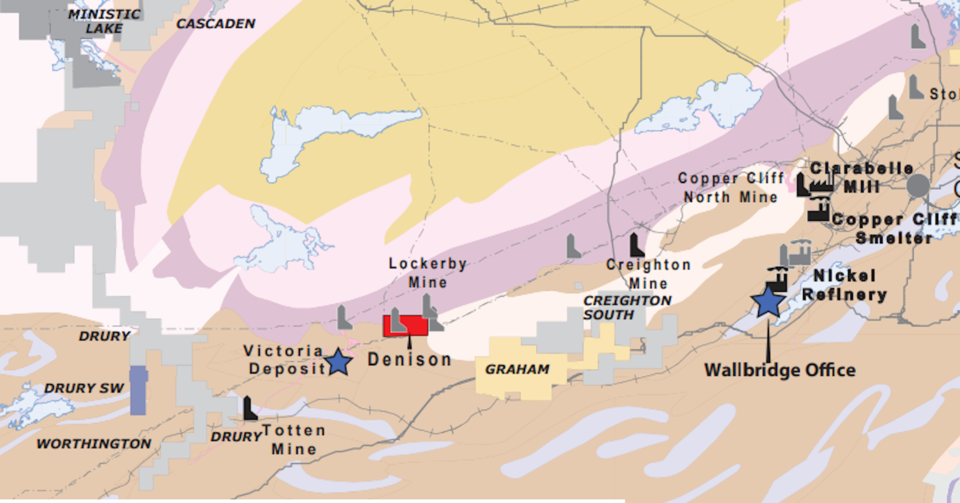

Magna Mining (TSXV: NICU) has agreed to buy 100% of Lonmin Canada Inc.’s (Loncan) assets, which include the Denison project and the inactive Crean Hill nickel-copper-PGM mine, both located in Ontario’s Sudbury basin.

Magna’s CEO Jason Jessup stated to investors: “We believe that this is, in every sense of the word, a transformational acquisition, and it is a key milestone in our vision to become the next mid-tier nickel producer in Canada.”

The Denison project, which includes the old Crean Hill mine, is 37 kilometers east of the company’s advanced-stage Shakespeare operation. From 1906 to 2002, Crean Hill was dug over three periods and yielded 20.3 million tonnes of ore containing 1.3% nickel, 1.1% copper, and 1.6 g/t platinum-palladium-gold. Loncan announced an agreement with Vale Canada regarding the transfer and development of the Denison project in 2018 after the mine closed.

After the operations were halted, several PGM-rich regions were investigated. Recent drilling has revealed 1.69% nickel, 2.28% copper, and 2.37 g/t platinum-palladium-gold over 8.23 meters in the 99 Shaft zone, and 1.87% nickel, 0.95% copper, and 3.14 g/t platinum-palladium-gold over 6.16 meters in the 109 West zone.

According to the share purchase agreement between Magna, Loncan and current Loncan shareholders – which consists of Sibanye UK (formerly known as Lonmin Ltd., a subsidiary of Sibayne Stillwater), Wallbridge Mining (with 16.5% ownership) and other minority shareholders – the total cost for all outstanding shares of Loncan will be C$16 million. This includes a closing payment of C$13 million in cash as well as a deferred payment amounting to $3 million.

Magna has proposed to issue approximately 74 million subscription receipts of the firm at a price of C$0.27 each in a private placement, raising aggregate gross proceeds of up to C$20 million, in order to finance the purchase of Loncan and exploration and development of the Denison project.

Jessup commented further in a press release: “The Crean Hill mine was a significant producer in the Sudbury basin for more than 80 years, and we believe the Denison project has potential to add tremendous value through development of the remaining historical mineral resources and additional exploration on the property. The successful closing of this transaction will be transformative for Magna and has several potential synergies with Magna’s fully permitted, advanced-stage Shakespeare project.”

The Shakespeare property is a past-producing nickel-copper-PGM mine located 70 km southwest of Sudbury. The project has an existing NI 43-101 resource (20.3 million tonnes in the indicated category grading 0.33% nickel, 0.36% copper, 0.32 g/t platinum, 0.35 g/t palladium and 0), permits for both the construction of a 4,500 t/d mill and recommencement of open pit mining activities recommend this surrounding 180 km² land package as being highly prospective for additional discoveries of nickel, copper and PGM deposits.

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.