With trading recently begun on the TSX Venture Exchange, Collective Mining (TSXV:CNL) continues to hit one success after another. The company’s San Antonio project, located 70 km south of Medellin, Colombia, is now advancing with a maiden 5,000 metre drill program. The 100% owned project in Caldas aims to determine the near surface geometry of three targets. Once they have been defined, Collective will begin testing for potential multiple, concealed, mineralized porphyry and breccia bodies. The testing area measures approximately 2 X 1 kilometres. The company expects assay results to be available early in the fourth quarter of 2021, giving investors yet another project update to look forward to.

The San Antonio Project

Located within the Middle Cauca Belt – a 250+ km, north-south trending gold and base-metal belt which hosts multiple porphyry and epithermal discoveries, the San Antonio project covers an area of 3,780 hectares. The

The project incorporates porphyry Cu-Au-Mo mineralization and associated hydrothermal alteration over that wide grid. Porphyry mineralization is now exposed over large areas because of the presence of both sheeted and stockwork vein systems and breccias associated with the multi-kilometre scale Au-Mo-Cu soil anomalies and associated hydrothermal alteration.

The Only Company to Realize the Project’s Potential

Collective (TSXV:CNL) is finally unlocking what other operators of the project could not. Past operators didn’t drill those main porphyry occurrences and instead only targeted high-grade vein style mineralization. That mineralization was located peripheral to the porphyry intrusive centers, but never realized significant results. Collective Mining has now begun drilling on the most promising section of the project, bringing the San Antonio project ever closer to the company’s goals.

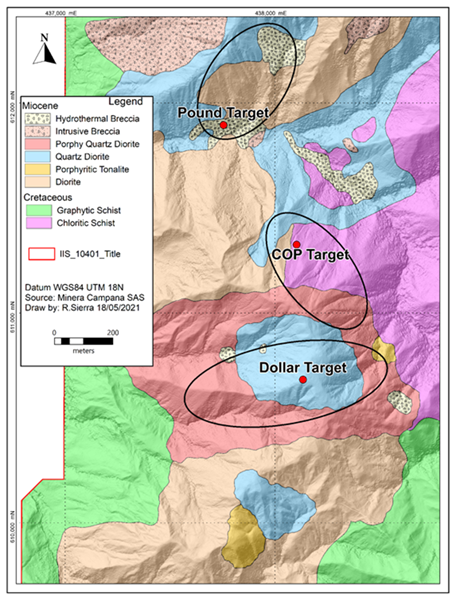

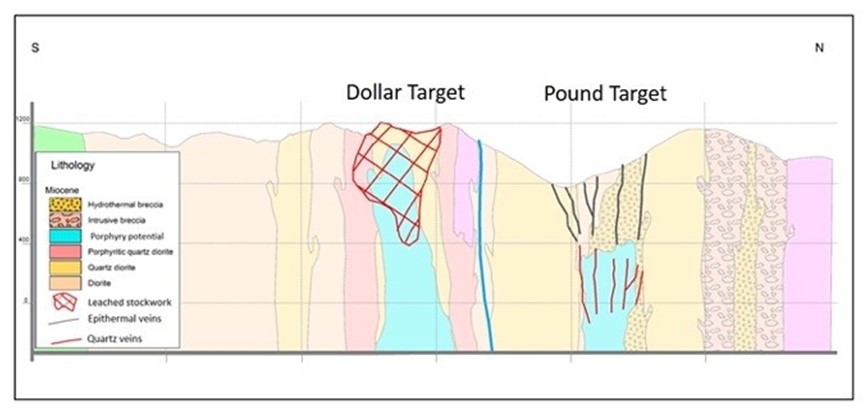

Details of the maiden drilling program are as follows (Referenced in Figures 1-4):

- Three specific grassroots exploration targets have been outlined by surface mapping, sampling, soil geochemistry, geophysical modelling and shallow scout drilling. These are referred to as the Dollar, COP and Pound targets.

- Two diamond drill rigs are operating at the project. To date, 1,857 metres of scout drilling, to define the geometry of the Dollar target, has been completed. Two deeper penetrating drill-holes to test for the potential metalliferous portions of the Dollar and Pound targets are currently in progress.

- The San Antonio project benefits from favorable topography with approximately 600 vertical metres of elevation change from the mountain peaks to the various flat lying valleys. Additionally, the topography is not overly steep, lending itself to multiple potential infrastructure development scenarios should an economic deposit be discovered in the future.

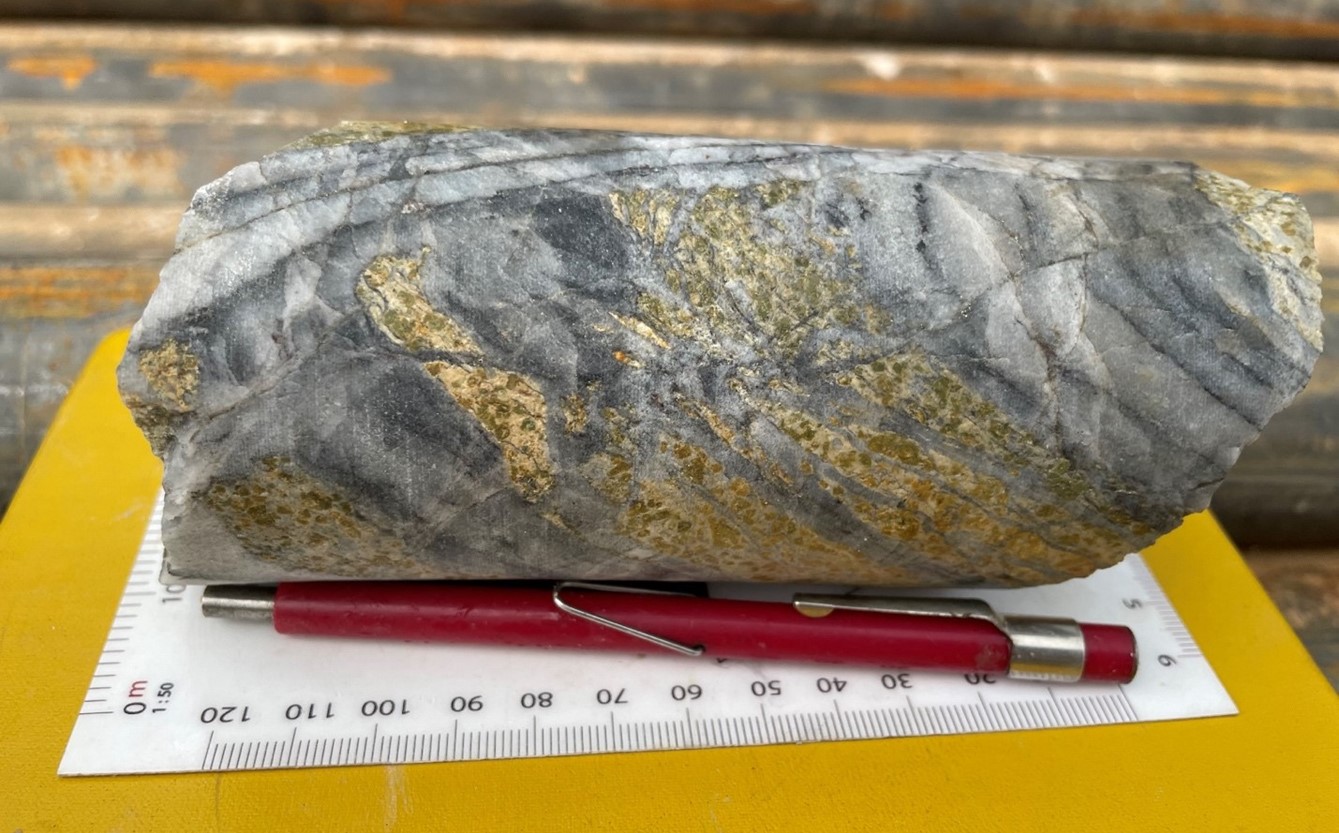

- The Dollar target is defined by outcrops of quartz-magnetite stockwork and sheeted veins emplaced within quartz diorite porphyry bodies in an area of 500 x 500 metres. The vein systems are associated with sericitic alteration. Shallow scout drilling has just been completed to define the geometry of the stockwork bearing porphyry and identified a strong overprint of yellow clay alteration, probably responsible for partial metal leaching. This accounts for the sporadic gold and molybdenum values encountered in surface outcrops. Deeper drilling is now in progress from a high elevation at a local mountain peak to test the porphyry system at 600 metres vertically below surface. This hole is expected to intersect a strong magnetic anomaly outlined by geophysical modelling, interpreted as being part of the potassic metal bearing porphyry centre.

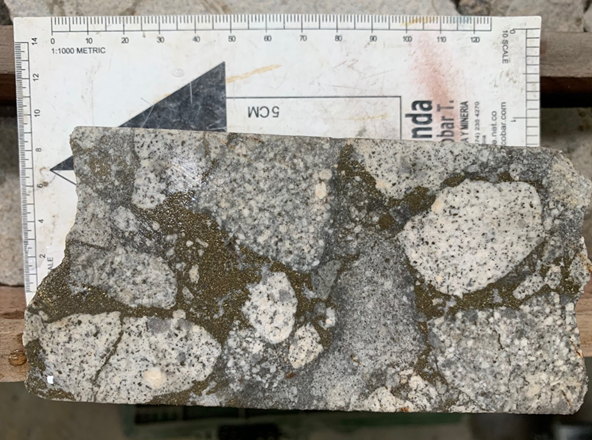

- The Pound target, located 1.2 km north of Dollar, is defined by hydrothermal breccias and polymetallic veins hosted within diorite intrusive over an area of 600 x 350 metres. Outcrop exposures on the southern border of this target area include epithermal vein systems within a preserved lithocap of advanced argillic alteration which is superimposed on hydrothermal breccia bodies. These rocks are interpreted to reflect preservation of the shallow levels of the porphyry system. Additionally, a strong circular magnetic anomaly (MVI) is located approximately 600-900 metres below surface and is interpreted to be the potential porphyry source for the hydrothermal breccias located directly above. The initial drill hole, currently coring into Pound, will test the potential of both the hydrothermal breccias and the porphyry at depth.

- The COP target is located 400 metres north-northwest of Dollar and is defined by highly anomalous molybdenum (8ppm to 108ppm) and gold (up to 2.74 g/t) in soils in association with altered diorite porphyry and quartz veinlets over an area of 650 x 350 metres. The surface expression of the COP target is coincident with geophysical anomalies at 200-300 metres depth which include a positive magnetic anomaly and IP chargeability and resistivity highs. COP has not been tested, other than a single historical borehole drilled just south of the target area, returned an intercept of 99 metres at 0.42 g/t gold and 4.9 g/t silver within unmineralized country rocks partially intruded by mineralized porphyry quartz veins at a depth of 608 metre downhole. The mineralization encountered in the drill-hole is interpreted to be leakage from the COP target directly to the north.

Source: Collective Mining

Source: Collective Mining

From Strength to Strength

Having recently debuted on the TSX Venture Exchange, Collective Mining (TSXV:CNL) is off to a strong start. The first day of trading saw the stock pop 205%, proving that investors are bullish on the management’s direction and the strength of the team leading the charge on both the San Antonio project, and the Guayabales project in the same region (Caldas, Colombia).

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.