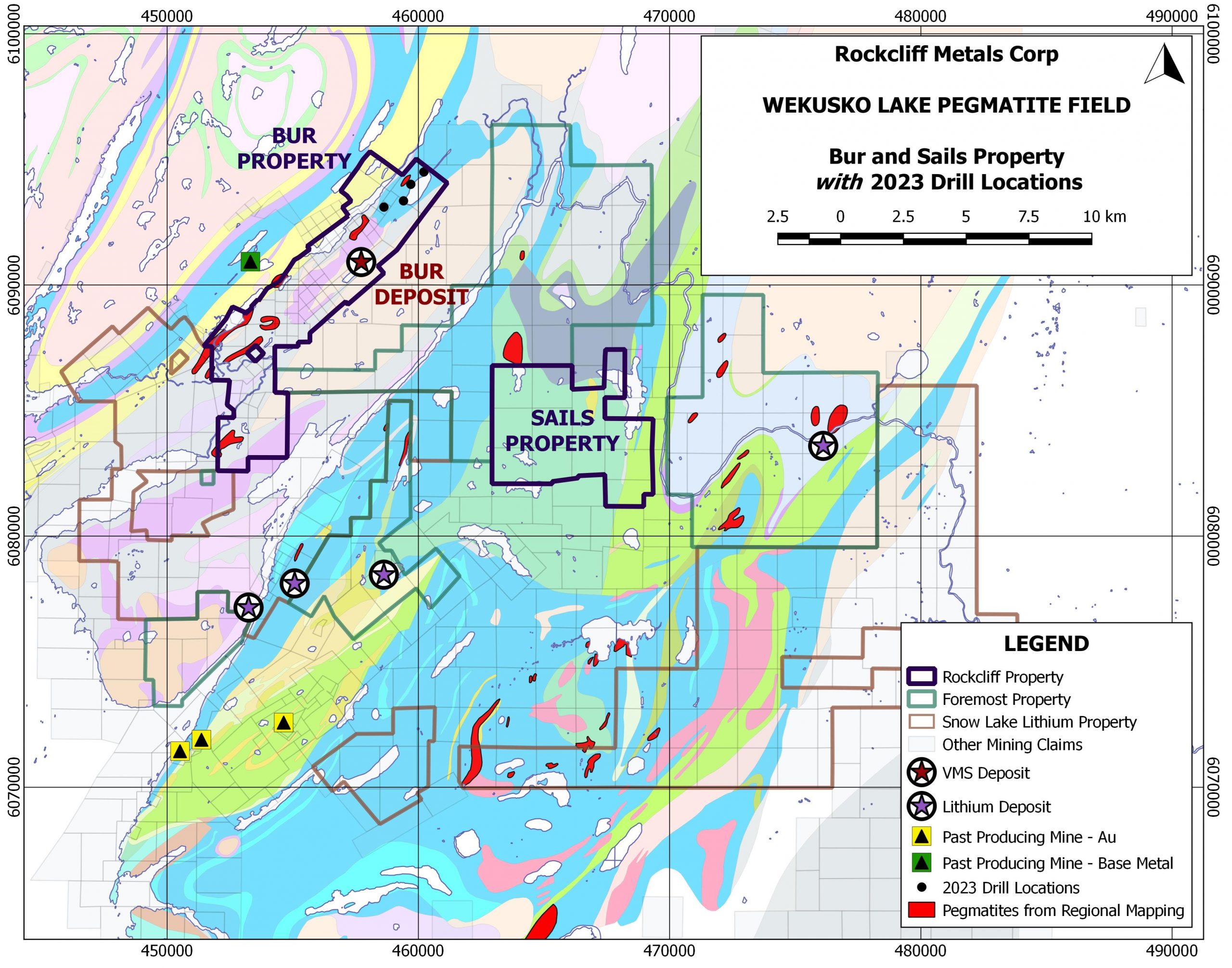

Rockcliff Metals Corporation (CSE: RCLF) has completed its focused winter drilling operations at the Bur Property. The strategic location of this property, being roughly 30 kilometres from the heart of the Snow Lake Mining Camp by gravel and paved road, makes it an advantageous area of operation.

The Snow Lake Project comprises four major deposits teeming with copper-zinc-gold-silver (Bur, Talbot, Tower, and Rail) and various budding prospects, each centered around Snow Lake. Integrated within the globally significant Flin Flon-Snow Lake Greenstone Belt (“The Belt”), this project resides in the world’s largest Paleoproterozoic volcanogenic massive sulphide (“VMS”) district and one of the most prolific VMS domains.

Deep Dive into the Winter Drill Program at the 100% Owned Bur Property VMS

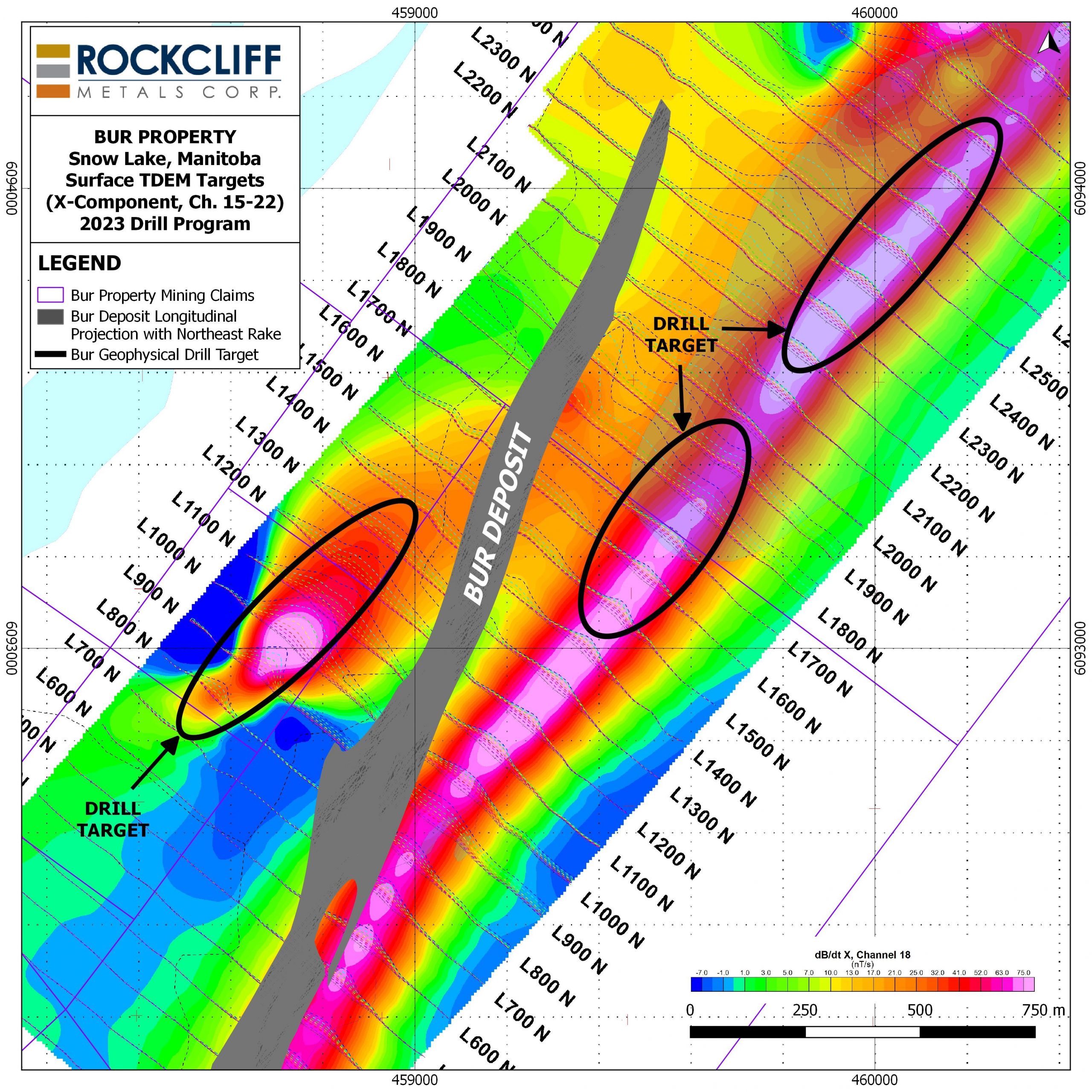

With an intense focus on identifying geophysical VMS targets, Rockcliff Metals Corporation completed 1,379 metres of drilling in four separate drills. Each drill tested distinct geophysical conductive targets in close vicinity to the strategically significant Bur VMS (copper-zinc) Deposit (Refer to Figure 1). This deposit, solely owned by Rockcliff, is a rich resource of copper and zinc that continues to offer potential as it remains open at depth and along strike.

All identified targets intersected and were validated by fine-grained to massive pyrite sulphides found within graphitic fault breccia. Despite these promising discoveries, the four drills completed did not intersect any substantial copper-zinc mineralization. Despite this, with its prime location and extensive resources, the Bur Property continues to hold strategic value for Rockcliff Metals Corporation.

| Classification | Tonnes (k) |

Cu (%) |

Zn (%) |

Au (g/t) |

Ag (g/t) |

CuEq (%) |

Cu (Mlbs) |

Zn (Mlbs) |

Au (koz) |

Ag (koz) |

CuEq (Mlbs) |

| Measured | 338 | 1.54 | 3.58 | 0.05 | 12.94 | 2.87 | 11.48 | 26.68 | 0.54 | 140.62 | 21.39 |

| Indicated | 2,679 | 1.70 | 6.45 | 0.02 | 3.41 | 3.97 | 100.41 | 380.95 | 1.72 | 293.71 | 234.48 |

| Measured/Indicated | 3,017 | 1.69 | 6.13 | 0.02 | 4.48 | 3.84 | 112.37 | 407.59 | 1.94 | 434.41 | 255.33 |

| Inferred | 2.342 | 1.03 | 8.65 | 0.00 | 0.91 | 4.04 | 53.18 | 446.62 | 0.00 | 68.52 | 208.59 |

- CIM definitions are followed for classification of Mineral Resource.

- Mineral resources are contained within a mineralized vein (zone) dipping at approximately 60 degrees towards the northwest whose closest vertical depth from surface is 6 m and maximum vertical depth is 1,274 m.

- Resources are constrained to a minimum true vein thickness of 0.2 m and where calculated block revenues after recovery are greater than costs for mining.

- CuEq (%) = Cu (%) + Zn (%) x 0.347 + Au(gpt) x 0.430 +Ag(gpt) x 0.005

- ZnEq (%) = Cu (%) x 2.885 + Zn (%) + Au(gpt) x 1.241 + Ag(gpt) x 0.016

- CuEq and ZnEq formulas are calculated using the following revenue inputs: Cu US$ 3.26/lb, Zn US$ 1.13/lb, Au US$ 1,744/oz, and Ag US$ 22.05/oz. Metal recoveries are: 80% Cu, 80% Zn, 40% Au and 40% Ag.

- Mining costs used to determine prospects for eventual economic extraction total C$110/t.

- US$ to C$ exchange rate applied is 1:1.31.

- Specific gravity for the mineralized zone is fixed at 3.1.

- Totals may not represent the sum of the parts due to rounding.

- The Mineral Resource estimate has been prepared by Derek Loveday, P. Geo. of Stantec Consulting Services Ltd. in conformity with CIM “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines and are reported in accordance with the Canadian Securities Administrators NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into mineral reserve.

- The 100% owned Bur Property is part of the Company’s extensive Manitoba property portfolio, has excellent infrastructure with a year-round access road, clearing for portable buildings, and a box cut and portal. The Bur Property lies within the Flin Flon-Snow Lake greenstone belt, the largest Paleoproterozoic VMS district in the world and the most prolific VMS district in Canada.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.