The gold miners’ stocks are correcting. They’ve been sliding and drifting lower on balance since their powerful recent upleg peaked a month ago. Corrections are normal and healthy in ongoing bull markets, rebalancing sentiment to pave the way for the next upleg. They also offer the best buy-low opportunities seen inside secular uptrends. Deploying capital in gold stocks after corrections multiplies wealth-building potential.

While most people dread corrections, battle-hardened speculators and investors embrace them. They make prices oscillate around their bull-market uptrends, greatly expanding their overall travel. The more price movement, the more potential upside to ride. Today’s gold-stock bull proves this. Consider it in terms of the most-popular gold-stock benchmark and trading vehicle, the GDX VanEck Vectors Gold Miners ETF.

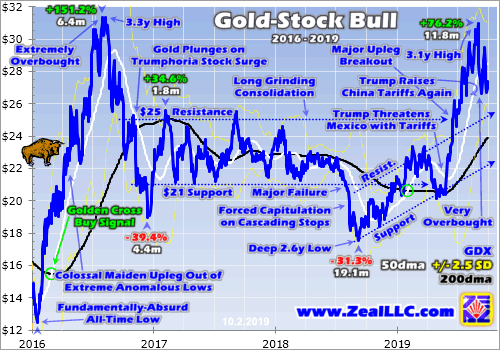

This gold-stock bull was born in mid-January 2016, from the depths of despair after a secular gold bear. Over the next 6.4 months, GDX skyrocketed 151.2% higher in an epic maiden upleg! That initial early-August-2016 peak has yet to be eclipsed, but GDX came within 1.2% as this latest upleg peaked in early-September 2019. So the maximum potential gains by buying and holding this entire bull are still 151.2%.

But it has actually enjoyed 3 separate uplegs, that initial 151.2%, a small 34.6% into early 2017, and the 76.2% one that peaked a month ago. Add these together, and the maximum potential gains from swing trading this bull’s uplegs and corrections are 262.0%. That’s over 1.7x better! Of course timing the exact bottoms and tops is impossible, so let’s lop off a quarter of that potential. That still leaves 196.5% versus 113.4%.

Speculators buying within 1/8th or so of correction bottomings and selling within about 1/8th of upleg toppings can generate far-bigger gains than buy-and-hold investors. That’s an achievable goal, as there are plenty of technical and sentimental indicators revealing when these key upleg-correction reversals are likely happening in real-time. Gold stocks are a volatile sector, so we may as well harness that in our favor.

This first chart provides perspective on this gold-stock bull through the lens of GDX. Its major upleg-and-correction swings so far are noted. Since gold overwhelmingly drives gold miners’ profits and thus gold-stock price action, gold-stock cycles are generally considered in gold terms. Despite their huge uplegs and brutal corrections, gold-stock bulls persist as long as gold’s own do. And gold’s bull is alive and well today.

Price movements are driven by the collective trading of all market participants. And their individual buy-and-sell decisions are heavily influenced by how they feel, or sentiment. The ethereal and unquantifiable greed and fear of the herd are what define when gold-stock uplegs and corrections run out of momentum and reverse. And there are plenty of signs when those key junctures for multiplying wealth are probably nearing.

Since this essay is on the current gold-stock correction, I’m going to focus on the topping side. Uplegs are ultimately constrained, they have finite amounts of buying power available to drive them. There are only so many speculators and investors interested in gold stocks at any given time, and they all have limited capital. So once their buying firepower is expended, which coincides with peak greed, uplegs top then fail.

While the whole mission of trading is buying low then selling high, our natural human instinct is to do the exact opposite. It’s hard buying gold stocks low late in corrections, as everyone is bearish on them and assumes the downside momentum will persist indefinitely. So after an initial short-covering spike, most of early uplegs tend to be gradual. Gold stocks have to rally sufficiently to convince skeptical traders to return.

But the higher gold stocks climb, the better they look and the more excited traders get. The faster gold stocks rally, the more capital traders deploy. The more they buy, the faster gold stocks climb. This powerful virtuous circle directly fueled by greed often drives prices sharply higher heading into the ends of uplegs. Eventually everyone interesting in buying anytime soon has already bought, so buying potential is exhausted.

The main technical indicator warning that gold-stock uplegs are likely peaking is how overextended GDX stretches. Measuring this empirically requires some kind of baseline, but it can’t be static since prevailing gold-stock price levels are always changing. My favorite has long been the 200-day moving average. With nearly 10 months of trading days feeding into it, it only changes gradually yet still slowly follows prices.

GDX’s 200dma is rendered in black in this chart. Note above that both of this bull’s major uplegs saw GDX soar far above its 200dma. Those were signs of overboughtness, that too much capital was flooding into gold stocks too quickly to be sustainable. The faster and more exciting gains after a long and strong upleg, the greater the odds they will soon run out of steam. They rapidly suck in all near-future buying potential.

Well over a decade ago I developed a trading system based on how stretched prices were relative to their own 200dmas, called Relativity Trading. It simply divides a price by its 200dma yielding a multiple. Over time in trending bull markets these form horizontal trading ranges, with distinctive topping and bottoming zones. Since I started analyzing this years before GDX was even born, I use the older HUI gold-stock index.

GDX’s latest upleg peaked at $30.95 on September 4th. A couple days later I published an essay warning “Gold Stocks Very Overbought” explaining why and the implications in depth. On that peaking day, GDX had soared way up to 1.341x its 200dma. For most gold-stock bull-market uplegs, seeing index prices stretched 30%+ above their 200dmas is a big warning sign. It means prices have run too far too fast.

Sentiment extremes always coincide with price extremes, since how traders feel is totally dependent on how prices are faring. When uplegs are topping, telltale emotions run rampant. Widespread greed mixes with exuberance, complacency, and even euphoria. When gold-stock prices are topping, traders as a herd are totally convinced the gold miners are on the verge of surging much higher. It is funny to watch.

Buying low then selling high requires being contrarian, actively fighting the crowd to do the opposite. But being contrarian requires so much hard training and emotional discipline that few bother painfully forging that mindset. So most traders, and most analysts and market commentators, just follow the momentum. They are most excited and eager to buy when prices are high, when popular greed infects their market outlooks.

While you can easily figure out when prices stretch really far over their 200dmas, sentiment isn’t directly measurable. But it can be inferred by paying attention to your own emotions and those of other traders and analysts. If prices have rallied long and far and you are really excited and bullish, you are getting greedy. If you are buying gold stocks when it feels good and validating, odds are you are buying late and high.

When gold-stock uplegs are topping, the widespread bullish sentiment becomes evident in the financial media. Most of the time this small contrarian sector is totally ignored. So when you see professionals on CNBC and Bloomberg appear much more often waxing bullish on the gold miners’ stocks, that’s a major warning sign. Financial television is very useful because it reflects and reveals prevailing sentiment!

Most gold-stock speculators and investors also follow some commentators, as not everyone can or wants to spend all day everyday studying the markets. Usefulness derived from market analysis is dependent on how a particular analyst thinks. Are they a herd-follower momentum trader or a contrarian? You need to figure that out before you trade on anyone’s advice. A little homework will clarify how they tend to think.

Look at what your commentator was predicting in real-time at known past major gold-stock toppings and bottomings. In early August 2016 and early September 2016 as gold-stock euphoria reigned, did they call for big additional gains? Or did they warn of an imminent correction. Contrarians are even rarer publicly since being in this camp draws mockery. Traders hate hearing when their beloved uptrends are ending!

So between how you feel about gold stocks, how professionals interviewed in the financial media feel, and how your favorite commentators feel, you can get a good idea of prevailing sentiment. Chances are if you are excited about buying gold stocks, much of the driving upleg has already run its course. The time to buy is when it feels miserable, after gold stocks have fallen so far that they seem hopeless again.

As a newsletter guy for the past couple decades now, I have an additional sentiment-revealing conduit that is super-valuable. I’m constantly e-mailed feedback and questions from subscribers. They grow excited about gold stocks when uplegs are topping, and depressed when corrections are bottoming. It is not just a collective thing, but even individuals. Certain people have written me periodically for years on end.

They’ve proven great contrary indicators. Like clockwork they are very bullish and excited when gold stocks are topping, and really bearish and disheartened when gold stocks are bottoming. If you happen to be fortunate enough to talk with someone regularly who also trades this sector, you can get a similar read by asking them where they think it is going. Unless they are hardened contrarians, do the opposite!

When technicals get really overbought and sentiment really greedy, it’s definitely time to be wary. But I still generally don’t sell high. Gold stocks are a volatile sector that can really surprise to the upside at times. So instead of selling outright and trying to catch an inherently-unpredictable precise top, instead I just ratchet up my trailing-stop-loss percentages. Tighter stops lock in more profits when prices reverse.

In early September gold stocks were very stretched technically, with GDX far above its 200dma baseline. And everywhere you looked, traders and analysts were wildly bullish on gold miners’ prospects. Those were all the hallmarks of an upleg peaking before a major correction. But a more-obscure indicator really caught my attention. It was how speculators were collectively positioned in gold futures, which is crucial.

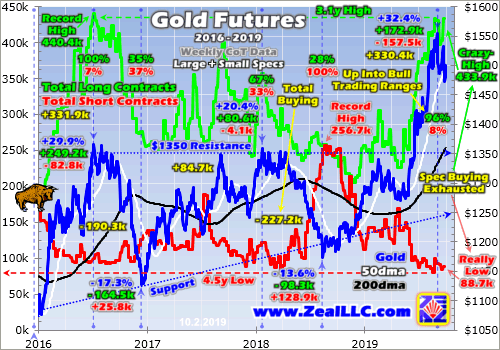

I wrote a whole essay explaining this in depth in mid-September, titled “Gold-Futures-Selling Overhang”. Gold stocks are essentially leveraged plays on gold, since it utterly dominates their earnings power. And the primary short-term gold driver is how gold-futures specs are betting. Like most gold-stock traders, they are momentum followers and not contrarians. So they grow really bullish when gold itself is topping.

This exuberant sentiment manifests itself on both sides of the gold-futures trade, longs and shorts. When these traders expect gold to keep rallying after a strong upleg, their long upside bets are very high. They also radically curtail their short-selling downside bets. These guys always bet wrong when uplegs are topping, and the extreme leverage inherent in gold-futures trading means they can’t afford to be wrong for long.

Gold stocks follow gold, which is mostly driven by speculators’ gold-futures trading. Thus whenever I’m assessing the likelihood of a major gold-stock upleg topping, I carefully consider specs’ positioning. If their collective bets are normal, longs and shorts both in the middle of their gold-bull-market ranges, then the odds of gold and thus gold-stock corrections are much lower. But when bets are extreme, watch out below.

This last chart looks at speculators’ total long and short contracts held in gold futures, which are published weekly. Long upside bets are rendered in green, and short downside bets in red. The higher longs, and the lower shorts, the more bullish gold-futures speculators. And that is more bearish for gold and gold stocks over the near term! A month ago this chart heavily influenced my warning on gold-stock overboughtness.

In early September as gold stocks stretched far above GDX’s 200dma and bullishness was universal, the gold-futures specs’ total longs were nearing an all-time record high! At the same time their shorts were very low. On September 3rd specs’ total longs and shorts were running 96% and 8% up into their gold-bull-market trading ranges since mid-December 2015. These guys were effectively all-in longs and all-out shorts!

Like gold-stock traders, gold-futures traders’ capital is finite. They buy aggressively in gold uplegs, which drives them higher. But eventually they’ve deployed all the capital they are able to wield, which leaves no more buying firepower left. At that point all they can do is sell when the right news catalyst hits sooner or later. That selling soon snowballs due to the crazy leverage, unleashing gold and gold-stock corrections.

With gold-futures speculators’ potential buying nearly tapped out in early September, gold wasn’t likely to go much higher but had high odds of selling off. And that would drag the gold stocks with it. The major gold miners that dominate GDX’s weightings tend to amplify underlying moves in gold by 2x to 3x. So when that inevitable gold-futures selling hit, it was going to hammer gold stocks particularly hard like usual.

Fast-forward to today, and spec gold-futures positioning is a key reason why gold stocks are suffering a correction now. The latest report on speculators’ collective gold-futures bets last Tuesday revealed their total longs and shorts are still running 97% and 5% up into their gold-bull-market trading ranges! That is close to the most-bearish-possible for gold of 100% and 0%, guaranteeing big gold-futures selling was coming.

And indeed we saw a lot of it over the week since. After peaking at $30.95 in early September yielding a 76.2% upleg gain over 11.8 months, GDX plunged 13.9% to $26.64 over the next couple weeks. That was beyond that classic 10% correction threshold for stock markets, although gold stocks are so volatile their definition should be wider. Then GDX rebounded fast, surging 10.7% higher to $29.49 on September 24th.

While early September’s sharp gold-stock selloff caught traders’ attention, that bounce rally rekindled lots of complacency. It’s fitting that secondary gold-stock topping hit the same day specs’ latest gold-futures positioning was so extreme. Gold fell sharply from there, dragging the gold stocks down with it. By the end of September, GDX had plunged another 13.7% to $26.71. Lower highs were forming a correction downtrend.

Still, at worst GDX was only down 13.9% correction-to-date. That’s nothing yet by gold-stock-correction standards. Today’s gold-stock bull has seen two prior corrections, a massive 39.4% into late 2016 and an also-ugly 31.3% into late-summer 2018. Both of these were excessive, exacerbated by market anomalies heading into their climaxes. But their 35.4% average losses illustrate how serious these get.

Bull-market corrections most often bounce at 200dmas, and GDX’s was running $23.90 as of the middle of this week. That would make for a 22.8% total correction. But since GDX’s price remains well above that 200dma, it is gradually rising. So it will be somewhat higher by the time GDX is forced back down to it by specs’ gold-futures selling. Another way to game the potential gold-stock downside is to look at gold.

Gold’s parallel bull that’s driving this gold-stock one also experienced those same two corrections so far, which ran 17.3% and 13.6%. That averages 15.5%. But again those were excessive, made way worse by some extreme market events that aren’t going to repeat. Gold should see a milder and more-normal bull-market correction this time around, somewhere in the 6%-to-12% range. GDX will amplify that by 2x to 3x.

That implies a gold-stock correction of 12% to 36%, for a 24% midpoint. 25% is reasonable, and right in line with past-bull-market precedent. During gold stocks’ last mighty secular bull across the entire 2000s decade, the average major gold-stock correction per the HUI was 26.1%. That excludes 2008’s wildly-anomalous stock-panic selloff, but covers fully 12 other corrections. Around 25% is par for the course.

That implies a GDX downside target around $23.21, another 15.3% lower from this week’s levels. It is interesting that gold stocks’ weakest seasonals of the year from late September to late October align with this as well. Last week I wrote a whole essay “Gold-Stock Red October” explaining why this is the case. Everything is lined up for considerable sector weakness in the coming weeks. Traders need to be ready.

Corrections are just a sentiment thing, a rebalancing to bleed off the excessive greed surrounding upleg toppings. The buying opportunity after this one will be really important, as gold miners’ fundamentals are rapidly improving with higher prevailing gold prices. In the just-finished third quarter, average gold prices soared a stupendous 12.6% higher quarter-on-quarter! So gold miners’ earnings must have exploded.

After every quarterly earnings season, I analyze the collective results of the GDX gold miners. In Q2’19, their average all-in sustaining costs ran $895 per ounce. That yielded sector profits of $414 per ounce at Q2’s $1309 average gold price. Assuming AISCs are flat in Q3, when they are actually likely to fall, those earnings soared to $579 at last quarter’s $1474 average gold price. That’s up an incredible 39.8% QoQ!

So gold miners’ upcoming releases of Q3 results between late October to mid-November are going to look fantastic. As long as gold’s own selloff is waning, this great fundamental news may cap the worst of gold stocks’ correction in time terms. Gold stocks’ powerful recent surge on gold’s decisive bull-market breakout caught traders’ attention, and the bottoming of this underway correction will be the time to buy big.

To multiply your capital in the markets, you have to trade like a contrarian. That means buying low when few others are willing, so you can later sell high when few others can. In the first half of 2019 well before gold stocks soared higher, we recommended buying many fundamentally-superior gold and silver miners in our popular weekly and monthly newsletters. We later realized big gains including 109.7%, 105.8%, and 103.0%!

To profitably trade gold stocks, you need to stay informed about gold’s major drivers and their likely near-term impacts. Our newsletters are a great way, easy to read and affordable. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. Subscribe today and take advantage of our 20%-off sale! Get onboard now so you can mirror our coming trades for gold’s next upleg after this correction largely passes.

The bottom line is a gold-stock correction is underway. The major gold miners have been grinding lower and sideways for a month now, after becoming very overbought technically. That major warning sign of upleg toppings was accompanied by exuberant popular sentiment. On top of that, speculators’ gold-futures positioning was and is again excessively bullish, signaling major gold selling is inevitable soon.

Corrections should be embraced, not dreaded. They are normal and healthy in bull markets, existing to bleed off excessive greed and restore sentiment balance. These selloffs offer the best opportunities to buy relatively low within ongoing bulls. Traders need to watch for them, prepare for them with stops, and hold off on redeploying stopped capital until they’ve run their courses. Then jump back in to ride the next upleg!

Follow us on Twitter

Follow us on Twitter Become our facebook fan

Become our facebook fan

Comments are closed.