ||||||||||

| LCG-008D1 | MC | 211.53 | 496,625 | 6,722,473 | -65 | 235 | 50.00 | 52.00 | 2 | 0.93 | 0.72 | 0.22 | 3.95 | 292.0 | 1.43 | ||

| LCG-008D2 | MC | 274.32 | 496,625 | 6,722,472 | -75 | 235 | 177.00 | 201.00 | 24 | 0.45 | 0.33 | 0.13 | 1.66 | 10.0 | 7.82 | Includes 0.3m of Core Loss | |

| LCG-009 | MC | 280.72 | 496,658 | 6,722,561 | -60 | 245 | 83.00 | 85.00 | 2 | 1.74 | 0.62 | 1.40 | 3.15 | 49.0 | 1.25 | ||

| 184.00 | 187.00 | 3 | 1.01 | 0.97 | 0.02 | 2.30 | 2.7 | 2.91 | |||||||||

| 194.00 | 223.00 | 29 | 1.14 | 0.83 | 0.32 | 6.60 | 8.5 | 24.09 | |||||||||

| Incl. | 194.00 | 205.00 | 11 | 2.29 | 1.67 | 0.63 | 13.98 | 6.0 | 18.36 | ||||||||

| Or | 199.00 | 205.00 | 6 | 2.89 | 2.02 | 0.91 | 17.71 | 10.4 | 12.13 | ||||||||

| LCG-009D1 | MC | 242.04 | 496,659 | 6,722,561 | -65 | 265 | 40.00 | 41.00 | 1 | 2.34 | 1.55 | 0.83 | 15.00 | 19.0 | 1.55 | ||

| 83.00 | 86.00 | 3 | 1.18 | 0.94 | 0.26 | 4.57 | 5.7 | 2.81 | |||||||||

| 206.20 | 242.04 | 35.84 | 1.59 | 1.35 | 0.21 | 8.01 | 14.7 | 48.33 | EOH | ||||||||

| Incl. | 221.60 | 242.04 | 20.44 | 2.55 | 2.17 | 0.34 | 12.84 | 13.3 | 44.41 | EOH | |||||||

| LCG-009D2 | MC | 248.72 | 496,659 | 6,722,561 | -55 | 261 | 65.00 | 67.00 | 2 | 0.76 | 0.66 | 0.09 | 2.8 | 39.0 | 1.32 | ||

| 134.70 | 138.00 | 3.3 | 0.62 | 0.50 | 0.13 | 1.6 | 44.0 | 1.64 | Includes 0.3m of Lost Core | ||||||||

| 167.00 | 175.70 | 8.7 | 2.36 | 2.06 | 0.13 | 20.97 | 5.0 | 17.96 | Ends in Core Loss from 175.7 to 180m | ||||||||

| 170.00 | 174.30 | 4.3 | 3.91 | 3.41 | 0.22 | 34.9 | 6.0 | 14.68 | |||||||||

| LCG-010 | MC | 156.06 | 496,514 | 6,722,726 | -45 | 246 | NSA | ||||||||||

| LCG-010D1 | MC | 198.12 | 496,514 | 6,722,726 | -55 | 65 | 188.00 | 189.00 | 1 | 2.69 | 1.28 | 1.61 | 16.9 | 14 | |||

| LCG-011 | MC | 86.26 | 496,631 | 6,722,678 | -60 | 245 | Assays Pending – Hole Suspended for Change of Season | ||||||||||

| 3,668 |

Table 1: Chief’s Trend Significant Intersections (Recent Drilling)

Copper Equivalent (CuEq) was based on the following assumed metal prices on the 21 April 2024 of $US 9.876 per tonne Cu, $2,390 per Ounce Au & US$28.69 per Ounce Ag. Mo was excluded from the calculation and recovery is assumed to be 100% as no metallurgical test work has been completed.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.